Feed Amino Acids Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Feed Amino Acids Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

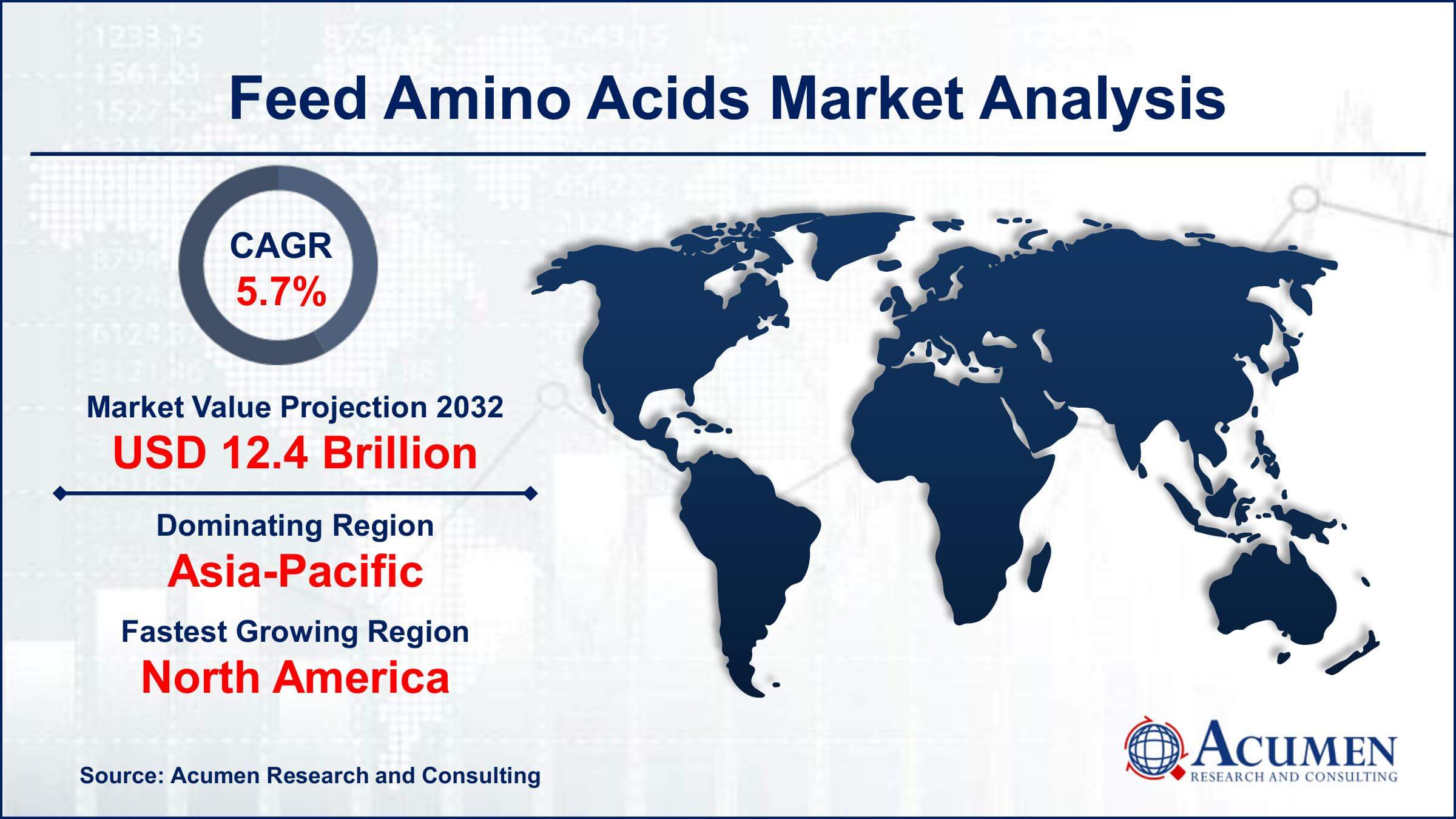

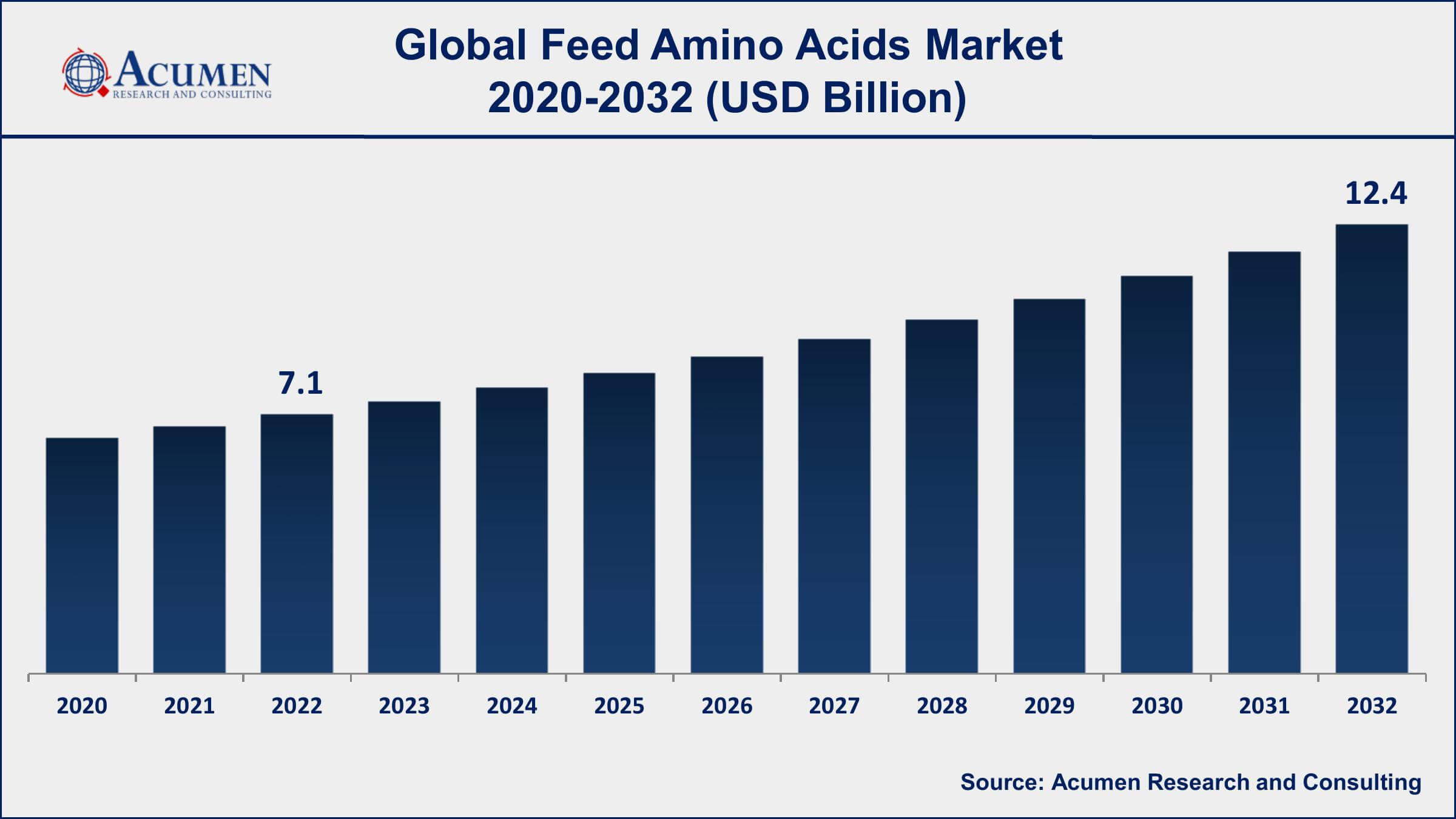

The Global Feed Amino Acids Market Size accounted for USD 7.1 Billion in 2022 and is projected to achieve a market size of USD 12.4 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Feed Amino Acids Market Key Highlights

- Global feed amino acids market revenue is expected to increase by USD 12.4 Billion by 2032, with a 5.7% CAGR from 2023 to 2032

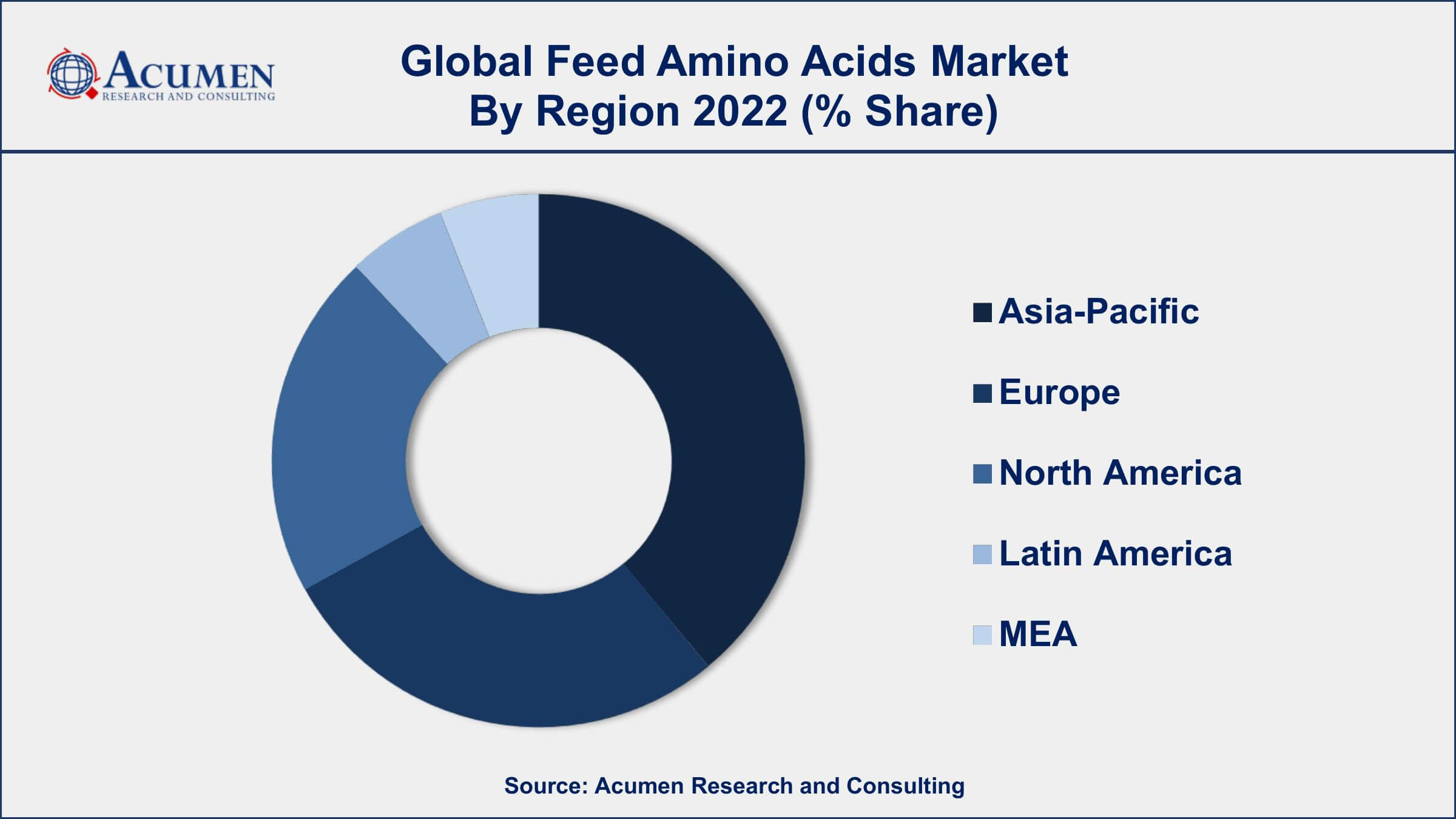

- Asia-Pacific region led with more than 38% of feed amino acids market share in 2022

- According to the US Department of Agriculture, the total production of broiler chickens in the United States in 2021 was estimated to be 43.1 billion pounds

- China is the world's largest producer of aquaculture products, with a production of 64.8 million tonnes in 2020, according to the FAO

- According to a report study, in 2019, the total amount of lysine, methionine, and threonine fed to poultry in the EU was approximately 1.2 million metric tons

- Rising demand for organic and natural animal feed, drives the feed amino acids market size

Feed amino acids are essential components of animal nutrition that play a crucial role in the growth and development of livestock. They are organic compounds that serve as building blocks for proteins, which are essential for muscle growth, tissue repair, and overall health. The most commonly used feed amino acids include lysine, methionine, threonine, and tryptophan. These amino acids are often added to animal feed in their pure form or as part of a blend to meet the specific nutritional needs of different livestock species.

The market for feed amino acids has been growing steadily in recent years due to the increasing demand for animal protein, the rise in meat consumption, and the need for improved animal nutrition. The growing population and the rise in disposable income have led to an increased demand for meat, dairy, and other animal products, which in turn has led to an increase in demand for feed amino acids. Furthermore, the increasing awareness of animal health and the need for sustainable animal production has resulted in the increased use of feed amino acids in animal feed. Additionally, the market is expected to benefit from technological advancements in the production and processing of feed amino acids, which is expected to increase their availability and affordability.

Global Feed Amino Acids Market Trends

Market Drivers

- Increasing demand for animal protein

- Rise in meat consumption

- Need for improved animal nutrition

- Increased awareness of animal health

- Growing aquaculture industry

Market Restraints

- High cost of production

- Regulations on the use of certain amino acids

- Fluctuations in raw material prices

Market Opportunities

- Increasing demand for plant-based protein alternatives

- Rising demand for organic and natural animal feed

Feed Amino Acids Market Report Coverage

| Market | Feed Amino Acids Market |

| Feed Amino Acids Market Size 2022 | USD 7.1 Billion |

| Feed Amino Acids Market Forecast 2032 | USD 12.4 Billion |

| Feed Amino Acids Market CAGR During 2023 - 2032 | 5.7% |

| Feed Amino Acids Market Analysis Period | 2020 - 2032 |

| Feed Amino Acids Market Base Year | 2022 |

| Feed Amino Acids Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cargill, Incorporated, Archer Daniels Midland Company (ADM), Evonik Industries AG, Ajinomoto Co., Inc., Novus International, Inc., CJ CheilJedang Corp., Royal DSM N.V., BASF SE, Sumitomo Chemical Co., Ltd., Chr. Hansen Holding A/S, Phibro Animal Health Corporation, and Adisseo France SAS. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Amino acids are organic compounds made from amino and carboxylic acid functional groups. The major elements of amino acids are oxygen, hydrogen, carbon, and nitrogen. Structurally, the amino acid is divided into alpha, delta, beta, and gamma. Due to their biological importance, amino acids are generally used in nutritional doses, food technology, and fertilizers. Amino acid, in industrial applications, is used for the production of chiral catalysts, biodegradable plastics, and drugs. Amino acid is used in feed additives to improve metabolism and nourish animals like pigs, cattle, and broilers, which are used primarily for the consumption of meat. Global meat consumption estimates are increasing every year; also lasin, methionine, threonine, and tryptophan are major animal feed additives. New production technology and mass production of amino acids make it more economical and, thus increase its user base. Increasing life expectancy, less availability of arable land and water resources for animal feed production, and demand for growing food crops for food and ethanol production have supplemented the growth of the meat industry, which in turn is creating the need to optimize feed use.

There has been an increasing demand for animal-based products mainly due to an increase in food production, standardization of meat products, disease outbreaks, implementation of innovative animal husbandry practices, improved quality of meat as well as increasing support by governments and environmentalists. In addition, increasing awareness among consumers regarding nutritious supplements for monogastric animals is posing attractive opportunities for market players. Also, the escalation in demand for meat has in turn increased overall livestock production. Thus, increasing livestock production is further estimated to drive the global feed amino acids market growth over the foreseeable years. Furthermore, the consumption of dietary supplements, especially in sports & nutrition applications, is projected to surge the development of the amino acid industry. In recent times, less availability of amino acid-rich raw materials such as soybean, wheat, and maize is challenging the growth of industry participants, which is further spurred by the increase in prices of amino acids. However, an upsurge in technology such as microfiltration provides potential opportunities for companies to increase yield. Moreover, the rise in demand for animal feed additives coupled with the increasing inclination of consumers towards meat consumption due to several health benefits is anticipated to bring impetus to the demand for amino acids over the forecast period.

Feed Amino Acids Market Segmentation

The global feed amino acids market segmentation is based on type, application, and geography.

Feed Amino Acids Market By Type

- Tryptophan

- Lysine

- Threonine

- Methionine

- Other

In terms of types, the tryptophan segment has seen significant growth in the feed amino acids market in recent years. This growth can be attributed to several factors, including the increasing demand for animal protein and the need for improved animal nutrition. Tryptophan is an essential amino acid that plays a crucial role in animal nutrition, especially in monogastric animals such as pigs and poultry. It is often added as a supplement in animal feed to meet their dietary requirements. Additionally, the growing trend of using plant-based protein sources in animal feed has also increased the demand for tryptophan supplements, as these plant-based sources may not contain sufficient levels of tryptophan. Furthermore, the increasing awareness of the importance of animal health and welfare has also led to the increased use of tryptophan supplements in animal feed.

Feed Amino Acids Market By Application

- Swine

- Aquatics

- Ruminants

- Poultry

- Equine

- Others

According to the feed amino acids market forecast, the aquatics segment is expected to witness significant growth in the coming years. This growth is attributed to the increasing demand for fish and other seafood products, particularly in the Asia-Pacific region. Aquaculture is one of the fastest-growing sectors in the food industry, and the use of feed amino acids in aquaculture has become increasingly important in ensuring the proper growth and development of fish and other aquatic species. Amino acids, including lysine, methionine, and tryptophan, are essential for the growth and development of fish and other aquatic species. The growth of the aquatics segment is expected to continue in the coming years due to several factors, including the increasing demand for fish and other seafood products, the growing awareness of the importance of sustainable aquaculture practices, and advancements in aquaculture technology.

Feed Amino Acids Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

The Asia-Pacific region dominates the feed amino acids market due to several factors, including the growing population, rising disposable income, and increasing demand for meat and other animal products. The region is home to some of the world's most populous countries, including China and India, where meat consumption has been on the rise. This has led to an increase in demand for animal protein, driving the demand for feed amino acids in animal feed. Moreover, the Asia-Pacific region is witnessing significant growth in the aquaculture industry, which is driving the demand for feed amino acids in the region. The region is a major producer and consumer of fish and other seafood products, and the demand for these products is expected to continue to grow in the coming years, creating opportunities for the growth of the feed amino acids market value.

Feed Amino Acids Market Player

Some of the top feed amino acids market companies offered in the professional report include Cargill, Incorporated, Archer Daniels Midland Company (ADM), Evonik Industries AG, Ajinomoto Co., Inc., Novus International, Inc., CJ CheilJedang Corp., Royal DSM N.V., BASF SE, Sumitomo Chemical Co., Ltd., Chr. Hansen Holding A/S, Phibro Animal Health Corporation, and Adisseo France SAS.

Frequently Asked Questions

What was the market size of the global feed amino acids in 2022?

The market size of feed amino acids was USD 7.1 Billion in 2022.

What is the CAGR of the global feed amino acids market from 2023 to 2032?

The CAGR of feed amino acids is 5.7% during the analysis period of 2023 to 2032.

Which are the key players in the feed amino acids market?

The key players operating in the global market are including Cargill, Incorporated, Archer Daniels Midland Company (ADM), Evonik Industries AG, Ajinomoto Co., Inc., Novus International, Inc., CJ CheilJedang Corp., Royal DSM N.V., BASF SE, Sumitomo Chemical Co., Ltd., Chr. Hansen Holding A/S, Phibro Animal Health Corporation, and Adisseo France SAS.

Which region dominated the global feed amino acids market share?

Asia-Pacific held the dominating position in feed amino acids industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of feed amino acids during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global feed amino acids industry?

The current trends and dynamics in the feed amino acids industry include increasing demand for animal protein, and need for improved animal nutrition.

Which application held the maximum share in 2022?

The poultry application held the maximum share of the feed amino acids industry.