Regenerative Medicine Scaffolds Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Regenerative Medicine Scaffolds Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

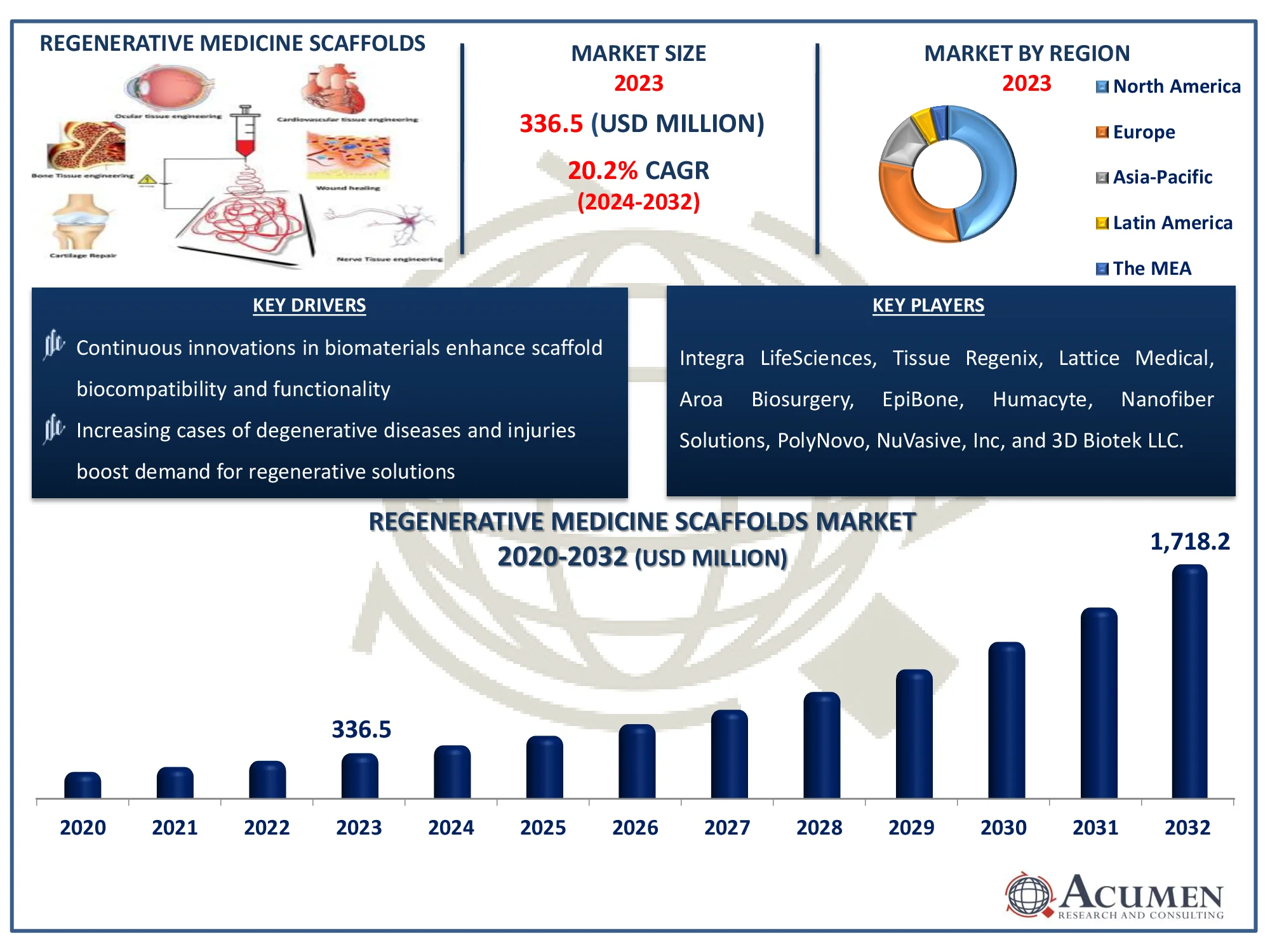

The Global Regenerative Medicine Scaffolds Market Size accounted for USD 336.5 Million in 2023 and is estimated to achieve a market size of USD 1,718.2 Million by 2032 growing at a CAGR of 20.2% from 2024 to 2032.

Regenerative Medicine Scaffolds Market Highlights

- Global regenerative medicine scaffolds market revenue is poised to garner USD 1,718.2 million by 2032 with a CAGR of 20.2% from 2024 to 2032

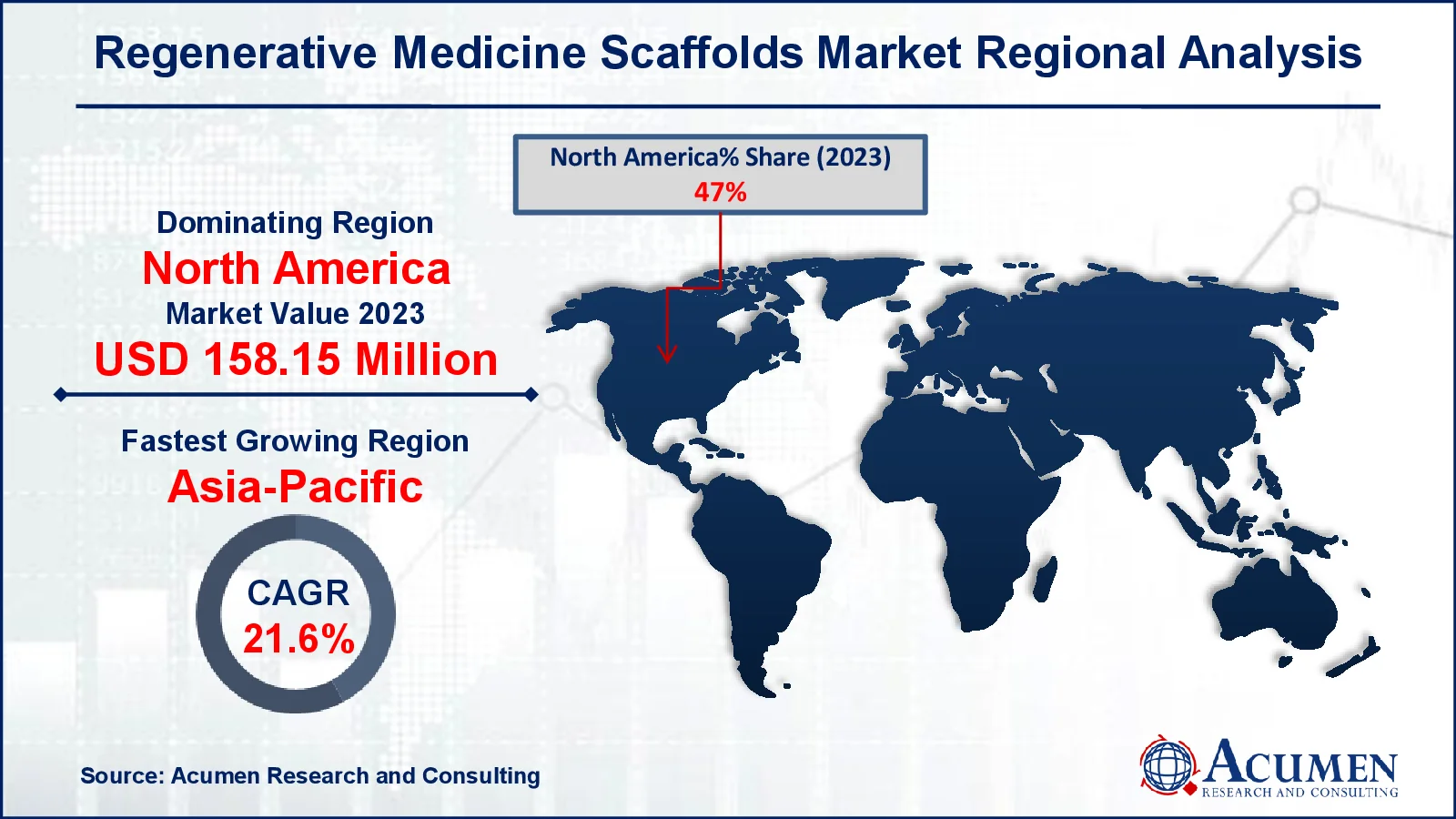

- North America regenerative medicine scaffolds market value occupied around USD 157.15 million in 2023

- Asia-pacific regenerative medicine scaffolds market growth will record a CAGR of more than 21.6% from 2024 to 2032

- Growing preference for personalized medicine is a popular regenerative medicine scaffolds market trend that fuels the industry demand

Regenerative medicine in scaffold technology focuses on creating biocompatible structures that promote cell proliferation, tissue healing, and organ regeneration. These scaffolds act as temporary matrices, guiding the creation of new functional tissues while resembling the normal extracellular matrix. They can be composed of biodegradable polymers, hydrogels, or bioactive ceramics that promote cell adhesion, proliferation, and differentiation. Applications include bone and cartilage regeneration, wound healing, and organ tissue engineering, which improve therapies for degenerative illnesses and traumas. Advances in 3D bioprinting and nanotechnology have improved scaffold designs, allowing for tailored and efficient regenerative therapies.

Global Regenerative Medicine Scaffolds Market Dynamics

Market Drivers

- Continuous innovations in biomaterials enhance scaffold biocompatibility and functionality

- Increasing cases of degenerative diseases and injuries boost demand for regenerative solutions

- Growing investments in tissue engineering and regenerative medicine drive market growth

Market Restraints

- Expensive R&D and clinical trials hinder market entry for new players

- Strict approval processes and compliance requirements slow down product commercialization

- Uncertainty regarding long-term efficacy and safety impacts adoption rates

Market Opportunities

- Advancements in 3D printing technology enable precise scaffold design and tissue regeneration

- Increasing focus on patient-specific treatments expands applications of scaffold-based therapies

- Rising healthcare investments in developing regions create new growth opportunities

Regenerative Medicine Scaffolds Market Report Coverage

|

Market |

Regenerative Medicine Scaffolds Market |

|

Regenerative Medicine Scaffolds Market Size 2023 |

USD 336.5 Million |

|

Regenerative Medicine Scaffolds Market Forecast 2032 |

USD 1,718.2 Million |

|

Regenerative Medicine Scaffolds Market CAGR During 2024 - 2032 |

20.2% |

|

Regenerative Medicine Scaffolds Market Analysis Period |

2020 - 2032 |

|

Regenerative Medicine Scaffolds Market Base Year |

2023 |

|

Regenerative Medicine Scaffolds Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Technology, By Tissue Type, By Technology, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Integra LifeSciences, Tissue Regenix, Lattice Medical, PolyNovo, Aroa Biosurgery, EpiBone, Humacyte, Nanofiber Solutions, NuVasive, Inc, and 3D Biotek LLC. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Regenerative Medicine Scaffolds Market Insights

Continuous advancements in biomaterials improve the biocompatibility, biodegradability, and mechanical qualities of scaffolds utilized in regenerative medicine. According to the Society for Biomaterials, the Materials Research Society (MRS) and the Society For Biomaterials (SFB) are collaborating on a joint webinar that will address recent 3D printing for medical applications, with a focus on recent advances in biomaterials for 3D printing and recent efforts to translate 3D printing technology.

Furthermore, the National Institute of Health (NIH) recently said that recent improvements in biomaterials for 3D scaffolds should not only support regenerating tissue and transplanted cells, but also achieve local release of regulatory or medicinal substances. Scaffolds capable of meeting a variety of biochemical and/or functional criteria are typically created by combining biomaterials with specific complimentary qualities that aid in local regeneration. These biomaterials advancements boost market growth by improving the mechanical qualities of scaffolds.

The rising prevalence of chronic diseases, such as osteoarthritis, cardiovascular ailments, and neurological conditions, is boosting demand for scaffold-based regenerative treatments. According to the National Institute of Health, the number of individuals aged 50 and older in the United States will grow by 61.11%, from 137.25 million in 2020 to 221.13 million in 2050. The number of people aged 50 and older with at least one chronic condition is expected to rise by 99.5%, from 71.522 million in 2020 to 142.66 million in 2050. As the aging population grows, the need for effective tissue regeneration solutions is expected to rise significantly.

The advancement of scaffold-based regenerative medicines necessitates significant investment in research, clinical trials, and manufacturing methods. Advanced biomaterials, specialized equipment, and regulatory compliance all contribute to high prices, which can stifle innovation and limit patients' access to inexpensive treatment options.

The advent of 3D bioprinting is revolutionizing scaffold technology by offering accurate, patient-specific tissue engineering options. The National Institute also demonstrates the use of 3D bioprinting in tissue engineering, stating that 3D bioprinting has exceptional tissue engineering capabilities with multiple applications in regenerative medicine, transplantation, and drug discovery. As an advanced production approach for sophisticated 3D constructions with acceptable biological, structural, and mechanical qualities, improvements are still needed, including technological advancements and a wider variety of material selection. As bioprinting technologies progress, they hold the potential to accelerate the commercialization of regenerative medicine products and expand treatment options.

Regenerative Medicine Scaffolds Market Segmentation

The worldwide market for regenerative medicine scaffolds is split based on tissue type, technology, material type, application, end-user, and geography.

Regenerative Medicine Scaffolds Market By Tissue Type

- Bone Regeneration

- Cartilage Regeneration

- Skin & Wound Healing

- Neural Tissue Engineering

- Cardiovascular Tissue Engineering

- Muscle Regeneration

According to regenerative medicine scaffolds industry analysis, bone regeneration is predicted to increase as the prevalence of orthopedic illnesses and trauma cases rises, as well as advances in biomaterial-based scaffolds. The demand for bone graft alternatives and 3D-printed scaffolds has increased, resulting in growth in this category. Cartilage regeneration, skin and wound healing, neural tissue engineering, cardiovascular tissue engineering, and muscle regeneration are all making substantial progress. Hydrogel scaffolds, nanotechnology, and bioengineered materials are improving tissue regeneration, increasing the market's overall potential.

Regenerative Medicine Scaffolds Market By Technology

- 3D Bioprinting

- Electrospinning

- Decellularized Scaffolds

- Self-assembling Peptide Scaffolds

3D bioprinting is predicted to expand in the regenerative medicine in scaffold technology market due to its precision in producing patient-specific scaffolds and complicated tissue architectures. The capacity to include living cells, growth hormones, and biomaterials layer by layer improves tissue regeneration, making it a popular alternative. Electrospinning, decellularized scaffolds, and self-assembling peptide scaffolds all make major contributions. Electrospinning allows for nanofiber-based scaffolds for regulated drug delivery, whereas decellularized scaffolds and self-assembling peptides provide biocompatible frameworks for tissue repair and organ engineering.

Regenerative Medicine Scaffolds Market By Material Type

- Natural Biomaterials

- Synthetic Biomaterials

- Hybrid Scaffolds

In the regenerative medicine scaffolds market, natural biomaterials are predicted to expand because of their high biocompatibility, biodegradability, and ability to replicate the native extracellular matrix. Materials such as collagen, alginate, and chitosan promote cell adhesion and proliferation, making them excellent for tissue engineering applications. Their extensive application in bone, cartilage, and wound healing reinforces their market dominance. Furthermore, synthetic biomaterials have customizable mechanical qualities and durability, whereas hybrid scaffolds combine the advantages of natural and synthetic materials, improving structural integrity and bioactivity for better tissue regeneration.

Regenerative Medicine Scaffolds Market By Application

- Stem Cell Therapy

- Organ Transplantation Support

- Soft Tissue Repair

- Bone & Joint Reconstruction

Historically, bone and joint reconstruction is frequently the first choice due to the high prevalence of orthopedic illnesses, fractures, and degenerative diseases such as osteoporosis and arthritis. The need for bioengineered scaffolds, 3D-printed bone grafts, and biodegradable implants has increased, fueling growth in this market. The remaining parts, which include stem cell therapy, organ transplantation support, and soft tissue healing, are also making remarkable development. Stem cell therapy uses scaffolds to promote cellular regeneration, whereas scaffold-based organ transplantation support and soft tissue healing improve graft integration and functional tissue restoration.

Regenerative Medicine Scaffolds Market By End-User

- Hospitals & Clinics

- Biotechnology & Pharmaceutical Companies

- Research Institutes & Universities

In the regenerative medicine in scaffold technology market, hospitals and clinics dominate due to the growing use of scaffold-based therapies for bone, cartilage, and soft tissue regeneration. The expanding number of surgical procedures, developments in tissue engineering, and rising demand for regenerative treatments all contribute to this segment's leadership position. Furthermore, hospitals and specialist clinics are at the forefront of incorporating novel scaffold technologies into patient treatment. Biotech and pharmaceutical businesses concentrate on developing new scaffold-based medicines, whilst research institutes promote innovation through preclinical and clinical trials, driving the market's overall progress.

Regenerative Medicine Scaffolds Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Regenerative Medicine Scaffolds Market Regional Analysis

North America has historically dominated the regenerative medicine scaffolds market, due to its excellent healthcare infrastructure, considerable investments in regenerative medicines, and the presence of major biotech businesses. For example, in May 2023, Canon entered the regenerative medicine field by acquiring cell culture firm Kyoto Seisakusho. Furthermore, in July 2023, Carmell Therapeutics announced a binding deal to merge with Axolotl Biologix, a regenerative medicine business that develops and markets human amnion-based allograft solutions for esthetics, active soft tissue repair, and orthopedic applications. Furthermore, the adoption of 3D bioprinting and biomaterial breakthroughs boosts North America's position in this market.

The regenerative medicine scaffolds market in Asia-Pacific is rapidly expanding as a result of increased government initiatives, rising healthcare spending, and improving research capacities. The expanding aging population and need for sophisticated regenerative treatments are fueling the region's market growth. According to the Asian Development Bank, by 2050, one-fourth of the population in Asia and the Pacific would be over 60. Between 2010 and 2050, the region's older population (those over the age of 60) will treble, reaching about 1.3 billion. Countries such as China, Japan, and South Korea are spending extensively in stem cell therapy and tissue engineering, resulting in market growth.

Regenerative Medicine Scaffolds Market Players

Some of the top regenerative medicine scaffolds companies offered in our report includes Integra LifeSciences, Tissue Regenix, Lattice Medical, PolyNovo, Aroa Biosurgery, EpiBone, Humacyte, Nanofiber Solutions, NuVasive, Inc, and 3D Biotek LLC.

Frequently Asked Questions

How big is the regenerative medicine scaffolds market?

The regenerative medicine scaffolds market size was valued at USD 336.5 million in 2023.

What is the CAGR of the global regenerative medicine scaffolds market from 2024 to 2032?

The CAGR of regenerative medicine scaffolds is 20.2% during the analysis period of 2024 to 2032.

Which are the key players in the regenerative medicine scaffolds market?

The key players operating in the global market are including Integra LifeSciences, Tissue Regenix, Lattice Medical, PolyNovo, Aroa Biosurgery, EpiBone, Humacyte, Nanofiber Solutions, NuVasive, Inc, and 3D Biotek LLC.

Which region dominated the global regenerative medicine scaffolds market share?

North America held the dominating position in regenerative medicine scaffolds industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of regenerative medicine scaffolds during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global regenerative medicine scaffolds industry?

The current trends and dynamics in the regenerative medicine scaffolds industry include continuous innovations in biomaterials enhance scaffold biocompatibility and functionality, increasing cases of degenerative diseases and injuries, and growing investments in tissue engineering and regenerative medicine.

Which tissue type held the maximum share in 2023?

The bone regeneration held the maximum share of the regenerative medicine scaffolds industry.?