Thermoplastic Polyamide Elastomers Market | Acumen Research and Consulting

Thermoplastic Polyamide Elastomers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

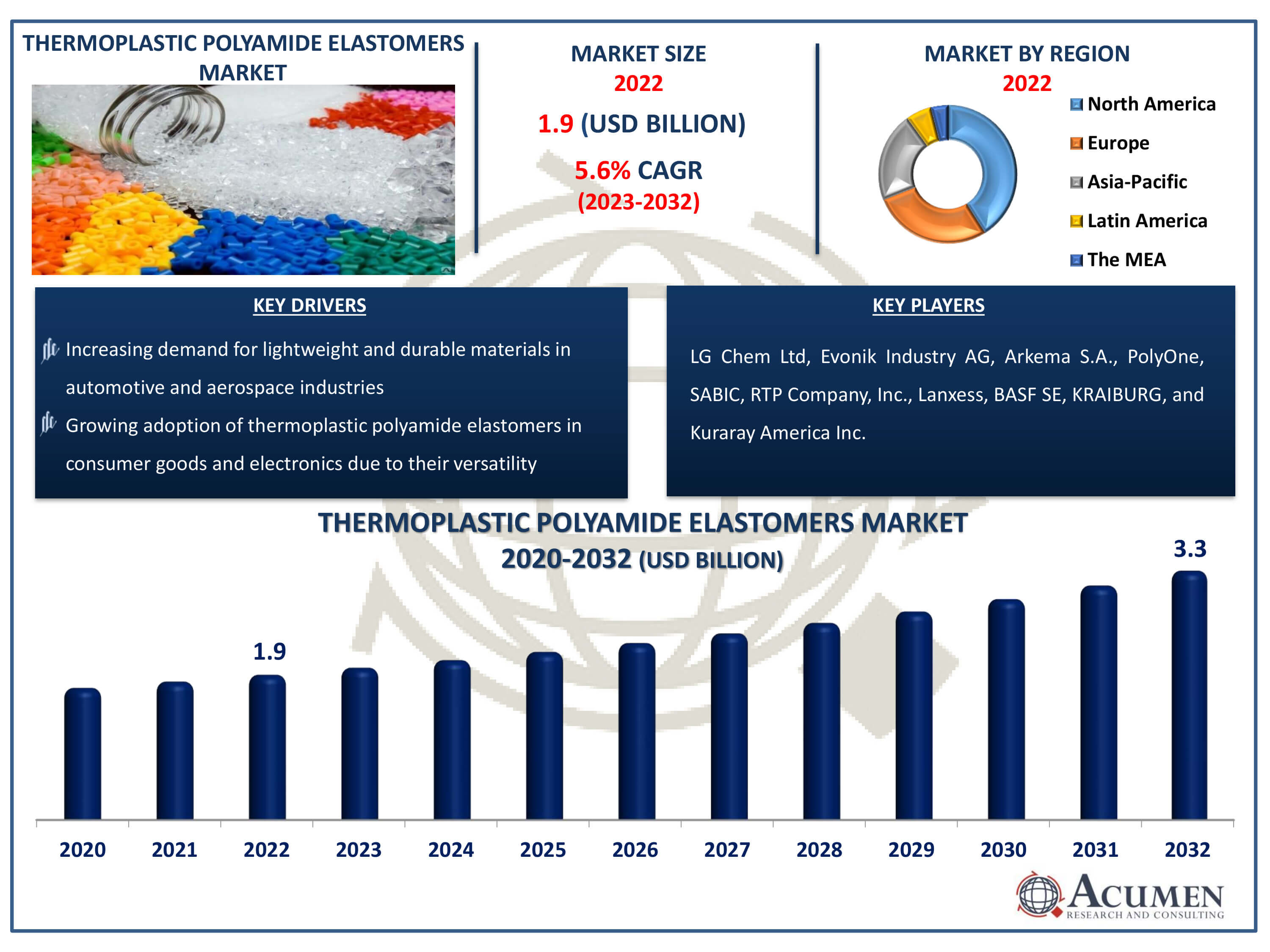

The Thermoplastic Polyamide Elastomers Market Size accounted for USD 1.9 Billion in 2022 and is estimated to achieve a market Technology of USD 3.3 Billion by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

Thermoplastic Polyamide Elastomers Market Highlights

- Global thermoplastic polyamide elastomers market revenue is poised to garner USD 3.3 billion by 2032 with a CAGR of 5.6% from 2023 to 2032

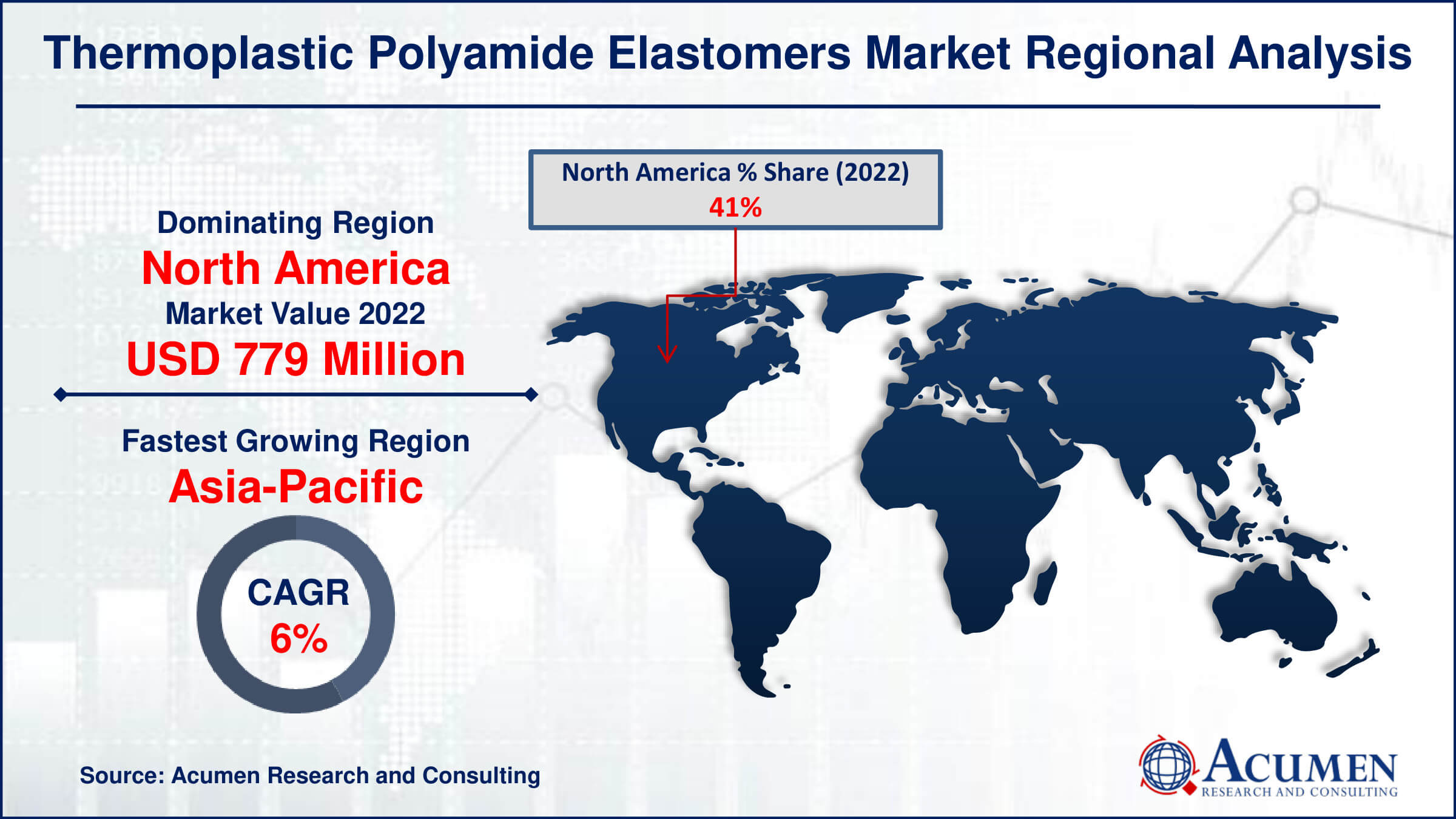

- North America thermoplastic polyamide elastomers market value occupied around USD 779 million in 2022

- Asia-Pacific thermoplastic polyamide elastomers market growth will record a CAGR of more than 6% from 2023 to 2032

- Among application, the consumer goods sub-segment generated more that USD 1.03 billion revenue in 2022

- Based on technology, the ether-based sub-segment generated noteworthy share in 2022

- Growing market penetration in emerging economies with rapid industrialization and urbanization is a popular thermoplastic polyamide elastomers market trend that fuels the industry demand

High-performance thermoplastic block copolymers based on nylon and polyethers are known as thermoplastic polyamide elastomers. They consist of rigid and flexible components. The mechanical and thermal properties of thermoplastic polyamide elastomers are determined by the chemical structure and composition of these two segments. Hard segments are primarily composed of aliphatic polyamides, while soft segments consist of polyethers and aliphatics. Various processing methods such as injection molding, extrusion, blow molding, heat shaping, and rotational molding can be used with thermoplastic polyamide elastomers. These elastomers are synthesized through polycondensation reactions between functional groups and may also undergo anionic ring-opening polymerization of lactams. Factors influencing the final properties include chemical composition, molecular weight distribution, and the ratio of hard to soft segments. Hard segments primarily control crystallinity, melting point, and mechanical strength, while soft segments determine low-temperature flexibility, thermal stability, and chemical resistance.

Global Thermoplastic Polyamide Elastomers Market Dynamics

Market Drivers

- Increasing demand for lightweight and durable materials in automotive and aerospace industries

- Growing adoption of thermoplastic polyamide elastomers in consumer goods and electronics due to their versatility

- Rising focus on sustainability and eco-friendly materials

- Technological advancements enhancing the performance and processing capabilities of thermoplastic polyamide elastomers

Market Restraints

- High initial investment and production costs

- Limited availability of raw materials, impacting supply chain stability

- Challenges in achieving consistent material properties and quality standards

Market Opportunities

- Expansion of applications in medical devices and healthcare sectors

- Emerging opportunities in construction and infrastructure projects

- Increased demand for thermoplastic polyamide elastomers in 3D printing applications

Thermoplastic Polyamide Elastomers Market Report Coverage

| Market | Thermoplastic Polyamide Elastomers Market |

| Thermoplastic Polyamide Elastomers Market Size 2022 | USD 1.9 Billion |

| Thermoplastic Polyamide Elastomers Market Forecast 2032 | USD 3.3 Billion |

| Thermoplastic Polyamide Elastomers Market CAGR During 2023 - 2032 | 5.6% |

| Thermoplastic Polyamide Elastomers Market Analysis Period | 2020 - 2032 |

| Thermoplastic Polyamide Elastomers Market Base Year |

2022 |

| Thermoplastic Polyamide Elastomers Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | LG Chem Ltd, Evonik Industry AG, BASF SE, Arkema S.A., PolyOne, SABIC, RTP Company, Inc., Lanxess, KRAIBURG and Kuraray America Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Thermoplastic Polyamide Elastomers Market Insights

Increased awareness of the health benefits of gymnastics is a key factor driving the demand for thermoplastic polyamide elastomers. Technological advancements in the athletic footwear industry enable manufacturers to produce lightweight, durable, fashionable, and comfortable footwear. The ability of thermoplastic polyamide elastomers to withstand cold temperature conditions makes them suitable for use in skis, boats, and other winter sport equipment. Ether-based thermoplastic polyamide elastomers have low glass transition temperatures, contributing to high energy return even in sub-zero environments. These elastomers offer beneficial properties such as lightweight, high comfort, resilience, flexibility, impact resistance, rapid regeneration of form, ease of treatment, and good molding capabilities.

The demand for thermoplastic polyamide elastomers has increased in the production of medical equipment such as catheters, tubes, masks, and bags. The properties of thermoplastic polyamide elastomers, such as high sterilization resistance, easy blending with other polymers, high torque transfer, and excellent impact resistance, are projected to further boost demand. Common medical applications of polyamide thermoplastic elastomers include tubing, catheters, grips (for racers and surgical tools), seals, bottles, patches, connectors, and soft-touch surfaces.

Thermoplastic polyamide elastomers, with their proprietary characteristics, are ideal for use in prosthetics, surgical tools, and mobility aids. These elastomers provide patient skin surfaces with a soft enough feel and can be hardened and reshaped repeatedly.

Core applications for thermoplastic polyamide elastomers include consumer goods (such as sports equipment and appliances), automotive equipment (including anti-static additives and respirable films), medical devices, electronics, and industrial products. Thermoplastic polyamide elastomers are primarily utilized in areas where other thermoplastic elastomers fail, particularly under low-temperature conditions. The sports and recreational goods industry widely employs thermoplastic polyamide elastomers in products such as outsoles, ski boots, goggles, tennis rackets, and bike grips. In the medical industry, thermoplastic polyamide elastomers are used for devices requiring flexibility, breathability, and sterilization resistance. With consumers increasingly prioritizing health and fitness, advanced thermoplastic elastomers are expected to drive demand for thermoplastic polyamide elastomers in winter sports accessories.

Thermoplastic Polyamide Elastomers Market Segmentation

The worldwide market for thermoplastic polyamide elastomers is split based on technology, type, application, and geography.

Thermoplastic Polyamide Elastomers (TPE) Market by Technologies

- Ester-Based

- Ether-Based

Accordning to the thermoplastic polyamide elastomers industry analysis, it is projected that the ether-based technology segment would hold the highest share in the market. This is mainly because ether-based elastomers have better qualities than their ester-based equivalents, namely lower glass transition temperatures and increased flexibility. Ether-based thermoplastic polyamide elastomers are perfect for applications that need to absorb shock repeatedly, including in sports equipment and medical devices, because of their exceptional resilience and endurance. They are also appropriate as winter sports gear because to their resistance to extreme cold. The global domination of ether-based thermoplastic polyamide elastomers is fueled by their performance and versatility, which establish them as the go-to option in a variety of applications.

Thermoplastic Polyamide Elastomers (TPE) Market by Types

- Polyester Amide (PEA)

- Polyether Ester Amide (PEEA)

- Polyether Block Amide (PEBA)

The polyether block amide (PEBA) segment is expected to hold the greatest share in the thermoplastic polyamide elastomers market. Excellent flexibility, resilience, and durability are just a few of the distinctive qualities that PEBA elastomers offer, making them extremely adaptable to a variety of applications. Due to its resilience to extremes in temperature and weather, PEBA is especially well-suited for high-stress sectors including sports equipment, medical devices, and automobiles. PEBA elastomers also have strong chemical resistance and are easily manufactured using standard thermoplastic methods like as extrusion and injection moulding. PEBA elastomers are in high demand because of their remarkable performance attributes, which have led to their market dominance in thermoplastic polyamide elastomers.

Thermoplastic Polyamide Elastomers (TPE) Market by Applications

- Automotive

- Medical

- Consumer Goods

- Electrical & Electronics

- Industrial

- Others (Including Breathable Films and Anti-static Additives)

The market for thermoplastic polyamide elastomers is anticipated to be led by the consumer goods segment because of its numerous uses in a variety of commonplace goods. Elastomers made of thermoplastic polyamide are widely used in consumer goods like footwear, appliances, sports gear, and household goods. These elastomers satisfy the various performance criteria of consumer goods with their remarkable flexibility, robustness, and durability. Thermoplastic polyamide elastomers are essential for maintaining the quality and functionality of products, from offering supportive and durable footwear outsoles to improving the impact resistance of athletic equipment. The market leadership of the consumer products category is further cemented by the increasing demand for lightweight and sustainable materials in consumer products, which propels the use of thermoplastic polyamide elastomers.

Thermoplastic Polyamide Elastomers (TPE) Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Thermoplastic Polyamide Elastomers Market Regional Analysis

In terms of thermoplastic polyamide elastomers market analysis, the global industry is segmented based on regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. In 2022, North America dominated the global market for polyamide thermoplastic elastomers, with high sales and volume primarily driven by consumption in the US. Following North America, Europe ranks second in consumption. Prominent European countries in the thermoplastic polyamide elastomer market include Germany, France, and Italy. In the Asia Pacific region, key drivers for market growth include expansion in the medical equipment sector, government initiatives, and low labor costs. China and Japan lead the Asia Pacific market for thermoplastic polyamide elastomers. Demand for thermoplastic polyamide elastomers in the Middle East, Africa, and Latin America has shown moderate growth in recent years, with this trend expected to continue in the thermoplastic polyamide elastomers industry forecast period.

Thermoplastic Polyamide Elastomers Market Players

Some of the top thermoplastic polyamide elastomers companies offered in our report includes EDF Energy, Duke Energy, Edison International, Southern Company, Engie, Schneider Electric SE, Siemens AG, General Electric, WGL Energy, and Orsted.

Frequently Asked Questions

How big is the thermoplastic polyamide elastomers market?

The thermoplastic polyamide elastomers market size was valued at USD 1.9 billion in 2022.

What is the CAGR of the global thermoplastic polyamide elastomers market from 2023 to 2032?

The CAGR of thermoplastic polyamide elastomers is 5.6% during the analysis period of 2023 to 2032.

Which are the key players in the thermoplastic polyamide elastomers market?

The key players operating in the global market are including EDF Energy, Duke Energy, Edison International, Southern Company, Engie, Schneider Electric SE, Siemens AG, General Electric, WGL Energy, and Orsted.

Which region dominated the global thermoplastic polyamide elastomers market share?

North America held the dominating position in thermoplastic polyamide elastomers industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of thermoplastic polyamide elastomers during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global thermoplastic polyamide elastomers industry?

The current trends and dynamics in the thermoplastic polyamide elastomers industry include increasing demand for lightweight and durable materials in automotive and aerospace industries, growing adoption of thermoplastic polyamide elastomers in consumer goods and electronics due to their versatility, rising focus on sustainability and eco-friendly materials, and technological advancements enhancing the performance and processing capabilities of thermoplastic polyamide elastomers.

Which application held the maximum share in 2022?

The consumer goods application held the maximum share of the thermoplastic polyamide elastomers industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date