Surge Protection Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Surge Protection Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

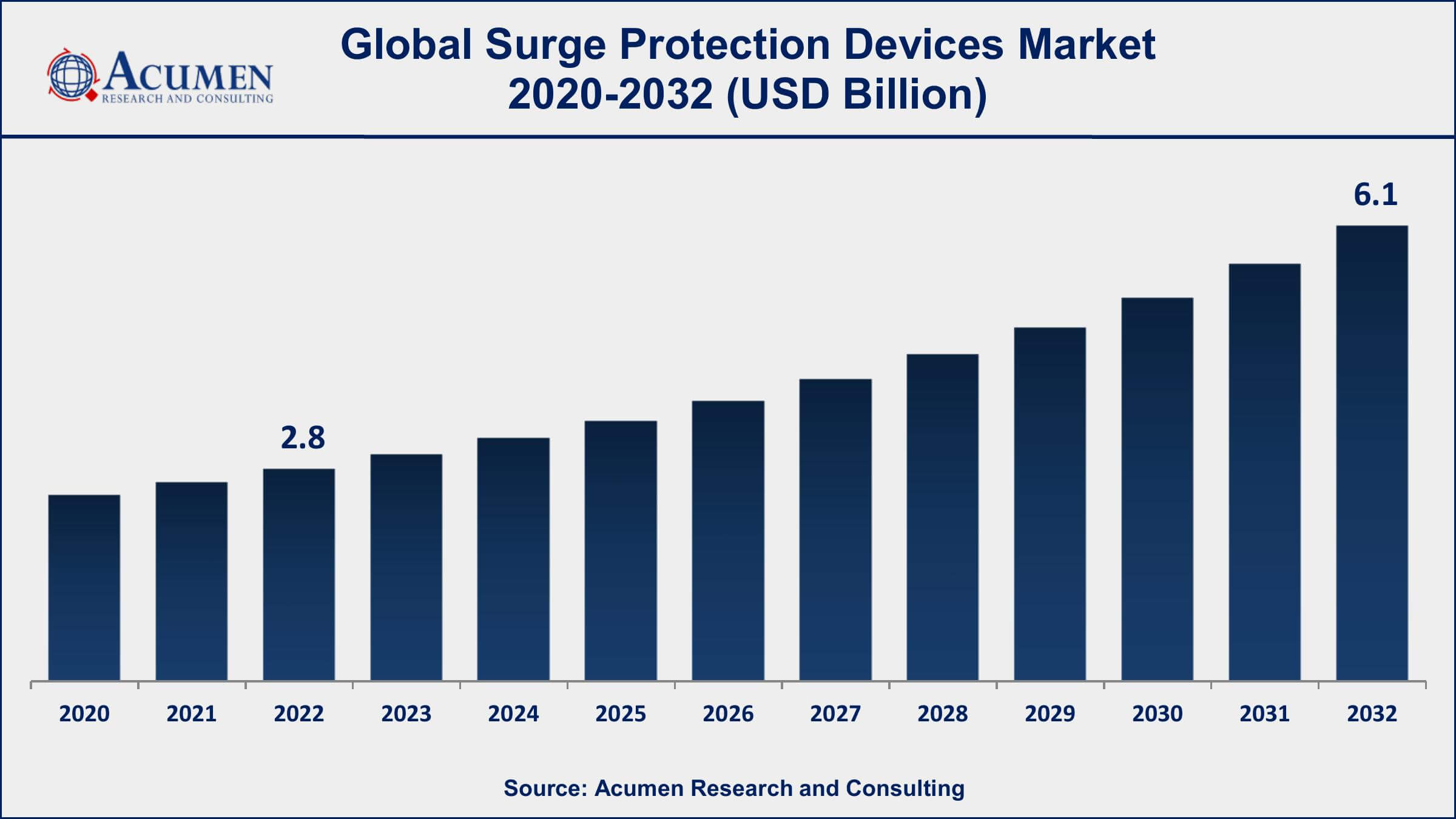

The Global Surge Protection Devices Market Size accounted for USD 2.8 Billion in 2022 and is projected to achieve a market size of USD 6.1 Billion by 2032 growing at a CAGR of 8.1% from 2023 to 2032.

Surge Protection Devices Market Highlights

- Global Surge Protection Devices Market revenue is expected to increase by USD 6.1 Billion by 2032, with a 8.1% CAGR from 2023 to 2032

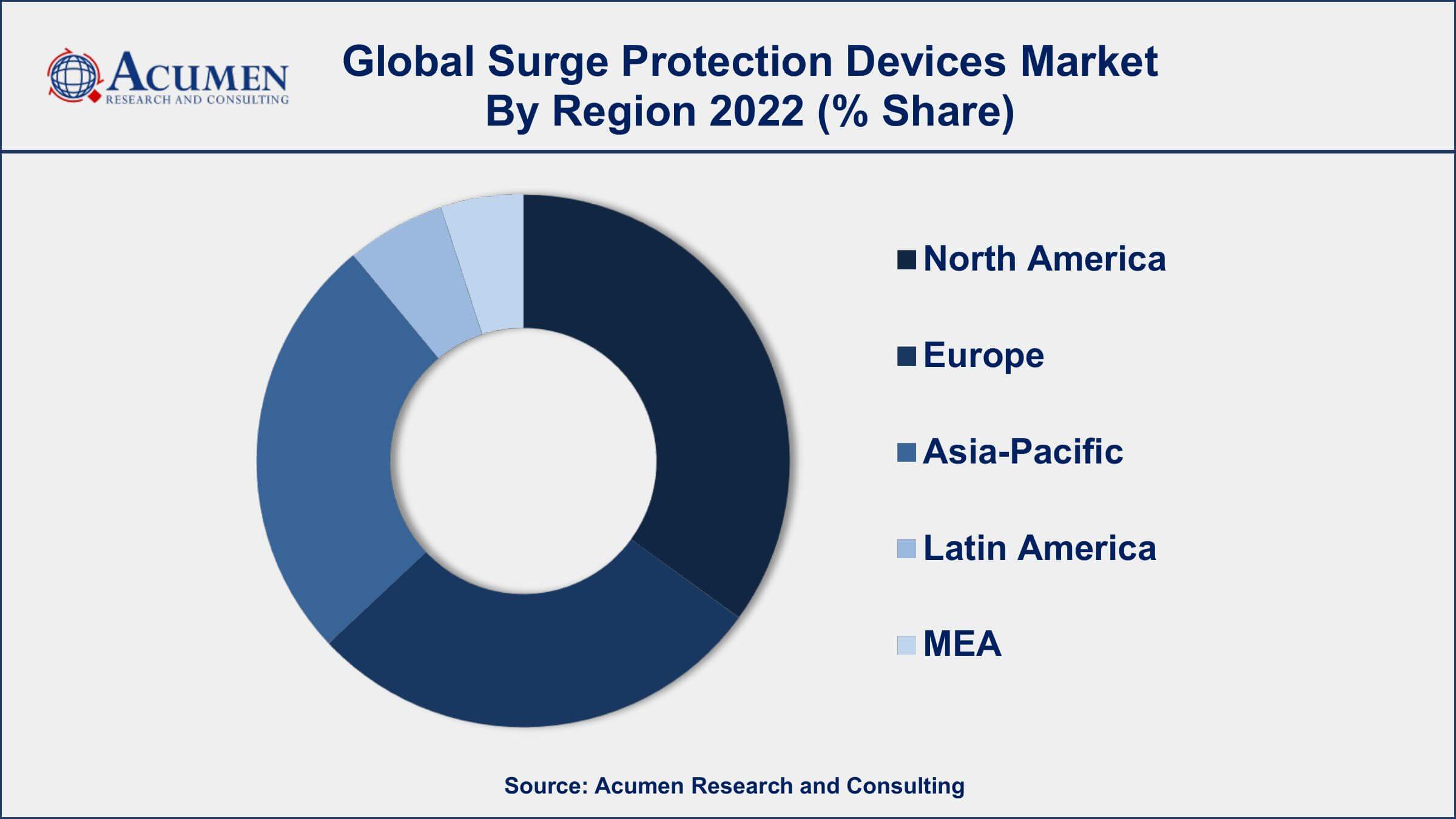

- North America region led with more than 38% of Surge Protection Devices Market share in 2022

- Asia-Pacific surge protection devices market growth will record a CAGR of more than 9% from 2023 to 2032

- By product, the hard-wired segment has recorded more than 43% of the revenue share in 2022

- By end-use, the commercial complexes segment is predicted to grow at the fastest CAGR of 8.8% between 2023 and 2032

- Increasing reliance on electronic devices in various sectors, drives the Surge Protection Devices Market value

Surge protection devices (SPDs) are devices designed to protect electrical and electronic equipment from voltage surges or transients that can damage or destroy sensitive components. These surges can occur due to lightning strikes, power grid switching, or electrical faults. Surge protection devices work by diverting excess voltage to the ground and limiting the voltage that reaches connected equipment. They play a crucial role in safeguarding devices such as computers, televisions, appliances, and industrial machinery from costly damage caused by power surges.

The market for surge protection devices has experienced significant growth over the years, driven by the increasing reliance on electronic devices and the need for reliable power quality. The proliferation of electronic equipment in homes, offices, industries, and data centers has led to a higher demand for surge protection solutions. Additionally, the rising occurrence of severe weather events and lightning strikes has further emphasized the importance of surge protection. Furthermore, advancements in technology have led to the development of more sophisticated surge protection devices that offer enhanced protection and performance.

Global Surge Protection Devices Market Trends

Market Drivers

- Increasing reliance on electronic devices in various sectors

- Growing demand for reliable power quality and protection against power surges

- Rising occurrence of severe weather events and lightning strikes

- Expansion of smart homes and connected devices

Market Restraints

- High competition among market players leading to pricing pressures

- Availability of counterfeit surge protection devices in the market

Market Opportunities

- Integration of surge protection devices with IoT and smart home technologies

- Expansion of data centers and IT infrastructure requiring robust surge protection

Surge Protection Devices Market Report Coverage

| Market | Surge Protection Devices Market |

| Surge Protection Devices Market Size 2022 | USD 2.8 Billion |

| Surge Protection Devices Market Forecast 2032 | USD 6.1 Billion |

| Surge Protection Devices Market CAGR During 2023 - 2032 | 8.1% |

| Surge Protection Devices Market Analysis Period | 2020 - 2032 |

| Surge Protection Devices Market Base Year | 2022 |

| Surge Protection Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Power Rating, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Schneider Electric, Eaton Corporation, ABB Ltd., Siemens AG, Emerson Electric Co., Leviton Manufacturing Co., Inc., Tripp Lite, Belkin International, Inc., Legrand SA, Phoenix Contact GmbH & Co. KG, Raycap Corporation SA, and Citel Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Surge protection devices (SPDs) are devices designed to protect electrical and electronic equipment from voltage surges or transients. These surges can occur due to various factors such as lightning strikes, power grid switching, or internal electrical faults. Surge protection devices act as a barrier between the power source and the connected equipment, redirecting excess voltage safely to the ground and limiting the voltage that reaches the protected devices. By doing so, they prevent damage to sensitive components and ensure the reliable operation of electrical and electronic systems.

The applications of surge protection devices are widespread across various sectors and industries. In residential settings, surge protection devices are commonly used to safeguard household appliances, computers, televisions, and other electronic devices from the damaging effects of power surges. In commercial and office environments, surge protection devices are employed to protect sensitive equipment such as servers, routers, and communication systems, ensuring uninterrupted operations and minimizing downtime.

The surge protection devices market has witnessed significant growth in recent years and is expected to continue growing at a steady pace. The increasing reliance on electronic devices across various sectors, coupled with the rising demand for reliable power quality, has been a major driver for the market. As the number of electronic devices continues to grow, the need to protect them from power surges and transient voltage events becomes paramount. This has led to a higher adoption of surge protection devices in residential, commercial, and industrial applications. The surge protection devices market has also been fueled by the growing occurrence of severe weather events and lightning strikes. These events pose a significant risk to electrical equipment, and surge protection devices play a crucial role in mitigating such risks.

Surge Protection Devices Market Segmentation

The global Surge Protection Devices Market segmentation is based on product, power rating, end-use, and geography.

Surge Protection Devices Market By Product

- Hard-wired

- Line Cord

- Plug-in

- Power Control Devices

According to the surge protection devices industry analysis, the hard-wired segment accounted for the largest market share in 2022. Hard-wired surge protection devices are installed directly into the electrical system of a building, offering robust and comprehensive protection against power surges. This segment has gained prominence due to its ability to provide long-term and reliable surge protection for various applications. One key driver for the growth of the hard-wired segment is the increasing adoption of surge protection measures in commercial and industrial settings. These environments typically have a higher concentration of critical and sensitive equipment, making them more vulnerable to power surges. Industries such as manufacturing, data centers, healthcare, and telecommunications are particularly focused on safeguarding their operations from electrical disturbances.

Surge Protection Devices Market By Power Rating

- 0-50 kA

- 50.1-100 kA

- 100.1-200 kA

- 200.1 kA and Above

In terms of power ratings, the 100.1-200 kA segment is expected to witness significant growth in the coming years. This segment represents surge protection devices with high surge current handling capacity, ranging from 100.1 kiloamperes (kA) to 200 kA. Surge events with larger magnitudes require surge protection devices capable of handling higher surge currents, making this segment crucial for applications where greater surge protection is necessary. One key driver for the growth of the 100.1-200 kA segment is the increasing demand for surge protection in critical infrastructure and industrial applications. Industries such as power generation, oil and gas, telecommunications, and transportation often operate with large-scale equipment and systems that are highly sensitive to power surges. These industries require surge protection devices with high surge current ratings to ensure the reliable operation and protection of their assets.

Surge Protection Devices Market By End-use

- Commercial Complexes

- Industries & Manufacturing Units

- Data Center

- Transportation

- Medical

- Telecommunication

- Residential Buildings & Spaces

- Others

According to the surge protection devices market forecast, the commercial complexes segment is expected to witness significant growth in the coming years. Commercial complexes encompass a wide range of buildings, including offices, shopping malls, hotels, and healthcare facilities, among others. These buildings often house a multitude of electrical and electronic equipment, making them highly susceptible to power surges. As a result, the demand for surge protection devices in commercial complexes has increased significantly. One of the key drivers for the growth of surge protection devices in commercial complexes is the growing emphasis on protecting sensitive equipment and ensuring uninterrupted operations. Commercial complexes rely on various electronic devices, such as computers, servers, HVAC systems, elevators, and security systems, to function efficiently. Any damage or disruption caused by power surges can lead to downtime, loss of productivity, and costly repairs.

Surge Protection Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Surge Protection Devices Market Regional Analysis

North America has emerged as a dominating region in the surge protection devices market for several reasons. Firstly, the region has a highly developed infrastructure, which includes a robust power grid and extensive deployment of electronic devices across various sectors. The widespread use of electronic equipment, including in residential, commercial, and industrial applications, creates a significant demand for surge protection devices to safeguard these sensitive devices from power surges. Moreover, North America experiences a range of weather conditions, including severe storms and lightning activity, which further increases the need for surge protection devices. Additionally, stringent safety and compliance regulations in North America drive the adoption of surge protection devices. Regulatory bodies, such as the National Fire Protection Association (NFPA) and the National Electrical Code (NEC), provide guidelines and standards that emphasize the installation of surge protection devices in specific applications. These regulations mandate the use of surge protection devices to ensure the safety of electrical systems and equipment. The adherence to these regulations by businesses, industries, and even homeowners contributes to the dominant position of North America in the surge protection devices market.

Surge Protection Devices Market Player

Some of the top surge protection devices market companies offered in the professional report include Schneider Electric, Eaton Corporation, ABB Ltd., Siemens AG, Emerson Electric Co., Leviton Manufacturing Co., Inc., Tripp Lite, Belkin International, Inc., Legrand SA, Phoenix Contact GmbH & Co. KG, Raycap Corporation SA, and Citel Inc.

Frequently Asked Questions

What was the market size of the global surge protection devices in 2022?

The market size of surge protection devices was USD 2.8 Billion in 2022.

What is the CAGR of the global surge protection devices market from 2023 to 2032?

The CAGR of surge protection devices is 8.1% during the analysis period of 2023 to 2032.

Which are the key players in the surge protection devices market?

The key players operating in the global market are including Schneider Electric, Eaton Corporation, ABB Ltd., Siemens AG, Emerson Electric Co., Leviton Manufacturing Co., Inc., Tripp Lite, Belkin International, Inc., Legrand SA, Phoenix Contact GmbH & Co. KG, Raycap Corporation SA, and Citel Inc.

Which region dominated the global surge protection devices market share?

North America held the dominating position in surge protection devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of surge protection devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global surge protection devices industry?

The current trends and dynamics in the surge protection devices industry include increasing reliance on electronic devices in various sectors, and growing demand for reliable power quality and protection against power surges

Which power rating held the maximum share in 2022?

The 100.1-200 kA segment power rating held the maximum share of the surge protection devices industry.