Copper Alloy Wire Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Copper Alloy Wire Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

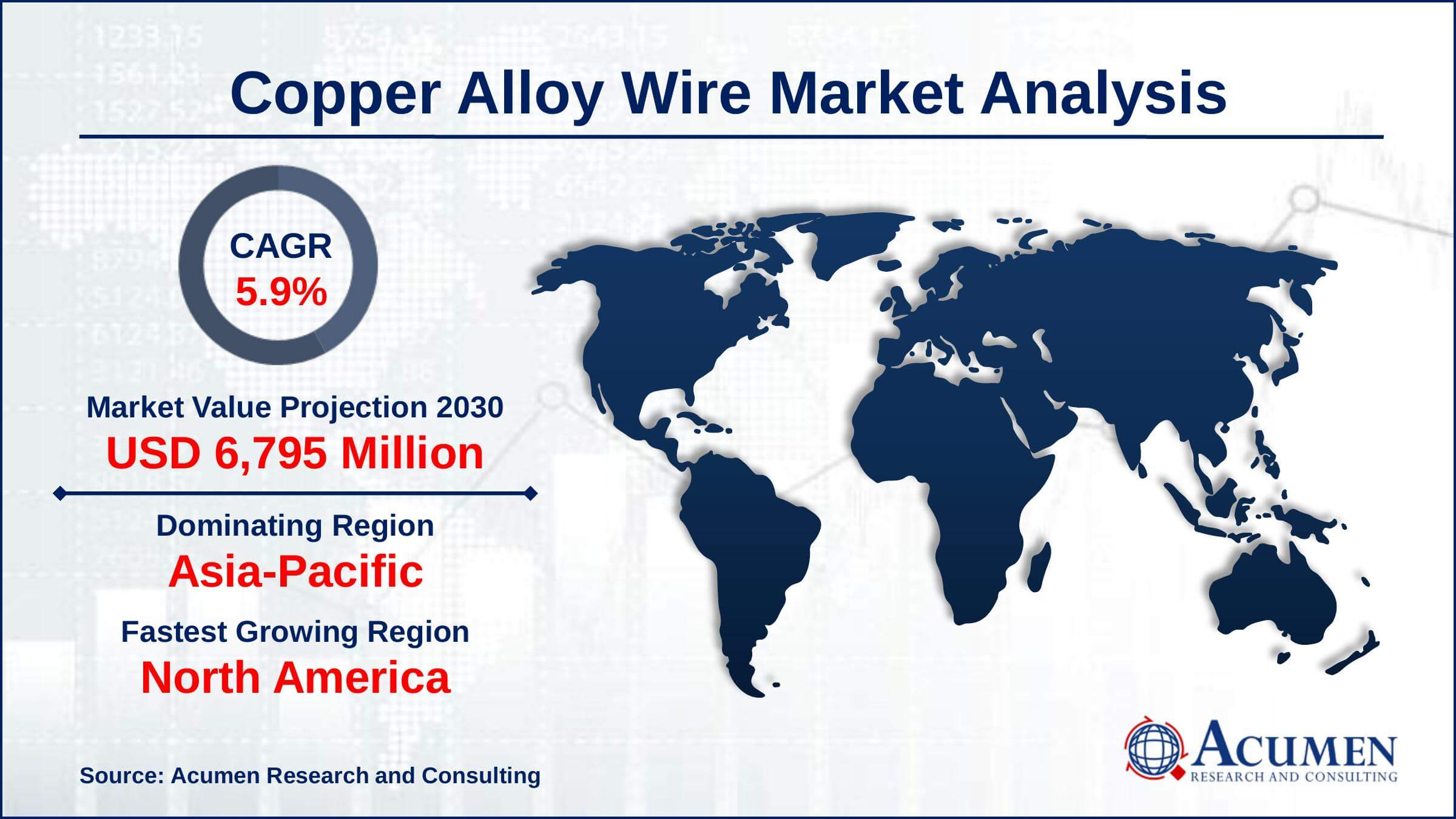

Request Sample Report

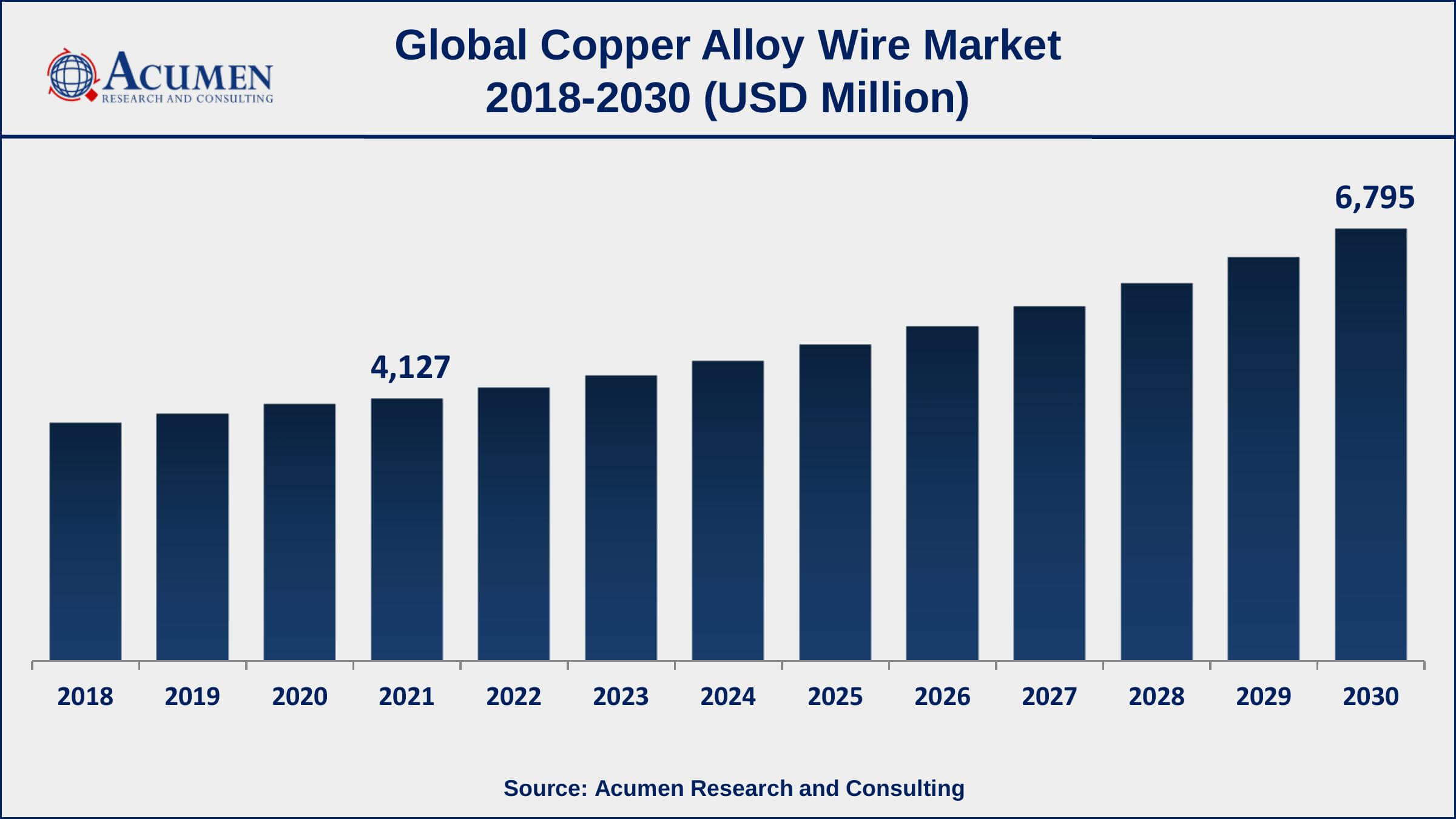

The Global Copper Alloy Wire Market Size accounted for USD 4,127 Million in 2021 and is estimated to achieve a market size of USD 6,795 Million by 2030 growing at a CAGR of 5.9% from 2022 to 2030. The rising construction sector is driving the copper alloy wire market growth, as it is utilized as a reinforcing material in concrete and as an electrical conductor in wiring. Furthermore, rising demand for renewable energy, such as wind and solar power, can create opportunities for growth of the copper alloy wire market value in the coming years.

Copper Alloy Wire Market Report Key Highlights

- Global copper alloy wire market revenue is estimated to expand by USD 6,795 million by 2030, with a 5.9% CAGR from 2022 to 2030.

- According to an analysis, 21 million metric tons of copper were produced globally in mines in 2021

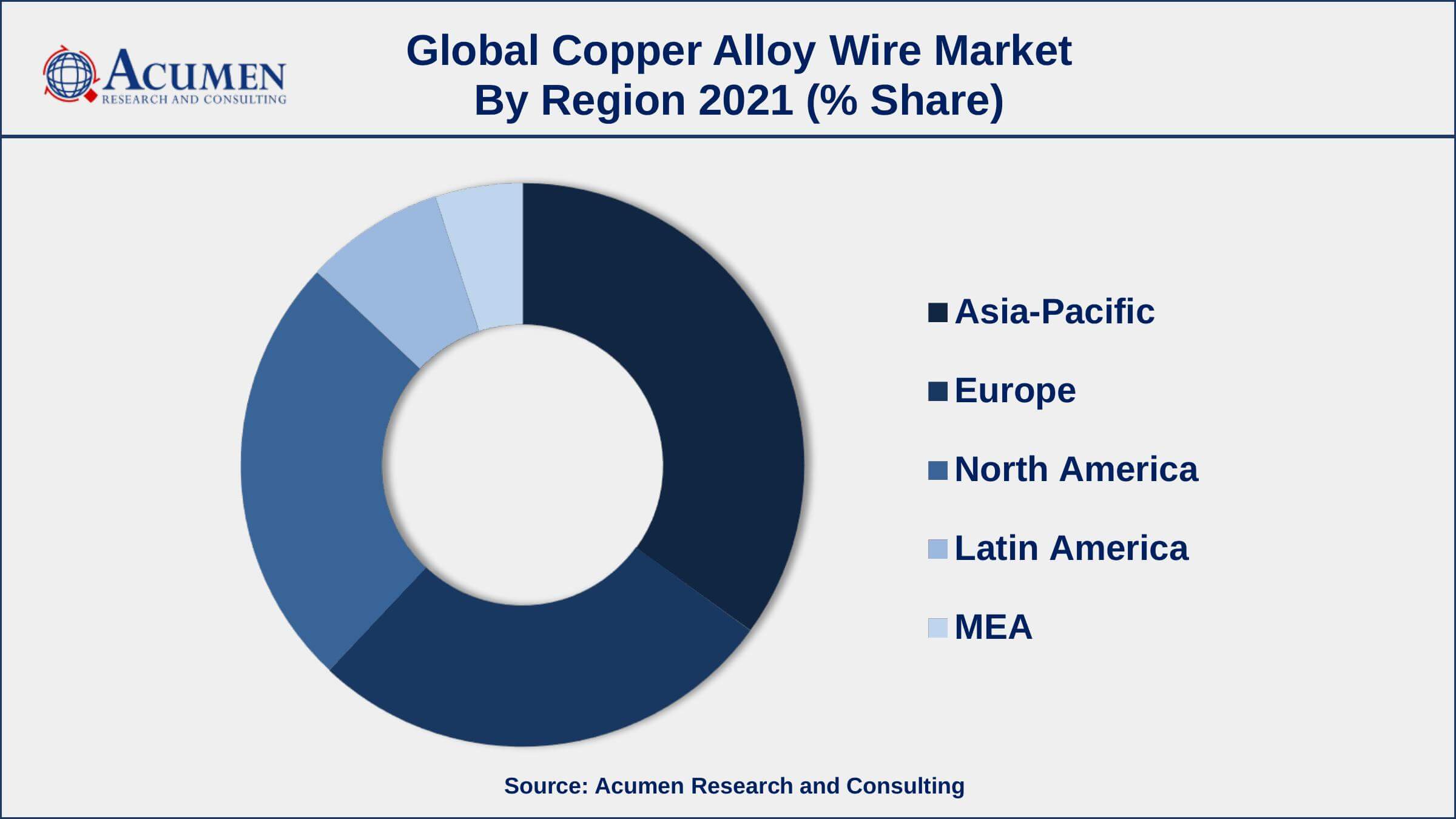

- Asia-Pacific copper alloy wire market share accounted for over 60% of total market shares in 2021

- Based on type, brass wire segment accounted for over 38% of the overall market share in 2021

- Among application, electrical and electronics segment engaged more than 42% of the total market share

- Increasing use in the automotive and aerospace industries, drives the copper alloy wire market size

Copper alloy wire is a kind of wire that is composed of copper and one or more other metals. Copper alloy wire is utilized in a variety of industries due to its unique combination of qualities such as electrical properties, resistance to corrosion, and mechanical strength. It is utilized in a variety of industries including electrical and electronics, construction, automotive, aerospace, marine, medical, and industrial. Copper alloy wire comes in a variety of diameters and can be made to have varying degrees of flexibility and strength. It can be covered or treated with different finishes to improve its appearance or performance in specific applications.

Global Copper Alloy Wire Market Trends

Market Drivers

- Growth in the construction industry

- Increasing demand for electrical and electronic products

- Increasing use in the automotive and aerospace industries

Market Restraints

- Volatility in raw material prices

- Competition from alternative materials

Market Opportunities

- Increasing demand for renewable energy

- Developing new alloys

Copper Alloy Wire Market Report Coverage

| Market | Copper Alloy Wire Market |

| Copper Alloy Wire Market Size 2021 | USD 4,127 Million |

| Copper Alloy Wire Market Forecast 2030 | USD 6,795 Million |

| Copper Alloy Wire Market CAGR During 2022 - 2030 | 5.9% |

| Copper Alloy Wire Market Analysis Period | 2018 - 2030 |

| Copper Alloy Wire Market Base Year | 2021 |

| Copper Alloy Wire Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aurubis AG, Luvata, Nippon Mining & Metals Co., Ltd., Fisk Alloy Inc., Southwire Company, LLC, Jiangsu Changjiang Copper Co., Ltd., Jinko Electric Wire Co., Ltd., Encore Wire Corporation, Tatsuta Electric Wire & Cable Co., Ltd., and Hitachi Cable America, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Pure copper is the best conductor of electricity; however, in its purest form, copper is malleable and low in strength and requires the addition of a small amount of alloying elements such as tin, iron, silver, and phosphorus to improve its hardness and strength without lowering the electrical conductivity. Copper and copper alloys are some of the most versatile engineering materials available. The blend of physical properties such as conductivity, corrosion resistance, strength, machinability, and ductility make it suitable for a variety of applications. These properties can be further enhanced with variations in composition and manufacturing methods.

The largest end-user of copper is the building and construction industry. Some of the important applications of copper in the construction industry include roofing, cladding, rainwater systems, heating systems, water pipes and fittings, electrical wiring, oil and gas, and others. Rising demand for copper in multiple applications, a multi-polar business world, increasing recycling efforts, and growing sustainability ambitions are some of the trends being observed in the global copper alloy wire market.

Copper Alloy Wire Market Segmentation

The worldwide copper alloy wire market segmentation is based on the type, application, and geography.

Copper Alloy Wire Market By Type

- Brass Wire

- Bronze Wire

- Nickel Silver Wire

- Copper-nickel Wire

- Others

According to the copper alloy wire industry analysis, the brass wire segment held the highest market share in 2021. Brass wire is a copper and zinc alloy with excellent electrical conductivity as well as resistance to corrosion. It is frequently used as a decorative material and in electrical applications. Various factors drive demand for brass wire, including expansion in the construction sector, rising demand for electronic and electrical products, and increased use of brass wire in the automobile and aerospace industries.

Copper Alloy Wire Market By Application

- Electrical and Electronics

- Automotive

- Construction

- Aerospace

- Others

According to the copper alloy wire market forecast, the automotive application segment is predicted to increase significantly in the coming years. In the automotive industry, copper alloy wire is utilized for a variety of purposes such as electrical wiring, connectors, and sensors. The automotive industry's need for copper alloy wire is determined by variables such as vehicle production and sales, technological improvements in the automotive sector, and regulatory requirements relating to vehicle safety and pollution. Furthermore, copper alloy wire is utilized in the manufacture of various sensors in automobiles, such as airbag sensors, engine management systems, as well as emissions control systems.

Copper Alloy Wire Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Holds The Largest Share Of The Global Copper Alloy Wire Market

The Asia-Pacific region is a major market for copper alloy wire, with China being the region's biggest market. The Asia-Pacific region's demand for copper alloy wire has been driven by rising demand for electronic products as well as increased vehicle manufacturing and sales. The Asia-Pacific region is home to a considerable number of copper alloy wire manufacturers, both national and international. These companies make a variety of copper alloy wire products for a variety of industries, including the electronic and electrical industries and the automobile industry. The Asia-Pacific copper alloy wire market is predicted to expand in the coming years due to rising demand for electronic gadgets and increased vehicle production and sales in the region.

Copper Alloy Wire Market Players

Some of the top copper alloy wire market companies offered in the professional report include Aurubis AG, Luvata, Nippon Mining & Metals Co., Ltd., Fisk Alloy Inc., Southwire Company, LLC, Jiangsu Changjiang Copper Co., Ltd., Jinko Electric Wire Co., Ltd., Encore Wire Corporation, Tatsuta Electric Wire & Cable Co., Ltd., and Hitachi Cable America, Inc.

Frequently Asked Questions

What is the size of global copper alloy wire market in 2021?

The estimated value of global copper alloy wire market in 2021 was accounted to be USD 4,127 Million.

What is the CAGR of global copper alloy wire market during forecast period of 2022 to 2030?

The projected CAGR copper alloy wire market during the analysis period of 2022 to 2030 is 5.9%.

Which are the key players operating in the market?

The prominent players of the global copper alloy wire market are Aurubis AG, Luvata, Nippon Mining & Metals Co., Ltd., Fisk Alloy Inc., Southwire Company, LLC, Jiangsu Changjiang Copper Co., Ltd., Jinko Electric Wire Co., Ltd., Encore Wire Corporation, Tatsuta Electric Wire & Cable Co., Ltd., and Hitachi Cable America, Inc.

Which region held the dominating position in the global copper alloy wire market?

Asia-Pacific held the dominating copper alloy wire during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for copper alloy wire during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global copper alloy wire market?

Growth in the construction industry and increasing demand for electrical and electronic products drives the growth of global copper alloy wire market.

By Type segment, which sub-segment held the maximum share?

Based on Type, Brass Wire segment is expected to hold the maximum share of the copper alloy wire market.