Telecom Power System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Telecom Power System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

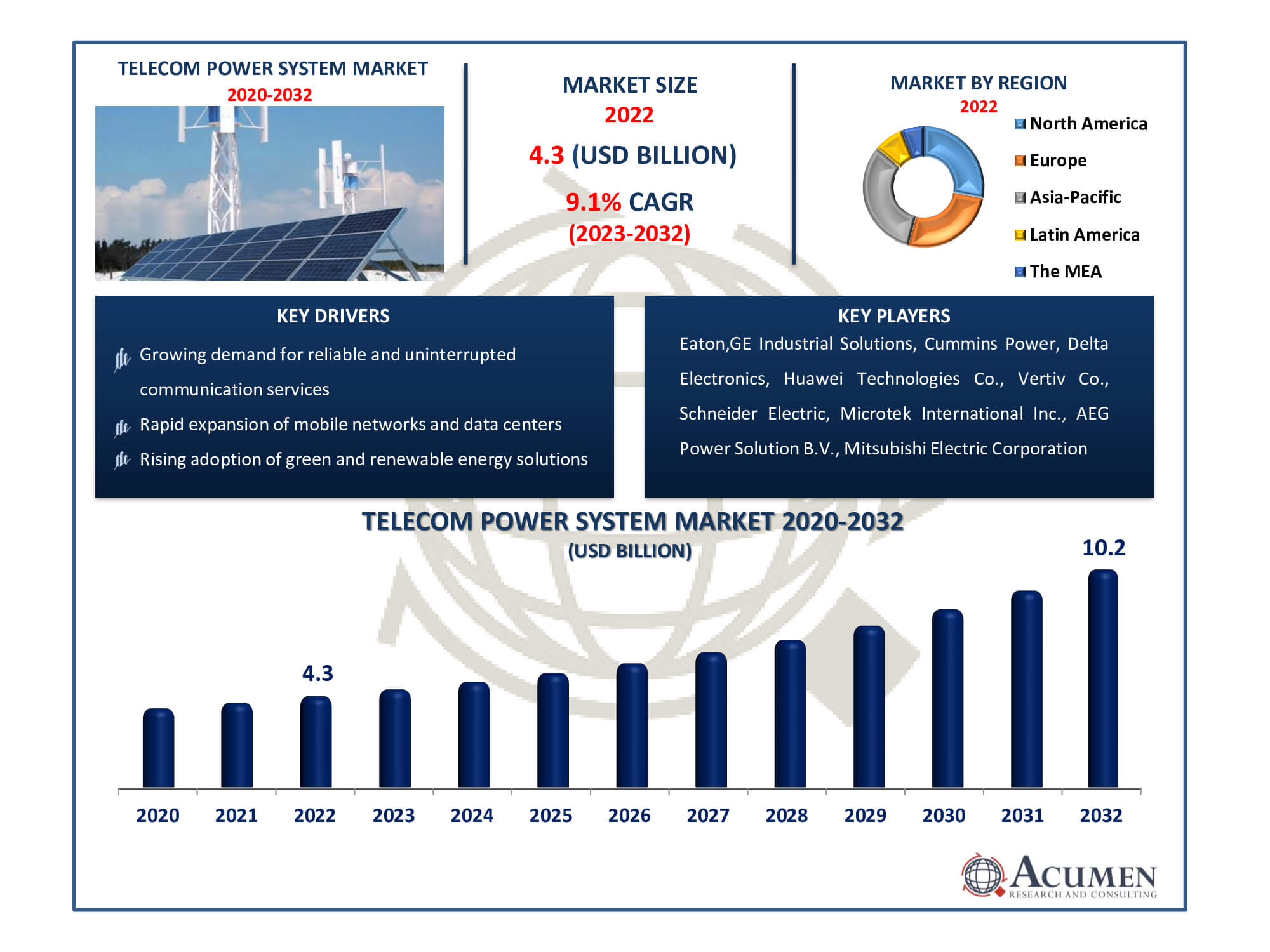

The Telecom Power System Market Size accounted for USD 4.3 Billion in 2022 and is estimated to achieve a market size of USD 10.2 Billion by 2032 growing at a CAGR of 9.1% from 2023 to 2032.

Telecom Power System Market Highlights

- Global telecom power system market revenue is poised to garner USD 10.2 billion by 2032 with a CAGR of 9.1% from 2023 to 2032

- Asia-Pacific telecom power system market value occupied around USD 1.3 billion in 2022

- Asia-Pacific telecom power system market growth will record a CAGR of more than 10.5% from 2023 to 2032

- Among grid, the on grid sub-segment generated over US$ 1.7 billion in revenue in 2022

- Based on product, the DC power systems sub-segment generated around 60% share in 2022

- Expansion of 5G networks and IoT is a popular telecom power system market trend that fuels the industry demand

Every day, the internet, high-speed data, telephone networks, and various other communication services rely on telecommunications (telecom) power systems. In the event of power interruptions and grid disturbances, these telecom networks ensure the protection of telecom services. Power management systems facilitate the monitoring and remote control of total battery life, storage efficiency, and the cost-effectiveness of energy resources on-site, while also functioning as predictive maintenance systems. Additionally, the system can be expanded by integrating renewable energy sources, leading to significant energy savings and reduced operational costs. The continuous operation of vital communication services is ensured by the telecom power system market, a crucial component of today's communication infrastructure. Power management solutions, which provide dependable power supply, proactive maintenance, and smooth integration of renewable energy sources for increased energy efficiency and cost savings, are included in this market.

Global Telecom Power System Market Dynamics

Market Drivers

- Growing demand for reliable and uninterrupted communication services

- Rapid expansion of mobile networks and data centers

- Rising adoption of green and renewable energy solutions

- Increasing need for remote monitoring and predictive maintenance

Market Restraints

- High initial investment and deployment costs

- Dependence on unstable power grids in some regions

- Environmental and regulatory challenges for renewable energy integration

Market Opportunities

- Emerging markets with untapped potential for telecom power systems

- Integration of energy-efficient technologies for cost savings

- Development of advanced energy storage solutions

Telecom Power System Market Report Coverage

| Market | Telecom Power System Market |

| Telecom Power System Market Size 2022 | USD 4.3 Billion |

| Telecom Power System Market Forecast 2032 | USD 10.2 Billion |

| Telecom Power System Market CAGR During 2023 - 2032 | 9.1% |

| Telecom Power System Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Grid, By Product, By Power Source, By Component, By Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Eaton, GE Industrial Off Grid, Cummins Power, Delta Electronics, Huawei Technologies Co., Vertiv Co., Schneider Electric, Microtek International Inc., AEG Power Solution B.V., and Mitsubishi Electric Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Telecom Power System Market Insights

Telecom towers are increasingly extending their reach into rural and remote areas, and the use of small cell power systems, particularly for LTE, is expected to boost demand for telecom systems. Mobile data transmission and telecommunication operators have significantly expanded their network coverage, both in rural and urban areas. The widespread adoption of mobile devices in cities has led to the incorporation of femtocells and picocells, which require DC power systems. The increasing use of hybrid power systems is anticipated to drive the growth of telecom power systems. The lack of network connectivity in rural areas is likely to encourage global suppliers to implement hybrid systems, offering energy-efficient and cost-effective solutions to address environmental concerns related to non-renewable power sources in the industry. With the decline in global renewable energy costs, hybrid systems are becoming more economically efficient and environmentally friendly compared to traditional power generation systems. There is a growing consumer preference to reduce the carbon footprint of the telecom industry while expanding its infrastructure. The growing use of energy-efficient technology presents a market potential for telecom power systems. Integrating energy-efficient technologies, including sophisticated batteries and renewable energy sources, offers the opportunity for considerable cost savings and a more sustainable, environmentally friendly infrastructure as the telecom industry works to minimize operational costs and environmental effect.

Telecom Power System Market Segmentation

The worldwide market for telecom power system is split based on grid, product, power source, component, type, and geography.

Telecom Power System Grids

- Off Grid

- On Grid

- Bad Grid

In the telecom power system market, the on grid category is the biggest. The fundamental cause of this domination is the widespread installation of telecom infrastructure in developed, urban regions that have dependable access to the main power grid. Compared to off-grid and bad-grid areas, on-grid systems have a reliable power supply, less need on backup power, and cheaper operating expenses. Because of this, they are frequently chosen for telecom installations, which contributes to their market popularity.

Telecom Power System Products

- DC Power Systems

- AC Power Systems

- Digital Electricity

As per the telecom power systems industry analysis, DC power systems category dominated the industry. This is mainly because, for telecom applications, DC (Direct Current) systems are the recommended option because they are compatible with most electrical devices in the industry and are energy-efficient. In addition to saving money and reducing energy waste, DC power solutions provide a simpler and more reliable way to power telecom equipment. Because of this inclination, DC systems dominate the market's product sector.

Telecom Power System Power Sources

- Diesel-Wind

- Diesel-Battery

- Diesel-Solar

- Other Sources

As per the telecom power system market forecast, the diesel-battery category is expected to be largest from 2023 to 2032. The reason for this supremacy is the careful balancing act done by reliability and environmental factors. Diesel-Battery systems combine battery backup for energy efficiency and load balancing with diesel generators to provide a reliable and steady power source. This combination guarantees a steady supply of electricity, particularly in places with erratic grid connections. Additionally, the dual-source strategy reduces the amount of diesel generators used, which lowers emissions and running costs. This is in line with the increasing emphasis on sustainability and economy, making it the preferred option in the market.

Telecom Power System Components

- Controllers

- Rectifiers

- Heat Management Systems

- Converters

- Generators

- Protection Devices

- Distribution Unit

- Circuit Breakers

- Others

Generators is the largest segment in the telecom power system market since they play such a crucial role as a major and dependable power source, especially in places with erratic grid connections. Generators guarantee continuous telecom services by offering instant backup power during blackouts. In remote or disaster-prone areas in particular, this is essential for preserving communication networks. Generators are the most popular product category in the market because they are needed to ensure the availability and dependability of telecom services, which is especially important in emergency situations.

Telecom Power System Types

- Low Pressure

- High pressure

- Atmospheric Pressure

With the biggest market share for telecom power systems, the atmospheric pressure sector is the most cost-effective and adaptable choice for a range of deployment situations. Although it only serves a smaller range of locales than atmospheric pressure systems, the second-largest category is low pressure because it provides a workable option for areas with particular atmospheric needs. Because low-pressure systems are necessary in certain circumstances, they are more popular than atmospheric pressure systems, which are capable of operating in a variety of conditions without modification.

Telecom Power System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Telecom Power System Market Regional Analysis

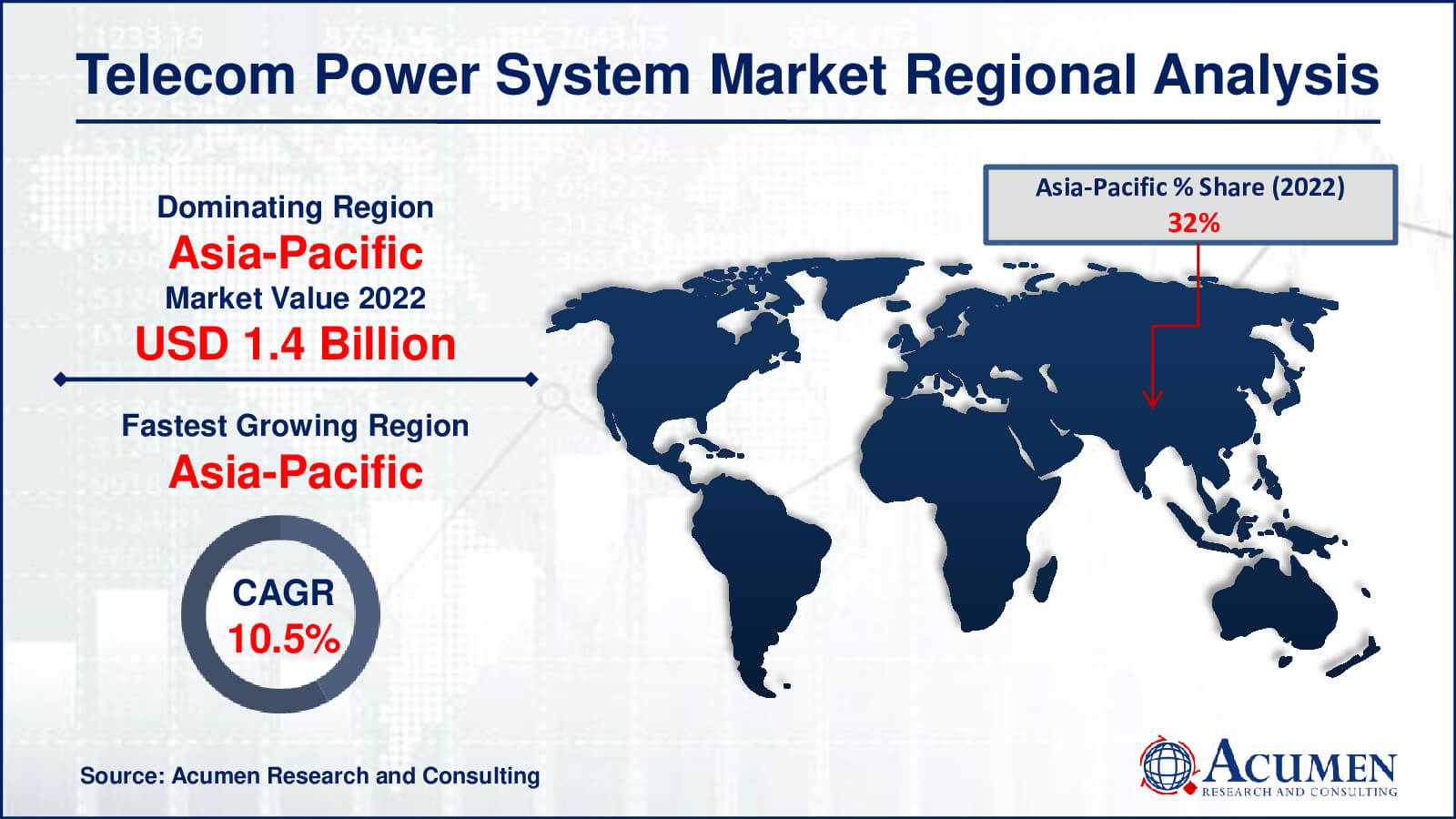

The telecom power system industry's greatest market is the Asia-Pacific area, primarily because of the region's exceptional economic growth and large population, which consistently needs cutting-edge telecommunication services. Numerous emerging economies in this region are experiencing substantial expansions in their telecom infrastructure due to factors like growing internet connectivity, increasing urbanization, and rising mobile device penetration. The need to expand network coverage to underserved and distant locations is strong in nations like China and India, which is driving up demand for telecom power systems.

The second-largest region in the telecom power system market is North America. This is mostly attributable to the area's sophisticated and advanced telecom infrastructure. Because of North America's dedication to delivering dependable and continuous communication services, there is a significant need for improved power systems. There is a continuing need for telecom power solutions in the region due to its vast networks, high mobile data usage, and ongoing need for cutting edge technologies.

Africa and the Middle East are the expected regions with the quickest growth. The primary cause of this expansion is the increased uptake of telecom services in formerly underserved and distant locations. One major driving reason has been the integration of renewable energy sources and the growth of mobile networks. The requirement for dependable connectivity in conjunction with the region's large geographic area is driving an increased uptake of telecom power systems.

Telecom Power System Market Players

Some of the top telecom power system companies offered in our report include Eaton, GE Industrial Solutions, Cummins Power, Delta Electronics, Huawei Technologies Co., Vertiv Co., Schneider Electric, Microtek International Inc., AEG Power Solution B.V., and Mitsubishi Electric Corporation.

Frequently Asked Questions

How big is the telecom power system market?

The market size of telecom power system was USD 4.3 billion in 2022.

What is the CAGR of the global telecom power system market from 2023 to 2032?

The CAGR of telecom power system is 9.1% during the analysis period of 2023 to 2032.

Which are the key players in the telecom power system market?

The key players operating in the global market are including Eaton, GE Industrial Solutions, Cummins Power, Delta Electronics, Huawei Technologies Co., Vertiv Co., Schneider Electric, Microtek International Inc., AEG Power Solution B.V., and Mitsubishi Electric Corporation.

Which region dominated the global telecom power system market share?

Asia-Pacific held the dominating position in telecom power system industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of telecom power system during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global telecom power system industry?

The current trends and dynamics in the telecom power system industry include growing demand for reliable and uninterrupted communication services, rapid expansion of mobile networks and data centers, rising adoption of green and renewable energy solutions, and increasing need for remote monitoring and predictive maintenance.

Which product held the maximum share in 2022?

The DC power systems product held the maximum share of the telecom power system industry.