Telecom API Market Size - Global Industry Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Telecom API Market Size - Global Industry Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Telecom API Market Size was valued at USD 221 Billion in 2021 and is predicted to be worth USD 1,113 Billion by 2030, with a CAGR of 20.2% from 2022 to 2030.

The widespread use of mobile internet and cloud-based services is projected to have an impact on the expansion of the telecom application programming interface (API) market size. The shift from 3rd generation to LTE (Long Term Evolution) as well as the evolving 5th generation, which increases demand for IPv6 migrations and IP-connected appliances, will drive global acceptance of the telecom API market growth. Rising Internet of Things adoption is likely to fuel the telecom API market. Furthermore, end-to-end transparency and the competitive advantage of Wireless telecommunications API are expected to have a favorable impact on the telecom API market value during the projection period.

APIs (application programming interfaces) have been employed to expose a variety of data types and services and to allow heterogeneous structures to communicate efficiently. The Telecom API is a set of programming instructions & standards for navigating a web-based application. It's utilized in smartphone apps and cloud-based telecommunications services including banking, webRTC, location sharing, email, identity management, and others. Moreover, APIs enable the development of apps and services that can be operated separately from the underlying hardware. Recently, telecom API market trends enables the development of user-friendly services for many devices operating on a specific network. A telecom provider provides MMS, voice, location, SMS, and finance APIs, allowing developers to incorporate the APIs into existing apps. By controlling the growing number of users in a system, telecom API improves an application's versatility and scalability.

Global Telecom API Market Analysis

Market Drivers

- Rapidly increasing proliferation of mobile internet and cloud technologies

- Growing network access to the 4G LTE network

- Increased scalability and reduced Time-to-Market, as well as lowering operational costs

- The spread of middleware architecture throughout telecom's business model

Market Restraints

- Security concerns led to growing API vulnerabilities

- Over-the-top (OTT) network operators are reducing telecom carriers' revenue and margins

Market Opportunities

- Growing adoption of machine-to-machine (M2M) systems

- Expanding research and development practices among market players

Telecom API Market Report Coverage:

| Market | Telecom API Market |

| Telecom API Market Size 2021 | USD 221 Billion |

| Telecom API Market Forecast 2030 | USD 1,113 Billion |

| Telecom API Market CAGR During 2022 - 2030 | 20.2% |

| Telecom API Market Analysis Period | 2018 - 2030 |

| Telecom API Market Base Year | 2021 |

| Telecom API Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By End-User, And By Region |

| Telecom API Market Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Vodafone Group PLC, Alcatel-Lucent, Orange S.A., Xura, Inc., Fortumo, Tropo, Inc., AT&T, Inc., Apigee Corporation, Verizon Communications, Inc., VONAGE, LocationSmart, and Aspect Software |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

The growing adoption of the Internet of Things (IoT), device integration, and wearable technology in the telecommunications industry is likely to boost the telecom API market growth throughout the forecast period. Telecom APIs enable end-to-end IoT solutions by serving as a single point of contact between different nodes within the same network, avoiding the need for several third-party internet services for systems development. With increasing IoT penetration, the telecom APIs market size is likely to rise at a breakneck pace.

The significant surge in the number of telecom API start-ups developed in emerging regions such as the Asia-Pacific and Africa is likely to open potential opportunity areas for telecom API market providers throughout the forecast year. Industry titans such as Vodafone, Google, communications service providers (CSPs), as well as other technology supplier groups have formed alliances with start-ups from such growing economies to encourage the expansion of telecom entrepreneurs by providing APIs for application development, hence boosting the telecom API market shares.

Telecom API Market Segmentation

The global telecom API market segmentation is based on the type, end-user and geographical region.

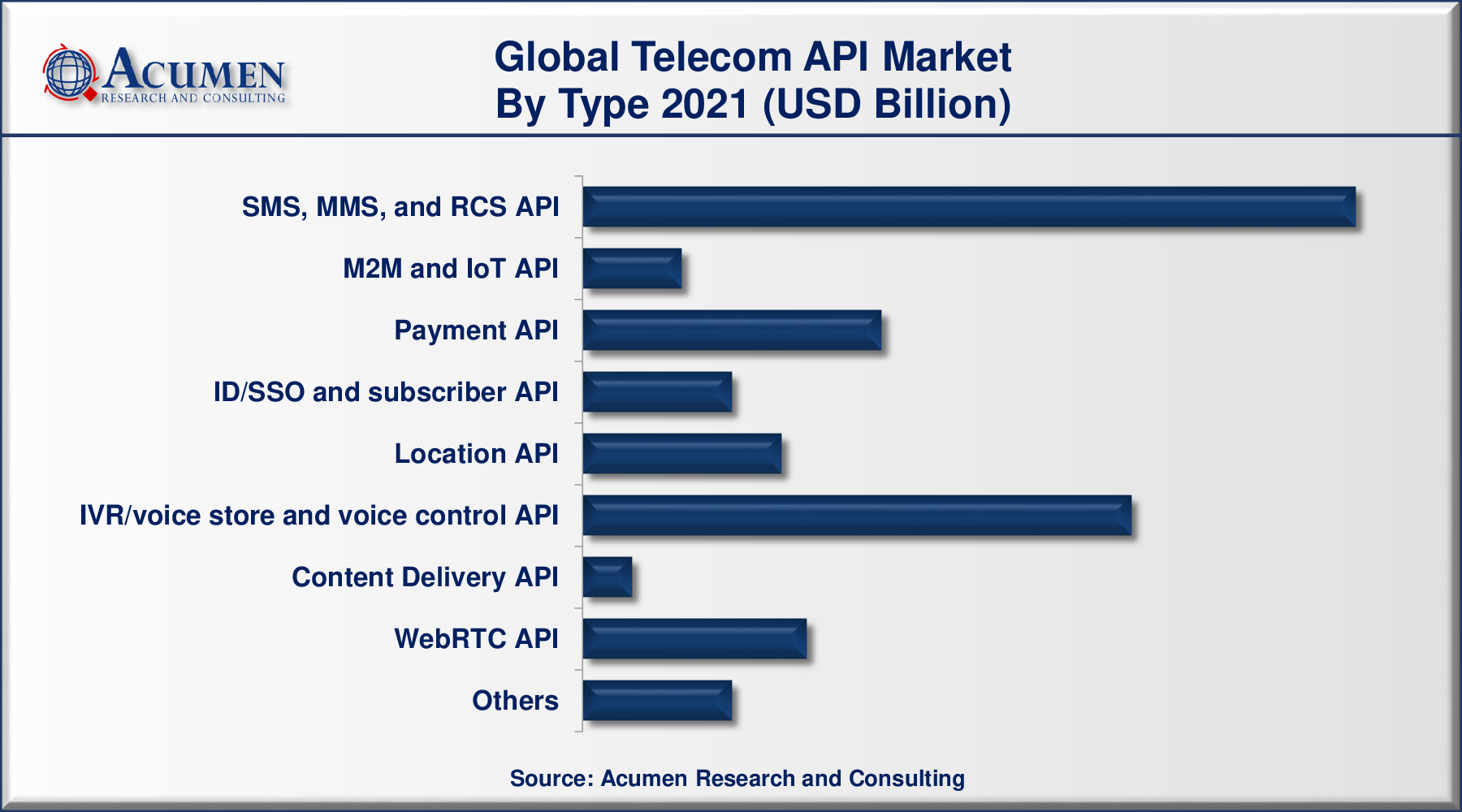

Market by Type

- SMS, MMS, and RCS API

- M2M and IoT API

- Payment API

- ID/SSO and subscriber API

- Location API

- IVR/voice store and voice control API

- Content Delivery API

- WebRTC API

- Others

According to a telecom API industry analysis, the SMS, MMS, and RCS API segment is expected to hold significant market shares in 2021. The significant rise of messaging APIs is due to the increasing desire for SMS, MMS, and RCS applications that use messaging APIs. The SMS industry continues to grow as a rising number of organizations use SMS platforms for tailored marketing and improving consumer experience and engagement. As a result, the need for SMS, MMS, and RCS APIs is increasing.

Furthermore, the IVR/voice store and voice control API segment is predicted to expand rapidly in the industry and gain significant telecom API market shares in the coming years. This market expansion can be ascribed to an augmentation in the number of BPO telecom operators, particularly in developing economies such as China, South Africa, and India.

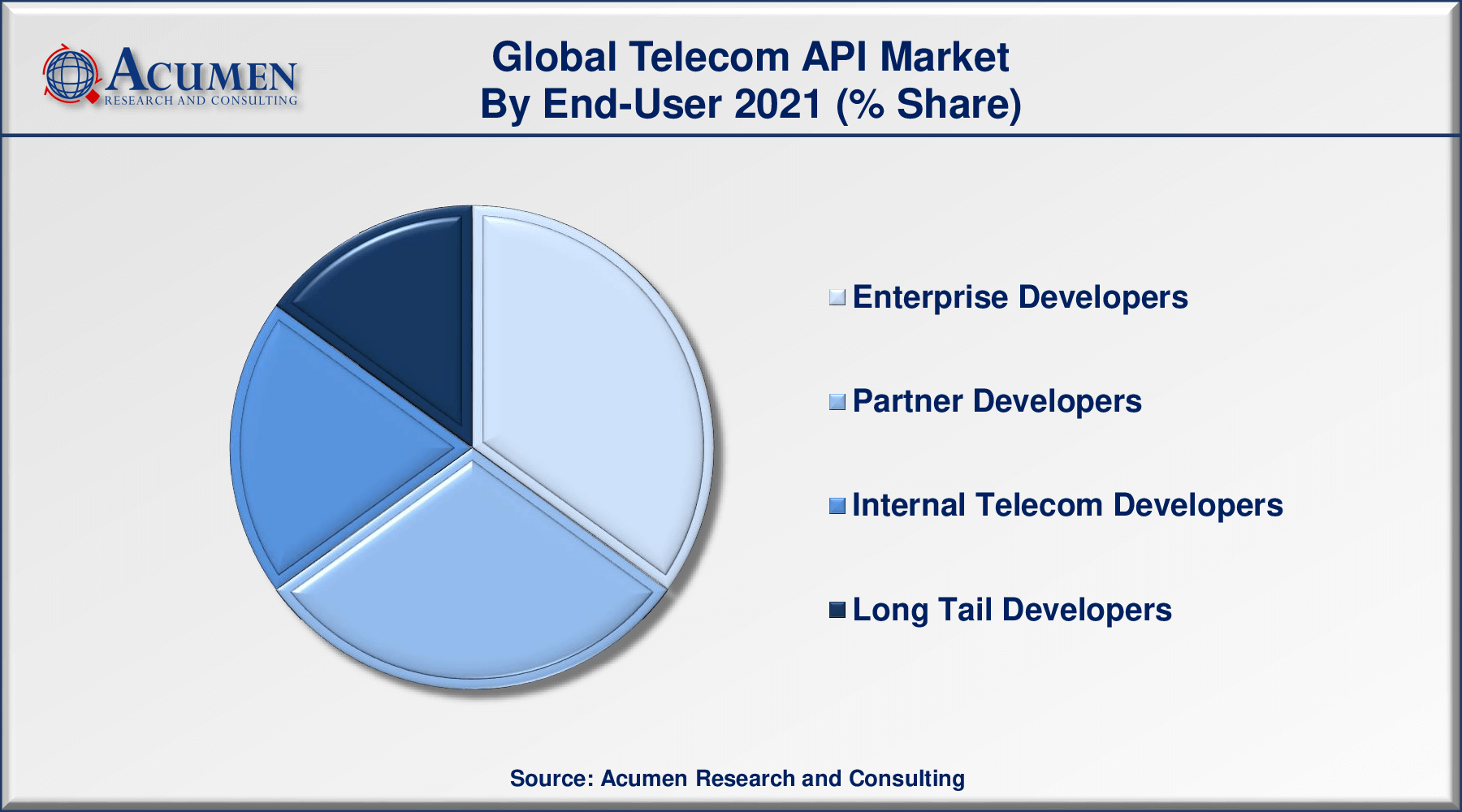

Market by End-User

- Enterprise Developers

- Partner Developers

- Internal Telecom Developers

- Long Tail Developers

In terms of end-user, the enterprise developer segment will dominate the telecom API market in 2021. This dominance is due to large-scale organizations' high penetration and adoption rates. Standardized communication protocols to enable messaging are mostly employed in large corporations to advertise discounts, promotional events, and changes to corporate rules, among other things. Organizations primarily employ mass messaging software and tools to drive telecom API market growth.

Furthermore, the telecom API market forecast predicts that the partner developer segment will increase at a rapid pace in the future years. Partner APIs aid in the development of an individual data service platform among CSPs and other developers in order to establish services such as payment as well as streaming platforms, among others. Moreover, when compared to corporate developers, the market share for the partner developers segment is rapidly rising, resulting in their development over the predicted period.

Telecom API Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Continuous Improvements in the IT and Telecom sector in Asia-Pacific, Drives Regional Market Expansion

Geographically, the Asia-Pacific region is expected to see considerable market growth in the next years. This growth is due to an increase in the number of mobile phone users as well as the increased deployment of 5G technologies in the region over the coming years. Furthermore, the region's Telecom API market is being driven by the steady increase in demand for 4G/LTE. Another factor that is predicted to increase the Asia-pacific industry for Telecommunication APIs is the growing number of mobile phones and M2M devices. Besides that, the rapid advancement of information technology has substantially increased demand for telecom application programming interfaces (API), with Asia-Pacific experiencing the fastest growth rate in the telecom API market.

Telecom API Market Players

Some of the prominent global telecom API market companies are Vodafone Group PLC, Alcatel-Lucent, Orange S.A., Xura, Inc., Fortumo, Tropo, Inc., AT&T, Inc., Apigee Corporation, Verizon Communications, Inc., VONAGE, LocationSmart, and Aspect Software

Frequently Asked Questions

How much was the global telecom API market size in 2021?

The global telecom API market size in 2021 was accounted to be USD 221 Billion.

What will be the projected CAGR for global telecom API market during forecast period of 2022 to 2030?

The projected CAGR of telecom API during the analysis period of 2022 to 2030 is 20.2%.

Which are the prominent competitors operating in the market?

The prominent players of the global telecom API market involve Vodafone Group PLC, Alcatel-Lucent, Orange S.A., Xura, Inc., Fortumo, Tropo, Inc., AT&T, Inc., Apigee Corporation, Verizon Communications, Inc., VONAGE, LocationSmart, and Aspect Software.

Which region held the dominating position in the global telecom API market?

North America held the dominating share for telecom API during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for telecom API during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global telecom API market?

Rapidly increasing proliferation of mobile internet and cloud technologies and growing network access to the 4G LTE network are the prominent factors that fuel the growth of global telecom API market.

By segment type, which sub-segment held the maximum share?

Based on type, SMS, MMS, and RCS API segment held the maximum share for telecom API market in 2021.