Reprocessed Medical Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Reprocessed Medical Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

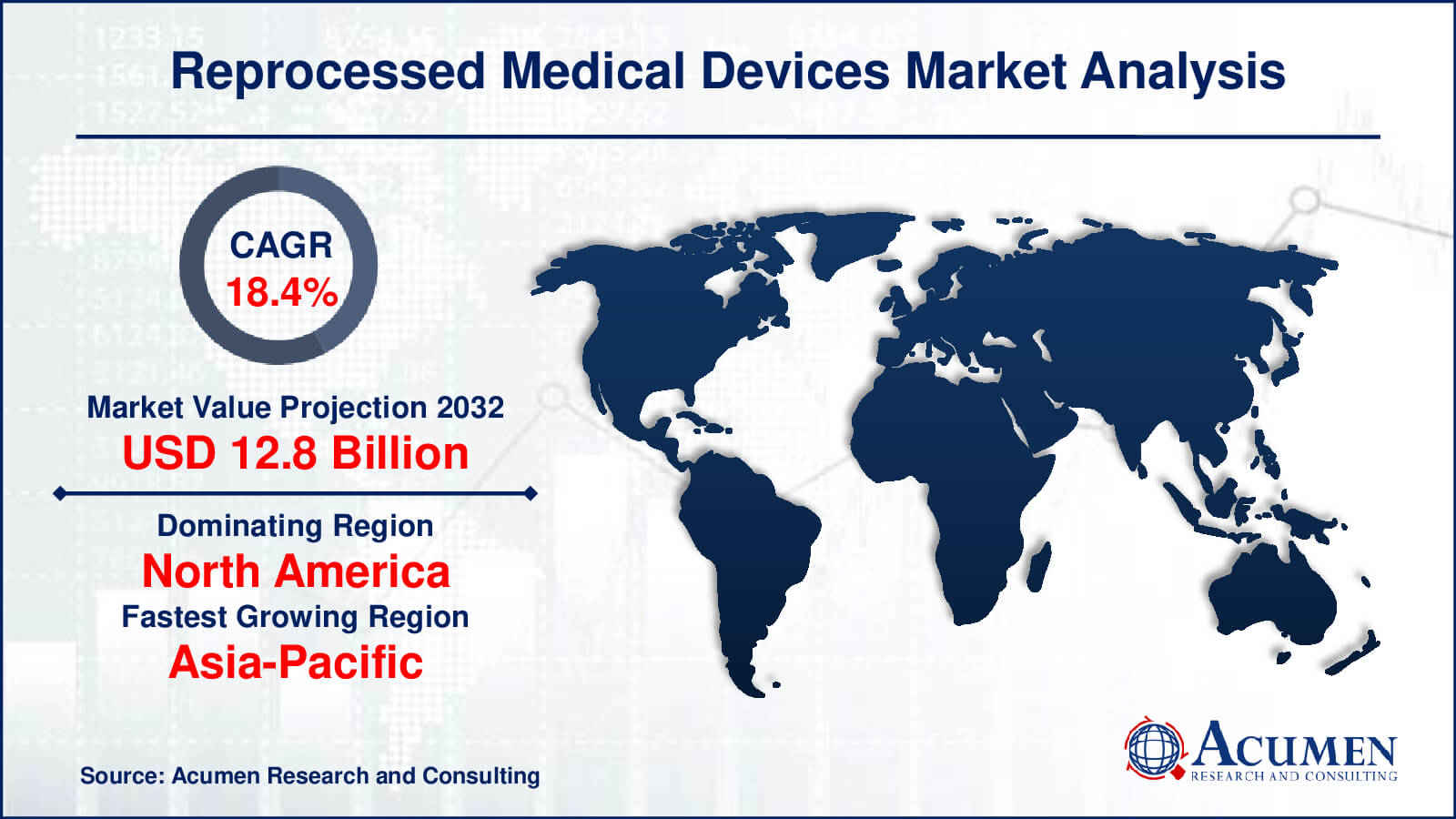

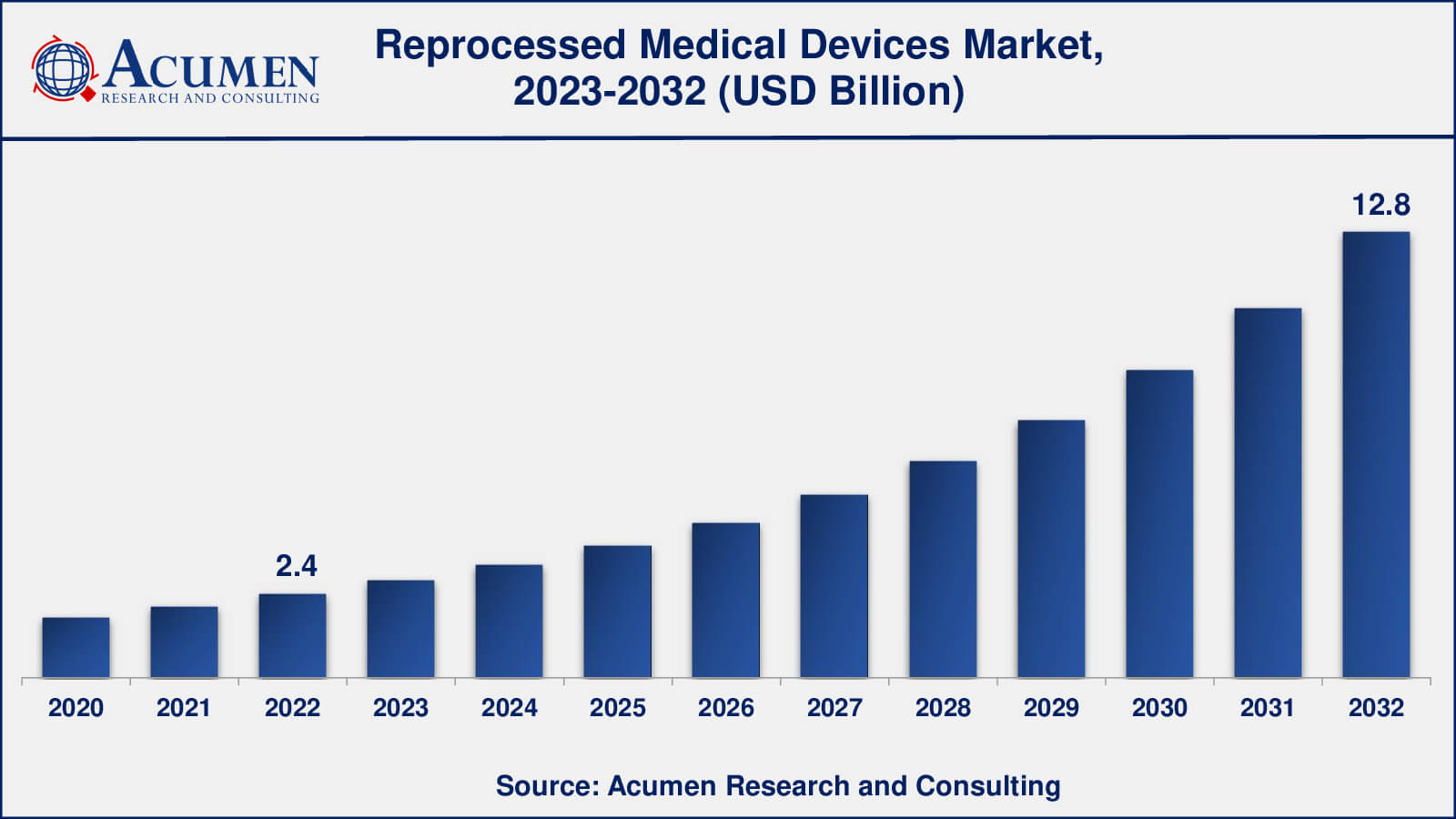

The global Reprocessed Medical Devices Market size was valued at USD 2.4 Billion in 2022 and is projected to attain USD 12.8 Billion by 2032 mounting at a CAGR of 18.4% from 2023 to 2032.

Reprocessed Medical Devices Market Highlights

- Global reprocessed medical devices market revenue is poised to garner USD 12.8 billion by 2032 with a CAGR of 18.4% from 2023 to 2032

- North America reprocessed medical devices market value occupied around USD 1.1 million in 2022

- Asia-Pacific reprocessed medical devices market growth will record a CAGR of more than 20% from 2023 to 2032

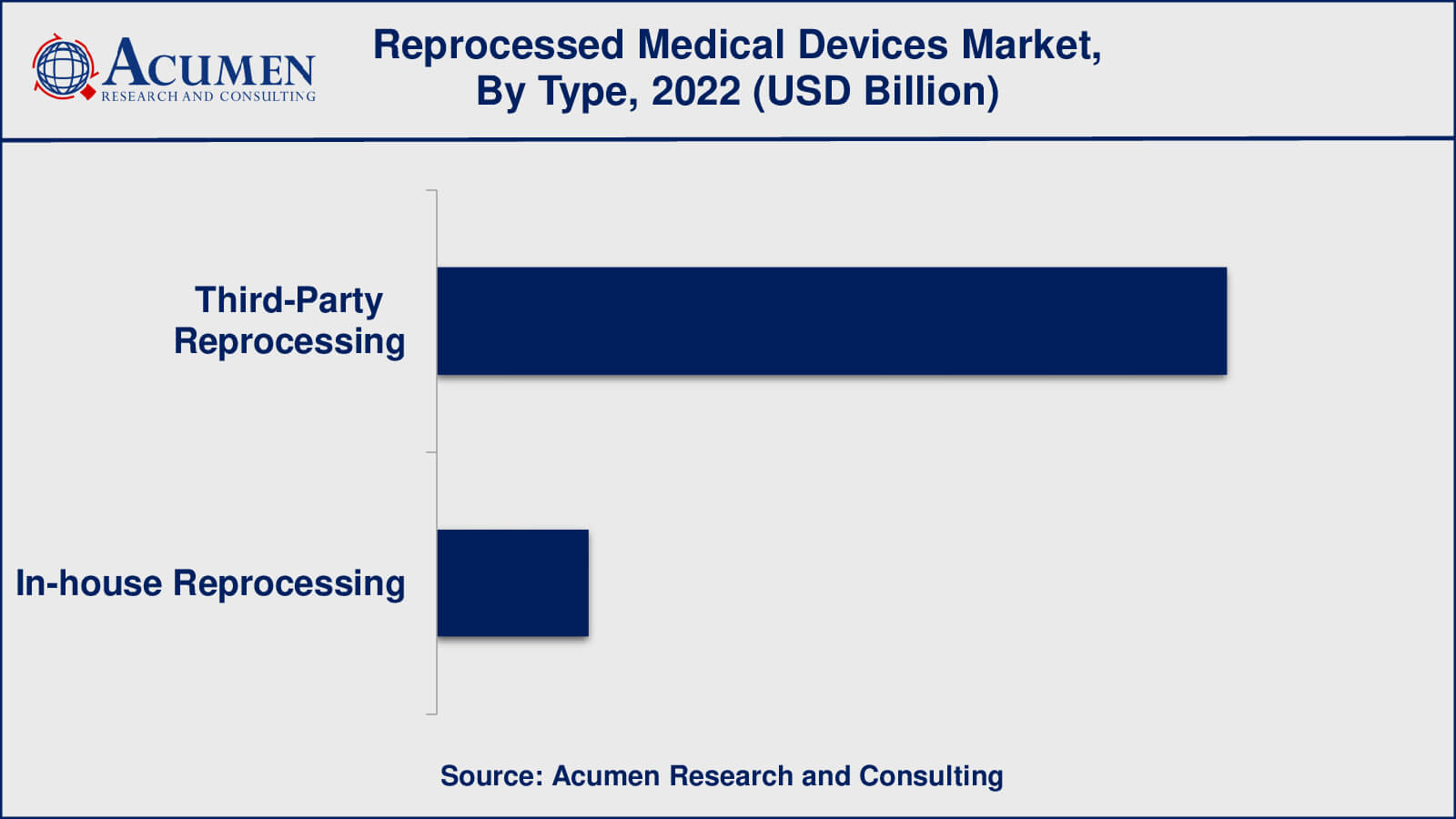

- Among type, the third-party reprocessing sub-segment occupied over US$ 2 billion revenue in 2022

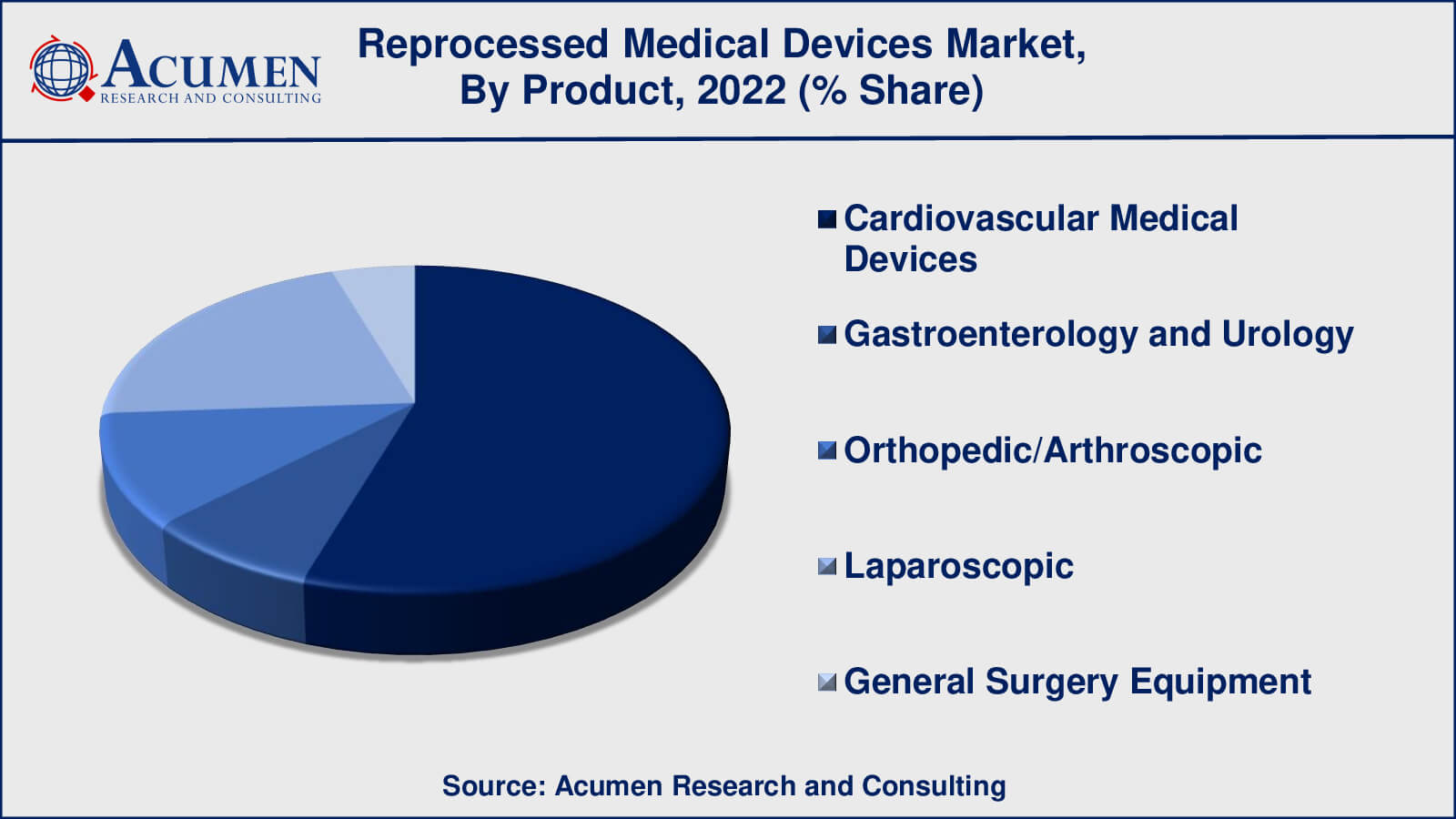

- Based on product, the cardiovascular medical devices sub-segment gathered around 55% share in 2022

- Integration of IoT and data analytics is a popular reprocessed medical devices market trend that drives the industry demand

Reprocessed medical devices are those that have been used, collected, cleaned, sterilized, and reconditioned for reuse on many patients. These devices are typically single-use items that were designed to be discarded after a single patient's use, but advances in technology and regulatory oversight have enabled certain devices to go through a controlled and regulated reprocessing process, allowing them to be used again safely and effectively.

Medical device reprocessing includes meticulous cleaning, disinfection, and sterilization techniques to guarantee that any possible pollutants, such as biological material and pathogens, are removed or eliminated. The reprocessing procedure seeks to restore the device to as close to its original state as feasible when it was first used. To assure the safety and efficacy of these devices, the reprocessing process is subject to intense regulatory control. Regulatory authorities such as the United States Food and Drug Administration develop rules to ensure that reprocessed devices meet the same stringent safety and performance standards as new devices. Despite the potential benefits, there are some worries about recycled medical equipment. One of the primary issues is the guarantee of safety and efficacy, which requires that the reprocessing procedure fully removes any potential contaminants while maintaining the device's original performance characteristics.

Global Reprocessed Medical Devices Market Dynamics

Market Drivers

- Growing need to reduce medical waste

- Reprocessed devices offer healthcare cost reduction

- Stringent regulatory framework to ensure safety and efficacy standards

- Reprocessing can alleviate supply chain disruptions

Market Restraints

- Potential for inadequate cleaning and sterilization

- Varying levels of trust in reprocessed devices among healthcare professionals

- Balancing patient consent and transparent communication

Market Opportunities

- Growing adoption due to cost-effectiveness and environmental benefits

- Advances in reprocessing technology

- Collaboration between reprocessing companies and healthcare institutions

Reprocessed Medical Devices Market Report Coverage

| Market | Reprocessed Medical Devices Market |

| Reprocessed Medical Devices Market Size 2022 | USD 2.4 Billion |

| Reprocessed Medical Devices Market Forecast 2032 | USD 12.8 Billion |

| Reprocessed Medical Devices Market CAGR During 2023 - 2032 | 18.4% |

| Reprocessed Medical Devices Market Analysis Period | 2020 - 2032 |

| Reprocessed Medical Devices Market Base Year | 2022 |

| Reprocessed Medical Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Product, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arjo, Cardinal Health, Innovative Health, Johnson & Johnson MedTech, Medline Industries, LP, NEScientific, Inc., Soma Tech Intl, Stryker, SureTek Medical, and Vanguard AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Reprocessed Medical Devices Market Insights

The key driver of the reprocessed medical device market for is the significant cost savings it provides to healthcare providers. Reprocessing enables healthcare organizations to receive high-quality medical devices for a fraction of the cost of new ones, allowing them to optimize budgets and deploy resources more efficiently. This cost-effectiveness is especially important in an era of growing healthcare costs and fiscal restrictions.

Furthermore, the growing emphasis on environmental sustainability is encouraging the use of recycled equipment. Reprocessing medical equipment offers a potential alternative to healthcare facilities seeking to decrease their environmental impact by reducing the development of medical waste. The market supports worldwide efforts to encourage environmentally friendly practices in the healthcare sector by extending the life cycle of these devices.

One of the most significant problems confronting the remanufactured medical device business is the persistent worry about safety. It is critical for patient safety to ensure that reprocessed equipment is completely cleaned, disinfected, and sterilized to eliminate any pathogens. Inadequate cleaning and sterilization methods might result in infections and other negative outcomes. To retain patient trust and confidence in the safety of reprocessed devices, this problem necessitates tight regulatory monitoring and precise quality control techniques.

The market for recycled medical equipment has tremendous development potential, owing to the confluence of cost-effectiveness and environmental conscience. Adoption of reprocessed devices is anticipated to expand as more healthcare institutions recognize the potential for financial savings without sacrificing patient safety. Furthermore, technical advancements are paving the way for safer and more efficient reprocessing processes, alleviating safety concerns and improving device performance after reprocessing.

Finally, the medical device reprocessing market is formed by a delicate interplay of cost-cutting initiatives, environmental consciousness, patient safety concerns, and technical improvements. As the healthcare industry pursues sustainable solutions that meet both budgetary and environmental goals, the market for reprocessed devices is primed for development, provided that safety remains a top priority and collaborations drive collaborative success in this changing scenario.

Reprocessed Medical Devices Market Segmentation

The worldwide market for reprocessed medical devices is split based on type, product, end-use, and geography.

Reprocessed Medical Devices Types

- Third-Party Reprocessing

- In-house Reprocessing

As per the reprocessed medical devices industry analysis, third-party reprocessing will have the biggest market share in 2022. Third-party reprocessing refers to the practise of outsourcing medical device reprocessing to specialised organisations or facilities that focus entirely on reprocessing activities. Third-party reprocessing is a practise in healthcare that involves sending old medical equipment, mainly single-use ones, to specialised external firms or facilities for cleaning, sterilisation, and refurbishing. This procedure is carried out by third-party reprocessing firms that specialise in returning these devices to a safe state for reuse. The major purpose is to provide healthcare institutions with a cost-effective and long-term alternative for reusing medical equipment that would otherwise be discarded after one usage.

The procedure begins with healthcare facilities collecting old gadgets. After that, the devices are sent to third-party recycling facilities. The gadgets are thoroughly cleaned, disinfected, and sterilised at these facilities to guarantee they satisfy high safety and hygiene requirements. To ensure that reprocessed devices fulfil the same safety and performance criteria as new devices, rigorous quality inspections are done. If necessary, devices can be reconditioned to restore their functionality and integrity. After being appropriately handled and examined, the devices are packed and supplied to healthcare facilities for reuse.

Reprocessed Medical Devices Product

- Cardiovascular Medical Devices

- Gastroenterology and Urology

- Orthopedic/Arthroscopic

- Laparoscopic

- General Surgery Equipment

According to our medical device reprocessing market analysis, cardiovascular medical devices have gained maximum market share in 2022. Cardiovascular medical devices are an important subset of the healthcare industry, covering a wide range of tools and equipment used in the diagnosis, treatment, and management of numerous cardiovascular disorders and illnesses. This category contains, among other things, cardiac catheters, angioplasty balloons, stents, pacemakers, and defibrillators. Reprocessed cardiovascular medical devices are those that have been previously used, collected, and then thoroughly cleaned, disinfected, sterilised, and refurbished to make them safe and effective for reuse in subsequent medical operations.

As a result, recycled cardiovascular medical equipment play an important role in offering cost-effective and environmentally responsible cardiovascular care solutions. To maintain the safety and efficacy of reprocessed cardiovascular devices in patient care, strict adherence to regulatory criteria, quality control methods, and open communication are required.

Reprocessed Medical Devices End-Uses

- Ambulatory Surgical Centers

- Hospitals

- Clinics

According to the reprocessed medical devices market forecast, hospitals are predicted to dominate the industry between 2023 and 2032. Because of the high amount of medical operations performed in hospitals, hospitals have been a prominent end-user sector in the reprocessed medical device industry. Reprocessed medical equipment are widely used in hospitals, where they can help with cost savings and environmental sustainability. Because of the vast amount of medical operations performed in hospitals, the possibility for recycling equipment without jeopardising patient safety is significant. Ambulatory surgical centres, often known as outpatient surgery centres, specialise in operations and medical treatments that do not need hospitalisation overnight. These facilities offer a simplified and efficient setting for surgical procedures in a variety of disciplines.

Furthermore, clinics are medical institutions that offer medical services but are often lower in size than hospitals. They include a wide range of locations, such as primary care clinics, specialist clinics, and community health centres. Clinics, like ambulatory surgical centres, may not do as many operations as hospitals, yet they remain vital healthcare access sources for many people.

Reprocessed Medical Devices Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Reprocessed Medical Devices Market Regional Analysis

Historically, North America dominated the recycled medical equipment business, particularly in the United States. This was owing to a well-established healthcare system, rigorous FDA regulatory control, and an emphasis on cost conservation. Hospitals and healthcare institutes used reprocessed devices in this region to cut expenses while assuring patient safety. However, there were differences across states regarding regulatory acceptability and the amount to which reprocessed devices were used..

The Asia-Pacific region witnessed growing interest in reprocessed medical devices due to increasing healthcare expenditures, the expansion of healthcare infrastructure, and efforts to optimize resources. Countries such as Japan, South Korea, and Australia investigated the use of reprocessed equipment in their sophisticated healthcare systems. Other nations in the area, facing resource constraints, recognized the potential benefits of reprocessing in terms of cost savings and waste reduction.

Reprocessed Medical Devices Market Players

Some of the top reprocessed medical devices companies offered in our report include Arjo, Cardinal Health, Innovative Health, Johnson & Johnson MedTech, Medline Industries, LP, NEScientific, Inc., Soma Tech Intl, Stryker, SureTek Medical, and Vanguard AG.

Frequently Asked Questions

What was the size of the global reprocessed medical devices market in 2022?

The size of reprocessed medical devices market was USD 2.4 billion in 2022.

What is the reprocessed medical devices market CAGR from 2023 to 2032?

The reprocessed medical devices market CAGR during the analysis period of 2023 to 2032 is 18.4%.

Which are the key players in the reprocessed medical devices market?

The key players operating in the global reprocessed medical devices market are Arjo, Cardinal Health, Innovative Health, Johnson & Johnson MedTech, Medline Industries, LP, NEScientific, Inc., Soma Tech Intl, Stryker, SureTek Medical, and Vanguard AG.

Which region dominated the global reprocessed medical devices market share?

North America region held the dominating position in reprocessed medical devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of reprocessed medical devices during the analysis period of 2023 to 2032.

What are the current trends in the global reprocessed medical devices industry?

The current trends and dynamics in the reprocessed medical devices industry include growing need to reduce medical waste, reprocessed devices offer healthcare cost reduction, and stringent regulatory framework to ensure safety and efficacy standards.

Which type held the maximum share in 2022?

The third-party reprocessing type held the maximum share of the reprocessed medical devices industry.