Sustainable Aviation Fuel Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Sustainable Aviation Fuel Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

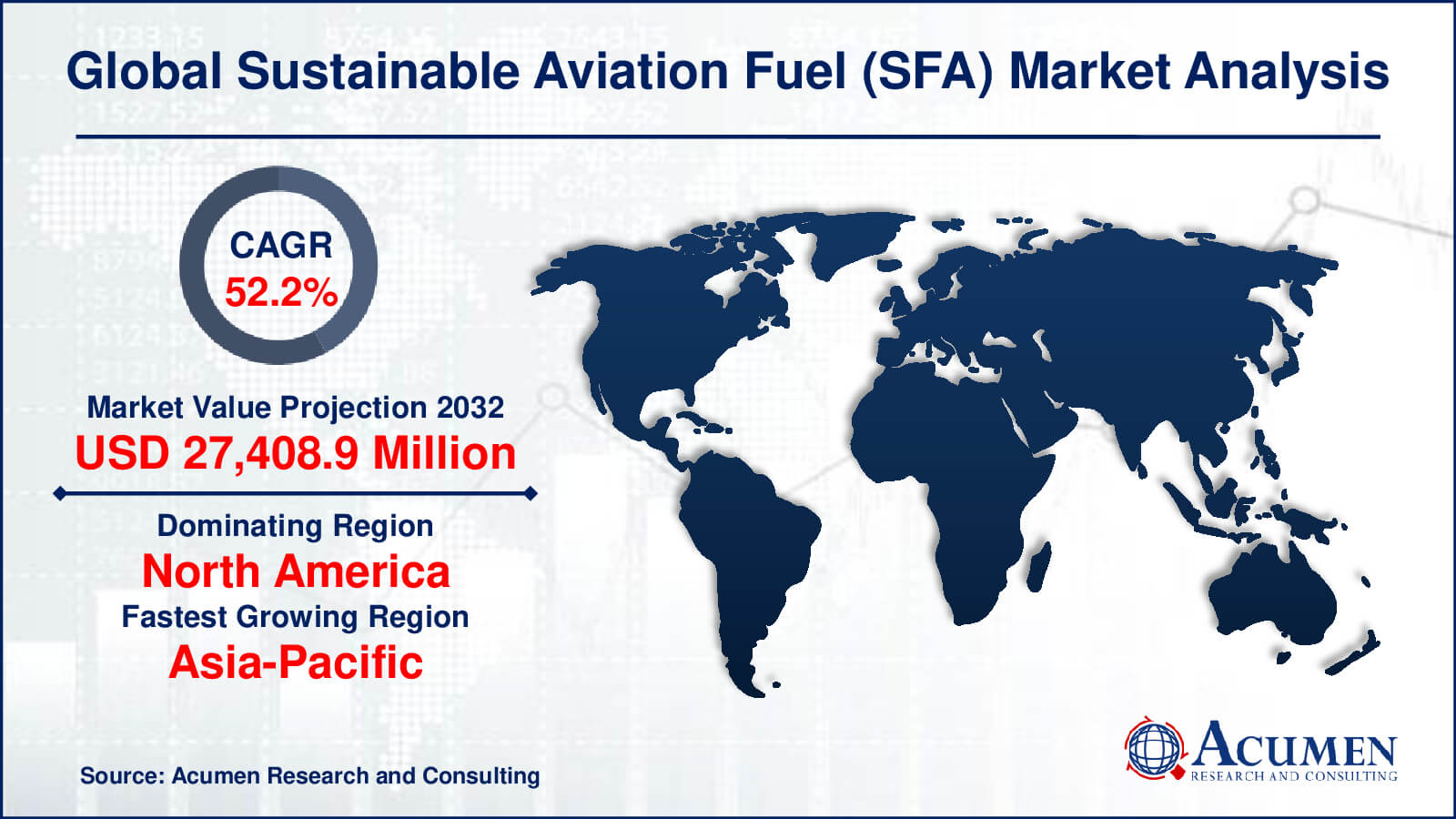

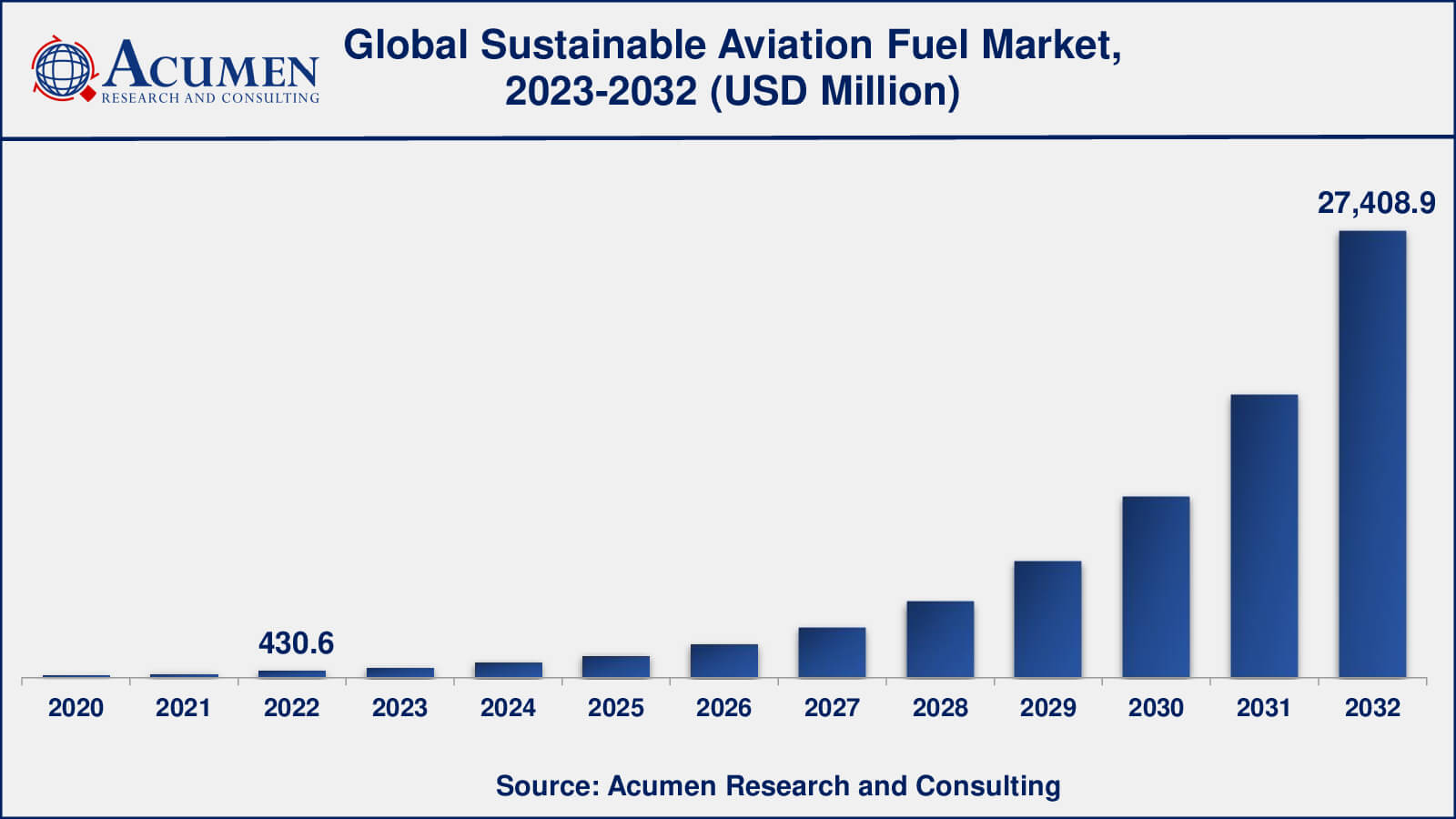

The global Sustainable Aviation Fuel Market size was valued at USD 430.6 Million in 2022 and is projected to attain USD 27,408.9 Million by 2032 mounting at a CAGR of 52.2% from 2023 to 2032.

Sustainable Aviation Fuel Market Highlights

- Global sustainable aviation fuel market revenue is poised to garner USD 27,408.9 million by 2032 with a CAGR of 52.2% from 2023 to 2032

- North America sustainable aviation fuel market value occupied around USD 180.8 million in 2022

- Asia-Pacific sustainable aviation fuel market growth will record a CAGR of more than 53% from 2023 to 2032

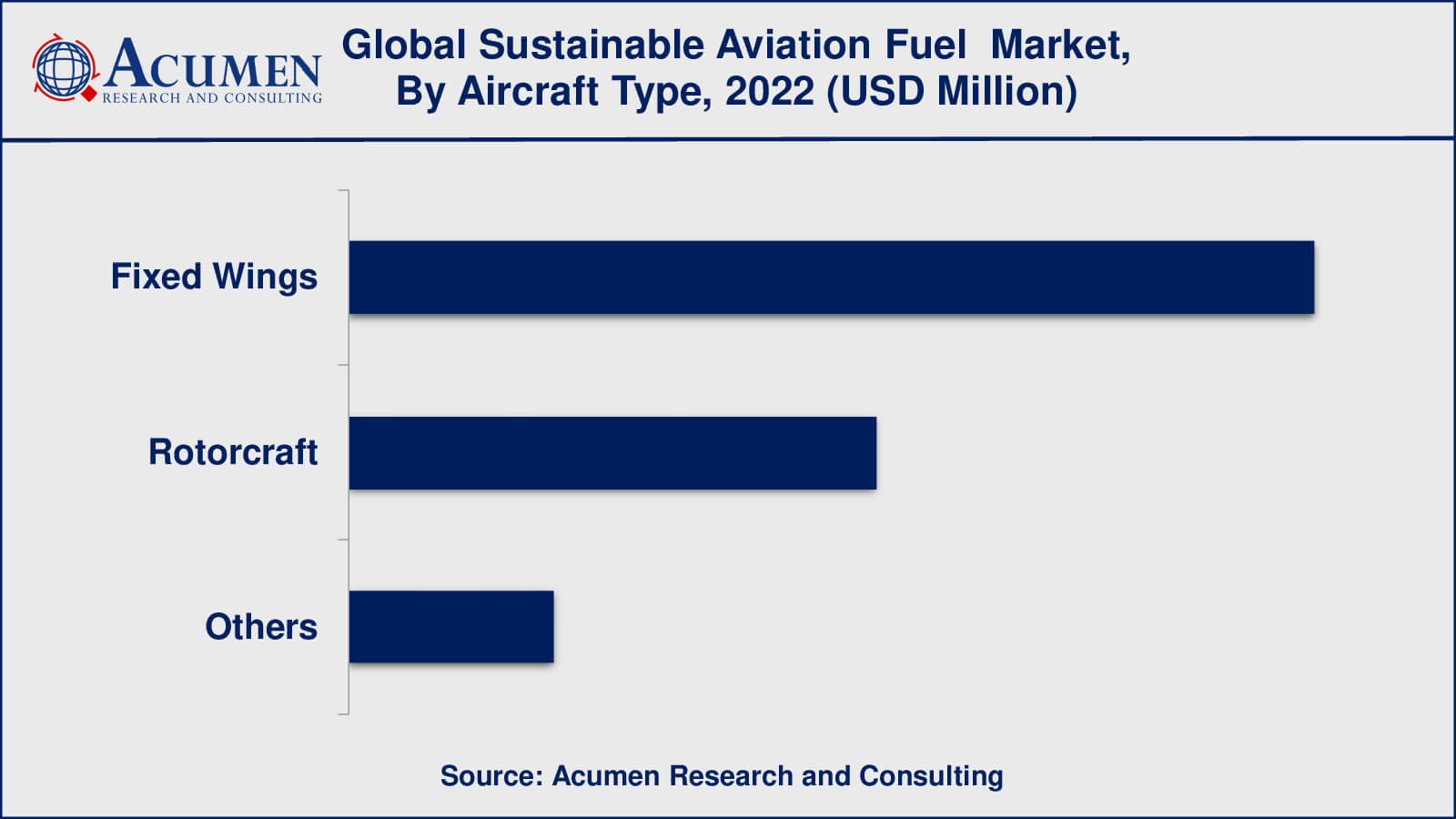

- Among aircraft type, the fixed wings sub-segment occupied over US$ 245.4 million revenue in 2022

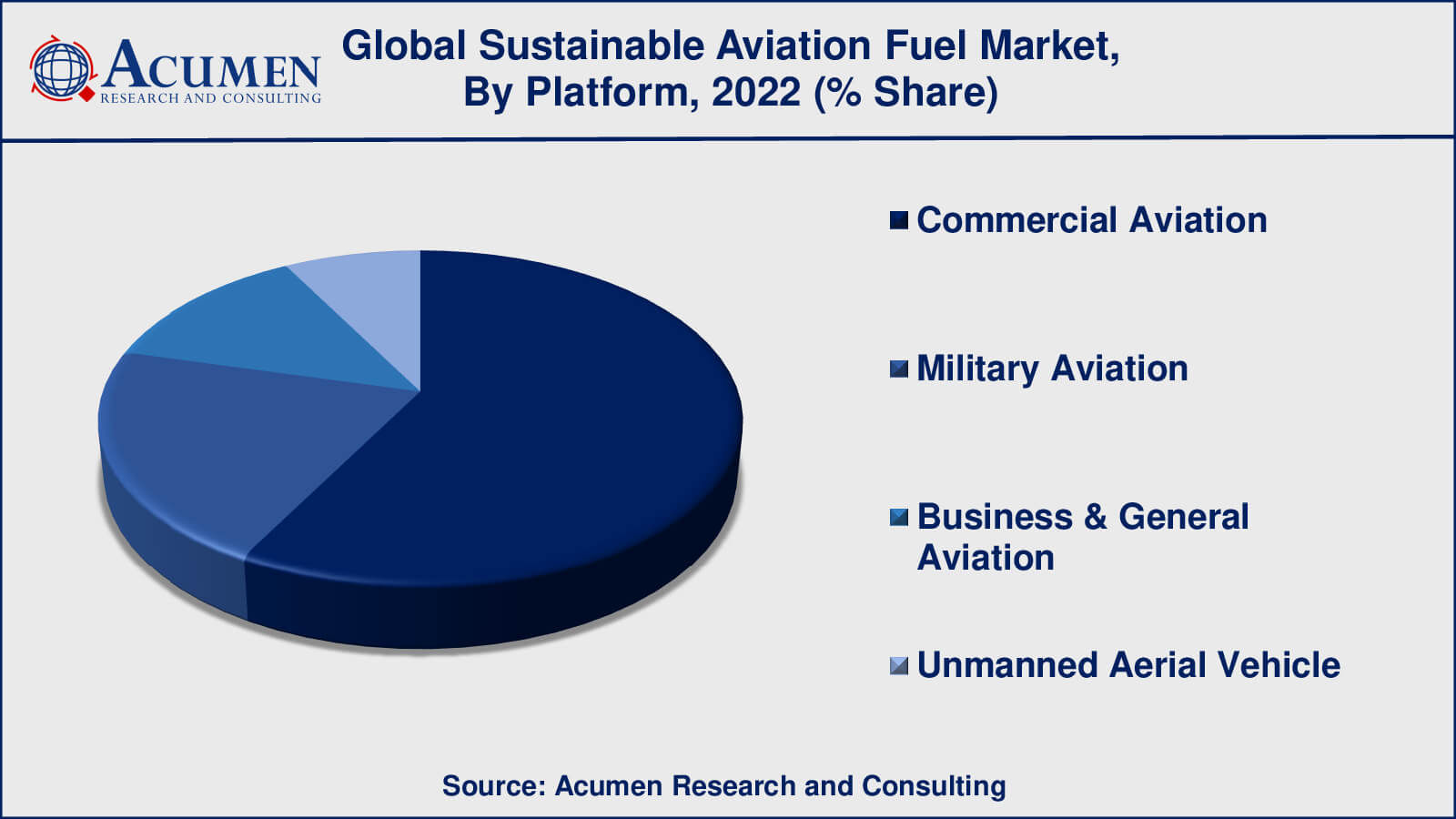

- Based on platform, the commercial aviation sub-segment gathered around 58% share in 2022

- Adoption of sustainable aviation fuel as a differentiating factor for airlines in competitive markets is a popular sustainable aviation fuel market trend that drives the industry demand

Sustainable aviation fuel (SAF) is an alternative to traditional fossil-based aviation fuel that is intended to lower the carbon footprint and environmental effect of the aviation sector. SAF, also known as biojet fuel or renewable jet fuel, is obtained from renewable and sustainable sources, giving it a more ecologically benign choice for aircraft power.

SAF is made from feedstocks that can be quickly supplied, such as agricultural products, algae, waste oils, and forest wastes. These feedstocks are refined using a variety of procedures, including hydroprocessing and Fischer-Tropsch synthesis, to provide a fuel compatible with current aircraft engines and infrastructure. The end product is a drop-in fuel that may be used as a straight substitute for conventional jet fuel without requiring aircraft or engine changes.

One of the primary benefits of SAF is its ability to dramatically cut greenhouse gas emissions. Sustainable aviation fuel has the potential to reduce carbon dioxide (CO2) emissions by up to 80% during its lifespan when compared to regular jet fuel. SAF serves to break the carbon emissions cycle by collecting CO2 during the growth of the feedstocks, compensating the emissions emitted when the fuel is consumed in-flight.

Global Sustainable Aviation Fuel Market Dynamics

Market Drivers

- Government regulations promoting carbon reduction in aviation

- Increasing airline commitments to reduce emissions and achieve sustainability goals

- Rising environmental consciousness among passengers and investors

- Advancements in SAF production technologies and feedstock diversification

Market Restraints

- High production costs and limited commercial-scale facilities

- Competing uses of feedstocks in other industries

- Uncertainty in long-term regulatory frameworks and policy support

Market Opportunities

- Incentives and subsidies driving investment in SAF production

- Collaborative initiatives and partnerships to expand SAF supply and demand

- Emerging markets for SAF in regions with ambitious sustainability goals

Sustainable Aviation Fuel Market Report Coverage

| Market | Sustainable Aviation Fuel Market |

| Sustainable Aviation Fuel Market Size 2022 | USD 430.6 Million |

| Sustainable Aviation Fuel Market Forecast 2032 | USD 27,408.9 Million |

| Sustainable Aviation Fuel Market CAGR During 2023 - 2032 | 52.2% |

| Sustainable Aviation Fuel Market Analysis Period | 2020 - 2032 |

| Sustainable Aviation Fuel Market Base Year | 2022 |

| Sustainable Aviation Fuel Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Fuel Type, By Aircraft Type, By Platform, By Technology, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aemetis Inc., Avfuel Corporation, Fulcrum Bioenergy, Gevo, Lanzatech, Neste, Preem AB, Sasol, SkyNRG, and World Energy. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Sustainable Aviation Fuel Market Insights

The market for sustainable aviation fuel (SAF) is driven by a mix of regulatory, environmental, and technical considerations. Governments throughout the globe are rapidly enacting legislation and incentives to minimize carbon emissions in the aviation industry, compelling airlines to look out sustainable options such as SAF. As airlines see the need to address their environmental effect, the need to attain carbon neutrality and satisfy sustainability targets has been a key motivator for the implementation of SAF. The public's and investors' rising awareness of environmental concerns and climate change is also driving up demand for SAF. Passengers are becoming more mindful of their carbon footprint and actively seeking greener transportation solutions. Similarly, investors are favoring airlines and aviation firms who are dedicated to lowering emissions, resulting in growing market demand for SAF.

Technological developments in SAF manufacturing techniques have been critical in driving market growth. More efficient and cost-effective production processes are being developed as R&D efforts grow, making SAF more economically feasible. Furthermore, feedstock diversity, such as algae, agricultural leftovers, and waste oils, is increasing the potential availability of sustainable raw materials for SAF synthesis.

However, the market for sustainable aviation fuel confronts a number of obstacles and constraints. One of the major impediments is the high production costs associated with SAF. Sustainable aviation fuel is currently more expensive to generate than regular jet fuel, making it less economically appealing for broad use. Furthermore, the scarcity of commercial-scale SAF production facilities makes supplying rising demand difficult. Another constraint for the SAF market is competition for feedstocks. Other sectors, such as biofuels and bio-based chemicals, rely on similar feedstocks, potentially leading to resource disputes and supply chain restrictions. This rivalry may limit the scalability and cost-effectiveness of SAF manufacturing.

Despite these obstacles, there are chances to propel the sustainable aviation fuel business ahead. Governments and international organizations can give incentives and subsidies to stimulate investment in SAF manufacturing, hence boosting market growth. Collaborative activities and partnerships between airlines, fuel companies, and governments can help to improve supply chains and boost SAF adoption.

Sustainable Aviation Fuel Market Segmentation

The worldwide market for sustainable aviation fuel is split based on fuel type, aircraft type, platform, technology, and geography.

Sustainable Aviation Types

- Biofuel

- Hydrogen Fuel

- Power to Liquid Fuel

- Gas to Liquid Fuel

According to the sustainable aviation fuel industry analysis, biofuel was the most dominant fuel type in the sustainable aviation fuel (SAF) market. Biofuels, which are derived from renewable and sustainable feedstocks such as agricultural crops, algae, waste oils, and forest residues, have been the primary focus of research, development, and commercial production in the SAF sector.

Biofuels are considered drop-in fuels, meaning they can be used as direct replacements for conventional jet fuel without the need for significant modifications to aircraft engines or infrastructure. This characteristic has made biofuels more attractive to the aviation industry, as they can be readily integrated into existing operations.

Hydrogen fuel, power to liquid fuel, and gas to liquid fuel are also considered potential pathways for sustainable aviation fuel. These alternative fuels offer the advantage of producing lower or zero emissions during combustion. However, their development and implementation in the aviation sector have been relatively less advanced compared to biofuels.

Sustainable Aviation Fuel Aircraft Types

- Fixed Wings

- Rotorcraft

- Others

According to the sustainable aviation fuel market forecast, fixed-wing aircraft are the most prevalent form of aircraft used in commercial aviation, including passenger airlines, freight carriers, and general aviation. Many airlines and aviation firms are actively studying the use of sustainable aviation fuel to lower their carbon footprint, and these aircraft have been the major focus of SAF adoption and testing.

Because fixed-wing aircraft are widely used in commercial aviation, they contribute significantly to the industry's greenhouse gas emissions. As a result, airlines have been aggressively investigating methods to lessen their environmental effect, with SAF emerging as a possible answer.

While rotorcraft (helicopters) and other forms of aircraft, including as drones and smaller general aviation planes, are equally important in the aviation business, their use of sustainable aviation fuel has been less widespread. This might be due to a variety of variables, such as the comparatively modest size of the rotorcraft market and the differences in operating needs and obstacles for other types of aircraft.

Sustainable Aviation Fuel Platforms

- Commercial Aviation

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicle

Commercial aviation controlled the market for sustainable aviation fuel (SAF). Passenger airlines and freight carriers perform scheduled and non-scheduled flights to transport passengers and products. Commercial airlines' large-scale operations and considerable contribution to greenhouse gas emissions in the aviation industry have made them a main focus for SAF adoption and integration.

As part of their attempts to minimise their carbon footprint and accomplish environmental sustainability targets, several major airlines across the world have been actively studying and adopting sustainable aviation fuel into their operations. This is due to the industry's acknowledgment of the need to address climate change as well as the increased demand from environmentally concerned passengers.

While commercial aviation has been the major driver of SAF adoption, other aviation sectors, including military aviation, business and general aviation, and unmanned aerial vehicles (UAVs), have expressed interest in investigating sustainable fuel alternatives. However, because these industries are on a lesser scale than commercial aircraft, their total influence on the SAF market has been minimal.

Sustainable Aviation Fuel Technologies

- HEFA-SPK

- FT-SPK

- HFS-SIP

- ATJ-SPK

The sustainable aviation fuel (SAF) industry was controlled by the HEFA-SPK (Hydrotreated Esters and Fatty Acids - Synthetic Paraffinic Kerosene) technology. One of the most commonly used and commercially established technology for creating sustainable aviation fuel is HEFA-SPK.

Through a hydrotreating process, HEFA-SPK is generated from diverse feedstocks such as vegetable oils, animal fats, and waste oils. This method eliminates contaminants and changes the molecular structure of the feedstocks, resulting in a fuel that can be used in current aircraft engines and infrastructure. HEFA-SPK is a drop-in fuel, which means it may be used as a straight substitute for conventional jet fuel without needing aircraft or engine changes.

This technology has acquired importance in the SAF industry because to its proved commercial viability and certification by aviation organisations such as ASTM International and the International Air Transport Association (IATA). Many airlines and fuel companies have invested in HEFA-SPK manufacturing facilities, resulting in the company's supremacy in the market for sustainable aviation fuel.

Sustainable Aviation Fuel Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Sustainable Aviation Fuel Market Regional Analysis

North America has been a pioneer in the use of environmentally friendly aviation fuel. SAF manufacturing and utilization have increased significantly in the United States, with various airlines and aviation industries aggressively integrating SAF into their operations. Government initiatives, incentives, and cooperation between airlines, fuel companies, and regulatory organizations have all helped to encourage the use of SAF.

Europe is another market leader in sustainable aviation fuel. Several European governments have put rules and legislation in place to encourage the development and usage of SAF. The European Union Aviation Safety Agency (EASA) has also recognized a number of sustainable aviation fuels, which is increasing their use in the aviation sector. Airlines in Europe have committed to increasing SAF adoption, and there is a rising interest in SAF research and investment.

The Asia-Pacific area is becoming increasingly interested in environmentally friendly aviation fuel. Countries such as Australia, Japan, and Singapore have made attempts to promote SAF adoption, and certain airlines in the area have performed SAF-powered flights. However, in comparison to North America and Europe, the Asia-Pacific SAF market is still in its early phases, having room for growth.

Sustainable Aviation Fuel Market Players

Some of the top sustainable aviation fuel companies offered in our report include Aemetis Inc., Avfuel Corporation, Fulcrum Bioenergy, Gevo, Lanzatech, Neste, Preem AB, Sasol, SkyNRG, and World Energy.

Frequently Asked Questions

What was the size of the global sustainable aviation fuel market in 2022?

The size of sustainable aviation fuel market was USD 430.6 million in 2022.

What is the sustainable aviation fuel market CAGR from 2023 to 2032?

The sustainable aviation fuel market CAGR during the analysis period of 2023 to 2032 is 52.2%.

Which are the key players in the sustainable aviation fuel market?

The key players operating in the global sustainable aviation fuel market are including Aemetis Inc., Avfuel Corporation, Fulcrum Bioenergy, Gevo, Lanzatech, Neste, Preem AB, Sasol, SkyNRG, and World Energy.

Which region dominated the global sustainable aviation fuel market share?

North America region held the dominating position in sustainable aviation fuel industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of sustainable aviation fuel during the analysis period of 2023 to 2032.

What are the current trends in the global sustainable aviation fuel industry?

The current trends and dynamics in the sustainable aviation fuel industry include government regulations promoting carbon reduction in aviation, increasing airline commitments to reduce emissions and achieve sustainability goals, and rising environmental consciousness among passengers and investors

Which fuel type held the maximum share in 2022?

The biofuel fuel type held the maximum share of the sustainable aviation fuel industry.