Ultra-Thin Glass Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Ultra-Thin Glass Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

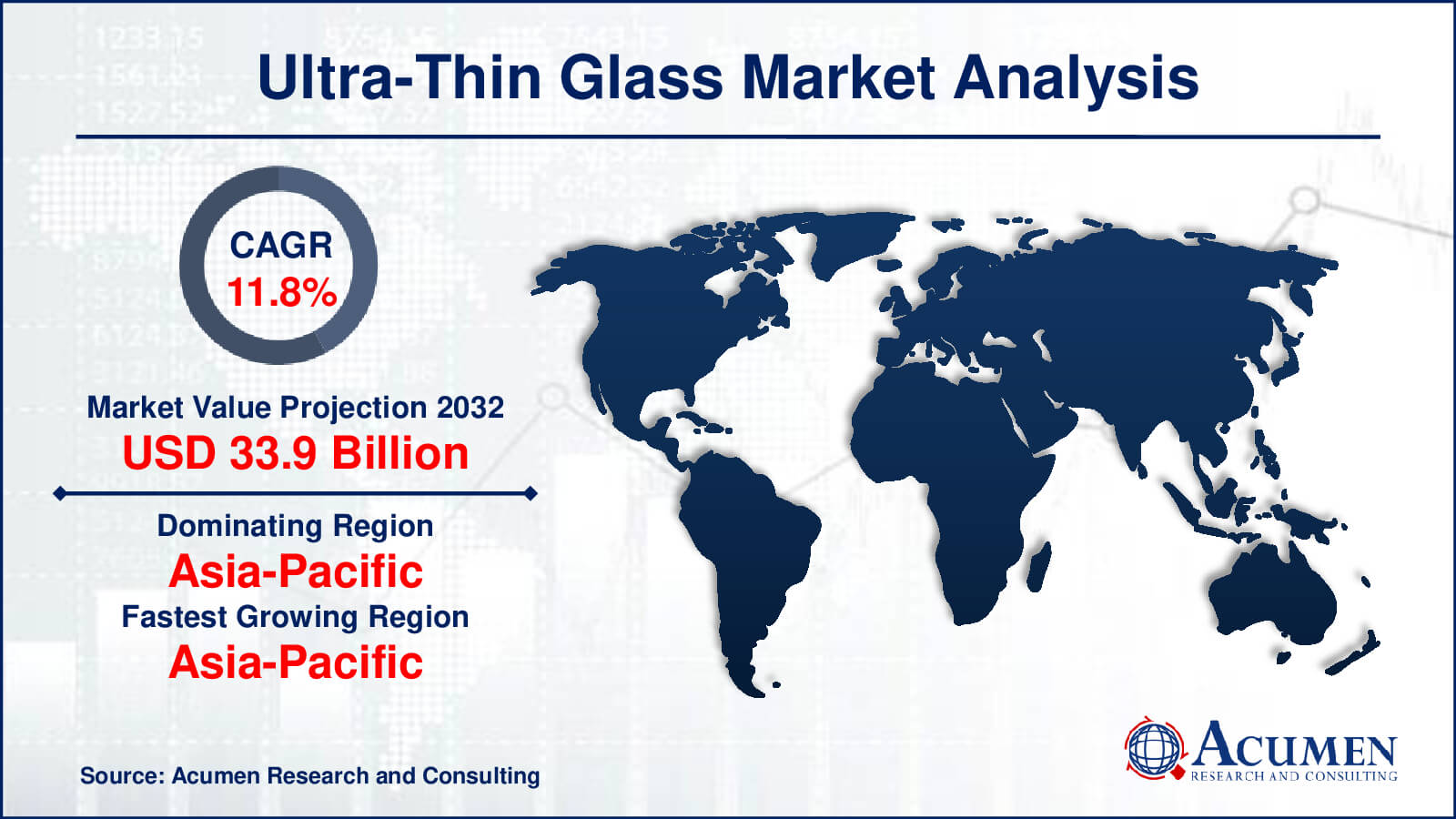

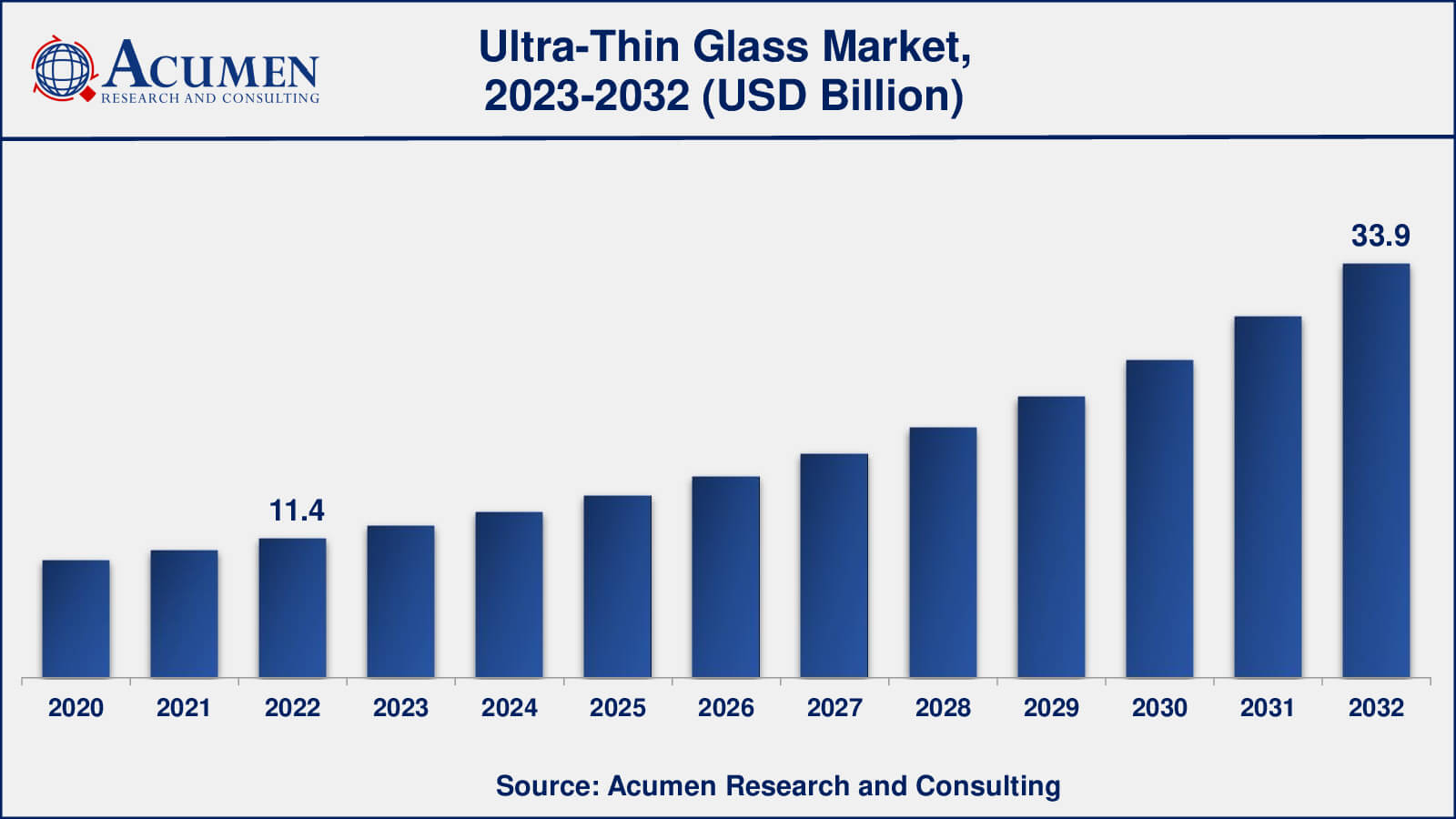

The global Ultra-Thin Glass Market gathered USD 11.4 Billion in 2022 and is expected to reach USD 33.9 Billion by 2032, growing at a CAGR of 11.8% from 2023 to 2032.

Ultra-Thin Glass Market Highlights

- The global ultra-thin glass market is poised to achieve a revenue of USD 33.9 billion by 2032, experiencing a CAGR of 11.8% from 2023 to 2032

- In 2022, the Asia-Pacific ultra-thin glass market held a value of approximately USD 5 billion

- The Asia-Pacific ultra-thin glass market is expected to witness substantial growth, with a projected CAGR of over 12% from 2023 to 2032

- Among thickness, the 0.1mm-0.5mm sub-segment accounted for revenue exceeding USD 6 billion in 2022

- In terms of manufacturing, the fusion sub-segment claimed a significant share, surpassing 60% in 2022

- Sustainable and recyclable glass solutions is one of the notable ultra-thin glass market trends

Ultra-thin glass is a specialized Thickness of glass known for its remarkable thinness and flexibility. It is typically produced from raw materials like silica sand powder, soda ash, and dolomite. The manufacturing process involves melting these materials in high-temperature furnaces, and the resulting molten glass is carefully spread onto a bath of molten tin, where it forms an extremely thin sheet.

Afterward, the glass undergoes controlled cooling and treatment processes to achieve the desired thickness, flatness, and strength. Once produced, ultra-thin glass can be customized for various applications, including electronic displays, solar panels, architectural glazing, automotive components, and more. It offers advantages such as lightweight design and excellent transparency, making it valuable in industries requiring thin and durable glass materials.

Global Ultra-Thin Glass Market Dynamics

Market Drivers

- Growing demand for lightweight and flexible electronic devices

- Increasing adoption of OLED displays in smartphones and TVs

- Expanding use in solar panels and energy-efficient building materials

- Advancements in manufacturing technologies for thinner glass

Market Restraints

- High production costs associated with ultra-thin glass

- Fragility and susceptibility to breakage

- Limited applications due to thickness constraints

- Intense competition from alternative materials

Market Opportunities

- Emerging applications in foldable and rollable displays

- Demand for high-transparency glass in automotive HUDs and AR/VR devices

- Collaborations and innovations in glass processing techniques

Ultra-Thin Glass Market Report Coverage

| Market | Ultra-Thin Glass Market |

| Ultra-Thin Glass Market Size 2022 | USD 11.4 Billion |

| Ultra-Thin Glass Market Forecast 2032 | USD 33.9 Billion |

| Ultra-Thin Glass Market CAGR During 2023 - 2032 | 11.8% |

| Ultra-Thin Glass Market Analysis Period | 2020 - 2032 |

| Ultra-Thin Glass Market Base Year |

2022 |

| Ultra-Thin Glass Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Thickness, By Manufacturing, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AEON Industries, Air-Craftglass, Asahi Glass, Aviation Glass & Technology BV., Central Glass, Changzhou Almaden, Corning, CSG Holding, Emerge Glass, Luoyang Glass, Nippon Electric Glass, Nippon Sheet Glass, Nittobo, SCHOTT, Suzhou Huadong Coating Glass, and Xinyi Glass. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ultra-Thin Glass Market Insights

The global ultra-thin glass market has experienced significant growth in recent years. Key factors driving this growth include the increased use of lightweight materials across industries and growing demand from the electrical and electronic sectors. Additionally, the rising adoption of ultra-thin glass in solar and healthcare products is expected to further boost market growth during the forecast period.

Ultra-thin glass plays a critical role in the electronics industry due to its properties such as abrasion and corrosion resistance, flexibility, gas barrier capability, surface smoothness, and transparency. These properties make it suitable for use in touch and display panels, electronic and optical sensors, energy storage devices, semiconductors, and organic electronics, including Fusion and moisture barriers.

The growing demand for electronic devices like LCDs, LEDs, OLEDs, smartphones, monitors, and laptops is likely to drive the utilization of flat display panels. For instance, in July 2018, Xiaomi launched a new smartphone called Hongmi Note 5 in South Korea, utilizing tempered ultra-thin glass with a thickness of 0.3 mm. This move expanded the company's presence in South Korea.

In addition to smartphones, smartwatches have gained popularity and are capturing an increasing share of the wearables industry. In 2018, smartwatch shipments for companies like Apple, Fitbit, Samsung, and Garmin reached 22.5 million units, 5.5 million units, 5.3 million units, and 3.2 million units, respectively. Therefore, the increased production of smartphones and smartwatches is expected to drive the growth of the ultra-thin glass industry.

Ultra-Thin Glass Market Segmentation

The worldwide market for ultra-thin glass is split based on thickness, manufacturing, application, end-use industry, and geography.

Ultra-Thin Glass Thickness

- <0.1mm

- 0.1mm-0.5mm

- 0.5mm-1.0mm

In the context of the ultra-thin glass industry analysis, typically, the category that falls within the range of 0.1mm to 0.5mm thickness dominates. These materials, often used in various industries, display a degree of versatility due to their flexibility and manageable thickness. The applications of materials within this range can vary considerably, from glass and plastics to metals, with each serving specific purposes depending on their properties and durability.

Materials in this thickness range find their way into common uses such as windows, protective coverings, or decorative panels, particularly in the case of glass. For metal sheets, this thickness range may be employed in crafting, light construction, or as a base material for various manufacturing processes. The strength and durability of materials within this range can differ, requiring additional treatments or coatings to enhance their properties and make them suitable for specific applications.

Ultra-Thin Glass Manufacturing

- Float

- Fusion

- Others

The float manufacturing process is widely used by manufacturers and is one of the leading manufacturing in ultra-thin glass market as of 2022. Float glass is manufactured using a melt process, where recycled glass, silica sand, lime, potash, and soda are melted in a furnace and then floated onto a bed of molten tin. The molten mass solidifies slowly as it flows over the bed of molten tin, after which it is annealed to remove stresses induced during the cooling process. Annealing also allows the glass to reach a more stable state, resulting in a higher density and higher refractive index.

Tinted float glasses are made by adding coloring agents during the melting process. Common colors include grey and bronze tints made from iron, cobalt, and selenium, green tints made with iron, and blue tints made from cobalt and iron. While tinting may provide aesthetic alternatives to clear glass, tinted glasses also offer materials with different properties, including heat and light transmission (and/or reflectance), ultraviolet transmission, and insulation properties.

Ultra-Thin Glass Applications

- Semiconductor Substrate

- Touch Panel Displays

- Fingerprint Sensors

- Automotive Glazing

- Others

As per the ultrathin glass market analysis, flat panel displays dominated the application segment in the year 2022 and are projected to maintain their dominance over the forecast period. This segment is primarily driven by the increasing demand from consumer electronics, such as LEDs and LCDs. TV panel makers are making significant investments in large-size screens. In December 2017, BOE Technology Cluster Co., Ltd., a Chinese electronic components producer, expanded its 10.5 TFT-LCD assembly line to include 65-inch and 75-inch displays in Hefei, Anhui province, China. This expansion is expected to boost product utilization over the coming years.

Ultra-Thin Glass End-Use Industries

- Consumer Electronics

- Automotive & Transportation

- Medical & Healthcare

- Others

According to the ultra-thin glass market forecast, consumer electronics represent a dynamic and rapidly evolving sector within the technology industry. This segment encompasses a wide range of electronic devices designed for personal use and entertainment, including smartphones, televisions, laptops, tablets, gaming consoles, audio systems, and more. Consumer electronics have become an integral part of modern life, with constant innovations and advancements driving consumer demand. Key factors driving this industry include the ever-increasing demand for connectivity, portability, and enhanced features in electronic devices. Consumers expect not only high performance but also sleek designs and user-friendly interfaces, which have led manufacturers to continually push the boundaries of technology

Ultra-Thin Glass Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ultra-Thin Glass Market Regional Analysis

The Asia-Pacific region accounted for a significant market share in the global ultrathin glass market, and it is expected to maintain its dominance over the forecast period. Several major factors contribute to this growth, including increased demand from end-user industries such as consumer electronics, automotive, and biotechnology in rising economies of the Asia-Pacific, including China, Japan, and South Korea. There is also a rising demand for flat panel displays, particularly in China, India, and South Korea.

China, in particular, holds nearly 50% of the world's flat panel display fabrication plants, followed by South Korea. Large LED and LED manufacturing firms are expanding into these countries to meet the growing demand from customers.

Ultra-Thin Glass Market Players

Some of the top ultra-thin glass companies offered in our report includes AEON Industries, Air-Craftglass, Asahi Glass, Aviation Glass & Technology BV., Central Glass, Changzhou Almaden, Corning, CSG Holding, Emerge Glass, Luoyang Glass, Nippon Electric Glass, Nippon Sheet Glass, Nittobo, SCHOTT, Suzhou Huadong Coating Glass, and Xinyi Glass.

Frequently Asked Questions

What was the size of the global ultra-thin glass market in 2022?

The size of ultra-thin glass market was USD 11.4 billion in 2022.

What is the ultra-thin glass market CAGR from 2023 to 2032?

The ultra-thin glass market CAGR during the analysis period of 2023 to 2032 is 11.8%.

Which are the key players in the ultra-thin glass market?

The key players operating in the global ultra-thin glass market are AEON Industries, Air-Craftglass, Asahi Glass, Aviation Glass & Technology BV., Central Glass, Changzhou Almaden, Corning, CSG Holding, Emerge Glass, Luoyang Glass, Nippon Electric Glass, Nippon Sheet Glass, Nittobo, SCHOTT, Suzhou Huadong Coating Glass, and Xinyi Glass.

Which region dominated the global ultra-thin glass market share?

Asia-Pacific region held the dominating position in ultra-thin glass industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ultra-thin glass during the analysis period of 2023 to 2032.

What are the current trends in the global ultra-thin glass industry?

The current trends and dynamics in the ultra-thin glass industry include growing demand for lightweight and flexible electronic devices, increasing adoption of OLED displays in smartphones and TVs, and expanding use in solar panels and energy-efficient building materials.

Which material held the maximum share in 2022?

The 0.1mm-0.5mm held the maximum share of the ultra-thin glass industry.