Satellite Internet Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Satellite Internet Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

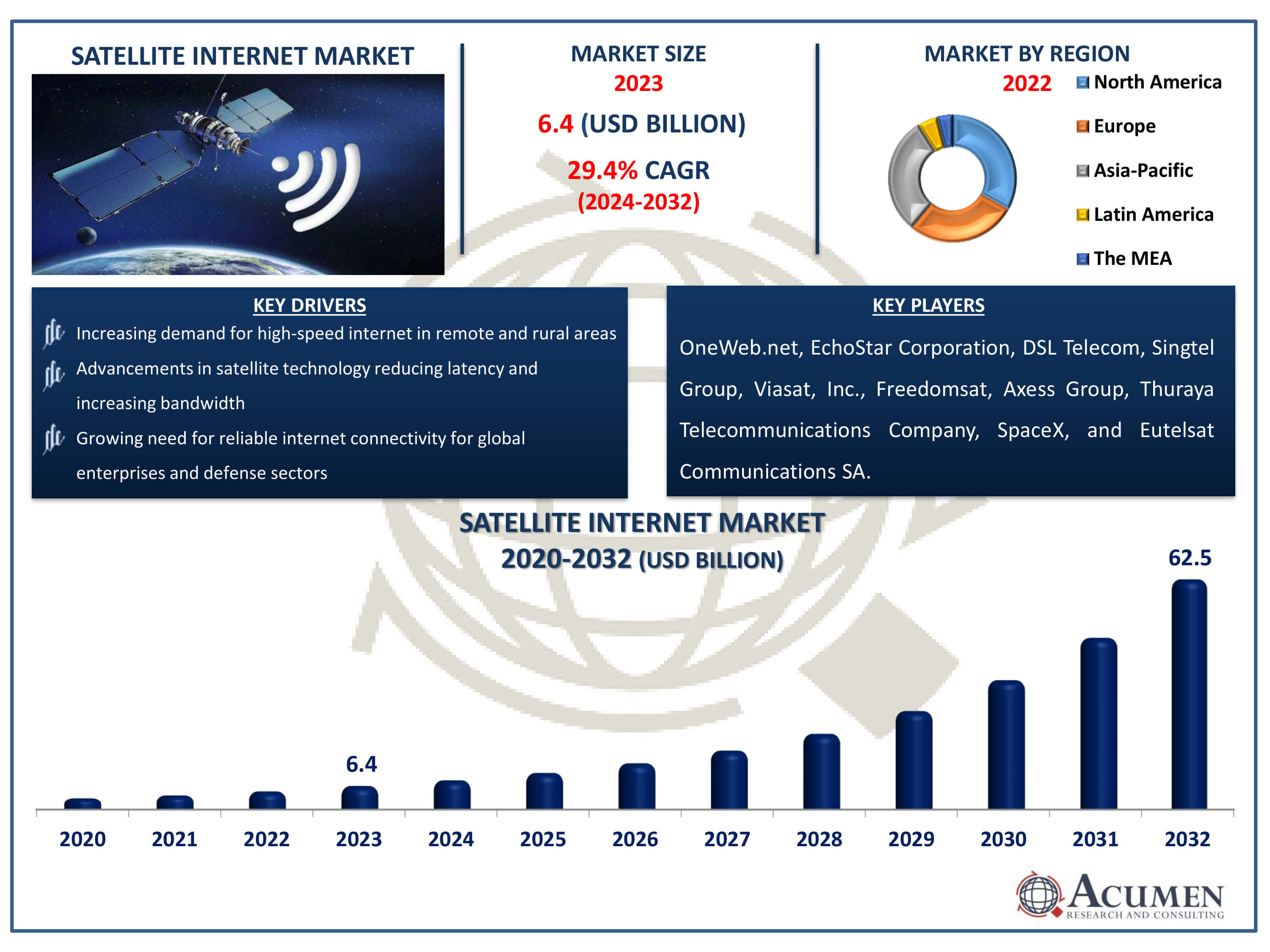

The Satellite Internet Market Size accounted for USD 6.4 Billion in 2023 and is estimated to achieve a market size of USD 62.5 Billion by 2032 growing at a CAGR of 29.4% from 2024 to 2032.

Satellite Internet Market Highlights

- Global satellite internet market revenue is poised to garner USD 62.5 billion by 2032 with a CAGR of 29.4% from 2024 to 2032

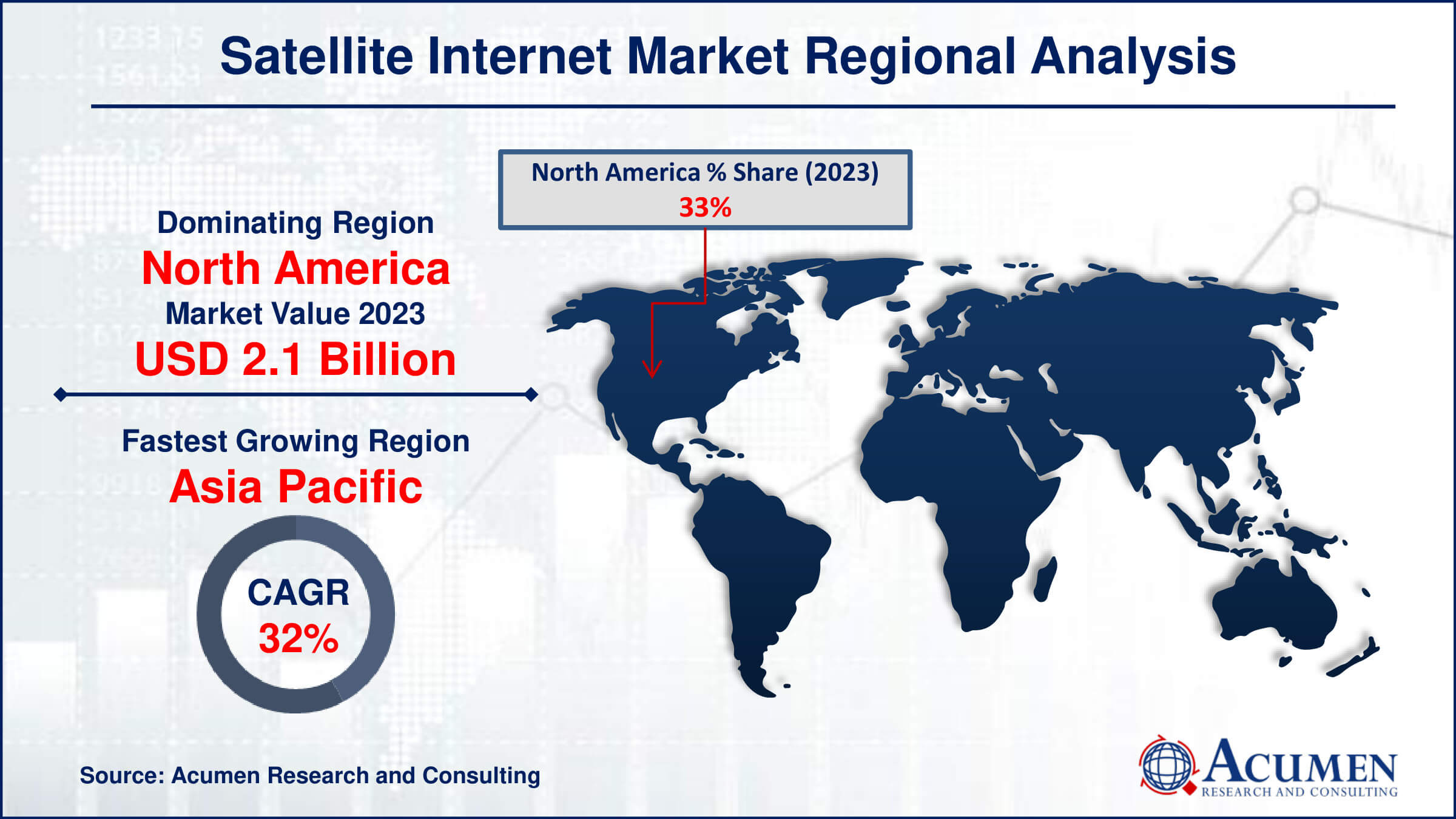

- North America satellite internet market value occupied around USD 2.1 billion in 2023

- Asia Pacific satellite internet market growth will record a CAGR of more than 32% from 2024 to 2032

- Among frequency type, the K-band sub-segment generated 42% of the market share in 2023

- Based on connectivity type, the two-way sub-segment gathered significant market share in 2023

- Advancements in low earth orbit (LEO) satellite and global demand for reliable and high speed internet access is the satellite internet market trend that fuels the industry demand

Satellite internet is a form of high-speed Internet service provided via communication satellites. Unlike traditional broadband connections, which rely on worldly infrastructures like cables and phone lines, satellite Internet transmits data through satellites orbiting the Earth. This allows for widespread coverage, reaching remote and rural areas where other forms of Internet service are unavailable. Applications of satellite Internet are diverse, including providing connectivity in underserved regions, supporting disaster recovery operations by maintaining communication when global networks fail, enabling Internet access on moving vehicles such as ships and airplanes, and facilitating global business operations by ensuring continuous connectivity in remote field locations. This technology is crucial for bridging the digital divide and ensuring that even the most isolated communities can access modern communication tools and information resources.

Global Satellite Internet Market Dynamics

Market Drivers

- Increasing demand for high-speed internet in remote and rural areas

- Advancements in satellite technology reducing latency and increasing bandwidth

- Growing need for reliable internet connectivity for global enterprises and defense sectors

Market Restraints

- High initial costs for satellite deployment and infrastructure

- Regulatory challenges and spectrum allocation issues

- Competition from terrestrial broadband and 5G networks

Market Opportunities

- Expansion into developing markets

- Integration with IoT and smart technologies

- Partnerships with telecom providers to enhance global connectivity

Satellite Internet Market Report Coverage

| Market | Satellite Internet Market |

| Satellite Internet Market Size 2022 | USD 6.4 Billion |

| Satellite Internet Market Forecast 2032 |

USD 62.5 Billion |

| Satellite Internet Market CAGR During 2024 - 2032 | 29.4% |

| Satellite Internet Market Analysis Period | 2020 - 2032 |

| Satellite Internet Market Base Year |

2022 |

| Satellite Internet Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Frequency Type, By Connectivity Type, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | EchoStar Corporation, DSL Telecom, Singtel Group, Viasat, Inc., Freedomsat, OneWeb.net, Axess Group, Thuraya Telecommunications Company, SpaceX, and Eutelsat Communications SA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Satellite Internet Market Insights

The growing need for high-speed internet in remote and rural areas is significantly driving the demand for the satellite internet market. These regions often lack the infrastructure required for traditional broadband services, making satellite internet an ideal solution due to its wide coverage and ability to provide reliable connectivity regardless of geographical barriers. As more aspects of daily life, such as education, work, and government & public sector, move online, the need for robust internet access in these underserved areas intensifies, further boosting the market for satellite internet services. Additionally, several governments are funding on companies to provide broadband services to rural population which significantly contributes to the growth. For instance, in January 2020, the Federal Communications Commission (FCC) announced the Rural Digital Opportunity Fund, which will provide USD 20.4 billion to expand broadband networks in remote locations. As a result, several factors with government initiatives further boosting demand of market.

High initial costs for satellite deployment and infrastructure significantly impede the growth of the satellite internet market. The expenses involved in manufacturing, launching, and maintaining satellites are substantial, often reaching hundreds of millions of dollars. Additionally, establishing ground infrastructure such as control centers and user terminals further inflates costs. These financial barriers limit the entry of new players into the market and restrict the expansion capabilities of existing companies. Consequently, the high capital requirements slow down technological advancements and the widespread adoption of satellite internet.

The integration of internet of things (IoT) and smart technologies with satellite internet presents a significant growth opportunity for the satellite internet market. For instance, in November 2020, Russia intended to build its own cluster of at least 500 next-generation multi-spectrum satellites. The initiative has been included in the state's 'Digital Economy' agenda, with the first satellite expected to launch in 2024. Moreover, IoT devices, ranging from smart home gadgets to industrial sensors, require reliable and widespread connectivity often in remote or underserved areas where worldly internet infrastructure is lacking. Satellite internet can bridge this gap by providing global coverage and consistent connectivity. This collaboration enables real-time data transmission and seamless operation of IoT systems, enhancing efficiency and expanding the reach of smart technologies. Consequently, the demand for satellite internet services is poised to rise, driven by the proliferation of IoT applications across various sectors such as agriculture, logistics, government & public sector, and smart cities.

Satellite Internet Market Segmentation

The worldwide market for satellite internet is split based on frequency type, connectivity type, end user, and geography.

Satellite Internet Frequency Type

- C-band

- L-band

- K-band

- X-band

According to the satellite internet industry analysis, K-band dominates the satellite internet market. K-band is mostly used in defence, security radar system and broadcasting. K-band monolithic microwave integrated circuit (MMIC) technology is an emerging trend that allows for the implementation of K-band low-noise amplifiers and power amplifiers at lower costs, with ease of large-scale production, and high durability, which further drives the growth of satellite internet market. This technology is also used to provide wireless broadband access in remote areas. This technology is utilized in digital point to point radio services, fixed satellites, and local multipoint distribution system (LMDS). K-band MMICs are novel for K-band frequency applications such terrestrial microwave communications, speed detectors and broadcasting. For instance, in March 2018, the Federal Communications Commission (FCC) of the United States approved SpaceX's proposal to employ satellite technology to provide internet services both nationally and internationally. As a result, these diverse applications of K-band maintain its position in market.

Satellite Internet Connectivity Type

- One-way

- Two-way

- Hybrid

The two-way segment is the largest product category in the satellite internet market and it is expected to increase over the industry The dominance of the two-way connectivity type segments in the Satellite Internet market is driven by its capability to offer bidirectional data transfer, ensuring efficient communication for both uploading and downloading data. This type of connectivity is crucial for various applications including residential internet, remote business operations, and emergency response services, where reliable and consistent internet access is necessary. The two-way connectivity allows users in remote and underserved areas to have the same quality of internet service as those in urban locations, making it a preferred choice in the expanding satellite internet market.

Satellite Internet End User

- Commercial Users

- Government & Public Sector

- Law Enforcement Agencies

- Fire Department

- Police Department

- Others

- Public Health Organizations

- Emergency Relief Centers

- Law Enforcement Agencies

- Corporate Institutions

- Maritime & Aircraft

- Others

- Government & Public Sector

- Individuals

According to the satellite internet industry forecast, commercial users as a end users segment expected to dominates the the Satellite Internet market. In commercial users, government & public sector segments is fastest growing in satellite internet market. Governments are investing significantly on satellite broadband technology to provide broadband services to every region. The moto behind this investments that to connects broadband network to rural areas. For instance, commercial release of HTS internet service announced by the Hughes Communications India in September 2022. Additionally, to operate smart cities governemets are implementing satellite internet worldwide, further contributes to segments dominance in satellite internet market.

Satellite Internet Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Satellite Internet Market Regional Analysis

For several reasons, the North America region dominates the satellite internet market. North America leads the satellite internet market primarily due to its advanced technological infrastructure, substantial investments in space technology, and the presence of major players like SpaceX, Viasat, and Hughes Network Systems. For instance, in August 2022, SpaceX Starlink and T-Mobile collaborate to launch Coverage Above and Beyond, a new effort that will deliver cell phone access anywhere. To deliver this service, the businesses built a new network that will transmit from Starlink satellites while utilizing T-countrywide Mobile's mid-band bandwidth. The region benefits from a combination of high consumer demand for reliable internet in rural and remote areas and government support for expanding broadband access. Additionally, ongoing innovations and launches of low Earth orbit (LEO) satellite constellations enhance connectivity, making satellite internet more accessible and competitive with traditional broadband services. For instance, on September 25, 2023, a Falcon 9 rocket launches another batch of SpaceX satellites for the Starlink Low Earth Orbit (LEO) constellation. As a result, this strong ecosystem drives North America's dominance in the global satellite internet market.

Asia-Pacific is the second largest region in the satellite internet market. With the ongoing investments in space technology and strong industrialization and infrastructure drives growth of market in Asian region. Countries like China, India, Japan, South Korea, and Australia contains robust key players due to their advancements and innovations in this industry further contribute to growth of market. For instance, Singtel announced iSHIP in May 2022, an all-in-one platform that offers satellite-enabled digital services and connectivity to the maritime industry. This iSHIP service provided ship owners and managers with significant visibility and freedom over their operations and resources. Overall, these advancements become Asia as a fastest growing region in satellite internet market.

Satellite Internet Market Players

Some of the top satellite internet companies offered in our report includes EchoStar Corporation, DSL Telecom, Singtel Group, Viasat, Inc., Freedomsat, OneWeb.net, Axess Group, Thuraya Telecommunications Company, SpaceX, and Eutelsat Communications SA.

Frequently Asked Questions

How big is the Satellite Internet market?

The satellite internet market size was valued at USD 6.4 billion in 2023.

What is the CAGR of the global Satellite Internet market from 2024 to 2032?

The CAGR of satellite internet is 29.4% during the analysis period of 2024 to 2032.

Which are the key players in the Satellite Internet market?

The key players operating in the global market are including EchoStar Corporation, DSL Telecom, Singtel Group, Viasat, Inc., Freedomsat, OneWeb.net, Axess Group, Thuraya Telecommunications Company, SpaceX, and Eutelsat Communications SA.

Which region dominated the global Satellite Internet market share?

North America held the dominating position in satellite internet industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of satellite internet during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Satellite Internet industry?

The current trends and dynamics in the satellite internet industry include increasing demand for high-speed internet in remote and rural areas, advancements in satellite technology reducing latency and increasing bandwidth, and growing need for reliable internet connectivity for global enterprises and defense sectors

Which frequency type held the maximum share in 2023?

The K-band frequency type held the maximum share of the satellite internet industry.