Space Technology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Space Technology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

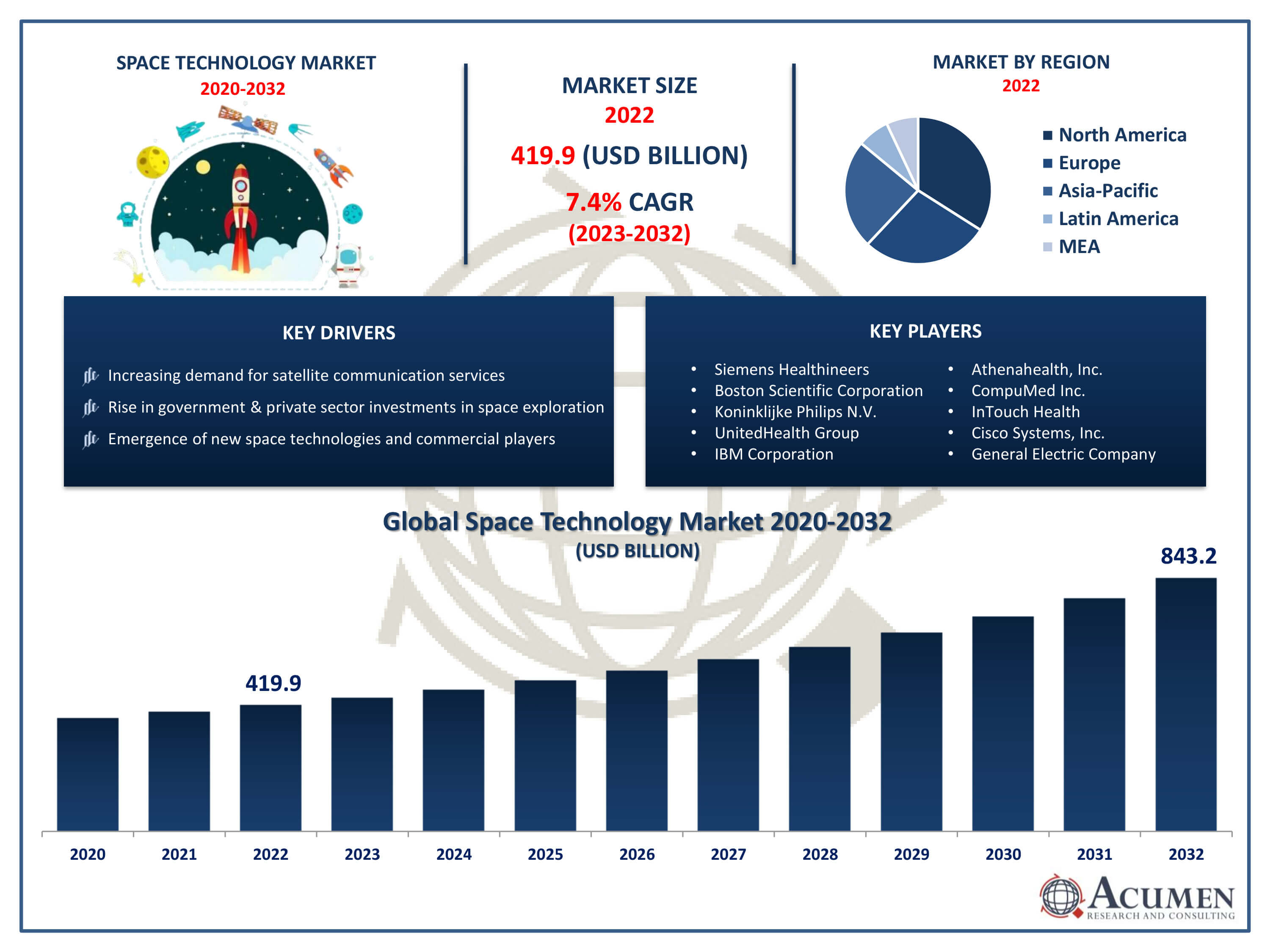

The Global Space Technology Market Size accounted for USD 419.9 Billion in 2022 and is projected to achieve a market size of USD 843.2 Billion by 2032 growing at a CAGR of 7.4% from 2023 to 2032.

Space Technology Market Highlights

- Global Space Technology Market revenue is expected to increase by USD 843.2 Billion by 2032, with a 7.4% CAGR from 2023 to 2032

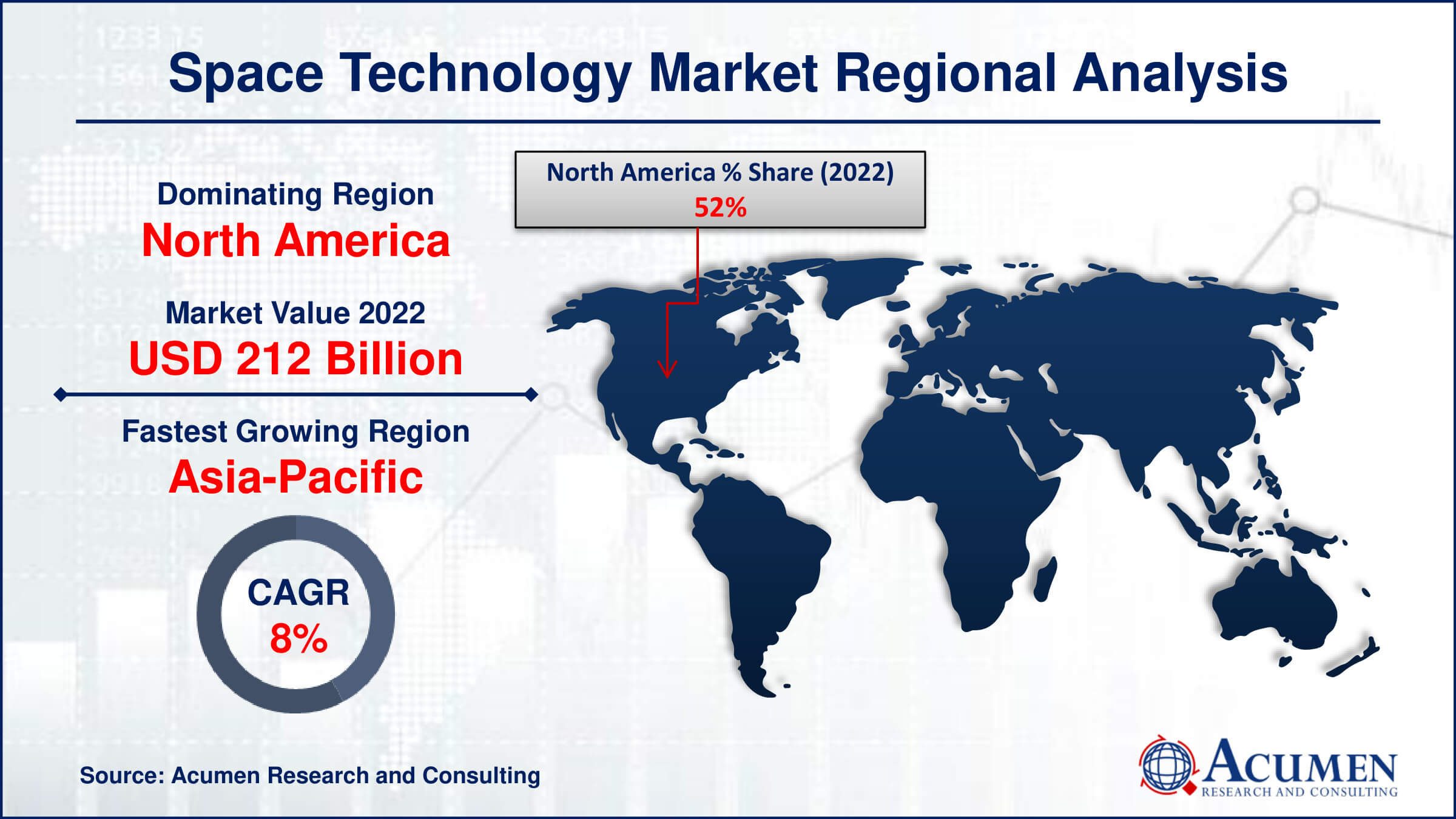

- North America region led with more than 52% of Space Technology Market share in 2022

- Asia-Pacific Space Technology Market growth will record a CAGR of more than 7.9% from 2023 to 2032

- By type, the space vehicles segment captured more than 65% of revenue share in 2022.

- By application, the navigation & mapping segment is projected to expand at the fastest CAGR over the projected period

- Rise in government and private sector investments in space exploration, drives the Space Technology Market value

Space technology refers to the various tools, equipment, and systems developed for use in outer space. It encompasses a wide range of technologies, including spacecraft, satellites, launch vehicles, space exploration instruments, and ground-based control systems. Space technology plays a crucial role in advancing our understanding of the universe, enabling communication, Earth observation, navigation, and scientific research. It also supports activities such as satellite television, weather monitoring, and global positioning systems.

The space technology market has experienced significant growth in recent years, driven by both government and private sector investments. Governments worldwide are increasingly recognizing the strategic importance of space activities for national security, scientific exploration, and economic development. Simultaneously, the emergence of private space companies, such as SpaceX, Blue Origin, and others, has injected new dynamism and competition into the industry. This has led to innovations in launch technologies, satellite constellations for communication and Earth observation, and the prospect of space tourism. As technology continues to advance and costs decrease, the space technology market is poised for further expansion, with increased emphasis on sustainability, international collaboration, and commercialization of space activities. The growing interest from both traditional space agencies and new private players indicates a promising future for the space technology sector.

Global Space Technology Market Trends

Market Drivers

- Increasing demand for satellite communication services

- Rise in government and private sector investments in space exploration

- Emergence of new space technologies and commercial players

- Growing interest in Earth observation for climate monitoring and resource management

- Advancements in miniaturized satellite technology leading to cost-effective solutions

Market Restraints

- High initial costs and risks associated with space missions

- Regulatory challenges and international collaboration complexities

Market Opportunities

- Expansion of satellite internet market and global broadband connectivity

- Commercialization of space tourism and related services

- Growth in demand for small satellite constellations for diverse applications

Space Technology Market Report Coverage

| Market | Space Technology Market |

| Space Technology Market Size 2022 | USD 419.9 Billion |

| Space Technology Market Forecast 2032 | USD 843.2 Billion |

| Space Technology Market CAGR During 2023 - 2032 | 7.4% |

| Space Technology Market Analysis Period | 2020 - 2032 |

| Space Technology Market Base Year |

2022 |

| Space Technology Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-use, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Airbus SE, Beijing Commsat Technology Development Co. Ltd., Ball Corporation, China Aerospace Science and Technology Corporation, Boeing, Hindustan Aeronautics Limited, General Dynamics Corporation, Honeywell International Inc., Maxar Technologies, Lockheed Martin Corporation, Northrop Grumman Corporation, Rocket Lab USA, Sierra Nevada Corporation, Thales Group, and SpaceX. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Space technology has become an integral part of modern life, influencing various sectors such as telecommunications, weather forecasting, agriculture, defense, and scientific research. One of the primary applications of space technology is in satellite systems. Satellites orbiting the Earth are used for communication, broadcasting, weather monitoring, and navigation through global positioning systems (GPS). Earth observation satellites provide valuable data for environmental monitoring, disaster management, and urban planning. Space technology also enables space exploration missions, such as sending robotic spacecraft to other planets and celestial bodies to gather scientific data. Additionally, advancements in space technology have paved the way for the development of international collaborations, contributing to the global understanding of space and fostering innovation across various industries.

The space technology market has witnessed robust growth in recent years, driven by a combination of technological advancements, increased demand for satellite-based services, and the emergence of private space exploration initiatives. The growing reliance on space-based applications, such as telecommunications, Earth observation, and navigation, has fueled the expansion of the market. Furthermore, the proliferation of small satellites and the development of reusable launch vehicles have contributed to a reduction in launch costs, making space more accessible to a broader range of stakeholders. The private sector's active involvement, led by companies like SpaceX, Blue Origin, and others, has injected competition and innovation into the industry. These companies have demonstrated the feasibility of reusable rocket technology, significantly lowering the overall cost of space missions.

Space Technology Market Segmentation

The global Space Technology Market segmentation is based on type, end-use, application, and geography.

Space Technology Market By Type

- Space Vehicles

- Satellites

- Communication Satellites

- Weather Satellites

- Navigation Satellites

- Astronomical Satellites

- Earth Observation Satellites

- Miniaturized Satellites

- Spacecraft

- Lander Spacecraft

- Flyby Spacecraft

- Rover Spacecraft

- Atmospheric Spacecraft

- Orbiter Spacecraft

- Others

- Orbital Launch Vehicles

- Space Stations

- Satellites

- In-Space Propulsion

- Deep-Space Communications

- Others

According to the space technology industry analysis, the space vehicles segment accounted for the largest market share in 2022. This gorwth is fueled by advancements in spacecraft design, propulsion systems, and manufacturing technologies. One key driver of this growth is the increasing demand for satellite deployment, driven by applications such as communication, Earth observation, and navigation. The miniaturization of satellites and the development of small satellite constellations have opened up new opportunities, allowing for more frequent and cost-effective launches. As a result, both traditional space agencies and private companies are investing in the development of a diverse range of space vehicles to meet the rising demand for satellite services. Moreover, the emergence of commercial space exploration initiatives has contributed significantly to the growth of the space vehicles segment. Companies like SpaceX have introduced reusable rocket technology, substantially reducing launch costs and increasing the frequency of space missions.

Space Technology Market By End-use

- Government

- Commercial

- Military

In terms of end-uses, the commercial segment is expected to witness significant growth in the coming years. Historically dominated by government-funded space agencies, the increasing participation of private companies has injected dynamism and competition into the sector. Commercial space activities span a wide range of applications, including satellite services, space tourism, launch services, and even resource exploration beyond Earth. One of the key drivers behind the commercial segment's growth is the rapid development of satellite-based services. Private companies are actively deploying satellite constellations for communication, Earth observation, and navigation. This increased connectivity and data collection capability have not only expanded commercial opportunities on Earth but have also paved the way for innovations in areas like precision agriculture, climate monitoring, and disaster response.

Space Technology Market By Application

- Navigation & Mapping

- Disaster Management

- Meteorology

- Earth Observation

- Satellite Communication

- Remote Sensing

- Satellite Television

- Science & Engineering

- Manufacturing

- Military and National Security

- Information Technology

- Data and Analytics

- Internet Services

- Others

According to the space technology market forecast, the navigation & mapping segment is expected to witness significant growth in the coming years. Satellite-based navigation systems, such as the Global Positioning System (GPS), have become integral to various industries, including transportation, agriculture, logistics, and emergency services. The proliferation of smartphones and the rise of the Internet of Things (IoT) have further amplified the need for precise navigation and mapping solutions, contributing significantly to the expansion of this market segment. One of the key factors propelling growth in this segment is the development of advanced satellite constellations designed specifically for Earth observation and mapping. These satellites provide high-resolution imagery, real-time monitoring, and geospatial data, supporting applications such as urban planning, environmental monitoring, and disaster response. The integration of satellite navigation into autonomous vehicles and drones also represents a growing market, as industries seek to leverage spatial data for improved efficiency and decision-making. As technological innovations continue to enhance the capabilities of navigation and mapping systems, the market is poised for continued growth, with potential applications in emerging fields such as augmented reality and smart city development.

Space Technology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Space Technology Market Regional Analysis

North America has emerged as a dominant force in the global space technology market, driven by a combination of technological prowess, robust infrastructure, and a thriving private space sector. The United States, in particular, is home to some of the world's most influential space agencies, including NASA (National Aeronautics and Space Administration), as well as leading private aerospace companies like SpaceX, Blue Origin, and Boeing. These entities have played a pivotal role in shaping the space technology landscape through their innovative projects, such as crewed space missions, satellite deployments, and the development of reusable rocket technology. The region's dominance is further accentuated by its extensive satellite communication infrastructure, with a multitude of satellites providing services ranging from telecommunications and broadcasting to Earth observation and navigation. The United States, with its well-established spaceports and launch facilities, has become a preferred destination for satellite launches, attracting both domestic and international customers. Additionally, the region has been at the forefront of space exploration, with ambitious missions to the Moon, Mars, and beyond. The collaborative efforts between government agencies, private enterprises, and research institutions in North America have created a conducive environment for innovation and investment, solidifying the region's leadership in the global space technology market.

Space Technology Market Player

Some of the top space technology market companies offered in the professional report include Airbus SE, Beijing Commsat Technology Development Co. Ltd., Ball Corporation, China Aerospace Science and Technology Corporation, Boeing, Hindustan Aeronautics Limited, General Dynamics Corporation, Honeywell International Inc., Maxar Technologies, Lockheed Martin Corporation, Northrop Grumman Corporation, Rocket Lab USA, Sierra Nevada Corporation, Thales Group, and SpaceX.

Frequently Asked Questions

How big is the space technology market?

The space technology market size was USD 419.9 Billion in 2022.

What is the CAGR of the global space technology market from 2023 to 2032?

The CAGR of space technology is 7.4% during the analysis period of 2023 to 2032.

Which are the key players in the space technology market?

The key players operating in the global market are including Airbus SE, Beijing Commsat Technology Development Co. Ltd., Ball Corporation, China Aerospace Science and Technology Corporation, Boeing, Hindustan Aeronautics Limited, General Dynamics Corporation, Honeywell International Inc., Maxar Technologies, Lockheed Martin Corporation, Northrop Grumman Corporation, Rocket Lab USA, Sierra Nevada Corporation, Thales Group, and SpaceX.

Which region dominated the global space technology market share?

North America held the dominating position in space technology industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of space technology during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global space technology industry?

The current trends and dynamics in the space technology industry include increasing demand for satellite communication services, rise in government and private sector investments in space exploration, and emergence of new space technologies and commercial players.

Which End-use held the maximum share in 2022?

The commercial end-use held the maximum share of the space technology industry.