System on Chip Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

System on Chip Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

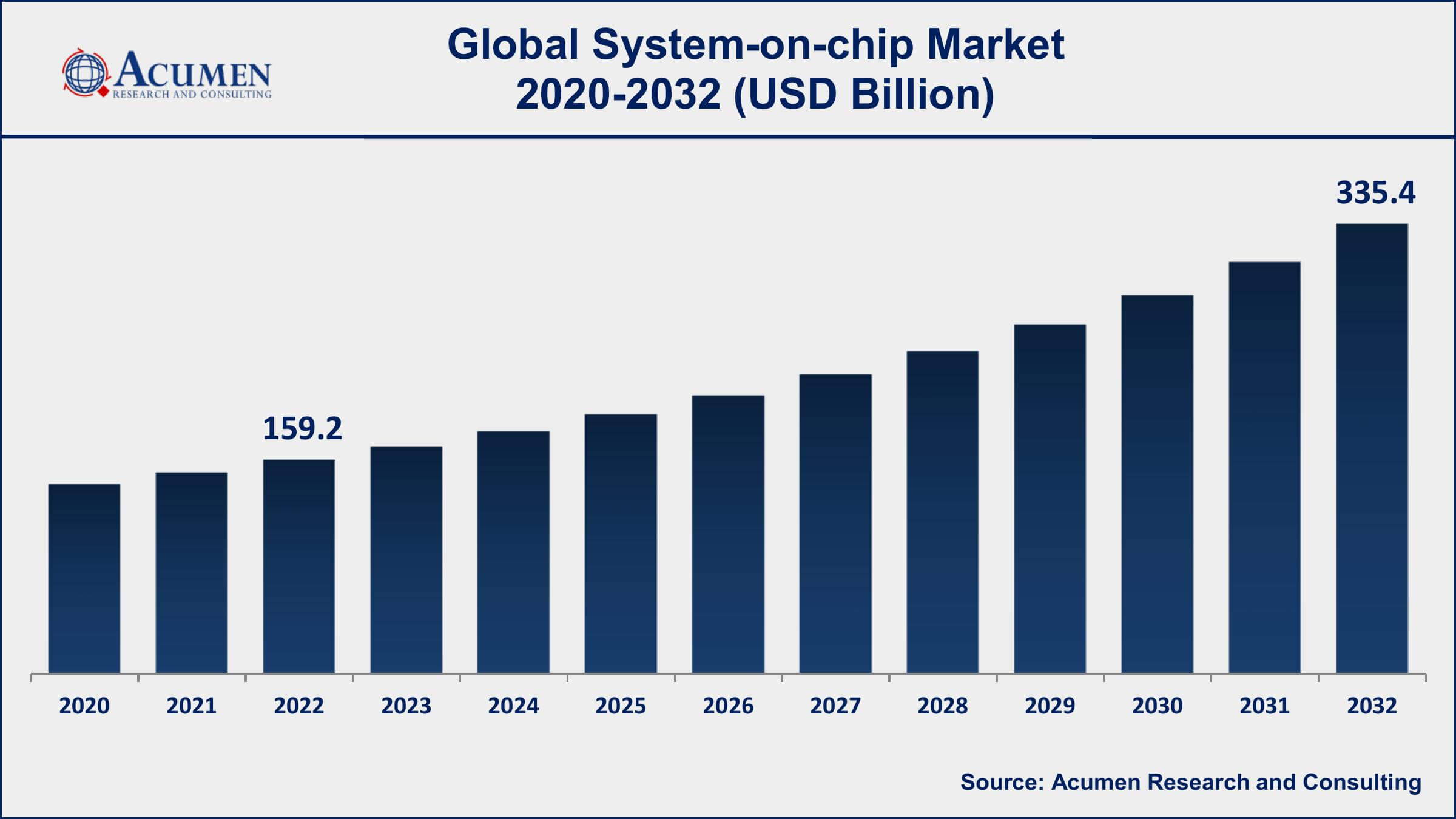

The Global System on Chip (SoC) Market Size accounted for USD 159.2 Billion in 2022 and is projected to achieve a market size of USD 335.4 Billion by 2032 growing at a CAGR of 7.9% from 2023 to 2032.

System On Chip Market Highlights

- Global System On Chip Market revenue is expected to increase by USD 335.4 Billion by 2032, with a 7.9% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 49% of System On Chip Market share in 2022

- North America system-on-chip Market growth will record a CAGR of around 8.2% from 2023 to 2032

- By type, the digital segment has generated of about 60% of the revenue share in 2022

- By application, the smartphones segment has accounted more than 28% of the revenue share in 2022

- Increasing demand for compact and power-efficient devices, drives the system-on-chip Market value

A System-on-Chip (SoC) is a compact integrated circuit that combines various electronic components and functions onto a single chip. These components can include a central processing unit (CPU), memory, graphics processing unit (GPU), input/output interfaces, and various other hardware and software components necessary for the operation of a computing device. SoCs are commonly used in a wide range of applications, including smartphones, tablets, IoT devices, automotive systems, and more. They offer significant advantages such as reduced power consumption, smaller form factors, and increased performance, making them essential components in modern electronics.

The SoC market has experienced substantial growth in recent years, driven by the proliferation of connected devices, the increasing demand for higher computing power in portable devices, and the expansion of the Internet of Things (IoT) ecosystem. The integration of multiple functions onto a single chip has not only improved the efficiency and performance of electronic devices but has also reduced production costs. Furthermore, the development of advanced manufacturing processes, such as 7nm and 5nm nodes, has enabled semiconductor companies to pack more transistors and functionalities into smaller SoCs, pushing the boundaries of what is achievable in terms of computing power and energy efficiency.

Global System On Chip Market Trends

Market Drivers

- Increasing demand for compact and power-efficient devices

- Growth of the Internet of Things (IoT) market

- Advancements in semiconductor manufacturing technology

- Rising demand for high-performance mobile devices

- Expansion of 5G networks and connectivity

Market Restraints

- Supply chain disruptions and semiconductor shortages

- High development and manufacturing costs

- Intellectual property and licensing challenges

Market Opportunities

- Emerging applications in healthcare and wearables

- Edge AI, robotics, and semiconductor market

- Automotive safety and connectivity features

- Industrial automation and Industry 4.0

System-on-chip Market Report Coverage

| Market | System-on-Chip Market |

| System-on-Chip Market Size 2022 | USD 159.2 Billion |

| System-on-Chip Market Forecast 2032 | USD 335.4 Billion |

| System-on-Chip Market CAGR During 2023 - 2032 | 7.9% |

| System-on-Chip Market Analysis Period | 2020 - 2032 |

| System-on-Chip Market Base Year |

2022 |

| System-on-Chip Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Qualcomm Incorporated, MediaTek Inc., Apple Inc., Samsung Electronics Co., Ltd., Intel Corporation, NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Broadcom Inc., Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., and Renesas Electronics Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A System-on-Chip (SoC) is a highly integrated semiconductor device that encapsulates multiple electronic components and functions onto a single chip. These components typically include a central processing unit (CPU), memory, input/output interfaces, graphics processing unit (GPU), and various other hardware and software elements necessary for a specific application or device. The key advantage of SoCs is their ability to reduce the size, power consumption, and complexity of electronic devices while enhancing their performance and efficiency.

SoCs find applications across a wide range of industries and technologies. In consumer electronics, SoCs power smartphones, tablets, smart TVs, and gaming consoles, providing the computational horsepower required for these devices to perform tasks such as running apps, playing multimedia content, and handling user interfaces seamlessly. In the automotive sector, SoCs are integral to advanced driver assistance systems (ADAS), infotainment systems, and autonomous driving technologies, enabling functions like collision avoidance, parking assistance, and connectivity. Additionally, SoCs are crucial in IoT devices, enabling these smart devices to process data locally, communicate with other devices or the cloud, and perform tasks like monitoring environmental conditions, managing smart homes, or tracking assets.

The System-on-Chip (SoC) market has been experiencing robust growth over the past several years and is expected to continue its upward trajectory in the foreseeable future. Several key factors are driving this growth. First and foremost is the proliferation of connected devices and the Internet of Things (IoT). As IoT applications continue to expand across industries, there is a growing need for power-efficient, compact, and integrated solutions, which SoCs excel at providing. This trend spans smart home devices, industrial automation, healthcare, and automotive applications, among others. Another significant driver is the relentless demand for high-performance mobile devices, such as smartphones and tablets. Consumers consistently seek more powerful and feature-rich devices, pushing manufacturers to integrate advanced technologies onto a single chip while maintaining energy efficiency.

System-on-Chip Market Segmentation

The global System-on-chip Market segmentation is based on type, application, end use industry, and geography.

System On Chip Market By Type

- Digital

- Mixed Signal

- Analog

According to the system-on-chip industry analysis, the digital segment accounted for the largest market share in 2022. Digital components play a central role in SoCs, serving as the computational and control engines that power various electronic devices. One of the primary drivers of growth in the digital segment is the increasing demand for high-performance computing solutions across a wide range of applications, from smartphones and laptops to data centers and emerging technologies like artificial intelligence (AI) and machine learning. Consumers and businesses alike are seeking faster processing speeds, improved energy efficiency, and enhanced capabilities, which require more advanced and specialized digital components within SoCs. Furthermore, the growth of the Internet of Things (IoT) has significantly boosted the digital segment of the SoC market.

System On Chip Market By Application

- Smartphones

- PC/Laptops

- Networking Devices

- Digital Cameras

- Game Consoles

- Others

In terms of applications, the smartphones segment is expected to witness significant growth in the coming years. The growth in this segment is propelled by the relentless demand for more powerful, energy-efficient, and feature-rich mobile devices. Consumers expect their smartphones to deliver faster performance, improved battery life, enhanced camera capabilities, and support for emerging technologies such as 5G connectivity and AI-driven applications. To meet these demands, smartphone manufacturers rely heavily on cutting-edge SoCs that integrate essential components like CPUs, GPUs, AI accelerators, and connectivity solutions onto a single chip. The adoption of 5G technology has been a major catalyst for growth in the smartphone SoC market. 5G networks require more advanced and efficient SoCs to deliver high-speed data transfer, lower latency, and support for a wide range of connected devices. As 5G continues to roll out globally, smartphone makers are racing to offer devices that can leverage its capabilities, which, in turn, fuels the development of more powerful and specialized SoCs.

System On Chip Market By End Use Industry

- Automotive

- IT and Telecommunication

- Aerospace and Defense

- Consumer Electronics

- Healthcare

- Industrial

- Others

According to the system-on-chip market forecast, the consumer electronics segment is expected to witness significant growth in the coming years. This segment encompasses a wide range of devices, including smart TVs, gaming consoles, home appliances, and wearable gadgets, all of which have benefited from the integration of powerful and energy-efficient SoCs. One of the primary growth drivers in the consumer electronics segment is the demand for smart and connected devices. Consumers increasingly seek products that offer connectivity and intelligent features, whether it's a smart refrigerator that can track groceries or a voice-controlled smart speaker. SoCs are instrumental in providing the processing power and connectivity needed to enable these functionalities. As the Internet of Things (IoT) ecosystem expands, SoCs designed for consumer electronics play a pivotal role in making homes and lifestyles more convenient and efficient. Additionally, the gaming industry is a significant contributor to the growth of SoCs in consumer electronics.

System-on-chip Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

System-on-chip Market Regional Analysis

Geographically, Asia-Pacific's dominance in the System-on-Chip (SoC) market can be attributed to several key factors that have propelled the region to the forefront of semiconductor manufacturing and innovation. Firstly, Asia-Pacific is home to some of the world's largest and most influential semiconductor manufacturing companies. Taiwan, South Korea, and China have established themselves as global leaders in semiconductor production, with companies like TSMC, Samsung, and SMIC leading the charge. These fabs are renowned for their advanced manufacturing processes and their ability to produce cutting-edge SoCs, attracting a significant portion of the global demand. Moreover, Asia-Pacific is a major hub for consumer electronics manufacturing. With countries like China, Japan, South Korea, and Taiwan at the forefront of consumer technology production, there is a high demand for SoCs to power a vast array of electronic devices, from smartphones and tablets to smart TVs and IoT gadgets. This regional ecosystem fosters innovation and collaboration between semiconductor companies and consumer electronics manufacturers, contributing to the region's dominance.

System-on-chip Market Player

Some of the top system-on-chip market companies offered in the professional report include Qualcomm Incorporated, MediaTek Inc., Apple Inc., Samsung Electronics Co., Ltd., Intel Corporation, NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Broadcom Inc., Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., and Renesas Electronics Corporation.

Frequently Asked Questions

What was the market size of the global system-on-chip in 2022?

The market size of system-on-chip was USD 159.2 Billion in 2022.

What is the CAGR of the global system-on-chip market from 2023 to 2032?

The CAGR of system-on-chip is 7.9% during the analysis period of 2023 to 2032.

Which are the key players in the system-on-chip market?

The key players operating in the global market are including Qualcomm Incorporated, MediaTek Inc., Apple Inc., Samsung Electronics Co., Ltd., Intel Corporation, NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Broadcom Inc., Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., and Renesas Electronics Corporation.

Which region dominated the global system-on-chip market share?

Asia-Pacific held the dominating position in system-on-chip industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of system-on-chip during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global system-on-chip industry?

The current trends and dynamics in the system-on-chip industry include increasing demand for compact and power-efficient devices, growth of the Internet of Things (IoT) market, and advancements in semiconductor manufacturing technology.

Which application held the maximum share in 2022?

The smartphones application held the maximum share of the system-on-chip industry.