Regulatory Affairs Outsourcing Market | Acumen Research and Consulting

Regulatory Affairs Outsourcing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format : ![]()

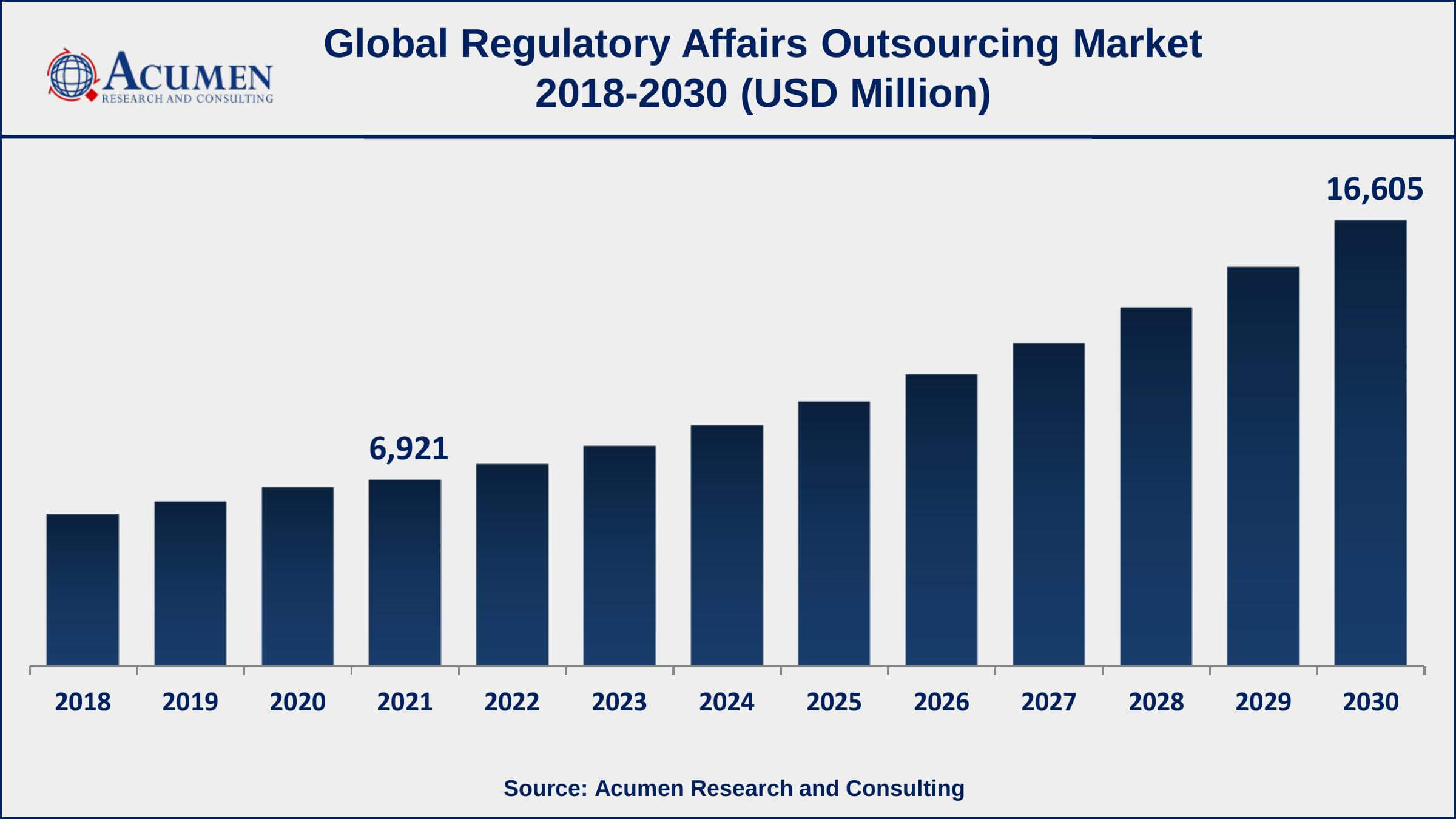

The Global Regulatory Affairs Outsourcing Market Size accounted for USD 6,921 Million in 2021 and is estimated to achieve a market size of USD 16,605 Million by 2030 growing at a CAGR of 10.4% from 2022 to 2030. The increase in research and development activities for new vaccines, drugs, and medical equipment is expected to boost the regulatory affairs outsourcing market growth. Furthermore, the introduction of effective software that keeps track of regulatory affairs is a crucial trend, which is driving the regulatory affairs outsourcing market value.

Regulatory Affairs Outsourcing Market Report Key Highlights

- Global regulatory affairs outsourcing market revenue is estimated to expand by USD 16,605 million by 2030, with a 10.4% CAGR from 2022 to 2030.

- Asia-Pacific regulatory affairs outsourcing market share accounted for over 37% of total market shares in 2021

- Europe regulatory affairs outsourcing market growth will observe highest CAGR from 2022 to 2030

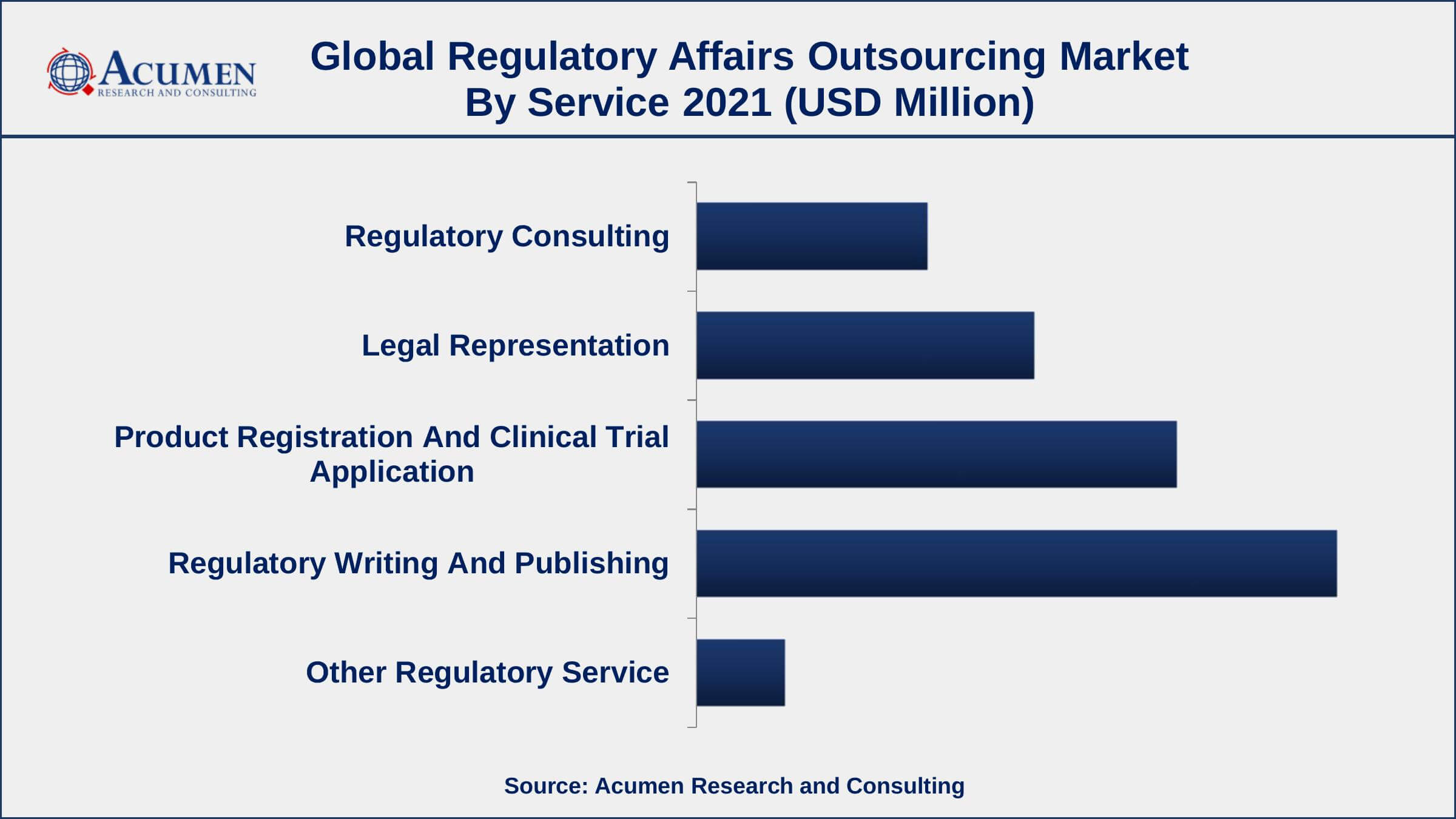

- Based on service, regulatory writing and publishing segment accounted for over 36% of the overall market share in 2021

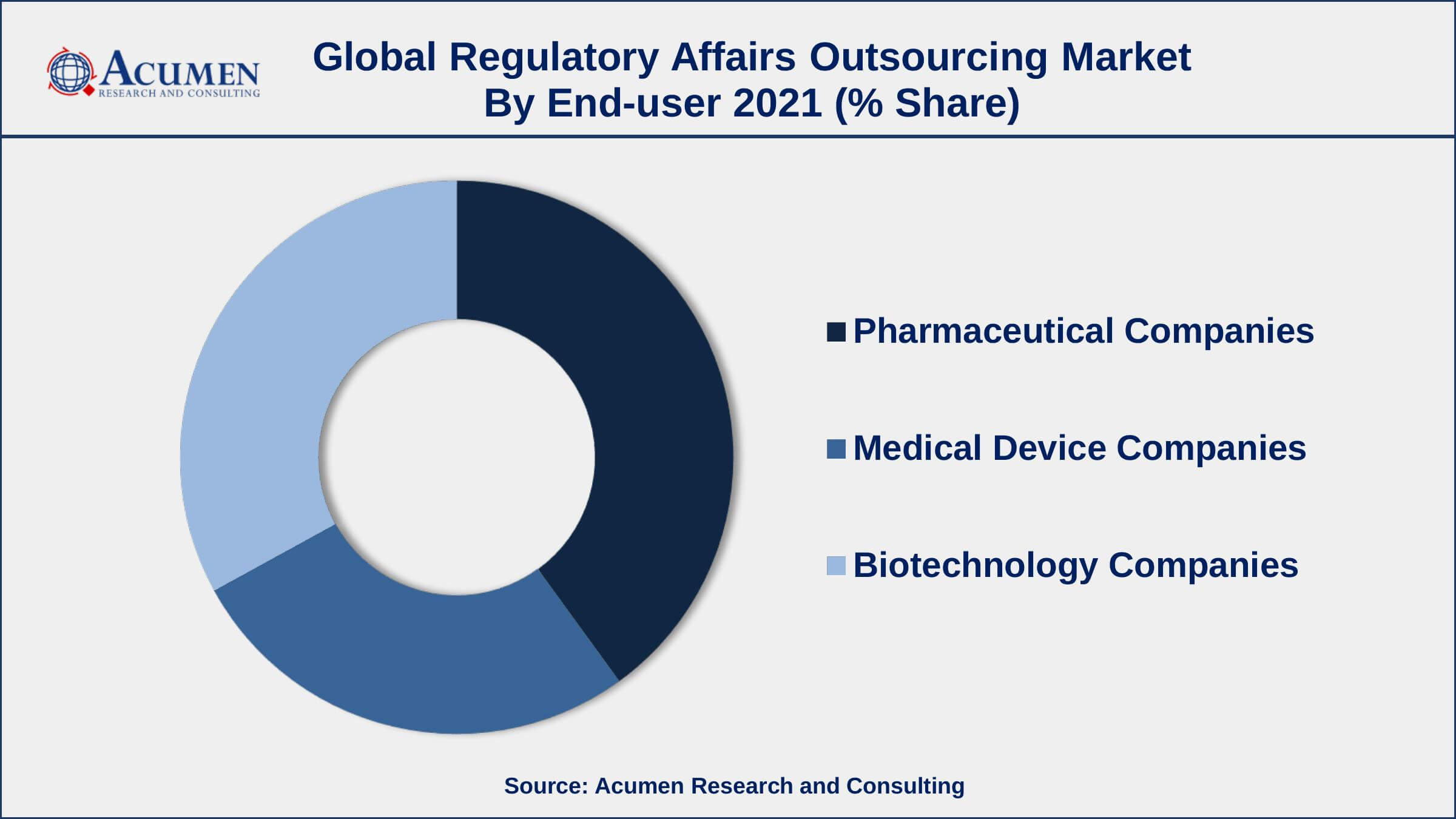

- Among end-user, pharmaceutical companies engaged more than 41% of the total market share

- Changing regulatory environment over the globe, drives the regulatory affairs outsourcing market size

Regulatory affairs outsourcing is growing more prevalent in the healthcare industry. The implementation of regulatory outsourcing systems is expected to be assisted by an increase in regional expansion operations by enterprises looking for quick permits in marketplaces. The regulatory affairs outsourcing sector is expanding due to an increase in R&D operations, coupled with a growth in the number of ongoing clinical study applications and product registration. Governments in various locations are continually putting pressure on companies to secure clinical licenses in a reasonable timeframe.

Global Regulatory Affairs Outsourcing Market Trends

Market Drivers

- Changing regulatory environment over the globe

- Life science businesses that emphasize their core strengths

- Increasing demand for a faster clearance process for novel medicines and devices

- Growing adoption of new solutions in the healthcare industry

Market Restraints

- Risks related to data security

- Monitoring concerns and a lack of standardization

Market Opportunities

- Increasing investments in research and development of novel biologic pharmaceuticals

- High costs related to the operations of regulatory affairs

Regulatory Affairs Outsourcing Market Report Coverage

| Market | Regulatory Affairs Outsourcing Market |

| Regulatory Affairs Outsourcing Market Size 2021 | USD 6,921 Million |

| Regulatory Affairs Outsourcing Market Forecast 2030 | USD 16,605 Million |

| Regulatory Affairs Outsourcing Market CAGR During 2022 - 2030 | 10.4% |

| Regulatory Affairs Outsourcing Market Analysis Period | 2018 - 2030 |

| Regulatory Affairs Outsourcing Market Base Year | 2021 |

| Regulatory Affairs Outsourcing Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Service, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medpace Inc., Charles River Laboratories International Inc, Accell Clinical Research, PRA International, Wuxi AppTec, PAREXEL International Corporation, Criterium Inc., Quintiles Transnational Holdings, Clinilabs Inc., and Dr. Regenold GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Ascend in R&D exercises, especially in the life science industry for the decrease in the overall approval process by lessening delays in administrative filings and the improvement in the Return on Investment (ROI) and cost productivity are anticipated to drive the development. Also, great administrative commands are foreseen to drive the adoption Food and Drug Administration (FDA) published ICH E17 direction on multi-territorial clinical preliminaries. This activity is required to bring worldwide clinical preliminaries under a solitary convention, put together by various experts in various regions.

A few medical gadget and pharmaceutical organizations are confronting exceptionally focused weight, over the world. Relevant issues, for example, expanded challenges, differential drug pricing systems of individual countries, and geopolitical issues, for example, Brexit has pressured organizations to redistribute their activities to regional organizations. Likewise, the rising R&D expenses and the strain to curtail cost is empowering the regulatory affairs outsourcing trend.

Regulatory Affairs Outsourcing Market Insights

Extensive organizations address limited issues and the absence of expertise in their internal departments by redistributing to smaller mid-size organizations. It likewise wipes out the extra remaining burden and combines administrative offices to keep away from duplication of work. Regulatory affairs incorporate exercises, for example, drug shipment approvals for clinical trials, drug master files, labeling, technical writing, serious adverse events reporting, review of Chemistry, Investigational New Drug (IND) maintenance, Manufacturing, eCTD conversion, Controls (CMC), and query management.

Regulatory affairs outsourcing saw a couple of critical industry occasions. For example, in August 2018, U.K.-based Syneos Health gained Kinapse, a supplier of pharmaco-vigilance consulting and post-industry regulatory services. With this procurement, the organization intends to twofold it is counseling impressions in Europe and related business administrations. Also, in October 2018, PAREXEL International Corporation presented the new China Advisory Services to help pharmaceutical organizations looking for market opportunities in China, to have an early mover advantage. The administrations incorporate office commitment, market access, and business methodologies. This occurred on the scenery of late changes actualized by the National Medicinal Products Administration (NMPA, for example, expedited approvals, quicker Multi-provincial Clinical Trials (MCT) applications, and clinical trial permission in two months.

Regulatory Affairs Outsourcing Market Segmentation

The worldwide regulatory affairs outsourcing market segmentation is based on the service, end-user, and geography.

Regulatory Affairs Outsourcing Market By Service

- Regulatory Consulting

- Legal Representation

- Product Registration And Clinical Trial Application

- Regulatory Writing And Publishing

- Other Regulatory Service

According to regulatory affairs outsourcing market analysis, the regulatory writing and publishing segment accounted for the largest market share in 2021. These services are provided starting with initial product development and continuing through the post-marketing authorization stage. Due to the widespread use of outsourcing of such services by big and mid-sized biopharmaceutical and medical product businesses, this sector is expected to lead the market over the forecast period.

Regulatory Affairs Outsourcing Market By End-user

- Pharmaceutical Companies

- Medical Device Companies

- Biotechnology Companies

According to the regulatory affairs outsourcing market forecast, the medical device and biotechnology companies categories are predicted to grow at the fastest rate in the coming years. This growth is due to rising demand for bioactive molecules, vaccinations, innovative medical equipment, and other products. The rapid growth of wearable devices, combined with recent pandemic events, is increasing the market share of these categories.

Regulatory Affairs Outsourcing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Holds The Largest Share Of The Global Regulatory Affairs Outsourcing Market

Asia-Pacific is anticipated to be a huge supporter of the development of the worldwide market. The presence of worldwide pharmaceutical and life sciences organizations, robust regulators, for example, the FDA, and the accessibility of the ability pool will add to the overall development. In any case, high administration cost contrasted with Asia-Pacific and Latin America is a noteworthy test influencing regional growth. Asia-Pacific is foreseen to be the quickest developing area in the prospective years. By 2030, the region is anticipated to represent over 40% of the market share. The accessibility of ease of work and rising instances of regulatory filings are the factors impelling regional development. The extension of global life science and pharmaceutical organizations is additionally anticipated to encourage regional demand.

Regulatory Affairs Outsourcing Market Players

Some of the top regulatory affairs outsourcing market companies offered in the professional report include Medpace Inc., Charles River Laboratories International Inc, Accell Clinical Research, PRA International, Wuxi AppTec, PAREXEL International Corporation, Criterium Inc., Quintiles Transnational Holdings, Clinilabs Inc., and Dr. Regenold GmbH.

Frequently Asked Questions

What is the size of global regulatory affairs outsourcing market in 2021?

The estimated value of global regulatory affairs outsourcing market in 2021 was accounted to be USD 6,921 Million.

What is the CAGR of global regulatory affairs outsourcing market during forecast period of 2022 to 2030?

The projected CAGR regulatory affairs outsourcing market during the analysis period of 2022 to 2030 is 10.4%.

Which are the key players operating in the market?

The prominent players of the global regulatory affairs outsourcing market are Medpace Inc., Charles River Laboratories International Inc, Accell Clinical Research, PRA International, Wuxi AppTec, PAREXEL International Corporation, Criterium Inc., Quintiles Transnational Holdings, Clinilabs Inc., and Dr. Regenold GmbH.

Which region held the dominating position in the global regulatory affairs outsourcing market?

Asia-Pacific held the dominating regulatory affairs outsourcing during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Europe region exhibited fastest growing CAGR for regulatory affairs outsourcing during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global regulatory affairs outsourcing market?

Changing regulatory environment and increasing demand for a faster clearance process for novel medicines and devices drives the growth of global regulatory affairs outsourcing market.

By service segment, which sub-segment held the maximum share?

Based on service, regulatory writing and publishing segment is expected to hold the maximum share of the regulatory affairs outsourcing market.