Surgical Tables And Lights Market | Acumen Research and Consulting

Surgical Tables and Lights Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

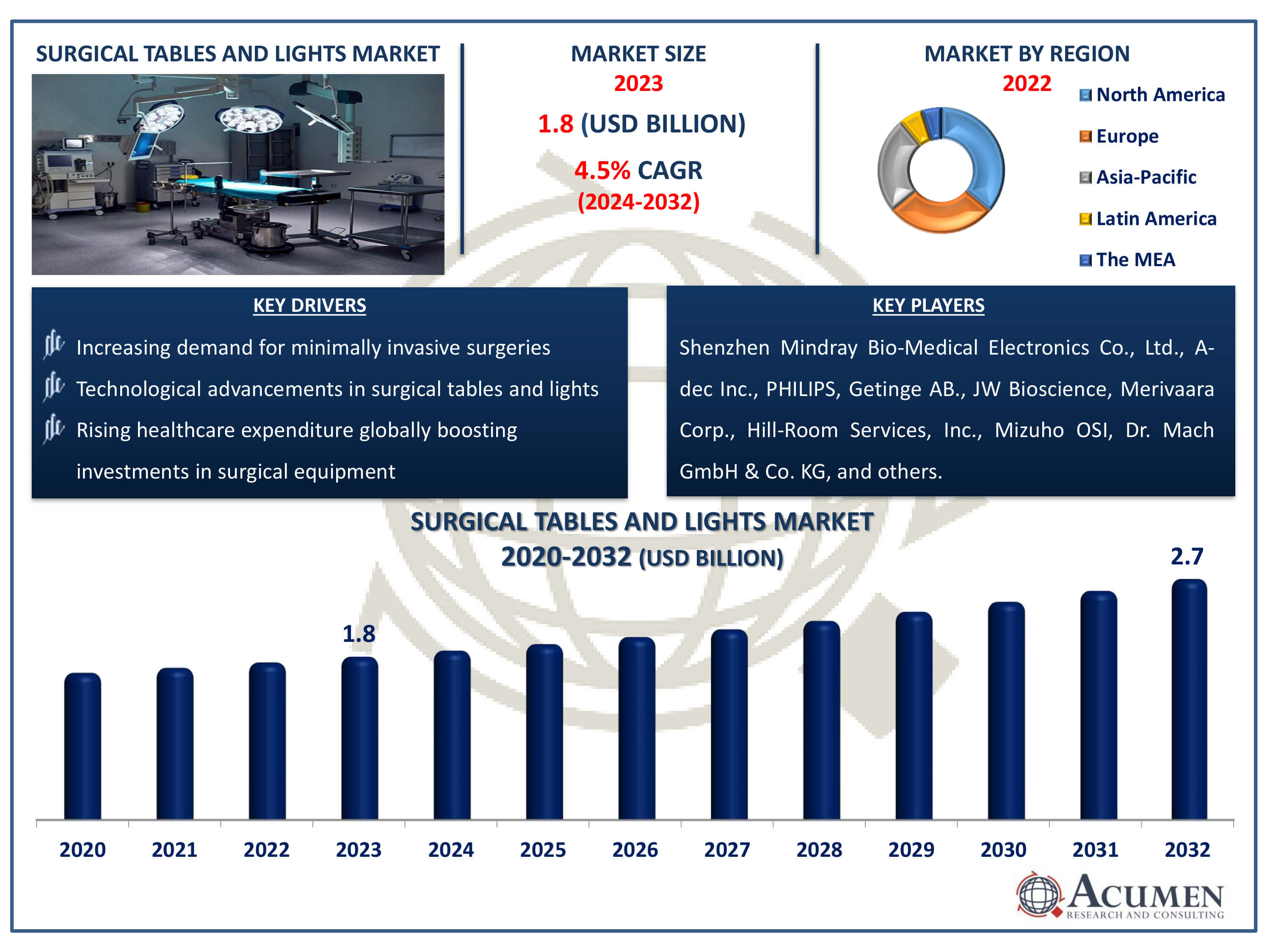

The Surgical Tables and Lights Market Size accounted for USD 1.8 Billion in 2023 and is estimated to achieve a market size of USD 2.7 Billion by 2032 growing at a CAGR of 4.5% from 2024 to 2032.

Surgical Tables and Lights Market Highlights

- Global surgical tables and lights market revenue is poised to garner USD 2.7 billion by 2032 with a CAGR of 4.5% from 2024 to 2032

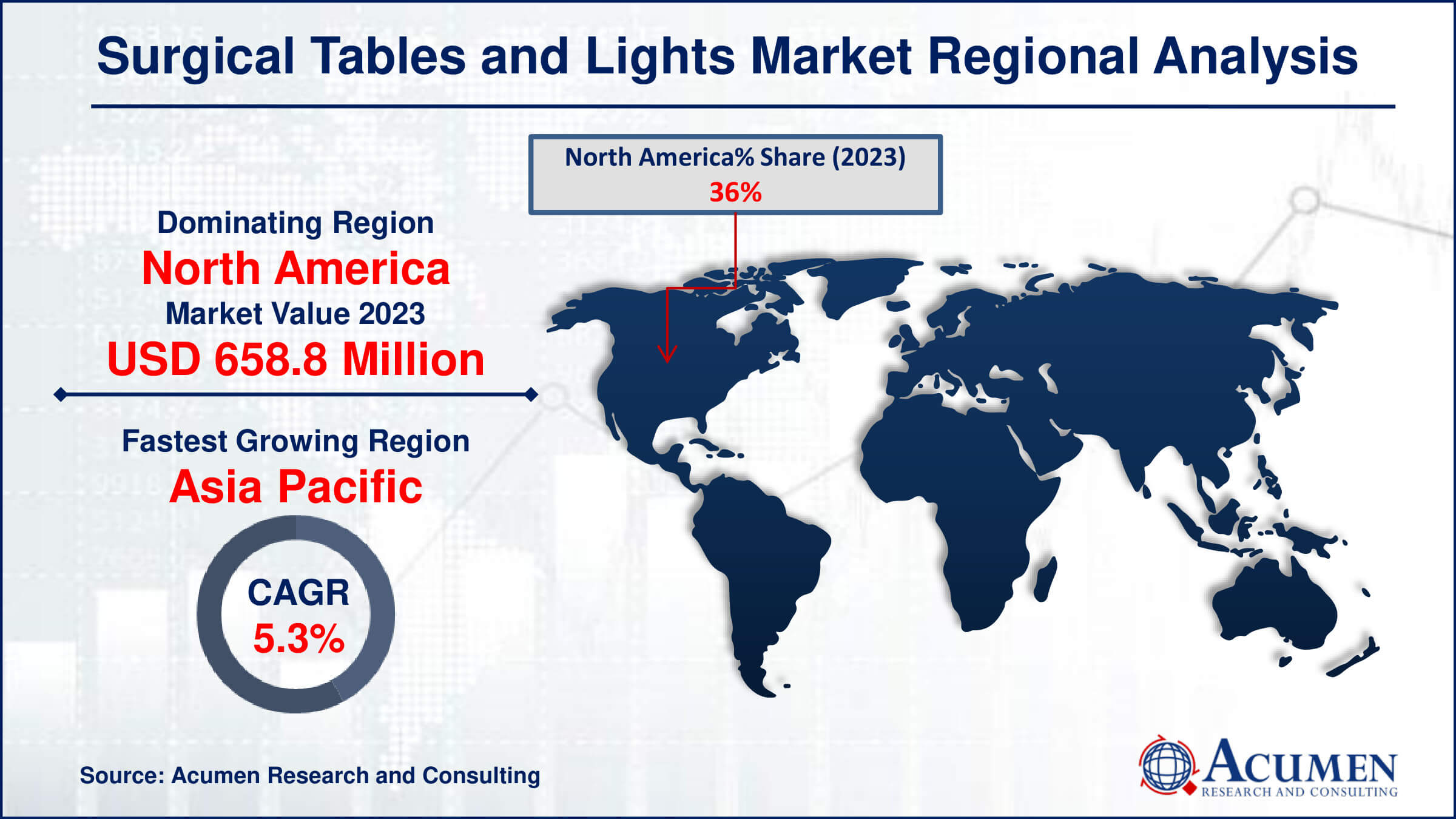

- North America surgical tables and lights market value occupied around USD 658.8 million in 2023

- Asia-Pacific surgical tables and lights market growth will record a CAGR of more than 5.3% from 2024 to 2032

- Among type, the surgical lights sub-segment generated significant market share in 2023

- Based on application, the general surgery sub-segment generated notable market share in 2023

- Increasing adoption of hybrid operating rooms driving demand for versatile surgical tables that accommodate both traditional and minimally invasive procedures is the surgical tables and lights market trend that fuels the industry demand

Surgical tables and lights are essential equipment in hospital operating rooms, crucial for enhancing patient treatment and care. They come in various types such as gynecology tables, orthopedic tables, and radiolucent C-arms compatible tables, tailored to specific operating room needs. The global market for these instruments is rapidly growing, driven by advancements in technology and the expansion of healthcare infrastructure in emerging economies. Market players are introducing state-of-the-art surgical tables and lights to meet evolving demands and improve surgical outcomes worldwide. This expansion is pivotal in enhancing medical practices and ensuring better patient care across diverse healthcare settings.

Global Surgical Tables and Lights Market Dynamics

Market Drivers

- Increasing demand for minimally invasive surgeries driving adoption of advanced surgical tables and lights

- Technological advancements in surgical tables and lights enhancing surgical outcomes and efficiency

- Rising healthcare expenditure globally boosting investments in surgical equipment, including tables and lights

Market Restraints

- High initial costs associated with advanced surgical tables and lights limiting adoption, especially in developing regions

- Regulatory challenges and stringent approval processes for new surgical equipment impacting market entry

- Limited awareness and training among healthcare professionals hindering effective utilization of advanced features

Market Opportunities

- Growing trend towards outpatient surgeries creating opportunities for portable and versatile surgical tables and lights

- Expansion of healthcare infrastructure in emerging markets driving demand for modern surgical equipment

- Increasing focus on patient safety and comfort propelling innovation in ergonomic designs and integrated technology for surgical tables and lights

Surgical Tables and Lights Market Report Coverage

| Market | Surgical Tables and Lights Market |

| Surgical Tables and Lights Market Size 2022 | USD 1.8 Billion |

| Surgical Tables and Lights Market Forecast 2032 | USD 526.2 Billion |

| Surgical Tables and Lights Market CAGR During 2023 - 2032 | 4.5% |

| Surgical Tables and Lights Market Analysis Period | 2020 - 2032 |

| Surgical Tables and Lights Market Base Year |

2022 |

| Surgical Tables and Lights Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Shenzhen Mindray Bio-Medical Electronics Co., Ltd., A-dec Inc., KONINKLIJKE PHILIPS N.V., Getinge AB., JW Bioscience, Merivaara Corp., Hill-Room Services, Inc., Mizuho OSI, Dr. Mach GmbH & Co. KG, Technomed India, Stryker, BihlerMED, STERIS plc., Integra LifeSciences Corporation, and NUVO. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Surgical Tables and Lights Market Insights

The increasing demand for minimally invasive surgeries has been a significant driver of growth in the surgical tables and lights market. For instance, in November 2022, New View Surgical Inc., a company specializing in minimally invasive surgery devices, secured USD 12.1 million in funding during its Series B-1 round. This investment has expedited the commercialization of the company's VisionPort System, leading to its introduction in the United States. These surgeries require specialized equipment that offers precise positioning and illumination, essential for the success of complex procedures performed through smaller incisions. Modern surgical tables are designed to accommodate advanced imaging technology and robotic-assisted procedures, enhancing surgical precision and patient outcomes. Concurrently, advancements in surgical lighting technologies ensure optimal visibility in the operating room, crucial for maintaining accuracy during delicate procedures. As healthcare providers continue to prioritize patient safety and recovery times, the adoption of advanced surgical tables and lights is expected to further propel market expansion globally.

Limited awareness and training among healthcare professionals pose significant challenges in fully harnessing the advanced features available in the surgical tables and lights market. The complexity of these technologies demands comprehensive training to optimize their use and benefits. Without proper education, healthcare providers may underutilize functionalities that could enhance surgical precision and patient outcomes. Addressing these constraints requires targeted education programs and continuous support to ensure healthcare professionals can effectively leverage the capabilities of modern surgical equipment for improved clinical results.

The rising emphasis on patient safety and comfort is driving significant innovation in the design of surgical tables and lights. For instance, the Patient Safety Flagship, initiated by World Health Organization (WHO), aims to drive significant changes in global, regional, and national patient safety efforts. At its heart is the support for implementing the Global Patient Safety Action Plan 2021–2030. Manufacturers are increasingly integrating ergonomic features and advanced technologies to enhance precision and efficiency during surgeries. This trend not only improves the overall surgical experience for patients but also aids healthcare providers in delivering better outcomes. As demand grows for more adaptable and user-friendly equipment, the surgical tables and lights market is poised for substantial growth, catering to the evolving needs of modern healthcare environments.

Surgical Tables and Lights Market Segmentation

The worldwide market for surgical tables and lights is split based on type, application, end-user, and geography.

Surgical Tables & Lights Market By Type

- Surgical Tables

- Operating Tables

- Gynecology Examination Tables

- Other

- Surgical Lights

- LED

- Halogen

According to the surgical tables and lights industry analysis, surgical lights holds maximum market share in 2023, due to their critical role in providing optimal visibility during surgical procedures. These lights are designed to minimize shadows and enhance precision, crucial for intricate surgeries. Technological advancements, such as LED lighting and adjustable intensity, improve efficiency and reduce energy consumption, making them increasingly attractive to healthcare facilities. With growing emphasis on patient safety and surgical outcomes, surgical lights remain indispensable, driving their dominance in the market alongside complementary equipment like surgical tables.

Surgical Tables & Lights Market By Application

- General Surgery

- Gynaecological

- Orthopaedic

- Ophthalmic

- Neurosurgery

- Urology

- Cardiology

- Others

The general surgery segment is the largest application category in the surgical tables and lights market and it is expected to increase over the industry, due to its broad application across various procedures, from routine appendectomies to complex abdominal surgeries. Surgeons rely heavily on specialized tables and lighting systems tailored for their specific needs during operations, ensuring optimal visibility and patient positioning. The demand for advanced features like ergonomic designs, integrated imaging technologies, and precise control mechanisms further drives the dominance of general surgery.

Surgical Tables & Lights Market By End-User

- Hospital & Clinics

- Ambulatory Surgical Centers

- Others

According to the surgical tables and lights industry analysis, hospital and clinics as end users dominate the surgical tables and lights market due to their extensive requirements for advanced surgical equipment to ensure precise and efficient procedures. These facilities demand ergonomic designs, versatility in functionality, and integration with other medical technologies, driving innovation in the market. The increasing number of surgeries globally further amplifies the demand for reliable and state-of-the-art surgical tables and lights, making hospitals and clinics pivotal stakeholders in shaping the market's growth and development.

Surgical Tables and Lights Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Surgical Tables and Lights Market Regional Analysis

For several reasons, North America holds a dominant position in the surgical tables and lights market due to advanced healthcare infrastructure and high healthcare spending. The region benefits from a large number of hospitals and surgical centers equipped with modern surgical technologies, including sophisticated surgical tables and lights. The presence of key market players and continuous technological advancements further solidify North America's leading position in this market. For instance, in November 2022, Stryker introduced an advanced Operating Room (OR) at its Flower Mound facility, providing customers with a unique interactive experience for envisioning new OR designs and technologies. This innovative model aims to enhance infection prevention and ease of cleaning, integrating smart technology and efficient components to save time. Additionally, stringent regulatory standards and a strong emphasis on patient safety drive the adoption of state-of-the-art surgical equipment in North America further maintain dominance in industry.

The Asia-Pacific region is fastest-growing region in the market for surgical tables and lights due to its burgeoning economies, advancing healthcare sector, and improved treatment accessibility. Moreover, rising incidence of chronic diseases such as cancer, COPD, and other serious illnesses, there is a growing need for various medical equipments, which is boosting market growth. For instance, according to National Institute of Health, each year, approximately 15 million individuals in the 30 to 69 age dye due to non-communicable diseases (NCDs). Furthermore, the availability of funding and stringent regulatory requirements will further propel market expansion.

Surgical Tables and Lights Market Players

Some of the top surgical tables and lights companies offered in our report include Shenzhen Mindray Bio-Medical Electronics Co., Ltd., A-dec Inc., KONINKLIJKE PHILIPS N.V., Getinge AB., JW Bioscience, Merivaara Corp., Hill-Room Services, Inc., Mizuho OSI, Dr. Mach GmbH & Co. KG, Technomed India, Stryker, BihlerMED, STERIS plc., Integra LifeSciences Corporation, and NUVO.

Frequently Asked Questions

How big is the surgical tables and lights market?

The surgical tables and lights market size was valued at USD 1.8 billion in 2023.

What is the CAGR of the global surgical tables and lights market from 2024 to 2032?

The CAGR of surgical tables and lights is 4.5% during the analysis period of 2024 to 2032.

Which are the key players in the surgical tables and lights market?

The key players operating in the global market are including Shenzhen Mindray Bio-Medical Electronics Co., Ltd., A-dec Inc., KONINKLIJKE PHILIPS N.V., Getinge AB., JW Bioscience, Merivaara Corp., Hill-Room Services, Inc., Mizuho OSI, Dr. Mach GmbH & Co. KG, Technomed India, Stryker, BihlerMED, STERIS plc., Integra LifeSciences Corporation, and NUVO.

Which region dominated the global surgical tables and lights market share?

North America held the dominating position in surgical tables and lights industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia Pacific region exhibited fastest growing CAGR for market of surgical tables and lights during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global surgical tables and lights industry?

The current trends and dynamics in the surgical tables and lights industry include increasing demand for minimally invasive surgeries driving adoption of advanced surgical tables and lights, technological advancements in surgical tables and lights enhancing surgical outcomes and efficiency, and rising healthcare expenditure globally boosting investments in surgical equipment, including tables and lights.

Which type held the maximum share in 2023?

The surgical lights held the maximum share of the surgical tables and lights industry.