Test and Measurement Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Test and Measurement Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

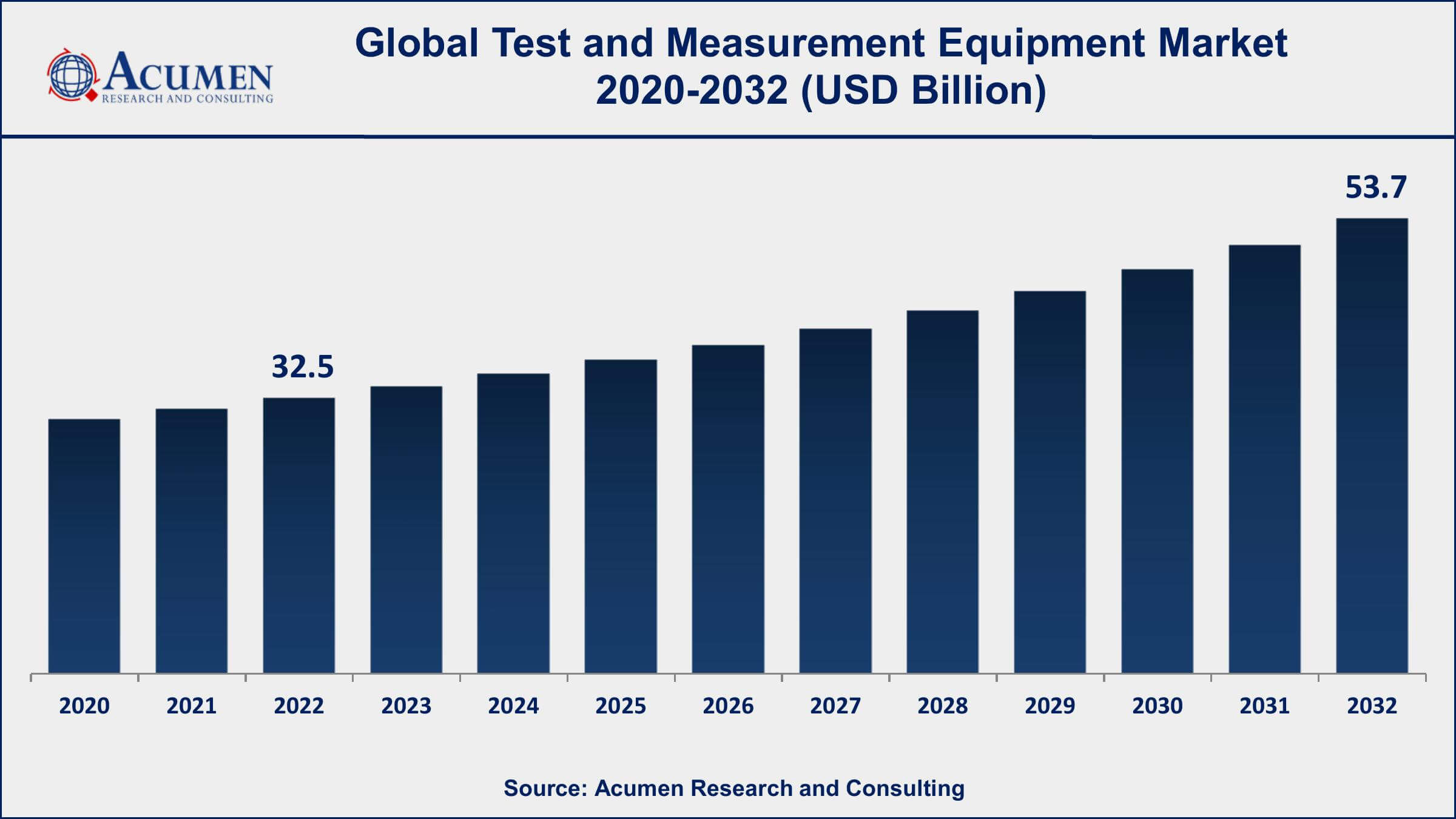

The Global Test and Measurement Equipment Market Size accounted for USD 32.5 Billion in 2022 and is projected to achieve a market size of USD 53.7 Billion by 2032 growing at a CAGR of 4.7% from 2023 to 2032.

Test and Measurement Equipment Market Report Key Highlights

- Global test and measurement equipment market revenue is expected to increase by USD 53.7 Billion by 2032, with a 4.7% CAGR from 2023 to 2032

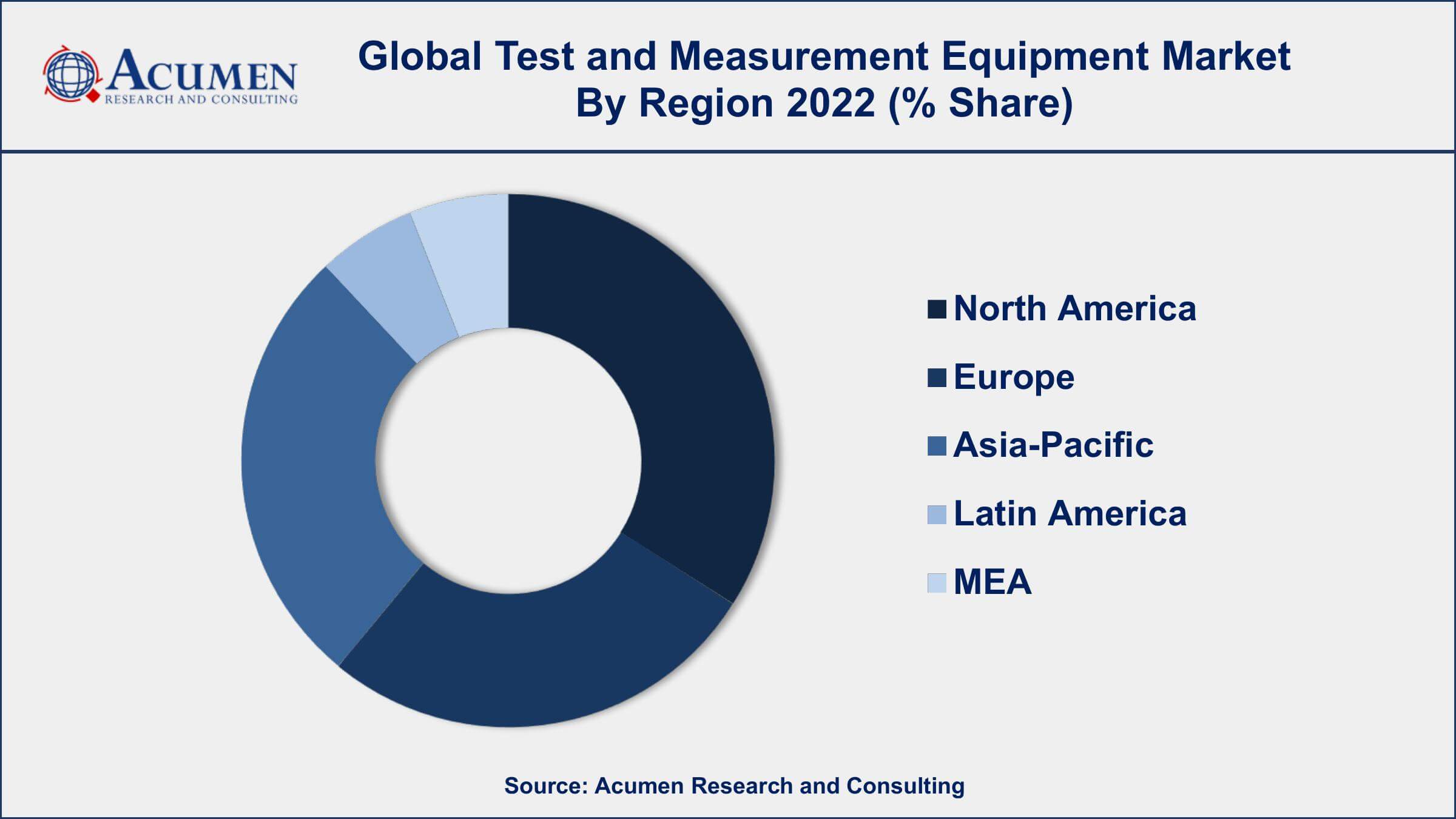

- North America region led with more than 34% of test and measurement equipment market share in 2022

- The telecommunications industry is the fastest-growing segment in market, with a CAGR of 6.7% from 2023 to 2032

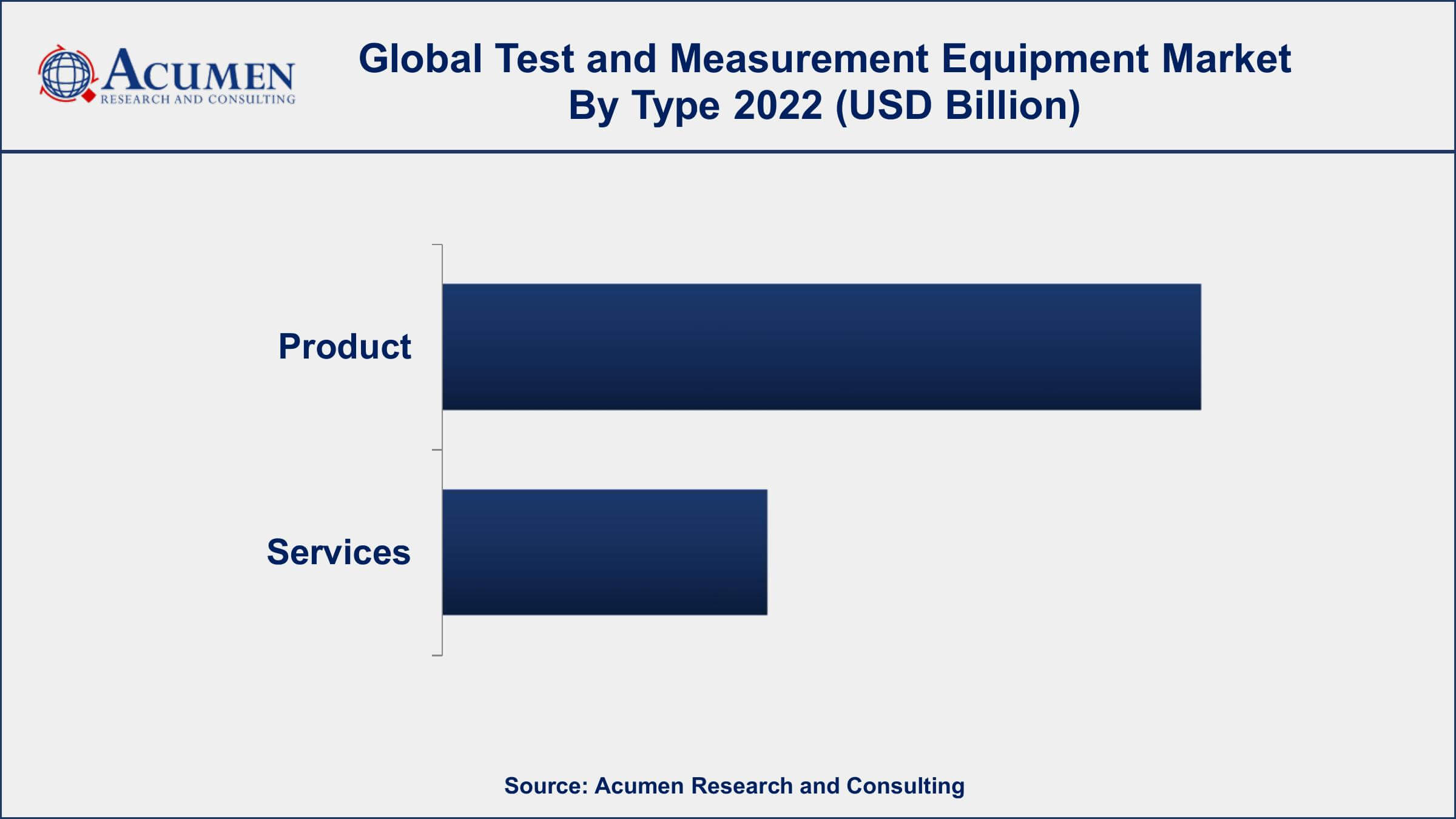

- By type, the product segment has accounted market share of over 69% in 2022

- By application, the healthcare segment captured the majority of the market

- Adoption of Industry 4.0 and the increasing demand for automation, drives the test and measurement equipment market size

Test and measurement equipment refers to a range of devices used to measure, test, analyze, and diagnose the performance and functionality of various electronic and mechanical systems. This equipment is used in a wide range of industries, including telecommunications, electronics, aerospace, defense, automotive, and healthcare. Examples of test and measurement equipment include oscilloscopes, multimeters, signal generators, spectrum analyzers, network analyzers, and power meters.

The test and measurement equipment market value has been growing steadily over the past few years. One of the main drivers of this growth is the increasing demand for advanced technologies in various industries. As new technologies emerge, there is a need for more sophisticated and specialized test and measurement equipment to ensure their proper functioning. For example, the rise of 5G networks has created a demand for new test equipment that can measure and analyze the performance of these networks. In addition, the growth of the Internet of Things (IoT) and Industry 4.0 has also contributed to the test and measurement equipment market growth. As more and more devices become connected, there is a need for specialized equipment to test and analyze their performance. This includes equipment that can test the connectivity and functionality of IoT devices, as well as equipment that can test the performance of industrial automation systems.

Global Test and Measurement Equipment Market Trends

Market Drivers

- Increasing demand for quality and safety in manufacturing

- Growing adoption of IoT and Industry 4.0 technologies

- Rising demand in the automotive, aerospace, defense, and healthcare industries

- Increasing investments in research and development to enhance the accuracy and efficiency of the equipment

Market Restraints

- High cost of test and measurement equipment

- Lack of skilled workforce to operate and maintain complex equipment

Market Opportunities

- Growing demand for wireless test and measurement equipment due to the increasing adoption of wireless technologies

- Rising demand in the renewable energy sector, including solar and wind power

Test and Measurement Equipment Market Report Coverage

| Market | Test and Measurement Equipment Market |

| Test and Measurement Equipment Market Size 2022 | USD 32.5 Billion |

| Test and Measurement Equipment Market Forecast 2032 | USD 53.7 Billion |

| Test and Measurement Equipment Market CAGR During 2023 - 2032 | 4.7% |

| Test and Measurement Equipment Market Analysis Period | 2020 - 2032 |

| Test and Measurement Equipment Market Base Year | 2022 |

| Test and Measurement Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Keysight Technologies Inc., Rohde & Schwarz GmbH & Co. KG, National Instruments Corporation, Anritsu Corporation, Fortive Corporation, Yokogawa Electric Corporation, VIAVI Solutions Inc., Teledyne Technologies Incorporated, Advantest Corporation, EXFO Inc., Spirent Communications plc, and Teradyne Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Factors driving the need for test and measurement equipment include growing demand for electronics products which is in turn boosting the need for testing and measurement equipment, rising investments in research and development, technological innovations and advancement in communication and networking, and complimentary government policies in various emerging countries. The fast growth of the communication sector in the Asia-Pacific region is one of the significant factors propelling the growth of the test and measurement equipment market, globally. The rising adoption of test and measurement solutions by mobile device manufacturers, telecom service providers, and network equipment manufacturers is expected to boost the growth of this market in the coming years. Also, Asia-Pacific provides major growth opportunities for communication test and measurement solutions as mobile device manufacturers heavily depend on communication test and measurement solutions to offer their consumers high-performance and high-quality service. In the global communications sector, Asia-Pacific is one of the rapidly growing markets and thereby has created a significant base of mobile Internet subscribers in developing countries such as China and India. This is expected to generate high demand for a faster 4G network and capacity expansion. The growth of the 4G network in the Asia-Pacific region will boost the growth of the test and measurement equipment market in near future.

Test and Measurement Equipment Market Segmentation

The global test and measurement equipment market segmentation is based on type, application, and geography.

Test and Measurement Equipment Market By Type

- Product

- Mechanical Test Equipment

- General Purpose Test Equipment

- Services

- Repair or After Sale Services

- Calibration Services

- Others

According to our test and measurement equipment industry analysis, the product segment accounted for the largest market share in 2022. The product segment includes a wide range of devices used to measure, test, and diagnose the performance and functionality of electronic and mechanical systems. This includes equipment such as oscilloscopes, signal generators, spectrum analyzers, network analyzers, and power meters. The product segment is further divided into various sub-segments based on the type of equipment and its application in different industries.

On the other hand, the services segment includes calibration, repair, and maintenance of the test and measurement equipment. Calibration services are essential to ensure the accuracy and reliability of the equipment, while repair and maintenance services help to keep the equipment in good condition and extend its lifespan. The services segment also includes training and consulting services, which help to train users on how to operate the equipment and provide guidance on how to optimize its performance.

Test and Measurement Equipment Market By Application

- Automotive

- Industrial

- IT and Telecommunication

- Aerospace and Defense

- Semiconductor and Electronics

- Manufacturing

- Healthcare

- Education and Government

- Others

According to the test and measurement equipment market forecast, the automotive segment is expected to grow significantly in the coming years. The automotive industry is one of the largest end-users of test and measurement equipment. The use of this equipment is critical in ensuring that automotive components and systems meet the required safety and quality standards. The automotive segment of the test and measurement equipment market includes equipment used in the testing of various automotive components such as engines, transmissions, brakes, and safety systems. One of the main drivers of the growth of the automotive segment in the test and measurement equipment market is the increasing demand for advanced safety and comfort features in modern vehicles. As automotive manufacturers continue to incorporate new technologies into their vehicles, there is a growing need for sophisticated test and measurement equipment to ensure that these features operate correctly and safely.

Test and Measurement Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Test and Measurement Equipment Market Regional Analysis

North America is dominating the test and measurement equipment market for several reasons. One of the main factors contributing to this dominance is the presence of several key players in the region. These companies have strong R&D capabilities and offer a wide range of advanced test and measurement equipment for various industries. In addition, the region has a well-established infrastructure and regulatory framework, which supports the growth of the market.

Furthermore, the North American region is home to several industries that are significant end-users of test and measurement equipment, including aerospace, defense, automotive, and telecommunications. These industries have a high demand for sophisticated test and measurement equipment to ensure the quality and safety of their products. As a result, the market for test and measurement equipment in North America is expected to continue growing in the coming years.

Test and Measurement Equipment Market Player

Some of the top test and measurement equipment market companies offered in the professional report includes Keysight Technologies Inc., Rohde & Schwarz GmbH & Co. KG, National Instruments Corporation, Anritsu Corporation, Fortive Corporation, Yokogawa Electric Corporation, VIAVI Solutions Inc., Teledyne Technologies Incorporated, Advantest Corporation, EXFO Inc., Spirent Communications plc, and Teradyne Inc.

Frequently Asked Questions

What was the market size of the global test and measurement equipment in 2022?

The market size of test and measurement equipment was USD 32.5 Billion in 2022.

What is the CAGR of the global test and measurement equipment market during forecast period of 2023 to 2032?

The CAGR of test and measurement equipment market is 4.7% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global test and measurement equipment market are Keysight Technologies Inc., Rohde & Schwarz GmbH & Co. KG, National Instruments Corporation, Anritsu Corporation, Fortive Corporation, Yokogawa Electric Corporation, VIAVI Solutions Inc., Teledyne Technologies Incorporated, Advantest Corporation, EXFO Inc., Spirent Communications plc, and Teradyne Inc.

Which region held the dominating position in the global test and measurement equipment market?

North America held the dominating position in test and measurement equipment market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for test and measurement equipment market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global test and measurement equipment market?

The current trends and dynamics in the test and measurement equipment industry include the increase in oil and gas production and transportation through pipelines, and stringent safety regulations.

Which type held the maximum share in 2022?

The product type held the maximum share of the test and measurement equipment market.