Poultry Vaccines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Poultry Vaccines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

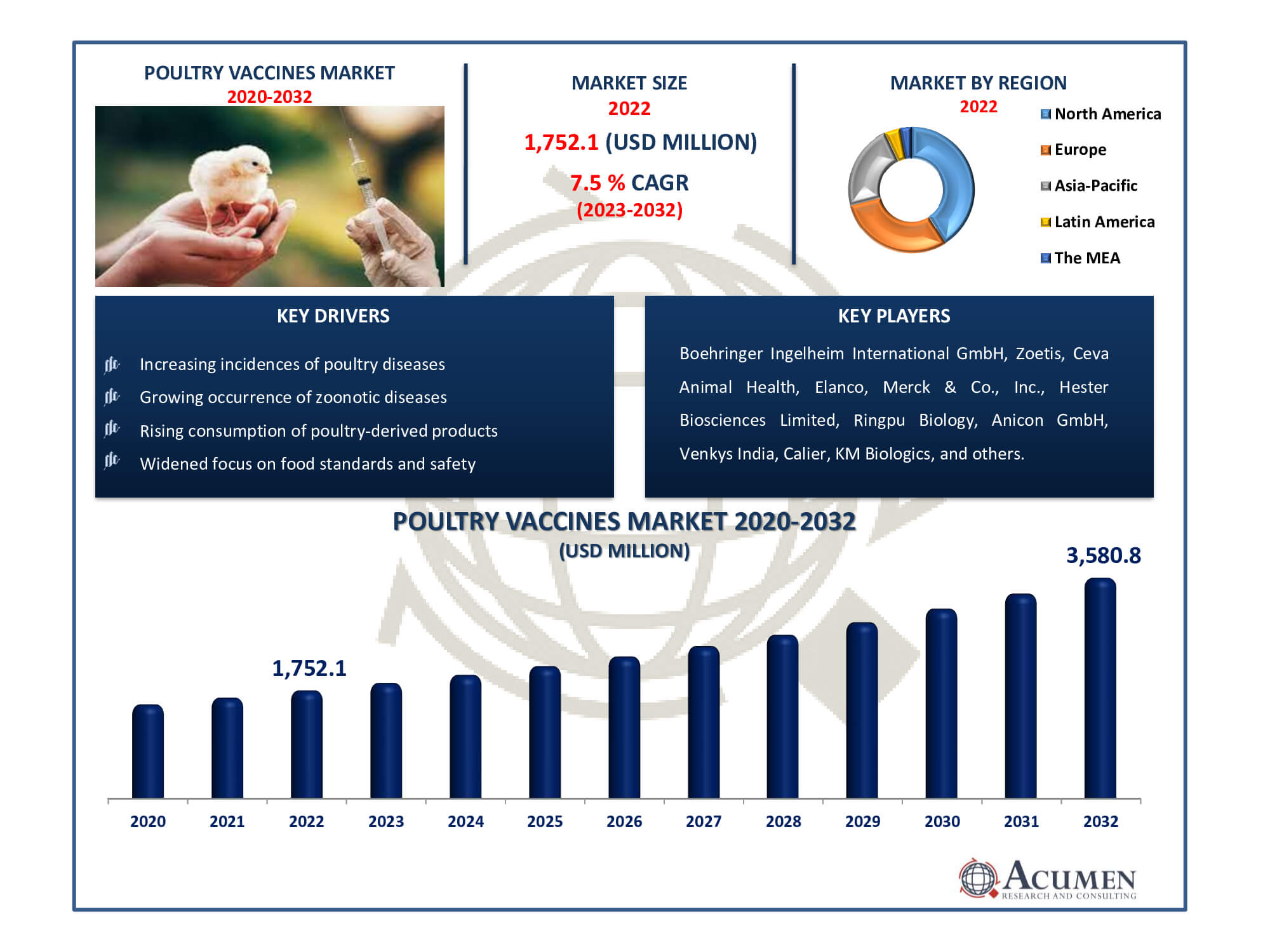

Request Sample Report

The Poultry Vaccines Market Size accounted for USD 1,752.1 Million in 2022 and is estimated to achieve a market size of USD 3,580.8 Million by 2032 growing at a CAGR of 7.5% from 2023 to 2032.

Poultry Vaccines Market Highlights

- Global poultry vaccines market revenue is poised to garner USD 3,580.8 million by 2032 with a CAGR of 7.5% from 2023 to 2032

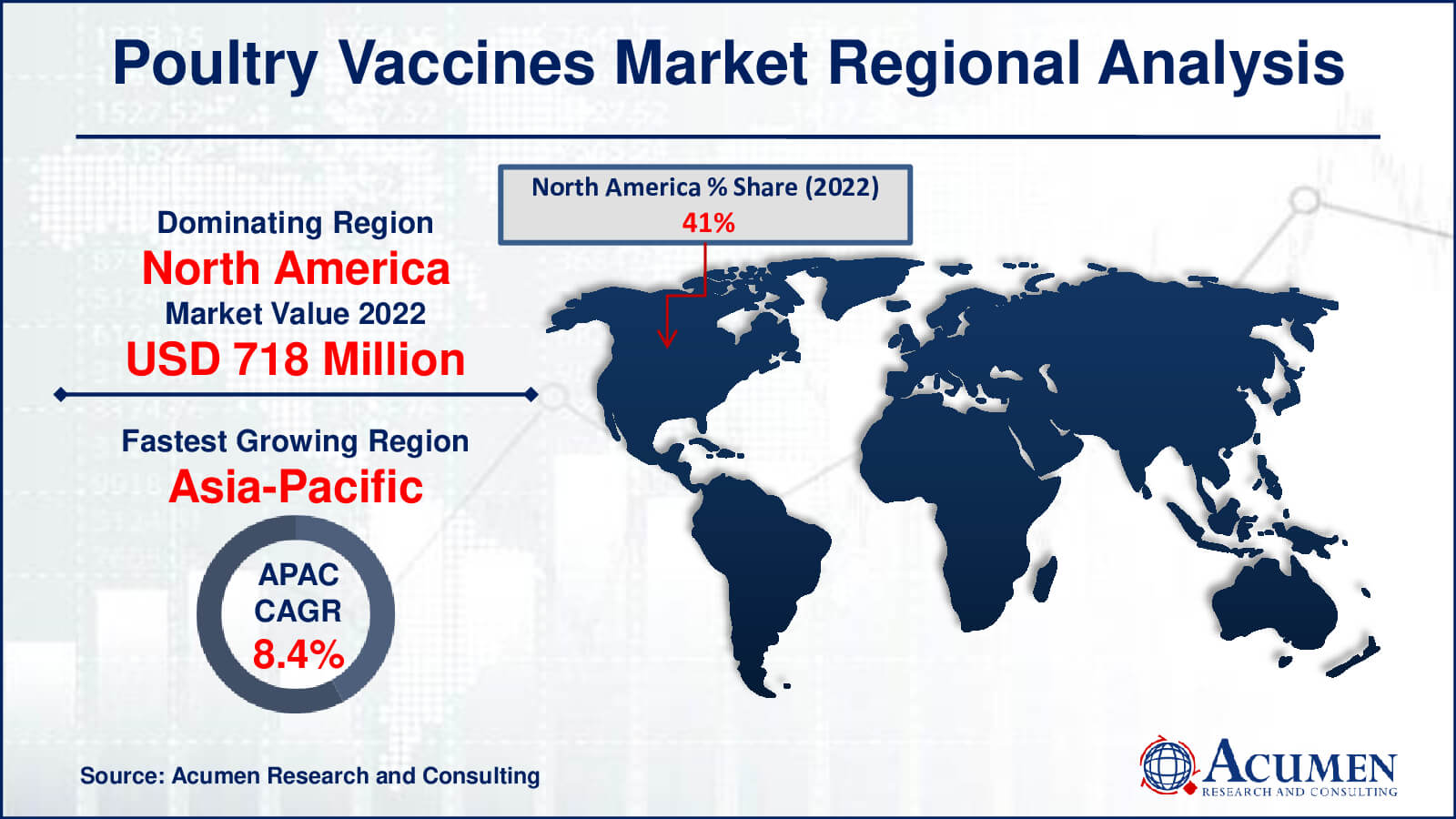

- North America poultry vaccines market value occupied around USD 718.3 million in 2022

- Asia-Pacific poultry vaccines market growth will record a CAGR of more than 8.4% from 2023 to 2032

- Among product, the attenuated live vaccines sub-segment generated over US$ 543.2 million revenue in 2022

- Based on application, the breeder sub-segment generated around 36% share in 2022

- Increasing usage of inactivated vaccines is a popular market trend that fuels the industry demand

Poultry vaccines are primarily used to prevent and control infectious poultry diseases. Their application in poultry farming is intended to prevent or reduce the emergence of active diseases at the farm level, thereby increasing production. Vaccines and vaccination programs vary significantly depending on various local factors, such as farming type, disease trends, costs, and potential losses. These programs are generally managed by the poultry sector. In the last decade, the economic losses caused by major chronic poultry diseases, such as avian influenza and Newcastle disease, have been massive for both the commercial and public sectors. However, vaccination should be used in the context of national or regional poultry disease eradication programs overseen by public veterinary services.

Global Poultry Vaccines Market Dynamics

Market Drivers

- Increasing incidences of poultry diseases

- Growing occurrence of zoonotic diseases

- Rising consumption of poultry-derived products

- Widened focus on food standards and safety

Market Restraints

- Increasing cost of the vaccines

- Rising acceptance of vegan and vegetarian food

- Side-effects of poultry vaccines

Market Opportunities

- Increasing government involvement in poultry treatment

- Leading industries expanding their vaccination programs

- Rising prevalence of avian influenza

Poultry Vaccines Market Report Coverage

| Market | Poultry Vaccines Market |

| Poultry Vaccines Market Size 2022 | USD 1,752.1 Million |

| Poultry Vaccines Market Forecast 2032 | USD 3,580.8 Million |

| Poultry Vaccines Market CAGR During 2023 - 2032 | 7.5% |

| Poultry Vaccines Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Disease, By Product, By Dosage Form, By Technology, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Boehringer Ingelheim International GmbH, Zoetis, Ceva Animal Health, Elanco, Merck & Co., Inc., Hester Biosciences Limited, Ringpu Biology, Anicon GmbH, Venkys India, Calier, KM Biologics, and Phibro Animal Health Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Poultry Vaccines Market Insights

Increase the importance of vaccination in poultry farms will drive the growth of the market. Vaccination plays a significant role in maintaining the health of poultry farms. It helps prevent various poultry diseases through a controlled process where healthy birds are exposed to weakened or inactivated pathogens. After vaccination, the birds' immune systems respond by mobilizing a specialized defense mechanism designed to detect and eliminate the invading pathogens before they can harm the birds. This process also leads to the formation of memory cells, which can recognize the specific pathogens the birds have been immunized against. As a result, if the pathogens are encountered later in life, the immune system can swiftly identify and neutralize them, providing disease protection and preserving the overall health of the flock.

Variability in disease challenges vaccine research and development is a restraint for the market. The continual evolution and variety of poultry diseases is a significant limitation in the poultry vaccines market. Pathogen strains and mutations evolve on a regular basis, making it difficult to produce vaccines that give broad-spectrum protection. This diversity can contribute to longer R&D procedures and higher vaccine development costs, impeding timely responses to new poultry health problems.

Growing demand for Antibiotic-Free poultry production is a opportunity for the market. The growing consumer desire for antibiotic-free poultry products creates a business opportunity. With mounting worries about antibiotic resistance and a desire for healthier chicken options, there is a growing demand for vaccines that might aid in the maintenance of poultry health without the use of antibiotics. Vaccine producers can capitalize on this trend by producing and distributing vaccines specifically designed to assist antibiotic-free chicken production, thus addressing the interests of both health-conscious consumers and the poultry sector.

Poultry Vaccines Market Segmentation

The worldwide market for poultry vaccines is split based on disease, product, dosage form, technology, application, end-user, and geography.

Poultry Vaccine Diseases

- Avian Influenza

- Infectious Bronchitis

- Newcastle Disease

- Marek's Disease

- Others

Avian influenza, also known as bird flu, is a disease associated with avian (bird) influenza (flu) Type A viruses. These viruses naturally circulate among wild aquatic birds worldwide and can infect domestic and household poultry, as well as other bird and animal species. Typically, bird flu viruses do not infect humans. Human infections with bird flu viruses have occurred sporadically. Recently, avian influenza A (H7N9) has been reported in China and detected in poultry. While some cases have resulted in mild illness, the majority of patients have experienced severe respiratory problems, and sadly, some have succumbed to the disease.

Poultry Vaccine Products

- Attenuated Live Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- Recombinant Vaccines

- DNA Vaccines

Live attenuated vaccines are derived from living bacteria or viruses that have been modified to weaken and reduce their virulence. These vaccines trigger a robust immune response and, in many cases, provide lifelong immunity after just one or two doses. Compared to other vaccines, they have the ability to stimulate the immune system to produce a higher number of antibodies. Moreover, immunization with live attenuated vaccines is more effective and provides protection against avian diseases such as infectious bursal disease, infectious bronchitis, and Newcastle disease. Additionally, increasing research and development (R&D) activities, particularly in the field of vaccination, are driving advancements in this segment, helping to control various outbreaks of the aforementioned diseases.

Poultry Vaccine Dosage Forms

- Liquid Vaccine

- Freeze Dried Vaccine

- Duct

The freeze dried vaccine segment accounts for the majority of the poultry vaccines market. This significance is attributable to a number of important causes. Freeze-dried vaccines are more stable and have a longer shelf life, making them appropriate for storage and transportation in a variety of environments. Furthermore, they are simple to reconstitute prior to injection, making the immunization process easier. These characteristics make freeze-dried vaccines a favoured choice for chicken farmers and vaccination programmes, leading to their market dominance. The ease of use, efficacy, and portability of freeze-dried vaccinations have led to their extensive use in the chicken industry.

Poultry Vaccine Technologies

- Recombinant Vaccines

- Inactivated Vaccines

- Live Attenuated Vaccines (LAV)

- Others

The Live Attenuated Vaccines (LAV) segment is the largest in the poultry vaccines market. This is primarily due to the presence of weakened, but still active, microorganisms that closely mimic disease-causing agents in live attenuated vaccines. This resemblance prompts a strong and long-lasting immunological response in chickens. Live attenuated vaccines provide a high level of protection, effectively lowering the prevalence of poultry illnesses. Their efficacy and low cost make them the ideal choice for poultry vaccination programmes, leading to their market domination. The widespread use of live attenuated vaccines in the poultry industry is a major contributor to this segment's dominance.

Poultry Vaccine Applications

- Broiler

- Layer

- Breeder

The breeding stock application segment played a dominant role in the market in 2020, primarily due to the increasing adoption of vaccines at breeder farms. These vaccines are instrumental in safeguarding poultry health and significantly enhancing farm productivity. This trend has been particularly pronounced as a result of proactive government initiatives that encourage poultry farming. Consequently, the poultry industry has witnessed a surge in the number of poultry farmers, breeder farms, integrators, and nutrient mills.

Poultry Vaccine End-Users

- Veterinary Hospitals

- Poultry Firm

- Poultry Vaccination Center

Local chicken poultry farms are a valuable resource that helps impoverished people in developing nations to improve their lives. Household or domestic chicken production provides food and income and is an essential component of rural poor food security. However, widespread poultry diseases, overexploitation, and poor production practices are among the challenges to village poultry's productive output. As a result of these factors, demand for the poultry vaccination center segment is expected to rise in the forecasting period.

Poultry Vaccines Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Poultry Vaccines Market Regional Analysis

North America dominates the poultry vaccines market, with the biggest market share. This is partly because the poultry industries in the United States and Canada are so advanced. The region's chicken farming practices are distinguished by a significant emphasis on disease control, biosecurity measures, and technical improvements, positioning it as a market leader.

Following closely behind is Europe, which holds the second-largest share of the poultry vaccines market. The European poultry sector is well-established and regulated, with a strong emphasis on producing safe and high-quality birds. In this region, the demand for effective poultry vaccinations has been pushed by stringent animal health and food safety laws.

The Asia-Pacific region has the fastest-growing poultry vaccination market. This expansion can be linked to a variety of factors, including greater poultry consumption, increased commercial poultry production, and increased knowledge of the need of immunization in disease control. Countries with enormous populations and a developing middle-class consumer base, such as China and India, are driving this rapid expansion. Furthermore, government measures targeted at increasing poultry production to fulfill increased demand for chicken products are propelling the market in this region even further.

Poultry Vaccines Market Players

Some of the top poultry vaccines companies offered in our report includes Boehringer Ingelheim International GmbH, Zoetis, Ceva Animal Health, Elanco, Merck & Co., Inc., Hester Biosciences Limited, Ringpu Biology, Anicon GmbH, Venkys India, Calier, KM Biologics, and Phibro Animal Health Corporation.

Frequently Asked Questions

How big is poultry vaccines market?

The market size of poultry vaccines was USD 1,752.1 million in 2022.

What is the CAGR of the global poultry vaccines market from 2023 to 2032?

What is the CAGR of the global poultry vaccines market from 2023 to 2032?

Which are the key players in the poultry vaccines market?

The key players operating in the global market are including Boehringer Ingelheim International GmbH, Zoetis, Ceva Animal Health, Elanco, Merck & Co., Inc., Hester Biosciences Limited, Ringpu Biology, Anicon GmbH, Venkys India, Calier, KM Biologics, and Phibro Animal Health Corporation.

Which region dominated the global poultry vaccines market share?

North America held the dominating position in poultry vaccines industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of poultry vaccines during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global poultry vaccines industry?

The current trends and dynamics in the poultry vaccines industry include increasing incidences of poultry diseases, growing occurrence of zoonotic diseases, rising consumption of poultry-derived products, and widened focus on food standards and safety.

Which disease held the maximum share in 2022?

The avian influenza disease held the maximum share of the poultry vaccines industry.