Network Security Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Network Security Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

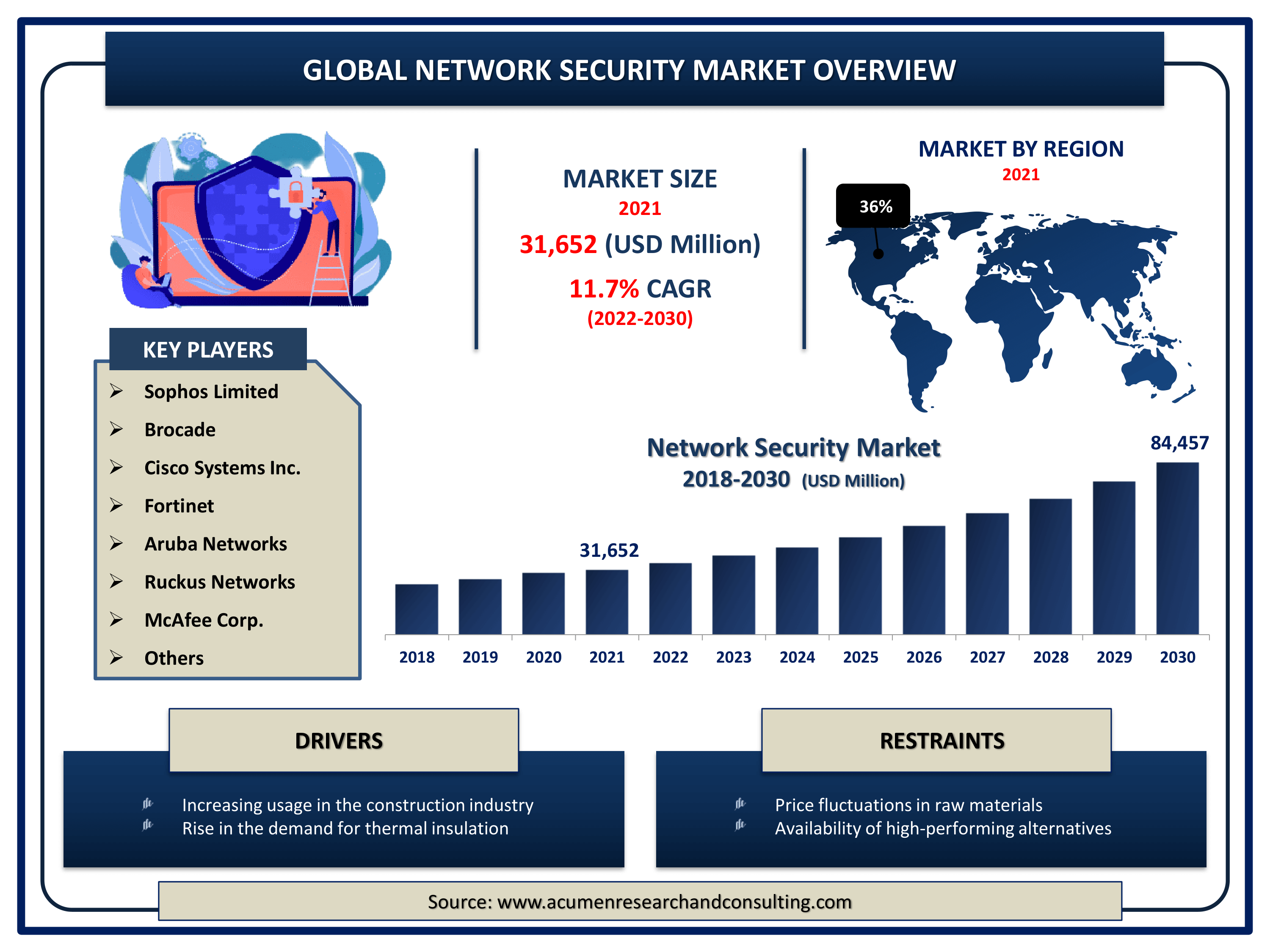

Request Sample Report

The Global Network Security Market Size accounted for USD 31,652 Million in 2021 and is estimated to achieve a market size of USD 84,457 Million by 2030 growing at a CAGR of 11.7% from 2022 to 2030. The increasing rate of cyber-attacks and data breaches has compelled most large and small enterprises to secure their networks, propelling the network security market growth. Moreover, the rapidly emerging trends of Bring Your Own Device (BYOD) regulations by organizations, as well as the widespread awareness of work-from-home arrangements amid epidemics, are projected to drive the worldwide network security market value over the next few years.

Network Security Market Report Key Highlights

- Global network security market revenue intended to gain USD 84,457 million by 2030 with a CAGR of 11.7% from 2022 to 2030

- North America region led with more than 36% network security market share in 2021

- Asia-Pacific regional market is expected to grow at a CAGR of more than 14% during the forecast period

- Among industry, IT and telecom sector engaged more than 22% of the total market share

- By deployment, cloud segment generated about 66% market share in 2021

- Increasing cyber threats at network point, drives the network security market trend

Network security refers to the steps taken by any business or organization to protect its computer network and data by utilizing both hardware and software systems. Network security encompasses a wide range of technologies, devices, and processes. It is a set of rules and configurations designed to safeguard the integrity, confidentiality, and accessibility of computer networks and data.

Global Network Security Market Trends

Market Drivers

- Increasing network security and privacy concerns

- Compliance is required due to stringent regulations

- Increasing level of cybercrime over the globe

- Continuing to rise BYOD policies in the organization

Market Restraints

- High setup costs

- Low-security budget

Market Opportunities

- Growing adoption of cloud-based security technologies

- Rising digitization and 5G deployment

Network Security Market Report Coverage

| Market | Network Security Market |

| Network Security Market Size 2021 | USD 31,652 Million |

| Network Security Market Forecast 2030 | USD 84,457 Million |

| Network Security Market CAGR During 2022 - 2030 | 11.7% |

| Network Security Market Analysis Period | 2018 - 2030 |

| Network Security Market Base Year | 2021 |

| Network Security Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Deployment, By Revenue, By Enterprise Size, By Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | NortonLifeLock Inc.,(Symantec Corporation), Aerohive Networks, Sophos Limited, Brocade, Motorola Solutions, Inc., Cisco Systems Inc., Fortinet, Aruba Networks, Ruckus Networks, Honeywell International Inc., McAfee Corp., and ADT Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Rising Cases Of Data Breach Have Raised High Demand For The Growth Of Global Network Security Market Size

A cybercriminal can exploit these weak points and cause internal system damage. An incident like this will result in the loss of funds, confidential information, and customer data, as well as destroy the company's reputation in the market. According to the EC-Council report, Mariott International suffered a major data breach in March 2020, in which the information of 5.2 million guests was accessed using the login credentials of two employees at a franchise property. Twitter was not spared by the pandemic or remote work. In June 2020, several high-profile individuals' accounts were compromised as a result of phone phishing. Robust network security techniques are modern-day necessities for business survival, but cyber hygiene awareness has also become a necessity. Furthermore, by implementing and learning about network security, a small business can make its employees more responsible, a law firm can be motivated to protect its data, and an interior designer can find more effective ways to control its heavy files.

Network Security Has Gained Huge Significance During COVID-19 Pandemic

The importance of network security in today's business environment has grown since a large portion of the workforce went remote due to COVID-19. The COVID-19 pandemic has forced millions of professionals all over the world to work remotely. As a result, it has created numerous opportunities for hackers. According to a recent international survey conducted by SailPoint Technologies Holdings, Inc., a U.S.-based tech company, 48% of U.S. participants said they had been targeted with phishing emails, calls, or text messages, both personally and professionally, while working from home over the course of six months. Furthermore, more than half of survey respondents in Europe, the Middle East, and Africa (EMEA), as well as those in Australia and New Zealand (ANZ), reported being phished during the pandemic, with 10% noticing phishing attempts at least once per week. Having the right tools and systems in place can help you avoid data breaches and cybercrime. It is critical for your organization to understand the cyber security measures available to protect its data and devices.

Online Influence Campaigns Bolster The Growth Of Global Network Security Market

According to a report published by Canada.ca, ransomware campaigns of varying sophistication will almost certainly continue to target the Canadian health sector in the near future. Ransomware attacks on healthcare providers, research facilities, and medical manufacturers will harm patient care and impede the development and production of Canadian medical research and domestic supply chains. Authoritarian governments are very likely to try to obtain and deploy foreign surveillance technologies under the guise of malware attacks. Concerns about privacy will almost certainly spark heated public debates, including in Canada, about the increasing use and effectiveness of surveillance technologies to combat ransomware attacks. It is very likely that influence campaigns will manipulate privacy concerns in order to sow discord and erode trust in public institutions. Such influence programs involve The STOP.THINK.CONNECT. The campaign is a national public awareness campaign aimed at increasing understanding of cyber threats and empowering the American public to be safer and more secure online, recognizing that cyber security is a shared responsibility. Furthermore, in its 17th year, National Cyber Security Awareness Month (NCSAM) continues to raise awareness about the importance of cyber security across the country, ensuring that all Americans have the resources they need to be safer and more secure online.

Network Security Market Segmentation

The worldwide network security market segmentation is based on the deployment, type, enterprise size, industry, and geography.

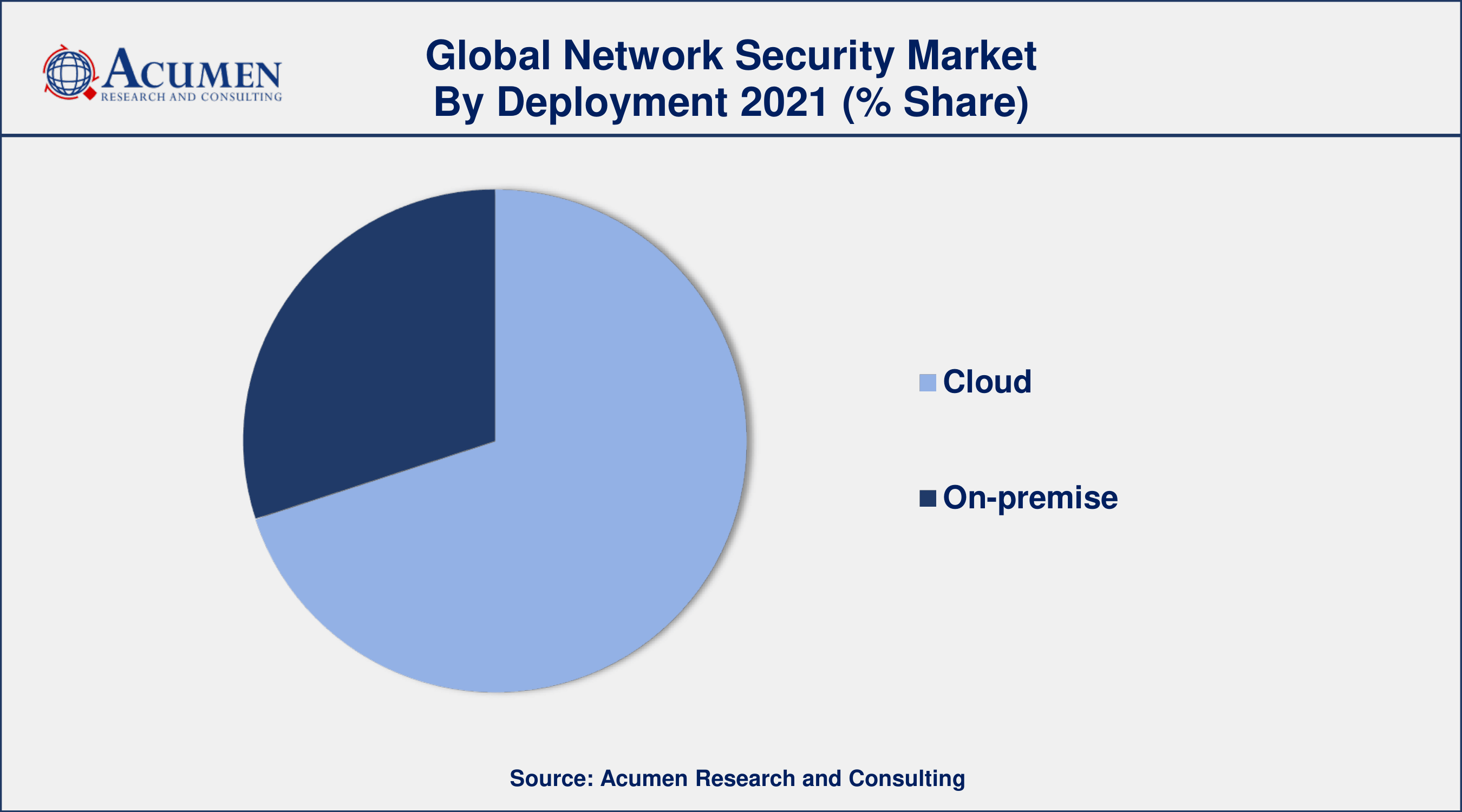

Network Security Market By Deployment

- Cloud

- On-premise

According to the network security industry analysis, the cloud deployment segment will account for the largest share of the global market. Firewall, VPN, and wireless security segments will gain significant traction in the network security market. The global network security market will be dominated by the large enterprise segment. Furthermore, the global network security market will grow at a faster rate in the BFSI, IT, and telecommunications segments.

Network Security Market By Type

- Firewalls

- VPN

- Antivirus and Anti-malware software

- Wireless Security

- Others

Based on the type, the firewall segment is expected to lead the market over the forecasting years. Firewall security is widely used across all industries, delivering the biggest revenue share. The firewall keeps track of all outgoing and inbound files to and from the IP address and authorized source, including ports & protocols.

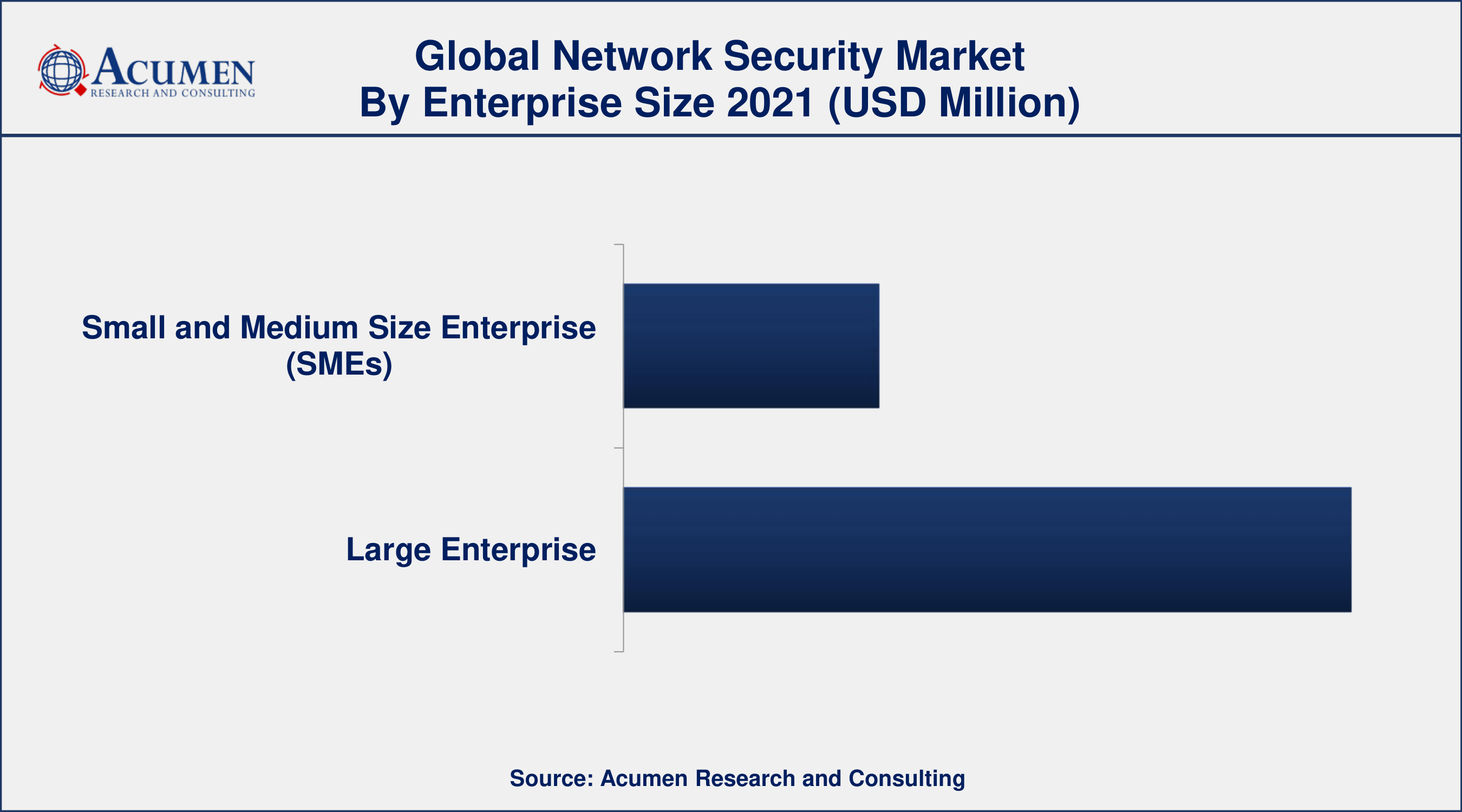

Network Security Market By Enterprise Size

- Small and Medium Size Enterprise (SMEs)

- Large Enterprise

According to the network security market forecast, the small and medium enterprises segment will develop at the fastest rate in the market over the next few years. Due to economic constraints, small and medium-sized businesses are more susceptible to cyber-attacks towards a low level of protection. Furthermore, an absence of security standards and personnel capabilities are among the essential elements causing an increase in cyber-attacks across SMEs. As a result, the increased requirement to reduce management and data breach expenses while still securing IT assets is expected to promote SME adoption.

Network Security Market By Industry

- IT and telecommunication

- Government

- BFSI

- Travel and Transportation

- Retail

- Healthcare

- Manufacturing

- Energy and Utilities

- Others

In terms of industry, the IT and telecommunications sectors are predicted to increase significantly over the next few years. Cyber telecommunication security refers to the techniques and methods used to detect, analyze, and mitigate any cyber hazards in the telecom industry. Telecom industries are still more susceptible to cyberattacks and hazardous conditions than ever before due to sensitive data. These companies rely on sensitive infrastructure, the majority of which keeps track of their customers' addresses as well as banking details.

Network Security Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America dominates; Asia-Pacific witness the highest CAGR for the network security market

North America is expected to have the largest share of the network security market. Software adoptions are highest in the United States, and top industries such as BFSI, healthcare, and retail are heavily implementing software to protect their data privacy. Furthermore, the United States is upgrading existing software, and its innovative new security techniques are having a positive impact on the network security market.

On the other hand, the Asia-Pacific network security market is expected to grow at a healthy CAGR during the forecast period. China is leading the Asia-Pacific region in market progress and investment in security software research and development. However, the government is also encouraging citizens to incorporate digitalization into their daily lives. With such widespread adoption, there is a high demand for secure networks, which boosts industry growth in India. Furthermore, the governments of several countries are enacting various security laws and policies to prevent data breaches, which stimulate network security growth in the Asia-Pacific region.

Network Security Market Players

Some of the top network security companies offered in the professional report include NortonLifeLock Inc.,(Symantec Corporation), Aerohive Networks, Sophos Limited, Brocade, Motorola Solutions, Inc., Cisco Systems Inc., Fortinet, Aruba Networks, Ruckus Networks, Honeywell International Inc., McAfee Corp., and ADT Inc.

Frequently Asked Questions

What is the size of global network security market in 2021?

The estimated value of global network security market in 2021 was accounted to be USD 31,652 Million.

What is the CAGR of global network security market during forecast period of 2022 to 2030?

The projected CAGR network security market during the analysis period of 2022 to 2030 is 11.7%.

Which are the key players operating in the market?

The prominent players of the global network security market are NortonLifeLock Inc.,(Symantec Corporation), Aerohive Networks, Sophos Limited, Brocade, Motorola Solutions, Inc., Cisco Systems Inc., Fortinet, Aruba Networks, Ruckus Networks, Honeywell International Inc., McAfee Corp., and ADT Inc.

Which region held the dominating position in the global network security market?

North America held the dominating network security during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for network security during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global network security market?

Increasing cyber threats at network point, and continuing to raise BYOD policies in the organization, drives the growth of global network security market.

By industry segment, which sub-segment held the maximum share?

Based on industry, IT and telecommunication segment is expected to hold the maximum share network security market.