Synthetic Lubricants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Synthetic Lubricants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

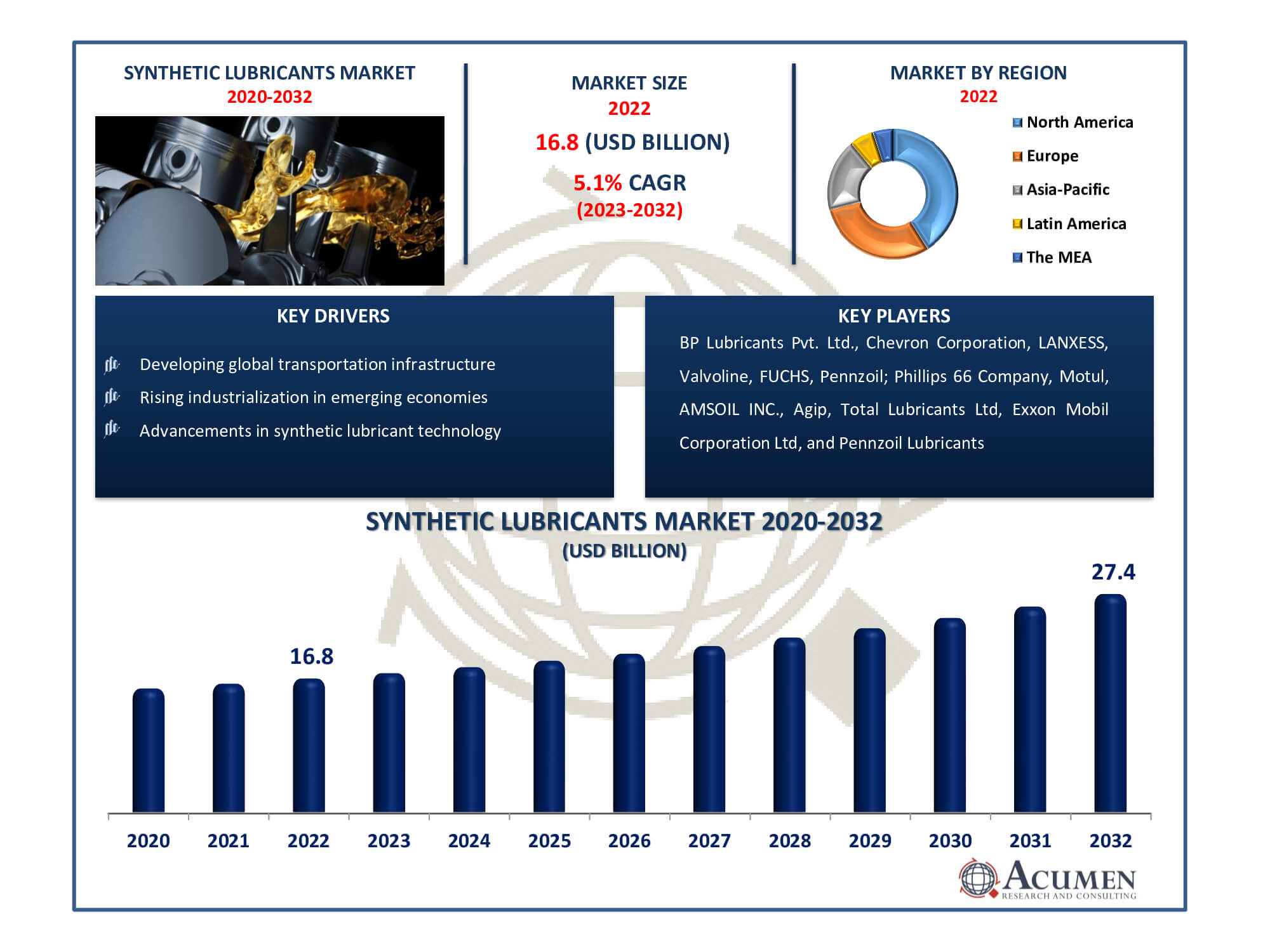

The Synthetic Lubricants Market Size accounted for USD 16.8 Billion in 2022 and is estimated to achieve a market size of USD 27.4 Billion by 2032 growing at a CAGR of 5.1% from 2023 to 2032.

Synthetic Lubricants Market Highlights

- Global synthetic lubricants market revenue is poised to garner USD 27.4 billion by 2032 with a CAGR of 5.1% from 2023 to 2032

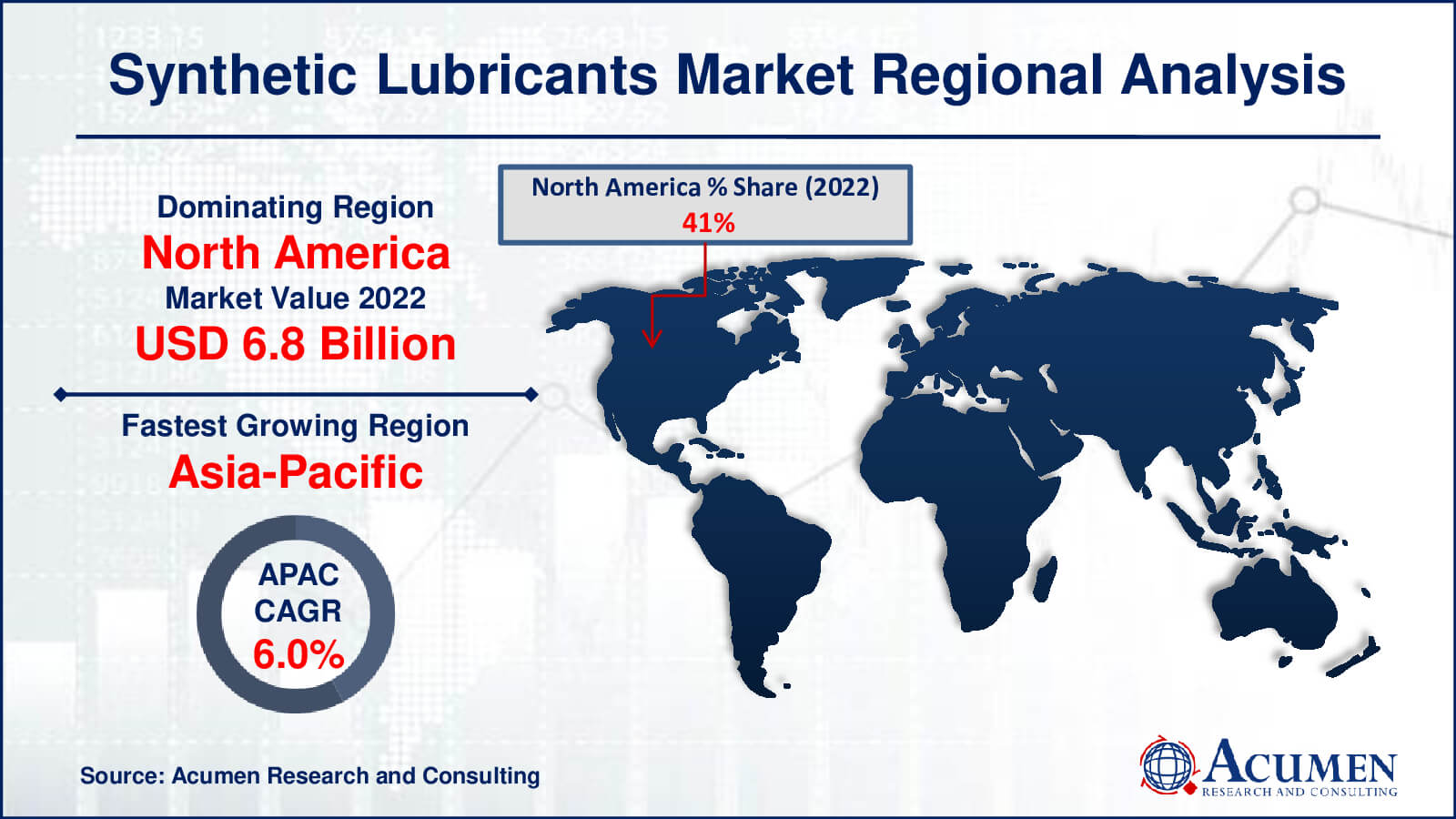

- North America synthetic lubricants market value occupied around USD 6.8 billion in 2022

- Asia-Pacific synthetic lubricants market growth will record a CAGR of more than 6% from 2023 to 2032

- Among type, the polyalphaolefin (PAO) sub-segment generated over US$ 8.2 billion revenue in 2022

- Based on application, the engine oil sub-segment generated around 36% share in 2022

- The growing emphasis on eco-friendly lubricants is a popular market trend that fuels the industry demand

The synthetic lubricants market is all about the particular oils that are utilized in automobiles and machinery. These lubricants are extremely slippery, decreasing friction and handling heat admirably. People are discovering the benefits of synthetic oils, particularly in developing economies such as Brazil, South Korea, China, and India. Large corporations are investing heavily in research and development to create even better oils. This is causing an increase in the demand for synthetic oils. However, there are some difficulties. Making these particular oils is costly, and they don't always function well with certain chemicals. However, the synthetic lubricants market is rising rapidly, owing to the booming automobile and machine sectors, as well as individuals discovering how beneficial these lubricants are.

Global Synthetic Lubricants Market Dynamics

Market Drivers

- Developing global transportation infrastructure

- Rising industrialization in emerging economies

- Growing demand for synthetic lubricants in automotive and industrial sectors

- Advancements in synthetic lubricant technology

Market Restraints

- Stringent environmental regulations and concerns

- Fluctuating raw material prices

- Limited availability of synthetic base oils

Market Opportunities

- Expansion of the electric vehicle (EV) market

- Developing industrialization in African region

- Expansion in aerospace and defense

Synthetic Lubricants Market Report Coverage

| Market | Automotive LiDAR Market |

| Automotive LiDAR Market Size 2022 | USD 16.8 Billion |

| Automotive LiDAR Market Forecast 2032 | USD 27.4 Billion |

| Automotive LiDAR Market CAGR During 2023 - 2032 | 5.1% |

| Automotive LiDAR Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BP Lubricants Pvt. Ltd., Chevron Corporation, LANXESS, Valvoline, FUCHS, Pennzoil, Phillips 66 Company, Motul, AMSOIL INC., Agip, Total Lubricants Ltd, Exxon Mobil Corporation Ltd, and Pennzoil Lubricants. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Synthetic Lubricants Market Insights

Synthetic lubricants are specialty chemicals used in automotive applications, offering significant advantages such as low friction and excellent thermal stability. Increasing consumer awareness of these benefits, in contrast to mineral-based lubricants, is a key factor expected to drive demand for synthetic lubricants and fuel the growth of the global synthetic lubricants market. One major application of synthetic lubricants is their use as heat transfer fluids, particularly in heat exchangers and heavy machinery. The growing industrial sector in developing regions like Asia-Pacific and LAMEA is anticipated to boost the demand for synthetic lubricants over the forecast period. Lubricants are substances used to reduce friction between moving parts, with the primary aim of preventing wear and damage to machinery components. They are typically categorized into three main product segments: bio-based lubricants, synthetic lubricants, and mineral-based lubricants.

The expanding automotive industry, coupled with the growing popularity of synthetic lubricants for automobile applications, is expected to boost the growth of the global synthetic lubricants market, especially in developing countries like Brazil, South Korea, China, and India. Additionally, increased research and development activities and investments by key players in the global synthetic lubricants market, aimed at developing enhanced grades, are projected to drive the demand for synthetic lubricants in the coming years. Key drivers of the global synthetic lubricant market include developing economies, increasing populations, and rising consumer awareness. However, the high initial and operational costs of synthetic lubricant production, as well as concerns related to potential decomposition in various chemical environments, may pose challenges to the market's growth.

Synthetic Lubricants Market Segmentation

The worldwide market for synthetic lubricants is split based on type, application, end-user, and geography.

Synthetic Lubricants Type

- Esters

- Polyalphaolefin (PAO)

- Group 3 (hydro cracking)

- Polyalkylene Glycol (PAG)

In the synthetic lubricants market, the polyalphaolefin (PAO) category is the largest. This is because PAO-based lubricants provide a good combination of performance, stability, and adaptability. They are a popular choice among consumers and enterprises due to their wide range of uses in the automotive and industrial sectors. PAO lubricants can withstand high temperatures, reduce friction, and work with a wide range of equipment. As a result, they have become the go-to alternative for many, fueling their market domination.

Synthetic Lubricants Application

- Engine Oil

- Heat Transfer Fluids (HTFs)

- Transmission Fluids

- Metalworking Fluids

- Others

In the synthetic lubricants market, the engine oil category is the largest. This is primarily due to the fact that engines are at the core of many businesses and vehicles, necessitating adequate lubrication for best performance and durability. Synthetic engine oils outperform conventional lubricants in terms of protection, friction reduction, and durability. They are critical for the efficient running of autos, industrial machines, and a variety of other equipment. As a result, demand for high-quality engine oil greatly outstrips that for other lubricating applications, establishing it as the market's dominating segment.

Synthetic Lubricants End-User

- Power Generation

- Automotive and Transportation

- Heavy Equipment

- Food and Beverage

- Metallurgy and Metalworking

- Chemical Manufacturing

- Other end-user industries

The automotive and transportation segment is expected to the largest in the synthetic lubricants market due to the widespread use of synthetic lubricants in cars to increase performance and efficiency. The power generation segment, which relies on these lubricants for the smooth and reliable operation of turbines, generators, and other machinery, is closely studied. In power generation, synthetic lubricants play an important role in decreasing friction and guaranteeing optimal energy production. The automotive and power generation industries account for the majority of the market, owing to the demand for high-performance lubrication solutions in these important industries, where efficiency, lifespan, and reduced maintenance are key concerns.

Synthetic Lubricants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Synthetic Lubricants Market Regional Analysis

North America is the largest region in the synthetic lubricants market due to a variety of factors. The region has a well-established automotive industry, and high-performance lubricants are in high demand. Furthermore, there is a heavy emphasis on the adoption of synthetic lubricants in the industrial sector, which is driving growth. The presence of significant firms, as well as extensive R&D activities, contributes to North America's dominance.

Europe is the second-largest market, owing mostly to its powerful automotive and industrial industries. European countries are known for having high quality standards and environmental laws, which makes synthetic lubricants an appealing alternative due to their efficiency and low emissions. The region also emphasizes sustainability, as evidenced by the use of synthetic lubricants, and its market position is bolstered by the presence of important car manufacturers and robust industrial production.

Asia-Pacific, on the other hand, is the region with the quickest growth. The primary driving forces include expanding industrialization, rising vehicle production, and the growing adoption of synthetic lubricants in a variety of industries. Demand for high-performance lubricants has increased as developing nations such as China and India expand their industrial capacities. Furthermore, as the Asia-Pacific automobile market expands, synthetic lubricants are becoming more popular due to their improved quality and performance. This, combined with increased R&D and investment in the region, propels the region's rapid market expansion, making Asia-Pacific the fastest-growing region in the synthetic lubricants market.

Synthetic Lubricants Market Players

Some of the top synthetic lubricants companies offered in our report include BP Lubricants Pvt. Ltd., Chevron Corporation, LANXESS, Valvoline, FUCHS, Pennzoil, Phillips 66 Company, Motul, AMSOIL INC., Agip, Total Lubricants Ltd, Exxon Mobil Corporation Ltd, and Pennzoil Lubricants.

Frequently Asked Questions

How big is the synthetic lubricants market?

The market size of synthetic lubricants was USD 16.8 billion in 2022.

What is the CAGR of the global synthetic lubricants market from 2023 to 2032?

The CAGR of synthetic lubricants is 5.1% during the analysis period of 2023 to 2032.

Which are the key players in the synthetic lubricants market?

The key players operating in the global market are including BP Lubricants Pvt. Ltd., Chevron Corporation, LANXESS, Valvoline, FUCHS, Pennzoil, Phillips 66 Company, Motul, AMSOIL INC., Agip, Total Lubricants Ltd, Exxon Mobil Corporation Ltd, and Pennzoil Lubricants.

Which region dominated the global synthetic lubricants market share?

North America held the dominating position in synthetic lubricants industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of synthetic lubricants during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global synthetic lubricants industry?

The current trends and dynamics in the synthetic lubricants industry developing global transportation infrastructure, rising industrialization in emerging economies, growing demand for synthetic lubricants in automotive and industrial sectors, and advancements in synthetic lubricant technology.

Which type held the maximum share in 2022?

The polyalphaolefin (PAO) type held the maximum share of the synthetic lubricants industry.