Small Hydropower Market | Acumen Research and Consulting

Small Hydropower Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

The Small Hydropower Market Size accounted for USD 2.3 Billion in 2023 and is estimated to achieve a market size of USD 2.9 Billion by 2032 growing at a CAGR of 2.7% from 2024 to 2032.

Small Hydropower Market Highlights

- Global small hydropower market revenue is poised to garner USD 2.9 billion by 2032 with a CAGR of 2.7% from 2024 to 2032

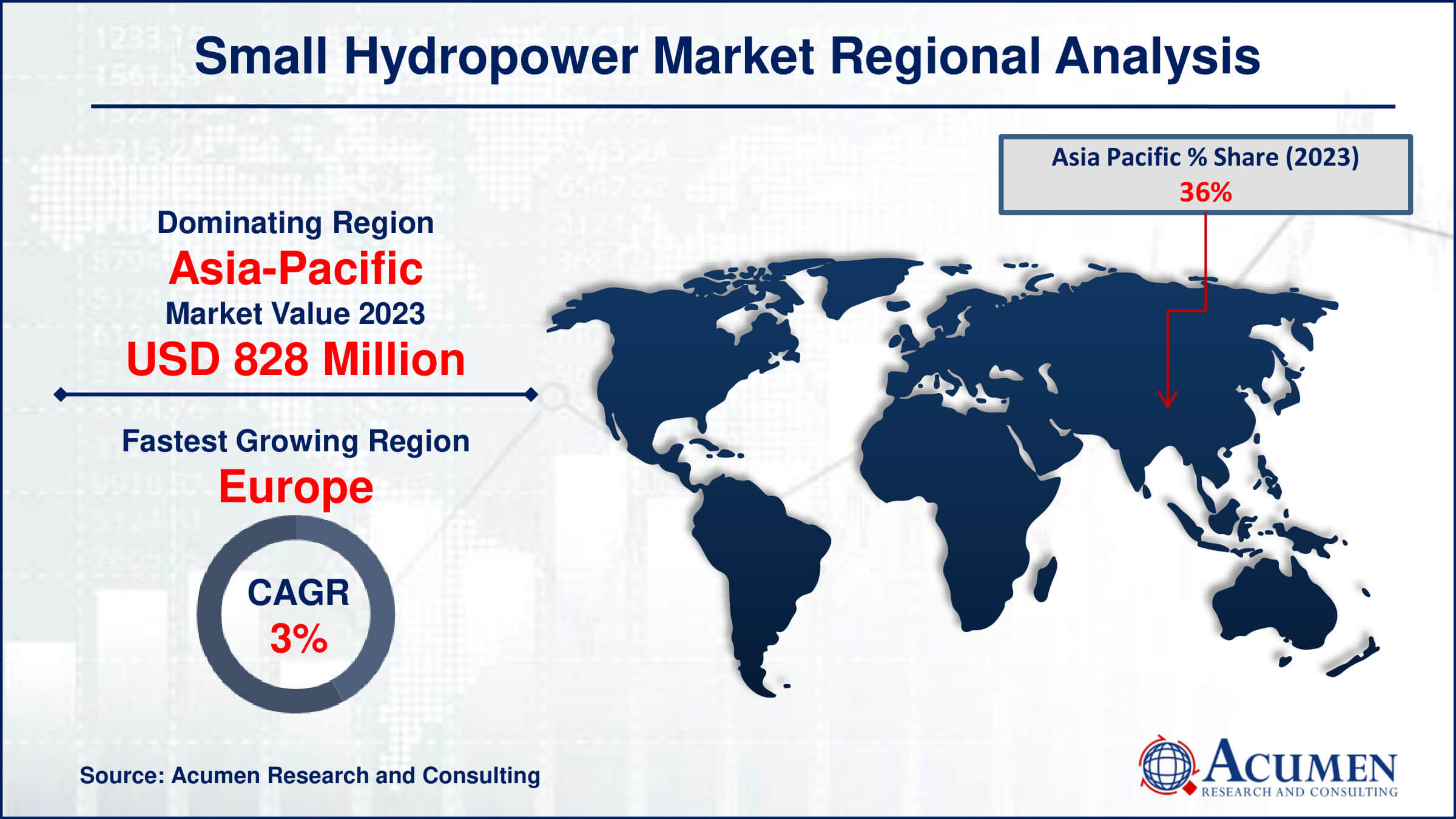

- Asia Pacific small hydropower market value occupied around USD 828 million in 2023

- Europe small hydropower market growth will record a CAGR of more than 3% from 2024 to 2032

- Among capacity, the up to 1 MW sub-segment generated 57% of the market share in 2023

- Based on type, the micro hydropower sub-segment generated 56% market share in 2023

- Increasing focus on micro hydropower systems catering to off-grid and remote communities is the small hydropower market trend that fuels the industry demand

Small hydropower is a clean, renewable, and reliable energy source designed to convert the mechanical energy of flowing water into electricity. These systems are primarily intended for use in isolated, remote areas as stand-alone applications rather than being connected to the grid, making them an excellent alternative to expensive diesel generators. Small hydropower plants are categorized into mini, micro, and Pico hydropower, with capacities ranging from less than 1 MW to 50 MW.

Mini hydro refers to hydroelectric power generation with an installed capacity below 10 MW, suitable for local communities and industries. Micro-hydro systems generate electricity with capacities ranging from 5 kW to 100 kW. Pico hydro, with a capacity of less than 5 kW, is designed for small remote communities to power basic household appliances such as light bulbs, TVs, or radios.

Global Small Hydropower Market Dynamics

Market Drivers

- Increasing demand for clean and renewable energy sources

- Government incentives and policies promoting small hydropower development

- Technological advancements making small hydropower more efficient and cost-effective

Market Restraints

- Environmental concerns and potential ecosystem disruption

- High upfront costs and long payback periods

- Limited availability of suitable sites for small hydropower projects

Market Opportunities

- Growing interest in distributed energy generation and microgrids

- Expansion of small hydropower in remote and off-grid areas

- Integration with existing infrastructure for water management and irrigation

Small Hydropower Market Report Coverage

| Market | Small Hydropower Market |

| Small Hydropower Market Size 2022 | USD 2.3 Billion |

| Small Hydropower Market Forecast 2032 | USD 2.9 Billion |

| Small Hydropower Market CAGR During 2023 - 2032 | 2.7% |

| Small Hydropower Market Analysis Period | 2020 - 2032 |

| Small Hydropower Market Base Year |

2022 |

| Small Hydropower Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Capacity, By Type, By Components, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Siemens, Toshiba, ANDRITZ AG, GE Renewable Energy, Mavel,a.s., Gilbert Gilkes & Gordon Ltd., Voith, BHEL, HNAC Technology Co, Canyon Hydro, and SNC-Lavalin |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Small Hydropower Market Insights

The small hydropower market is experiencing a surge in demand due to the global push for cleaner and more sustainable energy sources. For instance, Zarchob small hydropower plant was successfully inaugurated in Uzbekistan in March 2021, as announced by the developer of the country's state hydropower. This initiative forms a crucial component of Uzbekistan's broader energy strategy, which aims to generate electricity from renewable sources by 2030. The project specifically targets the production of 5GW of solar energy, 3.8GW of hydro energy, and 3GW of wind renewable energy. As societies seek to reduce carbon emissions and combat climate change, small hydropower emerges as a viable solution, offering reliable energy generation with minimal environmental impact. Its scalability makes it adaptable to various geographical locations, especially in remote areas where access to larger power infrastructure may be limited. Furthermore, advancements in technology have made small hydropower systems more efficient and cost-effective, attracting investment and fostering growth in the market. Overall, the rising demand for clean energy coupled with the versatility and efficiency of small hydropower is driving its market expansion worldwide.

The growth of the small hydropower market faces significant hurdles due to environmental concerns and the potential for ecosystem disruption. Many small hydropower projects involve altering natural waterways, which can lead to habitat destruction and harm to aquatic life. Additionally, the construction of dams and reservoirs can disrupt local ecosystems and alter the flow of rivers, impacting downstream communities. Stricter regulations and increased public awareness of environmental issues further complicate the development of small hydropower projects, necessitating careful consideration of sustainability and ecosystem preservation. As a result, alternative renewable energy sources may be favored over small hydropower in regions where environmental concerns are prominent.

The expansion of small hydropower in remote and off-grid areas presents a significant opportunity for the small hydropower market. These areas often lack access to traditional energy sources, making small hydropower a viable and sustainable alternative. With advancements in technology and increasing awareness of environmental concerns, there's growing interest in harnessing the power of small-scale hydroelectricity. This trend not only provides reliable electricity to underserved communities but also promotes economic development and reduces reliance on fossil fuels. Governments and investors are increasingly recognizing the potential of small hydropower, driving further investment and innovation in this sector. For instance, in January 2021, Elektroprivreda Bosne i Hercegovine (EPBiH), a state power utility, adopted a three-year business plan. The plan entails investments totaling approximately EUR 850 million, equivalent to around USD 1009.4 million, aimed at generating an electricity output of about 18,433 GWh. It encompasses the construction of small hydropower plants (SHPPs) along the Neretvica river, ongoing development work on hydropower plants (HPPs), and the exploration of new opportunities at the Vlaši? wind farm.

Small Hydropower Market Segmentation

The worldwide market for small hydropower is split based on capacity, type, components, and geography.

Small Hydropower Capacity

- Up to 1 MW

- 1-10 MW

- Others

According to the small hydropower industry analysis, up to 1 MW capacity dominates the small hydropower market. Their popularity stems from their ability to harness the energy of flowing water in rivers or streams, providing a reliable and environmentally friendly source of electricity. These systems often leverage existing infrastructure like dams or weirs, minimizing environmental impact and cost. Additionally, their modular nature allows for scalability, making them suitable for diverse geographical locations and energy demands. As governments and communities prioritize sustainability, the small hydropower sector is expected to continue its growth trajectory, contributing significantly to the global renewable energy.

Small Hydropower Type

- Micro Hydropower

- Mini Hydropower

- Pico Hydropower

Historically, the micro hydropower segment expected to dominates in small hydropower market due to its versatility and accessibility. Micro hydropower systems are typically smaller in scale and can be installed in a wide range of locations, including rural areas and off-grid communities. Additionally, advancements in technology have made micro hydropower more cost-effective and efficient, further driving its market dominance. Its ability to harness energy from small streams or rivers makes it a sustainable option for decentralized energy production, particularly in regions with abundant water resources. As the demand for clean and renewable energy solutions continues to rise, the micro hydropower segment is poised for significant growth and expansion in the small hydropower market.

Small Hydropower Components

- Electromechanical Equipment

- Turbine

- Generator

- Other Equipment (includes inlet valves gates, penstock, governors, and auxiliaries)

- Electric infrastructure

- Civil Works

- Others (includes engineering, structural, management, environmental mitigation, and project development)

According to the small hydropower industry analysis, the civil works segment is dominated due to its crucial role in project implementation. End-users such as government agencies, private developers, and utility companies, oversee the construction of infrastructure like dams, penstocks, and powerhouse structures. Their dominance stems from their responsibility for site selection, permitting, and ensuring compliance with regulatory standards. Additionally, End users often have the financial resources and expertise necessary to manage the complexities of civil works projects, thus exerting significant influence over the market. As a result, partnerships and collaborations with end users are essential for companies operating in the small hydropower sector to secure contracts and drive project success.

Small Hydropower Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Small Hydropower Market Regional Analysis

For several reasons, The Asia-Pacific region stands as a dominant force in the small hydropower market, leveraging its vast geographical diversity and abundant water resources. With an array of emerging economies and ambitious renewable energy goals, countries like China, India, and Vietnam drive significant growth in this sector. This growth trajectory underscores the global shift towards renewable energy sources and highlights the pivotal role of small hydropower in meeting clean energy targets while ensuring environmental sustainability. For instance, in 2022, ANDRITZ disclosed that it secured a contract from HH. Karnchang (Lao) Company Ltd. to supply the electro-mechanical equipment for the Luang Prabang run-of-river hydropower plant. As a result, as demand for clean energy continues to soar, both regions are poised to further capitalize on the opportunities presented by small hydropower, driving innovation and sustainable development across the globe.

Europe emerges as the fastest-growing region in the small hydropower market, propelled by stringent environmental regulations, robust infrastructure, and a growing emphasis on sustainable energy solutions. European nations, including Norway, Austria, and Switzerland, lead the charge with innovative technologies and favorable government policies, fostering a thriving small hydropower industry. For instance, in January 2022, Statkraft initiated the operation of two small hydropower facilities in Norway, boasting a combined installed capacity of 8.5 MW each: the Vesle Kjela power plant and the Storlia power plant.

Small Hydropower Market Players

Some of the top small hydropower companies offered in our report include Siemens, Toshiba, ANDRITZ AG, GE Renewable Energy, Mavel,a.s., Gilbert Gilkes & Gordon Ltd., Voith, BHEL, HNAC Technology Co, Canyon Hydro, and SNC-Lavalin.

Frequently Asked Questions

How big is the small hydropower market?

The small hydropower market size was valued at USD 2.3 billion in 2023.

What is the CAGR of the global small hydropower market from 2024 to 2032?

The CAGR of small hydropower is 2.7% during the analysis period of 2024 to 2032.

Which are the key players in the small hydropower market?

The key players operating in the global market are including Siemens, Toshiba, ANDRITZ AG, GE Renewable Energy, Mavel,a.s., Gilbert Gilkes & Gordon Ltd., Voith, BHEL, HNAC Technology Co, Canyon Hydro, and SNC-Lavalin.

Which region dominated the global small hydropower market share?

Asia Pacific held the dominating position in small hydropower industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of small hydropower during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global small hydropower industry?

The current trends and dynamics in the small hydropower industry include increasing demand for clean and renewable energy sources, government incentives and policies promoting small hydropower development, and technological advancements making small hydropower more efficient and cost-effective.

Which capacity held the maximum share in 2023?

The up to 1 MW capacity held the maximum share of the small hydropower industry.