Stable Cell Line Development Market Size (By Source, By Type Of Cell Line, By Application, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Stable Cell Line Development Market Size (By Source, By Type Of Cell Line, By Application, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

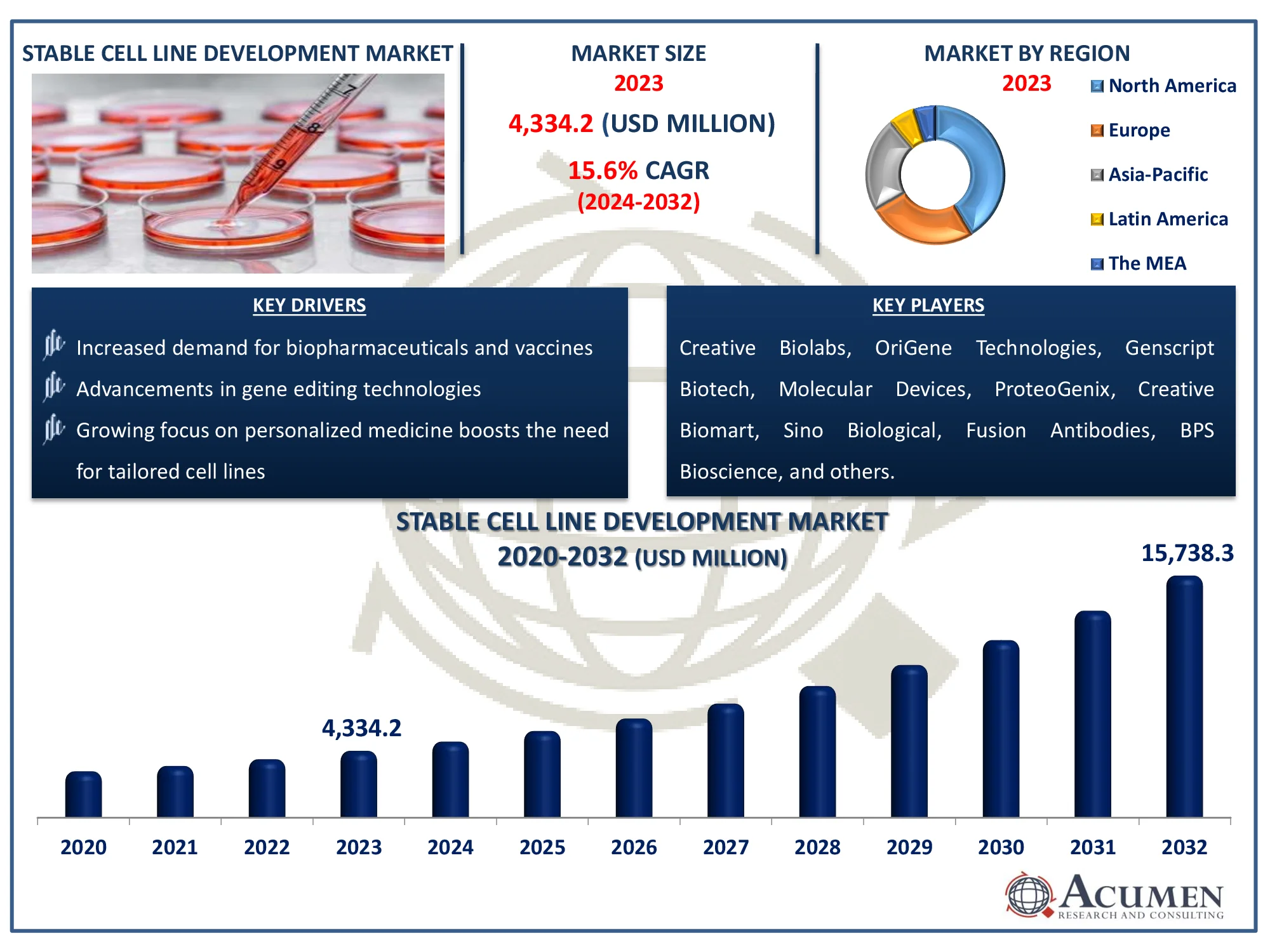

Request Sample Report

The Global Stable Cell Line Development Market Size accounted for USD 4,334.2 Million in 2023 and is estimated to achieve a market size of USD 15,738.3 Million by 2032 growing at a CAGR of 15.6% from 2024 to 2032.

Stable Cell Line Development Market Highlights

- The global stable cell line development market is projected to reach USD 15,738.3 million by 2032, with a CAGR of 15.6% from 2024 to 2032

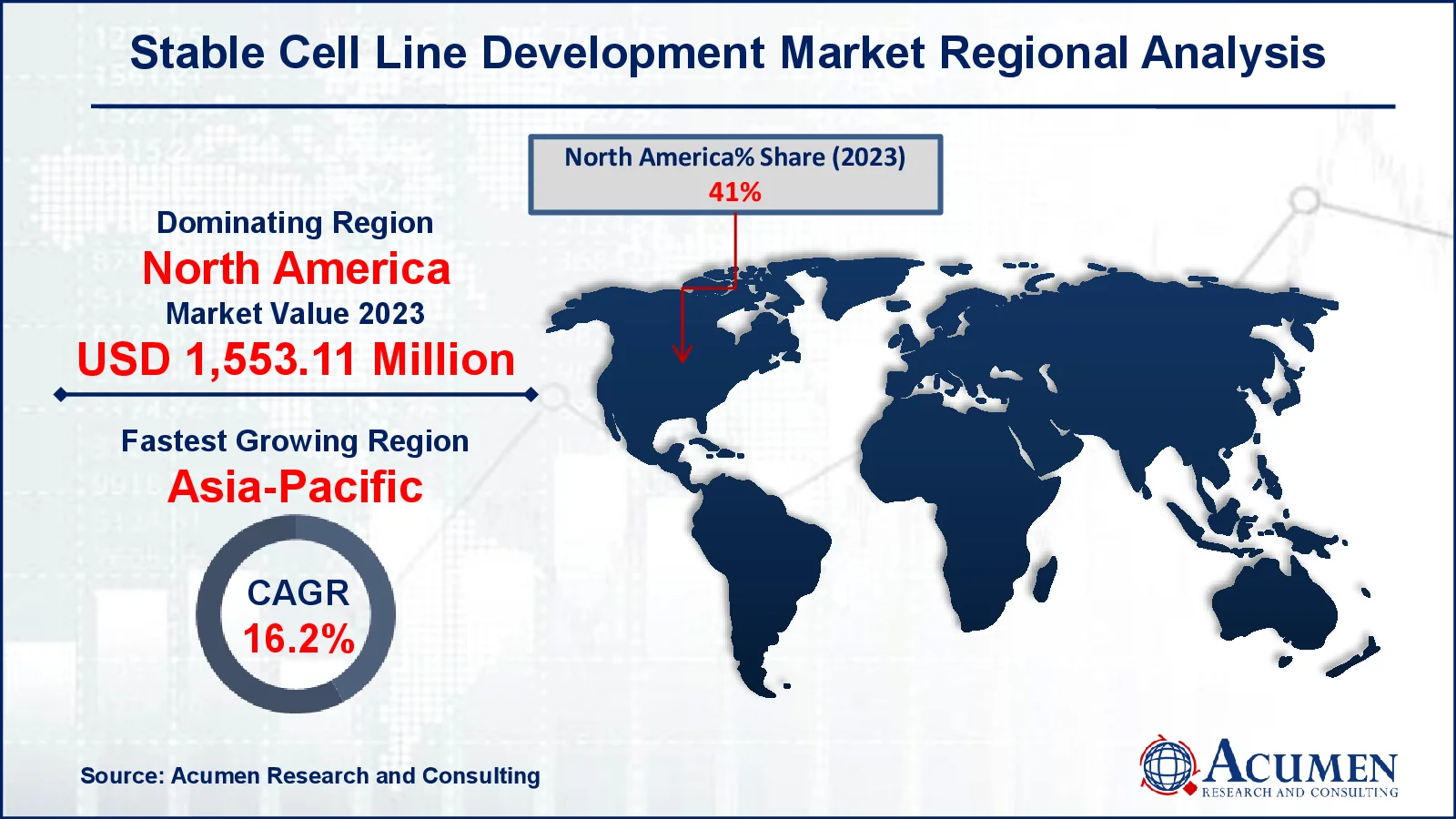

- In 2023, the North American stable cell line development market held a value of approximately USD 1,553.1 million

- The Asia-Pacific region is expected to grow at a CAGR of over 16.2% from 2024 to 2032

- The mammalian cell line source accounted for 79% of the market share in 2023

- The recombinant cell lines sub-segment as a cell type captured 39% of the market share in 2023

- Among application, bioproduction sub-segment dominates and covers 40% of market share in 2023

- Rising demand for monoclonal antibodies and biosimilars is the stable cell line development market trend that fuels the industry demand

Stable cell line development is the process of producing cells that produce a certain protein or product over time. Scientists accomplish this by inserting a gene of interest into a cell and selecting those that keep the gene active. These chosen cells are subsequently cultured and kept in a laboratory setting. The goal is to have a steady supply of cells capable of producing vast amounts of the target protein or chemical. This strategy is commonly used in medicine, biotechnology, and research to develop medicines and vaccines.

Global Stable Cell Line Development Market Dynamics

Market Drivers

- Increased demand for biopharmaceuticals and vaccines fuels cell line development

- Advancements in gene editing technologies enhance cell line stability

- Growing focus on personalized medicine boosts the need for tailored cell lines

Market Restraints

- High initial costs for developing stable cell lines

- Time-consuming process for optimizing and maintaining stable cell lines

- Regulatory challenges and compliance requirements

Market Opportunities

- Emerging markets offering growth potential for stable cell line development

- Innovations in cell culture technologies to improve production efficiency

- Rising adoption of cell-based therapies in regenerative medicine

Stable Cell Line Development Market Report Coverage

|

Market |

Stable Cell Line Development Market |

|

Stable Cell Line Development Market Size 2023 |

USD 4,334.2 Million |

|

Stable Cell Line Development Market Forecast 2032 |

USD 15,738.3 Million |

|

Stable Cell Line Development Market CAGR During 2024 - 2032 |

15.6% |

|

Stable Cell Line Development Market Analysis Period |

2020 - 2032 |

|

Stable Cell Line Development Market Base Year |

2023 |

|

Stable Cell Line Development Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Source, By Type Of Cell Line, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Creative Biolabs, OriGene Technologies, Genscript Biotech, Molecular Devices, ProteoGenix, Creative Biomart, Sino Biological, Fusion Antibodies, BPS Bioscience, InVivo BioTech, Thermo Fisher Scientific, Creative Biogene, and GeneCopoeia. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Stable Cell Line Development Market Insights

Increased demand for biopharmaceuticals, such as vaccines and monoclonal antibodies, is a key driver of the stable cell line development industry. According to the National Institutes of Health (NIH), the increasing use of biopharmaceuticals, such as monoclonal antibodies (mAbs), is propelling modern medicine forward. These medications are now used to treat a variety of ailments, including cancer, metabolic problems, and inflammatory conditions. As mAbs become more important in treatments for ailments such as cardiovascular disease, infections, and organ transplants, their demand grows. This spike in biopharmaceutical demand has a direct impact on the requirement for stable cell line development in order to efficiently create these medicines. This trend is projected to continue due to increased global healthcare demand and advances in illness treatment.

Recent advances in gene editing tools, such as CRISPR, have dramatically improved the ability to generate stable cell lines. According to the National Institutes of Health (NIH), the CRISPR base editing (BE) technology is a new innovation that enables precision gene editing without relying on DNA damage response systems. In this approach, a catalytically inactive dead Cas9 (dCas9) is coupled with deaminase, which can catalyze nucleotide conversion via deamination. As a result, gene editing has lowered the time and cost of producing stable cell lines, which benefits the entire industry.

One of the most difficult aspects of stable cell line development is the significant upfront investment necessary to produce and optimize these cell lines. Creating a stable cell line necessitates extensive study, effort, and finances, which can be a barrier for smaller companies. These costs may restrict market growth, particularly in regions with little finance.

Emerging regions, particularly in Asia-Pacific and Latin America, provide tremendous growth potential for the stable cell line development industry. According to the Press Information Bureau, India's pharmaceutical sector is predicted to develop at a 10-12% rate and reach $100 billion by 2025, owing to its strong local manufacturing base. India's biotechnology business has grown 13-fold over the last decade, from $10 billion in 2014 to more than $130 billion in 2024. With increased healthcare demands in these regions, as well as the biotechnology and pharmaceutical sectors, companies can develop their stable cell line technologies to meet these burgeoning markets.

Stable Cell Line Development Market Segmentation

The worldwide market for stable cell line development is split based on source, type of cell line, application, and geography.

Stable Cell Line Development Market By Source

- Mammalian Cell Line

- Non-Mammalian Cell Line

According to the stable cell line development industry analysis, mammalian cell lines are dominant because of their better ability to create complex, high-quality proteins. According to the American Institute of Chemical Engineers (AICHE), mammalian cells can create vaccinations through viral infection and therapeutic proteins through genetic engineering. Many of these medications are required for patients who lack the normal version of a protein or are unable to synthesize it in sufficient quantities. These cell lines, including CHO (Chinese Hamster Ovary) and HEK293, have excellent productivity and scalability, making them ideal for large-scale biopharmaceutical production. The increased need for monoclonal antibodies, recombinant proteins, and biosimilars reinforces the industry's preference for mammalian cell lines.

Stable Cell Line Development Market By Type of Cell Line

- Recombinant Cell Lines

- Hybridomas

- Continuous Cell Lines

- Primary Cell Lines

Recombinant cell lines are the dominant source in the stable cell line creation market due to their capacity to produce high-yield, consistent-quality biopharmaceuticals. These cell lines are genetically modified to express certain therapeutic proteins, which increases productivity and ensures batch-to-batch consistency. Their adaptability permits the synthesis of a diverse spectrum of biologics, such as monoclonal antibodies, vaccines, and enzymes. Furthermore, advances in genetic engineering and expression vector technologies have increased the stability and scalability of recombinant cell lines, making them the favored choice for biopharma manufacture.

Stable Cell Line Development Market By Application

- Bioproduction

- Drug Discovery

- Toxicity Testing

- Tissue Engineering

- Research

According to the stable cell line development market forecast, bioproduction applications dominate the market because of rising demand for biologics such as monoclonal antibodies, vaccines, and therapeutic proteins. Stable cell lines produce high-yield, consistent-quality products, which are crucial for large-scale biomanufacturing. The expanding biopharmaceutical sector and increased frequency of chronic diseases exacerbate the demand for efficient bioproduction systems. Furthermore, advances in cell line engineering and bioprocess optimization improve productivity, scalability, and cost-effectiveness, bolstering bioproduction's market supremacy.

Stable Cell Line Development Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Stable Cell Line Development Market Regional Analysis

For several reasons, in North America, the stable cell line development market is dominated by advanced biopharmaceutical research, a strong presence of important industry players, and significant financing for biotechnology advancements. For example, the United States government and the Biotechnology Innovation Organization (BIO) work together to foster biotechnology discoveries. Additionally, the National Institute of Fine Arts (NIFA) provides competitive and capacity funding, as well as program leadership, for extramural research, higher education, and extension operations in food and agricultural biotechnology. This assistance accelerates the growth of North America's stable cell line development market by encouraging increased investment and breakthroughs in biotechnology research and bioproduction capacities.

Asia-Pacific is seeing strong growth in the stable cell line development market, with countries such as China and India emerging as key participants due to their developing contract research and manufacturing organizations (CROs and CMOs). The region's cost-effective manufacturing capabilities, as well as government measures to increase biopharma R&D, help to accelerate market growth. For example, India is making great progress in science and biotechnology, due to the Vigyan Dhara initiative and the BioE3 (Biotechnology for Economy, Environment, and Employment) Policy, which was passed in August 2024. These projects aim to transform the country's science and technology and biomanufacturing sectors while supporting sustainable practices. They are consistent with India's goal of becoming a developed nation by 2047 through increased scientific research and innovation. As a result, these projects will help to expand the stable cell line development market in India by encouraging more investment and research in biomanufacturing, which relies on stable cell lines to produce high-quality biologics and therapeutic proteins.

Stable Cell Line Development Market Players

Some of the top stable cell line development companies offered in our report include Creative Biolabs, OriGene Technologies, Genscript Biotech, Molecular Devices, ProteoGenix, Creative Biomart, Sino Biological, Fusion Antibodies, BPS Bioscience, InVivo BioTech, Thermo Fisher Scientific, Creative Biogene, and GeneCopoeia.

Frequently Asked Questions

How big is the stable cell line development market?

The stable cell line development market size was valued at USD 4,334.2 Million in 2023.

What is the CAGR of the global stable cell line development market from 2024 to 2032?

The CAGR of stable cell line development is 15.6% during the analysis period of 2024 to 2032.

Which are the key players in the stable cell line development market?

The key players operating in the global market are including Creative Biolabs, OriGene Technologies, Genscript Biotech, Molecular Devices, ProteoGenix, Creative Biomart, Sino Biological, Fusion Antibodies, BPS Bioscience, InVivo BioTech, Thermo Fisher Scientific, Creative Biogene, and GeneCopoeia.

Which region dominated the global stable cell line development market share?

North America held the dominating position in stable cell line development industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of stable cell line development during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global stable cell line development industry?

The current trends and dynamics in the stable cell line development industry include increased demand for biopharmaceuticals and vaccines fuels cell line development, advancements in gene editing technologies enhance cell line stability, and growing focus on personalized medicine boosts the need for tailored cell lines.

Which source held the maximum share in 2023?

The mammalian cell line source held the maximum share of the stable cell line development industry.