Recyclable Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Recyclable Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

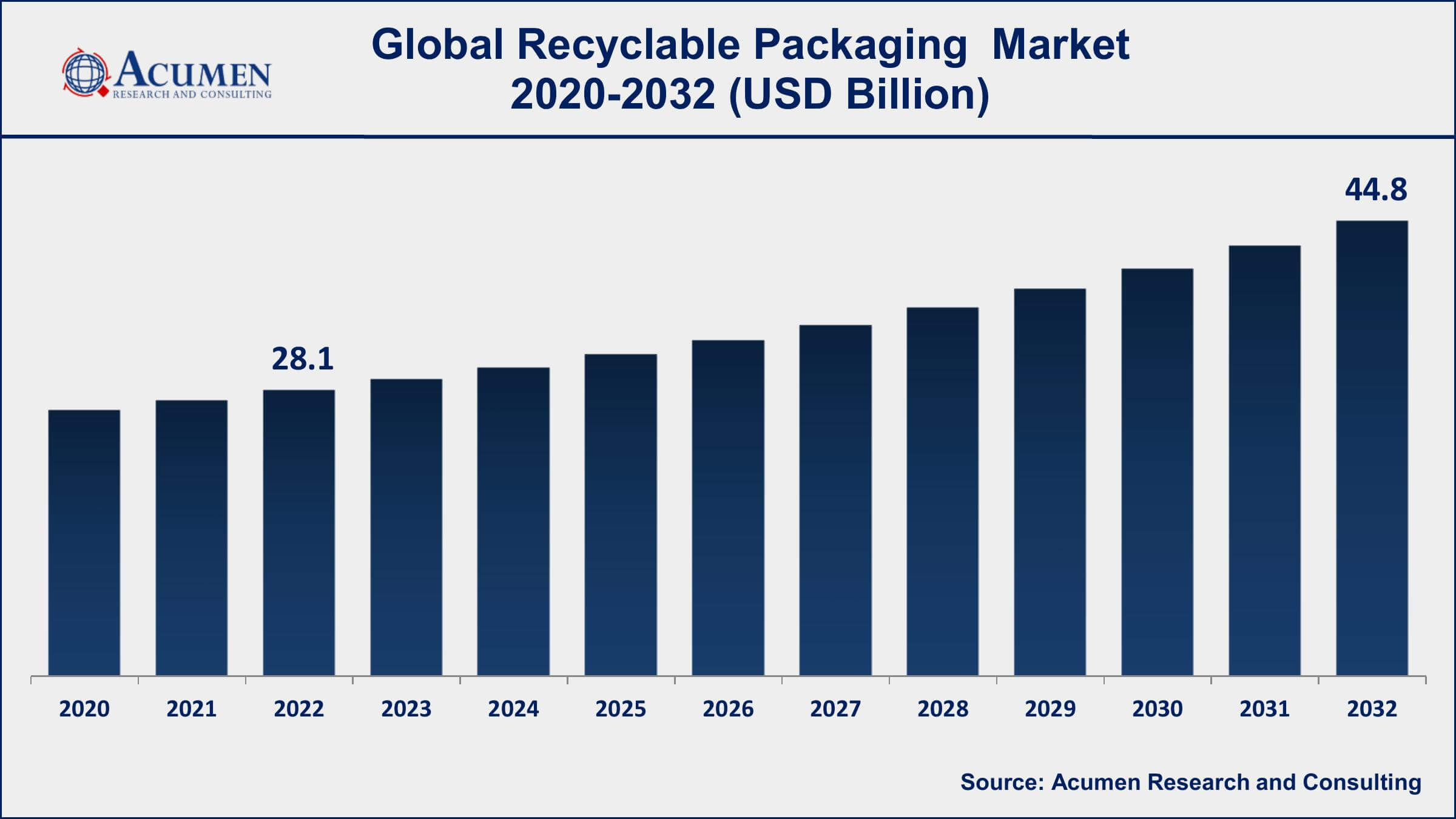

The Global Recyclable Packaging Market Size accounted for USD 28.1 Billion in 2022 and is projected to achieve a market size of USD 44.8 Billion by 2032 growing at a CAGR of 4.9% from 2023 to 2032.

Recyclable Packaging Market Highlights

- Global Recyclable Packaging Market revenue is expected to increase by USD 44.8 Billion by 2032, with a 4.9% CAGR from 2023 to 2032

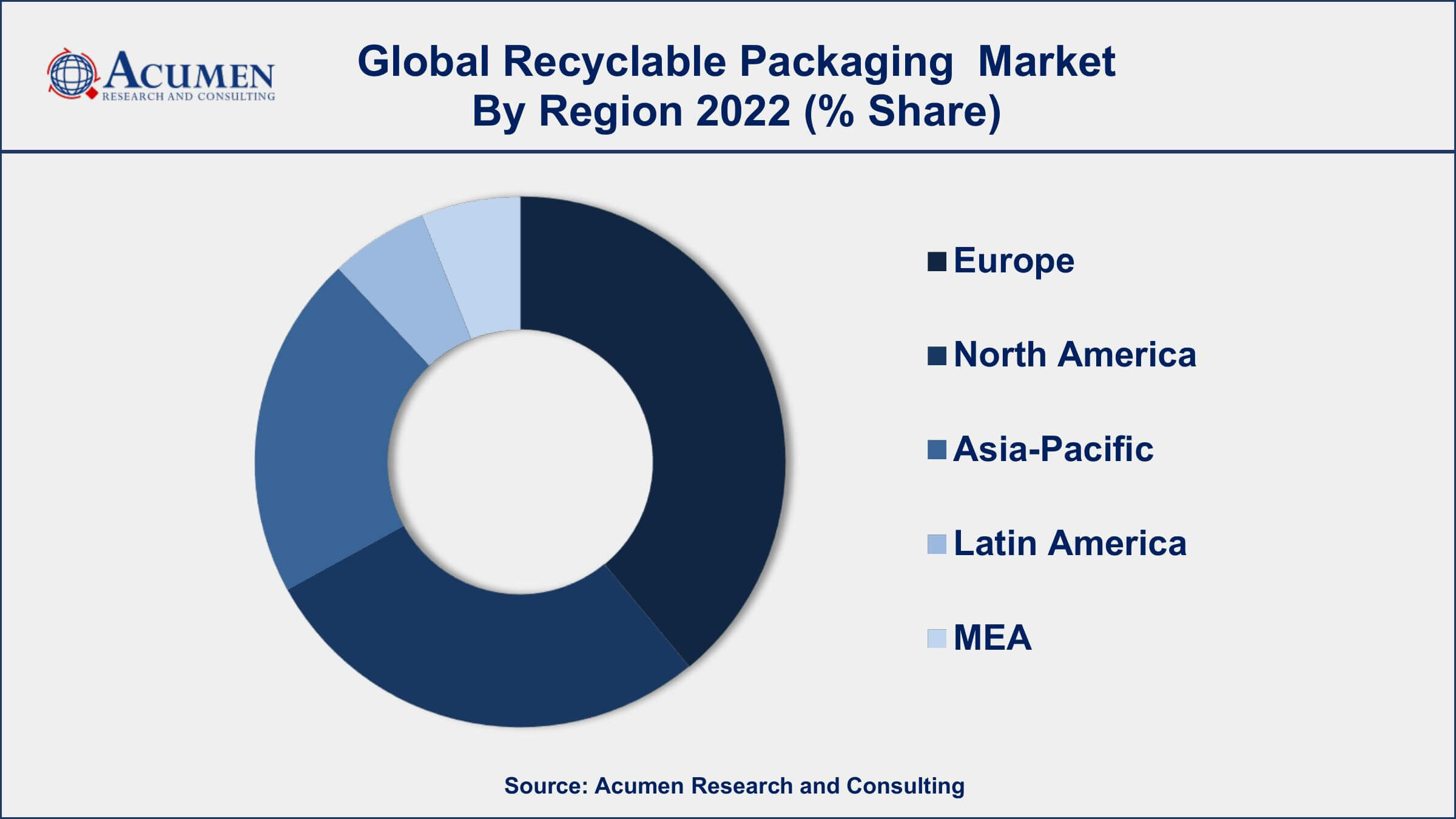

- Europeregion led with more than 39% of Recyclable Packaging Market share in 2022

- Asia-Pacific Recyclable Packaging Market growth will record a CAGR of around 5.4% from 2023 to 2032

- According to the Ellen MacArthur Foundation, only 14% of global plastic packaging is recycled, with the majority ending up in landfills, oceans, or being incinerated

- According to the American Forest & Paper Association, the paper recycling rate climbed to 68% in 2021, surpassing the highest rate ever achieved

- Glass is 100% recyclable, and it can be endlessly recycled without any loss in quality

- Increasing environmental awareness and sustainability concerns, drives the Recyclable Packaging Market value

Recyclable packaging refers to materials and designs used for packaging that can be recovered and reused in the manufacturing of new products. It involves the use of materials that are easily recyclable, such as paper, cardboard, glass, aluminum, and certain types of plastics. Recyclable packaging aims to reduce waste generation, conserve resources, and minimize the environmental impact associated with packaging materials.

The market for recyclable packaging has experienced significant growth in recent years due to various factors. Increasing environmental consciousness among consumers and stringent government regulations on waste management and sustainability have played a crucial role in driving the demand for recyclable packaging. Companies across industries are recognizing the importance of adopting sustainable packaging practices to meet consumer expectations and reduce their carbon footprint. Additionally, advancements in technology have led to the development of innovative recyclable packaging solutions. Manufacturers are focusing on creating packaging materials that are not only environmentally friendly but also offer the necessary protection and functionality for the products being packaged. As a result, the recyclable packaging market has witnessed the introduction of new materials, designs, and manufacturing processes that cater to diverse industry needs.

Global Recyclable Packaging Market Trends

Market Drivers

- Increasing environmental awareness and sustainability concerns

- Stringent government regulations promoting recycling and waste management

- Growing consumer demand for eco-friendly and sustainable packaging options

- Rise in corporate social responsibility initiatives by companies

- Advancements in technology and innovation in recyclable packaging materials and processes

Market Restraints

- High initial costs associated with transitioning to recyclable packaging materials

- Limited availability and accessibility of recycling facilities in certain regions

Market Opportunities

- Growth potential in emerging markets with increasing consumer awareness and demand for sustainable packaging solutions

- Integration of smart and intelligent technologies in recyclable packaging for enhanced traceability and recycling efficiency

Recyclable Packaging Market Report Coverage

| Market | Recyclable Packaging Market |

| Recyclable Packaging Market Size 2022 | USD 28.1 Billion |

| Recyclable Packaging Market Forecast 2032 | USD 44.8 Billion |

| Recyclable Packaging Market CAGR During 2023 - 2032 | 4.9% |

| Recyclable Packaging Market Analysis Period | 2020 - 2032 |

| Recyclable Packaging Market Base Year | 2022 |

| Recyclable Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material Type, By Type of Packaging, By End-User Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amcor plc, Tetra Pak International S.A., Ball Corporation, Sealed Air Corporation, DS Smith plc, WestRock Company, Huhtamaki Oyj, Smurfit Kappa Group plc, Mondi Group, International Paper Company, Crown Holdings, Inc., and Berry Global Group, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Recyclable packaging refers to packaging materials that can be collected, processed, and reused in the manufacturing of new products. These materials are designed to be recycled and contribute to the circular economy by reducing waste and conserving resources. Recyclable packaging aims to minimize the environmental impact associated with packaging materials by ensuring they can be recovered and reintroduced into the production cycle.

Recyclable packaging finds applications across various industries and product categories. In the food and beverage sector, recyclable packaging is used for products such as bottles, cans, cartons, and flexible pouches. These materials, such as glass, aluminum, paperboard, and certain types of plastics, can be recycled and repurposed, reducing the consumption of virgin materials and minimizing waste generation. In the e-commerce and retail industry, recyclable packaging solutions, such as corrugated cardboard boxes and paper-based padding materials, are widely utilized. They provide protection during shipping and can be easily recycled after use. The applications of recyclable packaging extend beyond consumer goods. In industrial sectors, recyclable packaging is employed for transportation and storage purposes. Materials like pallets, drums, and intermediate bulk containers (IBCs) made from recyclable materials such as wood, metal, or plastic are commonly used to safely transport goods.

The recyclable packaging market has been experiencing significant growth in recent years, driven by several key factors. Increasing consumer awareness and concerns about environmental sustainability have led to a greater demand for recyclable packaging options. Consumers are actively seeking products that come in packaging materials that can be easily recycled, reducing waste and minimizing their carbon footprint. This consumer preference has prompted companies to prioritize recyclable packaging solutions to meet customer expectations and stay competitive in the market. Additionally, governments and regulatory bodies worldwide are implementing stricter regulations and policies to promote sustainable packaging practices. These regulations aim to reduce waste generation, encourage recycling, and create a more circular economy. As a result, companies across various industries are adopting recyclable packaging as part of their sustainability initiatives, further driving market growth.

Recyclable Packaging Market Segmentation

The global Recyclable Packaging Market segmentation is based on material type, type of packaging, end-user industry, and geography.

Recyclable Packaging Market By Material Type

- Glass

- Paper

- Tinplate

- Plastic

- Biodegradable plastics

- Wood

- Aluminum

- Recycled papers

According to the recyclable packaging industry analysis, the paper segment accounted for the largest market share in 2022. Paper is a highly recyclable and renewable material, making it an attractive choice for eco-conscious consumers and businesses looking for sustainable packaging solutions. The demand for paper-based recyclable packaging is driven by increasing environmental concerns, government regulations promoting sustainable practices, and shifting consumer preferences towards greener alternatives. One of the primary drivers of growth in the paper segment is the rising awareness of the environmental impact of plastic packaging. Plastic pollution has become a global issue, leading to a growing shift towards more sustainable materials like paper. Paper packaging offers advantages such as being biodegradable, compostable, and easily recyclable. It provides an effective alternative to plastic packaging, especially for products that don't require the same level of moisture or barrier properties.

Recyclable Packaging Market By Packaging Type

- Paper & cardboard

- Void fill packing

- Bubble wrap

- Pouches & envelopes

In terms of packaging type, the paper & cardboard segment is expected to witness significant growth in the coming years. Paper and cardboard are highly recyclable materials, making them popular choices for sustainable packaging solutions. The demand for paper and cardboard-based recyclable packaging is driven by increasing environmental awareness, consumer preferences for eco-friendly options, and regulatory initiatives promoting recycling and waste reduction. One of the main drivers of growth in the paper and cardboard segment is the global movement towards reducing plastic waste. As plastic pollution becomes a significant concern, businesses and consumers are actively seeking alternatives that are more environmentally friendly. Paper and cardboard packaging offer several advantages, such as being renewable, biodegradable, and easily recyclable. This has led to a shift towards using paper and cardboard in various packaging applications, including corrugated boxes, cartons, labels, and wrapping materials.

Recyclable Packaging Market By End-User Industry

- Food

- Beverage

- Logistics

- Personal Care

- Pharmaceutical

- Others

According to the recyclable packaging market forecast, the beverage segment is expected to witness significant growth in the coming years. Consumers' increasing awareness of environmental sustainability and the detrimental effects of single-use plastic bottles have led to a rising demand for recyclable packaging solutions in the beverage industry. This has prompted beverage companies to adopt more sustainable alternatives, driving the growth of recyclable packaging in this segment. One of the key drivers behind the growth of recyclable packaging in the beverage segment is the implementation of stricter regulations and government initiatives aimed at reducing plastic waste. Many countries have introduced regulations and policies to promote recycling and discourage the use of single-use plastics. This has compelled beverage manufacturers to explore recyclable packaging options such as aluminum cans, glass bottles, and paper-based containers that are easily recyclable and have a lower environmental impact.

Recyclable Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Recyclable Packaging Market Regional Analysis

Geographically, Europe has emerged as a dominant player in the recyclable packaging market in 2022. The region has shown a strong commitment to environmental sustainability, which has translated into stringent regulations and policies promoting recycling and waste management. European countries have implemented comprehensive waste management systems and established extensive recycling infrastructure, enabling efficient collection, sorting, and processing of recyclable materials. This infrastructure supports the growth of the recyclable packaging market by ensuring the availability of recycling options for businesses and consumers. Moreover, European consumers have demonstrated a high level of environmental awareness and a preference for eco-friendly products. They actively seek out recyclable packaging options and are willing to pay a premium for sustainable packaging solutions. This strong demand from environmentally conscious consumers has incentivized businesses to prioritize recyclable packaging and invest in research and development to innovate and improve their packaging offerings.

Recyclable Packaging Market Player

Some of the top recyclable packaging market companies offered in the professional report include Amcor plc, Tetra Pak International S.A., Ball Corporation, Sealed Air Corporation, DS Smith plc, WestRock Company, Huhtamaki Oyj, Smurfit Kappa Group plc, Mondi Group, International Paper Company, Crown Holdings, Inc., and Berry Global Group, Inc.

Frequently Asked Questions

What was the market size of the global recyclable packaging in 2022?

The market size of recyclable packaging was USD 28.1 Billion in 2022.

What is the CAGR of the global recyclable packaging market from 2023 to 2032?

The CAGR of recyclable packaging is 4.9% during the analysis period of 2023 to 2032.

Which are the key players in the recyclable packaging market?

The key players operating in the global market are including Amcor plc, Tetra Pak International S.A., Ball Corporation, Sealed Air Corporation, DS Smith plc, WestRock Company, Huhtamaki Oyj, Smurfit Kappa Group plc, Mondi Group, International Paper Company, Crown Holdings, Inc., and Berry Global Group, Inc.

Which region dominated the global recyclable packaging market share?

Europe held the dominating position in recyclable packaging industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of recyclable packaging during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global recyclable packaging industry?

The current trends and dynamics in the recyclable packaging industry include increasing environmental awareness and sustainability concerns, stringent government regulations promoting recycling and waste management, and growing consumer demand for eco-friendly and sustainable packaging options.

Which material type held the maximum share in 2022?

The paper material type held the maximum share of the recyclable packaging industry.