Digital Health Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Digital Health Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

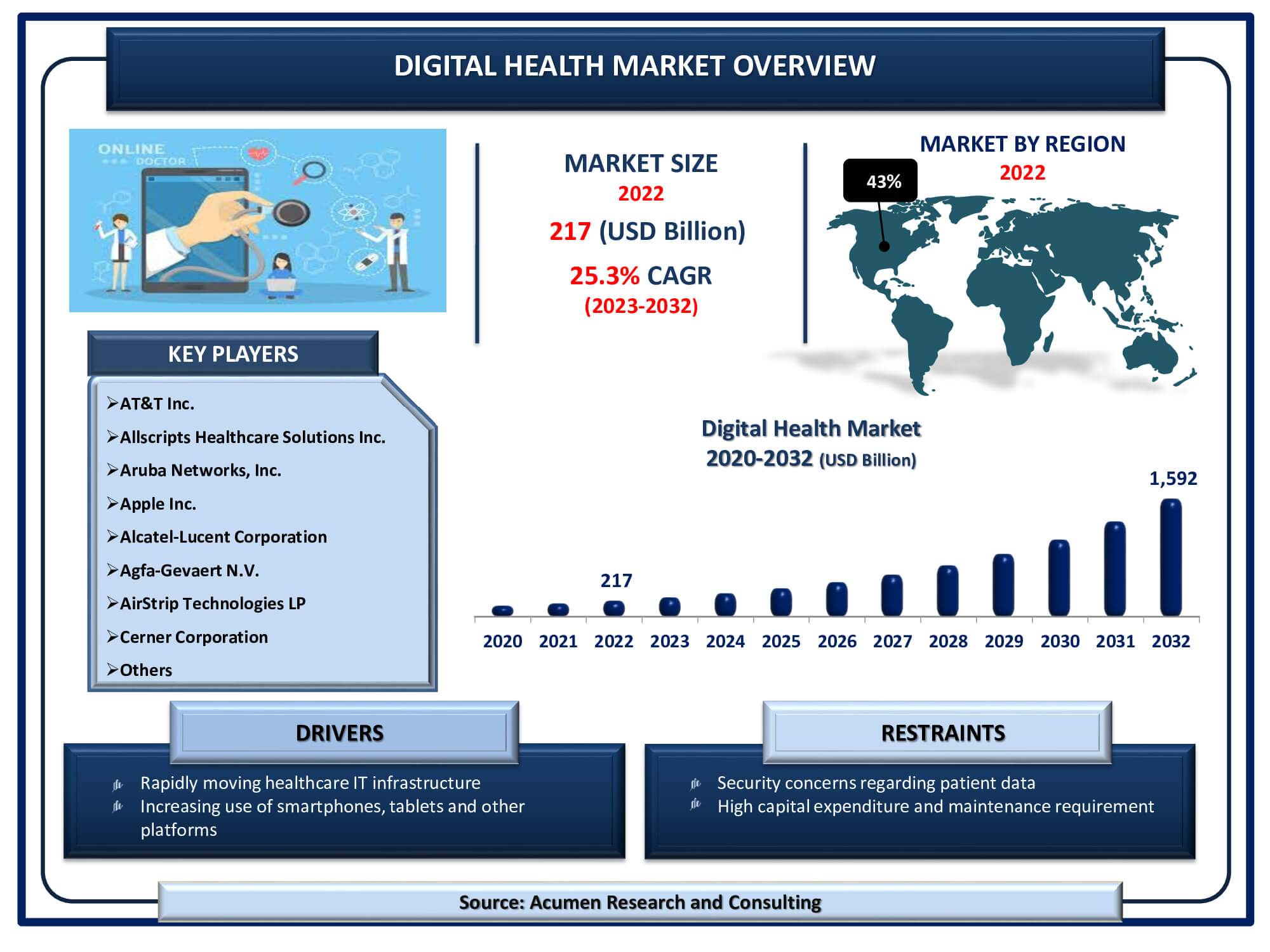

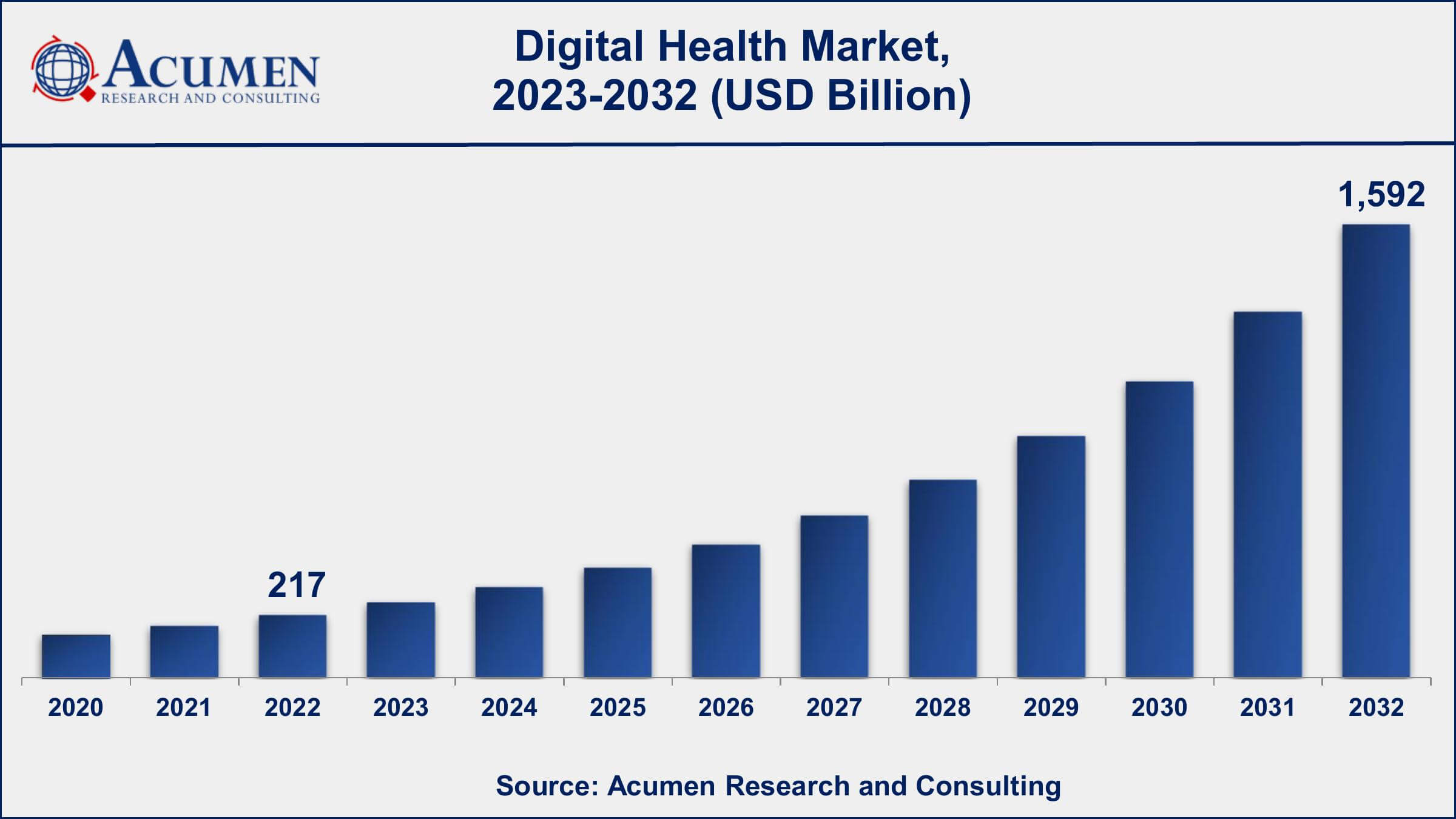

The Global Digital Health Market Size accounted for USD 217 Billion in 2022 and is estimated to achieve a market size of USD 1,592 Billion by 2032 growing at a CAGR of 25.3% from 2023 to 2032.

Digital Health Market Highlights

- Global digital health market revenue is poised to garner USD 1,592 billion by 2032 with a CAGR of 25.3% from 2023 to 2032

- North America digital health market value occupied around USD 93.4 billion in 2022

- Asia-Pacific digital health market growth will record a CAGR of more than 26% from 2023 to 2032

- Among component, the services sub-segment generated over US$ 143 billion revenue in 2022

- Based on technology, the telehealth sub-segment generated maximum share in 2022

- Rise in AI, IoT, and big data is a popular market trend that fuels the industry demand

Healthcare technology has undergone significant transformation over the last few decades, with the introduction of new technologies that have digitalized the healthcare sector. Digital health encompasses various platforms, including mobile health (mHealth), telehealth, and other wireless solutions, to deliver real-time healthcare services to patients. The increasing demand for home diagnosis and the positive impact of digital technology represent game-changing advancements in the healthcare sector, enabling real-time disease diagnosis. The growing adoption of smartphones, wearables, and other data-reading platforms is driving the expansion of the digital health market. However, high capital investments and privacy concerns are among the factors that pose challenges to the market's growth. Additionally, the rising adoption of technologies such as AI, big data, and IoT is expected to generate significant revenue in the digital health market during the forecast period from 2023 to 2032.

Global Digital Health Market Dynamics

Market Drivers

- Rapidly increasing healthcare IT infrastructure

- Surging adoption of smartphones, tablets, and other platforms

- Growing healthcare expenditure

Market Restraints

- Cybersecurity and privacy concerns

- High capital investments and maintenance required

- Concerns related to ensuring regulatory compliance

Market Opportunities

- Rise in AI, IoT, and big data

- Growing adoption of mobile health applications

- Increase in adoption of digital health devices and technologies

Digital Health Market Report Coverage

| Market | Digital Health Market |

| Digital Health Market Size 2022 | USD 217 Billion |

| Digital Health Market Forecast 2032 | USD 1,592 Billion |

| Digital Health Market CAGR During 2023 - 2032 | 25.3% |

| Digital Health Market Analysis Period | 2020 - 2032 |

| Digital Health Market Base Year |

2022 |

| Digital Health Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Technology, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AT&T Inc., Allscripts Healthcare Solutions Inc., Aruba Networks, Inc., Apple Inc., Alcatel-Lucent Corporation, Agfa-Gevaert N.V., AirStrip Technologies LP, Cerner Corporation, Symantec Corporation, Cisco Systems, Inc., Siemens Healthcare Epic Systems Corp., Qualcomm, Inc., and Philips Healthcare. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Digital Health Market Insights

In recent years, healthcare technology has undergone a significant transformation. The increasing prevalence of various diseases, including diabetes and chronic cardiovascular conditions, has been a driving force behind the growth of the digital health market. This global market is primarily propelled by advancements in healthcare technology, the digitalization of various devices, and the increasing purchasing power of individuals. Several factors have contributed to the market's expansion, including the growing geriatric population, the rising incidence of diabetes and other chronic diseases, and increased government support. According to the World Health Organization (WHO), more than 422 million people worldwide suffer from diabetes. Additionally, ongoing transformations in the healthcare sector and increased public awareness have bolstered market growth. One notable trend in the digital health market is the rise of telehealth and telemedicine, which are expected to drive industry demand in the coming years. However, the high cost of advanced digital equipment and the associated maintenance expenses may potentially hinder market growth. The increasing prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and respiratory illnesses, has created a growing demand for digital health solutions. These technologies play a crucial role in remote monitoring, disease management, and the enhancement of patient outcomes.

Digital Health Market Segmentation

The worldwide market for digital health is split based on component, technology, end-user, and geography.

Digital Health Components

- Hardware

- Software

- Services

According to our analysis of the digital health industry, the services sub-segment is expected to hold the largest market share. This is primarily due to the increasing demand for a wide array of services, including installation, training, maintenance, and others. Furthermore, key players in the digital health market are placing a growing emphasis on providing various types of services, further driving market share. For instance, well-established companies offer an extensive range of pre- and post-installation services, encompassing project planning, staffing, training, implementation, and resource allocation and optimization. Conversely, the software sub-segment is anticipated to experience the fastest growth between 2023 and 2032. This rapid growth can be attributed to the escalating demand for software systems in the healthcare industry, which serves healthcare facilities, patients, healthcare providers, and insurance payers.

Digital Health Technologies

- Telehealth

- Activity Monitoring

- LTC Monitoring

- Video Consultation

- Remote Medication Management

- Others

- Health Analytics

- MHealth

- BP Monitor

- Pulse Oximeter

- Glucose Meter

- Sleep Apnea Monitors

- Neurological Monitors

- Digital Health Systems

- Others

The telehealth sub-segment has consistently held the majority share in recent years, and this trend is expected to continue in the coming years. Within the telehealth sub-segment, there are several categories, including activity monitoring, long-term care (LTC) monitoring, video consultation, remote medication management, and others. Telehealth involves the use of communication technologies and digital information to access and manage healthcare services remotely. The increasing adoption of computers, laptops, tablets, and smartphones for telehealth purposes is a significant driver of the digital health market's growth.

Digital Health End-Users

- Healthcare Providers

- Payers

- Healthcare Consumers

- Others

According to the digital health market forecast, the healthcare providers segment has consistently dominated the market share and is poised to maintain its dominance throughout the forecasted period from 2023 to 2032. The increase in the prevalence of chronic diseases has resulted in a surge in demand for mHealth apps and the adoption of innovative technologies in the healthcare sector. This demand from the healthcare providers sector has been a major driving force behind the growth of the digital health market.

In terms of growth rate, the payers segment is expected to experience the fastest revenue growth, characterized by a high compound annual growth rate (CAGR) during the forecast period.

Digital Health Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Digital Health Market Regional Analysis

North America dominates the global digital health market due to its well-developed economy, increasing demand for advanced products, high spending power, and the presence of many leading players. The U.S. holds the largest share of the North American digital health market.

Europe represents the second-largest market for digital health. The primary factors driving the growth of the European market include the availability of substantial funds for research and development, strong government support, and high per capita income levels.

The Asia Pacific region is expected to experience the fastest growth in this market, primarily attributed to the presence of rapidly developing economies and increasing digitalization of technology.

In contrast, the LAMEA (Latin America, Middle East, and Africa) region currently holds the smallest market share. However, there are significant untapped opportunities in the LAMEA market, which are expected to contribute to a healthy future for the market during the forecasted period from 2023 to 2032.

Digital Health Market Players

Some of the top digital health companies offered in our report includes AT&T Inc., Allscripts Healthcare Solutions Inc., Aruba Networks, Inc., Apple Inc., Alcatel-Lucent Corporation, Agfa-Gevaert N.V., AirStrip Technologies LP, Cerner Corporation, Symantec Corporation, Cisco Systems, Inc., Siemens Healthcare Epic Systems Corp., Qualcomm, Inc., and Philips Healthcare.

Frequently Asked Questions

What was the market size of the global digital health in 2022?

The market size of digital health was USD 217 billion in 2022.

What is the CAGR of the global digital health market from 2023 to 2032?

The CAGR of digital health is 25.3% during the analysis period of 2023 to 2032.

Which are the key players in the digital health market?

The key players operating in the global market are including AT&T Inc., Allscripts Healthcare Solutions Inc., Aruba Networks, Inc., Apple Inc., Alcatel-Lucent Corporation, Agfa-Gevaert N.V., AirStrip Technologies LP, Cerner Corporation, Symantec Corporation, Cisco Systems, Inc., Siemens Healthcare Epic Systems Corp., Qualcomm, Inc., and Philips Healthcare.

Which region dominated the global digital health market share?

North America held the dominating position in digital health industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of digital health during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global digital health industry?

The current trends and dynamics in the digital health industry include rise in artificial intelligence, IoT, and big data, rapidly increasing healthcare IT infrastructure, surging adoption of smartphones, tablets, and other platforms, and growing healthcare expenditure.

Which component held the maximum share in 2022?

The services component held the maximum share of the digital health industry.