Software Defined Networking Market | Acumen Research and Consulting

Software Defined Networking Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

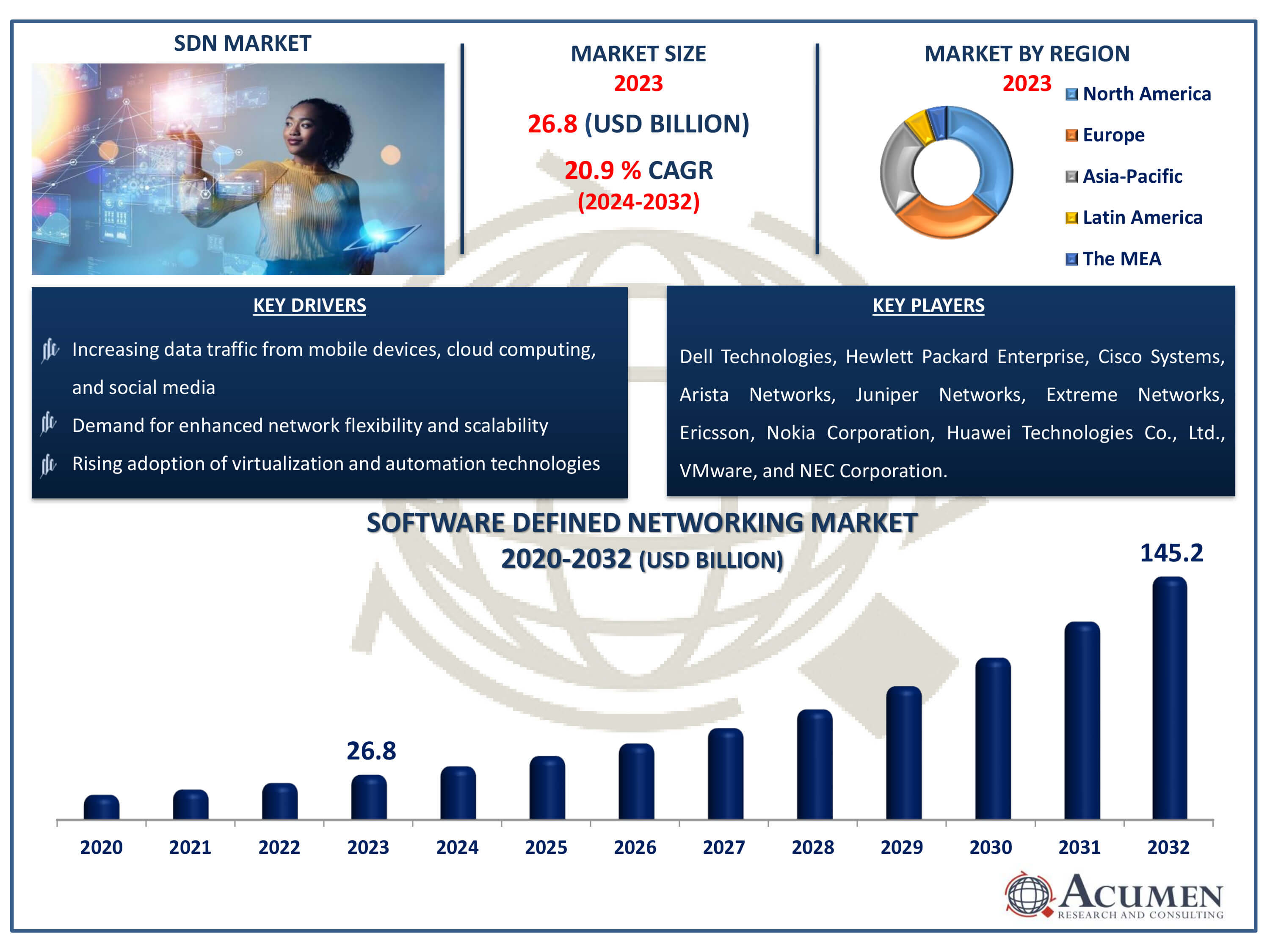

The Software Defined Networking Market Size accounted for USD 26.8 Billion in 2023 and is estimated to achieve a market size of USD 145.2 Billion by 2032 growing at a CAGR of 20.9% from 2024 to 2032.

Software Defined Networking Market Highlights

- Global software defined networking market revenue is poised to garner USD 145.2 billion by 2032 with a CAGR of 20.9% from 2024 to 2032

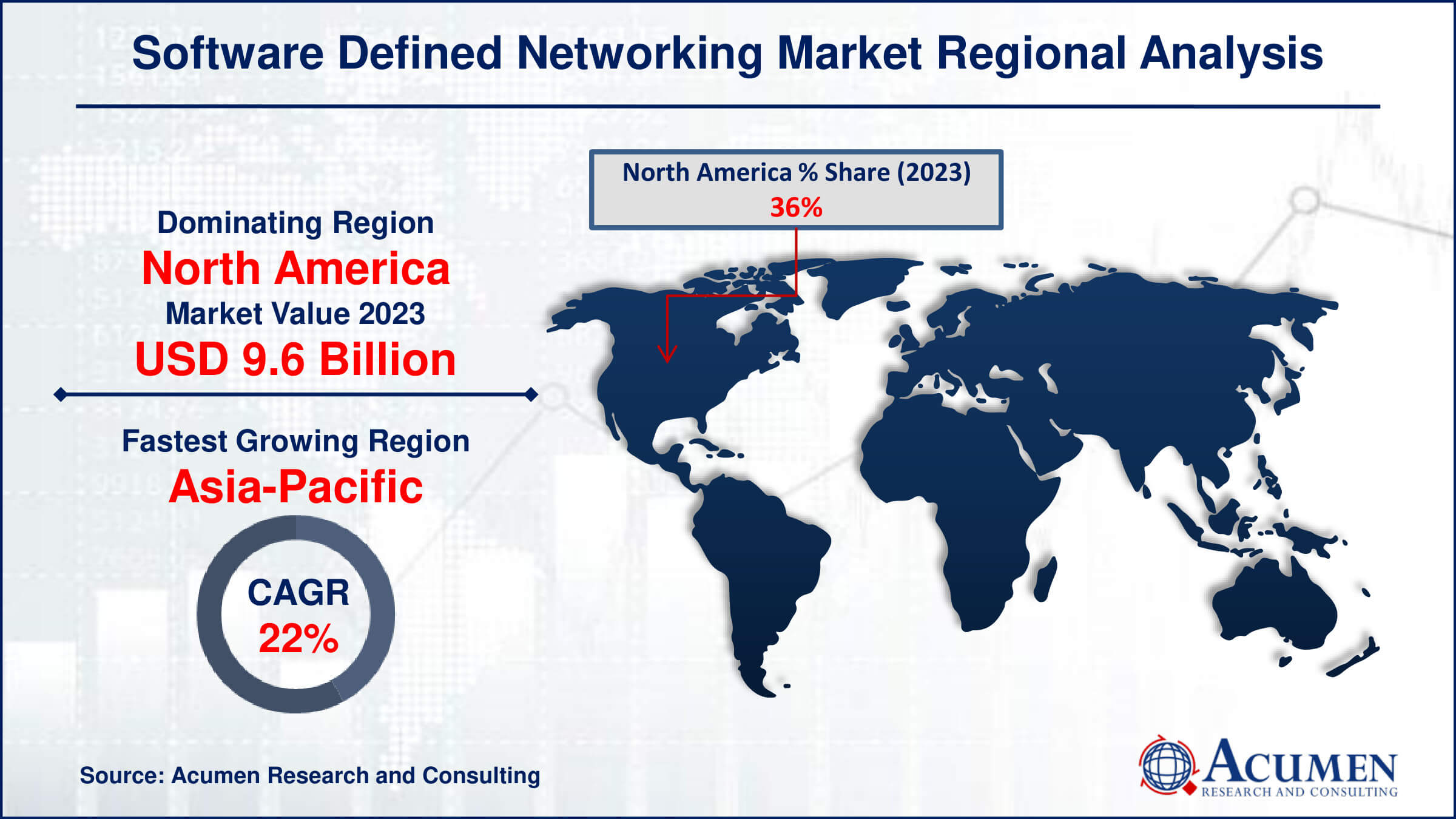

- North America software defined networking market value occupied around USD 9.6 billion in 2023

- Asia-Pacific software defined networking market growth will record a CAGR of more than 22% from 2024 to 2032

- Among component, the solutions sub-segment generated more than USD 19 billion revenue in 2023

- Based on end-user, the enterprises sub-segment generated significant software defined networking market share in 2023

- Increasing demand for edge computing solutions is a popular software defined networking market trend that fuels the industry demand

The explosion of data generated by mobile devices, cloud computing, and social media is pushing traditional networks to their limit. This surge in data has created a pressing need for advanced network infrastructures capable of managing such vast quantities of information. While innovations in automation and virtualization have significantly enhanced computing and storage, network capabilities remain a bottleneck. Software defined networking (SDN) emerges as a transformative solution, offering an efficient method for controlling network operations. SDN employs a programmatic approach to virtually manage, adjust, and control network behavior through software, enabling administrators and network engineers to quickly adapt to evolving business needs via centralized control.

Software defined networking integrates a variety of network technologies aimed at enhancing network flexibility and responsiveness, particularly in supporting the storage infrastructure of modern data centers. By providing a centralized and programmable network, SDN can dynamically adjust to changing business demands. Key benefits of SDN include significant reductions in capital and operational expenditures, direct programmability, centralized management and optimization, and fostering innovation. Additionally, SDN delivers enhanced agility and flexibility, making it a crucial component for the evolution of network infrastructures. The global market is poised for remarkable growth, with an anticipated compound annual growth rate (CAGR) of approximately 20.9% during the software defined networking industry forecast period.

Global Software Defined Networking Market Dynamics

Market Drivers

- Increasing data traffic from mobile devices, cloud computing, and social media

- Demand for enhanced network flexibility and scalability

- Rising adoption of virtualization and automation technologies

- Need for reduced capital and operational expenditures

Market Restraints

- High initial implementation costs

- Security concerns related to centralized network control

- Lack of standardization in SDN protocols and technologies

Market Opportunities

- Expansion of 5G networks requiring advanced SDN solutions

- Growing interest in IoT and its need for efficient network management

- Integration of artificial intelligence and machine learning in SDN for smarter networks

Software Defined Networking Market Report Coverage

| Market | Software Defined Networking Market |

| Software Defined Networking Market Size 2022 | USD 26.8 Billion |

| Software Defined Networking Market Forecast 2032 | USD 145.2 Billion |

| Software Defined Networking Market CAGR During 2023 - 2032 | 20.9% |

| Software Defined Networking Market Analysis Period | 2020 - 2032 |

| Software Defined Networking Market Base Year |

2022 |

| Software Defined Networking Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Organization Size, By End User, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Dell Technologies, Hewlett Packard Enterprise, Cisco Systems, Arista Networks, Juniper Networks, Extreme Networks, Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., VMware, and NEC Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Software Defined Networking Market Insights

Increasing Data Traffic From Mobile Devices, Cloud Computing, And Social Media

The exponential expansion of data traffic caused by mobile devices, cloud computing, and social media is a major driver of the software defined networking market. With billions of internet-connected gadgets and users creating massive volumes of data every day, traditional network infrastructures struggle to meet demand. SDN provides a solution by allowing for more flexible, efficient, and scalable network management. This programmatic method enables real-time modifications and optimization, guaranteeing that networks can handle rising traffic loads while maintaining performance and dependability. As organizations and consumers generate more data, the demand for robust and adaptive network solutions such as SDN will only grow.

High Initial Implementation Costs

One of the key barriers to the SDN industry is the high initial cost of implementation. Transitioning from traditional network configurations to SDN necessitates substantial investment in new hardware, software, and training. To properly manage and maintain SDN environments, organizations must invest in appropriate devices and controllers, as well as staff training. These initial expenses might be prohibitive, especially for smaller businesses or those with limited IT budgets. Despite the long-term cost savings and efficiency advantages that SDN can provide, the significant upfront investment may discourage some enterprises from implementing this technology right now.

Integration of Artificial Intelligence And Machine Learning in SDN

The integration of AI and ML technologies is a noteworthy development in the SDN business. AI and ML can improve SDN capabilities by enabling improved analytics, predictive maintenance, and automated decision-making. These technologies offer more intelligent and adaptive network management, allowing networks to self-optimize and respond to foreseeable difficulties in advance. This trend not only increases network performance and stability, but it also alleviates the burden on human administrators. As AI and ML technologies advance, their integration with SDN is likely to create additional breakthroughs and efficiencies in network management.

Software Defined Networking Market Segmentation

The worldwide software defined networking market is split based on component, organization size, end user, industry vertical, and geography.

Software Defined Networking SDN Market By Component

- Solutions

- Physical Network Infrastructure

- Virtualization & Control Software

- Software-Defined Networking Applications

- Services

- Professional Services

- Managed Services

According to software defined networking industry analysis, the component category is separated into solutions and services. The solutions segment is the category's leading segment. Solutions include the key technologies and products required to implement SDN, such as SDN controllers, network virtualization software, and related hardware. These technologies enable centralized control and management of network resources, resulting in more flexibility and efficiency. Their prevalence stems from the crucial role they play in changing traditional network topologies into programmable, flexible networks. As enterprises prioritize network agility and performance, the need for comprehensive SDN solutions grows, cementing this segment's global leadership position.

Software Defined Networking SDN Market By Organization Size

- SMEs

- Large Enterprises

Within the software defined networking (SDN) market, the organization size category includes small and medium-sized enterprises (SMEs) and large enterprises. The leading segment in this category is large enterprises. Large enterprises typically have more complex and extensive network infrastructures, requiring advanced solutions to manage their scale and diversity efficiently. They have the financial resources to invest in SDN technologies, which provide significant benefits such as reduced operational costs, improved network flexibility, and enhanced security. These organizations are also more likely to adopt innovative technologies to maintain a competitive edge, driving higher adoption rates of SDN solutions among large enterprises compared to SMEs.

Software Defined Networking SDN Market By End-User

- Telecom Service Providers

- Cloud Service Providers

- Enterprises

Enterprises represent the largest segment in the software defined networking (SDN) market due to their substantial need for scalable, flexible, and cost-effective network solutions. Unlike traditional networking, SDN allows enterprises to manage and optimize their networks dynamically, leading to improved efficiency and reduced operational costs. The growing adoption of cloud services, big data, and IoT technologies further drives enterprises to integrate SDN to handle complex and data-intensive applications seamlessly. Additionally, SDN enhances network security, agility, and automation, which are critical for enterprises to maintain competitive advantages in today's fast-paced digital landscape. This wide range of benefits makes SDN an attractive and essential investment for enterprises, ensuring their position as the largest segment in the SDN market.

Software Defined Networking SDN Market By Industry Vertical

- IT & Telecom

- Consumer Goods & Retail

- BFSI

- Defense

- Healthcare

- Others

The IT & telecom industry vertical dominates the software defined networking market. This dominance stems from the intrinsic necessity for a strong and adaptable network infrastructure to accommodate massive data traffic, continuous communication, and quick technological advances. Network scalability, effective management, and reduced latency are all priorities for IT and telecom organizations, and SDN capabilities help them achieve these goals. The transition to 5G, growing cloud computing adoption, and the rise of IoT applications all drive SDN integration in this vertical. Furthermore, SDN's capacity to streamline network operations and cut costs is well aligned with the IT & Telecom industry's goals, ensuring its dominant position in the SDN market.

Software Defined Networking Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Software Defined Networking Market Regional Analysis

In terms of software defined networking market analysis, North America emerged as the frontrunner in the industry in 2023 and is poised to maintain its supremacy moving forward. Being an early adopter of SDN technology, North America has witnessed widespread integration across diverse industry verticals, encompassing healthcare, BFSI, IT, energy, telecom, and beyond. The region's penchant for SDN stems from its robust standardization and early embrace of cloud computing, mobility services, and network virtualization. This proactive stance, coupled with substantial investments in research and development, alongside the presence of key SDN technology providers, fortifies North America's market dominance. Moreover, the escalating demand for cutting-edge network solutions to power big data analytics and IoT applications further bolsters its commanding position in the global SDN landscape.

Meanwhile, Asia-Pacific (APAC) is the fastest-growing region during the software defined networking market forecast period. This growth is driven by rapid digital transformation, increased internet penetration, and growing cloud service use in nations such as China, India, and Japan. The region's developing IT sector, as well as the growing demand for agile and cost-effective network solutions, is driving the rise of the SDN market in Asia-Pacific. The convergence of these variables places APAC as a key role in the future of SDN.

Software Defined Networking Market Players

Some of the top software defined networking market companies offered in our report include Dell Technologies, Hewlett Packard Enterprise, Cisco Systems, Arista Networks, Juniper Networks, Extreme Networks, Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., VMware, and NEC Corporation.

Frequently Asked Questions

How big is the software defined networking market?

The software defined networking market size was valued at USD 26.8 Billion in 2023.

What is the CAGR of the global software defined networking market from 2024 to 2032?

What is the CAGR of the global software defined networking market from 2024 to 2032?

Which are the key players in the software defined networking market?

The key players operating in the global market are including Dell Technologies, Hewlett Packard Enterprise, Cisco Systems, Arista Networks, Juniper Networks, Extreme Networks, Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., VMware, and NEC Corporation

Which region dominated the global software defined networking market share?

North America held the dominating position in software defined networking industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of software defined networking during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global software defined networking industry?

The current trends and dynamics in the software defined networking industry include increasing data traffic from mobile devices, cloud computing, and social media, demand for enhanced network flexibility and scalability, rising adoption of virtualization and automation technologies, and need for reduced capital and operational expenditures.

Which component held the maximum share in 2023?

The solutions component held the maximum share of the software defined networking industry.