Satellite Ground Station Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Satellite Ground Station Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

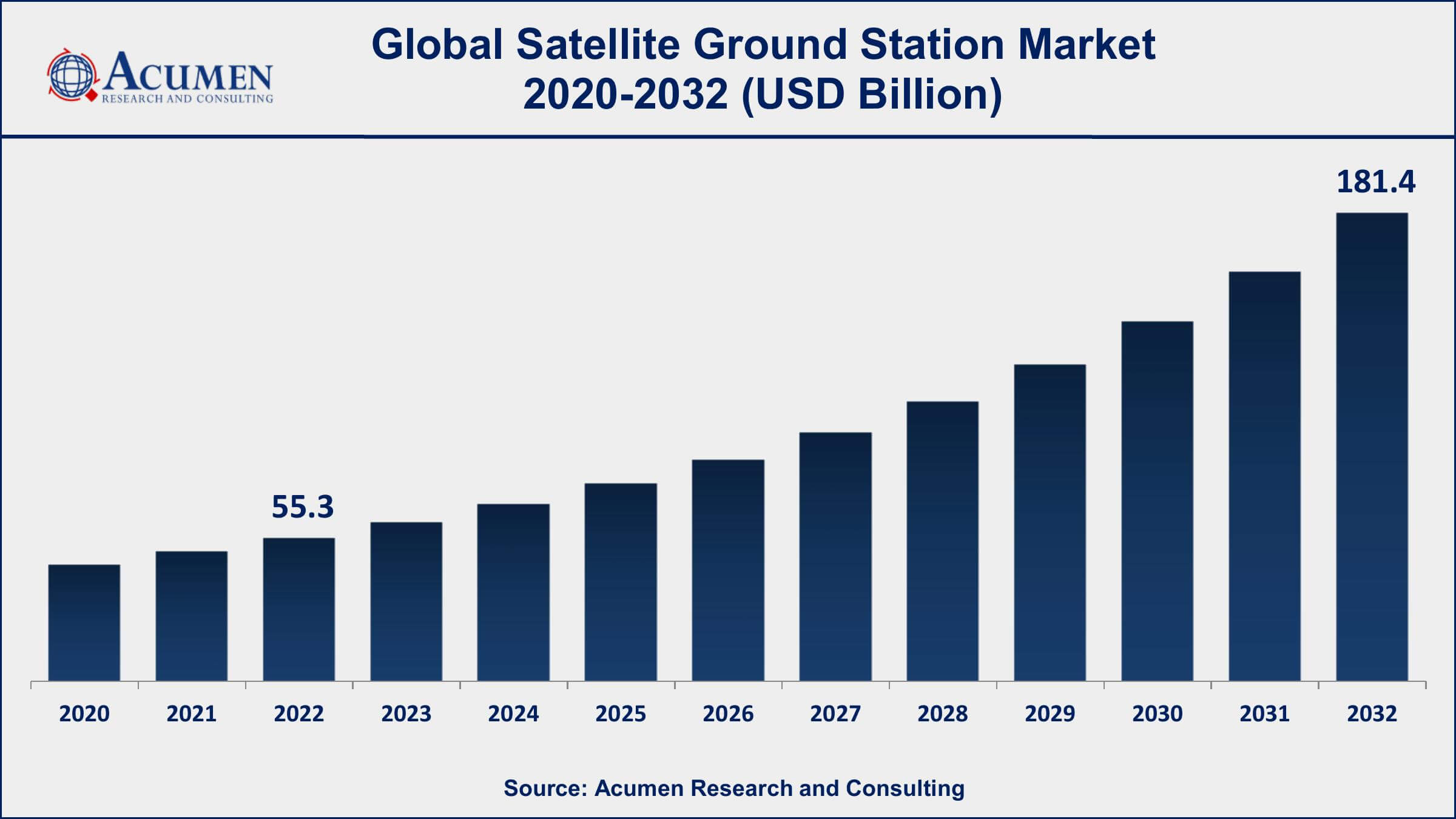

The Global Satellite Ground Station (SGS) Market Size accounted for USD 55.3 Billion in 2022 and is projected to achieve a market size of USD 181.4 Billion by 2032 growing at a CAGR of 12.8% from 2023 to 2032.

Satellite Ground Station (SGS) Market Highlights

- Global satellite ground station market revenue is expected to increase by USD 181.4 Billion by 2032, with a 12.8% CAGR from 2023 to 2032

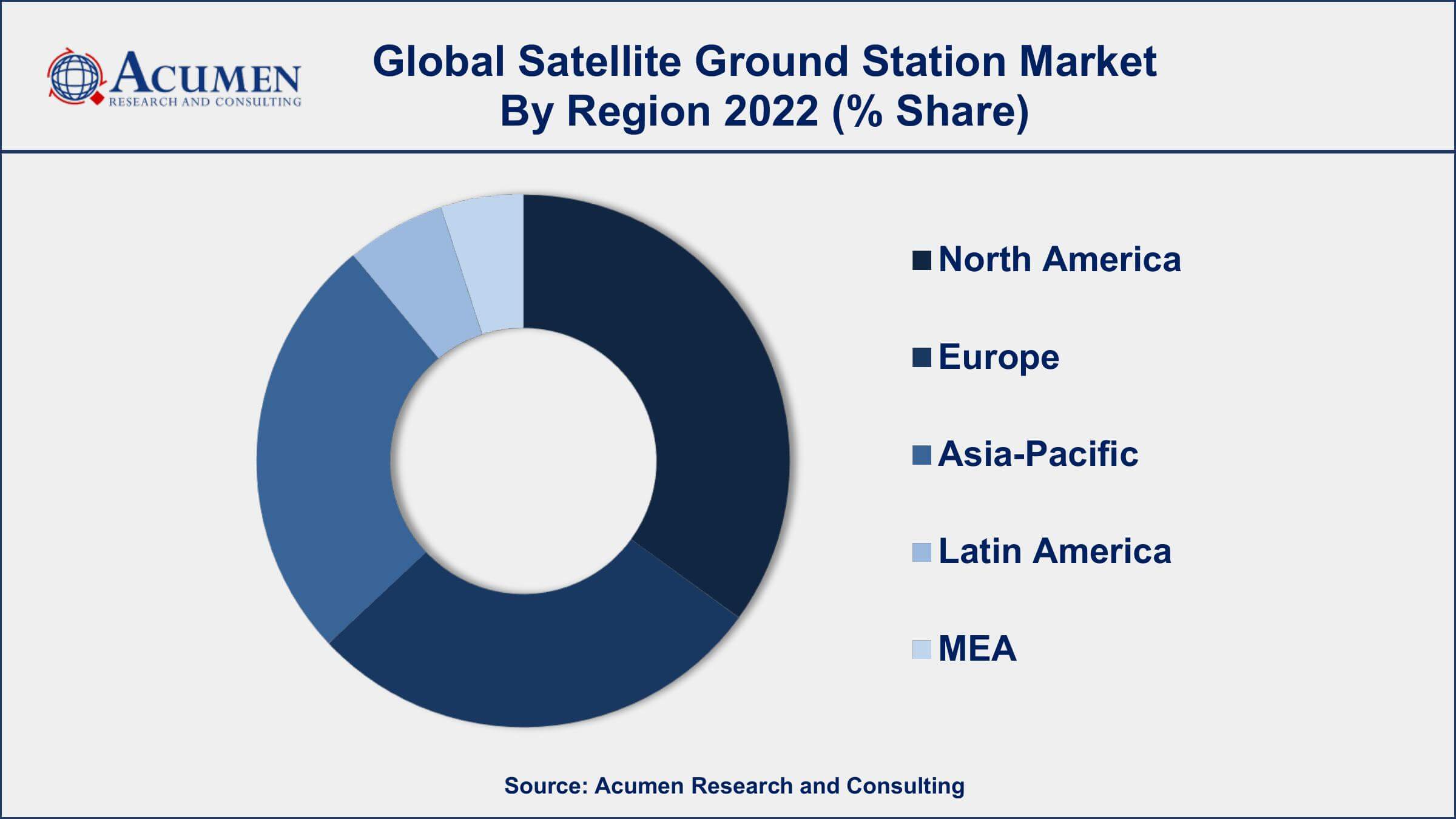

- North America region led with more than 41% of satellite ground station (SGS) market share in 2022

- Europe satellite ground station market growth will record a CAGR of around 14% from 2023 to 2032

- By platform, the fixed segment has recorded more than 64% of the revenue share in 2022

- By orbit, the market is divided into low earth orbit (LEO) segment has accounted more than 52% of the revenue share in 2022

- Increasing demand for high-speed internet and data connectivity in remote areas, drives the satellite ground station market value

A satellite ground station, also known as a ground terminal or earth station, is a crucial part of the satellite communication system. It serves as the interface between satellites in space and terrestrial networks, enabling communication, data transmission, and control of satellites. Ground stations consist of various equipment, such as antennas, receivers, transmitters, and signal processing systems. They are strategically located across the globe to ensure continuous coverage and seamless communication with satellites as they orbit the Earth.

The market for satellite ground stations has witnessed significant growth in recent years. This growth can be attributed to the increasing demand for satellite-based communication services, such as broadband internet, broadcasting, navigation, remote sensing, and military applications. With the proliferation of small satellites and mega-constellations, there is a greater need for a robust and reliable ground station infrastructure to manage and control these satellites effectively. Moreover, advancements in satellite technology, including high-throughput satellites and software-defined ground stations, have driven the adoption of more sophisticated ground station solutions.

Global Satellite Ground Station Market Trends

Market Drivers

- Increasing demand for high-speed internet and data connectivity in remote areas

- Growing deployment of small satellites and constellations

- Advancements in ground station technology, including phased array antennas and SDR solutions

- Rising applications of satellite technology in various sectors, such as agriculture and environmental monitoring

- Government and private sector investment in space exploration and satellite communication

Market Restraints

- Spectrum management and regulatory challenges

- Competition from terrestrial communication networks

- High initial setup costs for satellite ground station infrastructure

Market Opportunities

- Expansion of satellite services for disaster management and emergency response

- Demand for satellite ground stations in autonomous vehicles and drone communication

Satellite Ground Station Market Report Coverage

| Market | Satellite Ground Station Market |

| Satellite Ground Station Market Size 2022 | USD 55.3 Billion |

| Satellite Ground Station Market Forecast 2032 | USD 181.4 Billion |

| Satellite Ground Station Market CAGR During 2023 - 2032 | 12.8% |

| Satellite Ground Station Market Analysis Period | 2020 - 2032 |

| Satellite Ground Station Market Base Year | 2022 |

| Satellite Ground Station Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Platform, By Orbit, By Function, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | SES S.A., Intelsat, Eutelsat Communications, Viasat Inc., Inmarsat, Telesat Canada, Thales Alenia Space, Gilat Satellite Networks, General Dynamics SATCOM Technologies, SSL (Space Systems/Loral), Iridium Communications Inc., and COMSAT (Communication Satellite Corporation) |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A satellite ground station serves as the intermediary link between communication satellites orbiting the Earth and terrestrial communication networks. These ground stations are equipped with antennas and other sophisticated equipment that receive and transmit signals to and from satellites in space. When satellites pass over the station's coverage area, they establish a communication link with the ground station, enabling the transfer of data, voice, video, and other forms of communication. Satellite ground stations are strategically located across the globe to ensure continuous coverage and seamless communication with satellites in various orbits.

Satellite ground stations have a wide range of applications across different industries. One of the primary applications is satellite-based internet services. In remote or rural areas where traditional terrestrial internet infrastructure is limited or unavailable, satellite ground stations play a crucial role in delivering high-speed broadband internet. They enable internet access in regions where laying physical cables is not feasible or economically viable. Additionally, satellite ground stations are extensively used for satellite television broadcasting, allowing users to receive television channels and content from satellites directly to their homes. This technology has revolutionized the broadcasting industry, providing a wide range of channels and content to viewers worldwide.

The satellite ground station market had been experiencing steady growth with the increasing demand for satellite-based communication services and applications. One of the key drivers behind this growth is the rising need for high-speed internet and data connectivity in remote and underserved regions. Satellite ground stations play a critical role in providing broadband services to areas where traditional terrestrial infrastructure is limited or unavailable, making them essential for bridging the digital divide. Additionally, the growing deployment of small satellites and constellations, including CubeSats and nanosatellites, has created new opportunities in the market. These smaller satellites require more ground stations to maintain a continuous communication link, leading to an increased demand for ground station services and equipment.

Satellite Ground Station Market Segmentation

The global satellite ground station market segmentation is based on platform, orbit, function, end use, and geography.

Satellite Ground Station Market By Platform

- Fixed

- Mobile

- Portable

According to the satellite ground station industry analysis, the fixed segment accounted for the largest market share in 2022. Fixed ground stations are stationary installations equipped with antennas and other communication equipment that maintain a constant link with geostationary satellites. One of the key drivers of growth in this segment is the increasing demand for satellite-based broadband services. Fixed ground stations play a crucial role in providing high-speed internet connectivity to remote and rural areas where terrestrial infrastructure is limited. As the demand for internet access continues to rise globally, especially in developing regions, the deployment of fixed ground stations to cater to these underserved areas has been on the rise.

Satellite Ground Station Market By Orbit

- Low Earth Orbit (LEO)

- Geostationary Earth Orbit (GEO)

- Medium Earth Orbit (MEO)

In terms of orbits, the low earth orbit (LEO) segment is expected to witness significant growth in the coming years. The rise of LEO satellites can be attributed to the proliferation of satellite constellations, which consist of hundreds or even thousands of smaller satellites orbiting the Earth at lower altitudes compared to traditional geostationary satellites. LEO satellites offer several advantages, including reduced latency, increased data throughput, and enhanced global coverage, making them well-suited for various applications, such as internet connectivity, Earth observation, and Internet of Things (IoT) services. The LEO segment's growth is primarily driven by the increasing deployment of mega-constellations by prominent companies and startups alike.

Satellite Ground Station Market By Function

- Communication

- Navigation

- Space research

- Earth observation

- Others

According to the satellite ground station market forecast, the communication segment is expected to witness significant growth in the coming years. Communication satellites are widely used for various applications, including broadband internet services, television broadcasting, mobile communication, and data transmission. Ground stations serve as the essential interface between these communication satellites in space and the terrestrial communication networks, enabling seamless connectivity and data exchange. One of the primary factors contributing to the growth of the communication segment is the increasing demand for high-speed internet connectivity. Satellite-based broadband services provided by communication satellites and ground stations play a crucial role in bridging the digital divide, especially in rural and remote areas where traditional terrestrial infrastructure is limited. As more regions seek reliable and high-quality internet services, the demand for ground stations that support communication satellites is expected to rise.

Satellite Ground Station Market By End Use

- Commercial

- Government

- Defense

Based on the end use, the commercial segment is expected to continue its growth trajectory in the coming years. Commercial satellite ground stations are facilities operated by private companies and service providers to offer various satellite communication services and applications to a wide range of customers. The growth of the commercial segment can be attributed to the increasing demand for satellite-based services in various industries. One of the key drivers is the rising need for high-speed internet connectivity in remote and underserved areas. Commercial ground stations play a vital role in providing broadband services to businesses, governments, and individuals in regions where traditional terrestrial infrastructure is not feasible or cost-effective. As the global demand for internet access continues to grow, driven by the digital transformation of businesses and the increasing reliance on online services, the commercial segment of the SGS market is poised for further expansion.

Satellite Ground Station Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Satellite Ground Station Market Regional Analysis

Geographically, North America dominates the satellite ground station market in 2022. North America is home to some of the world's most prominent and technologically advanced satellite operators, manufacturers, and ground station service providers. Companies like SpaceX, Amazon's Project Kuiper, OneWeb, and Intelsat, among others, have been actively investing in satellite constellations and ground station infrastructure to support various communication and data services. The presence of these major players has contributed to North America's leading position in the market. Moreover, the region's strong and well-established aerospace and communication industries have provided a solid foundation for the satellite ground station market to thrive. North America has a long history of space exploration and satellite technology development, with significant expertise in satellite manufacturing, launch services, and ground station operations. This accumulated experience and knowledge have allowed North American companies to lead the way in developing cutting-edge ground station technologies and offering reliable communication services to customers worldwide.

Satellite Ground Station Market Player

Some of the top satellite ground station market companies offered in the professional report include SES S.A., Intelsat, Eutelsat Communications, Viasat Inc., Inmarsat, Telesat Canada, Thales Alenia Space, Gilat Satellite Networks, General Dynamics SATCOM Technologies, SSL (Space Systems/Loral), Iridium Communications Inc., and COMSAT (Communication Satellite Corporation).

Frequently Asked Questions

What was the market size of the global satellite ground station in 2022?

The market size of satellite ground station was USD 55.3 Billion in 2022.

What is the CAGR of the global satellite ground station (SGS) market from 2023 to 2032?

The CAGR of satellite ground station is 12.8% during the analysis period of 2023 to 2032.

Which are the key players in the satellite ground station market?

The key players operating in the global market are including SES S.A., Intelsat, Eutelsat Communications, Viasat Inc., Inmarsat, Telesat Canada, Thales Alenia Space, Gilat Satellite Networks, General Dynamics SATCOM Technologies, SSL (Space Systems/Loral), Iridium Communications Inc., and COMSAT (Communication Satellite Corporation).

Which region dominated the global satellite ground station market share?

North America held the dominating position in satellite ground station industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of satellite ground station during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global satellite ground station industry?

The current trends and dynamics in the satellite ground station industry include increasing demand for high-speed internet and data connectivity in remote areas, and rising applications of satellite technology in various sectors, such as agriculture and environmental monitoring.

Which orbit held the maximum share in 2022?

The low earth orbit (LEO) held the maximum share of the SGS industry.