Emergency Medical Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

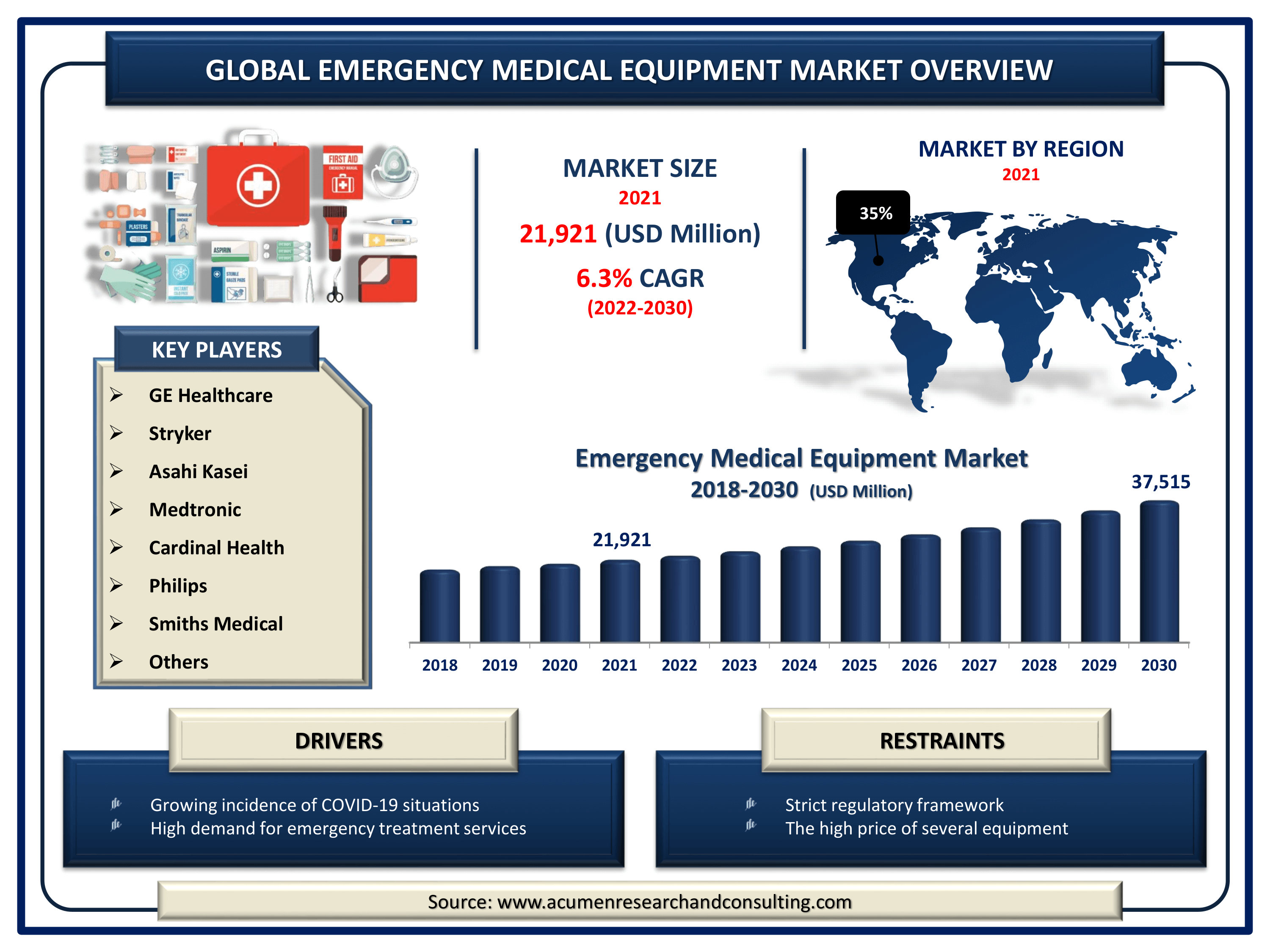

The Global Emergency Medical Equipment Market Size accounted for USD 21,921 Million in 2021 and is estimated to achieve a market size of USD 37,515 Million by 2030 growing at a CAGR of 6.3% from 2022 to 2030. The increasing need for emergency medical services as the geriatric population grows, as well as the growing incidences of chronic illnesses such as diabetes, cardiovascular disorders, and infectious diseases, is predicted to drive the global emergency medical equipment market growth over the coming years. Furthermore, the frequent occurrence of natural catastrophes such as floods, earthquakes, and so on, as well as the growing prevalence of trauma injuries, are driving the emergency medical equipment market value.

Emergency Medical Equipment Market Report Key Highlights

- Global emergency medical equipment market revenue is expected to increase by USD 37,515 million by 2030, with a 6.3% CAGR from 2022 to 2030

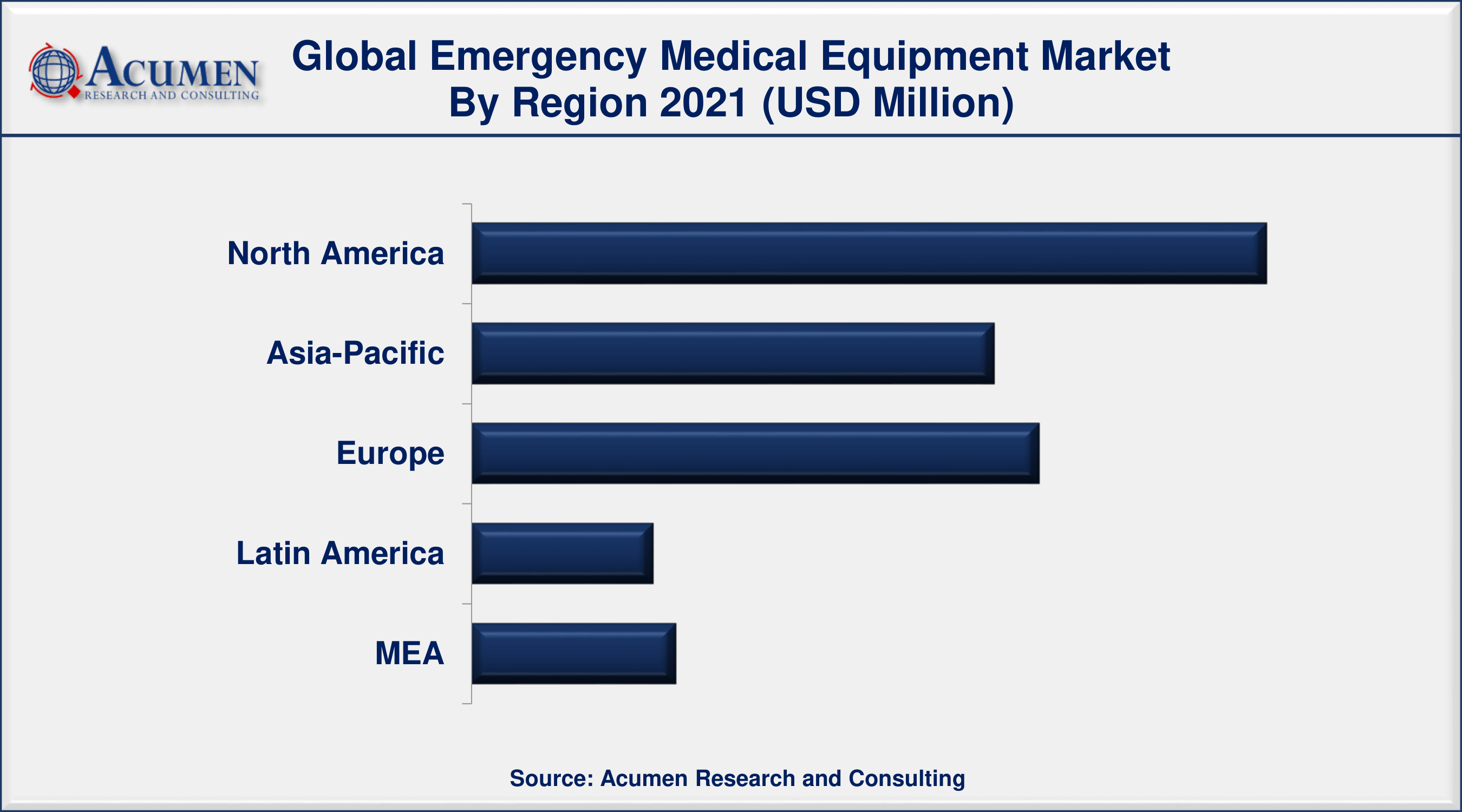

- North America region dominate the market with more than 35% share in 2021

- Among end-user, hospital sector occupied more than 45% of the total market share

- Asia-Pacific is expected to raise at a moderate pace and have a substantial market revenue share in 2021

- In September 2022, the WHO stated that there were 6.4 million fatalities and 605 million confirmed COVID-19 instances globally

- Increasing occurrence of traffic accidents and trauma incidents, drives the emergency medical equipment market size

Medical devices are utilized to prevent or treat emergency situations. These involve diagnostic equipment and tests, personal protective equipment such as masks or gloves, surgical tools, and supplies. According to the Public Health Emergency, the Strategic National Stockpile plays a vital role in supplying state and local media supplies and equipment during public health emergencies. The supply, medicines, and devices for lifesaving care contained in the stockpile can be used as a short-term, stopgap buffer when the immediate supply of these materials may not be available or sufficient.

Global Emergency Medical Equipment Market Dynamics

Market Drivers

- Growing incidence of COVID-19 situations and other chronic conditions

- High demand for emergency treatment services

- Increasing occurrence of traffic accidents and trauma incidents

- Rising healthcare spending in both wealthy and emerging economies

Market Restraints

- Strict regulatory framework

- The high price of several equipment

Market Opportunities

- Growing incidence of natural disasters like as earthquakes, floods

- Increase in government spending on advanced medical equipment

Emergency Medical Equipment Market Report Coverage

| Market | Emergency Medical Equipment Market |

| Emergency Medical Equipment Market Size 2021 | USD 21,921 Million |

| Emergency Medical Equipment Market Forecast 2030 | USD 37,515 Million |

| Emergency Medical Equipment Market CAGR During 2022 - 2030 | 6.3% |

| Emergency Medical Equipment Market Analysis Period | 2018 - 2030 |

| Emergency Medical Equipment Market Base Year | 2021 |

| Emergency Medical Equipment Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | GE Healthcare, Asahi Kasei, Philips, Stryker, Cardinal Health, Smiths Medical, Becton Dickinson, B. Braun, Medtronic, 3M, Smith & Nephew, and Johnson & Johnson. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Severe physical injuries such as trauma and medical emergencies such as cardiac arrest require quick medical attention. Thus, a rise in the incidences of trauma injuries and other medical emergencies creates lucrative opportunities for the overall growth of the emergency medical equipment market trend globally. According to the American Association for the Surgery of Trauma, injury is a major health problem in the US that is accounted for over 150,000 deaths and over 3 million non-fatal injuries annually. Across the world, injury is responsible for more than 5 million deaths every year. To overcome such scenario improvement in healthcare facilities, rising demand for emergency medical equipment and a surge in government expenditure is projected to drive the global market. Additionally, as per the World Economic Forum, firms are giving big calls to the government to intelligently and flexibly implement emergency response policies to avoid freezing the supply system for medical goods at a time when it is required the most. Also, businesses require flexibility to adopt production to manufacture critical goods, supply chain finance to keep suppliers working, and the legal adaptability to cope with complicated situations. Critical gods should not be kept as inventory for days for clearing customs.

Impact Of COVID-19 On Emergency Medical Equipment Market

The COVID-19 pandemic resulted in surging demand for emergency medical equipment. This is one of the prominent factors for up surging the global growth of the emergency medical equipment market. The governing bodies supported the supply of emergency medical equipment through funding or approval of various grants during the pandemic. According to the Asian Development Bank (ADB), in April 2020, ADB announced funding of US$ 100,000 for the purchase of emergency medical supplies through the United Nations Children’s Fund (UNICEF) in favor of Sri Lanka's ongoing response to the novel coronavirus (COVID-19) pandemic. The medical supplies and materials purchased involve 4 suction machines, 4 suction apparatus, 10 infusion pumps, 12 syringe pumps, 7 multipara monitors, 11 laryngoscopes, and 1 point of care analyzer. These supplies support COVID-19 isolation units in 14 hospitals across the country and were procured in direct response to the Ministry of Health and Indigenous Medical Services. Additionally, the public health emergency declaration under section 564(b) of the FD&C Act enabled the FDA to issue an emergency use authorization (EUA) in response to the COVID-19 pandemic. The measures authorize the emergency use of an unapproved drug, an unapproved or uncleared device, or an unlicensed biological product; or unapproved use of an approved drug or cleared device, or licensed biological product, provided that other statutory requirements are met clinically.

Stockpile Response Of COVID-19, All-Time High: Market Wrap For Emergency Medical Equipment

As per the Public Health Emergency (PHE), the National Stockpile was created in 1999 to ensure readiness against potential agents of bioterrorism. Currently, the Strategic National Stockpile works in collaboration with the governmental and nongovernmental partners for upgrading the ability to respond to a national public health emergency, ensuring that the federal, state, and local agencies are ready to receive, stage, and distribute the products. As per the estimates released by the PHE in January 2020, in response to COVID-19 more than 15.7K tons of cargo were shipped to support US repatriation efforts and state PPE needs, more than 635 flights transporting supplies, and more than 4,220 trucks transporting supplies. Additionally, more than 200 staffers were serving the stockpile operation center. This comprises engagement with more than 150 private industry partners for medical supply chain and delivery. Setting up deployment centers of SNS liaisons to the Department of Health and Human Services (HHS) Secretary's Operation Center in Washington D.C. for smooth supply of emergency medical equipment.

Emergency Medical Equipment Market Segmentation

The global emergency medical equipment market segmentation is based on type, application, end-user, and geography.

Emergency Medical Equipment Market By Type

- Wound Care Consumables

- Infection Control Supplies

- Emergency Resuscitation Equipment

- Personal Protection Equipment

- Patient Monitoring Systems

- Patient Handling Equipment

- Others

Based on type, the emergency resuscitation equipment segment is predicted to hold a significant market share in the forecast period. This is attributed to the increasing pool for the number of emergency visits resulting in the demand for emergency resuscitation equipment. This is well supported by rising incidences of heart stroke cases recorded globally. According to the American Heart Association, the age-adjusted deaths attributed to cardiovascular diseases (CVDs) based on 2017 data is 219.4 per 100,000. Additionally, on average someone dies of a stroke every 3.59 minutes in the US. There are about 401 deaths recorded from stroke each day, based on 2017 data. According to the World Health Organization (WHO), the Resuscitation Outcomes Consortium (ROC) is an ongoing clinical research network conducting clinical research in the areas of cardiopulmonary arrest and traumatic injury. Moreover, the Resuscitation Council (UK) has a modest research budget of US$ $223,000 that is allocated every year.

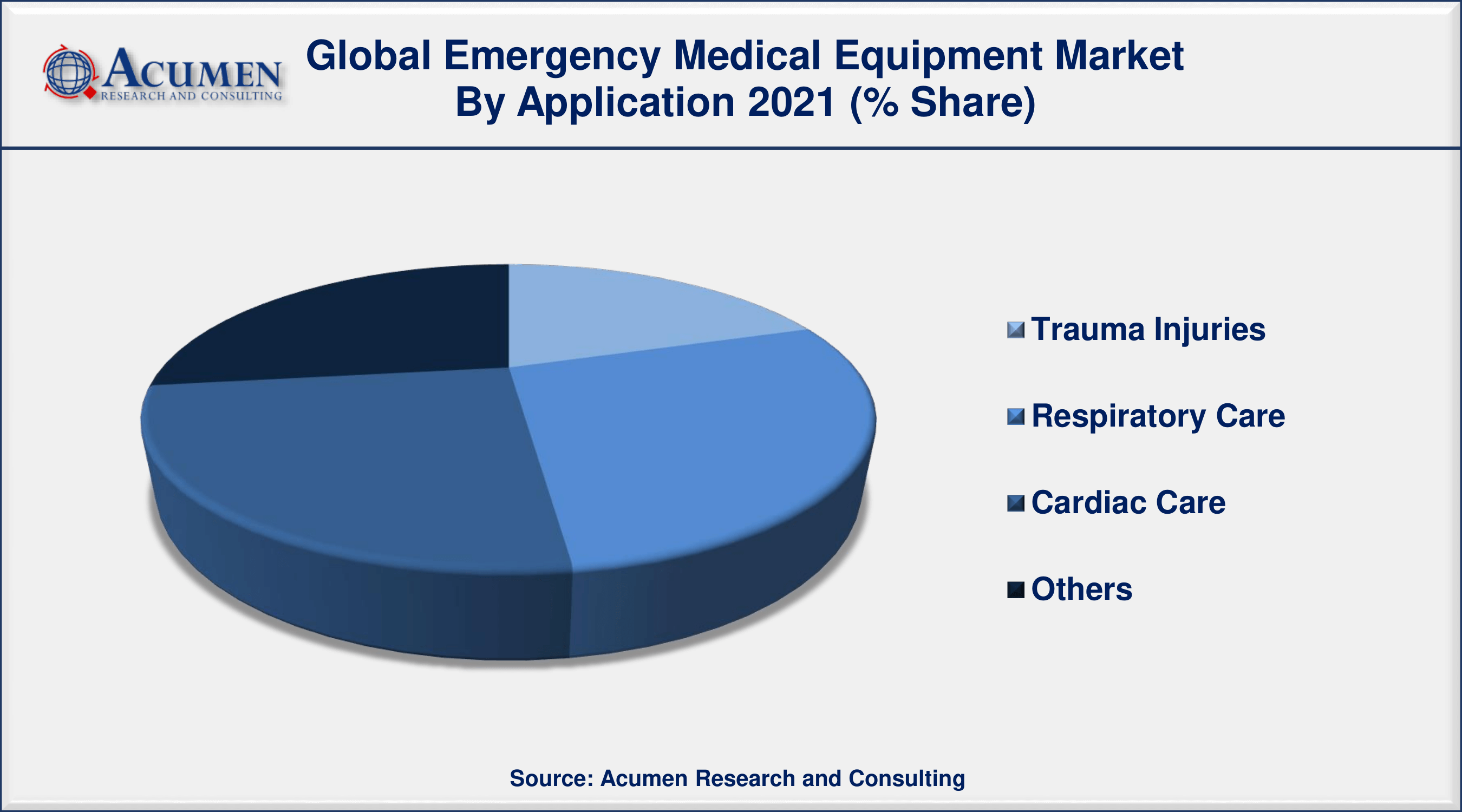

Emergency Medical Equipment Market By Application

- Trauma Injuries

- Respiratory Care

- Cardiac Care

- Others

According to the emergency medical equipment industry analysis, the cardiac care segment will account for a significant share of the global market. This is highly supported by the high prevalence of cardiac diseases and the increasing pool of geriatric population prone to cardiac diseases.

Emergency Medical Equipment Market By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

According to the emergency medical equipment market forecast, the hospital segment would dominate the global market throughout the forecast period. Development in the hospital infrastructure, rising number of hospital visits, and surging government spending on healthcare facilities are the factors that contribute fullest to the growth of the emergency medical equipment market worldwide.

Emergency Medical Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America Recorded The Largest Market Share For Global Emergency Medical Equipment

North America is projected to hold a significant market share. Asia-Pacific is expected to witness significant market share by recording a satisfactory CAGR in the forecast period. North America's regional market growth is attributed to high cases of trauma injuries, rising number of emergency visits, strong presence of prominent/key players, technological advancements, and well-established hospital infrastructure. On the other hand, the ever-growing geriatric population, high exposure to medical emergencies, and rising government funding in India and China are the stimulating factors for the growth of the Asia-Pacific regional market for emergency medical equipment market.

Emergency Medical Equipment Market Players

Some of the top emergency medical equipment market companies offered in the professional report include GE Healthcare, Asahi Kasei, Philips, Stryker, Cardinal Health, Smiths Medical, Becton Dickinson, B. Braun, Medtronic, 3M, Smith & Nephew, and Johnson & Johnson.

Frequently Asked Questions

What is the size of global emergency medical equipment market in 2021?

The estimated value of global emergency medical equipment market in 2021 was accounted to be USD 21,921 Million.

What is the CAGR of global emergency medical equipment market during forecast period of 2022 to 2030?

The projected CAGR emergency medical equipment market during the analysis period of 2022 to 2030 is 6.3%.

Which are the key players operating in the market?

The prominent players of the global emergency medical equipment market are GE Healthcare, Asahi Kasei, Philips, Stryker, Cardinal Health, Smiths Medical, Becton Dickinson, B. Braun, Medtronic, 3M, Smith & Nephew, and Johnson & Johnson.

Which region held the dominating position in the global emergency medical equipment market?

North America held the dominating emergency medical equipment during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for emergency medical equipment during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global emergency medical equipment market?

Growing incidence of COVID-19 situations and other chronic conditions, as well as high demand for emergency treatment services, drives the growth of global emergency medical equipment market.

By end-user segment, which sub-segment held the maximum share?

Based on end-user, hospitals segment is expected to hold the maximum share emergency medical equipment market.