Titanium Nitride Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Titanium Nitride Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

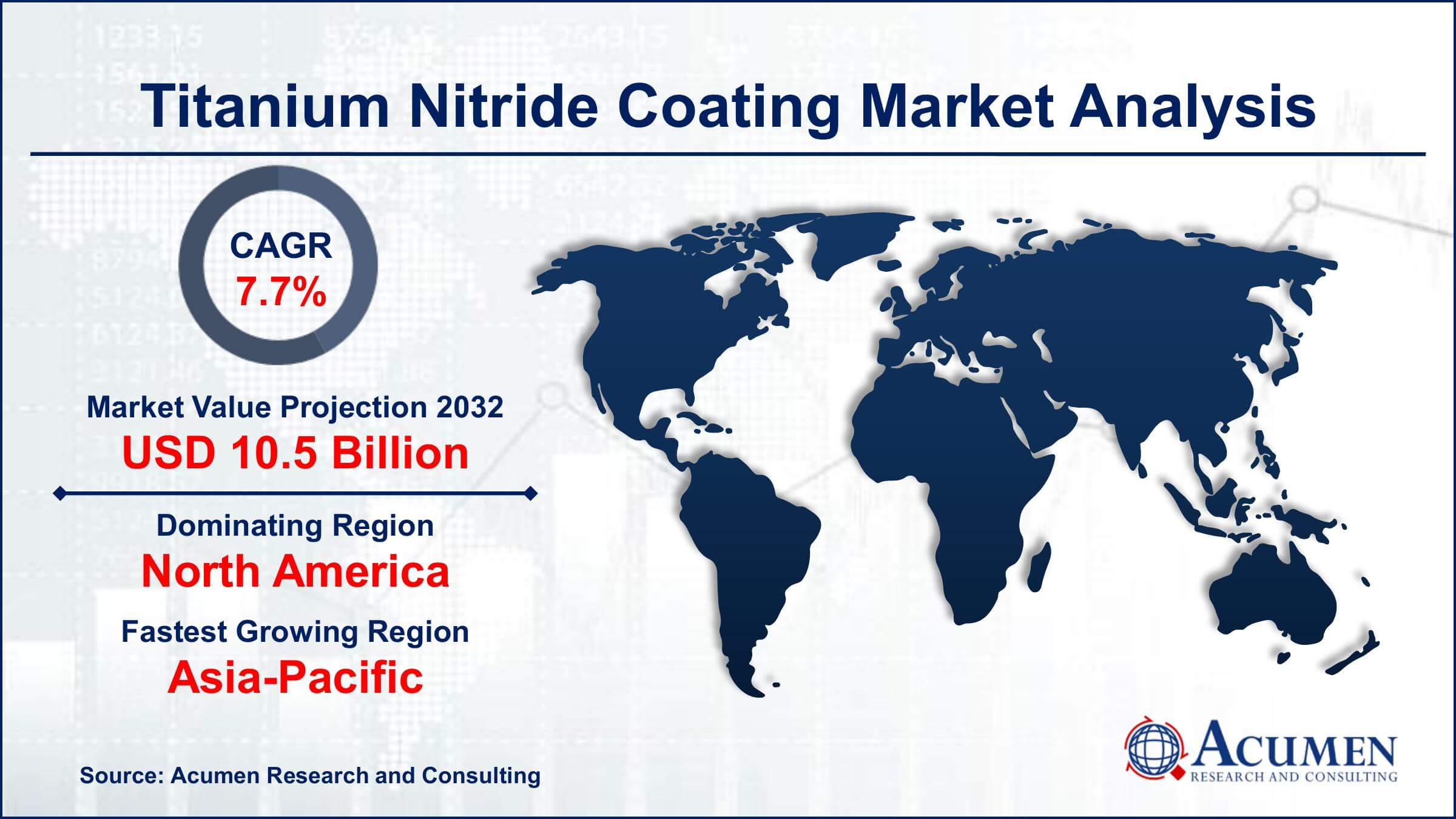

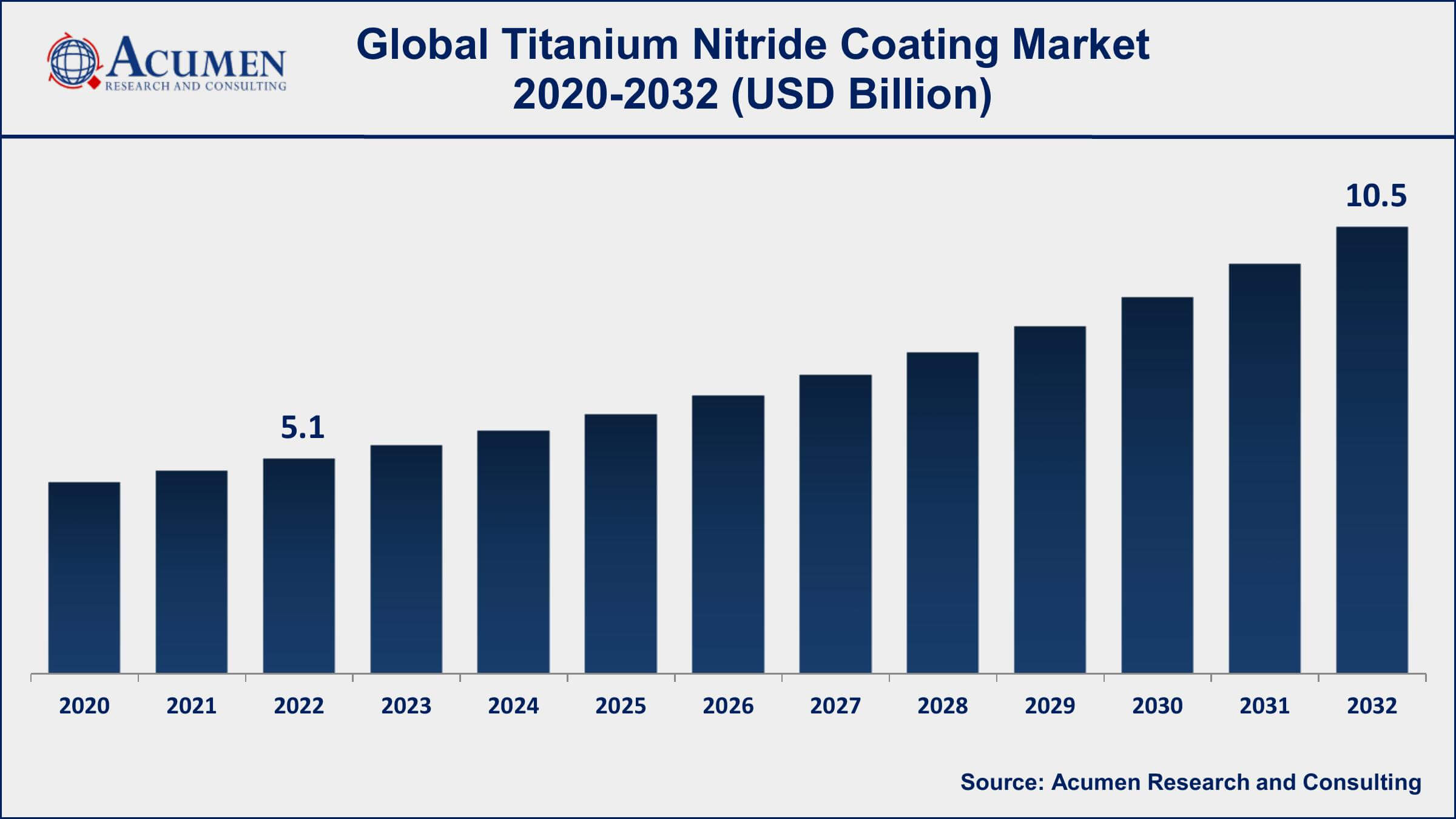

The Global Titanium Nitride (TiN) Coating Market Size accounted for USD 5.1 Billion in 2022 and is projected to achieve a market size of USD 10.5 Billion by 2032 growing at a CAGR of 7.7% from 2023 to 2032.

Titanium Nitride Coating Market Highlights

- Global titanium nitride coating market revenue is expected to increase by USD 10.5 Billion by 2032, with a 7.7% CAGR from 2023 to 2032

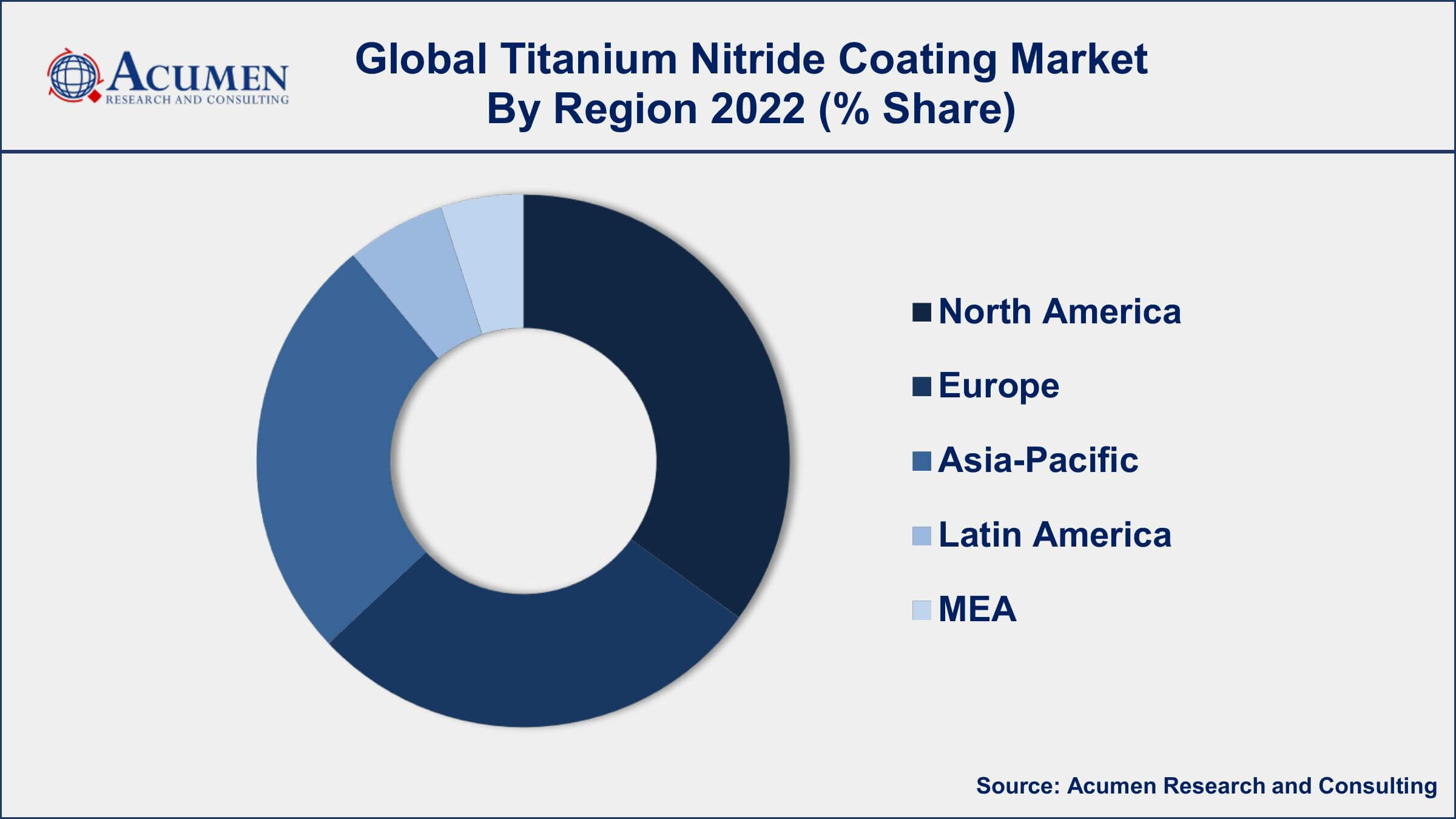

- North America region led with more than 32% of titanium nitride coating market share in 2022

- Asia-Pacific titanium nitride coating market growth will record a CAGR of around 8% from 2023 to 2032

- By deposition technique, the physical vapor deposition segment has recorded more than 54% of the revenue share in 2022.

- By application, the medical devices and equipment segment is predicted to grow at the fastest CAGR of 8.2% between 2023 and 2032

- Growing demand for high-performance materials in aerospace and defense industries, drives the titanium nitride coating market value

Titanium Nitride (TiN) coating is a hard, thin film coating that is applied to a variety of surfaces to improve their wear resistance, durability, and aesthetic appeal. It is a popular coating choice for industrial and cutting tools, medical implants, aerospace and defense components, and automotive parts. TiN coating is typically applied using physical vapor deposition (PVD) or chemical vapor deposition (CVD) processes, which deposit a layer of TiN onto the surface of the substrate material.

The titanium nitride coating market has experienced steady growth in recent years and is expected to continue to grow in the coming years. The growth of the market can be attributed to the increasing demand for durable and wear-resistant coatings in a variety of industries such as automotive, aerospace, medical, and industrial. Additionally, the growing demand for cutting tools, drills, and machine tools in emerging economies such as China and India are expected to fuel the growth of the TiN coating market in the Asia-Pacific region. Moreover, the increasing focus on developing lightweight and fuel-efficient vehicles is expected to create new opportunities for the TiN coating market in the automotive industry.

Global Titanium Nitride Coating Market Trends

Market Drivers

- Increasing demand for durable and wear-resistant coatings in various industries

- Rising demand for cutting tools, drills, and machine tools

- Growing demand for high-performance materials in aerospace and defense industries

- Increasing focus on developing lightweight and fuel-efficient vehicles

- Rising demand for medical implants and devices with improved wear resistance

Market Restraints

- High initial cost of equipment and materials used in the coating process

- Strict regulations regarding the use of hazardous materials in the coating process

Market Opportunities

- Emerging applications in renewable energy, such as solar panels and wind turbines

- Growing demand for TiN coatings in the electronics and semiconductor industries

Titanium Nitride Coating Market Report Coverage

| Market | Titanium Nitride Coating Market |

| Titanium Nitride Coating Market Size 2022 | USD 5.1 Billion |

| Titanium Nitride Coating Market Forecast 2032 | USD 10.5 Billion |

| Titanium Nitride Coating Market CAGR During 2023 - 2032 | 7.7% |

| Titanium Nitride Coating Market Analysis Period | 2020 - 2032 |

| Titanium Nitride Coating Market Base Year | 2022 |

| Titanium Nitride Coating Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Deposition Technique, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Oerlikon Balzers Coating AG, IHI Hauzer Techno Coating B.V., United Coatings Industries S.p.A., Sulzer Metaplas GmbH, CemeCon AG, IBC Coatings Technologies, Inc., Vergason Technology, Inc., Diarc-Technology Oy, Phygen Coatings, Inc., Techmetals, Inc., Von Ardenne GmbH, and Advanced Coating Technologies, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Titanium Nitride (TiN) coating is a thin film coating applied to a variety of surfaces to improve their wear resistance, durability, and aesthetic appeal. It is a popular coating choice for industrial and cutting tools, medical implants, aerospace and defense components, and automotive parts. TiN coating is typically applied using physical vapor deposition (PVD) or chemical vapor deposition (CVD) processes, which deposit a layer of TiN onto the surface of the substrate material. The properties of TiN coating make it an ideal choice for applications that require high hardness, low coefficient of friction, and high temperature resistance. TiN coating can improve the surface properties of cutting tools, such as drill bits and end mills, by reducing friction, increasing tool life, and improving the quality of the workpiece. In the aerospace and defense industries, TiN coating can enhance the durability and wear resistance of engine components, bearings, and other critical parts. In the medical industry, TiN coating is used to improve the wear resistance and biocompatibility of medical implants, such as joint replacements and dental implants.

The global titanium nitride coating market has been experiencing significant growth in recent years and is expected to continue to grow at a steady rate in the coming years. The market is being driven by the growing demand for wear-resistant and durable coatings across a wide range of industries, including automotive, aerospace, medical, and industrial tools. Additionally, the increasing use of titanium nitride coatings in electronic and semiconductor industries is expected to create new opportunities for the market. The automotive industry is a major contributor to the growth of the titanium nitride coating market, with increasing demand for high-performance coatings in the manufacturing of lightweight and fuel-efficient vehicles. The aerospace industry is also expected to contribute to the growth of the market due to the increasing use of high-performance materials in aircraft components that require wear-resistant coatings.

Titanium Nitride Coating Market Segmentation

The global titanium nitride coating market segmentation is based on deposition technique, application, and geography.

Titanium Nitride Coating Market By Deposition Technique

- Chemical Vapor Deposition (CVD)

- Physical Vapor Deposition (PVD)

- Others

According to the titanium nitride coating industry analysis, the physical vapor deposition segment accounted for the largest market share in 2022. Physical Vapor Deposition (PVD) is a popular method used for the deposition of Titanium Nitride (TiN) coating on various surfaces. PVD is a vacuum deposition process that involves the use of high-purity materials in a vapor state to coat the surface of the substrate material. The PVD process is known for its ability to produce a uniform and dense coating layer with excellent adhesion properties. The PVD segment is one of the major growth drivers in the TiN coating market. The PVD segment is expected to dominate the market during the forecast period due to the increasing demand for PVD coatings in the automotive, aerospace, medical, and industrial sectors. The PVD process provides a high-quality coating layer that improves the wear resistance, durability, and aesthetic appeal of the substrate material. Moreover, the PVD process is eco-friendly and provides a cost-effective solution for coating applications.

Titanium Nitride Coating Market By Application

- Cutting Tools

- Decorative Products

- Aerospace and Aircraft Components

- Injection Molding Equipment

- Medical Devices and Equipment

- Others

According to the titanium nitride coating market forecast, the medical devices and equipment segment is expected to witness significant growth in the coming years. The medical industry has been a major end-user of titanium nitride coatings due to their biocompatibility and excellent wear resistance properties. The increasing demand for medical implants and devices with improved wear resistance and longer lifespan is driving the growth of this segment. Titanium nitride coatings are widely used in orthopaedic implants, cardiovascular implants, dental implants, and surgical instruments. These coatings improve the durability and wear resistance of the implants and devices, reducing the need for replacement surgeries and improving patient outcomes. Moreover, titanium nitride coatings provide an excellent biocompatible surface that is resistant to corrosion, reduces bacterial adhesion, and minimizes the risk of inflammation and infection.

Titanium Nitride Coating Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Titanium Nitride Coating Market Regional Analysis

North America is one of the dominant regions in the global titanium nitride coating market, accounting for a significant share of the market. The region is home to several key players in the market, with a strong presence in the automotive, aerospace, medical, and industrial sectors. The growing demand for high-performance coatings in these sectors is driving the growth of the TiNcoating market in North America. The automotive industry is a major contributor to the growth of the titanium nitride coating market in North America, with increasing demand for lightweight and fuel-efficient vehicles that require high-performance coatings. Additionally, the aerospace industry is expected to contribute to the growth of the market due to the increasing use of high-performance materials in aircraft components that require wear-resistant coatings. The medical industry is also a significant contributor to the market, with the growing use of titanium nitride coatings in medical implants and devices due to their biocompatibility and improved wear resistance.

Titanium Nitride Coating Market Player

Some of the top titanium nitride coating market companies offered in the professional report include Oerlikon Balzers Coating AG, IHI Hauzer Techno Coating B.V., United Coatings Industries S.p.A., Sulzer Metaplas GmbH, CemeCon AG, IBC Coatings Technologies, Inc., Vergason Technology, Inc., Diarc-Technology Oy, Phygen Coatings, Inc., Techmetals, Inc., Von Ardenne GmbH, and Advanced Coating Technologies, Inc.

Frequently Asked Questions

What was the market size of the global titanium nitride coating in 2022?

The market size of titanium nitride coating was USD 5.1 Billion in 2022.

What is the CAGR of the global titanium nitride coating market from 2023 to 2032?

The CAGR of titanium nitride coating is 7.7% during the analysis period of 2023 to 2032.

Which are the key players in the titanium nitride coating market?

The key players operating in the global market are including Oerlikon Balzers Coating AG, IHI Hauzer Techno Coating B.V., United Coatings Industries S.p.A., Sulzer Metaplas GmbH, CemeCon AG, IBC Coatings Technologies, Inc., Vergason Technology, Inc., Diarc-Technology Oy, Phygen Coatings, Inc., Techmetals, Inc., Von Ardenne GmbH, and Advanced Coating Technologies, Inc.

Which region dominated the global titanium nitride coating market share?

North America held the dominating position in titanium nitride coating industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of titanium nitride coating during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global titanium nitride coating industry?

The current trends and dynamics in the titanium nitride coating industry include increasing demand for durable and wear-resistant coatings in various industries, rising demand for cutting tools, drills, and machine tools, and growing demand for high-performance materials in aerospace and defense industries.

Which deposition technique held the maximum share in 2022?

The physical vapor deposition technique held the maximum share of the titanium nitride coating industry.