Renewable Energy Investment Market Size - Global Industry Analysis, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Renewable Energy Investment Market Size - Global Industry Analysis, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

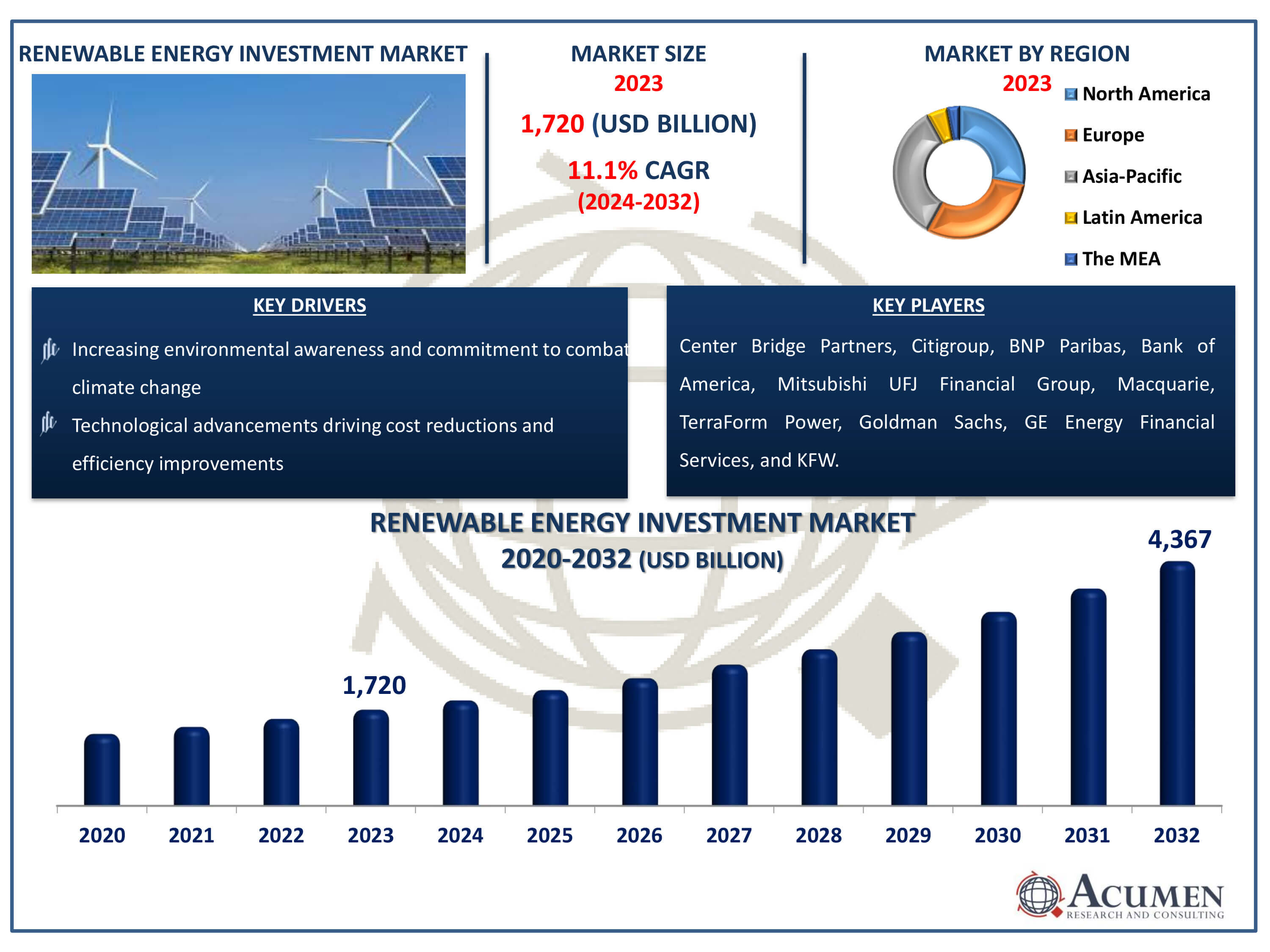

The Renewable Energy Investment Market Size accounted for USD 1,720 Billion in 2023 and is estimated to achieve a market size of USD 4,367 Billion by 2032 growing at a CAGR of 11.1% from 2024 to 2032.

Renewable Energy Investment Market Highlights

- Global renewable energy investment market revenue is poised to garner USD 4,367 billion by 2032 at CAGR of 11.1% from 2024 to 2032

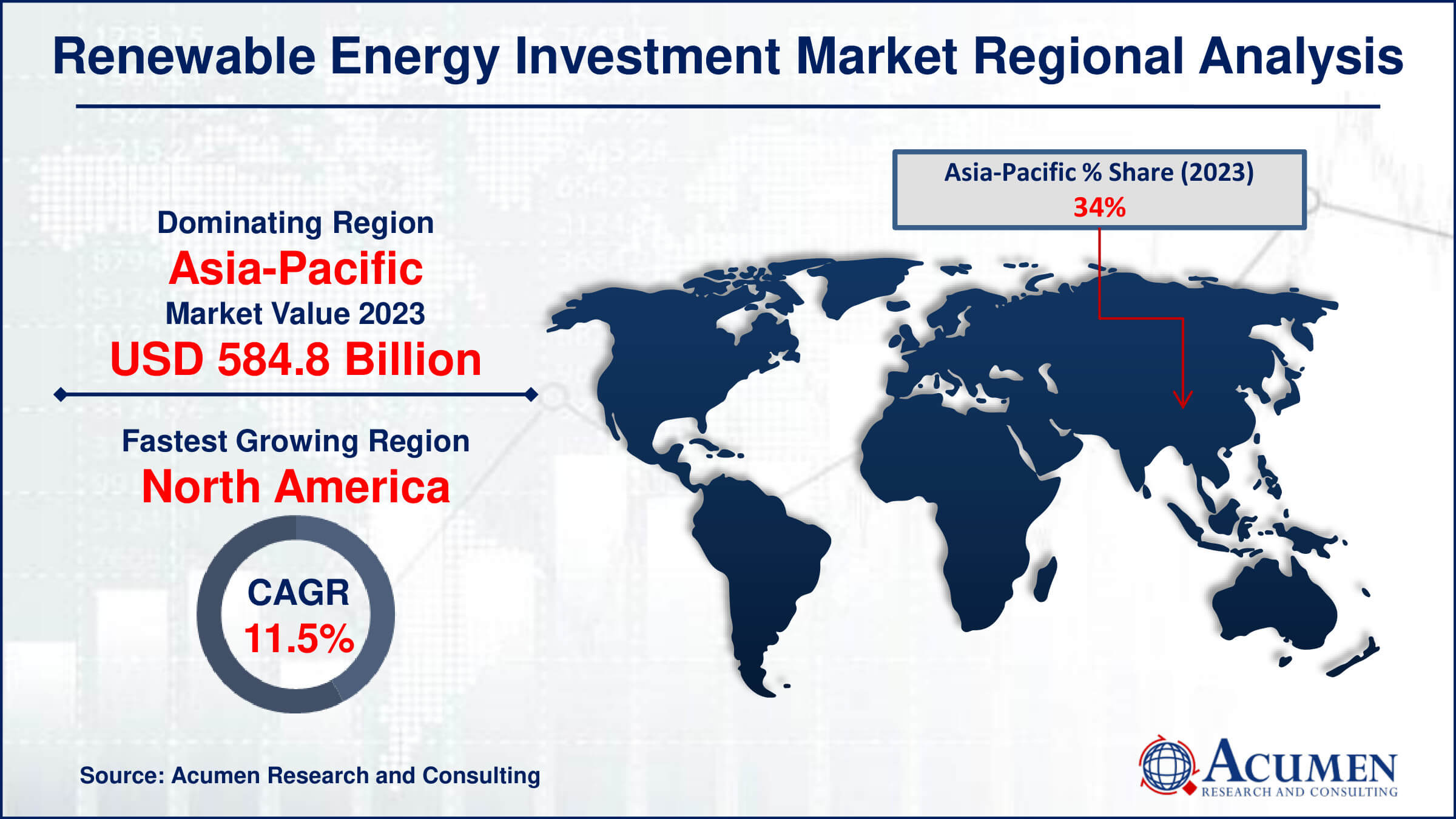

- Asia-Pacific renewable energy investment market value occupied around USD 584.8 billion in 2023

- North America renewable energy investment market growth will record a CAGR of more than 11.5% from 2024 to 2032

- Among product, the solar energy sub-segment generated noteworthy revenue in 2023

- Based on organization type, the energy company generated significant renewable energy investment market share in 2023

- Advancements in energy storage technologies enhancing grid stability and flexibility is a popular renewable energy investment market trend that fuels the industry demand

Natural resources used to generate renewable energy include tidal power, geothermal, biomass, wind, wave, and solar energy. Both corporations and governments are making significant investments in the enhancement and development of new renewable energy sources. These resources create huge amounts of energy while reducing greenhouse gas emissions that contribute to climate change. This coordinated push towards renewable energy not only improves sustainability, but it also stimulates economic growth and lowers dependency on fossil fuels. As societies recognize the significance of switching to cleaner energy sources, the renewable energy sector grows, providing great prospects for innovation and investment.

Global Renewable Energy Investment Market Dynamics

Market Drivers

- Government incentives and policies promoting renewable energy adoption

- Increasing environmental awareness and commitment to combat climate change

- Technological advancements driving cost reductions and efficiency improvements

- Growing demand for sustainable energy solutions amid global energy transition

Market Restraints

- Initial high capital costs and investment risks associated with renewable energy projects

- Regulatory uncertainties and policy fluctuations impacting investment confidence

- Challenges in integrating renewable energy into existing infrastructure and grids

Market Opportunities

- Expanding global market for renewable energy technologies and services

- Innovative financing models and partnerships facilitating project development

- Emerging markets offering untapped potential for renewable energy investment

Renewable Energy Investment Market Report Coverage

| Market | Renewable Energy Investment Market |

| Renewable Energy Investment Market Size 2022 | USD 1,720 Billion |

| Renewable Energy Investment Market Forecast 2032 |

USD 4,367 Billion |

| Renewable Energy Investment Market CAGR During 2023 - 2032 | 11.1% |

| Renewable Energy Investment Market Analysis Period | 2020 - 2032 |

| Renewable Energy Investment Market Base Year |

2022 |

| Renewable Energy Investment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Offering, By Organization Type, By Technology, By Investment Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Center Bridge Partners, Citigroup, BNP Paribas, Bank of America, Mitsubishi UFJ Financial Group, Macquarie, TerraForm Power, Goldman Sachs, GE Energy Financial Services, KFW, and EKF. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Renewable Energy Investment Market Insights

The renewable energy investment market is growing rapidly due to various factors. Firstly, there has been a significant increase in financing for renewable energy projects. This influx of finance is being driven by a range of stakeholders, including governments, private investors, and financial institutions, who recognize renewable energy's potential to combat climate change and meet sustainability objectives. The increased investment in wind and solar energy projects, in particular, demonstrates growing confidence in these technologies as viable alternatives to traditional fossil fuel-based energy sources. These investments not only contribute to increasing renewable energy capacity but also stimulate innovation and efficiency improvements in the sector.

However, despite the positive economic trajectory, uncertainty surrounding investments presents a significant obstacle. Regulatory changes, market volatility, and policy adjustments can all pose risks and deter investors from investing in renewable energy projects. These uncertainties can lead to project delays, higher costs, and reduced investor confidence, ultimately hindering the expansion of the renewable energy investment sector.

Nonetheless, providing equity funding to enterprises focusing on renewable energy offers a viable solution to address these challenges. Equity finance provides organizations with the funds they need to develop projects, expand operations, and explore growth opportunities. As more investors recognize the long-term promise and financial feasibility of renewable energy projects, the availability of equity funding is expected to grow. This infusion of equity capital not only enhances the scalability of renewable energy projects but also instills confidence in investors by aligning their interests with the success of these businesses

Renewable Energy Investment Market Segmentation

The worldwide market for renewable energy investment is split based on product, offering, organization type, technology, investment types, application, and geography.

Renewable Energy Investment Market By Product

- Solar Energy

- Wind Energy

- Hydro Energy

- Biomass Energy

- Ocean Energy

According to renewable energy investment industry analysis, solar energy is often the focus of the market. Solar energy has grown significantly in recent years due to a variety of variables. First, advances in photovoltaic technology have greatly decreased the cost of solar panel manufacture, making solar energy more competitive with traditional energy sources. Secondly, global government incentives and regulations, such as tax credits and feed-in tariffs, have accelerated the deployment of solar energy systems. Furthermore, solar energy is scalable and versatile, making it suited for a wide range of applications, including residential roofs and utility-scale solar farms. Its enormous resource availability and relatively minimal environmental effect add to its appeal as a sustainable energy source. Overall, these considerations make solar energy the largest part of the renewable energy investment market.

Renewable Energy Investment Market By Offering

- Service

- Platform

The service sector is often the larger of the service and platform offerings, and it is expected to grow over the forecast period in the renewable energy investment industry. This is because renewable energy projects frequently require a wide range of specialized services throughout their lifespan, such as consulting, engineering, construction, maintenance, and asset management. Service providers play a crucial role in the development, operation, and optimization of renewable energy assets by providing knowledge and assistance to project developers, investors, and operators. With the growing complexity and scope of renewable energy projects, the demand for bespoke services is increasing, making the service sector the dominant offering in the renewable energy investment market.

Renewable Energy Investment Market By Organization Type

- Private Equity Firm

- Banking Institution

- Energy Company

- Asset Manager

- Others

The energy company category is predicted to be the largest among all organization types in the renewable energy investment industry. Energy firms, encompassing both traditional and renewable sources, possess substantial experience, resources, and infrastructure for developing, operating, and investing in renewable energy projects. As the global transition to greener energy sources intensifies, energy corporations are diversifying their portfolios to include renewable energy assets. Their established market position, financial capabilities, and existing client base provide them with a competitive edge in the renewable energy sector.

Furthermore, energy firms often have long-term strategic goals aligned with sustainability and are well-positioned to capitalize on the increasing demand for renewable energy solutions, establishing them as market leaders. With their robust infrastructure and commitment to sustainability, energy companies are poised to play a significant role in driving the growth and adoption of renewable energy technologies in the coming years

Renewable Energy Investment Market By Technology

- Photovoltaic

- Concentrated Solar Power

- Wind Turbines

- Small Hydro

- Biomass Conversion

- Tidal and Wave Energy

Photovoltaic (PV) technology is expected to emerge as the most significant category in the renewable energy investment market. Also known as solar panels, PV technology has experienced rapid growth and widespread popularity owing to its adaptability, scalability, and cost-effectiveness. PV systems directly convert sunlight into energy and can be deployed across various settings, ranging from residential rooftops to utility-scale solar farms. Factors such as government incentives, technological advancements, and increasing environmental awareness have contributed to the swift expansion of the PV market. Additionally, PV installations are typically swift to deploy and have minimal environmental impact, making them attractive investments for both individual users and large-scale energy providers. As a result, the photovoltaic category is anticipated to dominate the renewable energy investment market throughout the forecast period.

Renewable Energy Investment Market By Investment Type

- Equity Investment

- Debt Financing

- Project Financing

- Public-Private Partnerships

The project financing subsegment is likely to dominate the market. Project finance entails organising the funding of renewable energy projects based on expected cash flows and assets. This technique enables developers to get funding without depending only on their own balance sheets, reducing financial risk and facilitating the execution of large-scale projects. Investors seeking reliable, long-term profits are drawn to project finance because renewable energy projects frequently have predictable income streams and operating lifespans. Furthermore, favourable legal frameworks and government incentives frequently promote project finance arrangements, which increases their appeal. As the renewable energy sector grows and matures, project finance is expected to remain a key financial driver of market development and innovation.

Renewable Energy Investment Market By Application

- Commercial

- Industry

- Residential

Residential is the largest category. A variety of variables contribute to its supremacy. To begin, home solar panel installations are becoming increasingly popular as a result of incentives, net metering rules, and lower installation prices. Homeowners are increasingly driven by the desire to lower their power expenses and contribute to environmental sustainability. Furthermore, technical advances have made renewable energy systems more accessible and cheap to residential customers. Furthermore, regulatory constraints in the residential sector are frequently lower than in commercial and industrial applications. With increasing awareness of climate change and energy independence, the residential segment is likely to continue to develop significantly and maintain its lead in the renewable energy investment market.

Renewable Energy Investment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Renewable Energy Investment Market Regional Analysis

In terms of renewable energy investment market analysis, Asia-Pacific emerges as the largest region, owing to a number of factors. First, Asia-Pacific nations, particularly China and India, have seen rapid industrialization and urbanization, resulting in increased energy consumption. Furthermore, regional governments have actively promoted renewable energy to solve environmental issues and provide energy security. This has led to considerable investments in solar, wind, and hydropower projects, supporting Asia-Pacific's renewable energy sector.

North America is the fastest-growing area in the renewable energy investment market. The region benefits from strong governmental backing, technical advancement, and rising investor interest in renewable energy initiatives. The United States and Canada, in particular, have enacted supporting policies such as renewable portfolio requirements, tax incentives, and clean energy objectives, resulting in significant increases in renewable energy expenditures. Furthermore, developments in renewable energy technology, notably solar and wind power have made them more competitive with traditional energy sources, boosting investment in the region.

Renewable Energy Investment Market Players

Some of the top renewable energy investment companies offered in our report includes Center Bridge Partners, Citigroup, BNP Paribas, Bank of America, Mitsubishi UFJ Financial Group, Macquarie, TerraForm Power, Goldman Sachs, GE Energy Financial Services, and KFW.

Frequently Asked Questions

How big is the renewable energy investment market?

The renewable energy investment market size was valued at USD 1,720 billion in 2023.

What is the CAGR of the global renewable energy investment market from 2024 to 2032?

The CAGR of renewable energy investment is 11.1% during the analysis period of 2024 to 2032.

Which are the key players in the renewable energy investment market?

The key players operating in the global market are including Center Bridge Partners, Citigroup, BNP Paribas, Bank of America, Mitsubishi UFJ Financial Group, Macquarie, TerraForm Power, Goldman Sachs, GE Energy Financial Services, and KFW.

Which region dominated the global renewable energy investment market share?

Asia-Pacific held the dominating position in renewable energy investment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of renewable energy investment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global renewable energy investment industry?

The current trends and dynamics in the renewable energy investment industry include government incentives and policies promoting renewable energy adoption, increasing environmental awareness and commitment to combat climate change, technological advancements driving cost reductions and efficiency improvements, and growing demand for sustainable energy solutions amid global energy transition.

Which product held the maximum share in 2023?

The solar energy product held the maximum share of the renewable energy investment industry.