Substation Market Size (By Technology: Conventional, and Digital; By Component: Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others; By Connectivity:? 33 kV, > 33 kV to ? 110 kV, > 110 kV to ? 220 kV, > 220 kV to ? 550 kV, and > 550 kV; By Application: Transmission and Distribution; By Voltage Level: Low, Medium, and High, and By End-Use: Utility and Industrial) � Global Industry Analysis, Market Size, Opportunities and Forecast 2021 � 2028

Published :

Report ID:

Pages :

Format :

Substation Market Size (By Technology: Conventional, and Digital; By Component: Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others; By Connectivity:? 33 kV, > 33 kV to ? 110 kV, > 110 kV to ? 220 kV, > 220 kV to ? 550 kV, and > 550 kV; By Application: Transmission and Distribution; By Voltage Level: Low, Medium, and High, and By End-Use: Utility and Industrial) � Global Industry Analysis, Market Size, Opportunities and Forecast 2021 � 2028

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

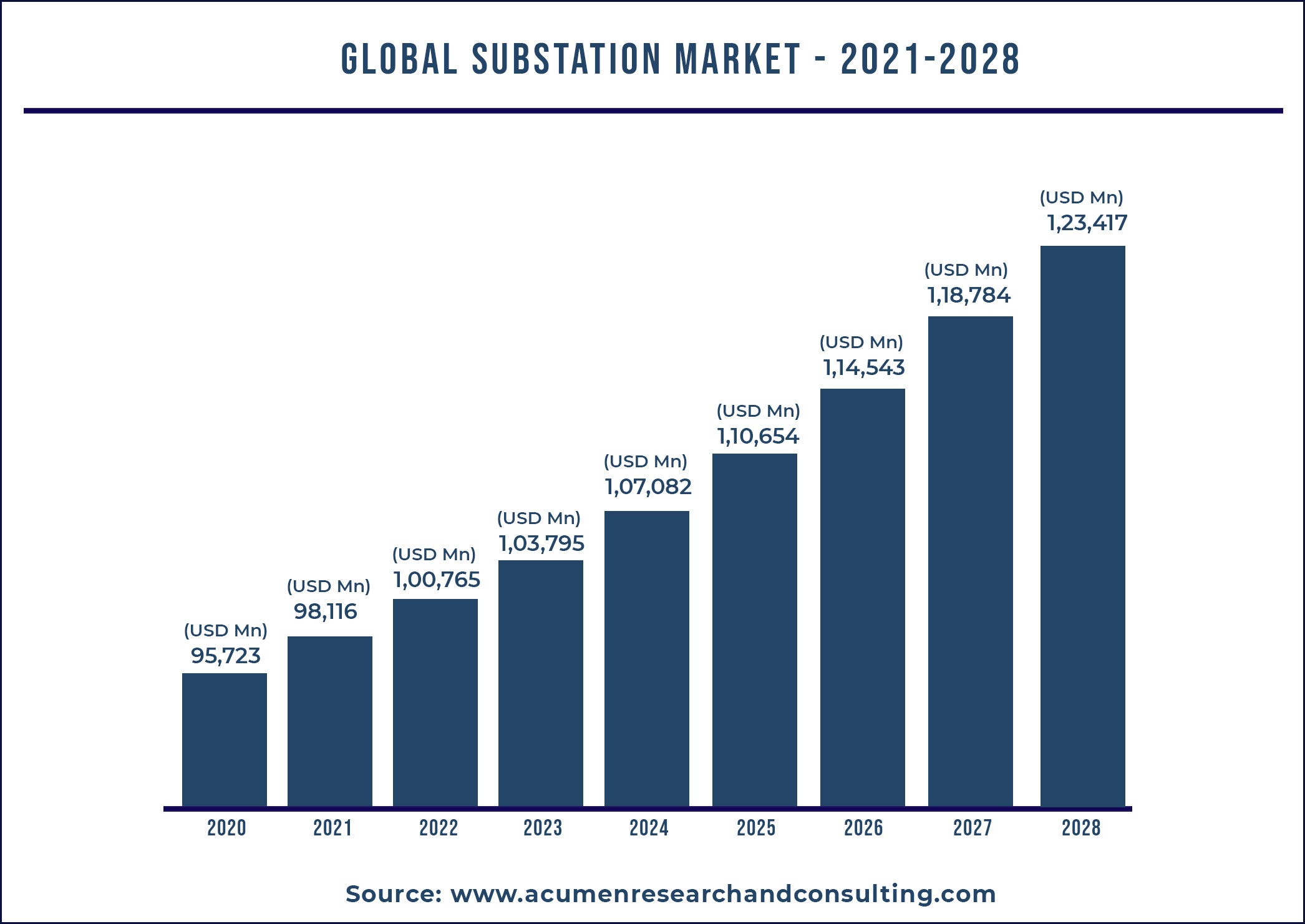

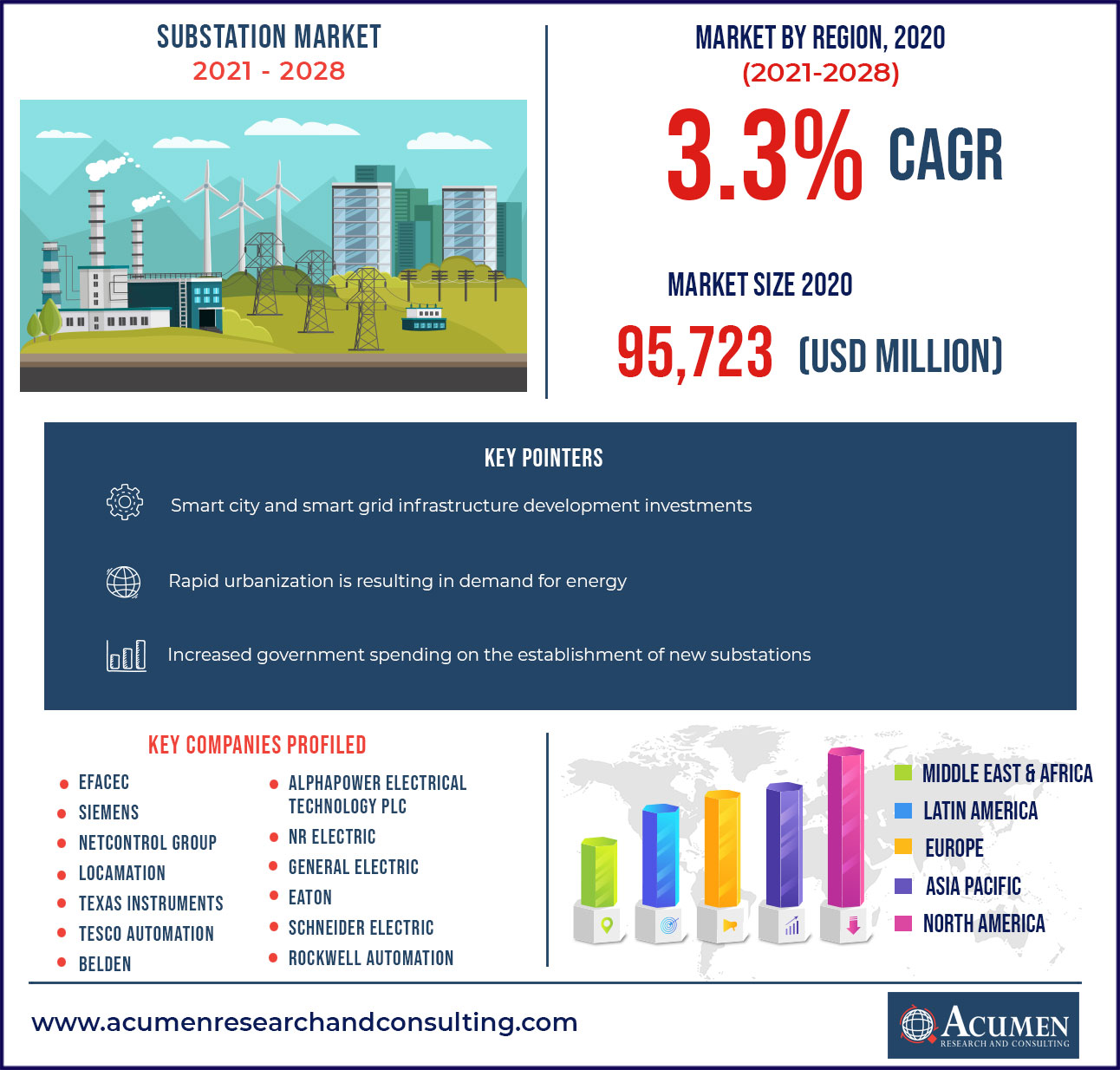

Request Sample Report

The Global Substation Market was worth US$ 95,723 million in 2020 and is predicted to grow to US$ 1,23,417 million by 2028 with a CAGR of 3.3% from 2021 to 2028.

According to the US Energy Information Administration, the US government spending on electric transmission systems was US$ 40 Bn in 2019 and is increasing with the changing year. In India, there are about 245 substations with 371,912 MVA of substation capacity. Rapid industrialization and urbanization in the country, coupled with new substation development projects are expected to fuel the market growth. A country with continuous economic development and an approach towards the adoption of renewable energy through the integration of automation is expected to impact the market growth. In 2020, the Power Grid Corp. of India, supported the automation growth implemented IEC 61850-based grid substation automation in more than 100 substations across the country. This implementation is expected to help companies enhance their operational efficiency.

Market Growth Drivers:

- Rapid urbanization is resulting in growing demand for energy

- Smart city and smart grid infrastructure development investments

Market Restraints

- High initial set-up costs linked with substations

- Growing concerns over cyber attacks

Market Opportunities:

- Increased government spending on the establishment of new substations

- Rising demand for renewable energy projects

Covid-19 Impact on the Global Substation Industry

The global economy experienced a minor downturn in the overall industry environment during the COVID-19 pandemic. Some countries stopped their manufacturing facilities and infrastructure projects in 2020, which slightly impacted the power generation industry. Nevertheless, the restart of the operations across manufacturing facilities, infrastructure projects, and power plants is likely to create numerous growth opportunities for the global substation market.

Report Coverage:

| Market | Substation Market |

| Market Size 2020 | US $95,723 Mn |

| Market Forecast 2028 | US $1,23,417 Mn |

| CAGR | 3.3 % During 2021 - 2028 |

| Analysis Period | 2017 - 2028 |

| Base Year | 2020 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Technology, By Component and By Connectivity By Application By Voltage Level By End-Use and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Efacec, Siemens, NetControl Group, Locamation, Texas Instruments, Tesco Automation, Belden, Alphapower Electrical Technology PLC, NR Electric, General Electric, and others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation

|

Market Dynamics

Increasing energy demand, inclination towards digitalization of energy sector and increasing government spending on infrastructure development are factors expected to augment the growth of global substation market. The governments of developed and developing countries are spending a large amount on the development of advanced energy infrastructure. Their approach towards providing unstoppable power to the residential and industrial sector is gaining traction.

Developed countries' inclination towards shifting their energy source from coal to green energy is gaining importance. They are spending high on the deployment of new solar and wind projects to harness the maximum amount of energy to cater to the rising demand. In 2021, the government of US jumpstarted the offshore wind energy projects that will help to build new American infrastructure and a clean energy economy. They announced the new “Wind Energy Area” projects in New York Bight. Enterprises are focused on enhancing the business by establishing new substations for better energy flow and easy access to wind energy.

Market Segmentation

The global substation market is segmented based on technology, component, connectivity, application, voltage type, end-use, and region.

Market by Technology

- Conventional

- Digital

Among technology, the digital segment conquered the maximum market share. Some of the major factors driving the expansion of the digital technology segment include surging power demand with limited space availability, bigger infrastructure development in smart cities, and rising need for renewable energy projects and battery technology to produce electricity.In addition, the continued trend towards electrification via off-grid networks and renewable electricity infrastructure will have a beneficial impact on technology adoption.

Market by Component

• Electrical System

- Transformer

- Busbar

- Protection Devices

- Circuit Breaker

- Protective Relay

- Switchgear

• Substation Automation System

• Communication Network

• Monitoring & Control System

- Human Machine Interface

- Programmable Logic Controller

- Others

• Others

Based on the component segment, the substation automation system registered significant growth in the year 2020. The advent of cloud computing and deployment of IoT are the two major trends that would integrate substation automation to derive operational and financial benefits. Increasing investment in renewable energy projects to meet energy demand creates a variety of potential prospects in the global market throughout the anticipated period. According to the International Energy Agency's (IEA) forecasts, renewable energy sources generated 25% of the world's electricity in 2019. Thus, heavy investments in numerous wind and solar energy plants escalate the demand for substation automation industry.

Market by Connectivity

- ≤ 33 kV

- > 110 kV to ≤ 220 kV

- > 220 kV to ≤ 550 kV

- > 33 kV to ≤ 110 kV

- >550 kV

The ≤ 33 kV segment is expected to gather a substantial market share by 2028 displaying a consistent growth rate during the forecast period from 2021 to 2028.

Market by Application

- Transmission

- Distribution

In 2020, the transmission segment is expected to account for an impressive market share during the forecast period 2021 – 2028. The transmission application allows the flow of electricity to multiple parallel inter-connections so that power can be transmitted effortlessly over long distances from any generator to any end user. These substations have high-voltage switches that allow transmission lines to be connected or disconnected in the event of a malfunction or repair work.

Market by Voltage Level

- Low

- Medium

- High

In 2020, the high voltage segment gained a significant impetus owing to the growing demand of high voltage electricity in developed as well as developing countries. Meanwhile, the medium and low segment witnessed a stable growth in the market as they have a bigger demand in small and medium industries.

Market by End-Use

- Utility

- Industrial

Among the end-use segment, the utility dominated the market with the highest shares in 2020. Rigorous regulatory compliances and government directives toward utility-aided grid networks in terms of electric infrastructure deployment will supplement market demand for digital substations. Furthermore, the use of energy-efficient, simple-to-install, and dependable intelligent technology are some of the factors that will improve the end-user implementation.

Substation Market Regional Overview

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Brazil

- Mexico

- Rest of Latin America

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Substation Market Regional Overview

APAC region registered the highest CAGR due to growing number of investments in the power sector

North American region accounted for the majority of the share in 2020 owing to the growing development of smart grid networks and restoration & retrofit of existing grid infrastructure. During the foreseeable period, the APAC region will experience rapid expansion. The region's rapid growth can be linked to increased peak load demand, the proliferation of micro-grid networks, and concerns about grid stability and supply security. China, India, and South Korea are three of the region's most important countries, all of which are expected to contribute to market growth. India, Singapore, Taiwan, and South Korea have all been recognized as potential investment destinations for multinational corporations from the West, notably in the fields of technology and healthcare. This suggests that APAC is investing heavily in the power sector. Furthermore, the Asia-Pacific Energy Cooperation (APEC) has set a goal of reducing APAC's total energy consumption by 45% by 2035 and encouraging sustainable energy practices.

Substation Market Competitive Landscape

This section of the report pinpoints various key vendors of the market. Some of the prominent vendors offered in the report include Efacec, Siemens, NetControl Group, Locamation, Texas Instruments, Tesco Automation, Belden, Alphapower Electrical Technology PLC, NR Electric, General Electric, and others.

Companies operating in the market are adopting a series of strategic activities to grab a significant hold in the competitive scenario. For instance, in 2021, Kiewit Corp. is expected to build the first U.S. offshore wind substation. The company is expected to develop the substation in 555-acre oil and gas fabrication facility in Texas.

In 2021, Aker Offshore Wind announced it will develop the first offshore wind underwater substation for Scotland. The substation will move energy created by wind turbines into homes and businesses. The substation will be placed underwater with the focus to lower the maintenance cost and increase the efficiency. As the substation is situated under water it provides better cooling, temperature stability, and better efficiency.

Frequently Asked Questions

How much was the estimated value of the Global Substation market in 2020?

The estimated value of Global Substation market in 2020 was accounted to be US$95,723 Mn.

What will be the projected CAGR for Global Substation market during forecast period of 2021 to 2028?

The projected CAGR of Substation during the analysis period of 2021 to 2028 is 3.3%.

Which are the prominent competitors operating in the market?

The prominent players of the global substation market involve Efacec, Siemens, NetControl Group, Locamation, Texas Instruments, Eaton, Schneider Electric, Rockwell Automation, Tesco Automation, Belden, Alphapower Electrical Technology PLC, NR Electric, General Electricand others

Which region held the dominating position in the Global Substation Market?

North America held the dominating share for Substation during the analysis period of 2021 to 2028

Which region exhibited the fastest growing CAGR for the forecast period of 2021 to 2028?

Asia-Pacific region exhibited fastest growing CAGR for Substation during the analysis period of 2021 to 2028

What are the current trends and dynamics in the Global Substation Market?

Rapid urbanization is resulting in demand for energy, increased government spending on the establishment of new substations, and smart city & smart grid infrastructure development investments are the prominent factors that fuel the growth of global substation market

By Technology segment, which sub-segment held the maximum share?

Based on technology, digital segment held the maximum share for Substation market in 2020?