Starch Blended Biodegradable Polymer Market | Acumen Research and Consulting

Starch Blended Biodegradable Polymer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

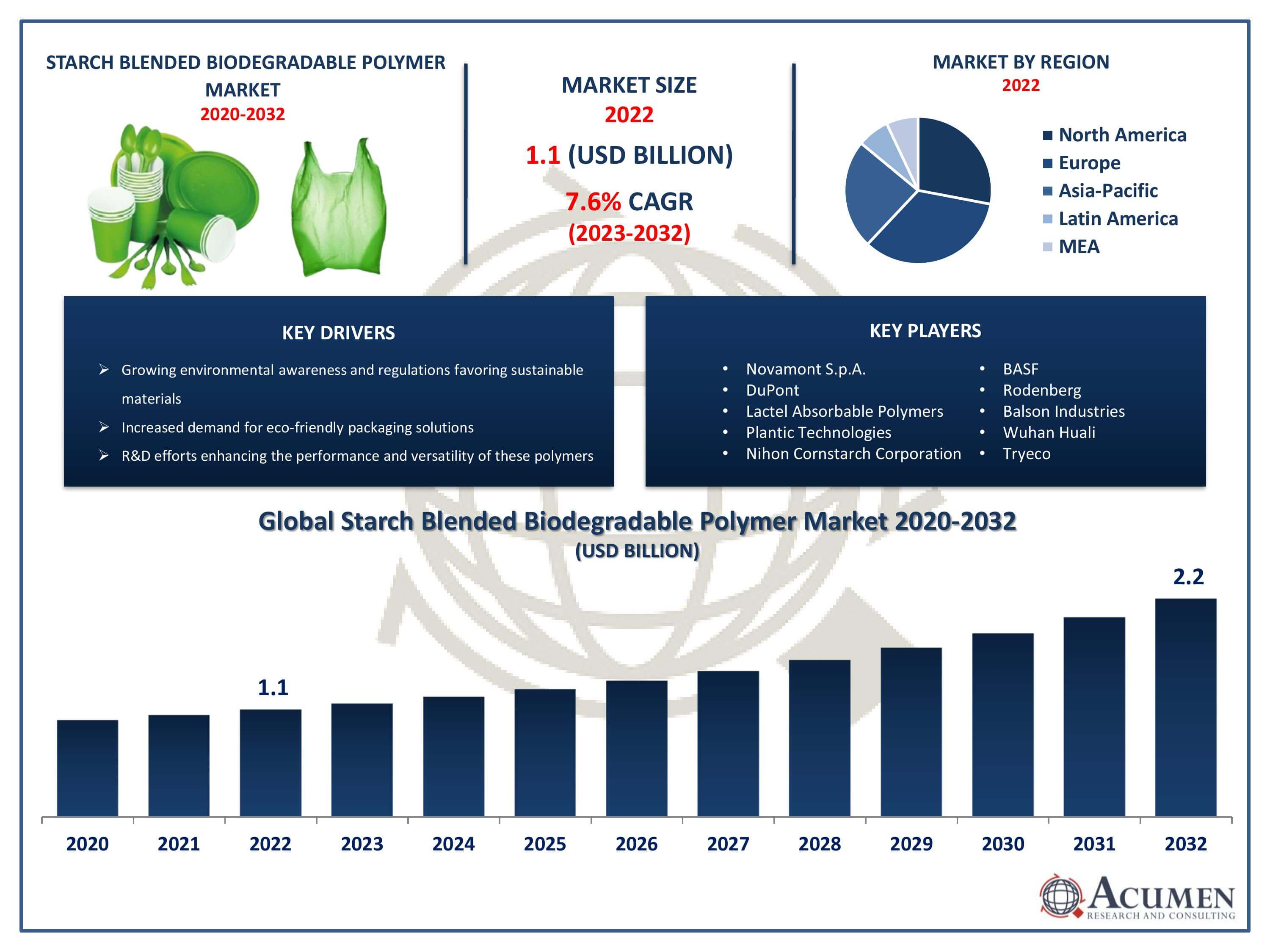

The Starch Blended Biodegradable Polymer Market Size accounted for USD 1.1 Billion in 2022 and is projected to achieve a market size of USD 2.2 Billion by 2032 growing at a CAGR of 7.6% from 2023 to 2032.

Starch Blended Biodegradable Polymer Market Highlights

- Global Starch Blended Biodegradable Polymer Market revenue is expected to increase by USD 2.2 Billion by 2032, with a 7.6% CAGR from 2023 to 2032

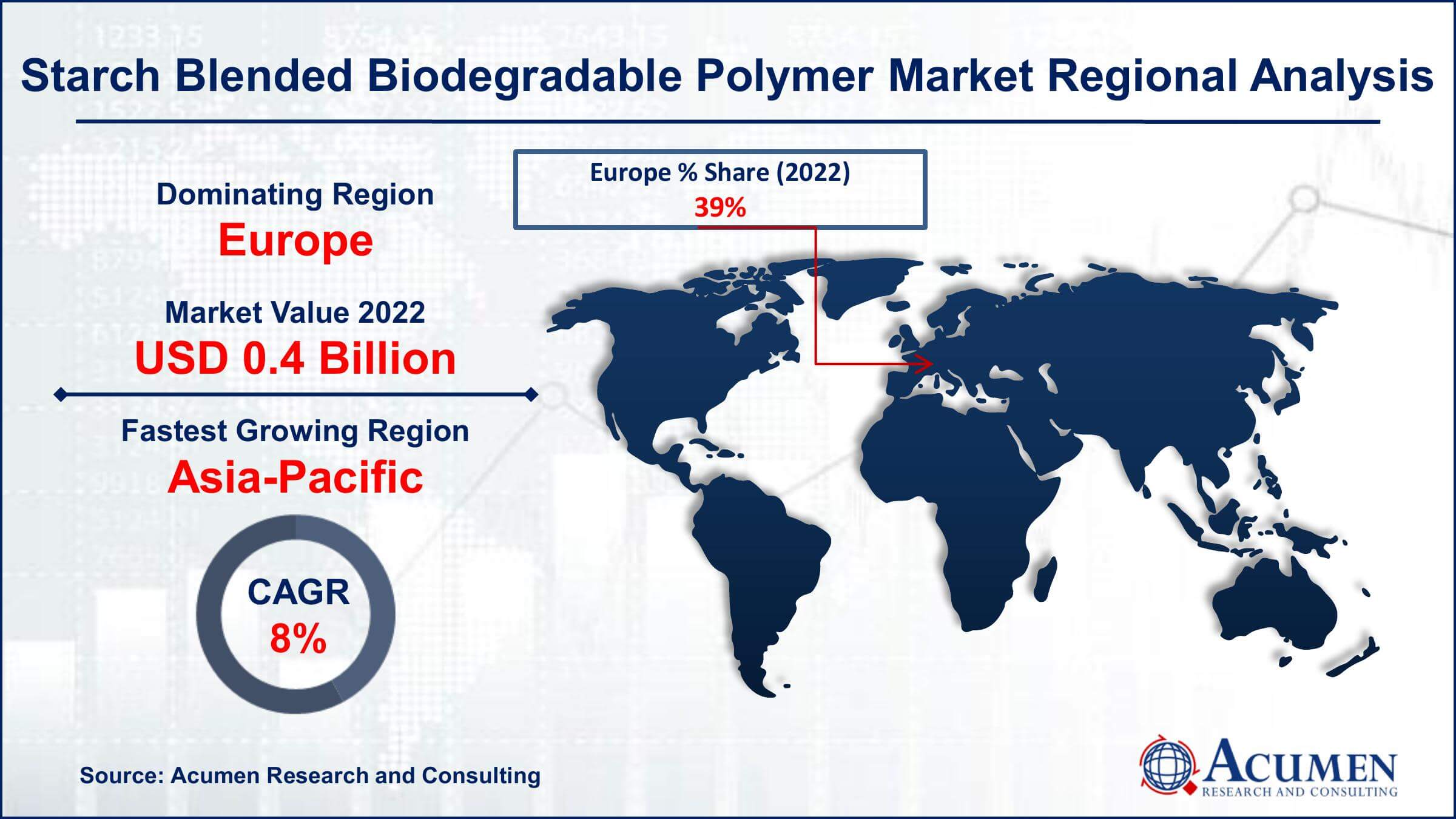

- Europe region led with more than 39% of Starch Blended Biodegradable Polymer Market share in 2022

- Asia-Pacific Starch Blended Biodegradable Polymer Market growth will record a CAGR of more than 8.1% from 2023 to 2032

- By polymer type, the biodegradable starch is the largest segment of the market, accounting for over 60% of the global market share

- By end use, the flexible packaging is one of the largest and fastest-growing segments of the starch blended biodegradable polymer industry

- Growing environmental awareness and regulations favoring sustainable materials, drives the Starch Blended Biodegradable Polymer Market value

Starch-blended biodegradable polymers represent a class of environmentally friendly materials that combine starch, a renewable and abundant natural polymer, with synthetic polymers to create biodegradable alternatives to traditional plastics. These blends typically leverage starch derived from corn, potatoes, or other agricultural sources, and are often combined with polymers such as polylactic acid (PLA) or polyhydroxyalkanoates (PHA). The incorporation of starch enhances the biodegradability of the polymer, making it a more sustainable option compared to conventional plastics derived from fossil fuels.

The market for starch-blended biodegradable polymers has experienced notable growth in recent years, driven by increasing environmental concerns and a growing demand for eco-friendly materials. Governments and consumers alike are seeking alternatives to traditional plastics, leading to a rise in regulations favoring the use of biodegradable materials. The packaging industry, in particular, has shown significant interest in starch-blended biodegradable polymers as a way to reduce the environmental impact of single-use packaging. Additionally, industries such as agriculture, textiles, and consumer goods are exploring the use of these polymers to meet sustainability goals and address the global issue of plastic pollution. As the push for environmentally conscious practices continues, the starch-blended biodegradable polymer market is expected to further expand, with ongoing research and development contributing to improved performance and broader application possibilities.

Global Starch Blended Biodegradable Polymer Market Trends

Market Drivers

- Growing environmental awareness and regulations favoring sustainable materials

- Increased demand for eco-friendly packaging solutions

- Rising interest in starch-blended biodegradable polymers across various industries

- Government initiatives promoting the use of biodegradable alternatives to traditional plastics

- Research and development efforts enhancing the performance and versatility of these polymers

Market Restraints

- Cost challenges associated with the production of starch-blended biodegradable polymers

- Limited scalability and commercial viability compared to conventional plastics

Market Opportunities

- Increasing consumer preference for sustainable and biodegradable products

- Expansion of applications beyond packaging, such as agriculture and textiles

Starch Blended Biodegradable Polymer Market Report Coverage

| Market | Starch Blended Biodegradable Polymer Market |

| Starch Blended Biodegradable Polymer Market Size 2022 | USD 1.1 Billion |

| Starch Blended Biodegradable Polymer Market Forecast 2032 | USD 2.2 Billion |

| Starch Blended Biodegradable Polymer Market CAGR During 2023 - 2032 | 7.6% |

| Starch Blended Biodegradable Polymer Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Polymer Type, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Novamont S.p.A., DuPont, Lactel Absorbable Polymers, Plantic Technologies, Nihon Cornstarch Corporation, BASF, Rodenberg, Balson Industries, Wuhan Huali, and Tryeco |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Starch-blended biodegradable polymers are a type of environmentally friendly material that combines starch, derived from renewable sources such as corn or potatoes, with synthetic polymers like polylactic acid (PLA) or polyhydroxyalkanoates (PHA). This blending process results in a polymer that retains the desirable properties of synthetic polymers while incorporating the biodegradability of starch, offering a more sustainable alternative to traditional plastics derived from fossil fuels. The starch component in these polymers acts as a natural, renewable resource, making them attractive for applications where reducing environmental impact is a priority. The applications of starch-blended biodegradable polymers span a range of industries, with a primary focus on packaging. These polymers are commonly used in the production of biodegradable bags, films, and disposable containers, addressing the environmental concerns associated with single-use plastics.

The increasing awareness of environmental issues, stringent regulations against traditional plastics, and a growing consumer preference for sustainable products were key factors driving the demand for biodegradable plastics market. The starch-blended biodegradable polymer market was finding traction, especially in the packaging industry where there was a significant shift toward eco-friendly alternatives. Companies and industries were increasingly adopting these polymers as part of their sustainability initiatives, aiming to reduce their environmental footprint. Ongoing research and development activities also contributing to the improvement of the performance characteristics of starch-blended biodegradable polymers, making them more versatile and applicable across various sectors. It's recommended to check more recent sources for the latest updates on the market growth of starch-blended biodegradable polymers and related trends.

Starch Blended Biodegradable Polymer Market Segmentation

The global Starch Blended Biodegradable Polymer Market segmentation is based on polymer type, end use, and geography.

Starch Blended Biodegradable Polymer Market By Polymer Type

- Durable Starch

- Biodegradable Starch

In terms of polymer types, the biodegradable starch segment accounted for the largest market share in 2022. This growth can be attributed to the rising demand for sustainable alternatives in various industries, particularly in packaging. One of the key drivers for the growth of the biodegradable starch segment is its versatility in applications. Starch-blended biodegradable polymers with a significant starch component are being used in diverse sectors, from food packaging to agricultural films, owing to their biodegradability and reduced environmental impact. Moreover, ongoing research and development efforts are focused on improving the performance characteristics of these starch-blended polymers, addressing factors like stability and flexibility, which will likely contribute further to the growth of the biodegradable starch segment in the starch-blended biodegradable polymer market.

Starch Blended Biodegradable Polymer Market By End Use

- Flexible Packaging

- Rigid Packaging

- Agriculture and Horticulture

- Consumer Goods

- Others

According to the starch blended biodegradable polymer market forecast, the flexible packaging segment is expected to witness significant growth in the coming years. Flexible packaging, which includes applications such as bags, pouches, and wraps, is a significant contributor to the overall demand for biodegradable polymers. This growth is driven by increasing consumer awareness of environmental issues, stringent regulations on single-use plastics, and a general shift toward sustainable packaging solutions. Starch-blended biodegradable polymers offer a viable alternative to conventional plastics in flexible packaging, providing the necessary balance between functionality, cost-effectiveness, and environmental sustainability. The flexibility and versatility of starch-blended biodegradable polymers make them well-suited for various flexible packaging applications. Manufacturers are increasingly incorporating these materials into their product offerings to meet the growing demand for eco-friendly packaging options.

Starch Blended Biodegradable Polymer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Starch Blended Biodegradable Polymer Market Regional Analysis

Geographically, Europe has been positioned as a dominant region in the starch-blended biodegradable polymer market, driven by a combination of regulatory initiatives, consumer awareness, and a commitment to sustainable practices. European countries have been at the forefront of implementing stringent regulations aimed at reducing the environmental impact of plastics. The European Union's Circular Economy Action Plan and the Single-Use Plastics Directive, for instance, have set ambitious targets for the reduction and eventual elimination of single-use plastics, fostering a conducive environment for the adoption of biodegradable alternatives, including starch-blended polymers. Additionally, consumers in Europe have shown a heightened awareness and preference for environmentally friendly products. This has led to increased demand from industries for sustainable packaging solutions, further boosting the growth of the starch-blended biodegradable polymer market. European companies are actively investing in research and development to enhance the performance and versatility of these polymers, ensuring they meet the stringent quality and sustainability standards prevalent in the region.

Starch Blended Biodegradable Polymer Market Player

Some of the top starch blended biodegradable polymer market companies offered in the professional report include Novamont S.p.A., DuPont, Lactel Absorbable Polymers, Plantic Technologies, Nihon Cornstarch Corporation, BASF, Rodenberg, Balson Industries, Wuhan Huali, and Tryeco.

Frequently Asked Questions

How big is the starch blended biodegradable polymer market?

The market size of starch blended biodegradable polymer was USD 1.1 Billion in 2022.

What is the CAGR of the global starch blended biodegradable polymer market from 2023 to 2032?

The CAGR of starch blended biodegradable polymer is 7.6% during the analysis period of 2023 to 2032.

Which are the key players in the starch blended biodegradable polymer market?

The key players operating in the global market are including Novamont S.p.A., DuPont, Lactel Absorbable Polymers, Plantic Technologies, Nihon Cornstarch Corporation, BASF, Rodenberg, Balson Industries, Wuhan Huali, and Tryeco.

Which region dominated the global starch blended biodegradable polymer market share?

Europe held the dominating position in starch blended biodegradable polymer industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of starch blended biodegradable polymer during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global starch blended biodegradable polymer industry?

The current trends and dynamics in the starch blended biodegradable polymer market growth include growing environmental awareness and regulations favoring sustainable materials, and increased demand for eco-friendly packaging solutions.

Which polymer type held the maximum share in 2022?

The biodegradable starch polymer type held the maximum share of the starch blended biodegradable polymer industry.