Aircraft Engines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Aircraft Engines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

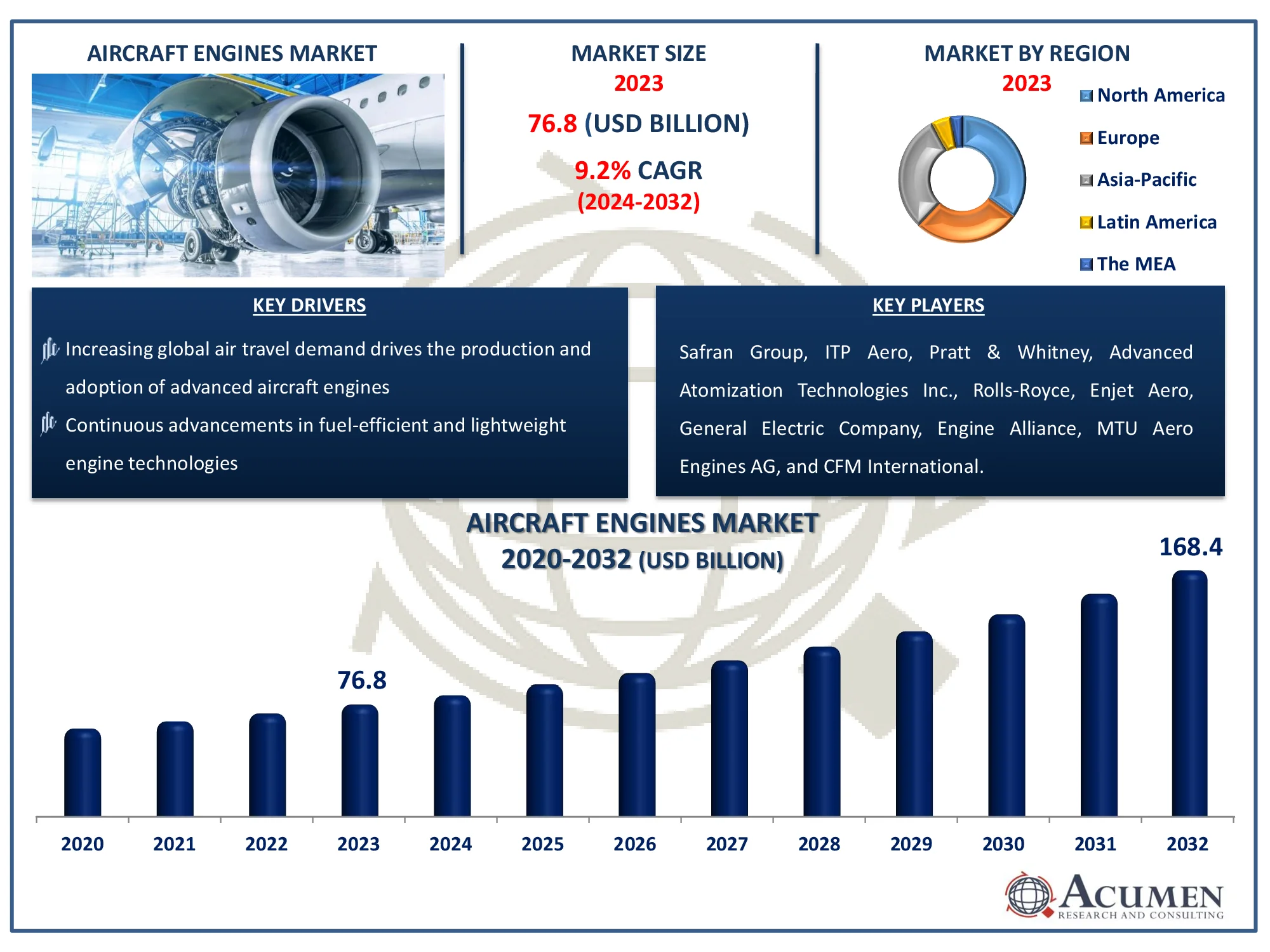

Request Sample Report

The Global Aircraft Engines Market Size accounted for USD 76.8 Billion in 2023 and is estimated to achieve a market size of USD 168.4 Billion by 2032 growing at a CAGR of 9.2% from 2024 to 2032.

Aircraft Engines Market Highlights

- Global aircraft engines market revenue is poised to garner USD 168.4 billion by 2032 with a CAGR of 9.2% from 2024 to 2032

- North America aircraft engines market value occupied around USD 26.9 billion in 2023

- Asia-Pacific aircraft engines market growth will record a CAGR of more than 10% from 2024 to 2032

- Among type, the turbofan engine sub-segment generated around USD 54.5 billion revenue in 2023

- Based on technology, the conventional engine sub-segment generated 55% aircraft engines market share in 2023

- Government investments in aviation is a popular aircraft engines market trend that fuels the industry demand

Aircraft engines are specialized power plants that propel aircraft using force or lift. They are critical components of an aircraft's propulsion system, converting energy into mechanical force to drive the plane forward. Depending on the kind of aircraft and its use, these engines are classified as turbofan, turboprop, turboshaft, or piston. Turbofan engines dominate commercial aviation due to their high fuel efficiency and power, although turboprop engines are prominent in regional aircraft. Modern aviation engines use modern materials such as titanium alloys and composites to provide lightweight design, durability, and performance under harsh situations. Engine technology innovations aim to reduce emissions, improve fuel efficiency, and increase reliability in order to satisfy the aviation industry's expanding expectations.

Global Aircraft Engines Market Dynamics

Market Drivers

- Increasing global air travel demand drives the production and adoption of advanced aircraft engines

- Continuous advancements in fuel-efficient and lightweight engine technologies

- Growth in commercial aircraft fleets, especially in emerging economies, supports market development

- Stringent emission standards push manufacturers to innovate sustainable and eco-friendly engines

Market Restraints

- The development and production of advanced aircraft engines involve significant capital investment

- Dependency on specialized materials and components can lead to production delays

- Meeting strict aviation safety and performance regulations increases costs and complexity

Market Opportunities

- Rising interest in eco-friendly propulsion offers new avenues for innovation

- Increasing airline operations in Asia-Pacific and the Middle East present lucrative opportunities

- Demand for engine maintenance, repair, and overhaul (MRO) provides steady revenue streams

Aircraft Engines Market Report Coverage

| Market | Aircraft Engines Market |

| Aircraft Engines Market Size 2022 |

USD 76.8 Billion |

| Aircraft Engines Market Forecast 2032 | USD 168.4 Billion |

| Aircraft Engines Market CAGR During 2023 - 2032 | 9.2% |

| Aircraft Engines Market Analysis Period | 2020 - 2032 |

| Aircraft Engines Market Base Year |

2022 |

| Aircraft Engines Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Component, By Platform, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Safran Group, ITP Aero, Pratt & Whitney, Advanced Atomization Technologies Inc., Rolls-Royce, Enjet Aero, General Electric Company, Engine Alliance, MTU Aero Engines AG, and CFM International. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Aircraft Engines Market Insights

The increasing aircraft order due to growing air traffic, which is generating demand for new engines, is supporting the market growth. The increasing demand for fuel-efficient engines and developments in newer generation aircraft is adding the market value. Along with this, several airlines are revamping their fleet by procuring new aircraft is another factor contributing to the market value. Moreover, rising concern about aviation emission is likely to create potential opportunities for fuel-efficient and lightweight engines over the aircraft engines market forecast period.

Significant delivery backlogs and engine lifecycle extensions provide issues for the aircraft engine sector. High demand for aircraft, combined with supply chain restrictions, has resulted in delays in the delivery of new engines, limiting market expansion. Manufacturers routinely miss production deadlines due to limited capacity and the difficulties of engine development. Furthermore, the lengthy operating life of aircraft engines, which can last decades with proper maintenance, limits the frequency of replacements, so restraining market expansion. Airlines and operators usually rely on maintenance, repair, and overhaul (MRO) services rather than investing in new engines, which further constrains growth. These forces work together to produce bottlenecks, which delay market opportunities while diminishing innovation and acceptance.

Aircraft Engines Market Segmentation

The worldwide market for aircraft engines is split based on type, component, platform, technology, applications, and geography.

Aircraft Engine Market By Type

- Turboprop Engine

- Turbofan Engine

- Turboshaft Engine

- Piston Engine

According to aircraft engines industry analysis, in 2023, the turbofan engine accounted for the major share in the global market. Turbofan engines are most widely used in commercial and military segments. The increasing commercial aviation segment is supporting the market value. The increasing investment in the military sector of various countries by the government is additionally projected to drive growth.

Aircraft Engine Market By Component

- Turbine

- Compressor

- Gearbox

- Fuel System

- Exhaust System

- Others

In the aircraft engines market, the turbine segment is expected to be the dominant component. Turbines serve an important role in engine operation by transforming thermal energy from combusted fuel into mechanical energy that powers the aircraft's propulsion systems. Their value lies in preserving efficiency, performance, and fuel economy, especially in modern jet engines. Turbine technology is improving due to a greater emphasis on lightweight, fuel-efficient designs, as well as advancements in materials such as ceramics and composites. The increasing demand for turbine replacements due to wear and tear in demanding operating conditions strengthens its global leading position. The turbine's vital operation and steady demand make it a key driver of market growth.

Aircraft Engine Market By Platform

- Fixed Wing

- Unmanned Ariel Vehicles

- Rotary Wing

The unmanned aerial vehicles (UAVs) sub-segment is expected to be the primary platform for the aircraft engines market. UAVs are being more widely used in defense, commercial, and industrial applications as autonomous technology advances. Their engines are meant to be extremely efficient, lightweight, and adaptable to a wide range of mission requirements, such as surveillance, delivery, and mapping. The increased demand for UAVs in military operations, border security, and disaster management is driving the segment's growth.

The fixed-wing category is expected to develop the fastest over the aircraft engines market forecast period of 2024 to 2032. The rising need for fixed-wing aircraft in general aviation, military aviation, and commercial aviation is essentially driving market expansion.

Aircraft Engine Market By Technology

- Electric/Hybrid Engine

- Conventional Engine

Conventional engines account for 55% of the worldwide aircraft engine market due to their widespread acceptance and proven reliability. The great majority of commercial and military aircraft still use turboprop, turbofan, and turbojet engines. Their proven efficiency, ability to handle long-haul flights, and compatibility with current aviation infrastructure make them indispensable. Despite advancements in electric and hybrid technologies, conventional engines benefit from decades of development, resulting in increased performance and decreased operational risks. The industry also thrives as a result of a strong support ecosystem for maintenance, repair, and overhaul (MRO), which assures long-term value. Conventional engines will continue to play a vital role in the industry, particularly in large-scale operations.

Aircraft Engine Market By Application

- Commercial Aviation

- Military Aviation

- General Aviation

The commercial aviation segment is projected to experience the fastest growth with major CAGR over the estimated period from 2024 to 2032. For instance, in 2023 according to the Airlines for America (A4A) commercial aviation drives 5% of U.S. GDP. The rapidly increasing air traffic owing to the increasing disposable income in developing economies is driving the market value. The increasing replacement of conventional components with the technologically advance components and systems in the commercial aviation sector is further projected to accelerate the aircraft engines market value.

Aircraft Engines Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

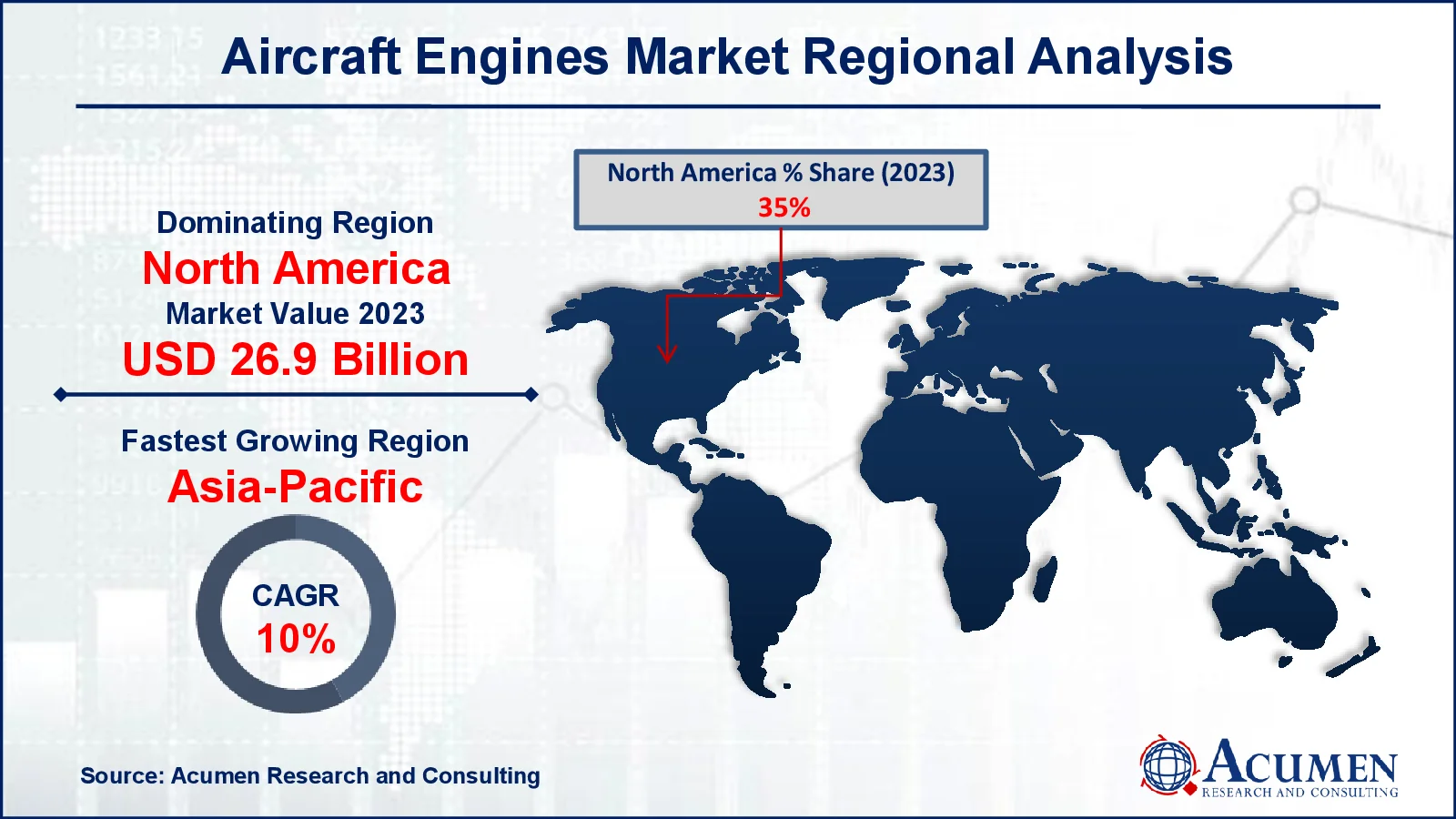

Aircraft Engines Market Regional Analysis

In 2023, North America accounted for the maximum share in the global aircraft engines market. For example in U.S., every day, the FAA's Air Traffic Organization (ATO) serves more than 45,000 flights and 2.9 million airline passengers throughout 29 million square miles of airspace. The region is particularly gaining growth because it has the largest fleet of aircraft in the world.

Moreover, the Asia-Pacific region is projected to exhibit the fastest growth over the forecast timeframe from 2024 to 2032. The increasing number of foreign travelers coupled with the rapidly increasing air traffic in the regional market is supporting the market growth. For instance, according to the Ministry of Tourism of the Government of India, 6.19 million foreign visitors visited India in 2022. The changing lifestyle, rapid urbanization, and increasing disposable income are supporting regional aircraft engine market growth.

Aircraft Engines Market Players

Some of the top aircraft engine companies offered in our report includes Safran Group, ITP Aero, Pratt & Whitney, Advanced Atomization Technologies Inc., Rolls-Royce, Enjet Aero, General Electric Company, Engine Alliance, MTU Aero Engines AG, and CFM International.

Frequently Asked Questions

How big is the aircraft engines market?

The aircraft engines market size was valued at USD 76.8 billion in 2023.

What is the CAGR of the global aircraft engines market from 2024 to 2032?

The CAGR of aircraft engines is 9.2% during the analysis period of 2024 to 2032.

Which are the key players in the aircraft engines market?

The key players operating in the global market are including Safran Group, ITP Aero, Pratt & Whitney, Advanced Atomization Technologies Inc., Rolls-Royce, Enjet Aero, General Electric Company, Engine Alliance, MTU Aero Engines AG, and CFM International.

Which region dominated the global aircraft engines market share?

North America held the dominating position in aircraft engines industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of aircraft engines during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global aircraft engines industry?

The current trends and dynamics in the aircraft engines industry include increasing global air travel demand drives the production and adoption of advanced aircraft engines, and continuous advancements in fuel-efficient and lightweight engine technologies.

Which type held the maximum share in 2023?

The turbofan engine type held the maximum share of the aircraft engines industry.