Smart Stethoscopes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Smart Stethoscopes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

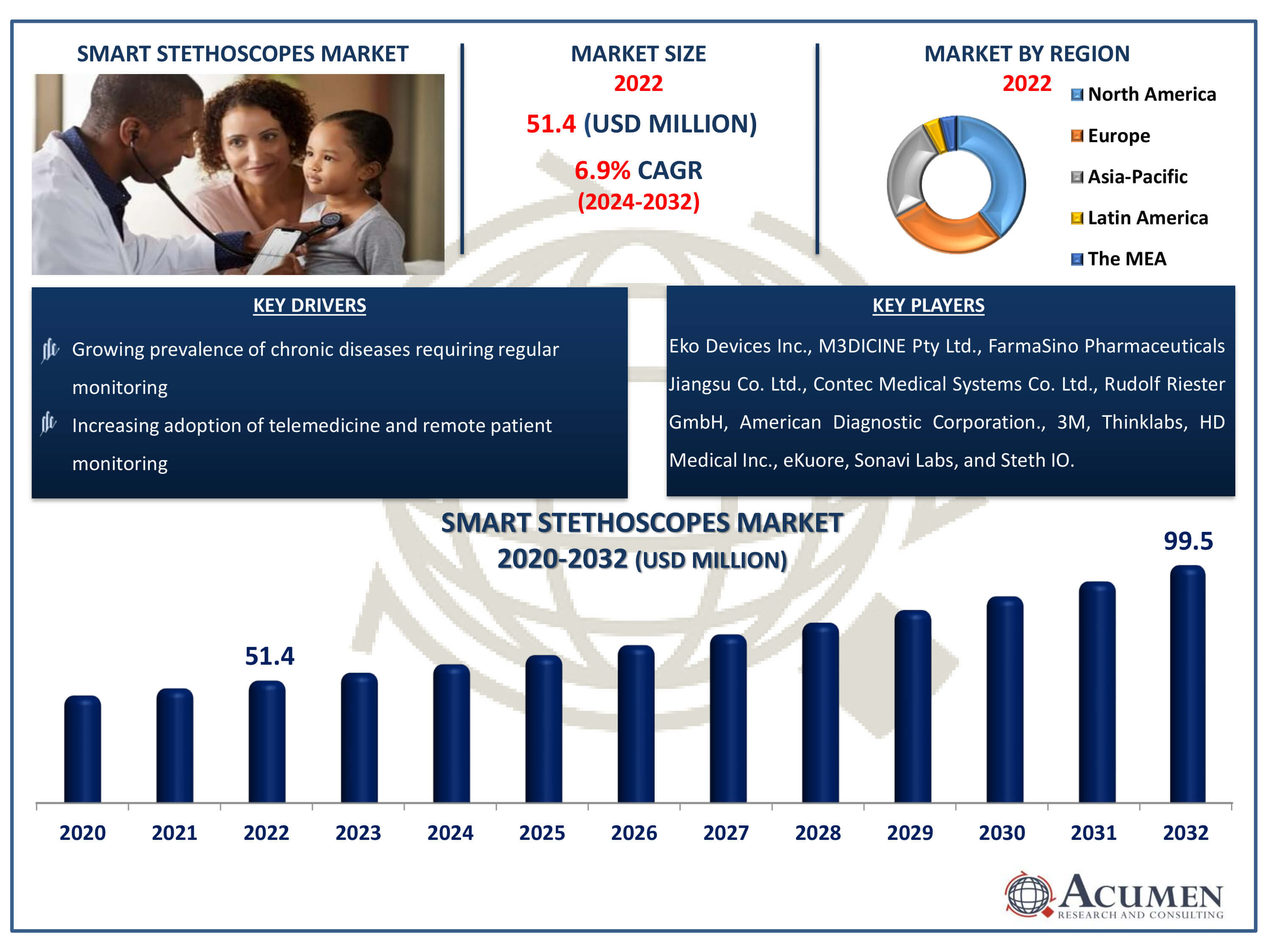

The Smart Stethoscopes Market Size accounted for USD 51.4 Million in 2022 and is estimated to achieve a market size of USD 99.5 Million by 2032 growing at a CAGR of 6.9% from 2024 to 2032.

Smart Stethoscopes Market Highlights

- Global smart stethoscopes market revenue is poised to garner USD 99.5 million by 2032 with a CAGR of 6.9% from 2024 to 2032

- North America smart stethoscopes market value occupied around USD 17.5 million in 2022

- Asia-Pacific smart stethoscopes market growth will record a CAGR of more than 7.5% from 2024 to 2032

- Among application, the cardiovascular sub-segment generated more than USD 15.4 million revenue in 2022

- Based on end use, the hospitals sub-segment generated around 62% market share in 2022

- Increasing focus on preventive healthcare and early disease detection is a popular smart stethoscopes market trend that fuels the industry demand

Smart stethoscopes combine new technology with traditional diagnostic instruments, transforming auscultation in healthcare. These devices include sensors, microphones, and networking capabilities that enable real-time analysis and transmission of heart, lung, and other bodily sounds. Smart stethoscopes, which can amplify, filter, and record sounds, improve diagnostic accuracy while also allowing for remote monitoring and telemedicine applications. They frequently contain artificial intelligence algorithms for autonomous interpretation and anomaly detection, which aid healthcare practitioners in detecting small anomalies. Smart stethoscopes provide adaptability by integrating with mobile apps and electronic health records, promoting smooth data management and cooperation among medical teams. Overall, these novel gadgets improve patient care by giving doctors useful information and increasing diagnostic efficiency.

Global Smart Stethoscopes Market Dynamics

Market Drivers

- Increasing adoption of telemedicine and remote patient monitoring

- Technological advancements such as AI and IoT integration

- Growing prevalence of chronic diseases requiring regular monitoring

- Rising demand for non-invasive diagnostic tools in healthcare

Market Restraints

- Concerns regarding data security and patient privacy

- High initial costs associated with smart stethoscope implementation

- Limited reimbursement policies for smart stethoscope usage in healthcare systems

Market Opportunities

- Expansion of smart healthcare infrastructure in developing regions

- Collaboration opportunities with tech companies for further innovation

- Integration of smart stethoscopes into wearable healthcare devices

Smart Stethoscopes Market Report Coverage

| Market | Smart Stethoscopes Market |

| Smart Stethoscopes Market Size 2022 | USD 51.4 Million |

| Smart Stethoscopes Market Forecast 2032 |

USD 99.5 Million |

| Smart Stethoscopes Market CAGR During 2024 - 2032 | 6.9% |

| Smart Stethoscopes Market Analysis Period | 2020 - 2032 |

| Smart Stethoscopes Market Base Year |

2022 |

| Smart Stethoscopes Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product Type, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Eko Devices Inc., M3DICINE Pty Ltd., FarmaSino Pharmaceuticals Jiangsu Co. Ltd., Contec Medical Systems Co. Ltd., Rudolf Riester GmbH, American Diagnostic Corporation., 3M, Thinklabs, HD Medical Inc., eKuore, Sonavi Labs, and Steth IO. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Smart Stethoscopes Market Insights

A gradual increase in the number of patients suffering from chronic diseases, coupled with rapid technological advancements in medical devices, is expected to drive the growth of the global smart stethoscope market. Medical device manufacturers are focusing on product development, integrating smart sensors to introduce wireless products with advanced features, which is influencing the market positively. Players in the industry are also focused on simplifying diagnosis procedures. The introduction of products that connect with smartphones, allowing users to collect and send auscultations to specialists, is attracting consumers' interest. Manufacturers' approach to enhancing business and expanding customer bases through the introduction of innovative solutions is an important factor expected to further augment the growth of the smart stethoscope market.

In 2018, M3DICINE Inc., a global manufacturer of medical devices, launched Stethee, the world’s first AI-enabled stethoscope system. The product allows users to listen to heart and lung sounds with sophisticated amplification and filtering technology. It also enables users to instantly capture and analyze heart and lung sounds and data via Bluetooth to the Stethee iOS or Android App, providing a whole new level of diagnostic capabilities. This product launch is expected to help the company enhance its business and increase its customer base.

In 2018, Steth IO, a provider of advanced medical solutions, launched a smartphone-based stethoscope that visualizes heartbeats, aiding doctors in detecting and diagnosing heart problems. The product launch is expected to help the company enhance its business presence and expand its product portfolio.

In 2018, eKuore, a medical device company, launched a digital interface for stethoscopes that digitizes and records auscultation sounds through smartphones or tablets. This is expected to help the company attract new customers and increase revenue.

Players' approach to enhancing their business presence in emerging economies through strategic partnerships and agreements, along with a focus on strengthening distribution channels, is expected to boost the growth of the smart stethoscopes market. Increasing government spending on the development of advanced healthcare infrastructure and the adoption of smart healthcare devices to facilitate medical services are factors expected to support the growth of the global smart stethoscopes market. However, factors such as technological glitches and concerns related to data security are expected to hamper market growth. Additionally, the high cost of advanced devices is expected to challenge the growth of the target market. Nevertheless, factors such as increasing investment in technological advancements by major players and the integration of AI in medical devices are expected to create new opportunities for players operating in the target market. Moreover, increasing partnerships between regional and international players are expected to support revenue transactions in the target market.

Smart Stethoscopes Market Segmentation

The worldwide market for smart stethoscopes is split based on product type, application, end use, and geography.

Smart Stethoscopes Product Types

- Wireless stethoscopes

- Wired Stethoscopes

According to smart stethoscopes industry analysis, the wireless stethoscopes sector is the largest product type category. This domination is due to the growing desire for mobility, convenience, and innovative features among healthcare workers. Wireless stethoscopes provide more flexibility, allowing professionals to move freely during patient examinations without being limited by cords. Furthermore, wireless versions frequently include novel technologies like Bluetooth connectivity and smartphone integration, which improve diagnostic capabilities and data management. As healthcare institutions seek for efficiency and modernity, the use of wireless stethoscopes grows, increasing their importance and market leadership in the smart stethoscope area.

Smart Stethoscopes Applications

- Cardiovascular

- Neonatal

- Pediatric

- Fetal

- Teaching

- Others

The cardiovascular sector dominates the industry and it will expected to grow during the smart stethoscope market forecast period. This dominance can be linked to the importance of cardiovascular evaluation in healthcare, where precise diagnosis is crucial to patient well-being. Smart stethoscopes with sophisticated features like AI-enabled analysis and wireless communication improve healthcare practitioners' ability to detect cardiac irregularities, monitor heart diseases, and assess overall cardiovascular health. Given the prevalence of cardiovascular disorders and the necessity for precise diagnoses, the cardiovascular segment is in high demand, propelling its position in the smart stethoscopes market.

Smart Stethoscopes End Uses

- Hospitals

- Ambulatory surgical centers

- Clinics

- Others

In terms of smart stethoscopes market analysis, the hospitals are the largest end-use category. This is largely owing to the extensive use of smart stethoscopes in hospitals, where precise diagnosis and efficient patient care are critical. Hospitals act as key centers for medical services, serving a wide spectrum of patients with various healthcare requirements such as routine checkups, emergency care, and specialized treatments. Smart stethoscopes serve an important role in these environments, allowing healthcare practitioners to do extensive auscultation, monitor patients' heart and respiratory status, and make rapid clinical evaluations. As a result, the hospital sector holds a sizable market share, thanks to the crucial role of smart stethoscopes in hospital-based healthcare delivery.

Smart Stethoscopes Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Smart Stethoscopes Market Regional Analysis

The market in North America is expected to account for a major revenue share in the global smart stethoscopes market due to the increasing number of patients suffering from chronic diseases and the rise in adoption of advanced diagnostic devices by healthcare professionals. Additionally, increasing government healthcare spending, the presence of a large number of players operating in the country, and the introduction of innovative solutions are factors expected to support revenue transactions in the smart stethoscopes market.

The market in Asia-Pacific is expected to witness faster growth in the target market due to developing medical device standards. Additionally, major players' approach towards tapping into the untapped market in developing countries is expected to drive the growth over the smart stethoscopes industry forecast period.

Smart Stethoscopes Market Players

Some of the top smart stethoscopes companies offered in our report includes Eko Devices Inc., M3DICINE Pty Ltd., FarmaSino Pharmaceuticals Jiangsu Co. Ltd., Contec Medical Systems Co. Ltd., Rudolf Riester GmbH, American Diagnostic Corporation., 3M, Thinklabs, HD Medical Inc., eKuore, Sonavi Labs, and Steth IO.

Frequently Asked Questions

How big is the smart stethoscopes market?

The smart stethoscopes market size was valued at USD 51.4 million in 2022.

What is the CAGR of the global smart stethoscopes market from 2024 to 2032?

The CAGR of smart stethoscopes is 6.9% during the analysis period of 2024 to 2032.

Which are the key players in the smart stethoscopes market?

The key players operating in the global market are including Eko Devices Inc., M3DICINE Pty Ltd., FarmaSino Pharmaceuticals Jiangsu Co. Ltd., Contec Medical Systems Co. Ltd., Rudolf Riester GmbH, American Diagnostic Corporation., 3M, Thinklabs, HD Medical Inc., eKuore, Sonavi Labs, and Steth IO.

Which region dominated the global smart stethoscopes market share?

North America held the dominating position in smart stethoscopes industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of smart stethoscopes during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global smart stethoscopes industry?

The current trends and dynamics in the smart stethoscopes industry include increasing adoption of telemedicine and remote patient monitoring, technological advancements such as AI and IoT integration, growing prevalence of chronic diseases requiring regular monitoring, and rising demand for non-invasive diagnostic tools in healthcare.

Which application held the maximum share in 2022?

The cardiovascular application held the maximum share of the smart stethoscopes industry.