Track and Trace Solutions Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Track and Trace Solutions Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

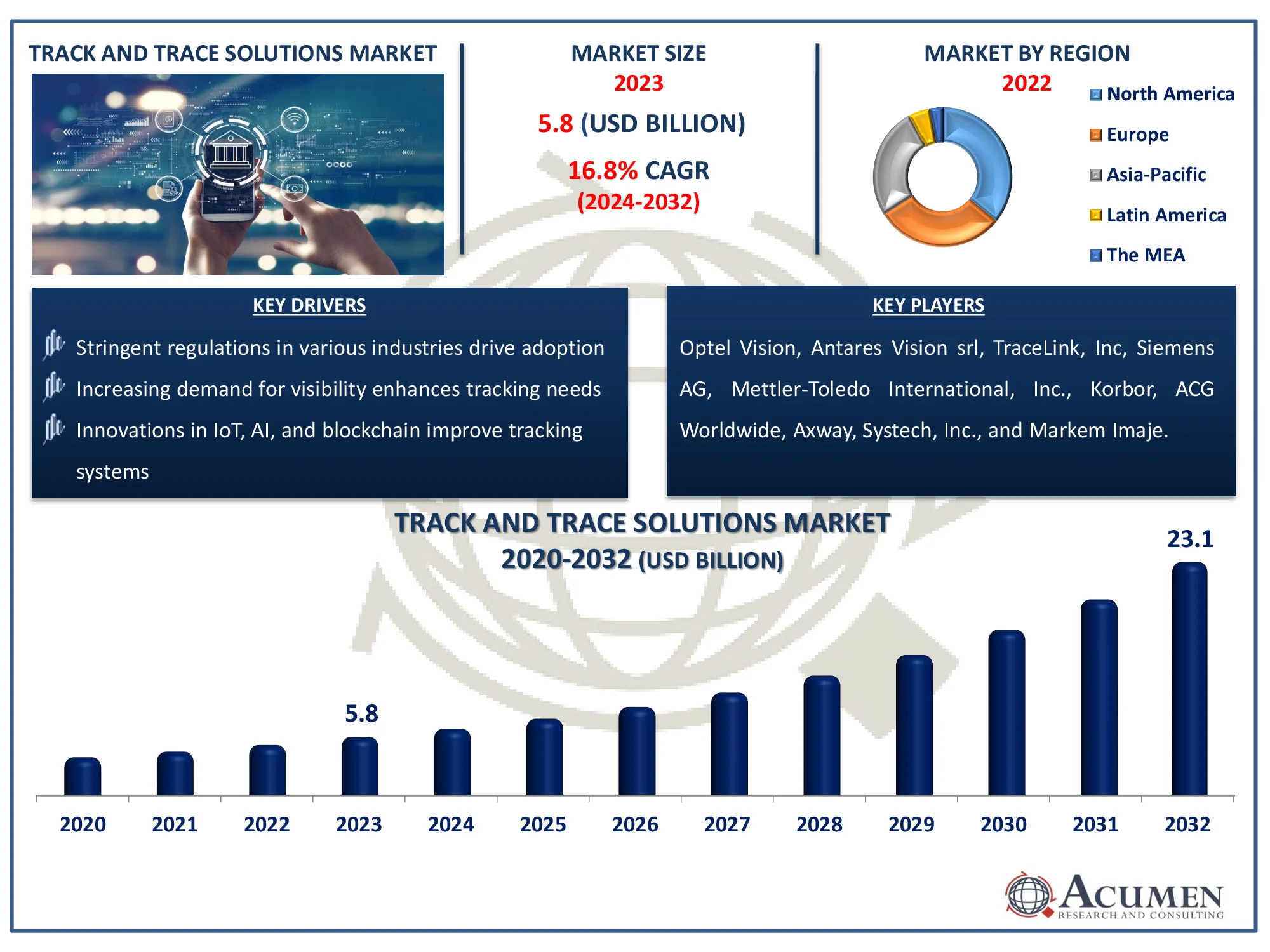

The Global Track and Trace Solutions Market Size accounted for USD 5.8 Billion in 2023 and is estimated to achieve a market size of USD 23.1 Billion by 2032 growing at a CAGR of 16.8% from 2024 to 2032.

Track and Trace Solutions Market (By Product Type: Hardware Systems, Software Solutions; By Technology: RFID, Barcode; By Application: Serialization solutions, Aggregation Solutions; By End-User: Pharmaceutical Companies, Consumer Packaged Goods, Medical device Companies, Luxury Goods, Food and Beverage, Other Healthcare End-Users; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Track and Trace Solutions Market Highlights

- The global track and trace solutions market is projected to reach USD 23.1 billion by 2032, with a CAGR of 16.8% from 2024 to 2032

- In 2023, the North American track and trace solutions market was valued at approximately USD 2.04 billion

- The Asia-Pacific region is expected to grow at a CAGR exceeding 17.4% from 2024 to 2032

- Software solutions accounted for 52% of the market share in 2023, based on product type

- The barcode technology segment held 81% of the market share in 2023

- Serialization solutions represented 56% of the market share in 2023, based on application

- Pharmaceutical companies contributed 26% of the market share in 2023, among end-users

- Expanding use of cloud-based solutions improves real-time tracking and scalability is the track and trace solutions market trend that fuels the industry demand

Track and trace solutions provide detailed cross-border shipping data and are widely used globally to track specific products or shipments. The track and trace solutions include a label with each business unit's name, a code with a serial number, and an obvious product seal. Tracking and tracing technologies are gaining traction in the medical device sector because they provide accurate data on device location when needed. With the increasing usage of these alternatives by medical device and pharmaceutical businesses, the tracking and tracing solutions market has a promising future. The track market is expected to grow in the near future as these alternatives are quickly adopted globally.

Global Track and Trace Solutions Market Dynamics

Market Drivers

- Stringent regulations in various industries drive adoption

- Increasing demand for visibility enhances tracking needs

- Innovations in IoT, AI, and blockchain improve tracking systems

Market Restraints

- Initial investments can be prohibitive for smaller businesses

- Security and privacy issues may hinder adoption

- Difficulties in merging new systems with existing infrastructure

Market Opportunities

- Growth in developing regions presents expansion opportunities

- Rising online shopping boosts demand for tracking

- Expansion and serialization regulations create significant growth potential

Track and Trace Solutions Market Report Coverage

| Market | Track and Trace Solutions Market |

| Track and Trace Solutions Market Size 2022 |

USD 5.8 Billion |

| Track and Trace Solutions Market Forecast 2032 | USD 23.1 Billion |

| Track and Trace Solutions Market CAGR During 2023 - 2032 | 16.8% |

| Track and Trace Solutions Market Analysis Period | 2020 - 2032 |

| Track and Trace Solutions Market Base Year |

2022 |

| Track and Trace Solutions Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Technology, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Optel Vision, Antares Vision srl, TraceLink, Inc, Siemens AG, Axway, Mettler-Toledo International, Inc., Korbor, ACG Worldwide, Systech, Inc., and Markem Imaje. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Track and Trace Solutions Market Insights

The primary factors driving the market's growth include high serialization requirements and laws, an increased emphasis on brand protection by manufacturers, an increase in the number of packaging-related recalls, and development in the medical device sector. The bar code method has a wide range of uses in the healthcare industry, including hospitals, diagnostic laboratories, medical equipment, and pharmaceutical producers. A barcode allows medical organizations to keep patient information, precisely manage inventory and the provenance of medicines, and affix barcode labels to blood supplies to assist distinguish between various specimens. This barcode technology has been utilized for many years and continues to be used for monitoring.

In the healthcare industry, barcode technologies are gaining traction by assisting in the tracking of patient data and prescription information, improving stock management of medical supplies, and adding barcode labels to blood supplies to differentiate between specimens. Many public restrictions, as well as an increase in the frequency of counterfeit pharmaceuticals, have led to the implementation of bar code technology in the health sector. Additional benefits include increased stock visibility and less waste, smaller cost disparities and higher quality care, improved safety and conformance, and automated supply chain activities. Drug counterfeiting is one of the most significant difficulties that large pharmaceutical and biopharmaceutical firms face. As a result, healthcare organizations use follow-up and trace tactics to ensure that brands obtain their fair amount of brand recognition throughout supply chains.

Counterfeiting has taken many forms, including mislabeling medicines and products, forging a legitimate authorized product, and inappropriate sales of medicines containing active chemicals. These counterfeit pharmaceutical items frequently include harmful or alien substances. Tracking and tracking solutions are becoming more popular in the health care industry as they have the potential to significantly reduce this rising issue. This growing acceptance by pharmaceutical companies accelerates the growth of the trace and trace alternatives industry.

Pharmaceutical businesses are considering current and prospective anti-counterfeiting legislation, as well as medication traceability legislation. Many governments choose to apply the serialization standards. Regulatory compliance for serialization is increasingly becoming a priority for pharmaceutical manufacturers and supply chain partners around the world. Most advanced and developing countries have either adopted or are in the process of building a regulatory framework for serialization. Increased drug-related operations and supply chain inefficiencies prompt legislative action to protect the pharmaceutical supply chain.

Track and Trace Solutions Market Segmentation

The worldwide market for track and trace solutions is split based on product type, technology, application, end-user, and geography.

Track and Trace Solutions Product Type

- Hardware Systems

- Printing & Marking Solutions

- Labeling Solutions

- Monitoring & Verification Solutions

- Others

- Software Solutions

- Line Controller Software

- Plant Manager Software

- Bundle Tracking Software

- Others

According to the track and trace solutions industry analysis, software solutions dominate market because they offer real-time monitoring, data analytics, and easy interaction with current systems. These technologies provide supply chain visibility, ensure regulatory compliance, and improve operational efficiency. With the growing use of cloud-based platforms, software solutions become more scalable and flexible, making them perfect for industries such as pharmaceuticals and logistics. Furthermore, enhanced capabilities including as serialization, aggregation, and reporting drive their wider adoption in global supply chains.

Track and Trace Solutions Technology

- RFID

- Barcode

According to the track and trace solutions industry analysis, barcode dominates in market. A barcode allows medical organizations to keep patient information, precisely manage inventory and the provenance of medicines, and affix barcode labels to blood supplies to assist distinguish between various specimens. This barcode technology has been utilized for many years and continues to be used for monitoring. In the healthcare industry, barcode technologies are gaining traction by assisting in the tracking of patient data and prescription information, improving stock management of medical supplies, and adding barcode labels to blood supplies to differentiate between specimens. Many public restrictions, as well as an increase in the frequency of counterfeit pharmaceuticals, have led to the implementation of bar code technology in the health sector.

Track and Trace Solutions Application

- Serialization solutions

- Label Serialization

- Bottle Serialization

- Data Matrix Serialization

- Carton Serialization

- Aggregation Solutions

- Case Aggregation

- Bundle Aggregation

- Pallet Aggregation

- Others

According to the track and trace solutions market forecast, serialization solutions dominate market, owing to regulatory requirements for product authenticity and supply chain transparency, particularly in the pharmaceutical and food sectors. These technologies provide unique product identification, improve traceability, and reduce the danger of counterfeiting. The rising emphasis on consumer safety and compliance with government laws is driving the deployment of serialization technologies.

Track and Trace Solutions End-User

- Pharmaceutical Companies

- Consumer Packaged Goods

- Medical device Companies

- Luxury Goods

- Food and Beverage

- Other Healthcare End-Users

According to the track and trace solutions market forecast, pharmaceutical businesses are the dominant end users in market due to severe regulatory requirements aimed at maintaining medicine safety, combating counterfeiting, and enhancing supply chain visibility. These technologies contribute to compliance with worldwide standards such as the Drug Supply Chain Security Act (DSCSA) and the EU Falsified Medicines Directive (FMD). Pharmaceutical companies use track and trace systems to improve product authenticity, streamline recalls, and maintain compliance, making them significant players in this sector.

Track and Trace Solutions Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Track and Trace Solutions Market Regional Analysis

For several reasons, because of the increasing prevalence of counterfeit medications in the region, developed economies such as North America will maintain their dominance in the tracking and tracking solutions market. The strong presence of advanced healthcare systems in the United States and Canada, emerging pharmaceutical and biotechnology businesses, and a burgeoning medical device sector are all major elements driving growth in North America. For instance, February 2023, DispatchTrack, a provider of last-mile delivery solutions, has added a new track and trace capability to its platform. This feature has been developed to take vast volumes of data, arrange it, and present it so that end users can obtain the information they need.

Furthermore, the Asia-Pacific region is experiencing strong expansion in the track and trace solutions market, owing to increased regulatory requirements for product serialization and rising demand for supply chain transparency in industries such as pharmaceuticals and healthcare.

In terms of income share, Europe is expected to see notable growth in market due to the existence of developed countries like Germany, Turkey, the United Kingdom, France, and Italy. To combat drug counterfeiting and theft, the European Union plans to gradually implement track and trace solutions for its health supply chain. Manufacturers who do not comply with drug serialization requirements will be barred from selling their products in Europe under the Falsified Medicines Directive.

Track and Trace Solutions Market Players

Some of the top track and trace solutions companies offered in our report include Optel Vision, Antares Vision srl, TraceLink, Inc, Siemens AG, Axway, Mettler-Toledo International, Inc., Korbor, ACG Worldwide, Systech, Inc., and Markem Imaje.

Frequently Asked Questions

How big is the track and trace solutions market?

The track and trace solutions market size was valued at USD 5.8 billion in 2023.

What is the CAGR of the global track and trace solutions market from 2024 to 2032?

The CAGR of track and trace solutions is 16.8% during the analysis period of 2024 to 2032.

Which are the key players in the track and trace solutions market?

The key players operating in the global market are including Optel Vision, Antares Vision srl, TraceLink, Inc, Siemens AG, Axway, Mettler-Toledo International, Inc., Korbor, ACG Worldwide, Systech, Inc., and Markem Imaje.

Which region dominated the global track and trace solutions market share?

North America held the dominating position in track and trace solutions industry during the analysis period of 2024 to 2032.

Which region registered fastest growing CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of track and trace solutions during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global track and trace solutions industry?

The current trends and dynamics in the track and trace solutions industry include stringent regulations in various industries drive adoption, increasing demand for visibility enhances tracking needs, and innovations in IoT, AI, and blockchain improve tracking systems.

Which product type held the maximum share in 2023?

The software solutions product type held the maximum share of the track and trace solutions industry.