Medical Waste Management Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Medical Waste Management Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

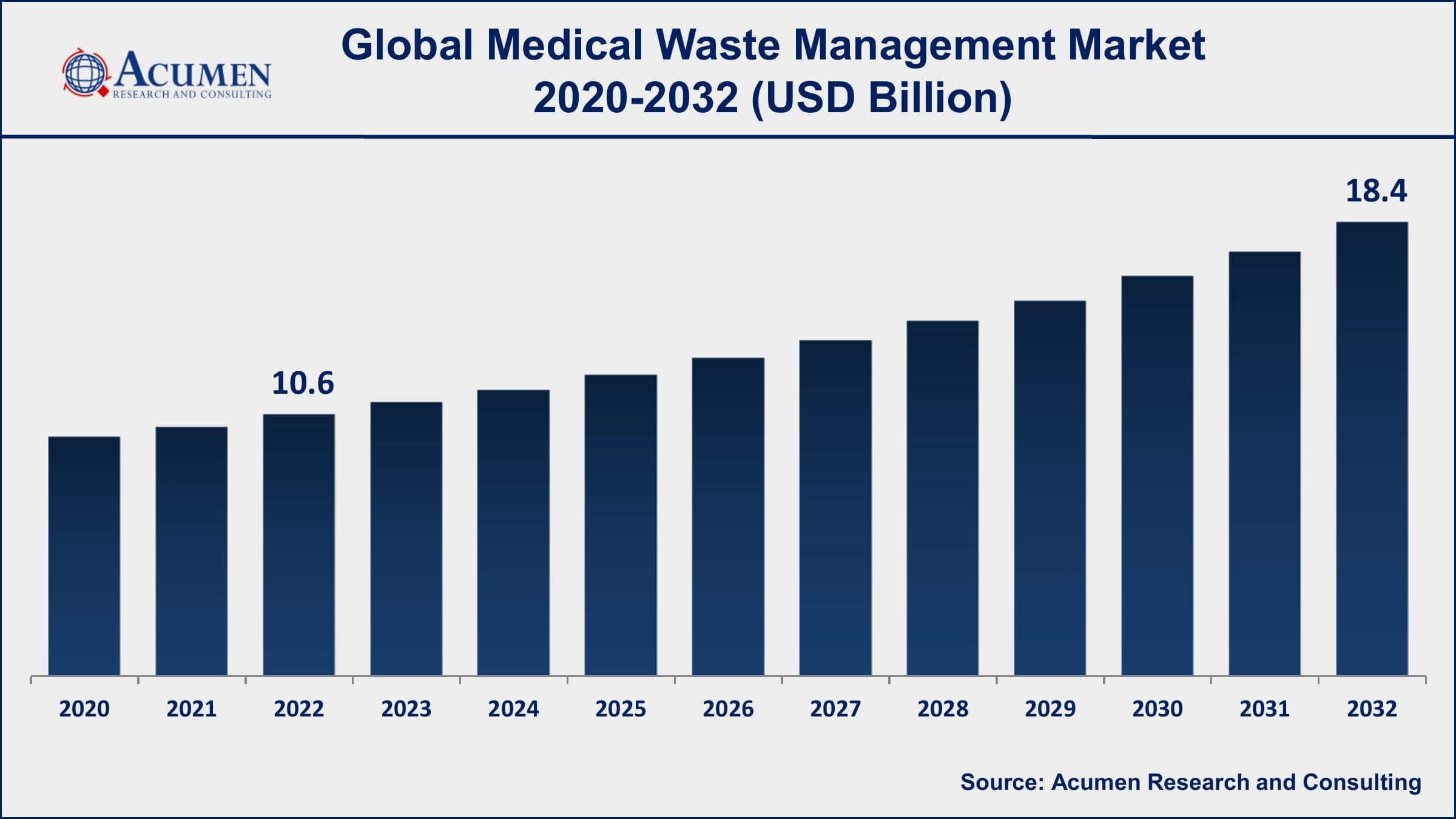

The Global Medical Waste Management Market Size accounted for USD 10.6 Billion in 2022 and is projected to achieve a market size of USD 18.4 Billion by 2032 growing at a CAGR of 5.8% from 2023 to 2032.

Report Key Highlights

- Global medical waste management market revenue is expected to increase by USD 18.4 Billion by 2032, with a 5.8% CAGR from 2023 to 2032

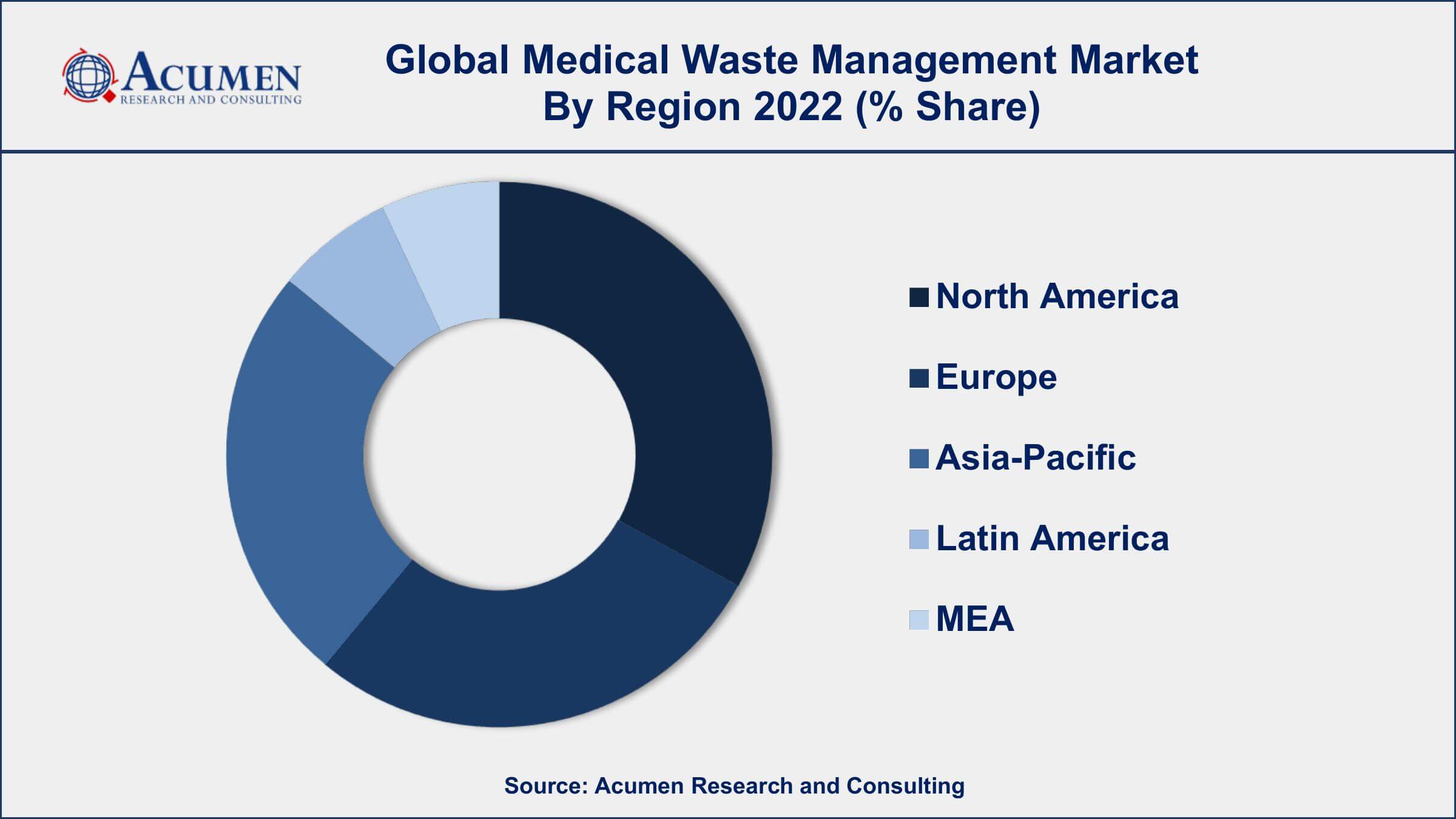

- North America region led with more than 42% of medical waste management market share in 2022

- According to the WHO, an estimated 16 billion injections are administered annually worldwide, and many of these injections generate medical waste

- According to the Environmental Protection Agency, healthcare facilities in the United States generate about 5.9 million tonnes of medical waste per year

- According to the EPA, the United States generates about 250 million pounds of unused or expired pharmaceuticals each year

- According to a study, the amount of medical waste generated globally is anticipated to increase by 33% between 2018 and 2022

- Growing demand for eco-friendly waste management solutions, drives the medical waste management market size

Medical waste management refers to the proper handling, treatment, and disposal of waste generated by healthcare facilities. This waste can include infectious waste, hazardous waste, pharmaceutical waste, and other materials that may pose a risk to human health and the environment. Medical waste management is crucial to prevent the spread of diseases, protect the environment, and comply with local regulations.

In recent years, the medical waste management market has experienced significant growth due to the increasing demand for safe and efficient waste disposal solutions. Factors driving this growth include the rise in healthcare facilities and medical research activities, the emergence of new diseases, and the growing awareness of environmental concerns. Additionally, governments and regulatory bodies are implementing strict guidelines and regulations to ensure proper medical waste management practices, further contributing to the growth of the market.

Global Medical Waste Management Market Trends

Market Drivers

- Increasing healthcare facilities and hospitals

- Growing number of diagnostic and pathological laboratories

- Emergence of new diseases and infectious agents

- Strict regulations and guidelines for medical waste management

- Growing awareness about environmental concerns

Market Restraints

- High capital and operational costs associated with waste management

- Limited availability of skilled personnel

Market Opportunities

- Growing demand for eco-friendly waste management solutions

- Increasing focus on sustainable waste management practices

- Rising demand for waste-to-energy solutions

Medical Waste Management Market Report Coverage

| Market | Medical Waste Management Market |

| Medical Waste Management Market Size 2022 | USD 10.6 Billion |

| Medical Waste Management Market Forecast 2032 | USD 18.4 Billion |

| Medical Waste Management Market CAGR During 2023 - 2032 | 5.8% |

| Medical Waste Management Market Analysis Period | 2020 - 2032 |

| Medical Waste Management Market Base Year | 2022 |

| Medical Waste Management Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Service, By Type, By Treatment Site, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Stericycle, Veolia Environment S.A., Clean Harbors, Inc., Suez Environnement S.A., Republic Services, Inc., Waste Management, Inc., BioMedical Waste Solutions, LLC, Daniels Sharpsmart, Inc., MedWaste Management, Sharps Compliance, Inc., Remondis Medison GmbH, and GRP & Associates, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical waste management refers to the proper processing of waste generated by various healthcare institutions such as laboratories, bloods banks, clinics, hospitals, and more. The rise of medical waste management solutions has played a vital role in preventing toxic compounds released from different healthcare institutions into water and land. Medical waste management solutions treat waste maturely by adopting eco-friendly treatment processes. These treatments are environmentally friendly and emit zero toxic compounds. The growth of the overall healthcare and medical industry is triggering the spontaneous demand for these systems. In addition, rising diseases such as chronic disorders and cancers, an increasing geriatric population, and the wide number of road accidents result in higher demand for these medical solutions. The development of advanced manufacturing techniques for medical devices in the pharmaceutical industry and drugs is growing rapidly. The rise in multispecialty clinics, hospitals, and diagnostic centers that necessitate the large number of inventories for daily demand fulfillment is also leading to the generation of more waste. Thus, overall growth in the healthcare industry is directly related to the rising patient population and requires extended medical and surgical aid, which is further fueling the growth of the medical waste management market value.

The medical waste management market is driven by the rising aging population, stringent regulations for medical waste management, and the generation of a wide amount of medical waste from various end users. In addition, the rising demand for safe waste management employing eco-friendly treatment processes is further driving market growth. The rapid growth in the healthcare industry would result in the generation of more amount of medical waste, thus posing a significant growth opportunity for the market. However, inadequate knowledge about waste management, lack of awareness of the ill-effects of health hazards, lack of training for proper disposal, and insufficient funds have stalled the global medical waste management market growth. Initiatives from governments to raise funds and support effective waste management are expected to drive market growth in the coming years.

Medical Waste Management Market Segmentation

The global medical waste management market segmentation is based on service, type, treatment site, and geography.

Medical Waste Management Market By Service

- Collection, Transportation, and Storage Services

- Recycling Services

- Treatment & Disposal Service

- Chemical Treatment

- Incineration

- Autoclaving

- Others

According to the medical waste management industry analysis, the collection, transportation, and storage services segment accounted for the largest market share in 2022. This segment involves the collection of medical waste from healthcare facilities, transportation to the treatment site, and storage until proper treatment and disposal can be carried out. The growth of this segment is directly related to the increasing demand for proper medical waste management practices and compliance with regulations. The market for collection, transportation, and storage services is expected to experience steady growth in the coming years due to factors such as the rise in healthcare facilities and the increasing adoption of disposable medical products. The expansion of the pharmaceutical and biotechnology industries is also expected to contribute to the growth of this segment as it generates a significant amount of medical waste. Additionally, the emergence of new diseases and infectious agents further highlights the need for efficient collection, transportation, and storage services.

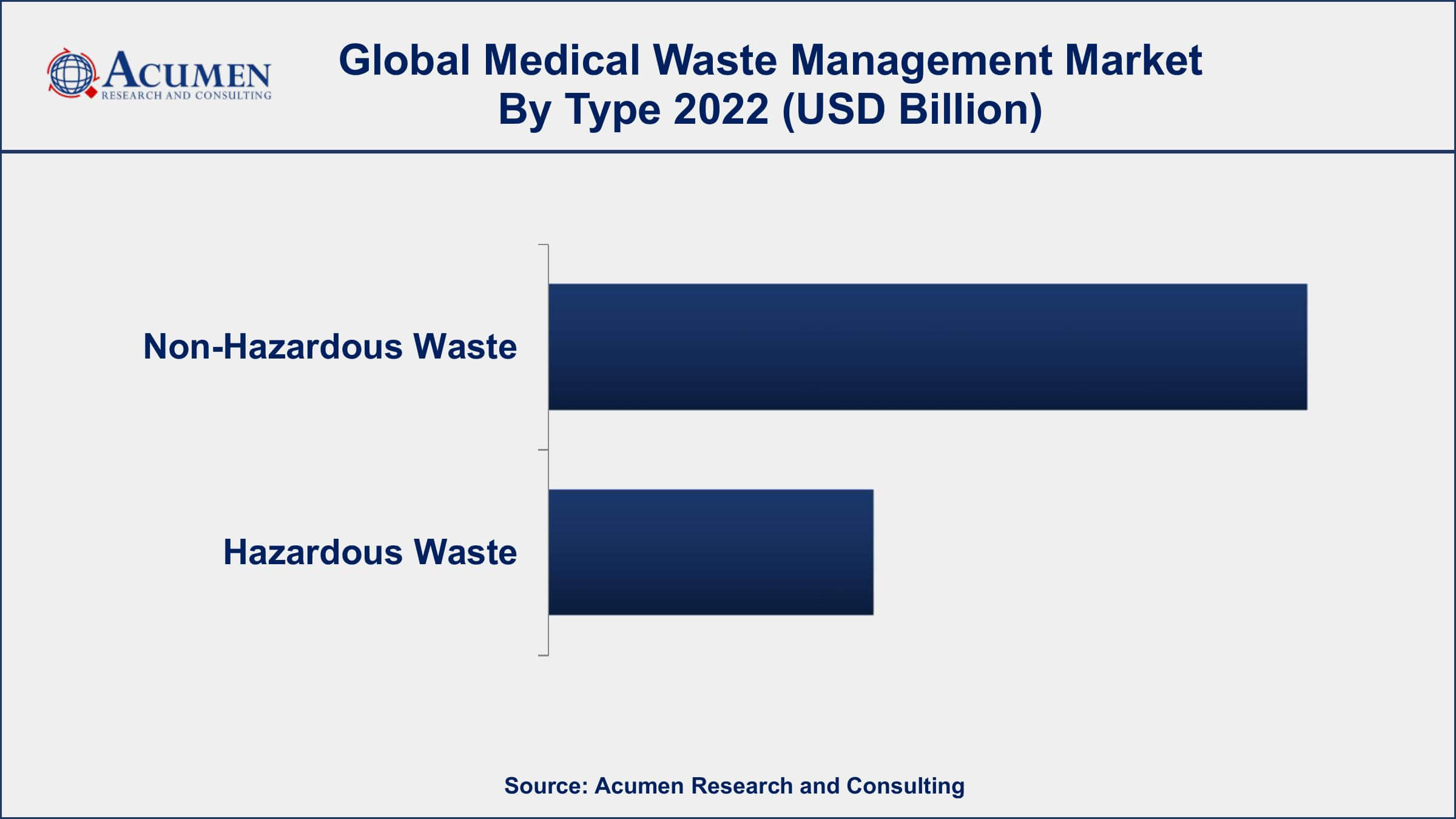

Medical Waste Management Market By Type

- Non-Hazardous Waste

- Hazardous Waste

- Pharmaceutical Waste

- Infectious & Pathological Waste

- Sharp Waste

- Others

In terms of types, the non-hazardous waste segment is expected to witness significant growth in the coming years. This includes materials such as paper, cardboard, and plastics that are generated by healthcare facilities during routine operations. The growth of this segment is driven by the increasing volume of non-hazardous waste generated by healthcare facilities, as well as the need for proper disposal and management of this waste. The non-hazardous waste segment is expected to experience steady growth in the coming years due to factors such as the increasing adoption of single-use medical products and the rise in healthcare facilities. The expansion of healthcare infrastructure and the growing demand for healthcare services is expected to contribute to the growth of this segment, as they generate a significant amount of non-hazardous waste.

Medical Waste Management Market By Treatment Site

- Offsite Treatment

- Onsite Treatment

According to the medical waste management market forecast, the onsite treatment segment is expected to witness significant growth in the coming years. This segment involves the use of various technologies such as autoclaving, microwaving, and chemical disinfection to treat medical waste and render it safe for disposal. The growth of this segment is driven by the increasing demand for sustainable and cost-effective waste management solutions. The onsite treatment segment is expected to experience significant growth in the coming years due to factors such as the increasing adoption of eco-friendly waste management solutions and the growing trend of sustainable waste management practices. The need for efficient and cost-effective waste management solutions is also expected to contribute to the growth of this segment, as it eliminates the need for offsite transportation and treatment of medical waste.

Medical Waste Management Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Waste Management Market Regional Analysis

North America dominates the medical waste management market due to various factors. The region has a well-established healthcare infrastructure, stringent regulations and guidelines for waste management, and high awareness about environmental concerns. The United States, in particular, is a major contributor to the growth of the medical waste management market due to the presence of a large number of healthcare facilities and the generation of a significant amount of medical waste. Moreover, the North American region has a well-developed waste management industry and a high degree of technological advancements, which have led to the adoption of efficient and sustainable waste management solutions. The growing trends of outsourcing waste management services and the presence of key players in the region have also contributed to the growth of the medical waste management market in North America.

Medical Waste Management Market Player

Some of the top medical waste management market companies offered in the professional report include Stericycle, Veolia Environment S.A., Clean Harbors, Inc., Suez Environnement S.A., Republic Services, Inc., Waste Management, Inc., BioMedical Waste Solutions, LLC, Daniels Sharpsmart, Inc., MedWaste Management, Sharps Compliance, Inc., Remondis Medison GmbH, and GRP & Associates, Inc.

Frequently Asked Questions

What was the market size of the global medical waste management in 2022?

The market size of medical waste management was USD 10.6 Billion in 2022.

What is the CAGR of the global medical waste management market from 2023 to 2032?

The CAGR of medical waste management is 5.8% during the analysis period of 2023 to 2032.

Which are the key players in the medical waste management market?

The key players operating in the global market are including Stericycle, Veolia Environment S.A., Clean Harbors, Inc., Suez Environnement S.A., Republic Services, Inc., Waste Management, Inc., BioMedical Waste Solutions, LLC, Daniels Sharpsmart, Inc., MedWaste Management, Sharps Compliance, Inc., Remondis Medison GmbH, and GRP & Associates, Inc.

Which region dominated the global medical waste management market share?

North America held the dominating position in medical waste management industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical waste management during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global medical waste management industry?

The current trends and dynamics in the medical waste management industry include increasing healthcare facilities and hospitals, and growing number of diagnostic and pathological laboratories.

Which type held the maximum share in 2022?

The non-hazardous waste type held the maximum share of the medical waste management industry.