Smart Elevator Automation System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Smart Elevator Automation System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

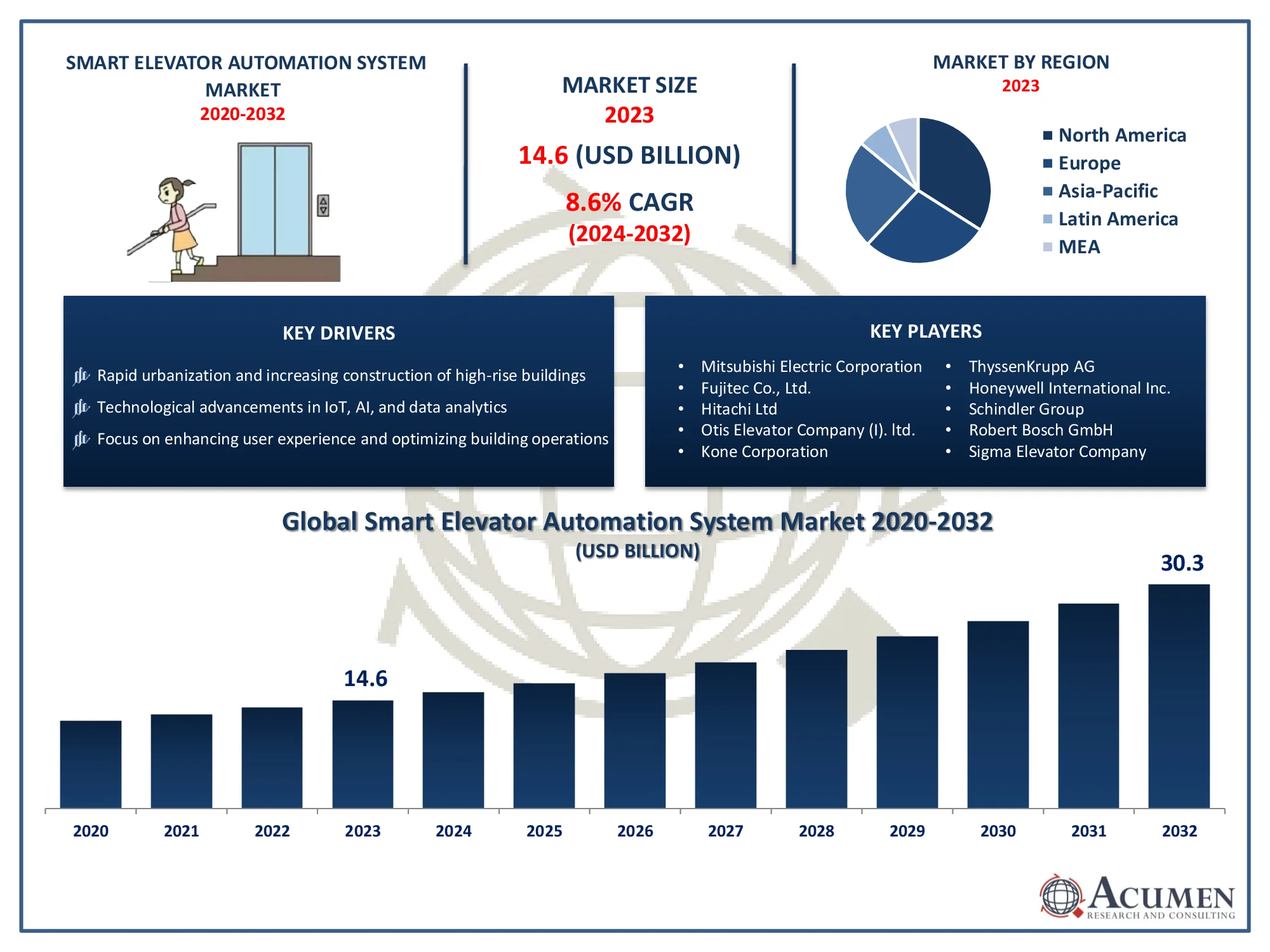

The Global Smart Elevator Automation System Market Size accounted for USD 14.6 Billion in 2023 and is projected to achieve a market size of USD 30.3 Billion by 2032 growing at a CAGR of 8.6% from 2024 to 2032.

Smart Elevator Automation System Market Highlights

- Global smart elevator automation system market revenue is expected to increase by USD 30.3 Billion by 2032, with a 8.6% CAGR from 2024 to 2032

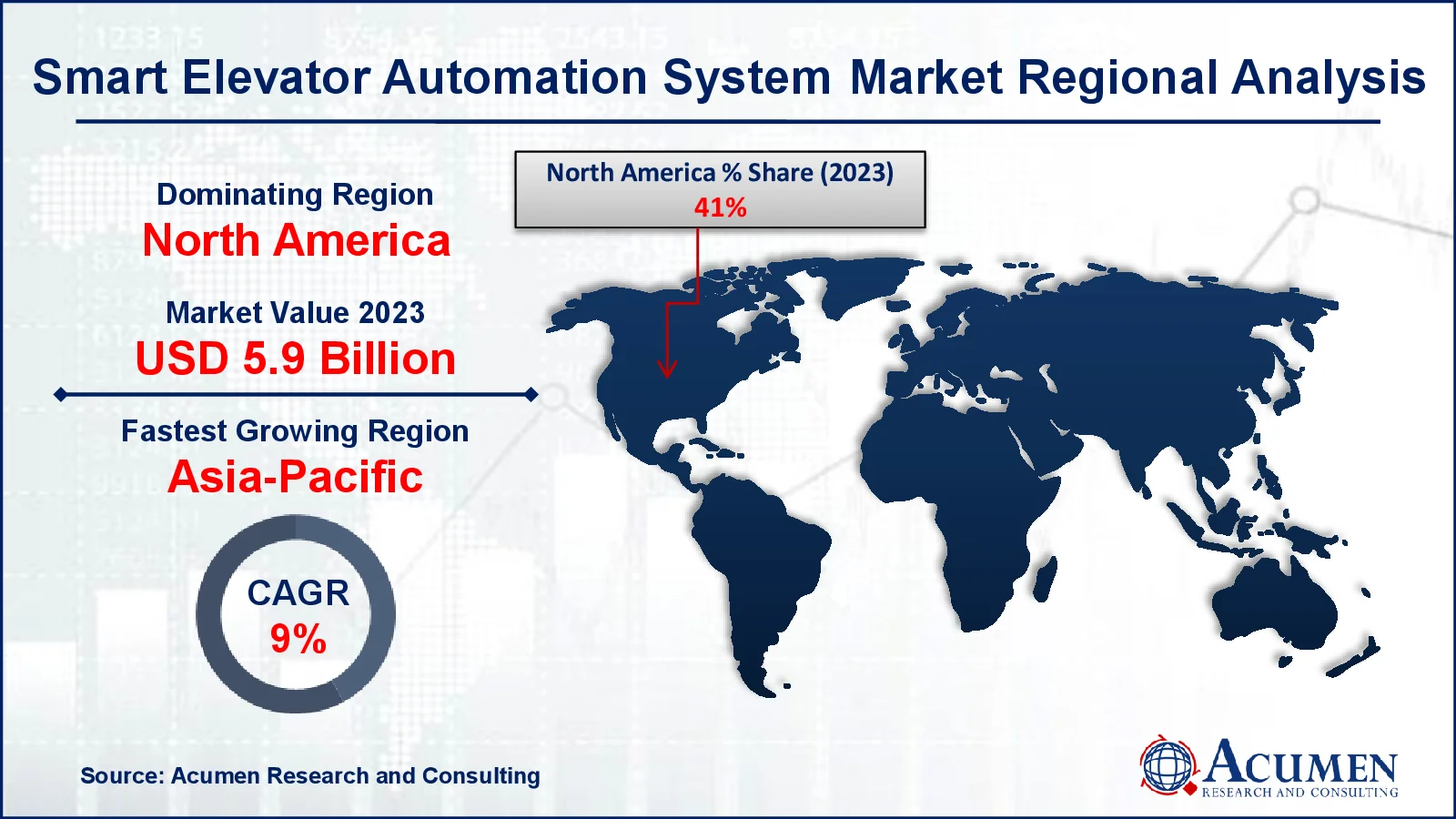

- North America region led with more than 41% of smart elevator automation system market share in 2023

- Asia-Pacific smart elevator automation system market growth will record a CAGR of more than 9.3% from 2024 to 2032

- By components, the building management system segment captured more than 21% of revenue share in 2023

- By end user, the industrial sector segment is projected to expand at the fastest CAGR over the projected period

- Rapid urbanization and increasing construction of high-rise buildings, drives the smart elevator automation system market value

A smart elevator automation system integrates cutting-edge technologies to enhance efficiency, safety, and convenience in vertical transportation. These systems leverage sensors, IoT (Internet of Things) connectivity, AI algorithms, and data analytics to optimize elevator operations. By collecting real-time data on passenger traffic patterns, weather conditions, and equipment status, smart elevators can intelligently adjust their operation to minimize wait times, reduce energy consumption, and improve overall user experience.

One of the key features of smart elevator systems is predictive maintenance. By continuously monitoring the performance of elevator components and detecting potential issues before they escalate into major problems, these systems help building managers schedule maintenance proactively, minimizing downtime and costly repairs. Moreover, smart elevators can offer personalized experiences to users through features like destination control, where passengers input their desired floor on a keypad, and the system assigns them to the most efficient elevator car, reducing congestion and wait times. The market for smart elevator automation systems is witnessing significant growth driven by factors such as rapid urbanization, the construction of smart buildings, and increasing focus on sustainability.

Global Smart Elevator Automation System Market Trends

Market Drivers

- Rapid urbanization and increasing construction of high-rise buildings

- Growing demand for energy-efficient and sustainable vertical transportation solutions

- Technological advancements in IoT, AI, and data analytics

- Focus on enhancing user experience and optimizing building operations

- Regulatory mandates for improved safety and accessibility standards

Market Restraints

- High initial investment costs associated with implementing smart elevator systems

- Concerns regarding data security and privacy in connected environments

Market Opportunities

- Integration of smart elevator systems with smart building ecosystems

- Development of innovative business models such as predictive maintenance as a service

Smart Elevator Automation System Market Report Coverage

| Market | Smart Elevator Automation System Market |

| Smart Elevator Automation System Market Size 2022 |

USD 14.6 Billion |

| Smart Elevator Automation System Market Forecast 2032 | USD 30.3 Billion |

| Smart Elevator Automation System Market CAGR During 2023 - 2032 | 8.6% |

| Smart Elevator Automation System Market Analysis Period | 2020 - 2032 |

| Smart Elevator Automation System Market Base Year |

2022 |

| Smart Elevator Automation System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Service, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Mitsubishi Electric Corporation, Fujitec Co., Ltd., Hitachi Ltd, Otis Elevator Company (I). ltd., Kone Corporation, ThyssenKrupp AG, Honeywell International Inc., Schindler Group, Robert Bosch GmbH, Sigma Elevator Company, Hyundai Elevator, and Toshiba Elevator and Building Systems Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Smart Elevator Automation System Market Dynamics

A smart elevator automation system is an advanced vertical transportation solution that integrates cutting-edge technologies to optimize elevator operations. These systems utilize sensors, IoT (Internet of Things) connectivity, AI algorithms, and data analytics to enhance efficiency, safety, and user experience. By collecting real-time data on passenger traffic patterns, weather conditions, and equipment status, smart elevators can intelligently adjust their operation to minimize wait times, reduce energy consumption, and improve overall performance. The applications of smart elevator automation systems span across various sectors including commercial, residential, healthcare, hospitality, and transportation hubs. In commercial buildings, these systems streamline vertical transportation by analyzing traffic patterns and dynamically assigning elevator cars to efficiently serve different floors.

The smart elevator automation system market is experiencing robust growth driven by several key factors. Rapid urbanization across the globe has led to an increased demand for efficient vertical transportation solutions, particularly in high-rise buildings and urban centers. As cities continue to grow, the need for smarter and more sustainable building infrastructure becomes imperative, spurring the adoption of smart elevator technologies. Additionally, the construction of smart buildings, equipped with IoT infrastructure and connected systems, is further driving the demand for advanced elevator automation solutions. Moreover, there is a growing emphasis on sustainability and energy efficiency in building operations. Smart elevator systems offer features such as predictive maintenance, destination control, and energy optimization, which help reduce energy consumption, minimize downtime, and enhance overall operational efficiency. As organizations and building owners seek ways to reduce their carbon footprint and operating costs, the value proposition of smart elevator automation becomes increasingly compelling.

Smart Elevator Automation System Market Segmentation

The global smart elevator automation system market segmentation is based on component, service, end user, and geography.

Smart Elevator Automation System Market By Component

- Card Reader

- Touchscreen and Keypad

- Biometric

- Security and Control System

- Building Management System

- Sensors, Motors, and Automation System

According to the smart elevator automation system industry analysis, the building management system (BMS) segment accounted for the largest market share in 2023. This growth is propelled by the increasing demand for integrated and interconnected building solutions. BMS, also known as Building Automation System (BAS), encompasses various technologies that monitor, control, and optimize building functions, including HVAC, lighting, security, and now, elevator systems. Integration of elevator systems into BMS platforms enables centralized monitoring and control of building operations, resulting in enhanced efficiency, safety, and sustainability. This integration allows building managers to synchronize elevator operations with other building functions, such as occupancy levels, energy usage, and security protocols. As a result, BMS-equipped smart elevators can adapt in real-time to changing building conditions, optimizing traffic flow, energy consumption, and user experience.

Smart Elevator Automation System Market By Service

- Installation Service

- Modernization Service

- Maintenance and Repair

In terms of services, the modernization service segment is expected to witness significant growth in the coming years. Many buildings around the world are equipped with conventional elevator systems that lack the efficiency, safety features, and connectivity offered by modern smart elevator solutions. As a result, there is a growing demand for modernization services to retrofit older elevators with smart technologies, such as IoT sensors, predictive maintenance algorithms, and destination control systems. One of the key drivers behind the growth of the modernization service segment is the need to enhance the performance and lifespan of aging elevator systems. By modernizing existing elevators, building owners can improve reliability, energy efficiency, and user experience while extending the operational life of their assets. Additionally, modernization services can help buildings comply with evolving safety regulations and accessibility standards, ensuring a safer and more inclusive vertical transportation environment.

Smart Elevator Automation System Market By End User

- Residential Sector

- Industrial Sector

- Commercial Sector

- Others

According to the smart elevator automation system market forecast, the industrial sector segment is expected to witness significant growth in the coming years. In industrial settings such as manufacturing plants, warehouses, and logistics centers, efficient vertical transportation plays a crucial role in optimizing workflow, maximizing productivity, and ensuring smooth operations. Smart elevator systems offer features such as predictive maintenance, real-time monitoring, and advanced traffic management, which are particularly beneficial in demanding industrial environments where downtime can result in significant losses. One of the key drivers behind the growth of the industrial sector segment is the need for enhanced safety and reliability in vertical transportation. Industrial facilities often operate in challenging conditions with heavy machinery, high foot traffic, and stringent safety regulations.

Smart Elevator Automation System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Smart Elevator Automation System Market Regional Analysis

North America is dominating the smart elevator automation system market. The North America region has a highly developed infrastructure with a significant concentration of skyscrapers, commercial buildings, and residential complexes, especially in major cities like New York, Chicago, and Los Angeles. The demand for efficient vertical transportation solutions in these densely populated urban areas is driving the adoption of smart elevator technologies. Additionally, North America boasts a robust economy with a strong focus on technological innovation and sustainable building practices, further fueling the growth of the smart elevator market. Furthermore, stringent safety regulations and building codes in North America incentivize the adoption of advanced elevator systems that comply with the latest safety standards. Smart elevator automation systems offer features such as real-time monitoring, predictive maintenance, and emergency response capabilities, which help ensure the safety and security of occupants in buildings across the region. Moreover, the increasing emphasis on energy efficiency and sustainability is driving the demand for smart elevator solutions that optimize energy consumption and reduce environmental impact. As a result, North America remains a dominant region in the smart elevator automation system market, with continued growth expected in the coming years fueled by technological advancements and evolving building requirements.

Smart Elevator Automation System Market Player

Some of the top smart elevator automation system market companies offered in the professional report include Mitsubishi Electric Corporation, Fujitec Co., Ltd., Hitachi Ltd, Otis Elevator Company (I). ltd., Kone Corporation, ThyssenKrupp AG, Honeywell International Inc., Schindler Group, Robert Bosch GmbH, Sigma Elevator Company, Hyundai Elevator, and Toshiba Elevator and Building Systems Corporation.

Frequently Asked Questions

What was the market size of the global smart elevator automation system in 2023?

The market size of smart elevator automation system was USD 14.6 Billion in 2023.

What is the CAGR of the global smart elevator automation system market from 2024 to 2032?

The CAGR of smart elevator automation system is 8.6% during the analysis period of 2024 to 2032.

Which are the key players in the smart elevator automation system market?

The key players operating in the global market are including Mitsubishi Electric Corporation, Fujitec Co., Ltd., Hitachi Ltd, Otis Elevator Company (I). ltd., Kone Corporation, ThyssenKrupp AG, Honeywell International Inc., Schindler Group, Robert Bosch GmbH, Sigma Elevator Company, Hyundai Elevator, and Toshiba Elevator and Building Systems Corporation.

Which region dominated the global smart elevator automation system market share?

North America held the dominating position in smart elevator automation system industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of smart elevator automation system during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global smart elevator automation system industry?

The current trends and dynamics in the smart elevator automation system industry include rapid urbanization and increasing construction of high-rise buildings, and growing demand for energy-efficient and sustainable vertical transportation solutions.

Which service held the maximum share in 2023?

The building management system service held the maximum share of the smart elevator automation system industry.