Paper Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Paper Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

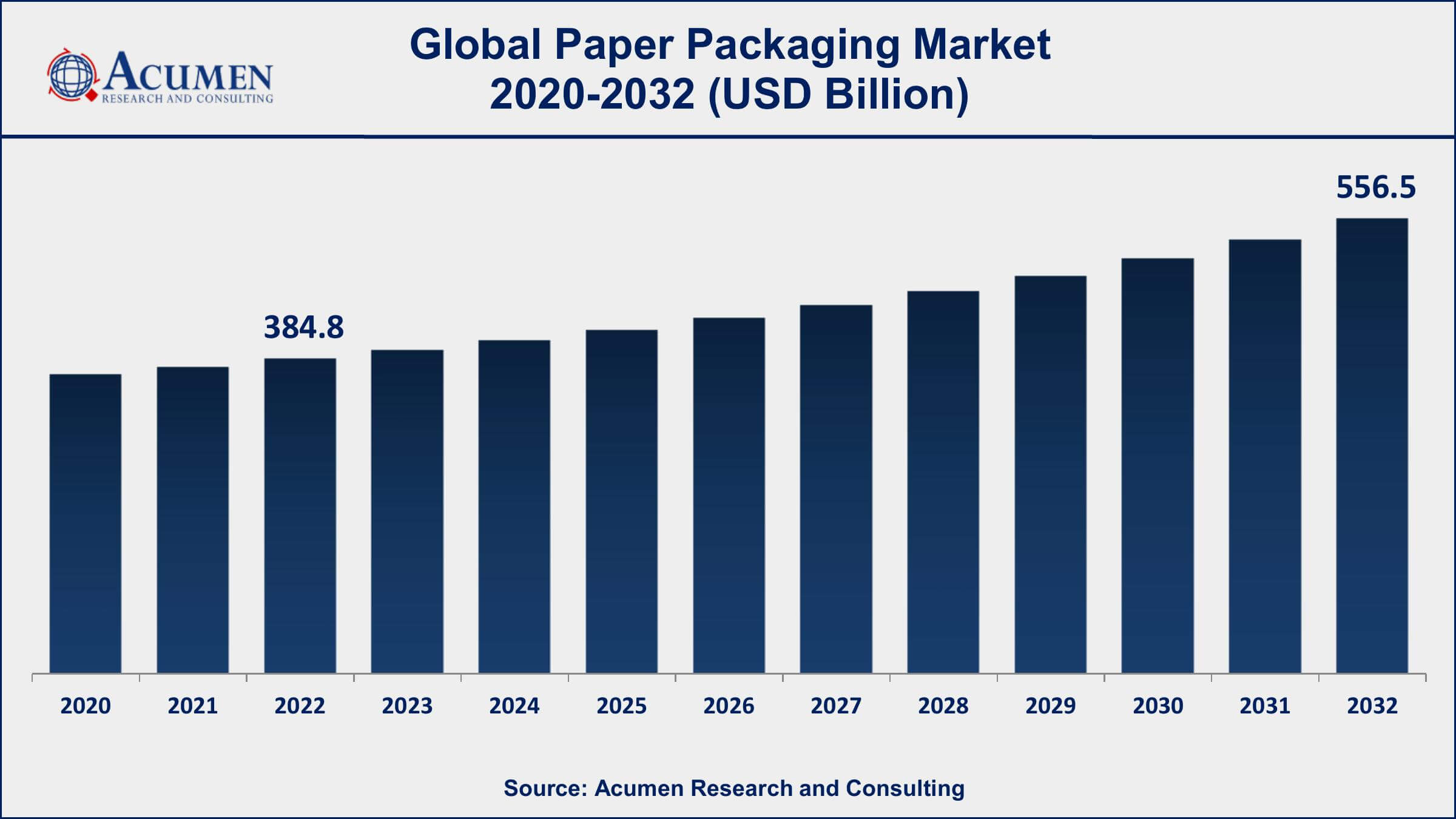

The Global Paper Packaging Market Size accounted for USD 384.8 Billion in 2022 and is projected to achieve a market size of USD 556.5 Billion by 2032 growing at a CAGR of 3.9% from 2023 to 2032.

Paper Packaging Market Highlights

- Global Paper Packaging Market revenue is expected to increase by USD 556.5 Billion by 2032, with a 3.9% CAGR from 2023 to 2032

- According to a study, the globe produces 300 million tons of paper each year. Global paper and paperboard output increased by 3% between 2010 and 2019

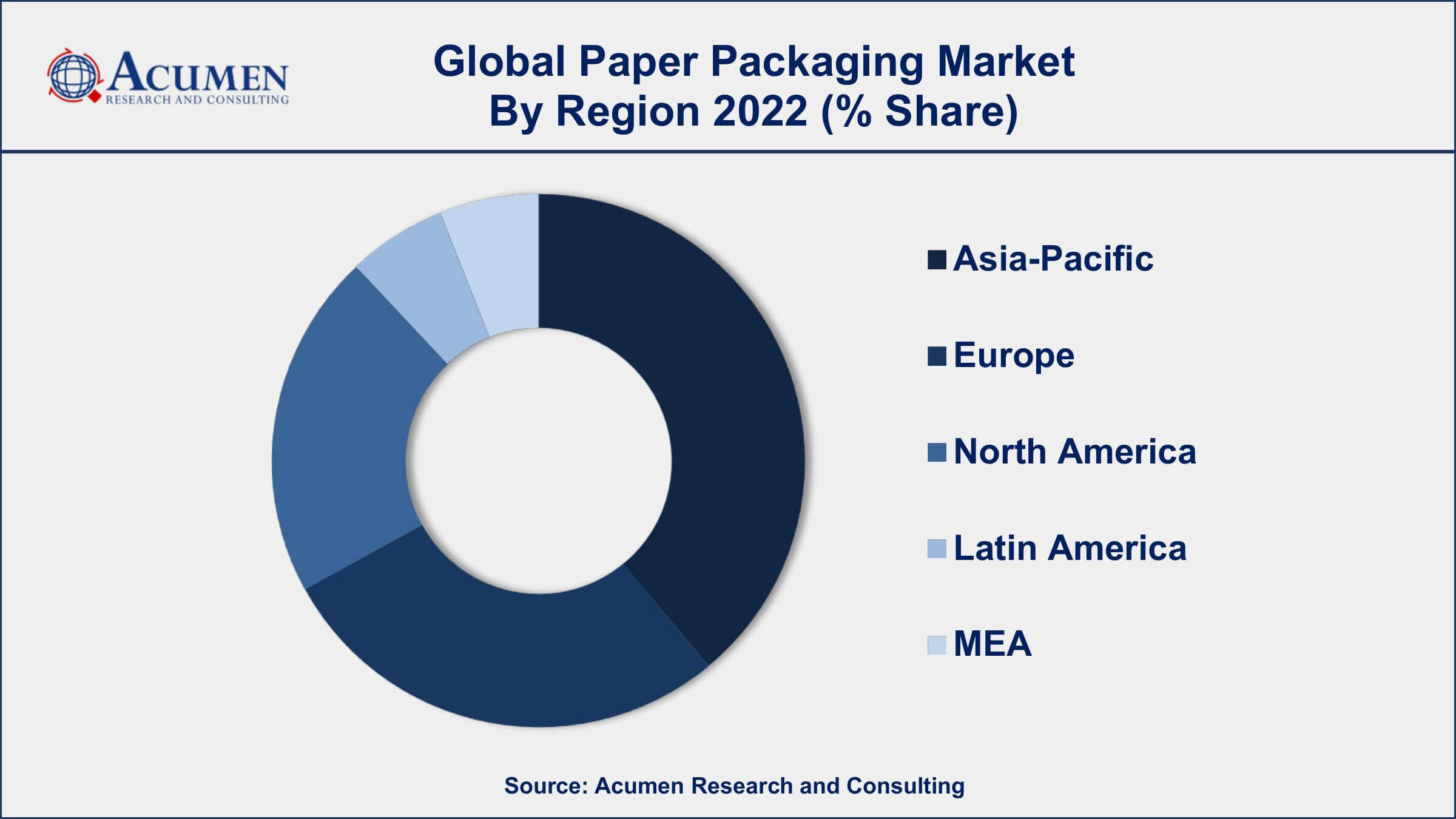

- Asia-Pacific region led with more than 38% of Paper Packaging Market share in 2022

- North America Paper Packaging Market growth will record a CAGR of around 4.2% from 2023 to 2032

- According to the American Forest & Paper Association, the recycling rate for paper and paperboard packaging in the United States reached 68% in 2021

- Increasing consumer demand for sustainable and eco-friendly packaging solutions, drives the Paper Packaging Market value

Paper packaging refers to the use of paper-based materials for packaging various products and goods. It includes a wide range of packaging solutions such as corrugated boxes, cartons, bags, pouches, and wrapping papers. Paper packaging is popular due to its eco-friendliness, recyclability, and biodegradability compared to other packaging materials like plastics. It provides protection, convenience, and branding opportunities for products across industries such as food and beverages, personal care, healthcare, and e-commerce.

The paper packaging market has experienced significant growth in recent years and is expected to continue its upward trajectory. One of the key drivers of this growth is the increasing demand for sustainable and eco-friendly packaging solutions. As consumers become more environmentally conscious, they are seeking products packaged in materials that have minimal impact on the environment. Paper packaging fits this requirement, as it is renewable, recyclable, and compostable. Moreover, the e-commerce sector has witnessed substantial expansion, driving the demand for paper-based packaging solutions. With the rise of online shopping, there is a need for secure and protective packaging that can withstand transportation and handling. Corrugated boxes, for instance, are widely used for shipping goods due to their strength and durability. The growth of the e-commerce industry has further fueled the demand for paper packaging.

Global Paper Packaging Market Trends

Market Drivers

- Increasing consumer demand for sustainable and eco-friendly packaging solutions

- Growth of the e-commerce industry, driving the need for protective and secure packaging

- Government regulations and initiatives promoting sustainable practices and reducing plastic waste

- Rising awareness among consumers about the environmental impact of packaging materials

- Growing preference for paper packaging due to its recyclability and biodegradability

Market Restraints

- Volatility in raw material prices, particularly for wood pulp, impacting the production costs of paper packaging

- Intense competition from alternative packaging materials such as plastics and metals

Market Opportunities

- Growing demand for premium and luxury packaging options in various industries

- Increasing investment in research and development to improve the strength and durability of paper packaging

Paper Packaging Market Report Coverage

| Market | Paper Packaging Market |

| Paper Packaging Market Size 2022 | USD 384.8 Billion |

| Paper Packaging Market Forecast 2032 | USD 556.5 Billion |

| Paper Packaging Market CAGR During 2023 - 2032 | 3.9% |

| Paper Packaging Market Analysis Period | 2020 - 2032 |

| Paper Packaging Market Base Year | 2022 |

| Paper Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Grade, By Packaging Level, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | International Paper Company, Smurfit Kappa Group, Mondi Group, WestRock Company, DS Smith Plc, Packaging Corporation of America, Stora Enso Oyj, Nine Dragons Paper (Holdings) Limited, Amcor Plc, Oji Holdings Corporation, Georgia-Pacific LLC, and Sappi Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Paper packaging is a versatile and widely used packaging solution that offers numerous benefits. Paper packaging can be made from recycled or virgin paper fibers and is known for its eco-friendly and sustainable nature. It is widely preferred due to its recyclability, biodegradability, and renewable source material. The applications of paper packaging are diverse and span across various sectors. In the food and beverage industry, paper packaging is commonly used for products such as cereals, snacks, bakery items, frozen foods, and beverages. It is used for packaging dry and wet goods, offering protection, convenience, and branding opportunities.

Paper packaging also finds applications in the personal care and cosmetics industry. It is used for packaging products like soaps, shampoos, creams, lotions, and perfumes. Paper-based packaging provides an aesthetic appeal, allowing for attractive designs, printing, and labeling options to enhance product visibility and branding. Additionally, paper packaging plays a significant role in the e-commerce sector. It is widely used for shipping and transportation purposes. Corrugated boxes made from paper provide strength, durability, and protection during the handling and transit of products. Paper-based packaging solutions like pouches and bags are also utilized for smaller items.

The paper packaging market has been experiencing steady growth in recent years and is expected to continue expanding in the foreseeable future. One of the key drivers of this growth is the increasing demand for sustainable and environmentally friendly packaging solutions. With growing awareness about the negative impacts of plastic packaging on the environment, consumers and businesses are shifting towards paper-based alternatives. Paper packaging is renewable, recyclable, and biodegradable, making it an attractive choice for eco-conscious consumers. This shift in consumer preferences has led to a surge in demand for paper packaging across various industries. Additionally, the rapid growth of the e-commerce industry has significantly contributed to the expansion of the paper packaging market.

Paper Packaging Market Segmentation

The global Paper Packaging Market segmentation is based on product type, grade, packaging level, end-use industry, and geography.

Paper Packaging Market By Product Type

- Corrugated Boxes

- Paper Bags and Sacks

- Liquid Paperboard Cartons

- Folding Boxes and Cases

- Others

According to the paper packaging industry analysis, the folding boxes and cases segment accounted for the largest market share in 2022. Folding boxes and cases offer versatile and cost-effective packaging solutions for a wide range of industries such as food and beverages, personal care, pharmaceuticals, electronics, and more. These boxes are typically made from corrugated board or solid board and are known for their ability to fold flat for efficient storage and transportation. One of the key drivers of growth in this segment is the increasing demand for sustainable packaging solutions. Folding boxes and cases made from paper are highly regarded for their eco-friendly attributes. They are renewable, recyclable, and biodegradable, making them a preferred choice for environmentally conscious consumers and businesses. As sustainability concerns continue to rise, the demand for folding boxes and cases made from paper is expected to grow, driving market expansion.

Paper Packaging Market By Grade

- Solid Bleached

- Uncoated Recycled

- Coated Recycled

- Others

In terms of grades, the uncoated recycled segment is expected to witness significant growth in the coming years. Uncoated recycled paper packaging is made from post-consumer recycled fibers, typically sourced from used paper and cardboard products. This segment caters to the increasing demand for sustainable packaging solutions and supports the circular economy by utilizing recycled materials. One of the key drivers of growth in the uncoated recycled segment is the growing emphasis on environmental sustainability. Consumers are increasingly conscious of the ecological impact of packaging materials and are seeking eco-friendly alternatives. Uncoated recycled paper packaging offers a sustainable choice as it reduces the demand for virgin materials and lowers the carbon footprint associated with production.

Paper Packaging Market By Packaging Level

- Tertiary Packaging

- Secondary Packaging

- Primary Packaging

According to the paper packaging market forecast, the primary packaging segment is expected to witness significant growth in the coming years. Primary packaging refers to the immediate packaging that directly comes into contact with the product, providing protection, containment, and branding. In recent years, there has been a notable shift towards paper-based primary packaging solutions driven by sustainability concerns, changing consumer preferences, and industry regulations. One of the key drivers of growth in the primary packaging segment is the increasing demand for sustainable packaging alternatives. Paper-based primary packaging offers several environmental advantages over traditional materials such as plastics. It is renewable, recyclable, and biodegradable, making it an attractive choice for businesses and consumers seeking eco-friendly packaging options.

Paper Packaging Market By End-Use Industry

- Food

- Beverage

- Healthcare

- Personal Care and Home Care

- Others

Based on the end-use industry, the food segment is expected to continue its growth trajectory in the coming years. Food packaging plays a crucial role in ensuring the safety, freshness, and quality of food products. The increasing demand for sustainable and eco-friendly packaging options, coupled with the growth of the food industry, is driving the adoption of paper packaging in this segment. One of the key drivers of growth in the food segment is the rising consumer preference for sustainable packaging solutions. With growing awareness about the environmental impact of packaging materials, consumers are seeking food products that are packaged in materials that are recyclable, biodegradable, and renewable. Paper packaging fits these requirements perfectly, as it is derived from renewable sources and can be recycled or composted.

Paper Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Paper Packaging Market Regional Analysis

Asia-Pacific dominates the paper packaging market for several reasons, making it the largest and most significant region in terms of market share. The Asia-Pacific region is home to populous countries such as China and India, which have witnessed significant population growth and rising disposable incomes. This demographic shift has led to increased consumption of consumer goods, including packaged food, beverages, and other products, creating a substantial demand for paper packaging solutions. Moreover, the region benefits from a strong manufacturing base and extensive supply chains. Many multinational companies have established production facilities in Asia-Pacific countries to capitalize on the lower labor and production costs. This has further contributed to the demand for paper packaging materials to support the packaging requirements of these manufacturing operations. Additionally, the presence of a vast network of suppliers and converters specializing in paper packaging provides a competitive advantage for the region. Furthermore, the Asia-Pacific region has seen a shift towards sustainable packaging practices and a growing focus on environmental concerns.

Paper Packaging Market Player

Some of the top paper packaging market companies offered in the professional report include International Paper Company, Smurfit Kappa Group, Mondi Group, WestRock Company, DS Smith Plc, Packaging Corporation of America, Stora Enso Oyj, Nine Dragons Paper (Holdings) Limited, Amcor Plc, Oji Holdings Corporation, Georgia-Pacific LLC, and Sappi Limited.

Frequently Asked Questions

What was the market size of the global paper packaging in 2022?

The market size of paper packaging was USD 384.8 Billion in 2022.

What is the CAGR of the global paper packaging market from 2023 to 2032?

The CAGR of paper packaging is 3.9% during the analysis period of 2023 to 2032.

Which are the key players in the paper packaging market?

The key players operating in the global market are including International Paper Company, Smurfit Kappa Group, Mondi Group, WestRock Company, DS Smith Plc, Packaging Corporation of America, Stora Enso Oyj, Nine Dragons Paper (Holdings) Limited, Amcor Plc, Oji Holdings Corporation, Georgia-Pacific LLC, and Sappi Limited.

Which region dominated the global paper packaging market share?

Asia-Pacific held the dominating position in paper packaging industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of paper packaging during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global paper packaging industry?

The current trends and dynamics in the paper packaging industry include increasing consumer demand for sustainable and eco-friendly packaging solutions, and growth of the e-commerce industry, driving the need for protective and secure packaging.

Which grade held the maximum share in 2022?

The uncoated recycled grade held the maximum share of the paper packaging industry.