Ultrasonic Metal Welding Machines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Ultrasonic Metal Welding Machines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

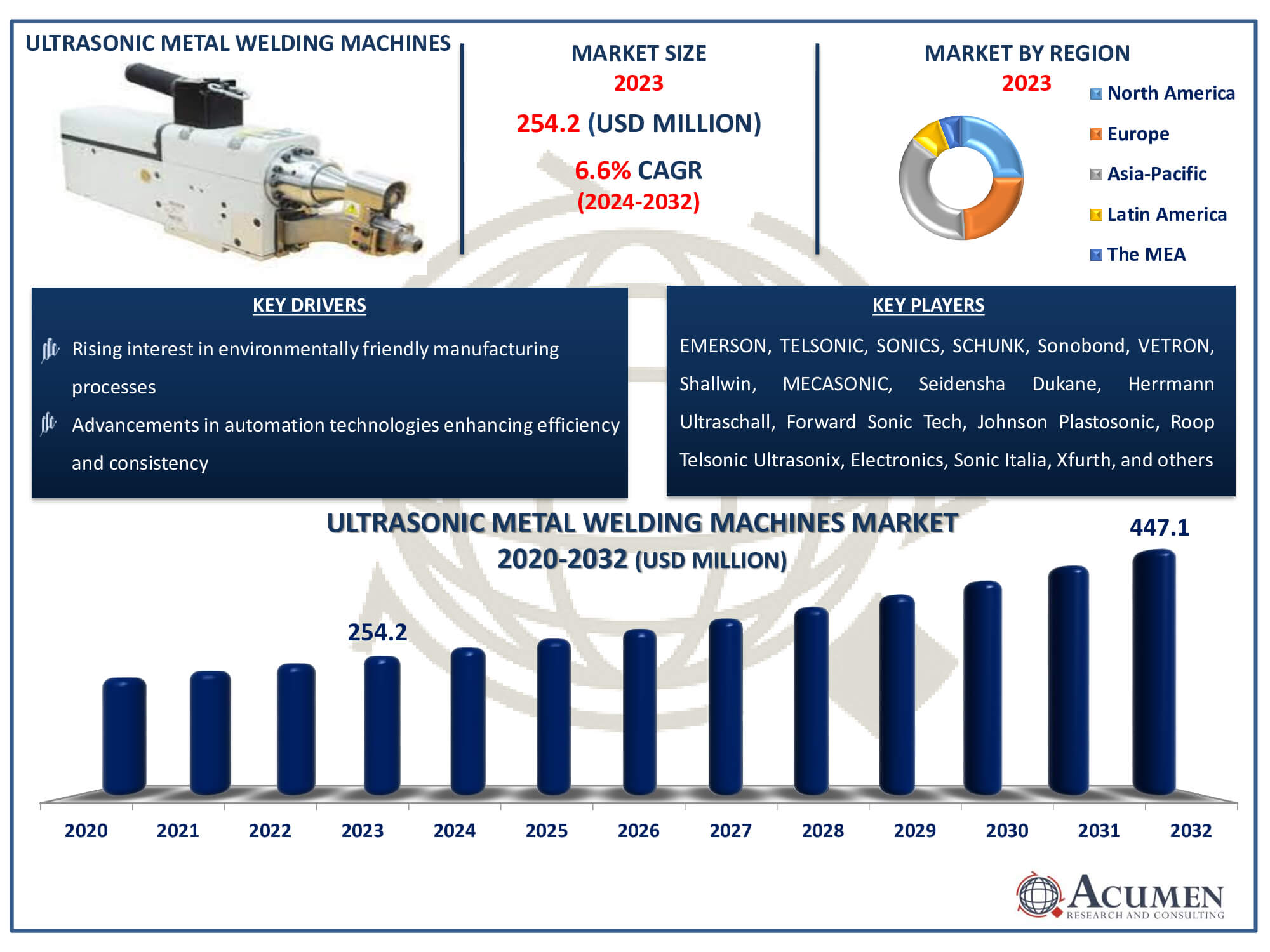

Request Sample Report

The Ultrasonic Metal Welding Machines Market Size accounted for USD 254.2 Million in 2023 and is estimated to achieve a market size of USD 447.1 Million by 2032 growing at a CAGR of 6.6% from 2024 to 2032.

Ultrasonic Metal Welding Machines Market Highlights

- Global ultrasonic metal welding machines market revenue is poised to garner USD 447.1 million by 2032 with a CAGR of 6.6% from 2024 to 2032

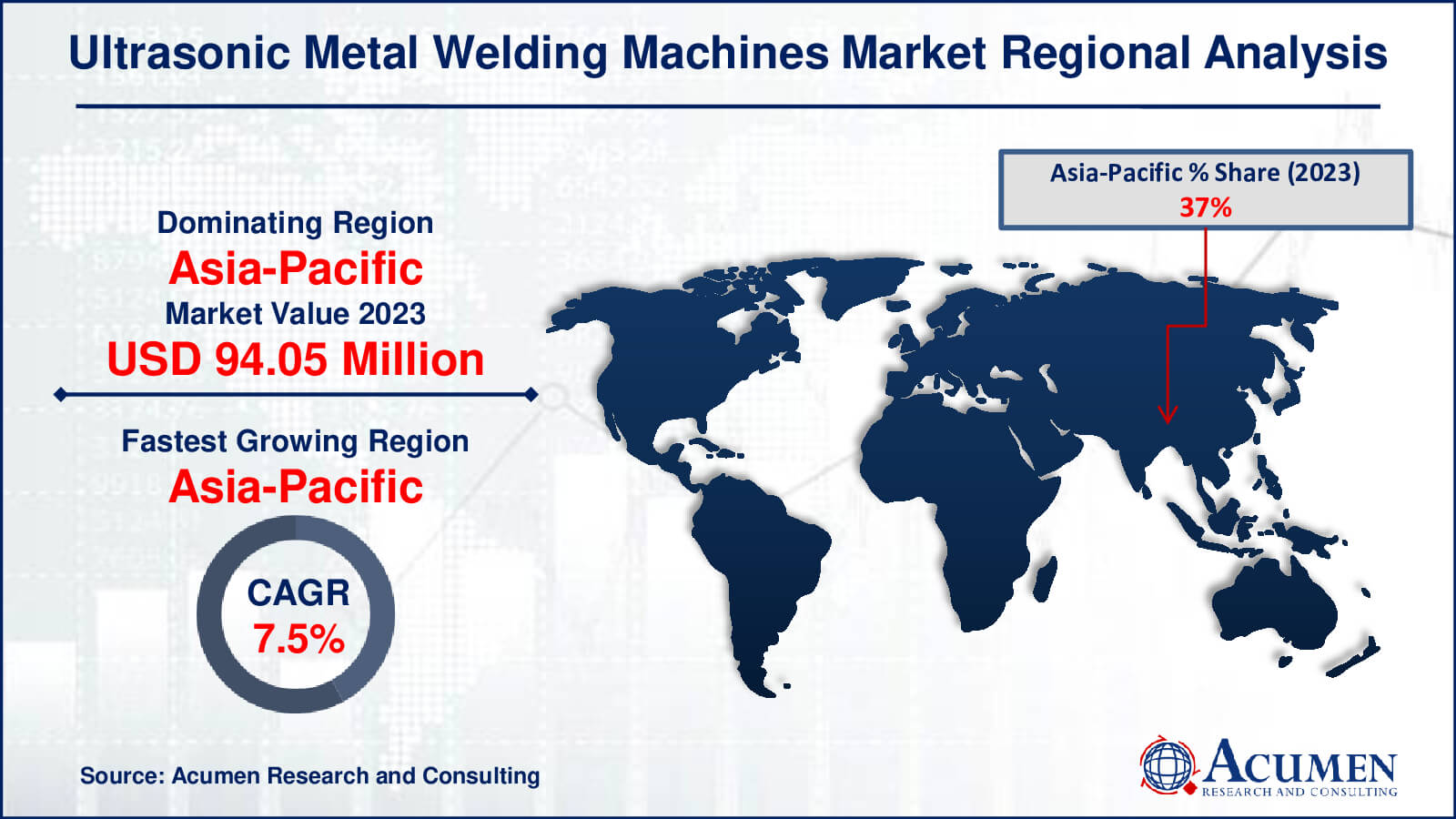

- Asia-Pacific ultrasonic metal welding machines market value occupied around USD 94 million in 2023

- Asia-Pacific ultrasonic metal welding machines market growth will record a CAGR of 7.5% from 2024 to 2032

- Among product type, the spot ultrasonic metal welder sub-segment gathered significant revenue in 2023

- Based on application, the automotive and aerospace sub-segment occupied noteworthy market share in 2023

- Integration of AI and robotics to enhance precision and efficiency in ultrasonic metal welding machines is a popular ultrasonic metal welding machines market trend that fuels the industry demand

Ultrasonic metal welding machines are specialized equipment that use ultrasonic vibrations to combine metal components. These machines use a sonotrode, which generates ultrasonic energy at frequencies ranging from 20 to 70 kHz. When the sonotrode is put on the metal parts to be welded, the ultrasonic energy causes quick, localized friction at the materials' interface. Friction generates heat, softening and bonding the metals without totally melting them. The procedure is quick, typically taking only seconds, and results in strong, high-quality welds without the need for extra materials such as solder or flux.

The fundamental advantage of ultrasonic metal welding is its ability to combine different metals and delicate or thin materials without causing damage. This makes it especially useful in areas like electronics, automotive, and aerospace, where precision and dependability are essential. Welding electrical contacts, battery tabs, and wire terminations are some of the most popular applications. The procedure is also eco-friendly, as it generates no hazardous emissions or trash. Furthermore, ultrasonic welding is extremely reproducible and easily automated, making it ideal for high-volume manufacturing operations.

Global Ultrasonic Metal Welding Machines Market Dynamics

Market Drivers

- Growing demand for lightweight, high-strength components in automotive and aerospace industries

- Increased adoption in electronics for precise, reliable connections without thermal damage

- Rising interest in environmentally friendly manufacturing processes

- Advancements in automation technologies enhancing efficiency and consistency

Market Restraints

- High initial investment and maintenance costs

- Limited applicability to thicker or bulkier metal parts

- Technical complexity requiring skilled operators

Market Opportunities

- Expanding use in emerging renewable energy sectors, like solar panel assembly

- Development of new ultrasonic welding techniques for diverse material combinations

- Integration with Industry 4.0 for enhanced process monitoring and control

Ultrasonic Metal Welding Machines Market Report Coverage

| Market | Ultrasonic Metal Welding Machines Market |

| Ultrasonic Metal Welding Machines Market Size 2022 | USD 254.2 Million |

| Ultrasonic Metal Welding Machines Market Forecast 2032 | USD 447.1 Million |

| Ultrasonic Metal Welding Machines Market CAGR During 2023 - 2032 | 6.6% |

| Ultrasonic Metal Welding Machines Market Analysis Period | 2020 - 2032 |

| Ultrasonic Metal Welding Machines Market Base Year |

2022 |

| Ultrasonic Metal Welding Machines Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ALPHR Technology, Dukane, Emerson, Forward Sonic Tech, Herrmann Ultraschall, Johnson Plastosonic, MECASONIC, Roop Telsonic Ultrasonix, SCHUNK, Seidensha Electronics, Shallwin Power System, Sonic Italia, Sonics & Materials, Sonobond Ultrasonics, and TELSONIC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ultrasonic Metal Welding Machines Market Insights

The market for ultrasonic metal welding equipment is expanding rapidly, driven by rising demand for innovative production technologies across a variety of industries. The automobile and aerospace industries, in particular, are important drivers of this trend, as they require lightweight, high-strength components that ultrasonic welding can easily create. This technology provides a non-destructive way to combine incompatible metals and sensitive materials, which is essential for developing high-performance, dependable products. Furthermore, the electronics industry benefits from ultrasonic welding's ability to form accurate, strong connections without producing excessive heat, safeguarding the integrity of sensitive components.

However, the market confronts a number of hurdles that could impede its expansion. Small and medium-sized businesses may find ultrasonic metal welding devices prohibitively expensive due to their high initial investment and continuous maintenance costs. Furthermore, the technology's intricacy needs competent operators, which might be an impediment in areas with low technical expertise. The machines are also less effective in welding bigger or heavier metal parts, limiting their use in specific manufacturing processes. Despite these restrictions, current research and development initiatives attempt to overcome them, potentially expanding the market's reach.

Opportunities abound in the ultrasonic metal welding machine market, particularly with the growth of renewable energy sectors such as solar and wind power. These sectors demand strong, long-lasting connections for components such as solar panel assembly, where ultrasonic welding is particularly useful. Furthermore, advances in ultrasonic welding processes are creating new opportunities for combining varied material combinations, increasing the technology's application. The incorporation of Industry 4.0 technologies, such as IoT and data analytics, into ultrasonic welding systems is also expected to improve process monitoring, control, and efficiency, giving manufacturers more reliable and simplified operations.

Ultrasonic Metal Welding Machines Market Segmentation

The worldwide market for ultrasonic metal welding machines is split based on product type, application, and geography.

Ultrasonic Metal Welding Machine Market By Type

- Seam Ultrasonic Metal Welder

- Spot Ultrasonic Metal Welder

- Tube Sealer Ultrasonic Metal Welder

- Wire Splicing Ultrasonic Metal Welder

According to the ultrasonic metal welding machines industry analysis, spot ultrasonic metal welders led the market due to their adaptability and widespread applicability in a variety of industries. These welders are especially popular in the automotive and electronics industries because they are effective at attaching small components and fragile materials without inflicting thermal damage. Their ability to quickly and neatly form strong, reliable joints makes them an indispensable tool in high-volume industrial situations, contributing to their market dominance.

Ultrasonic Metal Welding Machines Market By Application

- Electronics

- Aerospace & Automotive

- Life Sciences & Medical

- Battery

- Packaging

- Others

As per the ultrasonic metal welding machines market forecast, the automotive and aerospace industries will lead the market due to rising demand for lightweight, high-strength materials and the requirement for precise, dependable welding procedures. These sectors greatly benefit from ultrasonic welding technology, which produces strong, clean, and uniform welds without using excessive heat or additional materials. This makes it excellent for applications such as welding battery tabs in electric vehicles, combining delicate electronic components, and building strong aerospace assemblies. These sectors' market domination is driven by the vital need for efficiency, safety, and performance.

Ultrasonic Metal Welding Machines Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ultrasonic Metal Welding Machines Market Regional Analysis

The market for ultrasonic metal welding machines varies significantly by region, with North America leading due to its powerful automotive and aerospace industries. The region benefits from strong R&D activities, rapid adoption of new manufacturing technologies, and the presence of key market players such as Emerson and Dukane. The United States, in particular, promotes market growth through its emphasis on electric car production and the incorporation of new welding solutions into a variety of industrial applications. Additionally, supporting government policies and investments in manufacturing infrastructure help to drive market expansion in North America.

The market in Asia-Pacific is rising significantly, primarily to the expansion of the automotive, electronics, and renewable energy industries in countries such as China, Japan, and Korea. The region's large-scale production capabilities, combined with increased expenditures in high-tech manufacturing facilities, help to drive wider adoption of ultrasonic welding machines. China, as a key manufacturing hub, is critical, with a high need for welding solutions in battery production for electric vehicles and consumer electronics. Furthermore, favorable government measures to promote industrial automation and technical improvements in manufacturing processes are projected to drive market expansion in Asia-Pacific.

Ultrasonic Metal Welding Machines Market Players

Some of the top ultrasonic metal welding machines companies offered in our report include ALPHR Technology, Dukane, Emerson, Forward Sonic Tech, Herrmann Ultraschall, Johnson Plastosonic, MECASONIC, Roop Telsonic Ultrasonix, SCHUNK, Seidensha Electronics, Shallwin Power System, Sonic Italia, Sonics & Materials, Sonobond Ultrasonics, and TELSONIC.

Frequently Asked Questions

How big is the ultrasonic metal welding machines market?

The ultrasonic metal welding machines market size was valued at USD 254.2 million in 2023.

What is the CAGR of the global ultrasonic metal welding machines market from 2024 to 2032?

The CAGR of ultrasonic metal welding machines industry is 6.6% during the analysis period of 2024 to 2032.

Which are the key players in the ultrasonic metal welding machines market?

The key players operating in the global market are including ALPHR Technology, Dukane, Emerson, Forward Sonic Tech, Herrmann Ultraschall, Johnson Plastosonic, MECASONIC, Roop Telsonic Ultrasonix, SCHUNK, Seidensha Electronics, Shallwin Power System, Sonic Italia, Sonics & Materials, Sonobond Ultrasonics, and TELSONIC.

Which region dominated the global ultrasonic metal welding machines market share?

North America held the dominating position in ultrasonic metal welding machines industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ultrasonic metal welding machines during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global ultrasonic metal welding machines industry?

The current trends and dynamics in the ultrasonic metal welding machines market include growing demand for lightweight, high-strength components in automotive and aerospace industries, increased adoption in electronics for precise, reliable connections without thermal damage, and rising interest in environmentally friendly manufacturing processes.

Which type held the maximum share in 2023?

The spot ultrasonic metal welders held the maximum share of the ultrasonic metal welding machines industry.