Dietary Supplements Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Dietary Supplements Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

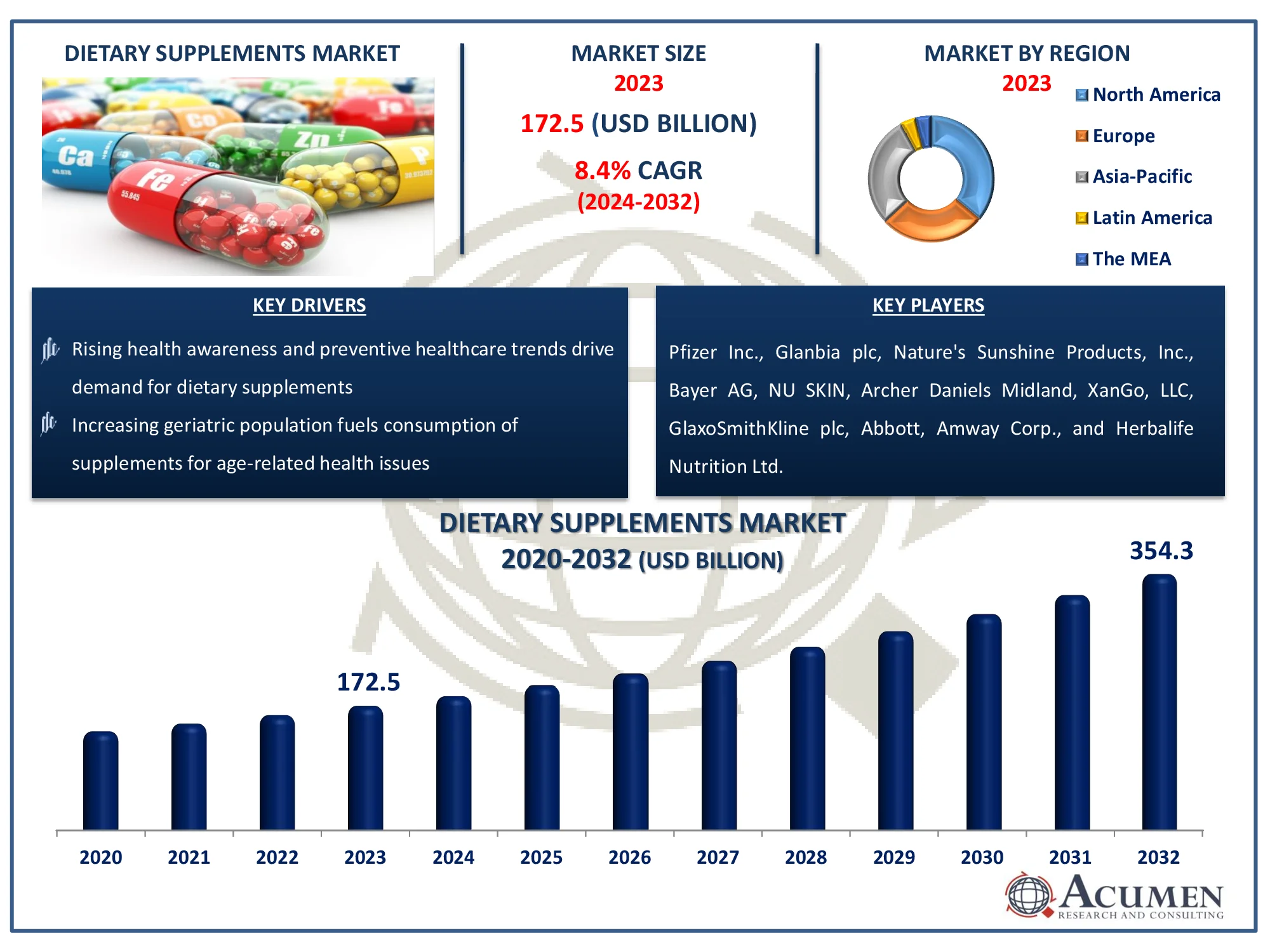

The Global Dietary Supplements Market Size accounted for USD 172.5 Billion in 2023 and is estimated to achieve a market size of USD 354.3 Billion by 2032 growing at a CAGR of 8.4% from 2024 to 2032.

Dietary Supplements Market Highlights

- Global dietary supplements industry revenue is poised to garner USD 354.3 billion by 2032 with a CAGR of 8.4% from 2024 to 2032

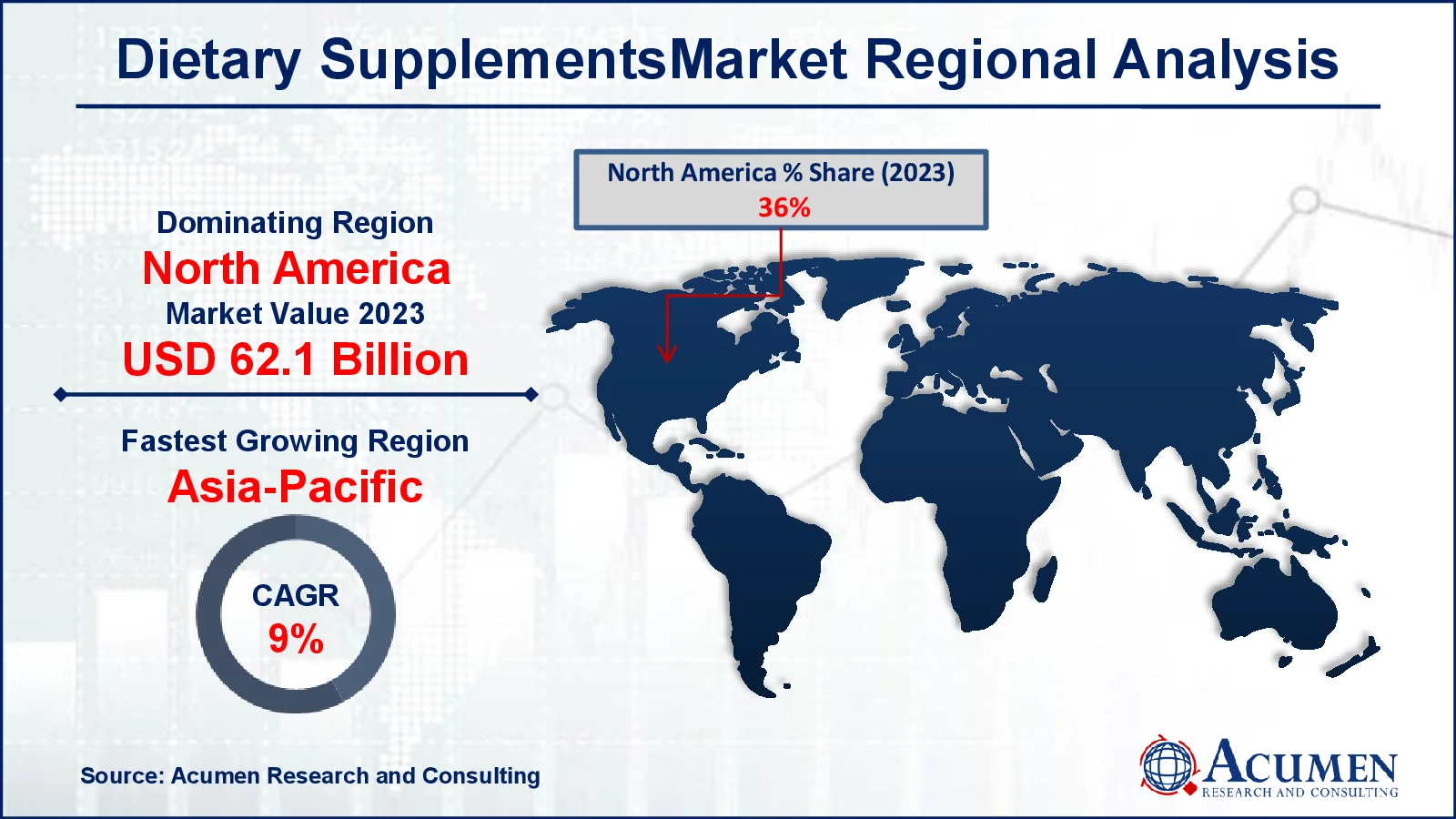

- North America dietary supplements market value occupied around USD 62.1 billion in 2023

- Asia-Pacific dietary supplements market growth will record a CAGR of more than 9% from 2024 to 2032

- Among application, the energy & weight management sub-segment generated 31% of the dietary supplements market share in 2023

- Based on ingredient, the vitamins sub-segment generated 30% dietary supplements market share in 2023

- Partnerships between supplement manufacturers and healthcare providers enhance credibility and market reach is the dietary supplements market trend that fuels the industry demand

A dietary supplement is a made item expected to supplement the eating routine when taken by mouth as a pill, container, tablet, or fluid. A supplement can give supplements either extricated from nourishment sources or engineered, independently or in the mix, so as to build the amount of their utilization.

The US FDA has characterized dietary supplements as items containing 'dietary' fixing empowering better ingestion. While a portion of the dietary supplements is gone for bringing down the danger of perpetual sicknesses, others are intended to improve the health benefit in day by day diet. The structure of dietary supplements, along these lines, contrast dependent on focused purchaser age, yet huge stays at improving the general wellbeing. As purchasers around the globe become progressively mindful of the advantages offered by dietary supplements, they are expected to request more for the equivalent, hence helping the dietary supplements market gain energy.

Global Dietary Supplements Market Dynamics

Market Drivers

- Rising health awareness and preventive healthcare trends drive demand for dietary supplements

- Increasing geriatric population fuels consumption of supplements for age-related health issues

- Growing popularity of fitness and sports nutrition supports demand for protein and energy supplements

- Expansion of e-commerce platforms enhances accessibility and availability of dietary supplements globally

Market Restraints

- Regulatory hurdles and stringent approval processes limit product launches

- High costs of premium supplements restrict market growth in developing regions

- Growing skepticism and misinformation about supplement efficacy hinder consumer trust

Market Opportunities

- Innovation in personalized nutrition creates avenues for customized supplement offerings

- Expansion into emerging markets presents growth potential due to increasing disposable incomes

- Rising demand for plant-based and organic supplements opens new product segments

Dietary Supplements Market Report Coverage

| Market | Dietary Supplements Market |

| Dietary Supplements Market Size 2022 |

USD 172.5 Billion |

| Dietary Supplements Market Forecast 2032 | USD 354.3 Billion |

| Dietary Supplements Market CAGR During 2023 - 2032 | 8.4% |

| Dietary Supplements Market Analysis Period | 2020 - 2032 |

| Dietary Supplements Market Base Year |

2022 |

| Dietary Supplements Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Ingredient, By Form, By Application, By End User, By Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pfizer Inc., Glanbia plc, Nature's Sunshine Products, Inc., Bayer AG, NU SKIN, Archer Daniels Midland, XanGo, LLC, GlaxoSmithKline plc, Abbott, Amway Corp., and Herbalife Nutrition Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Dietary Supplements Market Insights

Rising wellbeing worries alongside changing ways of life and diets have flooded the item request. Uplifting viewpoint towards games nourishment is among the significant dietary supplements market drivers. Increment in the number of worldwide games like Big Bash and Indian Premium group has constrained competitors to concentrate on their physical quality. What's more, an ascent in the quantity of games complex and exercise centers is expected to drive the development. Quick urbanization, ascend in discretionary cashflow, alongside developing shopper mindfulness with respect to medical problems is expected to push the dietary supplements market development throughout the following seven years. Ideal standpoint towards therapeutic nourishment because of the high commonness of cardiovascular ailments alongside weight the board projects is expected to impel the item request.

Purchaser mentality is sure in regards to dietary supplements with included wellbeing and health benefits. The rising geriatric populace, expanding social insurance costs, evolving way of life, sustenance development, therapeutic disclosures, and assumptions about their more expensive rates has supported the general market development just as the item request. Dietary supplements makers are additionally preparing endeavors to bring issues to light of their items which is driving buyers to effectively concentrating on their nourishing prerequisites. The utilization of dietary supplements can enable purchasers to remain sound by fortifying the safe framework and diminishing the odds of contracting ailments, hypersensitivities, and different issue. Subsequently, the developing attention to preventive medicinal services, combined with the nourishing advantages of devouring dietary supplements will fuel the dietary supplements market development during the conjecture time frame.

The developing prevalence of web based business channels will be one of the key dietary supplements market slants that will pick up footing over the figure time frame. The online offers of dietary supplements have seen high development over the previous decades attributable to retailers and producers endeavors towards teaching clients, streamlining the online retail process, giving better aftersales administrations, and focused on marketing efforts. These endeavors will keep on empowering a more prominent number of buyers to buy dietary supplements internet during the estimate time frame.

Dietary Supplements Market Segmentation

The worldwide market for dietary supplements containers is split based on ingredient, form, application, end user, type, distribution channel, and geography.

Dietary Supplements Market By Ingredient

- Botanicals

- Vitamins

- Minerals

- Fibers & Specialty Carbohydrates

- Proteins & Amino Acids

- Omega Fatty Acids

- Others

According to the dietary supplements industry analysis, the vitamin category has been widely used in the formulation of dietary supplements, and it is predicted to account for approximately 30% of total market share due to its ability to be properly discharged by kidneys. This market is predicted to see increased use among working professionals and athletes as multivitamin tablets, powders, and fluids over the next seven years.

Rising interest for herbs for the aversion of mind just as the physical issue is foreseen to help the botanicals segment over the gauge time frame. Besides, rising worries over the unfavorable impacts of ordinary meds including allopathic medications are expected to advance the utilization of natural concentrate as an element for the creation of dietary supplements throughout the following couple of years.

Dietary Supplements Market By Form

- Capsules

- Tablets

- Soft gels

- Liquids

- Powders

- Gummies

- Others

Tablet is the most ordinarily utilized sort of dietary supplements attributable to the cost-adequacy and simple bundling procedures. Tables are exceedingly favored attributable to their high time span of usability and simple material pressing. The segment is expected to contribute around 33% of the all-out dietary supplements market and to lose its offer to the cases and delicate gel segments inferable from its severe taste and the nearness of ointments which are not appropriate for utilization.

Dietary Supplements Market By Application

- General Health

- Energy & Weight Management

- Bone & Joint Health

- Immunity

- Gastrointestinal Health

- Cardiac Health

- Anti-cancer

- Diabetes

- Others

The energy & weight management segment is projected to hold the biggest dietary supplements market share of over 31% in 2023, inferable from the rising pattern of online get-healthy plans and government activities for smart dieting. Driven by a growing global emphasis on fitness, wellbeing, and weight management. Consumers are increasingly prioritizing maintaining a healthy body weight and raising energy levels, resulting in a surge in demand for dietary supplements that promote metabolism and fat burning. Protein powders, fat burners, and metabolism boosters are popular among people looking to better their physical performance and lose weight. The increased prevalence of obesity and lifestyle-related health disorders contributes to the segment's rise.

Dietary Supplements Navigation Market By End User

- Adults

- Geriatric

- Pregnant Women

- Children

- Infants

Based on the dietary supplements industry analysis, the adults are the significant shopper of dietary supplements, and therefore, expected to represent over 46% of worldwide income share in 2023. Rising mindfulness in regards to fat decrease and spotlight on improving nourishment admission among grown-ups is expected to advance the utilization of these supplements over the dietary supplements market forecast period.

Dietary Supplements Market By Type

- Prescribed

- OTC

The OTC segment, among the type categories, is expected to dominate the global dietary supplements market in 2023. Increasing interest in items particularly focused on skin wellbeing, individual consideration, and stomach-related wellbeing is likely to have a beneficial impact on segment development throughout the projected time frame of 2024-2032.

Dietary Supplements Market By Distribution Channel

- Offline

- Online

The offline sector is expected to be the primary distribution channel in the dietary supplements market forecast period. This dominance is due to consumers' strong preference for in-store purchases, which allow them to interact with products and obtain personalised advice from healthcare professionals or salespeople. Pharmacies, health stores, and supermarkets offer a safe atmosphere for customers to discover a variety of supplements, thereby improving the shopping experience. Despite the growing popularity of internet channels, the offline category retains a solid market position thanks to timely product availability and consumer trust, particularly among the elderly and those seeking expert advice.

Dietary Supplements Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Dietary Supplements Market Regional Analysis

Rising interest for games sustenance by virtue of the expanding significance of dynamic way of life alongside developing mindfulness in regards to the advantages of protein admission is expected to assume a vital job in advancing item use in North America. Besides, developing cognizance with respect to the utilization of proteins for keeping up the bulk and supporting ideal sustenance levels among moderately aged grown-ups in created nations including the U.S. also, Canada is expected to flood request. Rising interest of natural items in U.S., Argentina, and Australia has constrained administrative bodies to outline steady strategies to build generation yield for natural nourishment which will result in the decreased use of dietary supplements in the up and coming years.

The Asia-Pacific dietary supplements market is projected to rise at a significant rate of growth over the forecast period. Rising offers of illustrious jam, green juice, blueberries, dark vinegar, and chlorella in Japan attributable to the expanding interest for common items is expected to drive the interest for dietary supplements over the gauge time frame. Rising mindfulness about dietary enhancement in China and India is expected to remain a great factor for the Asia Pacific. In addition, development in the retail market in rising districts, for example, India, Indonesia, China, and Malaysia in light of administrative help to advance speculations alongside the administration activities is expected to support the territorial interest.

Dietary Supplements Market Players

Some of the top dietary supplements companies offered in our report include Pfizer Inc., Glanbia plc, Nature's Sunshine Products, Inc., Bayer AG, NU SKIN, Archer Daniels Midland, XanGo, LLC, GlaxoSmithKline plc, Abbott, Amway Corp., and Herbalife Nutrition Ltd.

Frequently Asked Questions

How big is the dietary supplements market?

The dietary supplements market size was valued at USD 54.2 billion in 2023.

What is the CAGR of the global dietary supplements market from 2024 to 2032?

The CAGR of dietary supplements is 8.4% during the analysis period of 2024 to 2032.

Which are the key players in the dietary supplements market?

The key players operating in the global market are including Pfizer Inc., Glanbia plc, Nature's Sunshine Products, Inc., Bayer AG, NU SKIN, Archer Daniels Midland, XanGo, LLC, GlaxoSmithKline plc, Abbott, Amway Corp., Herbalife Nutrition Ltd., and Abbott.

Which region dominated the global dietary supplements market share?

North America held the dominating position in dietary supplements market during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of dietary supplements during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global dietary supplements industry?

The current trends and dynamics in the dietary supplements market include rising health awareness and preventive healthcare trends drive demand for dietary supplements, increasing geriatric population fuels consumption of supplements for age-related health issues, growing popularity of fitness and sports nutrition supports demand for protein and energy supplements, and expansion of e-commerce platforms enhances accessibility and availability of dietary supplements globally

Which end user held the maximum share in 2023?

The adults end user held the notable share of the dietary supplements containers industry.