Solar Shading System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Solar Shading System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Solar Shading System Market Size accounted for USD 11.2 Billion in 2023 and is estimated to achieve a market size of USD 15.7 Billion by 2032 growing at a CAGR of 3.9% from 2024 to 2032.

Solar Shading System Market Highlights

- Global solar shading system market revenue is poised to garner USD 15.7 billion by 2032 with a CAGR of 3.9% from 2024 to 2032

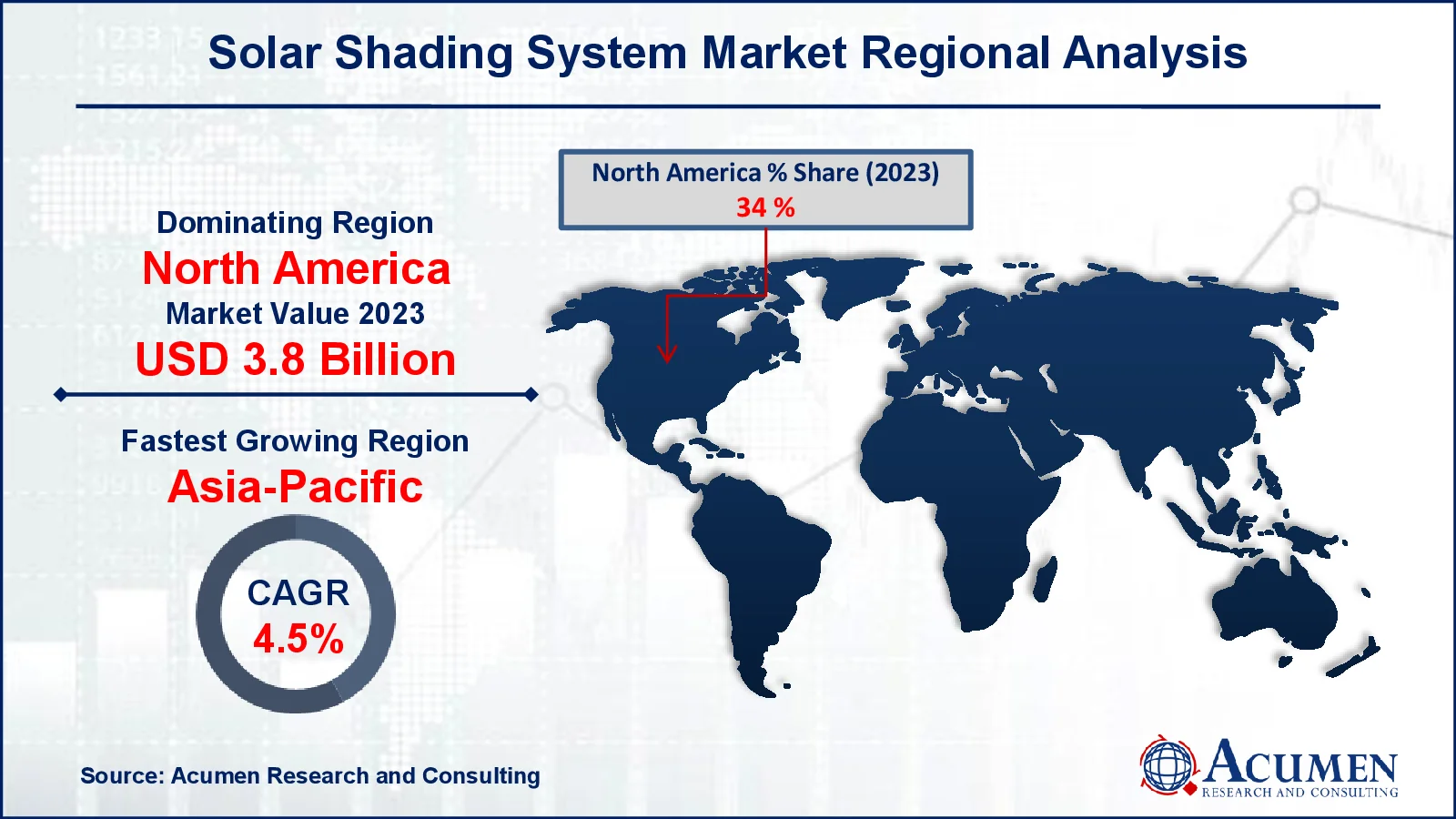

- North America solar shading system market value occupied around USD 3.8 billion in 2023

- Asia-Pacific solar shading system market growth will record a CAGR of more than 4.5% from 2024 to 2032

- Among type, the blinds sub-segment generated around USD 4.6 billion revenue in 2023

- Based on mechanism, the motorized sub-segment generated 42% solar shading system market share in 2023

- Penetration into emerging markets with growing construction activities is a popular solar shading system market trend that fuels the industry demand

Solar shading systems have received a lot of attention due to its capacity to save energy by reducing the amount of thermal radiation that enters both business and residential environments. One prominent characteristic of these systems is the use of flexible heat reflection rings, which provide significant protection against building overheating. Furthermore, solar shade systems are variable architectural solutions that efficiently concentrate and manage solar radiation while offering ideal shading. Furthermore, they help to improve interior comfort and reduce dependency on artificial cooling systems, which promotes sustainability. Solar shading systems, with their advanced technology and adjustable designs, continue to play an important part in current construction practices, assuring energy efficiency and environmental responsibility.

Global Solar Shading System Market Dynamics

Market Drivers

- Governments incentivize solar shading systems to reduce energy consumption in buildings, like the Energy Star program in the US

- Systems that contribute to LEED or BREEAM ratings witness increased demand due to sustainable building practices

- Integration with smart home systems such as Google Home or Amazon Alexa enhances user experience and convenience

- Policies mandating energy-efficient building solutions, such as the EU's Energy Performance of Buildings Directive, drive adoption

Market Restraints

- High upfront costs for installing solar shading systems hinder widespread adoption, especially for budget-conscious consumers

- Systems requiring intricate installation processes may deter customers, particularly in retrofitting existing structures

- Limited awareness among consumers about the benefits and types of solar shading systems affects market penetration

Market Opportunities

- Increasing adoption of solar shading systems in residential buildings due to rising awareness of energy efficiency and comfort

- Integration with internet of things (IoT) technologies enables remote control and automation, enhancing system functionality and appeal

- Development of novel materials, such as smart glass or advanced textiles, offers opportunities for improved performance and aesthetics

Solar Shading System Market Report Coverage

|

Market |

Solar Shading System Market |

|

Solar Shading System Market Size 2023 |

USD 11.2 Billion |

|

Solar Shading System Market Forecast 2032 |

USD 15.7 Billion |

|

Solar Shading System Market CAGR During 2024 - 2032 |

3.9% |

|

Solar Shading System Market Analysis Period |

2020 - 2032 |

|

Solar Shading System Market Base Year |

2023 |

|

Solar Shading System Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Geometry, By Mechanism, By Material, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Glasson GmbH, Lutron Electronics Co. Inc., Skyco Shading Systems Inc., Hunter Douglas Inc., Kawneer (Arconic Corporation), Springs Window Fashions, Duco Ventilation & Sun Control, Insolroll Corporate, Unicel Architectural Corp., and WAREMA Renkhoff SE. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Solar Shading System Market Insights

Solar shading systems are becoming recognised as critical solutions, not only for their innovative design but also for their efficiency in combating global warming. The growing concern about climate change has resulted in an increase in demand for these systems among both private consumers and business property owners globally. Beyond the initial installation, top players in the solar shading systems market are increasing income streams by providing extensive after-sales services suited to maintenance and repair requirements. Plus, these industry leaders have expanded their product offerings to include installation services, providing a consistent experience for their customers. They are pioneering the integration of automated technologies in collaboration with distributed service providers, simplifying operations and increasing consumer ease.

Solar shading systems have far-reaching applications beyond standard building construction. Their applications are broad, including airports, bridges, commercial malls, and tourist attractions. Notably, the incorporation of these systems into public areas has aided the growth of recycling activities, increasing their attractiveness and environmental sustainability. This new trend highlights the need of solar shading technologies in modern urban infrastructure construction. As stakeholders place a higher value on sustainability and energy efficiency, use of these systems is expected to increase. Leading market companies, with their innovative services and strategic alliances, are at the forefront of this disruptive trend, which will shape the landscape of solar shading solutions for many years to come.

Solar Shading System Market Segmentation

The worldwide market for solar shading system is split based on type, geometry, mechanism, material, applications, and geography.

Solar Shading Systems Market By Type

- Shades

- Blinds

- Louvers

- Textiles

According to solar shading system industry analysis, blinds are the most common type in the market. Blinds provide various light and heat control solutions that appeal to a wide range of demands in the residential, commercial, and industrial sectors. Their appeal originates from their capacity to provide changeable shade, which allows users to tailor their interior environment to their specific preferences and needs. Additionally, blinds are available in a variety of materials, shapes, and patterns, providing both aesthetic appeal and practicality. Whether horizontal or vertical, blinds are frequently used because to their simplicity of installation, upkeep, and price. As a consequence, the blinds category continues to dominate the market, fueled by rising demand for energy-efficient and pleasant living and working environments.

Solar Shading Systems Market By Geometry

- Horizontal

- Vertical

- Egg-Crate

Within the geometry area of the solar shading system market, horizontal shading systems are the largest category. Horizontal shading solutions, such as sunshades and awnings, are popular because they effectively block direct sunlight while providing adequate natural light and outward vistas. They are widely used in both residential and commercial structures, providing flexible options for sun control and glare reduction. Furthermore, horizontal shading systems are easier to install and maintain than vertical and egg-crate alternatives, making them a popular choice among customers. Their capacity to improve energy efficiency, optimise indoor comfort, and contribute to architectural aesthetics strengthens their position as industry leaders in the geometrical category of solar shading systems.

Solar Shading Systems Market By Mechanism

- Motorized

- Fixed

- Manual

The motorized segment dominates the market and it is expected to dominate over the solar shading system market forecast period due to its rising popularity and extensive implementation. Motorized shading systems provide unsurpassed simplicity and automation by allowing users to alter shades with the push of a button or a remote control. This level of automation improves user experience and comfort, particularly in vast or difficult-to-access areas. Furthermore, motorized systems may be combined with smart home technology, allowing for scheduling and remote operation to improve energy efficiency and security. Motorized systems were once considered a high-end choice; technological improvements have made them more inexpensive and available to a wider range of consumers. As a consequence, the motorized category continues to drive market expansion by meeting the rising need for smooth and efficient shading solutions in residential, commercial, and institutional settings.

Solar Shading Systems Market By Material

- Metal

- Glass

- Wood

- Others

In terms of solar shading system market analysis, metal is the main material option. Metal shading systems, such as aluminium or steel, are popular because of their durability, adaptability, and aesthetic appeal. They have exceptional structural strength, making them suited for a broad range of applications, including tiny home windows and big business facades. Furthermore, metal shading systems may be tailored to specific designs and finishes, allowing architects and designers to achieve desired aesthetics while also offering efficient sun management. Furthermore, metal components are both lightweight and strong, making them easy to install and require little upkeep. Metal shading systems remain the ideal choice for consumers looking for long-lasting and effective sun protection and architectural enhancements due to their excellent performance and design versatility.

Solar Shading Systems Market By Application

- Residential

- Non-Residential

In the solar shading system industry, the non-residential segment dominates. This category includes commercial, industrial, and institutional buildings. These constructions frequently have bigger windows and facades, demanding elaborate shading measures for sun protection. Examples include skyscrapers, shopping malls, schools, and office buildings. The need for solar shading systems in this industry is driven by concerns about energy efficiency and sustainability. Businesses and organisations prioritise developing comfortable interior environments while lowering energy usage and greenhouse gas emissions. As green construction methods become more popular and rules encourage energy efficiency, the non-residential segment continues to drive considerable growth in the solar shading system market.

Solar Shading System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Solar Shading System Market Regional Analysis

North America dominates the solar shading system market due to the significant presence of major industry players. The region experiences a higher level of trade and consumption, supported by state-of-the-art facilities, strong R&D potential, and leading technological standards. Asia-Pacific is the fastest growing region. The development of both retractable and fixed solar shading systems in countries like Japan, China, and India is projected to exhibit high compound annual growth rates (CAGRs) throughout the solar shading system market forecast period. the increase in construction and renovation activities involving solar shading systems in new buildings and home repairs is expected to drive the demand for such systems in the region. The Middle East and Africa are also anticipate to grow rapidly for solar shading systems, driven by the region's high temperatures and extreme solar radiation.

Solar Shading System Market Players

Some of the top Solar Shading System companies offered in our report includes Glasson GmbH, Lutron Electronics Co. Inc., Skyco Shading Systems Inc., Hunter Douglas Inc., Kawneer (Arconic Corporation), Springs Window Fashions, Duco Ventilation & Sun Control, Insolroll Corporate, Unicel Architectural Corp., and WAREMA Renkhoff SE.

Frequently Asked Questions

How big is the solar shading system market?

The solar shading system market size was valued at USD 11.2 billion in 2023.

What is the CAGR of the global solar shading system market from 2024 to 2032?

The CAGR of solar shading system is 3.9% during the analysis period of 2024 to 2032.

Which are the key players in the solar shading system market?

The key players operating in the global market are including Glasson GmbH, Lutron Electronics Co. Inc., Skyco Shading Systems Inc., Hunter Douglas Inc., Kawneer (Arconic Corporation), Springs Window Fashions, Duco Ventilation & Sun Control, Insolroll Corporate, Unicel Architectural Corp., and WAREMA Renkhoff SE.

Which region dominated the global solar shading system market share?

North America held the dominating position in solar shading system industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of solar shading system during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global solar shading system industry?

The current trends and dynamics in the solar shading system industry include governments incentivize solar shading systems to reduce energy consumption in buildings, like the Energy Star program in the US, systems that contribute to LEED or BREEAM ratings witness increased demand due to sustainable building practices, integration with smart home systems such as Google Home or Amazon Alexa enhances user experience and convenience, and policies mandating energy-efficient building solutions, such as the EU's Energy Performance of Buildings Directive, drive adoption.

Which type held the maximum share in 2023?

The blinds type held the maximum share of the solar shading system industry.