Telecom Enterprise Service Market | Acumen Research and Consulting

Telecom Enterprise Service Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

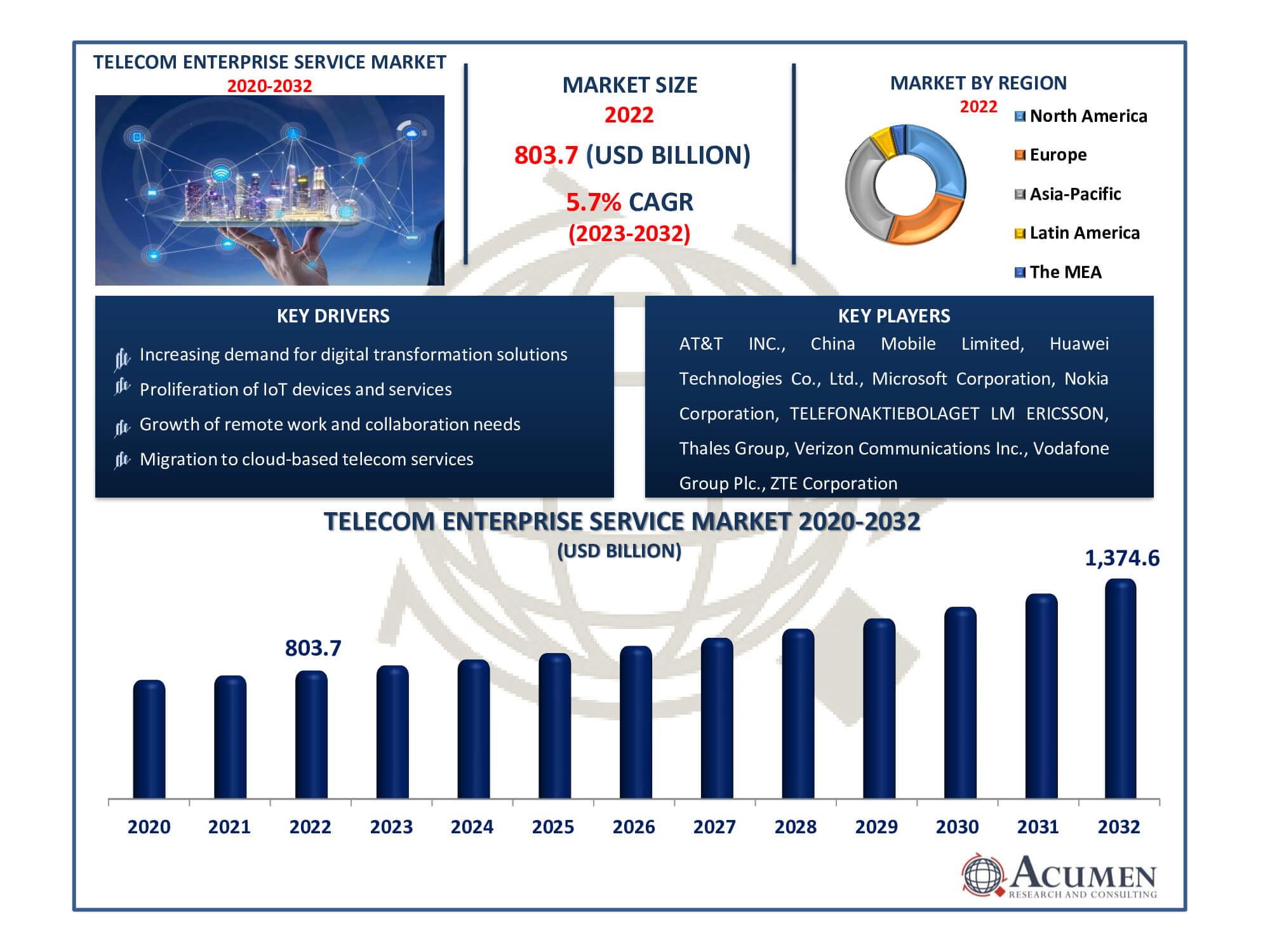

The Telecom Enterprise Service Market Size accounted for USD 803.7 Billion in 2022 and is estimated to achieve a market size of USD 1374.6 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Telecom Enterprise Service Market Highlights

- Global telecom enterprise service market revenue is poised to garner USD 1374.6 Billion by 2032 with a CAGR of 5.7% from 2023 to 2032

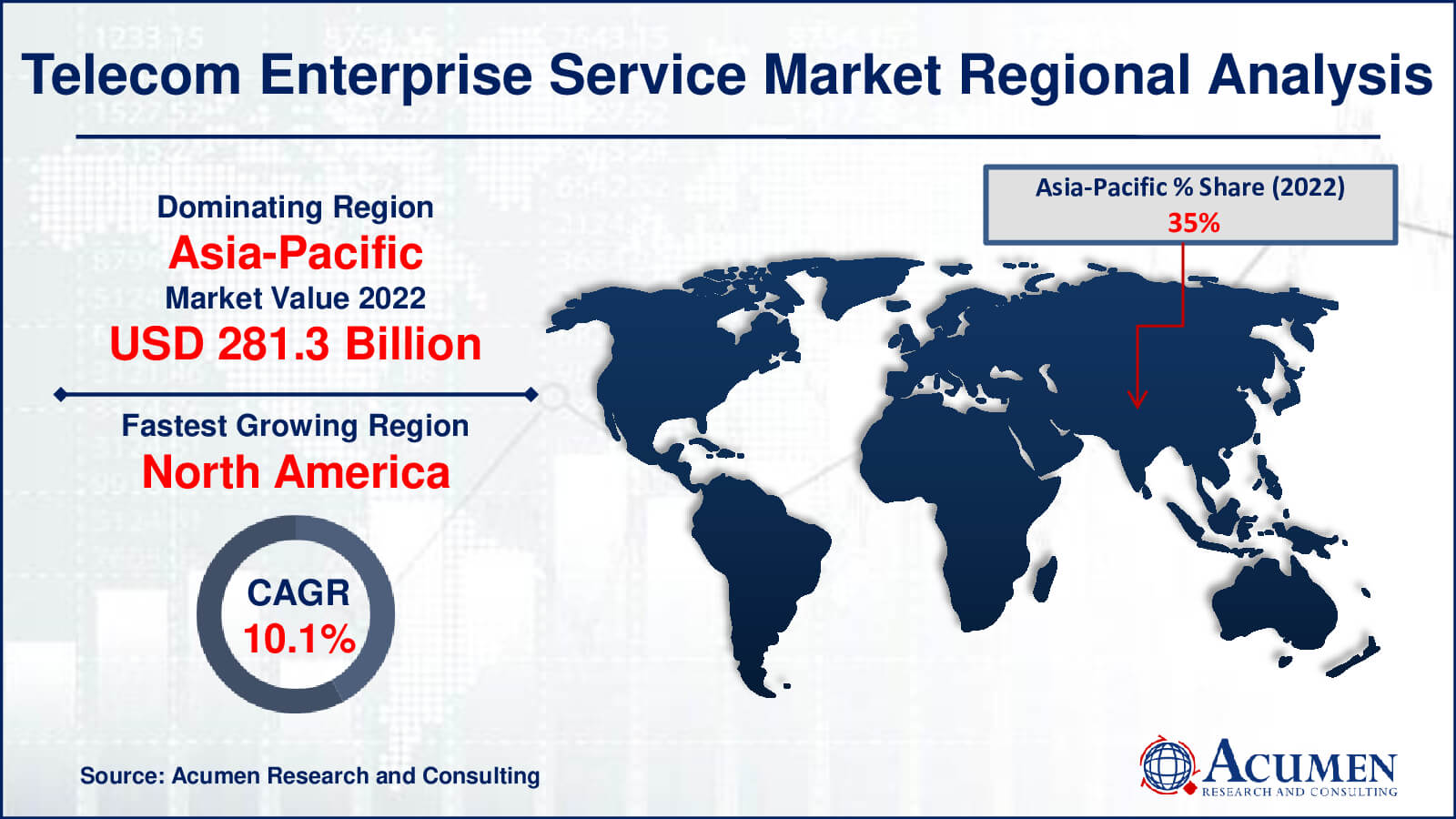

- Asia-Pacific telecom enterprise service market value occupied around USD 281.3 billion in 2022

- North America telecom enterprise service market growth will record a CAGR of more than 10.1% from 2023 to 2032

- Among transmission, the wireless sub-segment generated over US$ 602.8 billion in revenue in 2022

- Based on solution/service, the voice service sub-segment generated around 30% share in 2022

- Expansion into emerging markets for market growth and development is a popular telecom enterprise service market trend that fuels the industry demand

A variety of communication and telecommunications-related products and services created especially for companies and organizations are referred to as telecom enterprise services. These services are designed to satisfy the particular demands and specifications of businesses, which are frequently different from those of individual customers. The telecom industry is undergoing a significant shift in its approach to serving mobile operators. Global mobile operators are continuously innovating to maintain their competitive edge against new entrants and international telecom service providers. They are striving to transform themselves into comprehensive communication providers. However, their primary focus lies on large, small, and medium-scale enterprises. These enterprises are rapidly implementing IT and network technology solutions to boost productivity, enhance operational and capital efficiencies, and facilitate convergence across multiple devices. In contrast to larger enterprises, small-scale enterprises often lack in-house capabilities and rely on various service providers for their communication, security, and IT needs.

Global Telecom Enterprise Service Market Dynamics

Market Drivers

- Increasing demand for digital transformation solutions

- Proliferation of IoT devices and services

- Growth of remote work and collaboration needs

- Migration to cloud-based telecom services

Market Restraints

- Heightened cyber security threats and data security concerns

- Evolving and complex regulatory requirements

- Economic uncertainty impacting investment decisions

Market Opportunities

- Deployment and expansion of 5G networks for high-speed connectivity

- Growing demand for edge computing infrastructure

- Increasing interest in managed telecom services

Telecom Enterprise Service Market Report Coverage

| Market | Telecom Enterprise Service Market |

| Telecom Enterprise Service Market Size 2022 | USD 803.7 Billion |

| Telecom Enterprise Service Market Forecast 2032 | USD 1374.6 Billion |

| Telecom Enterprise Service Market CAGR During 2023 - 2032 | 5.7% |

| Telecom Enterprise Service Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Solutions/Service, By Revenue Stream, By Transmission, By Enterprise Size, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AT&T INC., China Mobile Limited, Huawei Technologies Co., Ltd., Microsoft Corporation, Nokia Corporation, TELEFONAKTIEBOLAGET LM ERICSSON, Thales Group, Verizon Communications Inc., Vodafone Group Plc., ZTE Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Telecom Enterprise Service Market Insights

Several key factors are contributing to the growth of the telecom enterprise services market. The rapid growth of medium, small, and micro enterprises, along with increasing industrial activities, plays a pivotal role. Enterprises are becoming more aware of the benefits offered by location-based marketing and advertising. Location-based applications are expected to drive market demand due to substantial investments from both small and large enterprises operating in location-based domains. The availability of a growing range of enabling technologies is poised to provide flexibility and multiple options, empowering solution providers, service providers, and other stakeholders in the value chain when adopting commerce applications and location-based services.

Cloud computing is anticipated to have a significant impact on telecom operators in the near future. It is gaining prominence among small and large enterprises in both developed and emerging markets. Small and medium-sized enterprises prefer enterprise-class features and conventional computing services that require relatively lower investments. The increasing number of SMEs in developing markets gravitates toward cloud pricing models with reduced upfront costs. These pricing models, tailored for small and medium enterprises with limited financial resources, present an opportunity for telecom service providers, especially in developing economies. Telecom operators are actively investing in and capitalizing on this opportunity, seeking to establish their position in the developing cloud value chain through direct investment, partnerships, and acquisitions.

Telecom Enterprise Service Market Segmentation

The worldwide market for telecom enterprise service is split based on solutions/service, revenue stream, transmission, enterprise size, ends user, and geography.

Telecom Enterprise Service Solutions/Service

- Voice Service

- Wireless/Mobility Service

- Data/Internet Service

- Managed Service

- Cloud Service

In the telecom enterprise service sector, voice service holds the largest market share due to its continued importance for business communication. Voice communication is still a vital component of business operations, despite the surge in popularity of data and internet services, according to market analysis. Voice services play a vital role in many important corporate operations, including internal communication, conference calls, and customer assistance. Voice services are additionally frequently used as the main method of communication with clients. This market sector is expected to remain significant and the largest component due to the continuous demand for dependable and superior voice communication as well as the advancement of technologies that improve voice services.

Telecom Enterprise Service Revenue Stream

- Carriers

- Master agents

- Others

According to our telecom enterprise service market analysis, carriers segment is the biggest source of revenue in the industry. Carriers are essential in providing telecom services to businesses because of their vast network infrastructure and range of services. They are able to provide a broad range of services and have a well-established clientele. Additionally, carriers frequently provide bundled solutions, which combine cloud, data, and voice services, so serving as a one-stop shop for enterprises. Their ability to invest in cutting-edge technologies and their current connections with major corporations help them maintain their leading position in the market, making them the segment that generates the most money.

Telecom Enterprise Service Transmission

- Wireless

- Wireline

According to the telecom enterprise service market forecast, the wireless transmission segment currently holds the largest share. the rising need for mobile connectivity including 5G networks, which provide high-speed data transmission is what is propelling the wireless segment's significance. Wireless technology offers enterprises mobility and flexibility by facilitating remote work and communication while on the road. The wireless market is predicted to grow faster than the traditional wireline market, which is limited by fixed infrastructure, as long as mobile technologies are adopted globally. According to the industry projection, wireless transmission will continue to expand in popularity among telecom enterprise service providers.

Telecom Enterprise Service Enterprise Size

- Large enterprise

- Small & medium enterprise (SME)

With a favourable market forecast, the small & medium enterprises (SME) category now holds the greatest position in the telecom enterprise service market. Based on market study, the reason for this domination is the sheer volume of SMEs in the world. The combined demand from SMEs is significant, even if large businesses may have more comprehensive needs on an individual basis. This market is also being helped by SMEs' growing recognition of the benefits of telecom services for improving their operations. As more SMEs adopt cutting-edge communication technologies to remain competitive, the market forecast predicts steady expansion, securing SMEs' position as the largest segment in the telecom enterprise service market.

Telecom Enterprise Service End User

- BFSI

- Education

- Manufacturing

- O&G and Mining

- Government & Defense

- Energy and Utilities

- IT & Telecom

- Media & Entertainment

- Healthcare

- Retail

- Transportation & Logistics

- Travel & Hospitality

- Others

The IT & telecom segment holds the highest share in the telecom enterprise service market because of its extensive impact on contemporary business operations. The telecom and IT industries have become major users of telecom services due to their growing reliance on technology and their ever-expanding communication infrastructure. Cloud-based solutions, reliable communication networks, and fast data transmission are always needed in this industry to support its intricate processes. In addition, the rapidly expanding data-intensive applications and technologies, such cloud computing and mobile services, have reinforced the demand for comprehensive and dependable telecom services, hence consolidating the IT & Telecom segment's leading position in the market.

Telecom Enterprise Service Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Telecom Enterprise Service Market Regional Analysis

A number of factors have combined to make Asia-Pacific the largest region in the telecom enterprise service market. The need for telecom services is primarily driven by the region's broad and varied economic landscape, which includes a considerable number of SMEs and major businesses. Significantly contributing to the region's dominance are nations like China and India, which have booming technological sectors and developing digital ecosystems. APAC is the largest market due in part to its aggressive use of cloud services and its reputation as a global hub for manufacturing and outsourcing.

In the telecom enterprise service market, North America is the region expanding at the highest rate. The swift expansion can be ascribed to multiple crucial elements. First off, North America is home to a large number of big firms, especially in the financial and technological sectors, as well as a highly established IT infrastructure. Advancement in enterprise services demand has been boosted by early investments in 5G and other cutting edge technologies. Furthermore, the continuous digital revolution occurring in several sectors such as healthcare, education, and finance is driving the uptake of telecom services in the area.

Telecom Enterprise Service Market Players

Some of the top telecom enterprise service companies offered in our report includes AT&T INC., China Mobile Limited, Huawei Technologies Co., Ltd., Microsoft Corporation, Nokia Corporation, TELEFONAKTIEBOLAGET LM ERICSSON, Thales Group, Verizon Communications Inc., Vodafone Group Plc., ZTE Corporation.

Frequently Asked Questions

How big is the telecom enterprise service market?

The market size of telecom enterprise service was USD 803.7 billion in 2022.

What is the CAGR of the global telecom enterprise service market from 2023 to 2032?

What is the CAGR of the global telecom enterprise service market from 2023 to 2032?

Which are the key players in the telecom enterprise service market?

The key players operating in the global market are including AT&T INC., China Mobile Limited, Huawei Technologies Co., Ltd., Microsoft Corporation, Nokia Corporation, TELEFONAKTIEBOLAGET LM ERICSSON, Thales Group, Verizon Communications Inc., Vodafone Group Plc., and ZTE Corporation.

Which region dominated the global telecom enterprise service market share?

Asia-Pacific held the dominating position in telecom enterprise service industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of telecom enterprise service during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global telecom enterprise service industry?

The current trends and dynamics in the telecom enterprise service industry include increasing demand for digital transformation solutions, proliferation of IoT devices and services, growth of remote work and collaboration needs, and migration to cloud-based telecom services.

Which revenue stream held the maximum share in 2022?

The carriers revenue stream held the maximum share of the telecom enterprise service industry.