Vegan Food Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Vegan Food Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

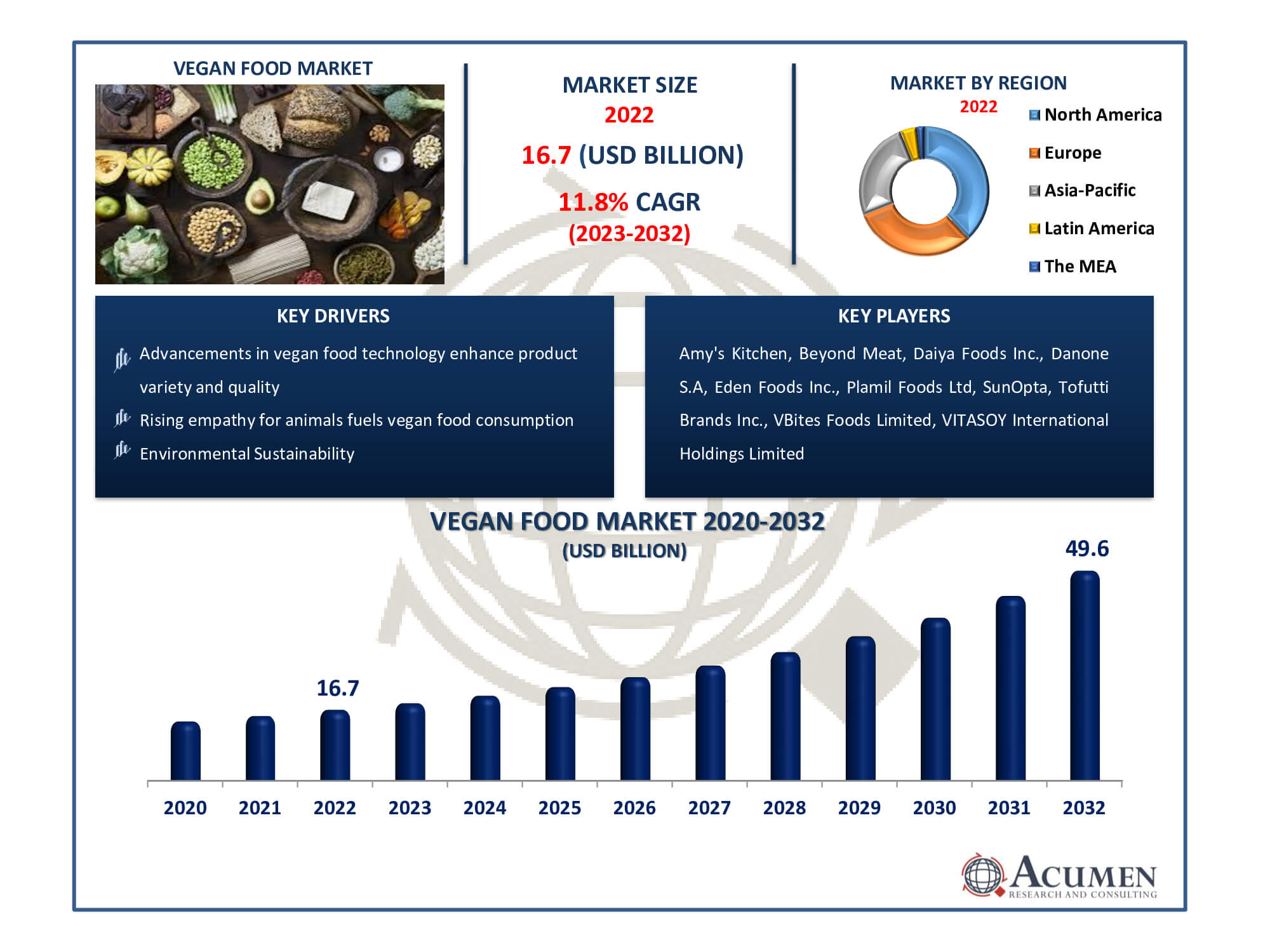

The Global Vegan Food Market Size accounted for USD 16.7 Billion in 2022 and is estimated to achieve a market size of USD 49.6 Billion by 2032 growing at a CAGR of 11.8% from 2023 to 2032.

Vegan Food Market Highlights

- Global vegan food market revenue is poised to garner USD 49.6 billion by 2032 with a CAGR of 11.8% from 2023 to 2032

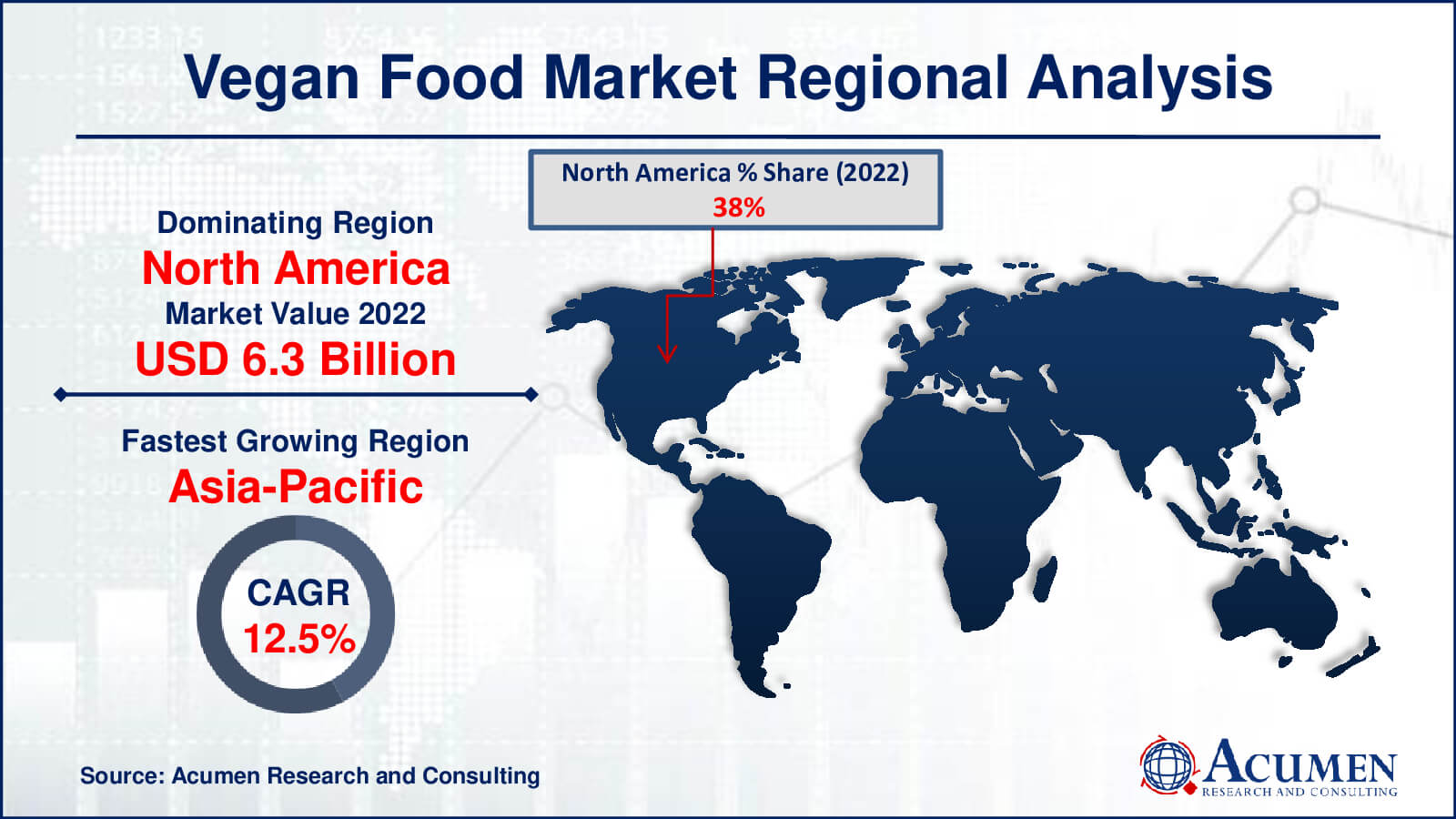

- North America vegan food market value occupied around USD 6.3 billion in 2022

- Asia-Pacific vegan food market growth will record a CAGR of more than 12.5% from 2023 to 2032

- Among product, the meat substitutes sub-segment generated over US$ 7.3 billion revenue in 2022

- Based on distribution channel, the offline sub-segment generated around 68% share in 2022

- Forming alliances with non-vegan food companies to introduce vegan product lines and reach wider audiences is a popular vegan food market trend that fuels the industry demand

Vegan relates either to an individual who eats or to the diet itself. In other words, the term vegan could serve as an adjective for the description of a food product, for example "This chicken is vegan" or "Vegans like cookies, too,” The term vegan is becoming increasingly important in the rapidly expanding vegan food business. A vast range of plant-based food items created to satisfy vegans' dietary requirements and ethical standards define this sector. The market's expansion includes a change in customer perception and tastes towards plant-based diet as well as the availability of vegan products. The phrase "vegan" is becoming more and more common as an adjective when describing food items, which is an example of the increased demand for these products. This change in language highlights the momentum in the market by reflecting the wider trend of customers actively searching out vegan solutions. The term "vegan" refers to a movement in the food industry that is revolutionizing the way we think about, produce, and consume food. This is becoming more and clearer as we dig further into the details of the vegan food market.

Global Vegan Food Market Dynamics

Market Drivers

- Growing consumer awareness of health benefits

- Rising empathy for animals fuels vegan food consumption

- Advancements in vegan food technology enhance product variety and quality

- Environmental sustainability

Market Restraints

- Perceived higher prices of some vegan items

- Navigating complex regulations and labeling standards

- Uneven distribution and awareness in certain regions

Market Opportunities

- Expanding the plant-based meat market with innovative products

- Meeting the rising demand for vegan offerings in restaurants and fast-food chains

- Providing resources to address concerns and promote balanced vegan diets

Vegan Food Market Report Coverage

| Market | Vegan Food Market |

| Vegan Food Market Size 2022 | USD 16.7 Billion |

| Vegan Food Market Forecast 2032 | USD 49.6 Billion |

| Vegan Food Market CAGR During 2023 - 2032 | 11.8% |

| Vegan Food Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amy's Kitchen, Beyond Meat, Daiya Foods Inc., Danone S.A, Eden Foods Inc., Plamil Foods Ltd, SunOpta, Tofutti Brands Inc., VBites Foods Limited, and VITASOY International Holdings Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Vegan Food Market Insights

Increased awareness of the benefits of a vegan diet plays a significant role in driving the development of the vegan food market. Notably, a substantial vegan population is concentrated in North America, Europe, and the Asia-Pacific region.

Growing concerns about animal health and cruelty in the food industry have led many individuals to switch from animal-based to plant-based diets. According to The Vegan Society, the demand for meat-free meals has seen a remarkable 987 percent increase, surpassing the popularity of gluten-free and vegetarian products threefold.

This underscores the rapid global growth of vegan products. Countries such as the United States, Australia, the United Kingdom, New Zealand, Sweden, and Canada have some of the world's largest vegan populations, as do Israel, Ireland, Austria, and Germany. In recent years, one in three Americans has either reduced meat consumption or eliminated it entirely. Sweden also saw a substantial decline in meat consumption.

Consumers in this sector have gained a better understanding of the numerous health benefits offered by plant-based food products. Plant-based items contribute to maintaining healthy blood pressure, reducing the risk of heart disease, stroke, prostate and colorectal cancer, cholesterol levels, and the likelihood of premature death.

Vegan Food Market Segmentation

The worldwide market for vegan food is split based on product, distribution channel, and geography.

Vegan Food Product

- Meat Substitutes

- Seiten

- Quorn

- Tofu

- TVP

- Others

- Dairy Alternatives

- Dessert

- Cheese

- Snacks

As per the vegan food industry analysis, the largest segment of the industry is meat substitutes due to several interconnected factors. First of all, because plant-based foods are thought to offer health advantages over meat, there is a growing global trend towards healthy eating patterns. Furthermore, there has been a notable shift towards meat replacements due to ethical concerns regarding animal welfare and the environmental impact of traditional meat production. Furthermore, products that closely resemble the flavour and texture of meat have been made possible by developments in food technology, increasing their appeal to a larger range of consumers. The adaptability of meat substitutes in many cuisines, such as burgers, sausages, and ground meat, also helps to explain why they are so popular. These elements work together to make the meat substitutes category of the vegan food market the largest.

Vegan Food Distribution Channel

- Online

- Offline

According to our vegan food market forecast, the offline segment has been the dominant distributor and is expected to maintain its dominance over the forecast period from 2023 to 2032. This category includes convenience stores, traditional brick-and-mortar shops, hypermarkets, and supermarkets, all contributing significantly to total product sales. Consumers tend to prefer in-person grocery shopping due to its ease of access and availability.

However, the highest compound annual growth rate (CAGR) anticipated due to the increasing internet penetration, driven by the widespread use of smartphones and other devices. Approximately 48% of U.S. customers are already purchasing food through online retail, and this proportion is expected to further increase. This trend has prompted major retail chains worldwide to make significant investments in expanding their online distribution channels. Walmart, a leading multinational retail company, has initiated online food delivery services.

Vegan Food Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Vegan Food Market Regional Analysis

North America leads the global vegan food market because of several reasons. First, more people in North America are focusing on their health and seeking plant-based options to stay healthy and fit, especially as lifestyle-related diseases and obesity are common challenges in the region. Second, there's a strong emphasis on animal welfare and ethics, and many North Americans choose vegan diets to address these concerns. The availability of a wide range of vegan products and continuous innovation also drives growth. North America's market is bigger, thanks to its variety of vegan options and many large food chains.

Europe is the second-largest market for vegan food, after North America. Many European countries, like Germany and the UK, have a long history of plant-based and vegetarian diets. Strict food safety laws in the European Union assure consumers of the quality of vegan products. Environmental awareness in Europe is growing, leading to increased demand for plant-based diets that are eco-friendly. Europe is a substantial market for vegan food due to its strong regulations, rising environmental consciousness, and cultural acceptance of veganism.

The vegan food market is growing fastest in the Asia-Pacific region, mainly due to the booming middle class in countries like China and India. As people in this region have more money to spend, they are becoming more health-conscious and eco-friendly. They see vegan diets as a way to improve their health and reduce their impact on the environment. Cultural factors are important too, especially in places like India where vegetarianism is common. The Asia-Pacific region's growth is powered by rising awareness, economic improvements, and cultural influences, making it the fastest-growing part of the global vegan food market.

Vegan Food Market Players

Some of the top vegan food companies offered in our report include Amy's Kitchen, Beyond Meat, Daiya Foods Inc., Danone S.A, Eden Foods Inc., Plamil Foods Ltd, SunOpta, Tofutti Brands Inc., VBites Foods Limited, and VITASOY International Holdings Limited.

Frequently Asked Questions

How big is the vegan food market?

The market size of vegan food was USD 16.7 billion in 2022.

What is the CAGR of the global vegan food market from 2023 to 2032?

The CAGR of vegan food is 11.8% during the analysis period of 2023 to 2032.

Which are the key players in the vegan food market?

The key players operating in the global market are including Amy's Kitchen, Beyond Meat, Daiya Foods Inc., Danone S.A, Eden Foods Inc., Plamil Foods Ltd, SunOpta, Tofutti Brands Inc., VBites Foods Limited, VITASOY International Holdings Limited.

Which region dominated the global vegan food market share?

North America held the dominating position in vegan food industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of vegan food during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global Vegan Food industry?

The current trends and dynamics in the vegan food industry include growing consumer awareness of health benefits, rising empathy for animals fuels vegan food consumption, advancements in vegan food technology enhance product variety and quality, and environmental sustainability.

Which product held the maximum share in 2022?

The meat substitutes product held the maximum share of the vegan food industry.