Stick Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Stick Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

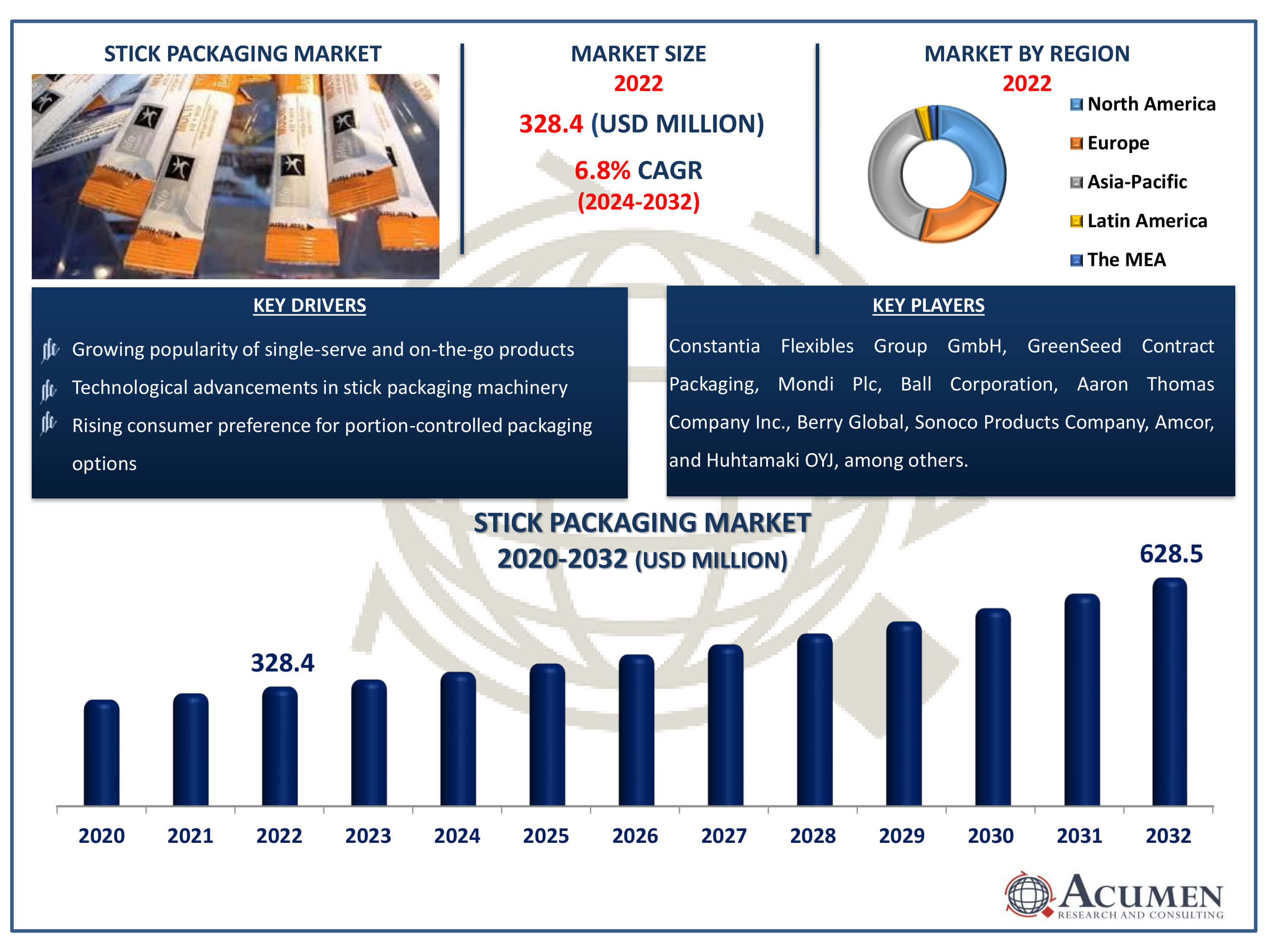

The Stick Packaging Market Size accounted for USD 328.4 Million in 2022 and is estimated to achieve a market size of USD 628.5 Million by 2032 growing at a CAGR of 6.8% from 2024 to 2032.

Stick Packaging Market Highlights

- Global stick packaging market revenue is poised to garner USD 628.5 million by 2032 with a CAGR of 6.8% from 2024 to 2032

- Asia-Pacific stick packaging market value occupied around USD 134.6 million in 2022

- North America stick packaging market growth will record a CAGR of more than 7.5% from 2024 to 2032

- Among material type, the polyethylene sub-segment generated noteworthy revenue in 2022

- Based on application, the food & beverages sub-segment generated significant market share in 2022

- Growing adoption of stick packaging in emerging economies due to changing consumer lifestyles is a popular stick packaging market trend that fuels the industry demand

The term "stick packaging" describes a kind of flexible packaging format that has a long, thin shape that makes it resemble a stick or straw. Single-serve goods including liquids, powders, granules, and solids like sweets or snacks are frequently used with it. Stick packaging has a number of benefits, including as portion control, portability, and convenience. It is frequently constructed from pliable materials that are readily sealed to maintain product freshness, including foil or plastic. Stick packaging is a common choice for small-scale product packaging and dispensing in a variety of sectors, such as food and beverage, pharmaceutical, and personal care items. It is an economical and effective option.

Global Stick Packaging Market Dynamics

Market Drivers

- Increasing demand for convenient and portable packaging solutions

- Growing popularity of single-serve and on-the-go products

- Technological advancements in stick packaging machinery

- Rising consumer preference for portion-controlled packaging options

Market Restraints

- Limited space for branding and product information on stick packaging

- Challenges in packaging certain types of products with stick packaging

- Concerns about environmental sustainability due to single-use packaging materials

Market Opportunities

- Expansion into new markets and product categories

- Innovation in sustainable stick packaging materials and designs

- Collaborations with manufacturers to develop customized stick packaging solutions

Stick Packaging Market Report Coverage

| Market | Stick Packaging Market |

| Stick Packaging Market Size 2022 | USD 328.4 Million |

| Stick Packaging Market Forecast 2032 |

USD 628.5 Million |

| Stick Packaging Market CAGR During 2024 - 2032 | 6.8% |

| Stick Packaging Market Analysis Period | 2020 - 2032 |

| Stick Packaging Market Base Year |

2022 |

| Stick Packaging Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Material Type, By Filler Type, By Capacity, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Constantia Flexibles Group GmbH, GreenSeed Contract Packaging, Mondi Plc, Ball Corporation, Aaron Thomas Company Inc., Berry Global, Sonoco Products Company, Amcor, Huhtamaki OYJ, Smurfit Kappa Group, Winpak Ltd., and Fres-co System USA Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Stick Packaging Market Insights

Two major drivers are driving the growth of the stick packaging market: the increasing trend of supplement and nutraceutical intake, and the expanding urbanisation of the population. Stick packaging is a great option for consumption while on the go because of the growing demand for portable and easy-to-use packaging solutions due to urban population density. Stick packaging is in high demand because consumers are becoming more aware of and receptive to supplements and nutraceuticals, which frequently need for accurate dosage and user-friendly packaging options.

Furthermore, by adding cutting-edge features, major manufacturers are helping the stick packaging industry to flourish. To maintain product freshness and shelf life, they are, for example, manufacturing stick packaging with a multi-laminated film structure that enhances moisture and oxygen-barrier qualities. These package options also provide precise dose fill, which lowers production waste and guarantees that consumers receive the right amount. These characteristics not only meet the growing needs of consumers for accuracy and convenience, but they also propel the worldwide stick packaging market's expansion.

In terms of stick packaging market analysis, the industry is anchored by the food and beverage sector, which has several prospects for producers. Stick packaging is frequently used in this industry for a variety of items, such as drink mixes, sauces, spices, liquid concentrates, and single-serve snacks. Its capacity to offer practical portion control and convenience of consumption when travelling is what makes it so appealing. Packaging choices that enable portability and simplicity are in high demand as consumer lives shift towards more mobility and fast-paced routines. Furthermore, stick packaging technology has advanced to become more flexible and adaptable to a wider range of food and beverage products, therefore reinforcing its status as the industry standard for packaging. These factors are expected to drive the demand during the stick packaging industry forecast period.

Stick Packaging Market Segmentation

The worldwide market for stick packaging is split based on material type, filler type, capacity, application, and geography.

Stick Packaging Material Types

- Polyester

- Polyethylene

- Biaxially Oriented Polypropylene (BOPP)

- Aluminum

- Paper

- Metallized Films

- Others

According to stick packaging industry analysis, polyethylene is perhaps the biggest market category. Stick packaging frequently uses polyethylene because of its many good qualities, including flexibility, durability, and resistance to chemicals and moisture. Because of its adaptability, it may be used in a variety of settings in the food, beverage, pharmaceutical, and personal care sectors. Manufacturers favour polyethylene because it is also easily customizable to fulfill unique packaging requirements. Stick packaging made of polyethylene is predicted to continue to be in high demand because to the growing need for portable and handy packaging options, particularly in the food and beverage industry. This will greatly contribute to polyethylene's dominance in the market.

Stick Packaging Filler Types

- Powder

- Liquid

- Tablets

The stick packaging market is anticipated to have the largest powder filler segment among the various filler kinds. Stick packaging frequently uses powder fillers because of their adaptability and extensive range of applications in a variety of industries. Stick packaging is common for items like drink mixes, instant coffee, condiments, spices, medicinal powders, and nutritional supplements. Powder fillers are used in this process. Powder fillers are widely used because they are simple to handle, can be accurately dosed, and work well with stick packaging designs. Furthermore, powder fillers make single-serving solutions lightweight, portable, and carry-easy for customers, adding to their convenience. The powder category is anticipated to maintain its dominant position in the stick packaging market because to the increased demand for simple packaging options and on-the-go consumption.

Stick Packaging Capacity

- 0 - 5 ml

- 5 ml - 10 ml

- 10 ml - 15 ml

- 15 ml - 20 ml

- 20 ml & above

In the stick packaging market, the 0–5 ml capacity category is anticipated to be the biggest. This is mostly because stick packaging is so commonly used for single-serving and small-quantity items in a variety of industries, including personal care, cosmetics, medicines, and food and beverage. Small package quantities are frequently needed for items like condiments, spices, flavourings, liquid concentrates, and sample-sized skincare products in order to satisfy customer preferences for mobility and convenience. Stick packaging with a capacity range of 0 to 5 ml also minimizes product waste by providing accurate dosing and portion control, making it perfect for on-the-go consumption. Because of this, it is anticipated that stick packaging in this capacity range will continue to be in great demand, contributing to its market domination.

Stick Packaging Applications

- Cosmetics & Personal Care

- Food & Beverages

- Industrial

- Pharmaceuticals

- Others

The food and beverage industry emerges as a major development engine that offers manufacturers enormous prospects. Stick packaging solutions are in high demand as consumers in this area want for healthier choices that fit their busy lifestyles. Products like quick drink mixes for bottled water or powdered coffee are good examples of how stick packaging is lightweight and small and meets customer convenience demands. In order to provide flawless client experiences, the hospitality sector also significantly depends on stick packaging for necessities like milk, coffee sugar, creamers, and drink mixes. These elements, together with the changing needs of consumers, will likely continue to drive demand in the stick packaging market forecast period.

Stick Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Stick Packaging Market Regional Analysis

Asia-Pacific is expected to hold the largest share in the stick packaging market. This dominance in the Asia-Pacific region is attributed to the high consumer acceptance of standardized packaging in the China Stick packaging is rapidly gaining popularity in the global market due to its various features such as low weight, convenience in handling, minimal film usage, and reduced carbon footprint. These factors are major drivers boosting the demand for stick packaging during the forecast period.

The North America region is anticipated to experience rapid growth with a significant compound annual growth rate (CAGR), driven by the growing importance of fitness and the increasing trend of supplements and nutraceuticals consumption. The popularity of single-serve packaging for supplements and nutraceuticals is on the rise, driven by changing lifestyles and an increased inclination towards fitness among consumers. As people become more health-conscious, these factors are projected to drive the growth of the stick packaging market in the coming years.

Stick Packaging Market Players

Some of the top stick packaging companies offered in our report includes Constantia Flexibles Group GmbH, GreenSeed Contract Packaging, Mondi Plc, Ball Corporation, Aaron Thomas Company Inc., Berry Global, Sonoco Products Company, Amcor, Huhtamaki OYJ, Smurfit Kappa Group, Winpak Ltd., and Fres-co System USA Inc.

Frequently Asked Questions

How big is the stick packaging market?

The stick packaging market size was valued at USD 328.4 million in 2022.

What is the CAGR of the global stick packaging market from 2024 to 2032?

The CAGR of stick packaging is 6.8% during the analysis period of 2024 to 2032.

Which are the key players in the stick packaging market?

The key players operating in the global market are including Constantia Flexibles Group GmbH, GreenSeed Contract Packaging, Mondi Plc, Ball Corporation, Aaron Thomas Company Inc., Berry Global, Sonoco Products Company, Amcor, Huhtamaki OYJ, Smurfit Kappa Group, Winpak Ltd., and Fres-co System USA Inc.

Which region dominated the global stick packaging market share?

Asia-Pacific held the dominating position in stick packaging industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of stick packaging during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global stick packaging industry?

The current trends and dynamics in the stick packaging industry include increasing demand for convenient and portable packaging solutions, growing popularity of single-serve and on-the-go products, technological advancements in stick packaging machinery, and rising consumer preference for portion-controlled packaging options.

Which application held the maximum share in 2022?

The food & beverages application held the maximum share of the stick packaging industry.