Cell Line Development Market Size (By Products & Service, By Source, By Type of Cell Line, By Application, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Cell Line Development Market Size (By Products & Service, By Source, By Type of Cell Line, By Application, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

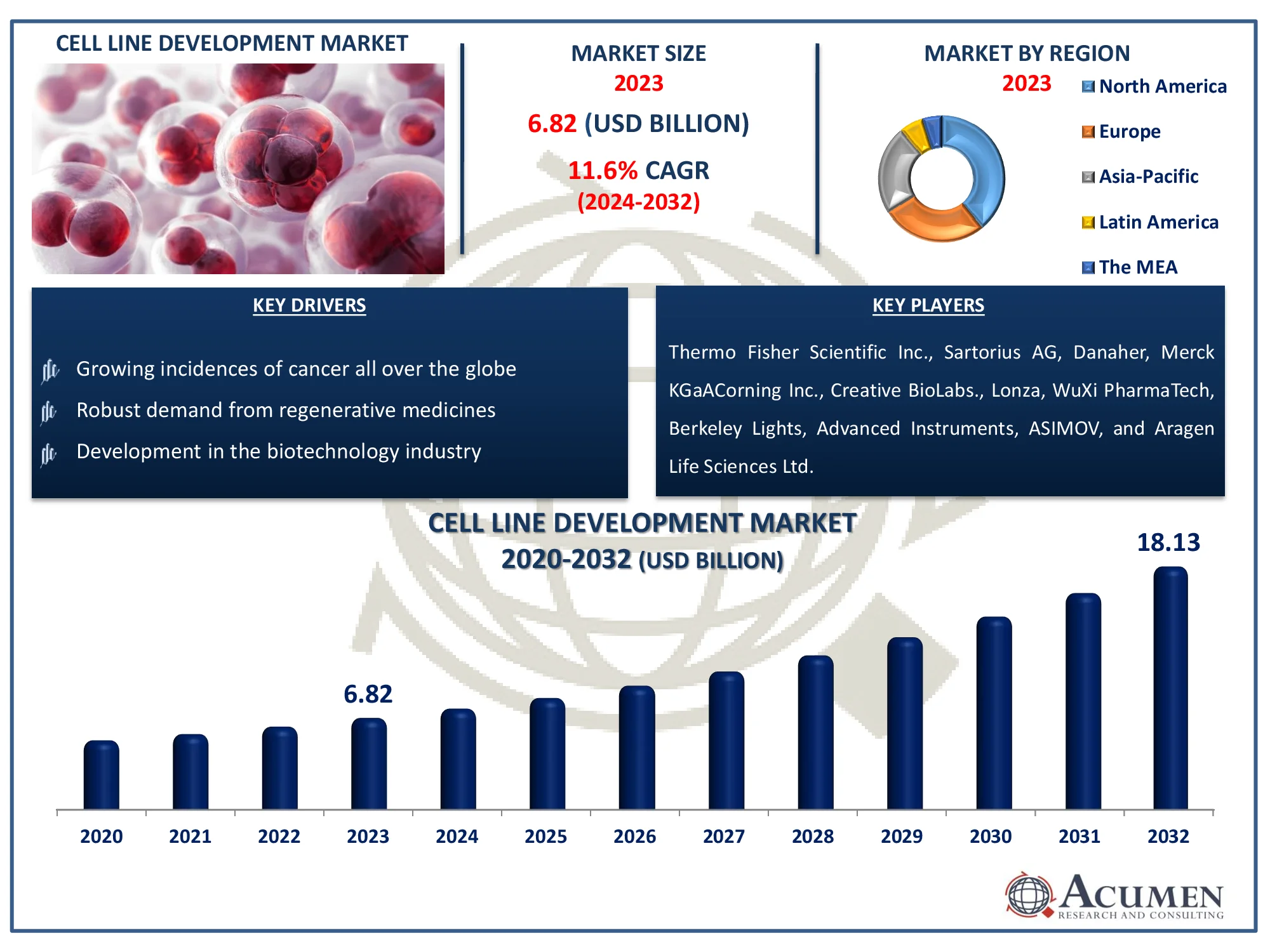

Request Sample Report

The Global Cell Line Development Market Size accounted for USD 6.82 Billion in 2023 and is estimated to achieve a market size of USD 18.13 Billion by 2032 growing at a CAGR of 11.6% from 2024 to 2032.

Cell Line Development Market Highlights

- Global cell line development market revenue is poised to garner USD 18.13 billion by 2032 with a CAGR of 11.6% from 2024 to 2032

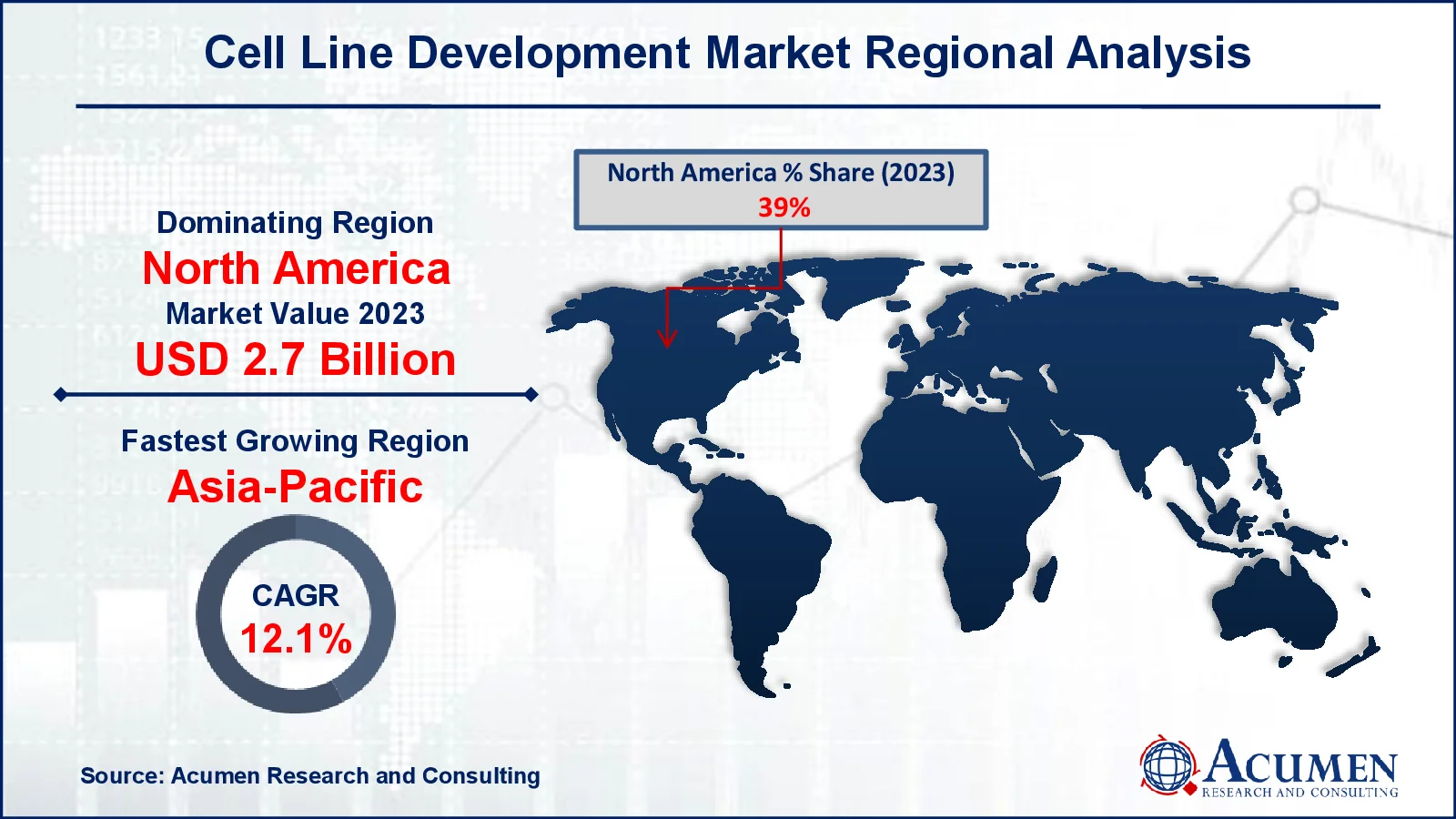

- North America cell line development market value occupied around USD 2.7 billion in 2023

- Asia-Pacific cell line development market growth will record a CAGR of more than 12.1% from 2024 to 2032

- Among products & service, the reagents & media sub-segment generated more than USD 3.5 billion revenue in 2023

- Based on type of cell line, recombinant sub-segment generated around 38% cell line development market share in 2023

- Rising integration of AI and automation in cell line development processes is a popular cell line development market trend that fuels the industry demand

Cell line development is a process of co-opting cellular machinery to produce therapeutic biological agents and other implicated proteins. Moreover, the development of stable and high-production cell lines is extremely crucial for the production of biotherapeutic products such as bispecific monoclonal antibodies, monoclonal antibodies, fusion proteins, and vaccines. For the development of cell lines, different expression systems can be used: bacterial, yeast, plant, and mammalian. The cost of drug discovery and development is extremely high. However, to reduce development costs, researchers are under increasing pressure to quickly and efficiently complete the early stages of biotherapeutic exploration and selection of biotherapeutic candidates. Additionally, these cell lines can also be used to conduct drug development research, screening, and large-scale production of compounds.

Global Cell Line Development Market Dynamics

Market Drivers

- Growing incidences of cancer all over the globe

- Robust demand from regenerative medicines

- Development in the biotechnology industry

Market Restraints

- Concerns associated with the stem-cell research

- The risk of cell line contamination

Market Opportunities

- Consistent research in drug development activities

- Global growth and advancements in the biotechnology industry

- Increasing adoption of cell-based assays in drug discovery and toxicity testing

Cell Line Development Market Report Coverage

|

Market |

Cell Line Development Market |

|

Cell Line Development Market Size 2023 |

USD 6.82 Billion |

|

Cell Line Development Market Forecast 2032 |

USD 18.13 Billion |

|

Cell Line Development Market CAGR During 2024 - 2032 |

11.6% |

|

Cell Line Development Market Analysis Period |

2020 - 2032 |

|

Cell Line Development Market Base Year |

2023 |

|

Cell Line Development Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Products & Service, By Source, By Type of Cell Line, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc., Sartorius AG, Danaher, Merck KGaA, Corning Inc., Creative BioLabs., Lonza, WuXi PharmaTech, Berkeley Lights, Advanced Instruments, ASIMOV, and Aragen Life Sciences Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cell Line Development Market Insights

The rising frequency of cancer in developing and underdeveloped nations is a major driver of the cell line development market. The increase in the adoption of regenerative medicines, rising cancer prevalence globally, and soaring R&D investments by biotechnology and pharmaceutical companies are driving the cell line development market growth. Furthermore, the consistent investigation into drug discovery practices is expected to drive market growth over the forecast period.

Furthermore, the increased emphasis on monoclonal antibody production and gene therapy breakthroughs is offering major potential in the industry. The desire for biosimilars and personalized treatment is also driving the use of cell line development approaches. Collaborations between research institutes and biotech companies are increasing, spurring innovation and leading to better cell line creation procedures. However, the difficulty in developing stable cell lines, as well as increased contamination from rigorous purification techniques, may limit market expansion.

Furthermore, the high expenses of cell culture material and equipment pose obstacles for smaller research labs and nascent biotech enterprises. Furthermore, the lack of regulatory standards and specified technological criteria for getting license poses a risk to the industry under examination. As regulatory authorities seek to provide formal rules, industry actors must overcome compliance issues while retaining quality and efficiency.

Cell Line Development Market Segmentation

The worldwide market for cell line development is split based on products & service, source, type of cell line, application, and geography.

Cell Line Development Products & Services

- Reagents & Media

- Equipment

- Incubator

- Centrifuge

- Bioreactor

- Storage Equipment

- Microscope

- Electroporators

- FACS

- Others

- Accessories & Consumables

- Services

According to cell line development industry analysis, based on the product type, the reagents and media segment occupied the maximum market share in 2023. Cell culture reagents are necessary for the success of biologically relevant cell models in bioproduction and biomedical research. Media, supplements, and sera are essential to culture reagents that promote proliferation, cell survival, and biological function. Moreover, the quality of these reagents has a direct impact on biotherapeutic production and experimental results. Besides that, selecting an optimized media for primary cells is essential for successful tissue culture assays and applications.

Cell Line Development Sources

- Mammalian

- Non-Mammalian

- Amphibians

- Insects

Based on the source, the mammalian segment held the dominant market share in 2023. Mammalian cell culture is essential for the development of protein therapeutics and viral vaccines. The demand for high-productivity production cell lines has increased as the number of innovator biologic and biosimilars products have grown, as has the demand for the mammalian segment. Viral infection and genetic engineering can also be used to programme mammalian cells to make vaccines and therapeutic proteins. Moreover, most pharmaceutical and biotechnology companies' mammalian cell line advancement technologies are currently based on either methotrexate amplification innovation or the glutamine synthetase system.

Cell Line Development Type of Cell Lines

- Recombinant

- Continuous Cell Line

- Hybridomas

- Primary Cell Line

Based on the cell line, the recombinant segment is expected to grow at the fastest CAGR during the cell line development market forecast period. The rapid growth of therapeutic recombinant proteins can be attributed in large part to technological advancements in vector interpretation, cell line culture engineering, and clone screening. Recombinant proteins can be developed using a variety of expression systems, including insect, yeast, microbial, mammalian cells, and transgenic cell systems. The primary goal of recombinant protein development is to create a monoclonal cell line, which is steady and continuously expresses the specified recombinant protein in high quantity and desired quality via a productive and cost-effective production process. However, due to the similarity of their metabolic and protein processing pathways to those of human cells, mammalian cell lines are the most commonly used production systems for recombinant proteins.

Cell Line Development Applications

- Toxicity Testing

- Drug Discovery

- Tissue Engineering

- Bioproduction

- Research

In terms of application, bioproduction segment is the largest in the market and the drug discovery segment is expected to account for a significant share of the market in the coming years. Stable cell lines are widely used in a wide range of critical applications, including biologics manufacturing, drug screening, tissue engineering, and functional genomics research. Recent technological advancements by cell line development experts have aided in the testing of various drug candidates during the early development phase, saving money and time. However, the collaboration between cell line development and drug development organizations has aided the growth of the cell-line development market.

Cell Line Development Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cell Line Development Market Regional Analysis

North America is likely to dominate the global cell line development market due to its well-established advanced healthcare infrastructure and services along with increasing government initiatives. Additionally, the market in the region is expected to benefit from the implementation of innovative technologies. The United States continues to dominate the North American region with a majority stake, due to government support to accelerate research in the biopharmaceutical and biotechnology sectors, which has increased the demand for cell line development. Moreover, the presence of key market players, combined with the positive initiatives undertaken by the governments of this region, supports the development of cell line development activities.

Cell Line Development Market Players

Some of the top cell line development companies offered in our report includes Thermo Fisher Scientific Inc., Sartorius AG, Danaher, Merck KGaA, Corning Inc., Creative BioLabs., Lonza, WuXi PharmaTech, Berkeley Lights, Advanced Instruments, ASIMOV, and Aragen Life Sciences Ltd.

Frequently Asked Questions

How big is the cell line development market?

The cell line development market size was valued at USD 6.82 Billion in 2023.

What is the CAGR of the global cell line development market from 2024 to 2032?

The CAGR of cell line development is 11.6% during the analysis period of 2024 to 2032.

Which are the key players in the cell line development market?

The key players operating in the global market are including Thermo Fisher Scientific Inc., Sartorius AG, Danaher, Merck KGaA, Corning Inc., Creative BioLabs., Lonza, WuXi PharmaTech, Berkeley Lights, Advanced Instruments, ASIMOV, and Aragen Life Sciences Ltd.

Which region dominated the global cell line development market share?

North America held the dominating position in cell line development industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cell line development during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global cell line development industry?

The current trends and dynamics in the cell line development industry include robust demand from regenerative medicines, and development in the biotechnology industry.

Which Application held the maximum share in 2023?

The bioproduction application held the maximum share of the cell line development industry.