Protein Ingredients Market - Global Industry Size, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Protein Ingredients Market - Global Industry Size, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

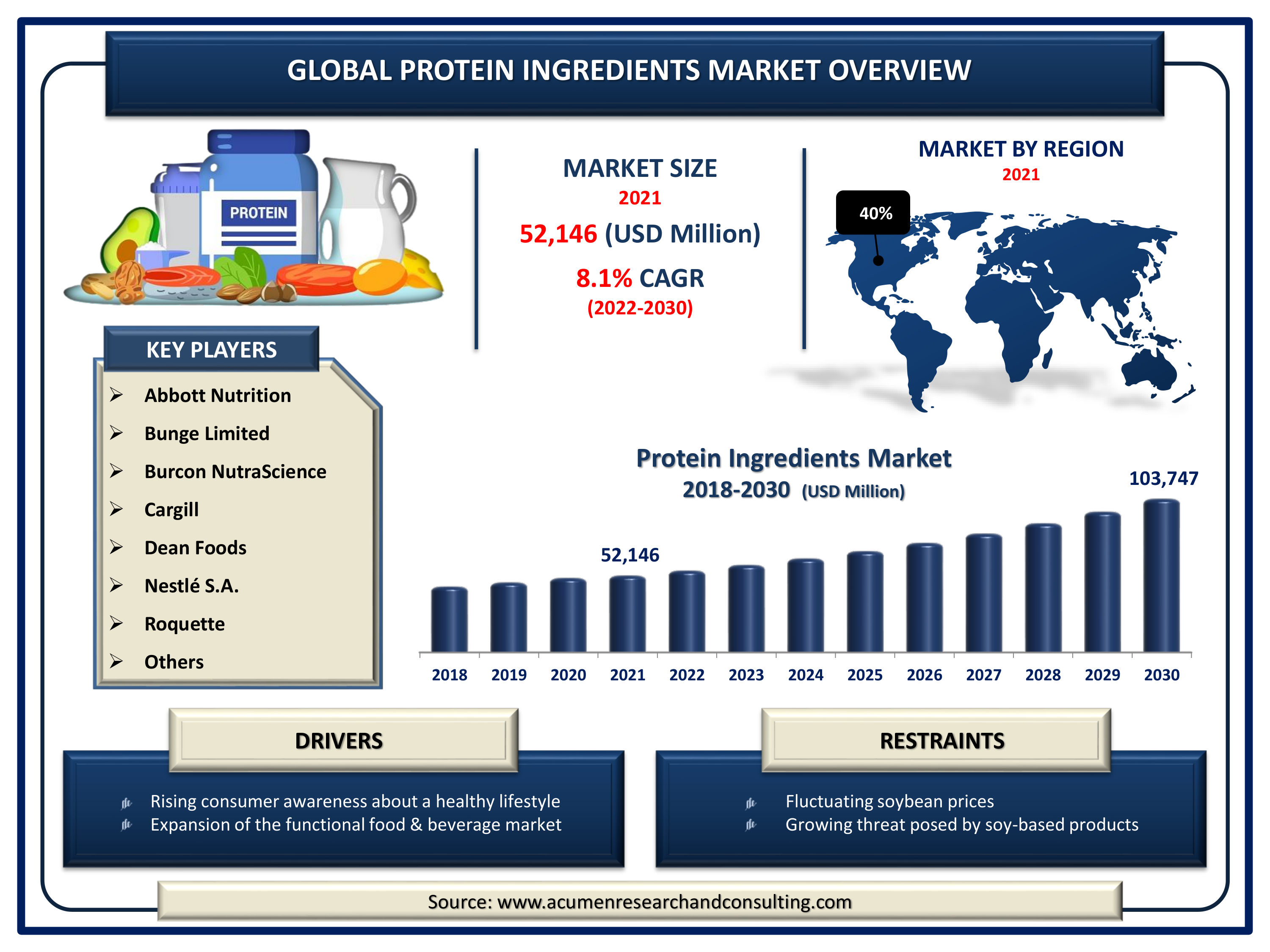

The Global Protein Ingredients Market Size was valued at USD 52,146 Million in 2021 and is predicted to be worth USD 103,747 Million by 2030, with a CAGR of 8.1% from 2022 to 2030.

Protein is typically composed of amino acids, these are organic compounds composed of elements like carbon, hydrogen, oxygen, and nitrogen. According to the National Institutes of Health (NIH), amino acids are the building blocks of proteins, and proteins are the building blocks of muscle mass. Protein ingredients are derived from the animal or plant with the help of processes that does the separation and purification of specific protein components from their original native sources.

Global Protein Ingredients Market DRO’s

Market Drivers

- Growing demands for proteins as functional and nutritious elements post Covid-19

- Rising consumer awareness about a healthy lifestyle to uplift immunity

- Expansion of the functional food & beverage market

- Innovative technical developments in the protein ingredient industry

- Increasing demand for livestock-related products

Market Restraints

- Fluctuating soybean prices

- The growing threat posed by soy-based products

- Cultural restriction on the consumption of gelatin

Market Opportunities

- The increasing importance of dairy and plant proteins

- Exploring new sectors through customization options

Report Coverage

| Market | Protein Ingredients Market |

| Market Size 2021 | USD 52,146 Million |

| Market Forecast 2030 | USD 103,747 Million |

| CAGR During 2022 - 2030 | 8.1% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Source of Protein, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Nutrition, Bunge Limited, Burcon NutraScience, Cargill, Dean Foods, Hilmar Cheese Company, Mead Johnson & Company, LLC, Nellson Nutraceutical LLC, Nestlé S.A., PepsiCo Inc., Roquette, Scoular, and Unilever. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The increasing demand for food products that are produced using protein ingredients like margarine, cold cuts, bakery products, spreads, yogurt, and milk sausages are driving the market growth. The increasing consumption of processed food containing protein ingredients across the globe is additionally supporting the market growth. The growing production of specific protein ingredients compositions that perform functions like satiety, muscle repair, weight loss, and energy balance is additionally boosting the market growth. The increasing demand for proteins as nutritional and functional ingredients among the health-conscious population is additionally proliferating the market value. The other prominent properties of the protein that are driving the market growth include emulsification, gelation/viscosity, water-binding/hydration, foaming, aeration properties, thickening ability, stabilizing ability, and solubility. Furthermore, the growing potential of dairy and plant proteins, as well as the development of new products through customization, is likely to create potential opportunities over the forecast period.

On the other side, cultural restrictions on the consumption of gelatin and the production of protein from genetically modified organisms (GMO) are likely to restrict the growth over the forecast period.

Protein Ingredients Market Segmentation

The global protein ingredients market segmentation based on the source of protein, application and geographical region.

Market by Source of Protein

- Animal Sourced

- Dairy products

- Milk protein concentrates

- Whey protein

- Casein/Caseinates

- Egg protein

- Gelatin

- Dairy products

- Plant Sourced

- Soy protein

- Soy protein concentrates

- Soy protein isolates

- Textured soy protein

- Wheat protein

- Vegetable protein

- Soy protein

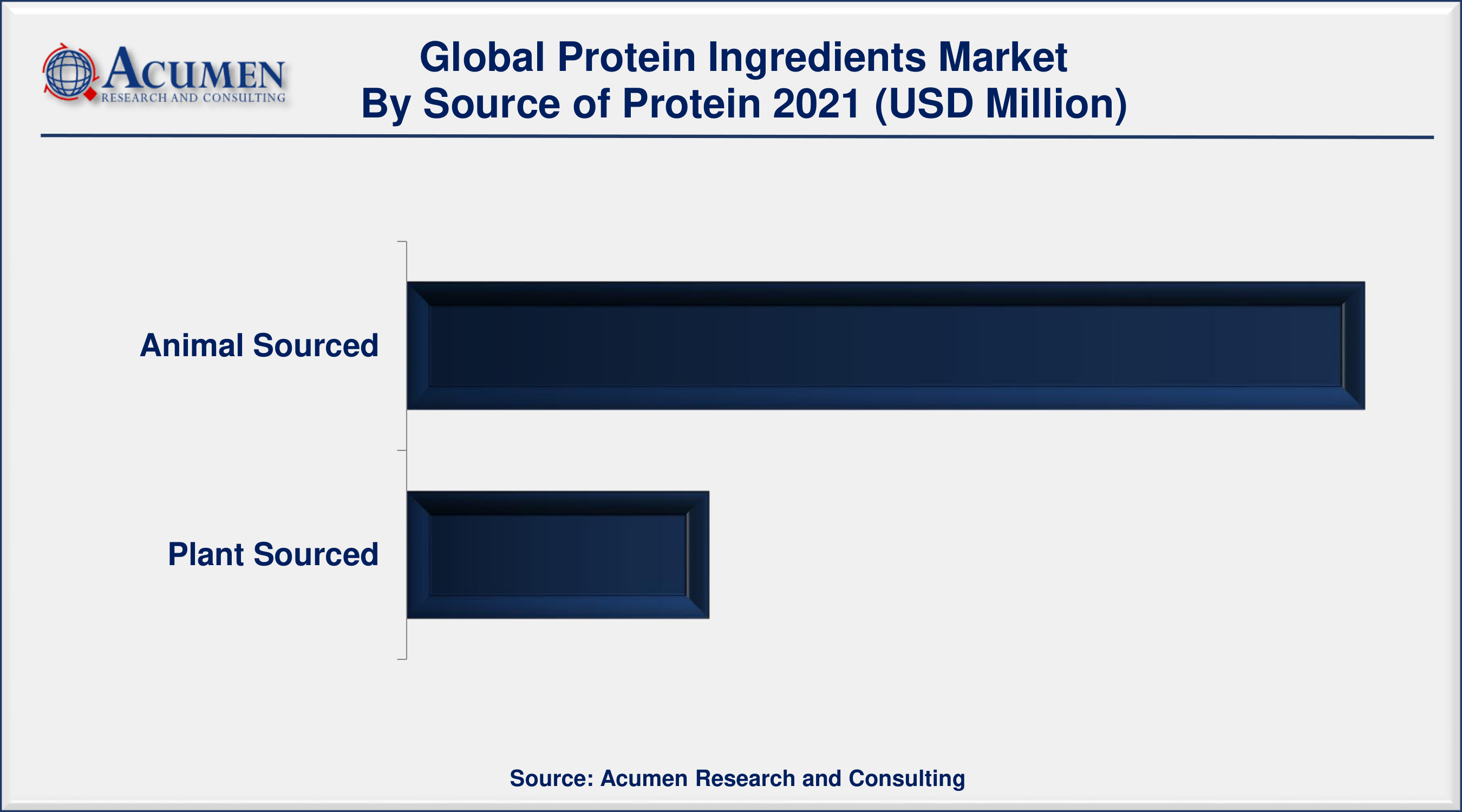

Based on the source of protein, the animal-sourced protein segment containing dairy products, egg protein, and gelatin, is leading the market with a major revenue share. The numerous benefits associated with the animal-derived protein ingredient, which are even supported by strong scientific evidence and recognized by the government food regulatory institutions, are boosting the market value. The absence of a direct substitute to the egg and gelatin in bakery and confectionery applications is additionally bolstering the segmental market value.

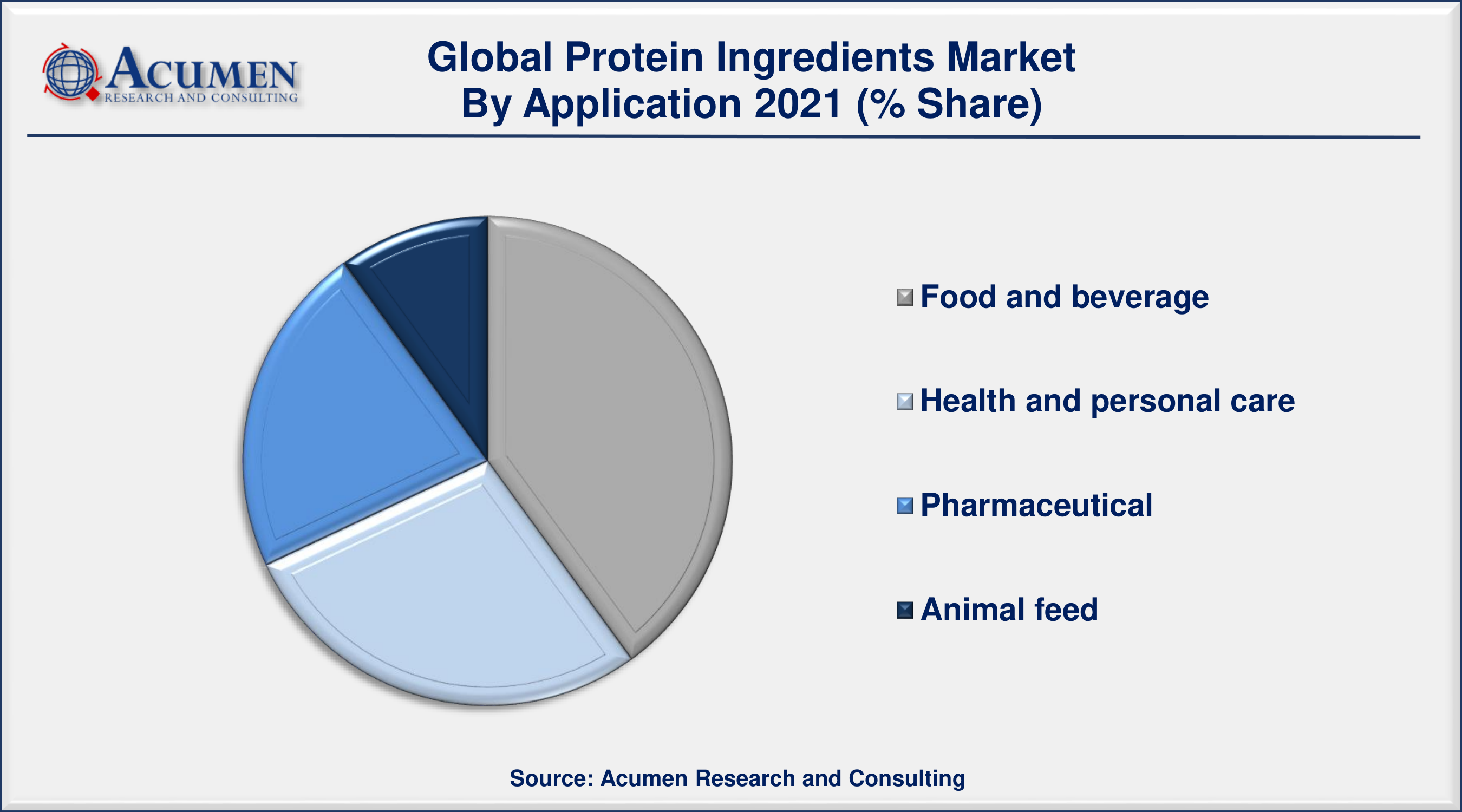

Market by Application

- Food and beverage

- Health and personal care

- Pharmaceutical

- Animal feed

According to the protein ingredients industry analysis, the food and beverages segment is expected to lead the market in 2021. Customers are becoming increasingly emphasizing balanced eating with reduced cholesterol and high nutritional value goods, which is contributing to a rise in protein ingredient consumption. As a result, there is an increasing need for nutritious and functional food. Additionally, proteins used in food and drinks are commonly accessible and extremely nutritious since they cater to the requirements of busy customers who want attractive choices but are not willing to compromise on healthcare, propelling the global protein ingredients market growth.

Protein Ingredients Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America accounted for the maximum revenue share in the global market

In 2021, North America held the maximum share in the protein ingredient market. The major economy of the region, the US, is contributing to the dominating share (%) in terms of revenue. Some of the major roles that protein plays in the human body include blood clotting, fluid balance, immune system responses, vision, hormones, and enzymes. The increasing demand and consumption of processed food in the regional market is driving the market growth.

Asia Pacific is projected to experience fastest growth over the forecast period

Asia Pacific is anticipated to exhibit the fastest growth with major CAGR over the forecast period from 2021 to 2030. The increasing number of health freaks in the developing economies of the region including China and India are contributing to the regional market growth. Major players are also expanding their reach in the developing countries of the region due to the availability of potential opportunities in the region is further boosting the regional market value. The rising awareness about the benefits associated with protein-rich food products is additionally expected to bolster growth over the forecast period.

Protein Ingredients Market Players

Some of the prominent global protein ingredients market companies are Abbott Nutrition, Bunge Limited, Burcon NutraScience, Cargill, Dean Foods, Hilmar Cheese Company, Mead Johnson & Company, LLC, Nellson Nutraceutical LLC, Nestlé S.A., PepsiCo Inc., Roquette, Scoular, and Unilever.

Frequently Asked Questions

How big is the protein ingredients market?

The protein ingredients market size in 2021 was accounted to be USD 52,146 Million.

What will be the projected CAGR for global protein ingredients market during forecast period of 2022 to 2030?

The projected CAGR of protein ingredients during the analysis period of 2022 to 2030 is 8.1%.

Which are the prominent competitors operating in the market?

The prominent players of the global protein ingredients market involve Abbott Nutrition, Bunge Limited, Burcon NutraScience, Cargill, Dean Foods, Hilmar Cheese Company, Mead Johnson & Company, LLC, Nellson Nutraceutical LLC, Nestl� S.A., PepsiCo Inc., Roquette, Scoular, and Unilever.

Which region held the dominating position in the global protein ingredients market?

North America held the dominating share for protein ingredients during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for protein ingredients during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global protein ingredients market?

Rising consumer awareness about a healthy lifestyle to uplift immunity and expansion of the functional food & beverage market are the prominent factors that fuel the growth of global protein ingredients market.

By segment source of protein, which sub-segment held the maximum share?

Based on source of protein, animal sourced segment held the maximum share for protein ingredients market in 2021.