Prebiotic Ingredients Market | Acumen Research and Consulting

Prebiotic Ingredients Market

Published :

Report ID:

Pages :

Format :

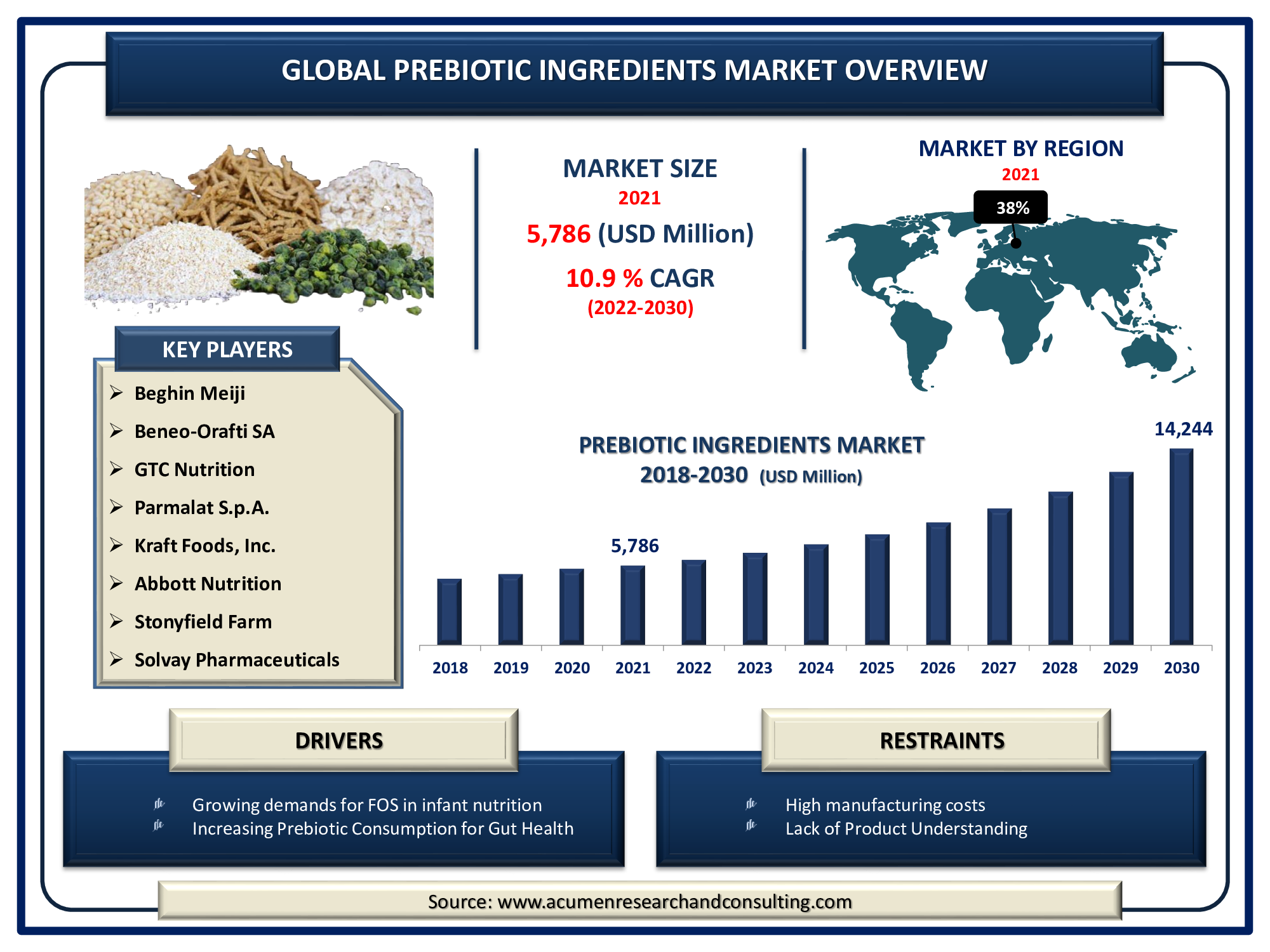

The global prebiotic ingredients market accounted for US$ 5,786 Mn in 2021 and is expected to reach US$ 14,244 Mn by 2030 with a considerable CAGR of 10.9% during the forecast timeframe of 2022 to 2030.

Prebiotics are food ingredients that cannot be digested but are thought to be beneficial to health due to their interaction with gut microorganisms. Prebiotic ingredients are usually observed in food supplements, which are conventional or improved foods that provide benefits in addition to basic nourishment. They help to stimulate the immune system, promote general digestive function, reducing stomach inflammation, increases absorption of calcium to improve bone strength, reduce diarrhea risk, and lower risk factors for cardiovascular events. Prebiotic ingredients that are beneficial to both animal and human health include oligosaccharides, inulin, galactooligosaccharide (GOS), mannan-oligosaccharide (MOS), fructooligosaccharides (FOS), and polydextrose. These benefits raise consumer awareness, which promotes prebiotic ingredients market expansion.

Drivers

Drivers

- Growing demands for FOS in infant nutrition

- Increasing Prebiotic Consumption for Gut Health

- Rising preference for plant-based products

- Increased consumption of dietary supplements

Restraints

- High manufacturing costs

- Lack of Product Understanding

Opportunity

- Improving consumer awareness of health and wellness

Report Coverage

| Market | Prebiotic Ingredients Market |

| Market Size 2021 | US$ 5,786 Mn |

| Market Forecast 2028 | US$ 14,244 Mn |

| CAGR | 10.9% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Application, By Source, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Roquette America, Inc., Cosucra Groupe Warcoing SA, Beghin Meiji, Beneo-Orafti SA, GTC Nutrition, Parmalat S.p.A., Kraft Foods, Inc., Abbott Nutrition, Stonyfield Farm, Solvay Pharmaceuticals SA, and Jarrow Formulas. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Prebiotic Ingredients Market Dynamics

Prebiotic ingredients are increasingly being used in dairy and personal care products due to their health benefits, boosting the market size. Furthermore, a growing middle-class demographic, increased cultivation and collecting of prebiotic herbal medicines and higher nutritional value knowledge are all driving the market demand. Rising R&D investment by many manufacturers to develop new ingredients, combined with growing demands for prebiotic-containing foods and beverages, is likely to drive market growth over the forecast period. Furthermore, age and economic status influence the purchase of prebiotic substances. Furthermore, increased technological advances in the synthesis of inulin and oligosaccharides are likely to drive market revenue throughout the assessment period.

Besides this, stringent trade regulations for such products will offer a significant impediment to industry growth. Furthermore, variations in raw material pricing and distribution network interruptions caused by the epidemic will slow market growth. High expenditures connected with research and development capabilities, as well as high production costs due to rigorous trials, will further impede market expansion.

Market Segmentation

The global Prebiotic Ingredients market segmented into type, application, source, and region.

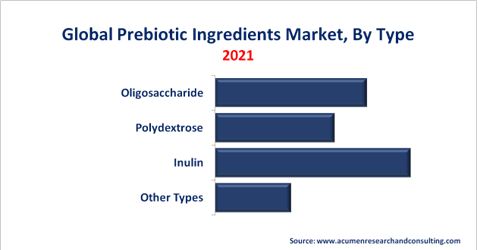

Market By Type

- Oligosaccharide

- Polydextrose

- Inulin

- Other

In terms of type, the inulin segment will have the biggest market share in 2021. Inulin is a rich source of fructans, a type of dietary fiber. These are naturally occurring polysaccharides that are produced by a variety of plants, but they are most commonly isolated from chicory. The inulin segment is expected to grow significantly during the forecast years due to the increasing use of prebiotic ingredients in the dairy processing industry and the manufacturing of various foods and drinks. Rising health consciousness has increased the demand for nutritional supplements, which is expected to boost the inulin segment ahead in the global market. Over the projected period, the increasing availability of chicory roots, a prominent source of inulin used in medications, is expected to assist the growth of the inulin segment.

Market By Application

- Food & Beverage

- Dietary Supplements

- Animal Feed

In terms of application, the food and beverage segment leads the market in 2021, with significant market shares. Prebiotics, as functional food ingredients, have an impact on the effectiveness of food items due to their textural and gelling characteristics. Prebiotics as processed foods has the potential to be extremely essential in the production of functional meals aimed at preventing or delaying the development of a wide range of diet-related disorders. They also have advantageous technical properties that improve the reliability of food and beverages. Furthermore, prebiotics is naturally occurring components of the human diet when vegetables, fruits, and whole grains are consumed in adequate quantities. Prebiotics can be found in asparagus, leeks, garlic, bananas, onions, Jerusalem artichoke, and chicory, as well as wheat bran, flour, and barley. This segment's growth is being fueled by changes in lifestyle, evolving client food preferences, and increased beverage consumption. Furthermore, rising demand for specialty foods including lactose-free food products is hastening the segment's growth.

Market By Source

- Roots

- Vegetables

- Grains

- Other

Based on the source, the cereals segment dominated the prebiotic ingredients market in 2021. Cereals rich in prebiotics include rice, wheat, oats, and barley, which are widely farmed and widely found all over the world. Growing awareness of the benefits of prebiotics, as well as increased acceptance of prebiotics derived from grains in the food and beverage industries, have all contributed significantly to the rise of the global prebiotics ingredients market.

Prebiotic Ingredients Market Regional Overview

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Asia-Pacific was one of the leading regions for the prebiotics ingredients markets in 2021. Due to the growth and advancement of the food and beverage industry, an ever-increasing geriatric population base, the presence of numerous end-user drug manufacturers of prebiotic ingredients, and increasing personal expendable cash, Asia-Pacific is expected to continue to experience significant gains during the forecast timeframe and will score the highest Growth rate. Additionally, fast population growth in developing nations such as China and India provides a large number of consumers for the prebiotic ingredients market. The market in this region is growing as a result of raising customer interest in a healthy diet and an increase in the range of uses in food and beverage goods.

Competitive Landscape

Some of the prominent players in global prebiotic ingredients market are Roquette America, Inc., Cosucra Groupe Warcoing SA, Beghin Meiji, Beneo-Orafti SA, GTC Nutrition, Parmalat S.p.A., Kraft Foods, Inc., Abbott Nutrition, Stonyfield Farm, Solvay Pharmaceuticals SA, and Jarrow Formulas.

Frequently Asked Questions

How much was the estimated value of the global prebiotic ingredients market in 2021?

The estimated value of global prebiotic ingredients market in 2021 was accounted to be US$ 5,786 Mn.

What will be the projected CAGR for global prebiotic ingredients market during forecast period of 2022 to 2030?

The projected CAGR of prebiotic ingredients during the analysis period of 2022 to 2030 is 10.9%.

Which are the prominent competitors operating in the market?

The prominent players of the global prebiotic ingredients market involve Roquette America, Inc., Cosucra Groupe Warcoing SA, Beghin Meiji, Beneo-Orafti SA, GTC Nutrition, Parmalat S.p.A., Kraft Foods, Inc., Abbott Nutrition, Stonyfield Farm, Solvay Pharmaceuticals SA, and Jarrow Formulas.

Which region held the dominating position in the global prebiotic ingredients market?

Europe held the dominating share for prebiotic ingredients during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for prebiotic ingredients during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global prebiotic ingredients market?

Growing demands for FOS in infant nutrition, increasing prebiotic Consumption for Gut Health, and rising preference for plant-based products are the prominent factors that fuel the growth of global prebiotic ingredients market.

By segment Type, which sub-segment held the maximum share?

Based on type, inulin segment held the maximum share for prebiotic ingredients market in 2021.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date