Human Microbiome Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Human Microbiome Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

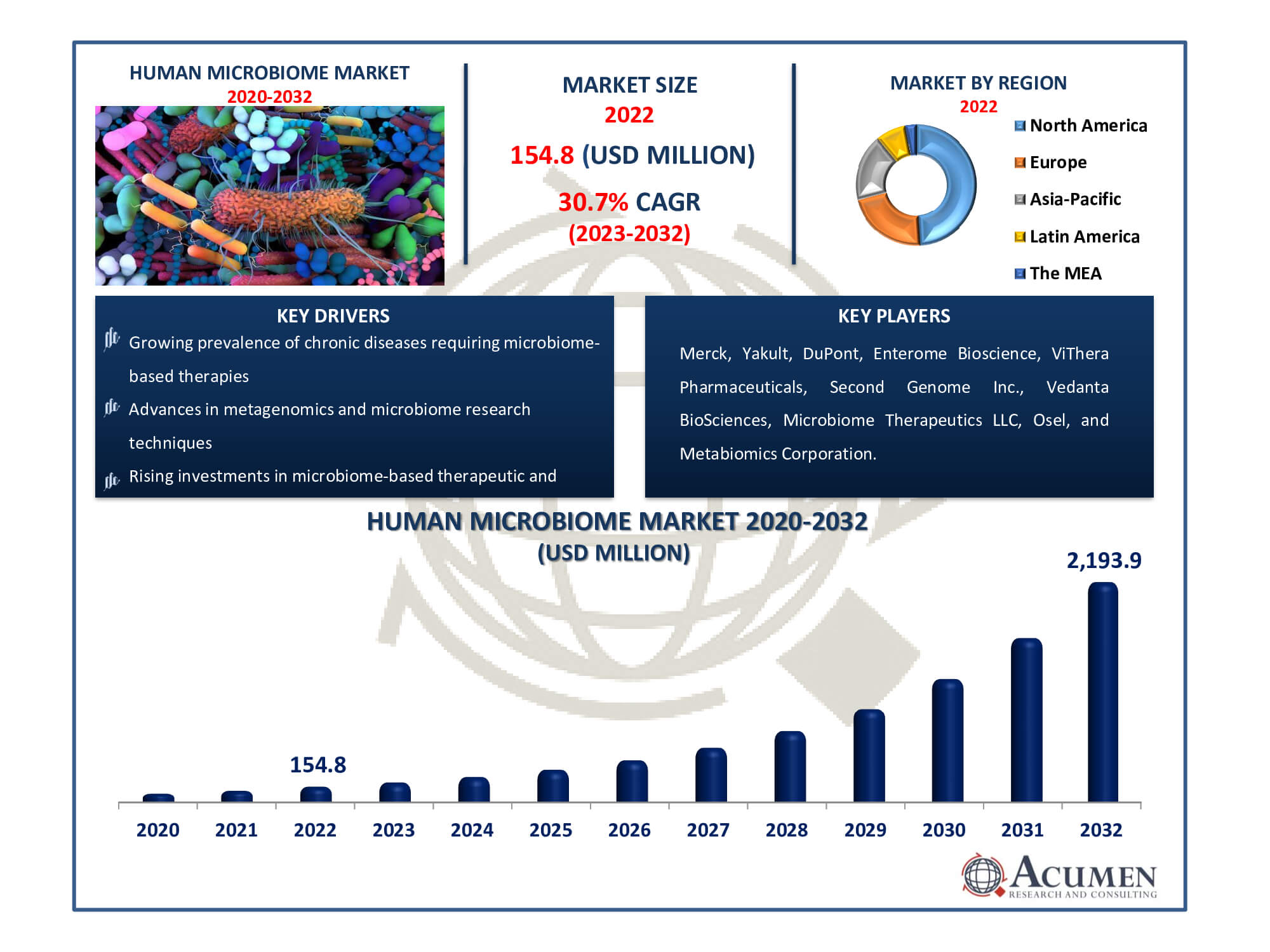

The Human Microbiome Market Size accounted for USD 154.8 Million in 2022 and is estimated to achieve a market size of USD 2,193.9 Million by 2032 growing at a CAGR of 30.7% from 2023 to 2032.

Human Microbiome Market Highlights

- Global human microbiome market revenue is poised to garner USD 2,193.9 million by 2032 with a CAGR of 30.7% from 2023 to 2032

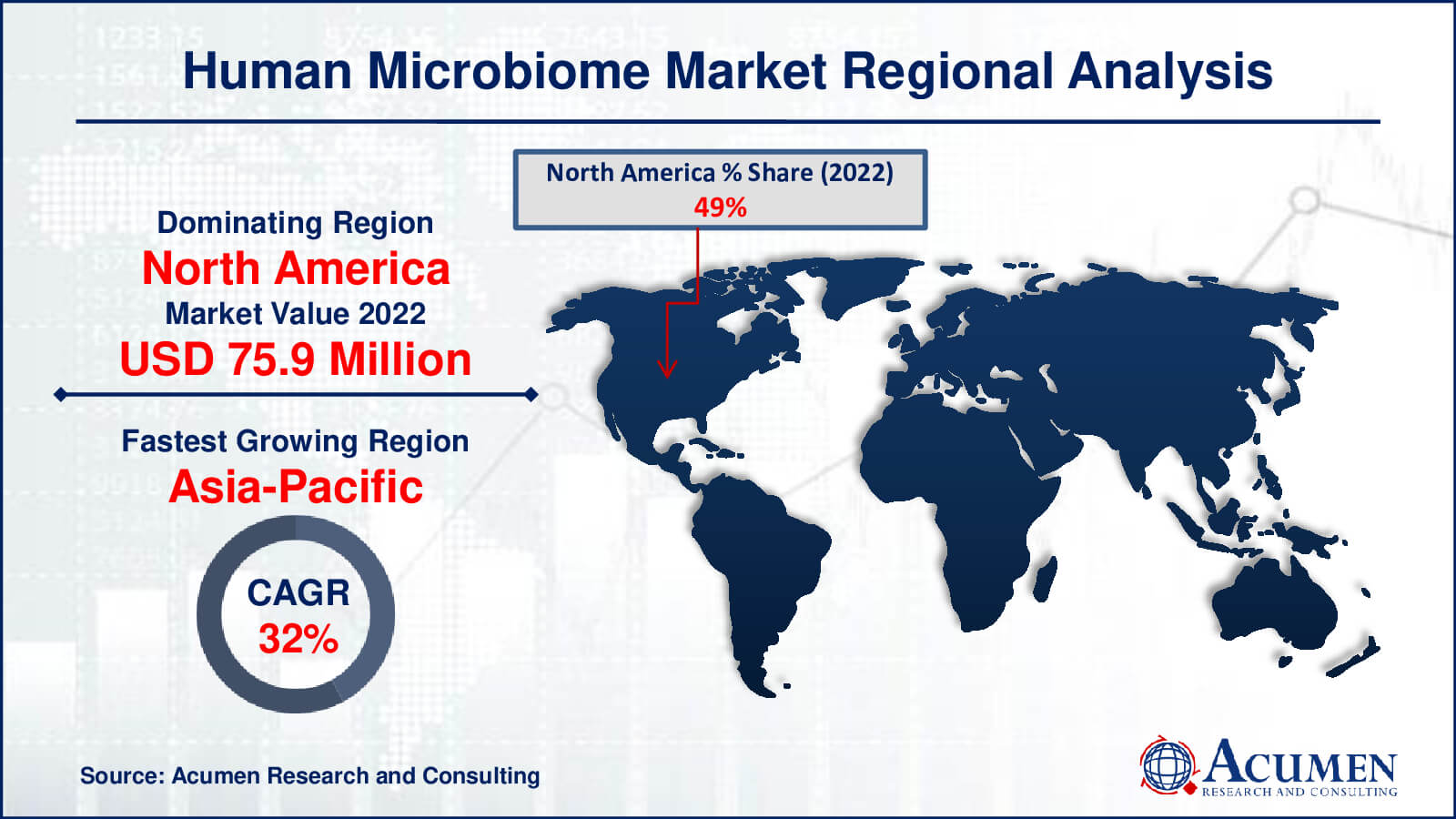

- North America human microbiome market value occupied around USD 75.9 million in 2022

- Asia-Pacific human microbiome market growth will record a CAGR of more than 32% from 2023 to 2032

- Among product, the probiotics sub-segment generated over US$ 62 million revenue in 2022

- Based on application, the therapeutics sub-segment generated around 66% share in 2022

- Collaboration between academic institutions and biotech companies for microbiome research is a popular human microbiome market trend that fuels the industry demand

The microbiome of humans is a vibrant community of microscopic creatures that reside within our bodies, primarily in our skin, gut, and other organs. These microorganisms, which are essential to our health, include fungi, bacteria, and viruses. They support healthy digestion, guard against dangerous intruders, and even have an impact on our immune system and mood. Scientists have recently found that our well-being is significantly influenced by our microbiota. This newly discovered information has sparked an expanding field of study and commercial prospects, from creating personalized medicines to bettering our comprehension of diseases. Scientists, medical practitioners, and businesses collaborate in the human microbiome market to investigate these microscopic worlds and discover novel approaches to maintaining human health.

Global Human Microbiome Market Dynamics

Market Drivers

- Increasing awareness of the impact of the human microbiome on health

- Advances in metagenomics and microbiome research techniques

- Growing prevalence of chronic diseases requiring microbiome-based therapies

- Rising investments in microbiome-based therapeutic and diagnostic research

Market Restraints

- Regulatory Challenges and Uncertainties in microbiome-based product approvals

- Limited understanding of microbiome interactions and their complexity

- Ethical concerns and privacy issues related to microbiome data collection

Market Opportunities

- Development of personalized microbiome-based therapies

- Expansion of microbiome research in areas like oncology and neurology

- Integration of microbiome data into healthcare and wellness applications

Human Microbiome Market Report Coverage

| Market | Human Microbiome Market |

| Human Microbiome Market Size 2022 | USD 154.8 Million |

| Human Microbiome Market Forecast 2032 | USD 2,193.9 Million |

| Human Microbiome Market CAGR During 2023 - 2032 | 30.7% |

| Human Microbiome Market Analysis Period | 2020 - 2032 |

| Human Microbiome Market Base Year |

2022 |

| Human Microbiome Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Disease, By Application, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Merck, Yakult, DuPont, Enterome Bioscience, ViThera Pharmaceuticals, Second Genome Inc., Vedanta BioSciences, Microbiome Therapeutics LLC, Osel, and Metabiomics Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Human Microbiome Market Insights

One of the key factors influencing the global human microbiome market is the growing incidence of chronic diseases, including diabetes, cancer, and obesity, coupled with an expanding geriatric population. For example, in 2010, 285 million people worldwide had diabetes, and it is estimated to reach 439 million by 2030, as reported by the National Biotechnology Information Centre (NCBI). The increasing prevalence of diabetes has significantly boosted the demand for human microbiome therapies for its treatment. Additionally, the rising awareness of the benefits of microbiome products among the public is contributing to the global growth of the human microbiome industry. However, stringent regulatory controls serve as a hindrance to the global microbiome market's expansion. Progress in biomedical research is providing valuable resources to the worldwide microbiome market. The global human microbiome market has been shaped by increasing mergers and acquisitions among key players and government partnerships.

The rising incidence of metabolic disorders, such as cancer, Crohn's disease, and bowel syndrome, has driven the growth of the global human microbiome sector. The presence of specialized research centers dedicated to human microbiomes has further expanded the industry. Recent advancements in the healthcare sector have been instrumental in fostering the global human microbiome market's expansion, especially in the research and treatment of metabolic conditions and diseases.

The increasing technological advancements in metagenomics and next-generation sequencing have simplified and made microbiome-based research more cost-effective. These advances allow for the rapid evaluation of the genomic composition of microorganisms from human samples, streamlining the development of microbiome-based diagnostics. In 2019, gastrointestinal and metabolic disorders were expected to dominate the market, with a growing interest in developing simplified therapeutic approaches for bowel syndrome and Crohn's disease. While cancer was projected to have a smaller market share compared to gut health and metabolic disorders, there is a business opportunity for diagnostic tests to identify cancer. For instance, Metabiomics has established diagnostic tests for colorectal cancer markers that offer a non-invasive alternative to traditional colonoscopy, using stool samples to analyze the patient's gut microbiome.

Human Microbiome Market Segmentation

The worldwide market for human microbiome is split based on product, disease, application, distribution channel, and geography.

Human Microbiome Products

- Probiotics

- Prebiotics

- Medical Foods

- Diagnostic Device

- Drugs

- Supplements

In 2022, in terms of products, the probiotics segment holds the largest market share. The human microbiome industry analysis indicates that the durg segment has taken the lead after probiotics. This is primarily due to the development of medications based on the microbiome that cater to a wide range of medical disorders, as suggested by market forecast. These medications utilize our expanding understanding of the human microbiome to offer specialized therapies for various illnesses, such as autoimmune diseases, infections, and gastrointestinal disorders. The pharmaceutical sector, backed by substantial research and investments in microbiome-based therapeutics, has propelled the medicines segment to the forefront. This has enabled the pharmaceutical business to provide innovative and effective therapeutic solutions, further contributing to its dominance in the human microbiome market.

Human Microbiome Diseases

- Obesity

- Diabetes

- Autoimmune Disorders

- Cancer

- Mental Disorders

- Others

According to the human microbiome market forecast, obesity disease is expected to acquire market dominance throughout 2023 to 2032. Research indicated a significant link between the human microbiome and obesity, offering potential for microbiome-based therapies to effectively address weight management. As obesity represents a global health challenge, the demand for microbiome-based remedies was projected to increase. Nevertheless, market dynamics can shift rapidly, so it is imperative to refer to the most recent market data and reports to confirm the current dominant sector in the human microbiome market, as the landscape may have evolved since then.

Human Microbiome Applications

- Therapeutics

- Diagnostics

Therapeutic applications are expected to hold the highest market share in the human microbiome space. Several organizations are actively developing products targeting various disease areas, each employing proprietary systems and innovative methods for market analysis and microbiome-based diagnostics. A common approach involves the use of living bacteria, either as single agents or in combinations, in a variety of products. Some companies are even engineering bacteria to assume different biochemical roles in order to combat specific and unusual conditions.

Human Microbiome Distribution Channels

- Supermarket & Hypermarket

- Retail Pharmacies

- Online Pharmacies

According to the market analysis, the online pharmacy category was developing and appeared to be the most important distribution channel in the human microbiome market. Customers seeking microbiome-related items and supplements have been increasingly drawn to online pharmacies due to their convenience and accessibility. This trend is being driven by the growing popularity of online shopping, particularly for health and wellness products. However, market dynamics can shift quickly, so it's crucial to review the most recent market data and reports to precisely identify the current leading distribution channel in the human microbiome market, as the landscape may have evolved since then

Human Microbiome Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Human Microbiome Market Regional Analysis

In terms of regional segments, North America has consistently held the largest revenue share in the human microbiome market in recent years. This growth can be attributed to increased government investments in the military, defense, and security sectors. In the United States, the demand for human microbiome has risen due to concerns regarding terrorist operations, further bolstering market growth in the region.

Europe follows closely behind with the second-largest revenue share in the human microbiome market. Germany, in particular, has shown a significant focus on advancing defense technologies, leading to an increase in the adoption of human microbiome systems. The rising demand for defense technology in Europe is expected to drive further growth in the market in the coming years.

The Asia-Pacific region, on the other hand, is experiencing the fastest growth in the human microbiome market. China, in particular, is witnessing a surge in the adoption of robotic systems, coupled with increasing emphasis on artificial intelligence (AI) applications, especially in the security and defense sectors. The government's focus on developing defense human microbiomeic systems is anticipated to be a key driver for market growth in the Asia-Pacific region.

Human Microbiome Market Players

Some of the top human microbiome companies offered in our report include Merck, Yakult, DuPont, Enterome Bioscience, ViThera Pharmaceuticals, Second Genome Inc., Vedanta BioSciences, Microbiome Therapeutics LLC, Osel, and Metabiomics Corporation.

Frequently Asked Questions

How big is the human microbiome market?

The human microbiome market was USD 154.8 million in 2022.

What is the CAGR of the global human microbiome market from 2023 to 2032?

The CAGR of human microbiome is 30.7% during the analysis period of 2023 to 2032.

Which are the key players in the human microbiome market?

The key players operating in the global market are including Merck, Yakult, DuPont, Enterome Bioscience, ViThera Pharmaceuticals, Second Genome Inc., Vedanta BioSciences, Microbiome Therapeutics LLC, Osel, and Metabiomics Corporation.

Which region dominated the global human microbiome market share?

North America held the dominating position in human microbiome industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of human microbiome during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global human microbiome industry?

The current trends and dynamics in the human microbiome industry include increasing awareness of the impact of the human microbiome on health, advances in metagenomics and microbiome research techniques, growing prevalence of chronic diseases requiring microbiome-based therapies, and rising investments in microbiome-based therapeutic and diagnostic research.

Which application held the maximum share in 2022?

The therapeutics application held the maximum share of the human microbiome industry.