Sexual Wellness Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Sexual Wellness Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

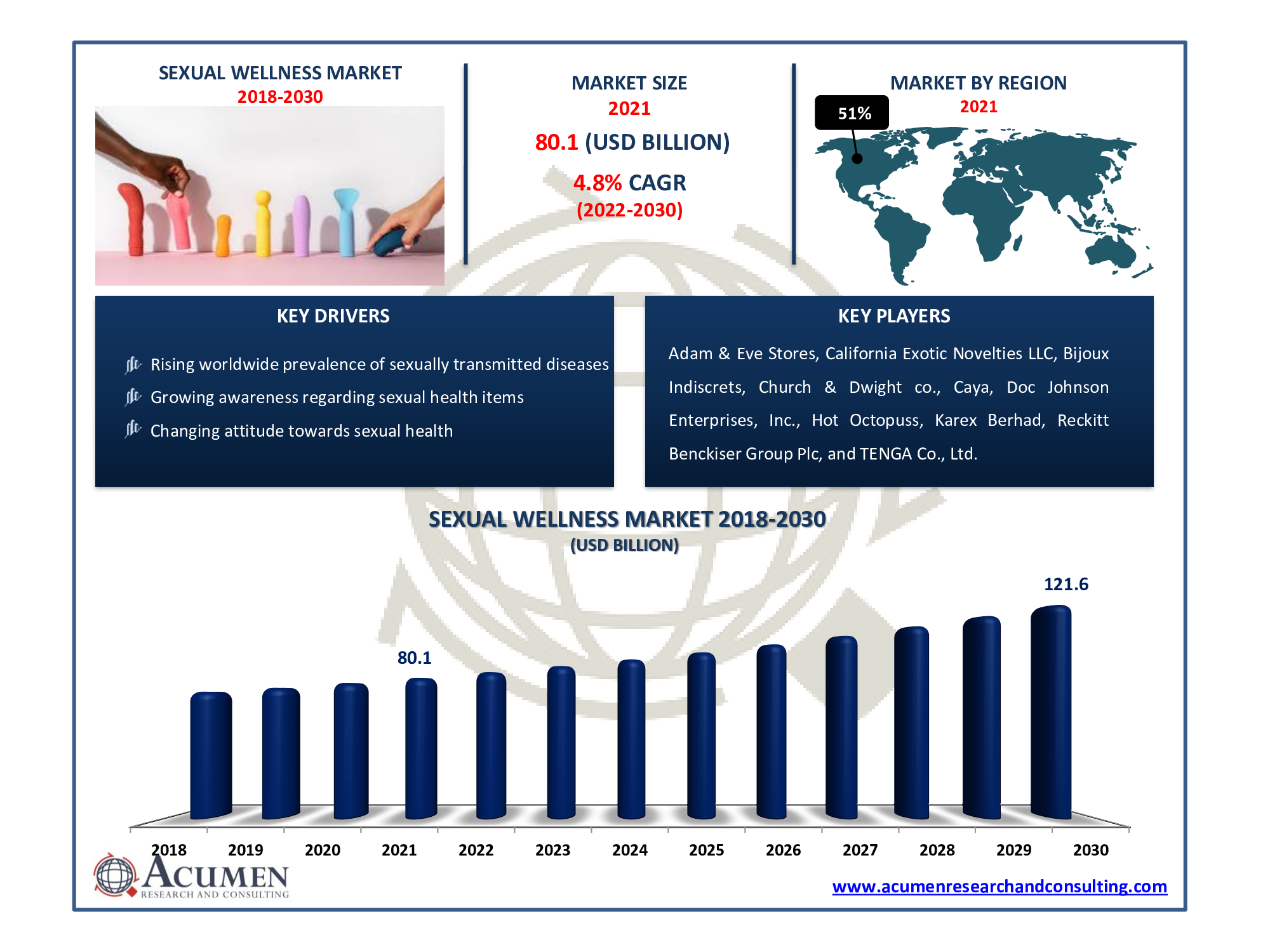

The Global Sexual Wellness Market size was valued at USD 80.1 Billion in 2021 and is estimated to reach USD 121.6 Billion by 2030, growing at a CAGR of 4.8% from 2022 to 2030.

Sexual wellness, as defined by the World Health Organization, is a state of physical, mental, emotional, and social well-being related to sexuality. It is more than just the absence of illness, dysfunction, or infirmity. Sexual health necessitates a positive and respectful attitude toward sexual orientation and sexual relationships, in addition to the ability to have pleasurable and safe sexual experiences that are free of discrimination, coercion, and violence. Sexual wellness is incorporated of several factors, including recognizing and respecting the sexual rights humans share, having access to sexual health information, education, and care, practicing safe sex, and seeking care when needed. The worldwide sexual wellness market revenue has been increasing due to the increasing cases of sexually transmitted diseases such as HIV/AIDs, STIs, and others. Additionally, the growing number of government initiatives to spread awareness about sexual well-being is considered one of the sexual wellness market trends fueling the demand in the coming years.

Sexual Wellness Market Dynamics

Market Growth Drivers:

- Rising worldwide prevalence of sexually transmitted diseases

- Growing awareness regarding sexual health items

- Changing attitude towards sexual health

Market Restraints:

- Lack of awareness and the reduced availability of correct sources for information

- Allergies from latex condoms

Market Opportunities:

- Increasing government initiatives and sex education programs

- New product launches and R&D among key companies

- Easy availability of sexual items by the growing e-commerce industry

Report Coverage

| Market | Sexual Wellness Market |

| Market Size 2021 | USD 80.1 Billion |

| Market Forecast 2030 | USD 121.6 Billion |

| CAGR During 2022 - 2030 | 4.8% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By End-User, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Adam & Eve Stores, California Exotic Novelties LLC, Bijoux Indiscrets, Church & Dwight co., Caya, Doc Johnson Enterprises, Inc., Hot Octopuss, KarexBerhad, Reckitt Benckiser Group Plc, and TENGA Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Growing awareness regarding sexual health items is one of the primary factors boosting the growth of the global sexual wellness market share. Sexual health wellness items include sex toys, condoms and contraceptives, attractive lingerie, individual ointments, and others, such as sex diversions, sexual enhancement supplements, testing cards, pregnancy testing units, and vaginal sexual wellness items, which ensure the safety and enjoyment of sexual experiences. In addition to that, the changing attitude towards sexual health is another factor fueling the sexual wellness market demand. Intimate and personal care products are quickly emerging to be the next huge opportunity as attitudes toward sex and sexual health shift. The transformation of self-care products from a luxury to a requirement has been critical to the market's emergence of sexual wellness products. Items falling under this umbrella blend enjoyment with wellbeing, catering to personal care, masturbation, and menstruation, and are not limited to toys and lubricants. Similarly, female sexual wellness is a huge business opportunity for retailers.

However, openly debating sex and sexual well-being as well as the use of sex toys and other sexual items is still considered taboo in many countries. In addition, the use of condoms can trigger latex allergy among some individuals. Also, a dry lubricant that is used on the surface of latex condoms could cause ovarian cancer as well as fibrosis in fallopian tubes, thereby making women infertile. Furthermore, an increase in government initiatives and sex education programs are considered to be creating numerous growth opportunities for the market throughout the forecasted years. For example, masturbation was recommended by the NYC Health Department as the safest form of sexual activity to minimize contact with others and the spread of COVID-19.

Sexual Wellness Market Segmentation

The global sexual wellness market segmentation is based on product, end-user, distribution channel, and region.

Market by Product

- Male Condoms

- Female Contraceptives

- Sex Toys

- Lubricants & Sprays

- Others

Based on products, the sex toys segment held for the majority of the sexual wellness market share in 2021 and is likely to do the same throughout the forecasted years 2022 – 2030. Sex toys have grown in popularity among the millennial population because of the benefits associated with them. These toys, for example, aid in the enhancement of sexual pleasure and the prevention of sexually transmitted diseases such as HIV/AIDS. The social stigma regarding using a sex toy is fading away, thereby propelling the market demand. Additionally, growing awareness due to various initiatives, increasing importance of self-pleasure, and enjoying sex toys with or without a partner are some factors that are contributing to the growth of sexual wellness market revenue.

Market by End-User

- Men

- Women

- LGBT Community

Women sexual wellness is considered as one of the lucrative segments in the industry. Women's segment growth is driven by an increase in the number of working women, sex education, gender neutrality, and sexual health awareness.Additionally, the growing female childbearing population in the United States, as well as the ease of online shopping and e-commerce, are expected to boost sales of sexual wellness products. Moreover, a rapid growth of sexual products can be witnessed among LGBT community. Rising awareness among LGBT community as well legalization of their marriages in emerging countries like India is likely to create numerous growth opportunities for the expansion of products like dildos, vibrators, lubricants, delay sprays etc.

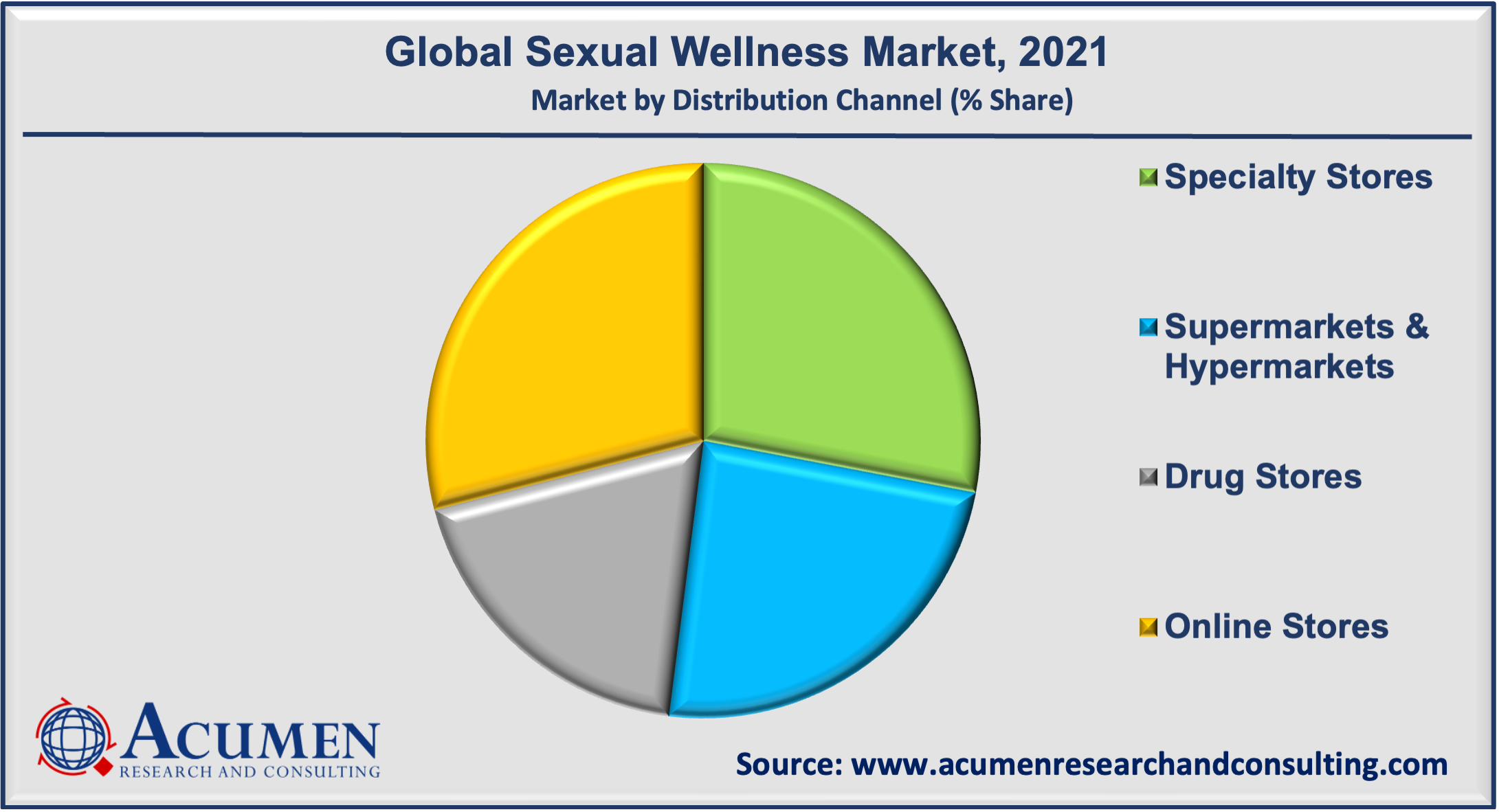

Market by Distribution Channel

- Specialty Stores

- Online Stores

- Drug Stores

- Supermarkets & Hypermarkets

Based on the distribution channel, the online stores' segment generated considerable revenue along with the fastest growth rate throughout the coming years. The growth in internet penetration as well as the widespread availability of products on e-commerce websites has triggered the online sales channel to spur lucrative growth opportunities. Furthermore, the anonymity maintained in product delivery is an added benefit for customers preferring online purchases over specialty or other stores, particularly in the case of sex toys. This factor has also contributed to the expansion of online sales channels.

Sexual Wellness Market Regional Overview

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

The presence of large number of sex toy companies in North America, fuels the regional market growth

Based on regional analysis, the North America region dominated the global sexual wellness market during the predicted timeframe from 2022 to 2030. One of the main reasons for this is the innovation brought by manufacturers in the US market in sex toys and condoms. Additionally, rising awareness of sexually transmitted diseases on the continent is expected to drive market growth. Furthermore, the US government is promoting sexual wellness by promoting safe sex, which is fueling the market's growth.

Sexual Wellness Market Players

Some of the top sexual wellness companies offered in the professional report include Adam & Eve Stores, California Exotic Novelties LLC, Bijoux Indiscrets, Church & Dwight co., Caya, Doc Johnson Enterprises, Inc., Hot Octopuss, KarexBerhad, Reckitt Benckiser Group Plc, and TENGA Co., Ltd.

Frequently Asked Questions

How big was the market size of global sexual wellness market in 2021?

The global sexual wellness market size in 2021 was valued at USD 80.1 Billion.

What will be the projected CAGR for global sexual wellness market during forecast period of 2022 to 2030?

The projected CAGR of sexual wellness market during the analysis period of 2022 to 2030is 4.8%.

Which are the prominent competitors operating in the market?

The prominent players of the global sexual wellness market involve Adam & Eve Stores, Bijoux Indiscrets, California Exotic Novelties LLC, Caya, Church & Dwight co., Doc Johnson Enterprises, Inc., Hot Octopuss, KarexBerhad, Reckitt Benckiser Group Plc, and TENGA Co., Ltd.

Which region held the dominating position in the global sexual wellness market?

North America held the dominating share for sexual wellness during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for sexual wellness during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global sexual wellness market?

Rising worldwide prevalence of sexually transmitted diseases, growing awareness regarding sexual health items, and changing attitude towards sexual health drives the growth of global sexual wellness market.

By segment product, which sub-segment held the maximum share?

Based on product, sex toys segment held the maximum share for sexual wellness market in 2021.