Tubeless Insulin Pump Market | Acumen Research and Consulting

Tubeless Insulin Pump Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

The Global Tubeless Insulin Pump Market size was accounted for USD 1,066 Million in 2021 and is estimated to reach the market value of USD 6,027 Million by 2030, growing at a CAGR of 21.7% from 2022 to 2030.

The tubeless insulin pump market is expanding as a result of factors such as technical advances in tubeless insulin pumps, an increasing number of diabetes patients, and injuries and diseases caused by conventional invasive insulin pumps. Over the forecast period, progressions in insulin pump technologies to reduce the need for regular insulin infusion doses are supposed to drive the tubeless insulin pump market growth.

A tubeless insulin pump is a diagnostic tool used to help control blood glucose levels. These are almost entirely used to reduce the occurrence of intravenous injections. It comes with the standard pod/patch, remote, and equipment like battery systems and storage tanks. They are widely used in a variety of end-use industries, including healthcare institutions, pharmacies, home care settings, and e-commerce. Furthermore, to avoid frequent injections, a significant portion of diabetes patients use these insulin pumps for disease prevention. Tubeless insulin pods or patches provide an effective, less intrusive alternative to the existing devices, with benefits such as ease of use and reduced infection risk, which are supposed to propel product adoption. Further to that, these transversal patches are less painful and more comfortable, allowing patients to manage their diabetes while staying active.

Tubeless Insulin Pump Market Dynamics

Drivers

- Increasing prevalence of diabetes

- Diabetes care is becoming more expensive

- Long-term consequences of traditional and invasive insulin pumps

- Technological advancements in tubeless insulin pumps

Restraints

- The long-term costs of the tubeless insulin pump are high

- Stringent government regulations

Opportunity

- Increase in the geriatric and diabetic populations

- Increasing Implementation of Facilitative Initiatives

Report Coverage

| Market | Tubeless Insulin Pump Market |

| Market Size 2021 | USD 1,066 Million |

| Market Forecast 2030 | USD 6,027 Million |

| CAGR During 2022 - 2030 | 21.7% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Component, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Corporation, Abbott Diabetes Care, Spring Health Solution Ltd., Tandem Diabetes Care, Johnson and Johnson, Roche Holding AG, Medtrum Technologies Inc., Medtronic Plc., Debiotech, CeQur SA, and Cellnovo Group SA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The tubeless insulin pump market has expanded due to a deliberate and consistent shift in patient preference away from traditional insulin delivery equipment and toward newer and portable devices with automated and integrated pump advanced technologies. In a number of developed countries, most notably Europe and North America, discrete insulin delivery systems have entered the market and are expected to gain traction in the coming years. Furthermore, the addition of smart glucose meters to all of these devices has improved the user experience in the tubeless insulin pump market. When introducing new products in the tubeless insulin pump market, medical equipment manufacturers are increasingly focusing on patient comfortability.

The widespread use of connected and smart diabetes treatment systems in the coming years will elevate patients' performance standards even higher. It will then be necessary to make these devices more secure. The tubeless insulin pump market trend has seen a growing number of innovative product launches in recent years. Many medical device companies appear to have benefited from a user-centered design approach in tubeless technology solutions. In the future, glucose-responsive insulin techniques will pave the way for cutting-edge technology solutions in the tubeless insulin pump industry.

Tubeless Insulin Pump Market Segmentation

The global tubeless insulin pump market segmentation is based on the component, end-use and geographical region.

Market by Component

- Pod/Patch

- Remote

- Others

Based on the components, the Pod/patch segment held the largest market share in 2021 and is expected to grow significantly over the projected period. Pod is a disposable, lightweight vessel that can be placed anywhere on the patient's body and can hold three to four days of continuous insulin administration. However, patients prefer pods due to their lightweight, compact size, and reliability, which is driving the segment growth. Demand for tubeless insulin pumps will increase in the coming years as pod quantity and functionality improve with patients. The constant need to replace a transmitter drives up demand for these instruments. Process improvement will hasten the development of remote control that can regulate pump functions from a distance in the coming years.

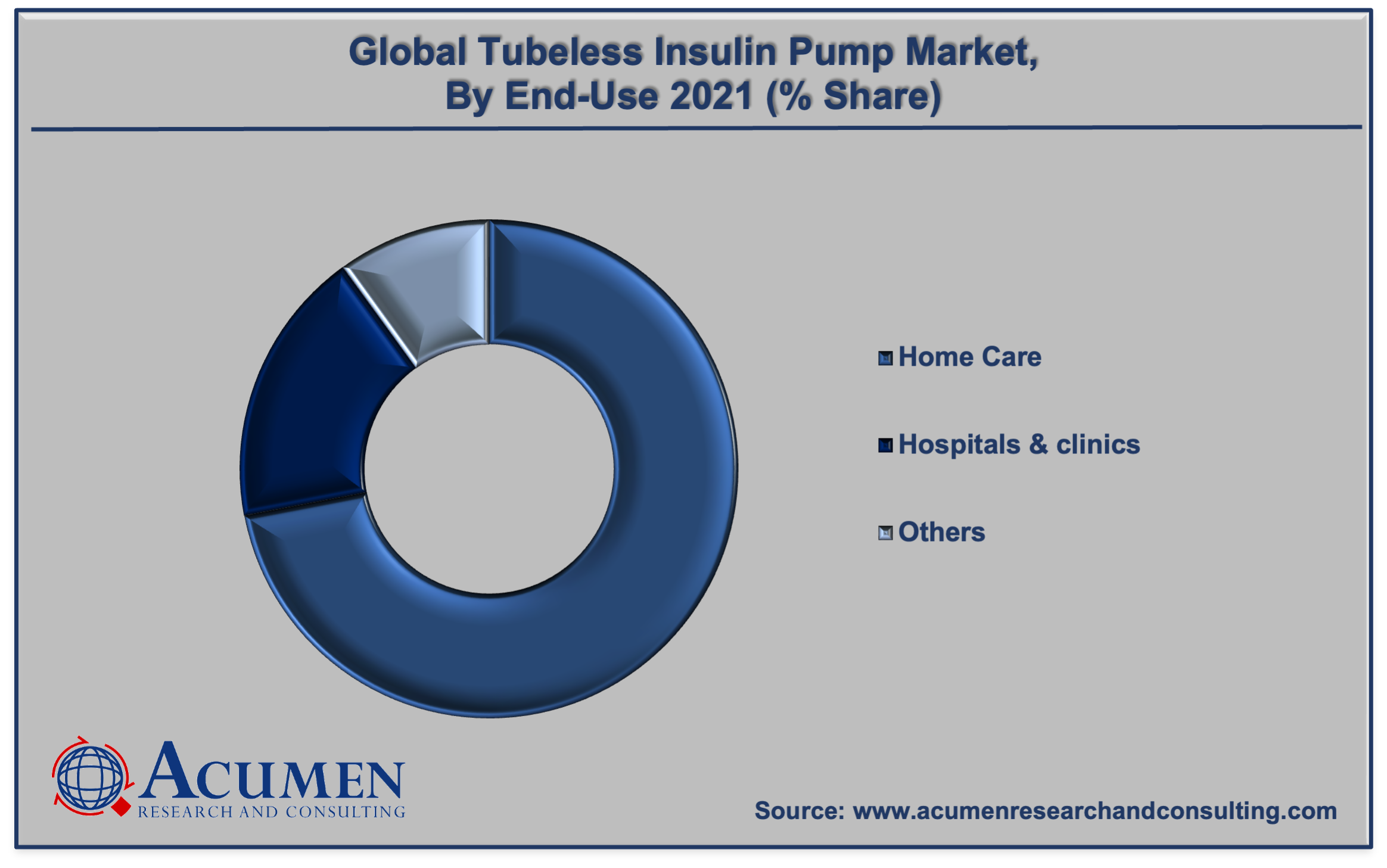

Market by End-use

- Home Care

- Hospitals & Clinics

- Others

According to the tubeless insulin pump market forecast, the homecare segment is projected to expand significantly in the coming years. This expansion can be attributed to rapid progress in in-home care settings, increased disposable income, and rising adoption of such devices in in-home care settings. Recent technological advancements and the incorporation of novel methodologies have resulted in the creation of user-friendly, novel, and more convenient devices. The incorporation of automation technology has increased the widespread adoption of these devices because they are self-managing, improve the customer experience, and optimize patient involvement. As a result, the introduction of sophisticated solutions to improve the patient experience while remaining simple to use is expected to drive product demand in-home care settings.

Tubeless Insulin Pump Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

The North America region is expected to hold the majority of tubeless insulin pump market shares due to advancements in diabetic management solutions and an increase in diabetes cases in the region. In addition, the market for tubeless insulin pumps in the United States is estimated to expand significantly in the coming years. Working experts are increasingly using insulin pumps to provide a simple, lightweight, and convenient insulin administration structure. Moreover, a number of government approaches and information sessions held across the region have stimulated regional tubeless insulin pump market companies to introduce effective and innovative diabetes management and treatment equipment. This increased device penetration, along with growing developments, a preference for advanced home care settings, and an increase in the number of manufacturers and suppliers, will drive pump consumption throughout the region.

Tubeless Insulin Pump Market Players

Some of the prominent global tubeless insulin pump market companies are Insulet Corporation, Abbott Diabetes Care, Spring Health Solution Ltd., Tandem Diabetes Care, Johnson and Johnson, Roche Holding AG, Medtrum Technologies Inc., Medtronic Plc., Debiotech, CeQur SA, and Cellnovo Group SA.

Frequently Asked Questions

What was the market size of global tubeless insulin pump market in 2021?

The global tubeless insulin pump market size was valued to be USD 1,066 Million in 2021.

What will be the projected CAGR for global tubeless insulin pump market during forecast period of 2022 to 2030?

The projected CAGR of tubeless insulin pump during the analysis period of 2022 to 2030 is 21.7%.

Which are the prominent competitors operating in the market?

The prominent players of the global tubeless insulin pump market involve Insulet Corporation, Abbott Diabetes Care, Spring Health Solution Ltd., Tandem Diabetes Care, Johnson and Johnson, Roche Holding AG, Medtrum Technologies Inc., Medtronic Plc., Debiotech, CeQur SA, and Cellnovo Group SA.

Which region held the dominating position in the global tubeless insulin pump market?

North America held the dominating share for tubeless insulin pump during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for tubeless insulin pump during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global tubeless insulin pump market?

Increasing prevalence of diabetes, technological advancements in tubeless insulin pumps and long-term consequences of traditional and invasive insulin pumps are the prominent factors that fuel the growth of global tubeless insulin pump market.

By segment component, which sub-segment held the maximum share?

Based on component, pod/patch segment held the maximum share for tubeless insulin pump market in 2021.