Smart Home Healthcare Market | Acumen Research and Consulting

Smart Home Healthcare Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

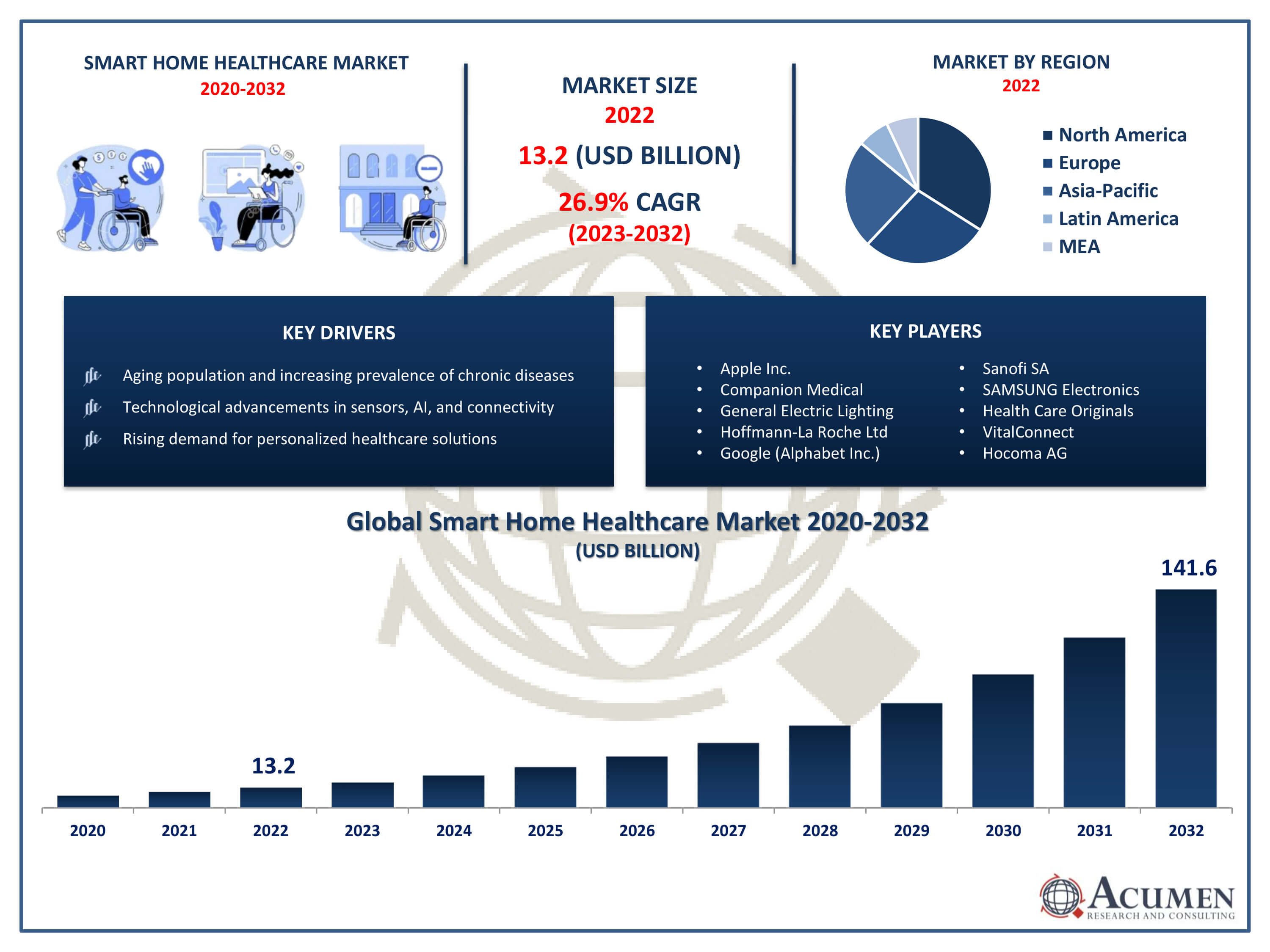

The Smart Home Healthcare Market Size accounted for USD 13.2 Billion in 2022 and is projected to achieve a market size of USD 141.6 Billion by 2032 growing at a CAGR of 26.9% from 2023 to 2032.

Smart Home Healthcare Market Highlights

- Global smart home healthcare market revenue is expected to increase by USD 141.6 billion by 2032, with a 26.9% CAGR from 2023 to 2032

- North America region led with more than 35% of smart home healthcare market share in 2022

- Asia-Pacific smart home healthcare market growth will record a CAGR of more than 28.2% from 2023 to 2032

- By technology, the wireless segment captured more than 62% of revenue share in 2022

- By service, the installation and repair segment are projected to expand at the fastest CAGR over the projected period

- Aging population and increasing prevalence of chronic diseases, drives the smart home healthcare market value

Smart home healthcare refers to the integration of technology into residential environments to support and improve healthcare delivery and management. It encompasses a wide range of devices and systems, including wearable sensors, remote monitoring tools, smart appliances, and artificial intelligence (AI) algorithms. These technologies enable individuals to monitor their health parameters, receive personalized insights, and even facilitate remote consultations with healthcare professionals, all from the comfort of their own homes.

The market for smart home healthcare has experienced significant growth in recent years, driven by several factors. The increasing prevalence of chronic diseases, aging populations, and the rising demand for personalized healthcare solutions are among the primary drivers of market expansion. For instance, in 2023 the prevalence of diabetes has risen to 11.5% of the adult population, affecting nearly 31.9 million adults. Similarly, the prevalence of depression has increased to 21.7% of the adult population, impacting nearly 54.2 million adults in the United States. Additionally, advancements in sensor technology, AI, and connectivity have made smart home healthcare devices more accessible, affordable, and user-friendly. For instance, in November 2023, DarioHealth Corp., a leading innovator in the global digital health sector, unveiled a new smart blood sugar meter designed for Apple iPhone 15 users. As a result, the smart home healthcare market is projected to continue growing rapidly in the coming years, offering opportunities for innovation and investment across the healthcare ecosystem.

Global Smart Home Healthcare Market Trends

Market Drivers

- Aging population and increasing prevalence of chronic diseases

- Technological advancements in sensors, AI, and connectivity

- Rising demand for personalized healthcare solutions

- COVID-19 pandemic accelerating adoption of remote healthcare

- Growing emphasis on preventive and proactive healthcare measures

Market Restraints

- Data privacy and security concerns

- High initial costs and potential lack of reimbursement

Market Opportunities

- Expansion of telehealth and patient monitoring devices

- Integration of smart home healthcare into existing healthcare ecosystems

Smart Home Healthcare Market Report Coverage

| Market | Smart Home Healthcare Market |

| Smart Home Healthcare Market Size 2022 | USD 13.2 Billion |

| Smart Home Healthcare Market Forecast 2032 | USD 141.6 Billion |

| Smart Home Healthcare Market CAGR During 2023 - 2032 | 26.9% |

| Smart Home Healthcare Market Analysis Period | 2020 - 2032 |

| Smart Home Healthcare Market Base Year |

2022 |

| Smart Home Healthcare Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Service, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Apple Inc., Companion Medical, General Electric Lighting, Hoffmann-La Roche Ltd, Google (Alphabet Inc.), Sanofi SA, SAMSUNG Electronics, Health Care Originals, VitalConnect, Hocoma AG, Medtronic, and Medical Guardian. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Smart home healthcare refers to the integration of technological solutions into residential environments to facilitate and enhance healthcare delivery and management. These technologies encompass a diverse range of devices and systems, including wearable sensors, remote monitoring tools, smart appliances, and artificial intelligence (AI) algorithms. The primary goal of smart home healthcare is to empower individuals to take proactive control of their health and well-being by providing access to personalized, convenient, and efficient healthcare services within the comfort of their own homes. The applications of smart home healthcare are extensive and impactful. One key application is remote monitoring, where individuals can use wearable devices and sensors to track vital signs, activity levels, and other health metrics in real-time. This enables healthcare providers to remotely monitor patients' health status, identify potential issues early, and intervene promptly when necessary. Another application is medication management, where smart pill dispensers and medication reminders help individuals adhere to their prescribed medication schedules, reducing the risk of medication errors and improving treatment outcomes.

The smart home healthcare industry has experienced remarkable growth in recent years, driven by a convergence of technological advancements, demographic shifts, and changing healthcare delivery models. For instance, in January 2023, Schneider Electric, a renowned company in power management and automation, announced collaboration with Sendal Inc. to enhance home air quality. With the proliferation of Internet of Things (IoT) devices, artificial intelligence (AI), and wearable sensors, individuals now have unprecedented access to personalized healthcare solutions within the comfort of their own homes. These technologies enable continuous monitoring of vital signs, early detection of health issues, and proactive intervention, thereby empowering users to take control of their health and well-being. Moreover, the COVID-19 pandemic has further accelerated the adoption of smart home healthcare solutions as people seek to minimize visits to healthcare facilities and reduce the risk of exposure to infectious diseases. Remote patient monitoring, telemedicine, and virtual care have become integral components of healthcare delivery, driving increased investment and innovation in the smart home healthcare industry.

Smart Home Healthcare Market Segmentation

The global smart home healthcare market segmentation is based on technology, service, application, and geography.

Smart Home Healthcare Market By Technology

- Wired

- Wireless

According to the smart home healthcare industry analysis, the wireless segment accounted for the largest market share in 2022. Wireless technologies such as Bluetooth, Wi-Fi, Zigbee, and cellular networks have become integral components of smart home healthcare devices, enabling seamless data transmission, remote monitoring, and real-time communication between devices and healthcare providers. The elimination of wired connections enhances mobility and convenience for users, facilitating continuous monitoring of health parameters and enabling prompt intervention when necessary. Moreover, the proliferation of smartphones, tablets, and other mobile devices has further fueled the adoption of wireless smart home healthcare solutions. These devices serve as central hubs for managing and monitoring health data, providing users with easy access to vital information and enabling remote communication with healthcare professionals. Additionally, advancements in battery technology and low-power wireless protocols have extended the battery life of wireless devices, improving reliability and reducing maintenance requirements for users.

Smart Home Healthcare Market By Service

- Installation and Repair

- Renovation and Customization

In terms of services, the installation and repair segment is expected to witness significant growth in the coming years. As more individuals and healthcare facilities invest in these technologies, there is a growing demand for professional installation services to ensure proper setup, configuration, and integration with existing infrastructure. Additionally, as the market matures, there is a need for ongoing maintenance and repair services to address technical issues, software updates, and hardware failures, ensuring the continuous functionality and reliability of smart home healthcare solutions. Moreover, the complexity of smart home healthcare systems and the diversity of devices available on the market create opportunities for specialized installation and repair providers. These professionals possess the expertise and technical skills required to navigate the intricacies of various devices, networks, and protocols, providing customized solutions modified to the needs of individual users and healthcare facilities.

Smart Home Healthcare Market By Application

- Safety and Security Monitoring

- Memory Aids

- Nutrition or Diet Monitoring

- Fall Prevention and Detection

- Health Status Monitoring

- Others

According to the smart home healthcare industry forecast, the safety and security monitoring segment is expected to witness significant growth in the coming years. This growth is driven by the increasing emphasis on aging-in-place solutions, the rising awareness of home safety among caregivers, and advancements in sensor technology. These systems incorporate various sensors, cameras, and alarms to monitor the living environment and detect potential hazards or emergencies such as falls, fires, or intrusions. They provide peace of mind to both individuals living independently and their caregivers by offering real-time alerts and notifications in the event of an emergency, enabling prompt intervention and assistance when needed. Furthermore, the integration of safety and security monitoring systems with smart home healthcare platforms enhances the overall functionality and value proposition of these solutions. By leveraging connectivity and data analytics capabilities, these systems can offer personalized insights and recommendations to improve home safety and prevent accidents.

Smart Home Healthcare Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

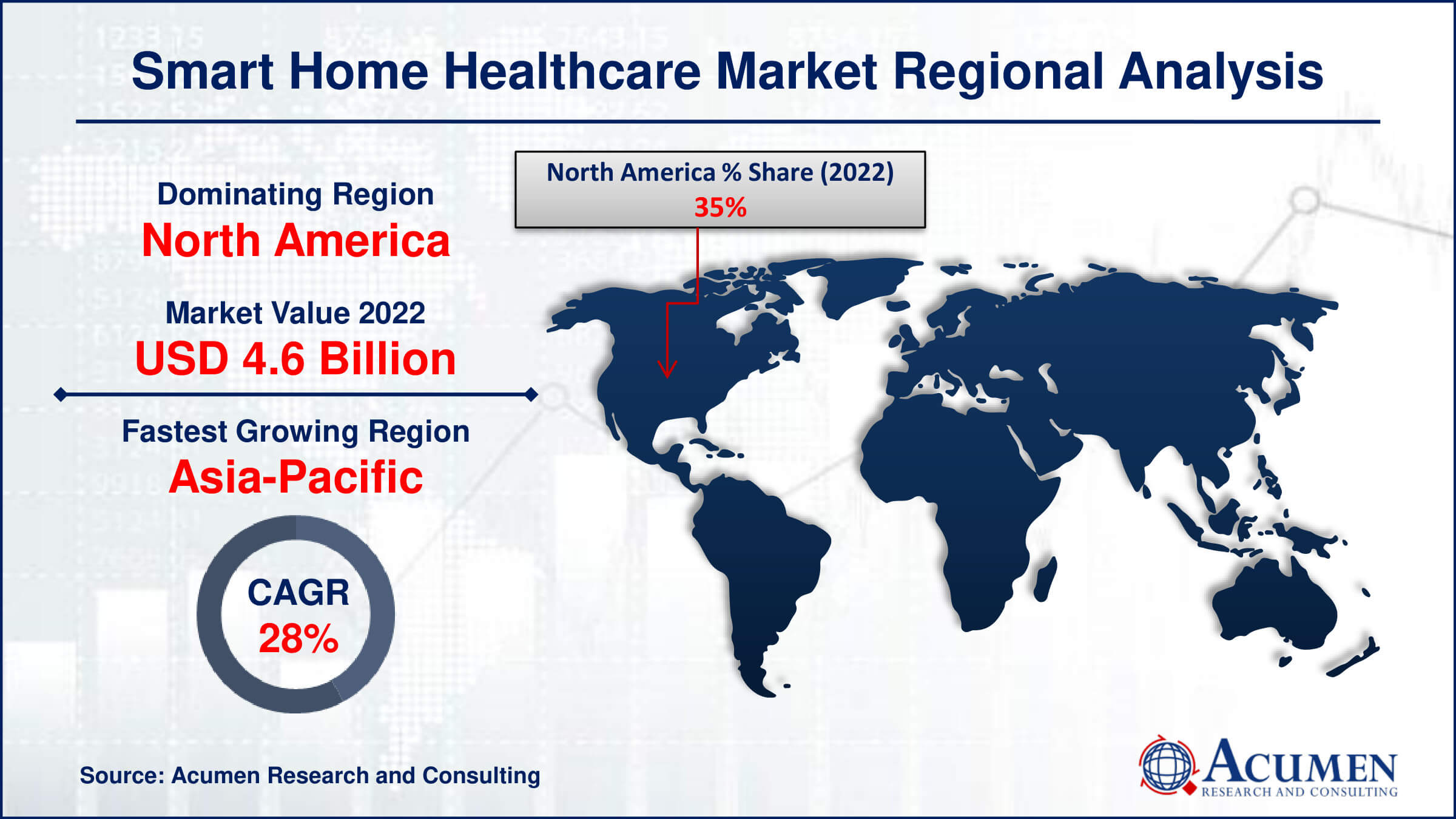

Smart Home Healthcare Market Regional Analysis

North America is dominating the smart home healthcare market for several reasons, primarily due to its robust infrastructure, technological innovation, and high adoption rates of digital healthcare solutions. For instance, virtual care has become a prevalent aspect of contemporary healthcare. In 2023, 76% of survey respondents reported having utilized virtual care (delivered through video, phone, text, or app) at some point. The region boasts advanced healthcare systems, extensive internet penetration, and a tech-savvy population, creating a fertile ground for the adoption of smart home healthcare technologies. For instance, as of 2024, approximately 95% of the United States population, or around 322,563,519 individuals, have internet access according to a U.S. Census report. Additionally, the presence of leading technology companies and startups focused on healthcare innovation further accelerates the development and deployment of smart home healthcare solutions in North America. For instance, in March 2022, the digital health company Quil, a joint venture between Independence Health Group and Comcast, announced the limited commercial launch of Quil Assure. This new smart home platform is designed to help seniors age in place, providing them with more independence while allowing friends and family to offer support as caregivers. Moreover, favorable government initiatives and policies aimed at promoting digital health and remote patient monitoring contribute to the dominance of North America in the smart home healthcare market. For instance, the United States has implemented various reimbursement programs and regulatory frameworks to incentivize the adoption of telehealth and remote monitoring solutions, driving widespread adoption among healthcare providers and consumers alike. Furthermore, the COVID-19 pandemic has acted as a catalyst for the adoption of smart home healthcare technologies, with North America experiencing a surge in demand for remote monitoring, telemedicine, and virtual care services.

The Asia Pacific region is experiencing the fastest growth in the smart home healthcare industry due to its rapidly aging population, increasing adoption of advanced technologies, and rising healthcare costs. For instance, in 2023, China's population aged 60 and above reached approximately 297 million, accounting for 21.1% of the total population. This qualifies China as a "super-aged society" according to World Bank standards. This growth is further propelled by government initiatives supporting digital health solutions and an expanding middle class with greater disposable income. For instance, initiatives such as Ayushman Bharat Digital Mission, the CoWIN App, Aarogya Setu, e-Sanjeevani, and e-Hospital have significantly expanded access to healthcare facilities and services across India. These digital solutions create a bridge between various stakeholders in the healthcare ecosystem, effectively closing existing gaps through advanced digital infrastructure. Moreover, advancements by key players further prompting growth in this region. For instance, in January 2022, Fresenius Medical Care, a leading provider of products and services for individuals with renal disorders, announced the launch of Carrie. This specially designed mobile application connects, informs, and supports clinical teams and Fresenius Kidney Care nurses in the Asia-Pacific region. Consequently, there is a heightened demand for smart home healthcare devices that offer convenience and improved quality of life for patients.

Smart Home Healthcare Market Player

Some of the top smart home healthcare market companies offered in the professional report include Apple Inc., Companion Medical, General Electric Lighting, Hoffmann-La Roche Ltd, Google (Alphabet Inc.), Sanofi SA, SAMSUNG Electronics, Health Care Originals, VitalConnect, Hocoma AG, Medtronic, and Medical Guardian.

Frequently Asked Questions

How big is the smart home healthcare market?

The smart home healthcare market size was USD 13.2 Billion in 2022.

What is the CAGR of the global smart home healthcare market from 2023 to 2032?

The CAGR of smart home healthcare is 26.9% during the analysis period of 2023 to 2032.

Which are the key players in the smart home healthcare market?

The key players operating in the global market are including Apple Inc., Companion Medical, General Electric Lighting, Hoffmann-La Roche Ltd, Google (Alphabet Inc.), Sanofi SA, SAMSUNG Electronics, Health Care Originals, VitalConnect, Hocoma AG, Medtronic, and Medical Guardian.

Which region dominated the global smart home healthcare market share?

North America held the dominating position in smart home healthcare industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of smart home healthcare during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global smart home healthcare industry?

The current trends and dynamics in the smart home healthcare industry include aging population and increasing prevalence of chronic diseases, technological advancements in sensors, AI, and connectivity, and rising demand for personalized healthcare solutions.

Which service held the maximum share in 2022?

The installation and repair service held the maximum share of the smart home healthcare industry.