Pretreatment Coatings Market | Acumen Research and Consulting

Pretreatment Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

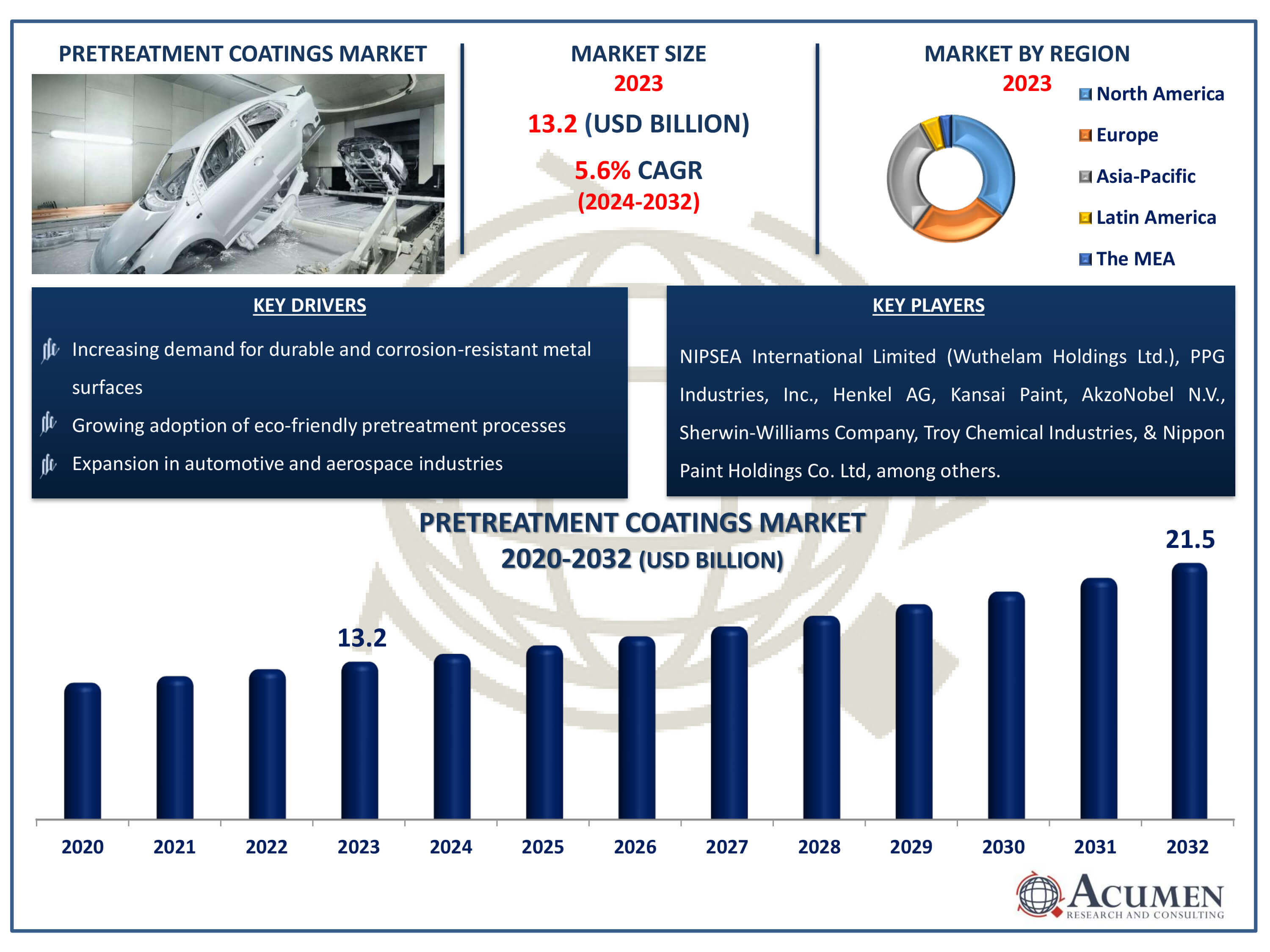

The Pretreatment Coatings Market Size accounted for USD 13.2 Billion in 2023 and is estimated to achieve a market size of USD 21.5 Billion by 2032 growing at a CAGR of 5.6% from 2024 to 2032.

Pretreatment Coatings Market Highlights

- Global pretreatment coatings market revenue is poised to garner USD 21.5 billion by 2032 with a CAGR of 5.6% from 2024 to 2032

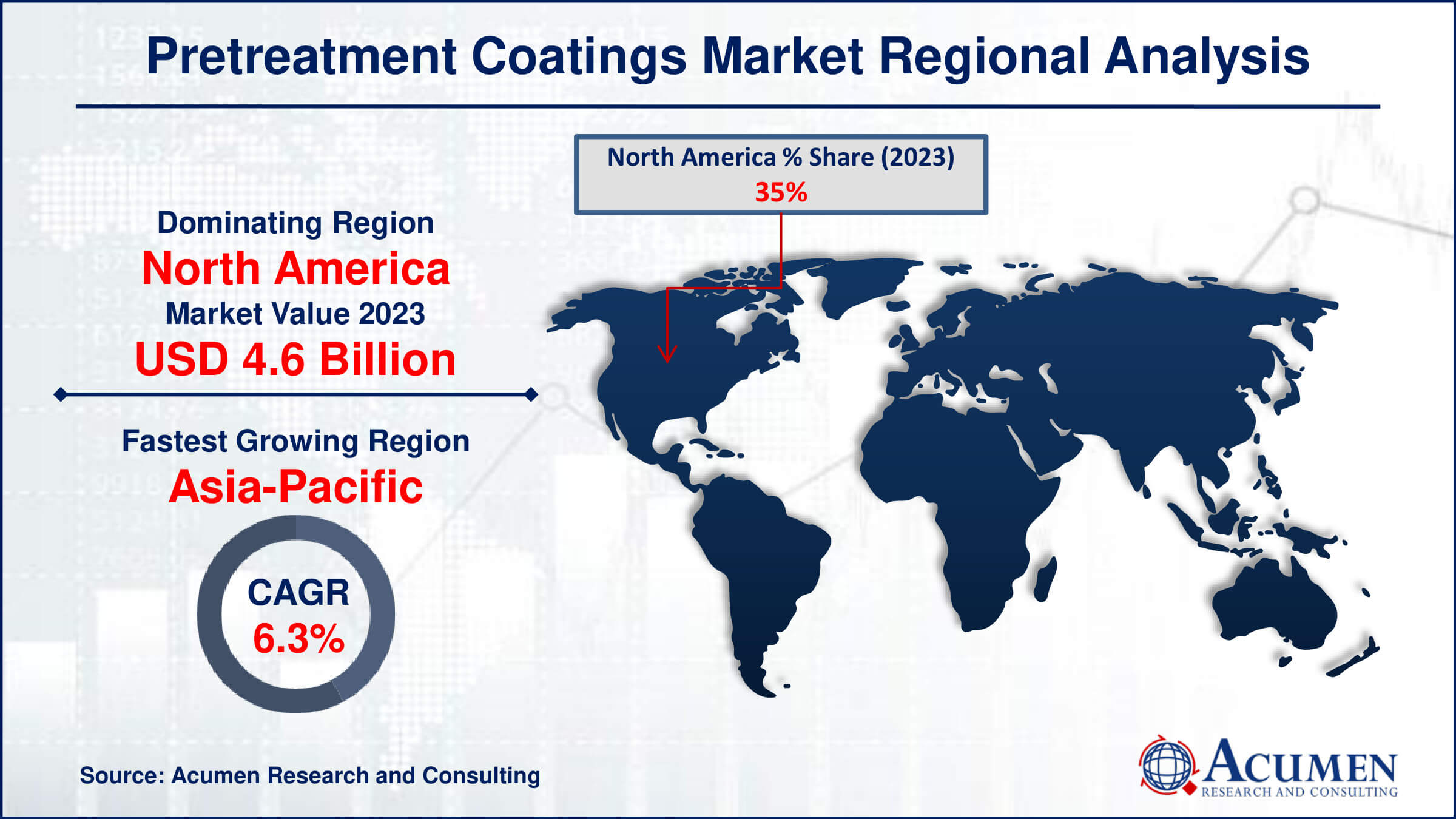

- North America pretreatment coatings market value occupied around USD 4.6 billion in 2023

- Asia-Pacific pretreatment coatings market growth will record a CAGR of more than 6.3% from 2024 to 2032

- Among metal, the aluminum sub-segment generated notable revenue in 2023

- Based on application, the construction and building sub-segment generated significant pretreatment coatings market share in 2023

- Emerging markets in Asia-Pacific and Latin America is a popular pretreatment coatings market trend that fuels the industry demand

Pretreatment coatings are critical for increasing the lifetime and durability of metals like zinc, aluminum, silver, and copper alloys. These coatings are an important step before applying powder coatings because they considerably improve corrosion resistance and lengthen the shelf life of metal surfaces. The current availability of simple house loans with low interest rates has boosted demand for new residential buildings. This tendency is leading to growing use of pretreatment coatings in a variety of architectural and design applications. Effective pretreatment techniques safeguard metal components while also ensuring they fulfill high performance standards for long-term dependability. As industries evolve, pretreatment coatings continue to play an important role in preserving and improving metal surface quality across a wide range of sectors.

Global Pretreatment Coatings Market Dynamics

Market Drivers

- Increasing demand for durable and corrosion-resistant metal surfaces

- Growing adoption of eco-friendly pretreatment processes

- Expansion in automotive and aerospace industries

- Technological advancements in coating formulations

Market Restraints

- High initial setup and operational costs

- Stringent environmental regulations

- Limited availability of raw materials

Market Opportunities

- Rising investments in infrastructure development

- Expansion of the electronics manufacturing sector

- Adoption of pretreatment coatings in renewable energy applications

Pretreatment Coatings Market Report Coverage

| Market | Pretreatment Coatings Market |

| Pretreatment Coatings Market Size 2022 | USD 13.2 Billion |

| Pretreatment Coatings Market Forecast 2032 | USD 21.5 Billion |

| Pretreatment Coatings Market CAGR During 2023 - 2032 | 5.6% |

| Pretreatment Coatings Market Analysis Period | 2020 - 2032 |

| Pretreatment Coatings Market Base Year |

2022 |

| Pretreatment Coatings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Metal, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | NIPSEA International Limited (Wuthelam Holdings Ltd.), PPG Industries, Inc., Henkel AG, Kansai Paint, AkzoNobel N.V., Sherwin-Williams Company, Troy Chemical Industries, Nippon Paint Holdings Co. Ltd, Axalta Coating Systems, and 3M Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pretreatment Coatings Market Insights

The market for pretreatment coatings is thriving due to their ability to extend product lifespan by protecting components from corrosion. This is particularly crucial in industries such as construction, automotive, furniture, aerospace, and electronics, where there is high demand. Pretreatment coatings offer benefits like enhanced durability and corrosion resistance, which significantly drive market growth. Furthermore, the global surge in residential, commercial, and infrastructure construction projects, coupled with increasing adoption of powder coatings, is fueling demand for pretreatment coatings. However, challenges such as toxicity concerns in metal finishing processes and environmental issues could hinder industry growth.

Despite these challenges, the automotive sector presents lucrative opportunities, especially in pretreating vehicle parts like engine components and fuel tanks. This segment is expected to see substantial growth during the pretreatment coatings industry forecast period. Additionally, the aerospace industry's expansion, driven by rising air travel demand and disposable incomes, further boosts the market. Metals are essential in aircraft manufacturing, creating a strong demand for pretreatment coatings. Overall, the market for pretreatment coatings is propelled by their critical role in extending product lifespan through corrosion protection. While facing challenges related to environmental impact and toxicity, opportunities abound in automotive and aerospace sectors, supported by global construction booms and the increasing popularity of powder coatings. These factors underscore the dynamic growth potential of pretreatment coatings in various industrial applications worldwide.

Pretreatment Coatings Market Segmentation

The worldwide market for coating pretreatment market is split based on type, metal, application, and geography.

Coating Pre-Treatment Market By Types

- Chromate

- Blast Clean

- Free from Chromate

- Phosphate

According to pretreatment coatings industry analysis, the chromate sector is predicted to be the notable. Chromate pretreatment coatings are popular due to their superior corrosion protection qualities, especially for metals such as aluminum and zinc. They create a protective layer that improves the adhesion and endurance of future coatings like paints and powder coatings. Despite environmental worries over hexavalent chromium compounds, chromate coatings are nevertheless used in areas that require high-performance corrosion resistance, such as aerospace, automotive, and industrial applications.

The supremacy of chromate coatings is based on their proven effectiveness and adaptability in a variety of working circumstances and substrate materials. However, regulatory demands and growing environmental consciousness are driving advances in alternate pretreatment processes, such as phosphate-based and chromate-free coatings. Nonetheless, the Chromate category is likely to maintain its market leadership because to its proven durability and widespread adoption across key end-user industries worldwide.

Coating Pre-treatment Market By Metals

- Steel

- Aluminum

In the terms of pretreatment coatings market analysis, the aluminum sector is expected to be the largest. This is primarily driven by the growing usage of aluminum in a variety of industries, including automotive, aerospace, construction, and packaging, due to its lightweight qualities and corrosion resistance. Aluminum is favored because of its versatility and ability to tolerate extreme climatic conditions, making it perfect for applications that require long-lasting surface protection. Aluminum pretreatment coatings are gaining popularity due to technological advances in coating compositions that improve adherence and endurance. Furthermore, increased demand for eco-friendly solutions and strong legislation promoting sustainable practices favor aluminum, which is inherently recyclable and more environmentally friendly than other metals. Although steel remains important in a variety of industries, including automotive and construction, the growing applications and benefits of aluminum in lightweight and high-performance applications are likely to fuel its dominance in the pretreatment coatings market.

Coating Pretreatment Market Applications

- Construction and Building

- Transport and Automotive

- Appliances

- Others

The construction & building section is predicted to be the biggest and it is expected to grow throughout the pretreatment coatings market forecast period. This rise is being driven by the ongoing expansion of infrastructure projects around the world, which raises demand for durable and long-lasting materials. Pretreatment coatings are critical in this industry for protecting structural components from corrosion, improving adhesion, and extending the life of materials like steel and aluminum. The growing emphasis on sustainable and resilient building methods accelerates the use of these coatings. As urbanization and development projects continue to expand, the demand for dependable and effective pretreatment solutions in construction and building applications is expected to maintain the segment's market dominance.

Pretreatment Coatings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Pretreatment Coatings Market Regional Analysis

North America holds the largest share of the global pretreatment coatings market, driven by the presence of leading end-user sectors such as manufacturing, automotive, and aerospace. The region's advanced industrial base and focus on innovation in coating technologies contribute to its market dominance.

The Asia-Pacific region, however, is the fastest-growing market for pretreatment coatings. This rapid growth is attributed to the booming commercial and residential construction activities, along with significant infrastructural development. The increasing demand for durable and protective coatings in these sectors is expected to accelerate market growth in Asia-Pacific during the projected timeframe.

Europe region is the taking notable share in this market, largely due to the presence of major automotive manufacturers in Germany. The strong automotive industry in Europe drives the demand for high-quality pretreatment coatings to ensure durability and performance.

Additionally, the Middle East & Africa is projected to witness substantial growth as a developing hub for construction and infrastructure projects. The rising investments in these regions for development initiatives are likely to boost the demand for pretreatment coatings significantly.

Pretreatment Coatings Market Players

Some of the top pre-treatment coatings market companies offered in our report include NIPSEA International Limited (Wuthelam Holdings Ltd.), PPG Industries, Inc., Henkel AG, Kansai Paint, AkzoNobel N.V., Sherwin-Williams Company, Troy Chemical Industries, Nippon Paint Holdings Co. Ltd, Axalta Coating Systems, and 3M Company.

Frequently Asked Questions

How big is the pretreatment coatings market?

The pretreatment coatings market size was valued at USD 13.2 billion in 2023.

What is the CAGR of the global pretreatment coatings market from 2024 to 2032?

The CAGR of pretreatment coatings is 5.6% during the analysis period of 2024 to 2032.

Which are the key players in the pretreatment coatings market?

The key players operating in the global market are including NIPSEA International Limited (Wuthelam Holdings Ltd.), PPG Industries, Inc., Henkel AG, Kansai Paint, AkzoNobel N.V., Sherwin-Williams Company, Troy Chemical Industries, Nippon Paint Holdings Co. Ltd, Axalta Coating Systems, and 3M Company.

Which region dominated the global pretreatment coatings market share?

North America held the dominating position in pretreatment coatings industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of pretreatment coatings during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global pretreatment coatings industry?

The current trends and dynamics in the pretreatment coatings industry include increasing demand for durable and corrosion-resistant metal surfaces, growing adoption of eco-friendly pretreatment processes, expansion in automotive and aerospace industries, and technological advancements in coating formulations.

Which metal held the maximum share in 2023?

The aluminum Metal held the noteworthy share of the pretreatment coatings industry.